The Economic Report of the President, 2020 is out as of today. Chapter 9 presents the underpinnings for the seemingly implausible GDP forecast presented in the Budget last week — a forecast that’s a full percentage point faster than CBO’s.

Source: Economic Report of the President, 2020.

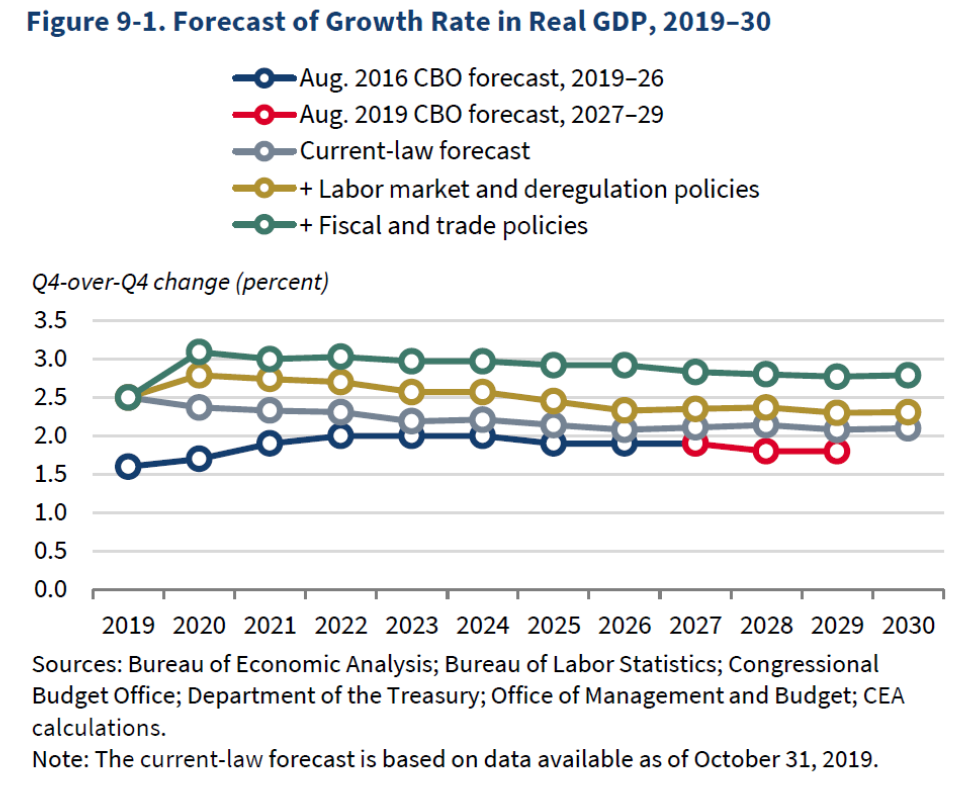

This figure highlights the fact that the out-year forecasts are driven by implementation of deregulatory initiatives and trade liberalization. From page 297:

we have decomposed this forecast into a current-law baseline and intermediate and top lines that reflect estimated growth effects discussed in this Report, as well as in the 2018 and 2019 Reports and the President’s Fiscal Year 2021 Budget. We then build up to our top-line, policy-inclusive forecast by successively adding to the current-law baseline the estimated effects of future deregulatory actions, immigration reform, additional labor market reforms to incentivize higher labor force participation, rendering the individual provisions of the Tax Cuts and Jobs Act (TCJA) permanent, additional fiscal policy proposals, including the Administration’s infrastructure plan, and improved trade deals with international trading partners. The top-line forecast constitutes the Administration’s official “Troika” forecast of the Council of Economic Advisers, Office of Management and Budget, and Department of Treasury. For comparison, we also report a pre-policy baseline consisting of the Congressional Budget Office’s 2019–27 projection made in August 2016, extended by its August 2019 current-law projection.

So while Administration forecasts are always conditional on implementation of Administration proposals (and CBO projections are conditional on current law), this year the implications are larger because (1) the implementation of initiatives are so implausible (still waitin’ for that infrastructure bill), and (2) the implied effects — particularly attributed to deregulation — are so questionable.

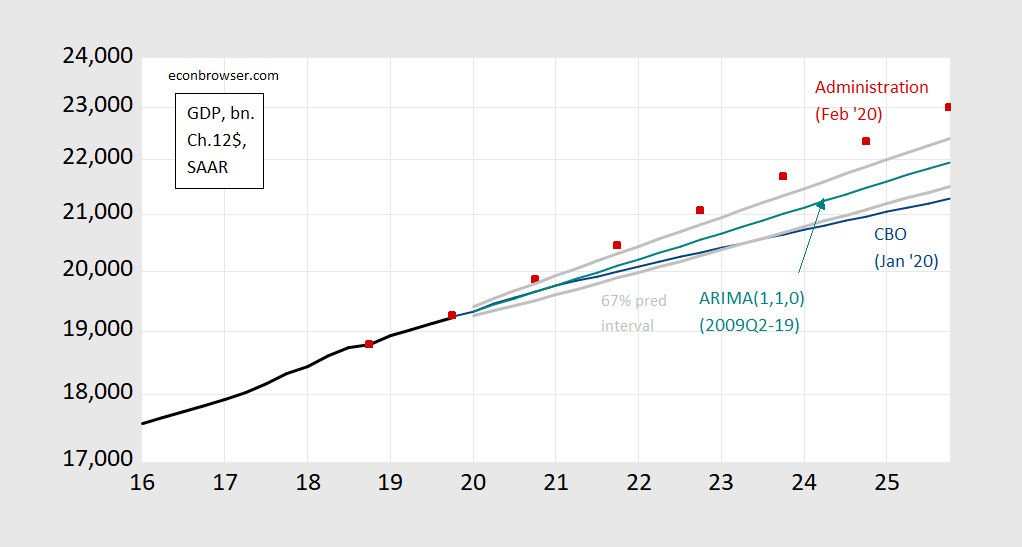

To reiterate, the Administration’s forecast looks implausible from the perspective of a naive time series model:

Figure 1: GDP in bn Ch.2012$ SAAR as reported (black), Administration forecast (red square), CBO January 2020 projection (blue), ARIMA(1,1,0) on log GDP 2009Q2-2019Q4 (teal), and 67% prediction interval (gray lines). Source: BEA, 2019Q4 advance release, CBO, Budget and Economic Outlook, January 2020, OMB, Budget for FY2021, February 2020, Table S-9, and author’s calculations.

Signed by Tomas J. Philipson and Tyler B. Goodspeed – not exactly stellar economists are compared to those who served on the CEA back under JFK and LBJ. But they had to be embarrassed with that introduction which had lovely subtitles such as:

The Transformative Power of Work

Previously Forgotten Americans Are Forgotten No More

Pro-Growth Policies Are Pro-Worker Policies

Oh wait – Trump seems to have written the BS text in this introduction and then attacked his oversized signature to this sheer intellectual garbage. I think this Economic Report of the President has set a new low.

Heck, even Nixon had better CEA economists, like Herb Stein. But then despite his paranoias, he was actually pretty smart and knowledgeable, and, well, those were the days for the CEA (not that they have nothing but bad staff people somewhat more recently… ).

Too bad Team Trump didn’t show us some real growth accounting to explain how those regulatory and trade reforms were going to boost GDP. I’ve always liked this takedown from Dietrich Vollrath:

Structural reforms don’t generate massive short-term changes in growth rates because they are fiddling with marginal decisions, making people marginally more likely to invest, or change jobs, or get an education, or start a company. By permanently changing those marginal decisions, structural reforms act like glaciers, slowly carving the economy into a new shape over long periods of time. Think of occupational licensing reform. If you enacted that tomorrow, GDP would not move at all. But over the course of the next few years, as new people graduated high school or college, or lost jobs, some of them, on the margin, would now find it worthwhile to become a physical therapist, or a hairdresser, or an interior decorator. They’d presumably be more efficient in these positions than flipping burgers, so the economy would be more efficient and GDP would be higher. But this takes years.

https://growthecon.com/blog/you-cant-reform-your-way-to-rapid-growth/

And a lot of their “reforms” were ones suggested by Mercatus, and if you read the fine print you’ll find that the overwhelming majority are state regulations, not federal regulations. Just smoke and mirrors for Fox Noise cultists. What a joke. Why oh why can’t the WH find better economists? This report was pathetic. It read like some pamphlet from Heritage.

Sardonically funny. 5-star comment.

Curiously the various Economic Freedom Indexes for the US, numbers estimated by outfits like Heritage and the Fraser INstitute, have been drifting to less free bascially since around 2005. But the main reason for this drift is indeed the increase in state regulations, especially those related to occuptional licensing, which has been spreading almost like an epidemic, classic rent seeking.

“Structural reforms don’t generate massive short-term changes in growth rates because they are fiddling with marginal decisions, making people marginally more likely to invest, or change jobs, or get an education, or start a company. By permanently changing those marginal decisions, structural reforms act like glaciers”

While this sounds right, it will make John Cochrane all grumpy again. Cochrane is promoting some weeds in the garden “model” where if you take out the weeds, the garden (economy) flourishes. When asked whether this notion has microfoundations, Cochrane goes grumpy again!

Why should donald trump pay attention to economic numbers when the orange creature is busy trying to get white male criminals a “get out of jail free” card. This is going to happen, the pardon is going to happen, so get ready for it. (pardon the opening commercial if there is one)

https://www.youtube.com/watch?v=L8X35JgC0rc

Maybe this has some connection to Barkley Junior’s “visions” of Babylon as “the first city ever” in the world with over 100k population??? I know Barkley Junior and Belshazzar were grade school friends, so there’s no way Junior could be wrong on what he said about it:

“But note in history that the first city ever to exceed 100,000 population and the world’s largest for several centuries came to cease to exist and not with a bang but with a whimper. That would be Babylon.”

This is what I love about Barkley Junior, he’s very studious and exacting on numbers. That….. and history.

Oh dear, Moses, you really want to make a big fuss about this city size bit since it was pointed out that you were off-base to argue that Detroit could only go up in population because it had hit bottom because even the world’s largest city once upon a time had fallen in population to zero.

As I have pointed out, there are competing sources on what cities were what size in the past, with at least four being candidated for being the first to pass 100,000, including Babylon, along with Ur, Avaris, and Nineveh. Your own source, which has Ur as the first to pass 100,000, has Babylon being the first to pass 200,000. What does seem to be agreed upon by all parties is that whatever their populations were, when Babylon became the world’s largest, somewhere between 700 and 500 BCE, it was larger than any other city before it had been. Yet is went to zero.

For that matter my point is even reinforced more by all this as at least two of the three rivals for “first over 100,000” have also completely siaappeared, also going to zero in population. Those would be Ur and Nineveh, now just ruins like Babylon. I am not sure about Avaris, which was in the Egyptian delta. And no city in China was the first to exceed 100,000, although a few may have hit that mark before Babylon did.

And again, there are serious uncertainties about populaton estimates, with these disagreements going on now about current cities, with 11 different cities possible being among the four metropolitan areas ranking from second through fifth in population, following Tokyo the acknowldged current world leader.

You would be better off just admitting that you made an inaccurate statement about what was necessarily going to happen to Detroit’s population, and that there was no guarantee at all that it would hit bottom and turn around and go up as it is indeed doing now.

Today’s QCEW shows year-over-year job growth through Sept 2019 isn’t 2.0 million, but more like 1.7 million. Consumer spending continues to stagnate, and China’s economy is going to slow for the start of 2020.

Combine that with an aging country, declining immigration, and us already being beyond full employment, and you tell me where the growth is going to come from. It’s now just a race to see when this asset Bubble pops – before or after the election.

https://www.nytimes.com/reuters/2020/02/16/world/asia/16reuters-japan-economy-gdp.html

Certainly the broad indicators imply growth below 2% for the USA going clear into 2021. My question keeps going back to equity markets. Because that is where reality is apt to hit home in the most “immediate” fashion—even if an external news (external to equity markets themselves) item is what initiates the large equities fall. My main suspect right now is STILL corporate bonds and shadow banks. That is not a prediction, but where I see the most likely candidate at this time right now.

BTW, I am on record on this blog as seeing a recession anytime before end of July 2020. I’m not backing off that, and am willing to take my bitter medicine from other commenters, if I end up being wrong on it happening before then. I still feel my odds are better than 50% that I end up right, even if I admittedly have no idea where it will come from, other than just very slow growth, and what I mentioned just above.

people looking for the black swan event to cause the next economic disruptions may have just found it in the emerging coronavirus problem. its not that we don’t consider a pandemic event, its that it comes from a virus we knew nothing about two months ago. i don’t think markets worldwide are prepared to digest and understand the impacts of this virus over the next 12-24 months. it appears the disruptions are just beginning.

@ baffling

My guess is (and yes, it’s only a gut feeling guess) the public fear and reaction to coronavirus has been over exaggerated. That being said, none of the Chinese government quoted numbers can be trusted, even after they were more realistically adjusted after a friendly “nudging” by the WHO. To me the big question is, did the virus make it out to other provinces outside of Hubei while local officials were trying to hide what was happening in the outsetting weeks?? If it did travel to other Chinese provinces then it will become more of a world-wide drag (because of GVC in China, not because of virus contagion outside of China). Nobody knows, but I think most of the damage has already been done, via GVC.

It’s also the kind of event that gives would be strong men the excuse they need to suspend elections and civil liberties.

@ 2slugbaits

Something I hadn’t given any thought to until you’d said it. I don’t think it will get to that (contagion wise), but it’s worthy of note. VERY worthy of note.

Of course Bruce Hall will once again ManSplain to us how these QCEW are “faulty surveys”!

@ pgl

I’m not trying to be provocative or upsetting here, honest to God I’m not. You have been a voice of reason on this blog for awhile now, and most of your comments are informative. But I have never heard any male (internet or planet Earth) use the word “mansplain” as much as you do. And I still think your style of convo/verbiage/phrasing is very much how a female talks. I know I am gonna get whacked on this, but I can’t stop myself from saying it.

I respect your anonymity, but I have to say, I’m curious as hell on your actual gender.

I’m just your average white dude. Well maybe a few inches short of being average but get me on a Brooklyn basketball court and watch out.

: )

Everything this administration puts out is a lie. That includes the “the’s” and the “and’s”.

America’s new theme song??

https://www.youtube.com/watch?v=n1Esuqywo9k

While we are listening to The Lords of the New Church, we should go with the new Republican theme song – Russian Roulette

https://www.youtube.com/watch?v=FOii45HUP40

Trump is an optimist and a salesman. Of all people, you economists understand the power of expectations. They can become self fulfilling prophesies.

Sammy! Did you say snake oil saleman? Optimist must be the new Urban Dictionary term for blatant liar!

You know I always wanted to play center for the Los Angeles Laker. I guess self fulfilling prophesies means I am 7′ 3″. Oh wait I’m only 5′ 6″. But I’m sure I could still drop 50 on you anyday!

BTW – if you ever bother to check actual economic predictions like the forecasts of potential real GDP from the economists at CBO, you might note that it is forecasted to grow by only 1.8% per year through 2030. CBO has a well established model.

What does Trump have? Oh yea some babble from the Bernie Boy’s favorite hack Gerald Friedman. Oh wait – do you even know who Gerald Friedman even is? Or the hammering of his stupid paper from economists both on the left and on the right? You don’t – do you?

sammy You’ve described a con man. Con men are always on the lookout for gullible marks like yourself.

Gullible marks are easy to spot these days – they often wear MAGA hats.

https://www.cnet.com/news/twitter-experiments-with-labeling-harmfully-misleading-tweets-by-politicians/

“A leaked demo shows bright orange labels beneath the tweets.” Orange for Trump’s hair and skin color no doubt! Everyone of his tweets should be labeled “harmfully misleading”!

“Twitter tests labeling ‘harmfully misleading’ tweets by politicians … Twitter is exploring whether to add brightly colored labels beneath misleading tweets from politicians and public figures, a move that could make high-profile users more wary about spreading lies.”

Guess who is trying to help mob boss Donald Trump out the author?

https://talkingpointsmemo.com/news/navarro-anonymous-writer-trump

‘Though Peter Navarro is director of the Office of Trade and Manufacturing Policy in name, he’s been spending considerable time “hunting” the administration official who wrote the anonymous New York Times op-ed in September 2018 and the book, “A Warning.” On CNN’s New Day Friday, Navarro said it’s a “vocation” and that there are “suspects everywhere.” His amateur sleuthing has already cost one official her job, as Victoria Coates left the National Security Council for the Department of Energy. Though the book publishers insisted that Coates was not the author, Navarro’s suspicion was enough to make her job at the NSC untenable. President Donald Trump claimed that he knows the identity of the author earlier this week, but wouldn’t name names, saying he wasn’t at liberty to say.’

OK – if Trump knows who wrote this piece, WTF is Navarro doing?

Remember the 2018 NYTimes oped I Am Part of the Resistance Inside the Trump Administration? Or the book A Warning?

Chapter 4 touts all sorts of alleged benefits from the shale revolution. One that caught my eye was the claim that the shale revolution would have benefits in terms of slowing climate change. Yea – this sounds a bit counterintuitive. A better discussion seems to be this one:

https://media.rff.org/documents/RFF-IB-18-01.pdf

‘Despite the near-term climate benefits of low-cost natural gas, multiple studies have demonstrated that—over the coming 25 to 30 years—the shale revolution may not be a net benefit for climate change. This finding stems from two main causes. First, low cost natural gas does not just make coalfired electricity generators less competitive, it also competes with zero-carbon sources such as nuclear, wind, and solar power. Low natural gas prices have contributed to the closure of multiple nuclear reactors in recent years, and incentivized power generators to build new natural gas, rather than wind or solar plants. Second, the shale revolution’s impact on energy prices—lowering the price of natural gas, oil, and electricity—encourages higher overall energy use. While low energy prices are a boon for consumers, they lead to greater consumption, thereby increasing emissions. When researchers take into account all of these effects, including the displacement of coal and the issue of methane emissions described above, most results show that the shale revolution—in the absence of policy (see next section)—is neither a climate savior nor a climate villain.’

This is followed by a closing section entitled “The Role of Policy”, which notes in part:

“With an abundant supply of low-cost natural gas, US policymakers can achieve substantial additional reductions in greenhouse gas emissions at low cost. The clearest opportunity to achieve this comes in the electric power sector, where natural gas can continue to displace coal-fired generators. At the same time, well-designed climate policies would seek to reduce methane emissions across the vast infrastructure of domestic oil and natural gas systems (notably, some states have implemented such policies, and some operators have implemented voluntary programs to reduce emissions). They would also recognize that preventing the worst effects of climate change will require far greater emissions reductions in the coming decades.”

Of course, Trump’s policy would likely increase the reliance on coal-fired generations and increase methane emission, which is likely why the ERP did not go into these issues.

I was pretty disappointed in Klobuchar when she was defending fracking during the Nevada debate. You know I was thinking she’d be a great running-mate for Bernie, but it’s stuff like that has me doing second thoughts on that duo.

Moses,

I am going to admit being wrong about Bernie having a celling on his support for the Dem nomination. Clearly he is now the solid frontrunner, with his divided opposition in very poor shape to stop him from getting the nomination now. None of them will be willing to drag in his support for Trotskyist Socialist Workers Party candidates during 1980-1984, somehow curiously missing from his quite detailed Wikipedia entry, out of fear of being accused of McCarthyism by loyal Berniebros.

As it is, an important reason for him doing well that not many observers had been paying attention to is that with Castro and O’Rourke gone, he was basically the only Dem candidate making a serious outreach to the Latino population, which is responding favorably with lots of support, as his big win in Nevada shows.

The Washington Post reports that, at a private event in England on Wednesday night, acting White House Chief of Staff Mick Mulvaney said the U.S. economy needs more immigrants to keep growing. He told the crowd that the United States is “desperate — desperate — for more people. We are running out of people to fuel the economic growth that we’ve had in our nation over the last four years. We need more immigrants.” He stressed that they must come in a “legal fashion.”

Let’s put some numbers around these claims.

GDP growth is a function of growth of the labor force and the growth of labor productivity. We can grow the economy by either adding more workers or by each worker producing more per year. Labor productivity growth has averaged 1.1% per year since 2015, 1.4% per year during the Trump administration and over the last fifteen years overall. The CBO uses 1.4% in its projections to 2030 as well. Notwithstanding, labor productivity in Japan, which is ahead of us on the demographic curve, is essentially unchanged in the last seven years. Consequently, US labor productivity growth may fall short of expectations. Productivity growth of 1.4% is about as much as we can reasonably anticipate, with the risk to the downside.

To productivity can be added the growth in the labor supply. Since 2011, the US has added approximately 2.4 million jobs annually. In 2019, this pace fell to just over 2.0 million incremental jobs, in part because the potential labor pool is largely exhausted.

Looking forward, the CBO expects the potential labor pool to expand on average by only 680,000 annually to 2030, and only 580,000 per year after 2025, contributing a mere 0.4% to GDP growth. This may prove pessimistic as labor reserves could be larger. The core 25-64 working age group is increasing by only 350,000 / year on average in the 2020s, so the CBO and Census Bureau are already assuming 300,000 of the gains in the potential workforce are coming from increased labor force participation either within or without the core working age group. For example, labor force participation in the 65+ age group is rising steadily. Japan has managed to stave off a decline in its workforce through such adaptations, most notably increased workforce participation by women. Thus, US domestic reserves of labor may be modestly — but not vastly — greater than the CBO expects.

Caveats notwithstanding, the productivity and population trends above lead the CBO to project GDP growth of only 1.7% on average in the 2020s, not the 2.9% presented in the February 2020 report of the Council of Economic Advisors (p. 299).

Immigration can increase the pace of economic growth. The Bureau of Labor Statistics reports approximately 160 million persons employed in the United States. Increasing the GDP growth rate by 0.1% would therefore require an additional 160,000 workers. To average 2.5% GDP growth, immigration would have to rise by 1.3 million additional migrant workers annually, plus their dependents, perhaps 1.8 million persons / year in total in today’s visa regime (but only 1.5 million or so in an MBV program).

The current GDP forecasts of both the CBO and CEA already assume 1.0 million net international migration into the US. Thus, those hoping to maintain a 2.5% GDP growth rate have to reckon with increasing the pace of immigration by 180% or so.

Meanwhile, demand should be robust. Nearly 20 million Americans will turn 65 in the coming decade, and studies suggest that their consumption falls by only 15% at retirement. Consequently, there will be plenty of demand for labor even as our worker shortage continues to unfold.

And this brings us full circle to Mick Mulvaney’s speech at the Oxford Union. The Federal budget deficit is wildly out of control, even as the retirement of the Baby Boomers portends further rises in government spending. Historically, we have grown our way out of deficits, but if GDP growth is only 1.7%, then this avenue is all but blocked. And Mulvaney knows that. Hence his desperation for more immigrants, necessary to both keep the economy growing and provide services for an aging US population.

Now this is a long winded way of saying CBO is projecting 1.8% growth per year in terms of real potential GDP through 2030 – something I have briefly noted a few times already. Breaking it down the way you did – without all the long-winded verbage – if productivity grows by 1.4% per year at best and if the workforce grows by 0.4% per year, we get that magic 1.8%.

So learning to write concisely might make you more productive per word. But do continue to write long winded rants as we know Fox and Friends pay you by the word!

“The Federal budget deficit is wildly out of control”. So sayeth Paul Ryan who too just hates the idea we might pay people the Social Security checks they were promised. Of course it is ironic that in a post that bashes to inhumanity and sheer stupidity of Paul Ryan, Princeton Stevie Boy parrots Ryan’s BS!

I was not attempting to forecast GDP, but rather quantify Mulvaney’s statement in terms of need for immigrants. We are entering a new regime wrt demographics and GDP growth, and neither the political nor the policy world yet comprehends what that means. I am trying to show them in numbers with a simple model with comprehensible assumptions.

Steven,

So I agree with you and Mulvaney that limiting immigration as severely as Trump is doing will reduce GDP growth. Given that Mulvaney has gone against the views of Dear Leader, how much longer do you think he will be Acting Chief of Staff for same?

Now that you have brought up Mulvaney in England, he also said that he is retaining the title of Acting Chief of Staff because that allows him to collect an extra $20,000 a year from the OMB which he used to head.

It’s not just the corruption of these Trump folks, it is the astonishing littleness and cheapness of their corruption. Never miss an opportunity to pick up an extra nickel.

I thought this was a great article, and fit in well under this thread:

https://arstechnica.com/tech-policy/2020/02/trump-report-bizarrely-claims-net-neutrality-repeal-raised-incomes-50b-a-year/

I wonder what the CBO or other neutral parties have to say about these “efficiencies”??