From Cass Freight Index Report – September 2019:

With the -3.4% drop in September, following the -3.0% drop in August, -5.9% drop in July, -5.3% drop in June, and the -6.0% drop in May, we repeat our message from the previous four months: the shipments index has gone from “warning of a potential slowdown” to “signaling an economic contraction.”

The report continues:

The weakness in spot market pricing for many transportation services, especially trucking, is consistent with the negative Cass Shipments Index and, along with airfreight and railroad volume data, strengthens our concerns about the economy and the risk of ongoing trade policy disputes. Weakness in commodity prices, and the ongoing decline in interest rates, have all joined the chorus of signals calling for an economic contraction.

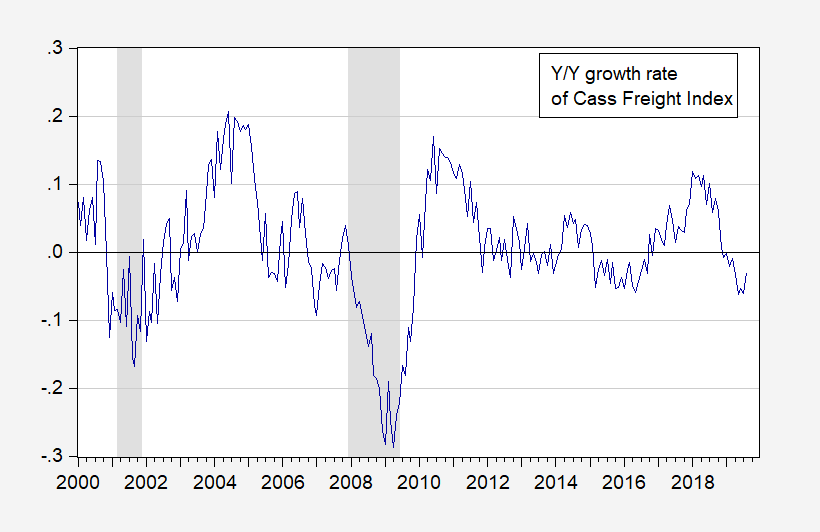

Here is year-on-year growth in the index:

Figure 1: Cass Freight Index – Shipments, year-on-year growth calculated as log-differences (blue). NBER defined recession dates shaded gray. Source: Cass Freight Index Report via FRED, NBER, and author’s calculations.

Boy, I’m really confused now (and there’s no sarcasm there as there sometimes is when I use this phrase). Uh, I’m guessing Menzie checks these numbers in a religious fashion, whereas I only check them semi-religiously due to personal lethargy and absent-mindedness. But the Nowcast numbers are quite fascinating—creating some mixed signals like many economic barometers are now (let’s stay off the topic of scientifically calibrated thermometers for CoRev’s sake. Or was Hanson the one that thought demonic Freemasons were hiding behind the thermometer face?? I can only keep track of so many kookballs at once).

My bringing up Nowcast topic was instigated by Menzie’s GDP question in the post title. Did we kind of semi-agree that NYFRB Nowcast tends to be more cynical/downside-ish than the Atlanta Nowcast? But has anyone other than Menzie and Prof Hamilton looked at the most recent numbers?? Atlanta’s Nowcast has now become “more pessimistic” than the NYFRB Nowcast.

Atlanta Nowcast—1.7%

NYFRB Nowcast—2.03%

Color me near shocked (again, no sarcasm).

I bet Ed or CoRev accuses Menzie of manipulating the data by not taking back to say 1917. FRED provides this series dating back to 1999:

https://fred.stlouisfed.org/series/FRGSHPUSM649NCIS

Now if our Usual Suspects think they can find earlier reports – let them provide them.

Looking at the chart.

The only time on the chart a sharp drop of the index was followed quickly by a recession was the end of 2001. But remember, no one (except Presidential candidate Bush) was predicting a recession and of course, accordingly to Menzie, it was proper they did not.

More observations

A similar but larger drop during 2005 but no recession for years.

A very tiny drop (quite common in size) late 2007 was quickly followed by the start of great recession.

A very similar drop but of greater size occurred during 2011 with no recession.

The index on chart remained mostly negative until the election of 2017, with no recession.

Need I observe that the index recovered after the election of President Trump.

I do not claim to know the Cass index better than the people who created the report, but it seems that anyone interested might look up reports from the times of the above list. This quick look would seem that the index is not very good at calling recessions. Perhaps that is why they use the term contraction instead,. But we already know that GDP growth rate has slowed but that is not the same as recession.

So to answer the title question, who knows? But this index has a very bad record of calling when GDP turns negative.

By the way, another look at the index can be found at:

https://fred.stlouisfed.org/series/FRGSHPUSM649NCIS

And the look at this FRED chart does not look particularly menacing.

Ed

Ed Hanson: What are you babbling about? I was *in* the Bush Administration in 2001 (until June). I don’t recall anybody in the Executive Office of the President (including my boss, the Chair of the CEA) saying we were in, or about to be in, a recession.

Where *do* you get your information?

Oh, and FYI, the NBER dating for the recession is March 2001 to November 2001 – not the end of 2001.

I do recall a couple of rationals for the 2001 tax cut. After the fact, Mankiw said it helped stimulate consumption. Of course Glenn Hubbard was running around saying the tax cut would actually raise savings. Huh! Time to head down to Penn Station and take an Amtrak to Washington DC and Boston at the same time.

And let’s give the FED some credit – they are busy cutting interest rates in early 2001.

Well I’m guessing this is neither here nor there for you Menzie, but I think the Cass Freight Index is a very important number, and VERY helpful as a supplemental number in a package of economic numbers to foresee recession. In other words, I am glad and appreciative you put this post up. It is worth noting Alan Greenspan was a pretty big fan of the Cass Freight Index and other barometers of rail and truck traffic. Now people can say what they like about Greenspan, and I am not a very big fan of his as things stand today. But it appears according to the trend line of Washington DC cocktail parties at the time he was Fed Chair, the man was respected on these issues at one time.

@ Menzie

Maybe Cass already seasonally adjust theses numbers?? But I was thinking right now that the Christmas season could make these numbers look “overly positive” when say, the November and December numbers come out. I’m wondering (again assuming it’s not already adjusted for in the numbers) if there is a statistical method to “smooth out” those numbers, or say compare the Cass index for this end year, Specifically November and December numbers to Christmas season numbers for other recession or “contraction” years.

Moses Herzog: The Cass freight shipments index is not seasonally adjusted; doing 12 month log differences is kind of a seasonal adjustment.

Not surprised you did the “extra work” there (although I know in your mind, and you’re right, it would have been a “crime” had you not). I guess what I was thinking was you can already see a blip there at the tail end, although it would be stretching it on my part to say it’s Christmas related. What I’m anticipating is that Cass number will look artificially high later in the year (possibly rising a small amount) and yet I doubt the numbers at that point will be a true representation of the American economy (this is me “using my gut” again, but I think the Cass numbers would be bent overly positive at that time). I suppose by that stage a person could look at other numbers like retail sales (which would be more “immediate” or “time appropriate”) and then compare that to other Christmases. For whatever it’s worth STILL strongly believe Cass is an important number.

“Where *do* you get your information?”

this is the same complaint i have against rick stryker, and accordingly continue to bring up the issue of his approval to lying. the conservative base has accepted the practice (and trump has perfected it) of intentionally lying to achieve ones goals. people like ed hanson may attribute such “mistakes of fact” to ignorance and such, but they also do not care whether it is actually true or not, as long as they can further their agenda. their behavior is intentional. notice ed will not apologize fo pushing a false narrative? same with dick striker.

Hey Ed – I too posted the FRED chart, which was clearly labeled “index” as in level. The Cass Freight report that Menzie linked to showed the year to year changes in the index. OK you do not know the difference but maybe Menzie can explain it to you.

Maybe you missed this but the largest declined occurred between 2007 and 2010, which corresponds to the Great Recession. Yea I know – your name is Mr. Magoo so maybe you cannot see this.

“This quick look would seem that the index is not very good at calling recessions.”

Quick look! This is really funny coming from our Mr. Magoo! Hey Ed – what is your forecast record on calling business cycles?!

Looks like Ed is now casting G Bush II in the role of Carnac the Magnificent, predictor of future events, knower of all things.

This would be the same guy who also predicted in 2001 that he would” retire $1Trillion in debt over the next four years…”? The same guy who proposed borrowing another $4 Trillion to privatize Social Security? The same guy who warned about paying down debt too quickly?

The same guy who, along with a Republican congress, presided over a $6 Trillion increase in the national debt?

The guy, who as Business Insider said, pushed through “An extremely large tax cut that failed to pay for itself, two wars on the nation’s credit card, an unfunded expansion of an entitlement program, and general overspending (that) turned what could’ve been a cushy surplus into a huge deficit.”?

Yes, that guy. No surprise he’s Ed’s go-to guy on fiscal matters.

Carson reference. You’ll never have to prove your coolness factor on this blog ever again.

Isn’t he the same genius that thought Shock and Awe would be easy?

Obviously Iraq was the biggest screw up, with the Great Recession coming in a very close number 2. But I’d be lying if I didn’t confess my personal favorite was his praise of Michael Brown with TV cameras rolling. That’s why none of this stuff with donald trump really shocked me after having a few minutes to take it in (and Nate Silver’s royal failure in polling). Any nation that will give “W” Bush and Ronald Reagan TWO terms in office has already proven itself functionally illiterate.

For me, I’ll frankly say Nate Silver’s inability to even come close to predicting things correctly was a much larger shock to me, than the fact the typical American would run out and vote for a bastard like donald trump—I kid you not.

Republicans STILL walk around declaring Reagan a “deficit fighter” when they know damned well it’s never ballooned quicker and larger under any other President. Certainly not under any other President not burdened by a significant sized war.

Is it possible that this drop is similar to what happened in 2015? That led to specific industry contractions, but not an overall drop in GDP. It appears the drop is deeper now than in 2015, and it appears that the rate of contraction is remaining mostly greater than it was in 2015. However, it has not been contracting as long – yet. Is there a way to stare into the cloudy plastic crystal ball and figure out whether volumes and prices will recover in the next six months or so?

And for what it’s worth, I’m completely convinced that the drop is either concurrent with or a predictor of slowing economic growth, just as it was is 2015. I cannot figure out what Ed Hanson is looking at. 2005 and 2011 were not the same as or as deep as what is happening now, according to the chart or anything else that I know of.

Menzie

I am so proud of you, never a misspelling or a typo. But for the rest of us who are willing to look to determine if it is a typo, it is obvious that the drop before 2001 recession was in 2000. Never, Menzie, never read someone for what they mean, it is safer that way.

Anyway, I stand by my line about that oncoming recession,, “and of course, accordingly to Menzie, it was proper they did not.”

OF course you don’t remember, you did not imagine a repub could win and never noticed that Bush said many times that the economic slowdown would become a recession. And just think, if the dem administration had not tried so hard to not admit to economic problems of the day, some voters might have appreciated political honesty for a change and actually reward Gore with their vote.

and that might have been enough in that close race.

Ed

I’m surprised that Mr. Magoo managed to type this much gibberish. But at the end of the day – your comment is nothing more than gibberish. Of course ALL of your comments are gibberish.

Ed, more voters rewarded Gore than Bush. The 512 vote difference in Florida (out of 8 million) determined the election. Gore, however, was the clear winner of the popular vote. You’re history-challenged too?

BTW, which Vice President was it who insisted “Reagan proved deficits don’t matter.”? The same one who rationalized squandering a budget surplus to reward supporters with tax cuts that never came close to paying for themselves.

But remember Bush got the important vote: 5-4.

noneconomist Actually, a later recount of the entire state of Florida found that Gore probably won that state as well. The irony is that Team Gore only wanted a few Democratic leaning recounted whereas Team Bush wanted the entire state recounted if there was going to be a recount. The irony is that the end result would have gone against whichever side prevailed in that argument about the scope of the recount. Of course, the SCOTUS short-circuited the process and crowned Bush. Another often overlooked fact (per militarytimes.com) is that years later we found out that many of the overseas military ballots that went heavily for Bush were in fact illegal ballots because the commanders had backdated them. A lot officers told militarytimes.com writers that they deeply regretted backdating those ballots given that it gave them Donald Rumsfeld.

2slugs, are you telling me there was voter fraud on a national level committed by republican voters?

Willie

The title question is about negative GDP (as in recession), not a slow down. The post is just more of Menzie propaganda about an upcoming recession.

That is what I am looking at.

Don’t know where you stand, hoping for an election year recession like Menzie for the good of the election, or wish or expect the economy not to go into recession for the good of the people.

Ed

“That is what I am looking at.”

Mr. Magoo is “looking at” what? Seriously Ed – make a real point or just run away.

Ed, I expect a recession, but not for the good of the people. I expect a recession for a number of reasons including numerous Trump blunders. Recessions hurt people. Trump blunders will hurt people. Not propaganda – cause and effect.

Willie

I suspected that is what you thought, and it is a good answer. But you have to realize that while there are some indicators showing possible recession, there are many strong indicators not showing recession. The last two ‘titled as question’ Menzie posts neither indicated upcoming recession, nor were particular good indicators for recession. To be clear, they do indicate the already reduced

gdp growth rate, just not recession.

I agree, facts in themselves are nor propaganda. But facts are used by propagandist. And one technique of propaganda is use of leading question. This combined with the obviously little value as recession indicator charts that Menzie posted constitutes propaganda more than just presenting facts.

I read that Menzie hopes for an election year recession for political purposes. It is why he joined the recession drumbeat, under the theory that it might change peoples behavior turning a slowdown into recession. Fortunately, it will not work.

And also to be clear, I do not believe President Trump committed economic blunders. His tax reduction, especially the reduction in corporate rate, was clearly needed and has brought on astounding results. His border policy is needed. His tariff policy seeks to change the world in a good way and in the long run. That China’s trade policy toward the US (and the rest of the world) was and still is terribly wrong and needing corrected or trade must be reduced. But our allies to have created unfairness toward the US. EU has chosen to protect industries with high tariffs to discourage import competition. President Trump seeks to correct that very ‘unfree’ trade policy. And finally to show that President Trump really has free trade in mind, just look at the completed negotiations improving NAFTA. Too bad the dems in congress refuse to let approval legislation because politically they see it as a President Trump victory more than they see as good for American (and Canadian and Mexican) citizens.

Ed

Professor Chinn,

Thanks for the September 2019 update of the Cass Freight Index Report. I notice that FRED (FRGSHPUSM649NCIS) shows only the August 2019 update data. Updating FRED for the September 2019 index value of 1.199, the probit model of being in a recession now is about 8% down from about 18% in May 2019.

I also notice that the probability seems to have a “hair trigger”. The probability of recession from the model was only 2% in December 2007. The model I got shows:

USRECM = -1.94 -16.17*log difference(-12)(Cass Index) + error

McFadden R sq. 0.51

NObs 237 (2000 M01 to 2019M09)

Similar result from your post: https://econbrowser.com/archives/2019/09/freight-shipping-growth-and-recession-probability

Shouldn’t the focus be on the demand side: consumption, government deficit spending and the trade war?

The transportation index would not seem to be a direct indicator of GDP growth.

Well yea – we should be examining the components of aggregate demand. But there is an entire literature on what are called leading indicators.

It is sort of like leaving the house checking on whether it is currently raining to decide whether or not to take the umbrella. Hint, hint – the early morning shows have weather forecasts that will give you an educated guess of what the weather may be hours from now. OR – just try http://www.accuweather.com!

Paul,

If you have not read the linked report for Cass, take a look. Cass seems to think that the freight volume is a leading indicator of GDP growth or contraction and seems to have a lot of charts and data to help support the Cass view.

I love it when right wingers fight. Ed Hanson has now twice declared that the Cass Freight Index has a poor record when it comes to forecasting economic activity. His evidence for this? Nada – except his own “quick look”. Like I said – Ed Hanson is our version of Mr. Magoo. Quick look – please!

Not that I’m a big fan of Tim Worstall but Fortune publishing his writings. Timmy has this to say:

https://seekingalpha.com/article/4276375-cass-freight-index-signalling-slowdown-u-s-economy

“A useful guide to the temperature of the economy is how much freight is moving around it. The Cass Freight Index gives us this volume plus also pricing – the volume is declining. This is an indication, but not a sure sign, of a slowdown in the U.S economy.”

Hey now, I saw a freight truck on the highway today. In Edland, that must be clear economic evidence that everything is normal. If Obama had been President and if I saw the same truck, that would have indicated economic catastrophe was upon us and that Obama must be impeached immediately.)

well a snowball is sufficient evidence for global cooling.

Before we get too carried away, remember that the BEA estimate of real retail sales is up 4.4% in August and that is the strongest reading in a year.

Moreover,housing appears to also be improving.

What we are seeing is the negative impact of weak trade on manufacturing and transportation , but the consumer, housing and government seem to be OK.

Do not forget that Trump’s military spending is also boosting the economy. Industrial production of defense and space equipment is up almost 10%.

GDP does have many components. And it looks like Trump’s mishandling of Syria is about to create World War III so expect military spending to soar next year.

Spencer gets it right again:

Federal Government: National Defense Consumption Expenditures and Gross Investment (FDEFX)

https://fred.stlouisfed.org/series/FDEFX

Up by 15% in nominal terms in the last 2.5 years. OK inflation adjusted this is only a 10% real increase. I guess the Trump 2020 boom will occur as Trump’s foreign policy incompetence is about to cause World War III. MAGA!

“Do not forget that Trump’s military spending is also boosting the economy.”

Yes – GDP has many components and with Trump’s mishandling of Syria, it looks like World War III is about to start. Which means military spending is about to soar!

Nah. Trump’s utter cowardice will save us from World War III. We should count our blessings.

Trump thinks steel tariffs on Turkey will make up for his cowardly abandonment of our Kurdish allies in Syria?

https://talkingpointsmemo.com/news/after-threats-to-destroy-turkish-economy-trump-announces-hike-in-steel-tariffs

‘President Donald Trump announced Monday that tariffs on imported Turkish steel would be raised to 50%, among other measures, in response to the country’s invasion of Kurdish-controlled areas of Northern Syria. Just days ago, Trump threatened to “totally destroy and obliterate the Economy of Turkey” amid bipartisan criticism of his sudden withdrawal of forces after a call with Turkish President Recep Tayyip Erdogan. In addition to raising tariffs on Turkish steel to 50% — matching the rate from five months ago — Trump’s statement said he’d authorized sanctions on anyone “contributing to Turkey’s destabilizing actions in northeast Syria.” He also said he had put trade talks on hold.’

Wait, wait – we had a 50% tariff earlier in the year. That did not destroy the Turkish economy. Let’s ask Census about the data:

https://www.census.gov/foreign-trade/statistics/product/enduse/imports/c4890.html

“(14100) Iron and steel mill products”. Imports from Turkey used to be just over $1 billion before Trump’s trade war. They are now just over $0.5 billion. Oh yea – reducing their exports of steel to us is a big deal only the dumbest person on the planet. Which of course is President Donald J. Trump!

@ Menzie

You might add this to your prescribed reading materials (if they are not over-burdened as it is with the other MMT stuff) for your students. Or read it yourself and use your own personal judgement to calibrate its learning value to young people.

https://www.peri.umass.edu/component/k2/item/1220-modern-money-theory-mmt-in-the-tropics-functional-finance-in-developing-countries

As I am getting a better grip on MMT at a snail’s pace, I am coming to learn a great deal of MMT’s arguments are dependent on both it being sovereign currency, and possibly even having good reserve currency status—but certainly sovereign. The table legs get weak for MMT in non-sovereign conditions. I remember you both mentioning your problems with MMT’s handling (or “non-handling”) of “h” (sensitivity of money demand to changes in interest rates) and supply constraints—which I take you (Menzie) to mean production not keeping up with demand (and causing inflation). I’m still working on catching up to how MMT explains these two problems, but I have not forgot your specific objections.

Maybe it will be labeled the Pence recession!

https://www.theguardian.com/us-news/2019/oct/14/fiona-hill-testimony-trump-impeachment-inquiry?fbclid=IwAR07IvuRXHsmV9aQwF0g3Xbnqqv_5YVXW9HXPveXkwkqy9RX_SMJPHQIx8M

Trump-Ukraine: John Bolton ‘sounded alarm about Rudy Giuliani’s actions’

Fiona Hill testifies that Bolton called Giuliani a ‘hand grenade’

Hill says Bolton likened lawyer’s operation to a ‘drug deal’

Yes – Trump impeached and removed from office before the New Year and President Pence gets to preside over the 2020 recession!

Spence 2020!

See Truman 1948…….

When will the Schiff/Nadler behind closed doors, political circus become open and controlled by adults? When the vote is taken and C-SPAN runs the leaks.

Oh gag, there you go again, ilsm, spouting Fox News propaganda lines. The function of the House in an impeachment process is equivalent to that of a grand jury, determining if there are grounds for a trial, which is what happens in the Senate. The Constitution allows the House to do whatever it wants.

GOPsters have been lying that previous House hearings were all open. Not true. During the Clinton impeachment the Judiciary committee held three days of closed hearings. In this case the parties involved have public records of publicly lying, especially Trump, now up to over 13,000 lies since becoming president. There is an obvious case for having the hearings be closed door so that Trump’s allies are not able to coordinate false stories.

If Trump is impeached by the House, the Senate trial will be open.

Interesting, CNBC reports Bloomberg considering entering the race if Biden falters.

I think Bloomberg would be a great VP choose for Warren.

Bloomberg was the NYC mayor for the billionaires on the Upper West Side/Upper East Side. Yea he was a moderate on a lot of issues but on the economic issues, he was closer to Romney. Something tells me Warren would not be interested to have him as her running mate.

@ pgl

Bloomberg wouldn’t take the VP slot anyway, his ego wouldn’t let him. He’d certainly run as an independent copying Perot’s gameplan. You of all people on this blog should know that. Just the thought of him taking the role of VP about gives me involuntary giggles.

bloomberg is another that is simply too old. these guys have had their chance to change the world. some of them are simply too old and at risk of not making it through the term. others are losing their mental edge. then you get guys like william barr, who take advantage of the fact their shelf life is limited to push through changes that will affect our nation long after they are dead and buried. i want people who will live long enough to face the ramifications of their actions, not act with impunity. it is wholly inappropriate for a septuagenarian to impose a lifetime curse on a teenager.

He is 77 years old which makes one wonder who get his $50 billion after he dies. I’m sure there are lots of Manhattan gold diggers lining up to date this old but rich geezer.

I agree. Bloomberg – like a lot of other NYC arrogant clowns – think he should be the ruler of the world. Second fiddle ain’t his style.

What good might shipping numbers be without considering existing inventory levels?

Watched some unpatriotic Midwestern farmers on the news discussing their lack of interest–and lack of resources–in purchasing new equipment. Report also discussed pending layoffs at Caterpillar and John Deere. They’re crying about making far less on their crops than they should have and thus refuse to go deeper in debt to buy more equipment.

Obviously the Fake Newsers–aided by these ungrateful aggies– will stop at nothing to smear our glorious leader in his continued fight for truth, justice, and the American way.

How hard will it be to really MAGA if these nervous nellies and their snooty media cohorts continue acting like enemies of the people?

Glad you brought up Caterpillar:

https://finance.yahoo.com/quote/CAT?p=CAT

Note its stock has struggled as late. I bring this up as I just listened to Trump babbling as he sat next to the Italian President. A lot of incoherent lies including how his abandonment of the Kurds in Syria was brilliant strategy on his part. He also babbled about how much economic power he has created for the U.S. His shining example of how powerful we have become from his alleged business – the stock market. Someone ask Caterpillar’s shareholders whether they are feeling all that powerful!

I was expecting the Italian President to literally run out of the room screaming in Italian – “this man is insane”.

Then too, just how telling can consumption data be without knowing how much of it is paid for without an increase in debt levels?