Every recession is different. The recession of 2020 will not be an exception to that rule.

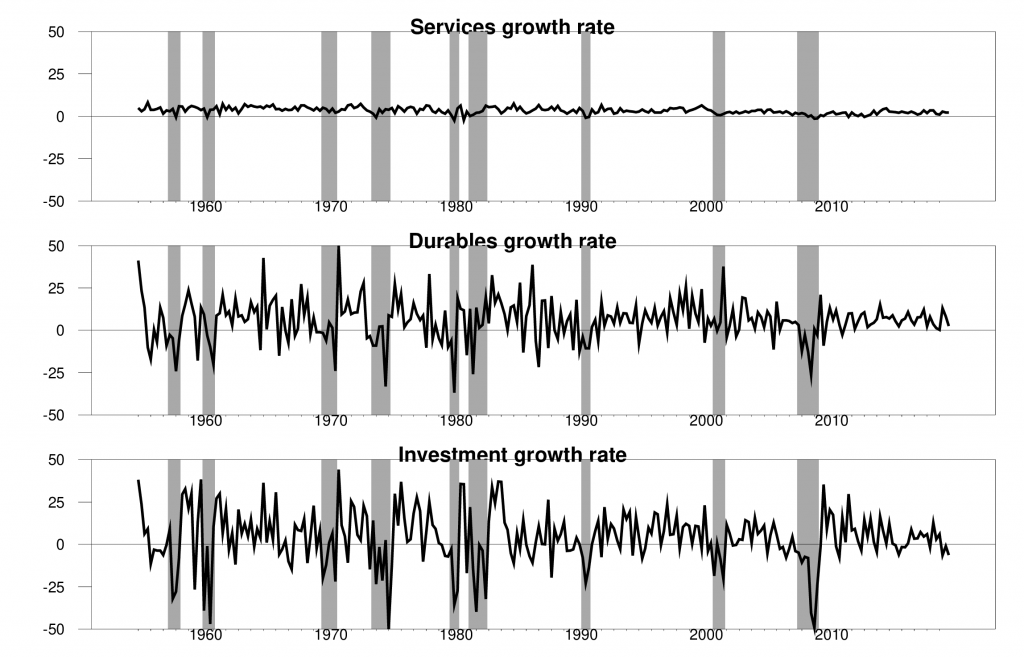

Spending on consumer services, which accounts for 47% of U.S. GDP, is normally quite stable over the business cycle. In a typical recession, service spending grows at a slower than normal rate but doesn’t actually fall. Not so this time. Restaurants, hotels, theaters, airlines, and so much more are devastated by the current environment.

Top panel: percent change in real personal consumption expenditures on services. Middle panel: percent change in real personal consumption expenditures on durables. Bottom panel: percent change in real investment spending. All growth rates are reported at an annual rate.

In typical recessions, most of the action is in investment spending and purchases of consumer durables. We’ll see that this time, too. Who is planning to buy a car this month? Businesses that can postpone big new expenditures surely will. U.S. oil companies have announced big spending cuts.

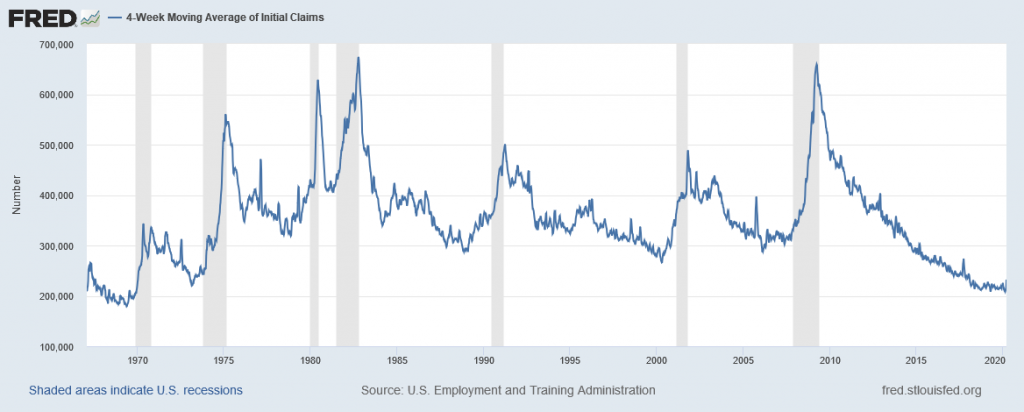

None of this is showing up in the main economic indicators yet. But it soon will. The most reliable leading economic indicator has always been initial claims for unemployment insurance. That’s moved up quite sharply over the last few weeks.

4-week average of initial claims for unemployment insurance, Jan 2019 to Mar 14, 2020.

Goldman Sachs is talking about an estimate of 2.25 million for the number of new claims for unemployment insurance during the last week. To put that in perspective, if GS is right, new claims for unemployment insurance during the last week were three times as bad as the worst week the U.S. has ever recorded.

Weekly initial claims for unemployment insurance, 1970 to Mar 14, 2020.

That’s enough to bring a sad face back to our Econbrowser Emoticon. We’ve used the countenance of the Little Econ Watcher to summarize our overall qualitative impression of incoming economic news. Today we’re bringing back the sad face, something we haven’t had to show since August of 2009.

| Date | Status |

|---|---|

| Sep 13, 2006 |

|

| Feb 21, 2007 |

|

| Apr 25, 2007 |

|

| Jun 27, 2007 |

|

| Oct 5, 2007 |

|

| Jan 4, 2008 |

|

| Aug 30, 2009 |

|

| Oct 30, 2014 |

|

| Mar 23, 2020 |

|

So what’s the end game? If a vaccine or cure could be found and mass-produced, this could all be put back together as rapidly as it fell apart. Most people could go back to their old jobs, and this would all be an asterisk to the economic statistics and a horrible shared dream. This scenario would mean a V-shaped recession with sharp recovery. Unfortunately, most health experts think that a real cure or vaccine are a long way off. Still, a lot of very smart people are working very hard on this from all kinds of different angles. It’s often a mistake to underestimate the resourcefulness and ingenuity of the human race. Don’t count us out just yet.

The more realistic scenario is that we continue to hunker down, waiting for lockdowns to bring the number of active infections down. But when the lockdowns are lifted and more people try to return to some semblance of normal life, the virus will spread again, until it is ultimately checked by immunity of the growing number of people who have been exposed. That’s a scenario in which life takes years to get back to normal, and many businesses must deal with a huge long-term shock.

The more months that the normal patterns of business amd work are disrupted, the harder it’s going to be to rebuild. As more companies go bankrupt, as more restaurants never re-open, it means more people can’t go back to their old jobs. Permanent dislocations make the process of rebuilding the economy much longer and more painful, and mean a recession that looks more like an L than a V.

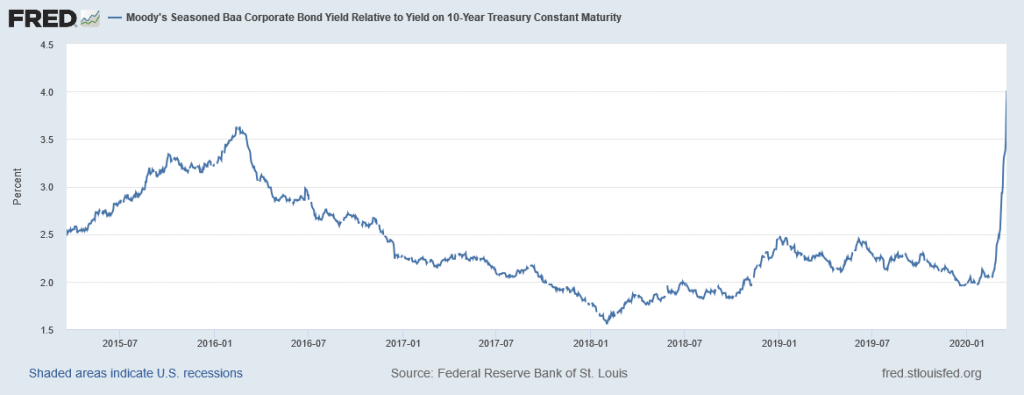

The Federal Reserve has responded appropriately by bringing short-term interest rates back to zero. But despite a lower risk-free interest rate, corporate borrowing costs have been shooting up as a result of a spiking risk premium.

Spread between yields on Baa-corporate bonds and 10-year U.S. Treasuries.

To deal with that, the Fed is resuming large-scale purchases of mortgage-backed securities and today announced a number of new facilities designed to help get credit to consumers and businesses, taking some of the risk off private-sector lenders and putting it on the balance sheets of the Fed and the U.S. Treasury. Like the emergency measures adopted in the fall of 2008, these may help prevent the situation from becoming worse than it otherwise would be. But they are not going to turn the economy around. It is one goal (and a very important one) to prevent a bad situation from becoming even worse. But no monetary stimulus will cause oil companies to resume their spending plans.

I would say the same thing about the massive fiscal stimulus measures currently being debated. I do not buy the Keynesian view that the core problem in the current situation is that there’s not enough spending. In my view, the core problem is that we have huge sunk capital investments in infrastructure like airplanes and restaurants and hotels that were very valuable a few weeks ago but in current circumstances can contribute nothing to GDP. Nothing the Fed or Treasury can do will change that.

My recommendation is for a fiscal stimulus that is targeted at some of the very specific problems that the federal government is uniquely equipped to address. Medical bills and health-care providers need to be paid, whether patients are insured or not. Hospitals must have access to the supplies they need to deal with the enormous task with which they’re about to be confronted. Parents who are forced to stay home with children out of school, or are prevented themselves from working at their old jobs, need help keeping the bills paid.

And the highest priority of all is to develop effective vaccines and treatments and then distribute them widely.

A technical point and a question:

10-year government bond yields are only 0.92% while 20-year government bond yields are 1.56%.I’m glad you raised the BBB corporate bond spread issue as I’m still trying to get THE RAGE to present actual data. Your graph shows this spread as 4.5% but that graph relies on the 10-year government bond rate while the FED reports the interest rate on 20-year corporate bonds. Which means this spread is really is only 3.8% not 4.5%. Still that is really high.

An interesting discussion on the components of aggregate demand but your thoughts on what the current situation means for residential investment?

The comparison of ten-year treasury yields to longer-maturity mortgage and corporate bonds is common. One reason is that hedging for longer-maturity private debt is done with shorter-dated treasuries. The lower yield on treasuries results in longer duration, relative to privately issued debt. Hedging involves matching the duration of the hedge to the duration of the instrument being hedged.

Good post. Hard to argue with it. I would add that in addition to airplanes, restaurants and hotels facing a stranded capital problem, so too will another sector a little closer to your home. I’m talking about colleges and universities. There’s going to be a lot more remote learning, for better or for worse. A lot of smaller, private liberal arts colleges might not be able to survive in that kind of world.

I guess this crisis will likely give us a conclusive answer with respect to the MMT debate, which seems like ancient history now.

I don’t know how that resolves MMT, but I’d love to hear more than a “hit and run” type comment on that if you have it in you. Which school of Economic thought exactly did you think had the magic solution for this??

Keynes was MMT before there was MMT. That is why he wanted to abandon the gold standard for unbounded money. No doubt he would approve what the Fed and Congress are doing now. But I doubt even Krugman supports them.

Paul Mathis proves his ignorance by stating “Keynes was MMT before there was MMT. That is why he wanted to abandon the gold standard for unbounded money. No doubt he would approve what the Fed and Congress are doing now. But I doubt even Krugman supports them.”

You seem to have zero knowledge of the VAST difference between MMT and Keynesianism. Please stop posting, you are out of your league. Hint. Krugman, who is certainly at the thousand foot level a Keynesian is very skeptical of MMT.

Dave, I doubt you have even held in your hands The General Theory of Employment, Interest and Money let alone read it even once. I have read it many times, as well as many other books on Keynesian theory by Minsky, Hanson, et al. If you can prove me wrong with actual quotes from Keynes, then do it. Otherwise, you are a charlatan.

One of the biggest problems with any MMT discussion is that “MMT” stands in for actual economic ideas. It is easy to read “MMT” as mostly a Keynesian view, since it involves the use of fiscal policy, rather than monetary policy, to dampen economic swings. It is also easy to read “MMT” as mostly neo-Keynesianism since the intellectual history of MMT involves a great deal of Keynesian thought.

In my reading of public discussion of (perhaps “combat over” would be more apt) MMT, a common claim by MMT defenders is that the other side doesn’t understand MMT, reason enough for supporters to go beyond the simple recitation of an acronym. For one thing, it is entirely possible that members of the other side do understand MMT (whatever that means) and simply disagree with it. In addition, academic writers who support MMT regularly add to and changing their views, so any number of ideas could be meant when the acronym is tossed out. It’s hard to have a useful discussion of MMT based simply on the label itself. This is not an isolated problem. Terms like “globalization” and “free markets” and “muscular policy” (yuck!) suffer from the same problem.

So hows about MMT supporters (and detractors and everybody in between) who comment here say what specifically they have in mind, point by point? That actually makes it more fun, right?

The central premise of MMT is that nations such as the U.S. have unlimited money to counteract problems such as we currently face. Neel Kashkari said exactly that on 60 Minutes last Sunday. He would know.

The same as ANY economic school there are slight variations. This is probably the best breakdown you’ll find. Certainly for beginners. As far as intermediate texts I am aware of some, but couldn’t definitively tell you which one is best. There’s 5-10 names probably out there. Some are mentioned in the book I just referenced below:

https://www.amazon.com/Modern-Money-Theory-Macroeconomics-Sovereign/dp/1137539909

Make certain it’s the 2nd Edition.

@ 2slugbaits

My reply/question was overly “reactive” and slightly rude. I apologize, but still interested in your thoughts. Maybe this COVID gunk has me on a short fuse. Or maybe I’m just cranky most the time, but I am sorry for that.

I am not opposed to MMT in the crisis. I don’t know that it’s strictly necessary, but I would be holding a no-layoffs, no bankruptcies, no disconnections or foreclosures policy for the until May, and I would do whatever it takes, including printing money.

And we thought MMT was a theoretical approach and not some policy. But the expert on everything seems to call for MMT policy? OK! But to be fair to little Stevie boy – the way MMT types right they as confused as Stevie boy.

You mean “the way MMT types write”?? Oh, that was an unfortunate timing in , uh, writing errors. As a defender of at least some portions of MMT, you knew I had to dog you.

Menzie is far from being a fan of MMT, but still has the tolerance and wide enough scope of mind to teach it in class (or “cover” it in class, if Menzie prefers this lexicon), with very constrained time to cover a high volume of subject area. I think it says something.

“I am not opposed to MMT in the crisis. ”

That does that even mean? You are truly incoherent.

I am not opposed to printing and distributing unsterilized money. I am happy to trade off inflation for solvency and liquidity under the circumstances.

Got it?

@ “Princeton”Kopits

You mean when a Republican is in the White House, THEN you think it’s OK to use these tools, but a crime against humanity when a Democrat is in the White House?? We already knew you and the vast majority of establishment Republicans felt this way. That’s been standard Republican operating procedure since roughly August of 1981. It’s otherwise known as “kill state revenues and spend” or what you call “Reaganomics”

unsterilized money? What is unsterilized Stevie know it all? Watch out – it might have COVID 19!

Moses –

I think it comes down to the type of crisis.

In a financial crisis, the central bank and legislature has to stabilize the banking system, whatever it takes. Therefore I supported TARP. In a pandemic which is expected to be temporary, the government must similarly provide bridging finance, in my opinion. If you start to liquidate the economy, then I fear it could become a depressionary spiral, which would have been avoidable otherwise. It’s like a power black out: you don’t want to abandon your house and move just because the power went off. Instead, you get out the candles and flash lights and wait for the darkness to pass. Same in a pandemic, to the extent the effects are anticipated to be temporary. This is not a Keynesian stimulus. It is not intended to ‘stimulate’ the economy. It is intended to hold the structure of the economy together during a transient crisis. Put another way, Keynesian stimulus trying to make something — GDP growth — happen, and thus constitutes ‘offense’. A bridging program, by contrast, is trying to prevent bad things from happening, that is, the liquidation of the underlying structure of the economy. It is defense, not offense. Bridge financing is not targeting GDP maximization. Rather, it is about keeping the components of the economy in place while the storm passes, and it is built on the assumption that relative prices in the economy are not materially distorted otherwise — true in this case, I think.

I would also note that I have stated that, in a depression — which usually involves the compromise of collateral values, typically housing — the prescription appears to be unsterilized (but hopefully socially distanced) injections directly to the household sector. The interest rate mechanism, as that intended by various rounds of QE, will prove ineffective — as did the various rounds of QE. So the choice is either letting the household sector recapitalize their home equity over a period of, say, 7-10 years or debasing the currency with unsterilized injections into the household sector and essentially letting inflation do the job faster. That’s not Keynesian as I understand it; instead, it’s full on MMT — which is where my analysis takes me for one specific event, a depression. This kind of logic could also hold (but strictly speaking, need not), in my opinion, for a temporary pandemic, in which we are trying to hold the economic system together for a finite period of time lasting not more than a few months. You have to build and hold the bridge, whatever it takes — if you assume the disruption is temporary.

Finally, in an ordinary recession, and in part in a depression, the prices of various factors become misaligned. Thus, in July 2008, tankers and bulkers were trading at 3x long-term replacement costs and carrying loans at 70% of market value, ie, 2x long term replacement cost. Fixing this without a crisis is well nigh impossible, to my way of thinking. So recessions and depressions are often about realigning relative factor values and it’s not clear that the pain can be prevented at some level. Trying to prevent the readjustment of prices may just prolong the agony, and that makes me a skeptic about the underlying value of traditional, deficit-financed Keynesian stimulus.

In the short term, spending does not seem to be an issue. I have not seen supermarkets as cleared out as they are. Next month or even next week could be different. Likewise, demand for medical services, equipment, and pharmaceuticals is currently high. That is unlikely to change. As you point out, paying for it is the issue. With people losing work, demand will crater when the money runs out. Then what? Whether it is the services or manufacturing sector that failed is secondary. Because services have become such a large part of the economy, it was inevitable that services would lead us into a recession eventually.

Cars and other large consumer durables are crashing like a rock.

Trump has made sure there is no then enough demand for Bruce Hall’s favorite treatment:

https://talkingpointsmemo.com/news/chloroquine-hydrochloroquine-trump-covid-19-lupus-rheumatology

When Donald Trump boosted an old anti-malaria drug on Thursday as a potential therapy for COVID-19, falsely suggesting the FDA had approved it for use, he spurred a global rush for the drug that’s having serious knock-on effects.

At a press briefing Thursday, referring to the drug hydroxychloroquine, Trump falsely said that “the nice part is, it’s been around for a long time, so we know that if things don’t go as planned, it’s not going to kill anybody.” And on Saturday, the President tweeted that “HYDROXYCHLOROQUINE & AZITHROMYCIN, taken together, have a real chance to be one of the biggest game changers in the history of medicine.” In fact, the drugs’ efficacy against COVID-19 is shaky at best: Chloroquine and hydrochloroquine have long been used against malaria, though the latter is a safer alternative to the former, and has for decades also been used with lupus and rheumatoid arthritis patients. Azithromycin is an antibiotic — and while its use alongside hydroxychloroquine on COVID-19 patients has shown some very limited promise, there’s been no clinical data to suggest the duo is ready as a widespread treatment. “What worries me is that doctors now are giving hydroxychloroquine without any information about whether or not it works,” Dr. Paul Offit, a virology and immunology expert and an attending physician in the Division of Infectious Diseases at Children’s Hospital of Philadelphia, told TPM Monday. “That’s a dangerous, ill-informed thing to do,” he said. Trump’s suggestion that the anti-malaria medications chloroquine and hydroxychloroquine can fight COVID-19 has led to a rush on the market. Several large drug makers have reported shortages of the medicines in recent days, according to the American Society of Health-System Pharmacists, and pharmacy boards in several states have moved in recent days to restrict the number of doses that can be given out. “There has been a huge uptick in prescriptions of these drugs and we need to make sure that they are being used in the most appropriate way,” Ohio Gov. Mike DeWine (R) said on Twitter yesterday. “There is hoarding going on of these medications.”

Dangerously ill-informed. That is Bruce Hall to a tee. Shortages of hydroxychloroquine for patients who really need it driven by stupid people like Bruce Hall who are hoarding this like it is toilet paper!

@pgl – agree with you completely. We are about to have a big uncontrolled trial in NYC as the state has received a large shipment of all three drugs you mention. I’m hoping that they can at least generate some data that might inform us. I’m amazed that the world is spinning around based on a poorly conducted French study that only involve about 30 patients. There are some large trials underway but I have not seen published results yet. I don’t know whether these drugs have been tried in the Lombardy outbreak. It should also be noted that the dosage for treating malaria may have no relevance at all for the treatment of COVID-19.

I’ll refrain from making a snide political comment.

Thanks for this information on NY getting this experimental treatment. We already have an alarming number of confirmed cases and it will only get worse in the next couple of weeks. This despite the fact that we were the first to go on lock down.

A little personal goods news. After my 5:30-7AM run in the park – social distancing at its best as few were even awake then – I went grocery shopping. First store has almost everything I needed but no toilet tissue which was on the top of my list as I was down to 2 rolls. The other store had only one package left but it was a 12 pack. Got it and was glad I’m set for a while. The little things!

I get a sinking feeling that we could be in for a five to ten year recovery unless one or more of the current attempted therapies are quickly effective in either curtailing virus infection or effective in preventing infection. Quick effective treatment seems like a long-shot.

Since 2011, the US economy has been able to add 2.4 million jobs / year at a pretty steady pace. We could see that many initial unemployment claims in the next week or two. So if layoffs start snowballing, and in particular, if bankruptcies start to spread, the damage could prove durable indeed.

Hey, look at the bright side. If dear guppy reopens the economy too soon, COVID 19 will spread and wipe out some percentage of the population, partly by itself, partly due to collateral damage caused by the collapse of our healthcare system. Unemployment will go down because people will be dead! The numbers will look great, and we will save big on Social Security because COVID 19 seems pretty efficient at getting rid of grandpa.

Alright, I’ll bite.

Low unemployment in the coming decade will be a function of a rapidly increasing retired class faced with comparatively few new entrants into the workforce. So grandpa will, in fact, be responsible for low unemployment rates.

It is also true that grandpa will be contributing to the fiscal imbalance in the economy, but he’s not the only guy at the trough.

Human society was probably not designed to have such a large portion of the population in the third phase of life. This is something new. I believe my generation — the tail end of the Baby Boomers — is frankly oppressive to our children’s generation. The Boomers have set the demographic tone ever since they were born, and we continue to to set it today. Is that healthy? I have my doubts. In particular, one has to wonder whether the presence of a senior generation has suppressive effects on fertility rates. Are we just taking up too much space?

Probably a moot point at the end. To hell with Logan’s Run. We’re the Baby Boomers, and we’ll be dictating terms until we die.

Ohp!!!! A recession brought Underdog Hamilton out of hiding in the Laguna Mountains. Quicker than Lawrence Kudlow when the old gang calls him for a “smash and grab” of the local pharmacies.

https://www.youtube.com/watch?v=Pa1fH0SvGPg

Why does that 1st villian remind me of Peter Navarro?

One should hope for a mere recession. I fear it will be much worse

Our fearless “leader” tells us that the economy will roar back shortly. Of course he predicted that only 15 people would catch this virus.

The cure, economic shutdown, might be worse than the disease. After all, unemployment and recession may kill more people than coronavirus.

Gee – copied and pasted straight from Kelly Anne Conway’s Powerpoint presentation!

Sammy is not the only one echoing Trump’s new line:

https://talkingpointsmemo.com/news/texas-dan-patrick-grandparents-sacrifice-lives-coronavirus-economy

Texas Lieutenant Gov. Dan Patrick (R) made the astonishing argument on Monday night that the elderly ought to be willing to die from COVID-19 for the sake of the economy. During an interview with Fox News host Tucker Carlson, Patrick argued that social distancing measures against the coronavirus should be lifted to let Americans go back to work, even if it means older people becoming infected with the illness. “Those of us who are 70+, we’ll take care of ourselves but don’t sacrifice the country,” Patrick said. “Don’t do that. Don’t ruin this great American Dream.” The lieutenant governor asserted that grandparents have a “choice” to make in the face of “total collapse” in the economy.

My kids at least know that their grandparents survived the Great Depression only to go and save the world from Hitler. So no – they deserve our support.

Patrick himself is 69 years old so maybe he should just take his own advice and die.

sammy Yours was truly one of the most brain dead comments I’ve heard yet. To begin with, economies are immortal and will always recover sooner or later. Not so with COVID-19 patients. For some there will be no recovery. Secondly, there is no reason why unemployment should kill anyone unless Mitch McConnell is feeling especially evil. The government has the resources to feed and shelter people. Perhaps not in the custom to which they aspire or desire, but living is better than not living. A lot of our GDP is geared around nonessential activities that could be shutdown, such as closing theaters, restaurants, spas, tattoo parlors, hair salons, yoga classes, Forever 21 and 99% of the stores in a typical mall. You’ll notice that a lot of those sectors involve personal services that involve close contact with people. Many people can work from home. Many people work in relative isolation, such as truck drivers delivering critical goods. Even factory workers can be spread out temporally in order to simulate spatial separation. You are simply invoking a false choice because you wear a MAGA hat and you’re just following orders from the Central Committee at Fox Noise. Finally, you don’t seem to understand how COVID-19 works. If you’ve been paying attention you will have noticed that relatively few people have fully recovered. The mortality rate might “only” be 1%, but many of those who do recover will never be fully recovered. The damage to their lungs will be permanent, which means they won’t be as economically productive for the remainder of their lives. And those lives will be shorter. Learn how to read and understand a Kaplan-Meier curve. COVID-19 will push down that curve. Of course, if you believe Trump’s insane rants, then by all means go to one of his MAGA rallies and shake as many hands as you can find. It will simply mean one less Trump voter in November. But please don’t come in contact with any of us who aren’t so stupid as to believe anything Trump says.

The Federal government values an American life at anywhere from $7 to $11 million. Let’s call it $8 million. If COVID has a 60% infection rate, it will probably have a 3.4% fatality rate as the already inadequate US healthcare system is overwhelmed. That means 6.7 million deaths. 6.7 x $8 million is close to $54 trillion dollars.

US GDP is just under $20 trillion. so, you can shut down the US entirely for three years and you still don’t cost as much as a full-blown COVID outbreak would cost.

Okay, we need to build a robust model that also takes into account deaths from the depression to see which kills more.

People prefer passive murder to active murder, so we need to debate which is which in this case. I would argue that allowing the virus to run through the population in order to protect the DJIA is active murder while the deaths from a recession or depression are passive murder.

In any case, I invite journalists to present Trump with a list of all of America’s elderly and ask him to sign off on their deaths. That is what Trump and his band of greedy, insane supporters are suggesting. If that is what they want, then let them put their name on it. And let them go down in history as authors of a genocide.

The Fed is a waste here. It’s not a banking crisis and won’t be one. It’s vehicle’s are trash and useless. It’s a organization that needs to admit it useless and end all operations until July.

Oh my – no data again. Just raging away with your usual nonsense. Then again you tag is The RAGE!

You’ve written that before, I think. You simply don’t know what you’re talking about. Why would a massive interruption in payments, the result of a massive disruption of income, leave banks unharmed? Why would damage to the banking system have no effect on the rest of the economy? Please explain.

So, here’s what I can only guess is wrong with your thinking, since you have not fleshed out your argument. You seem to be thinking of a simply system, one in which only treating the ultimate cause of the problem is helpful. Everything else, you seem to think, will take case of itself once Covid-19 is sorted out, and nothing that is not aimed at sorting out Covid-19 will do any good.

The economy is not a simple system. Economies involve serious positive feedback mechanisms which need to be interrupted to prevent problems from compounding. The Fed is attempting to interrupt several of those positive feedback mechanisms, including a shortage of dollars, a sharp rise in payment risk resulting in a deterioration in collateral, a drop in financial liquidity, collapsing hedging strategies, a withdrawal of credit and so on.

Is it your view that none of these mechanisms exist, or that they are not at work now? Please, enlighten us. What the heck are you going on about?

Dear James, you quite rightly underline that ” U.S. oil companies have announced big spending cuts.”

In a recent billet (“Secular stagnation post COVID-19, and oil : just stagnation ? Really ?” on my Linkedin ; or on ASPO website : https://aspofrance.files.wordpress.com/2020/03/version-aspo-secular-stagnation-larry-summers.pdf ), I comment a recent article by Larry Summers an secular stagnation.

COVID-19 could trigger a “dearth of investments” in the Oil & Gas industry. With immense middle term and long term consequences, as you are the man who knows best …

I have translated your billet in french :

Faire face au choc économique du COVID-19

https://www.linkedin.com/pulse/faire-face-au-choc-économique-du-covid-19-par-le-prof-michel-lepetit/?published=t

Interesting, and disturbing, case history of how quickly the virus can spread.

NYT: Party Zero: How a Soirée in Connecticut Became a ‘Super Spreader’

https://www.nytimes.com/2020/03/23/us/coronavirus-westport-connecticut-party-zero.html?action=click&module=Spotlight&pgtype=Homepage

Excerpt:

About 50 guests gathered on March 5 at a home in the stately suburb of Westport, Conn., to toast the hostess on her 40th birthday and greet old friends, including one visiting from South Africa. They shared reminiscences, a lavish buffet and, unknown to anyone, the coronavirus.

Then they scattered.

The Westport soirée — Party Zero in southwestern Connecticut and beyond — is a story of how, in the Gilded Age of money, social connectedness and air travel, a pandemic has spread at lightning speed. The partygoers — more than half of whom are now infected — left that evening for Johannesburg, New York City and other parts of Connecticut and the United States, all seeding infections on the way.

Westport, a town of 28,000 on the Long Island Sound, did not have a single known case of the coronavirus on the day of the party. It had 85 on Monday, up more than 40-fold in 11 days.

At a news conference on Monday afternoon, Gov. Ned Lamont of Connecticut said that 415 people in the state were infected, up from 327 on Sunday night. Ten people have died. Westport, with less than 1 percent of the state’s population, now makes up more than one-fifth of its Covid-19 infections, with 85 cases. Fairfield County, where Westport is, has 270 cases, 65 percent of the state’s total.

A recent WSJ article summarized our predicament: As Economic Toll Mounts, Nation Ponders The Trade-offs, The cost of confronting the pandemic is millions of jobs and trillions in wealth lost to save potentially millions of lives

Trump is considering easing off on social isolation policies, but Trump ally Lindsey Graham is opposed and tweeted yesterday: “Try running an economy with major hospitals overflowing, doctors and nurses forced to stop treating some because they can’t help all, and every moment … played out in our living rooms, on TV, on social media, and shown all around the world.”

As a friend put it: economic recovery is harder to accomplish with dead people. Worrying too much about the economy at the expense of containing the bug will have the effect of a broken economy and a broken healthcare system. We can try to save the healthcare system. The economy was already shaky. Now it is going to tank, but it will come back faster if people are healthier. This seems self evident to me. Maybe it isn’t.

Trump will also find that he cannot ‘order’ things to resume. Nothing he says will induce people to fly, eat out more in restaurants, attend events and, in many cases, even return to work.

Trump is now pretending that this virus mess will all end by Easter (April 12). Gee and money grows on trees.

We Are All Keynesians Now!

In the long run we are all dead. Economists set themselves too easy, too useless a task, if in tempestuous seasons they can only tell us, that when the storm is long past, the ocean is flat again.

Where are the economists capable of sailing the ship through this tempestuous ocean? Powell looks like a real captain and no doubt Bernanke is his first mate.

“Who is planning to buy a car this month?”

I am. I have placed an order and deposit on the new Corvette Stingray, as have many others. Not everyone believes we are doomed.

Lol, that barely registers. Try harder.

A bunch of transfers are the weakest form of Keynesian according to the man himself.

I believe you mean “weakest form of stimulus”.

The “man himself” did not have the benefit of decades of experience with the actual practice of his ideas. We do. Transfers to households have a fairly high multiplier relative to tax cuts. That multiplier is higher in bad times than in good. Transfers to households have the added benefit of providing an immediate increase in human welfare, We might want to keep that in mind when assessing policy.

You know – I used to try to reason with THE RAGE but to no avail. THE RAGE is not a person. It is a Russian bot.

And if the virus is as bad as all that, you will never have to worry about paying off the loan for that Stingray. Good thinking!

Reportedly Powell is paying most attention to Janet Yellen and then Benranke. She is the First Mate; he is the Second Mate. Both are being helpful. Just why did you ignore her, Paul? Is she too short for you as she was for Trump?

She initiated the reduction of the Fed’s balance sheet and started raising rates too soon. Ben got policy right once the crisis hit.

Paul,

If the rates had not been raised, they would not have been able to be reduced. The economy was growing well. It was the time move them back up towards normal territory. The situation Bernanke faces was quite different.

So it was actually conscous that you ignored her. You are reallyi an idiot. She is the best Fed Chair we have ever had.

Fwiw, my young nephew got laid off from a Honda store due to lack of sales. It has already started. Subprime banks are toast. When things rebound, it will slow growth.

“The Federal government values an American life at anywhere from $7 to $11 million.”

Bravo ExPat! A first nod to a cost-benefit analysis, which is amazing given the number of economists on this blog.

sammy You might want to work through the arithmetic. Spoiler alert: It doesn’t help your case. But then again, it’s not like you’ve ever actually done any real benefit/cost analysis, so you probably wouldn’t know how.

I would correct ExPat on one point. In a proper analysis you wouldn’t just apply the statistical value of a life against those who die. You would also have to factor in the shortened life expectancy of those who survive but have to live with diminished life prospects, disabilities, chronic pain, etc.

for those of you who appear to be moving into the “don’t let the cure be worse than the disease” thinking of the conservative echo chamber, i only request a couple of things from you. first, please volunteer at your local hospitals. they are overwhelmed, and anybody who could assist in cleaning up etc would certainly be welcome. second, please clarify that you are NOT interested in receiving medical care if stricken by the virus. this will help to alleviate the overload our healthcare system will experience. this could be your contribution to the crisis, and help save the economy.

you folks really should consider the burden you are placing on our healthcare providers. they are sinking and you simply want to compound the fact. why should they continue to sacrifice on the front lines so you can send them more patients? if you go down this path, expect healthcare workers to eventually stop the sacrifice.

It also depends on how your bread is buttered. Those people in academia, government, retirement or other jobs that are only marginally impacted by this, won’t want to take any risk at all. Lock everything down, I’ll sacrifice by cooking my own meals as, you know, “every life is priceless” maybe even nab one of those $1000 checks.

Those employed in hospitality, travel, retail etc. your cooks, waitresses, clerks are faced with $0 paychecks, and business owners faced with ruin and total loss, would have to figure out an entirely different way of “coping.”

sammy What are you talking about? Maybe Fox Noise hasn’t been covering the real news, but the $2T stimulus is all about taking care of those whose bread happens to be buttered on the wrong side. That’s what those $1200 (not $1000) checks are all about. That’s what the expanded unemployment benefits are all about. What part of that do you not understand?

We all know that you’re a rugged, individualistic, Chuck Norris luv’n kind of tough guy, but the point of locking everything down isn’t just to protect you personally. If that were the case, then I assure you no one would be arguing for a lock down. The reason we need to lock down nonessential businesses is not to protect you, but to protect other people from the consequences of your irresponsible behavior. Every society has its share of idiots, so we need laws to protect society from the current crop of Darwin Award winners.

OK, 2slugs, so the expanded unemployment insurance is going to take care of the people decimated by this? Let’s add this up: Retail employment 15.7 million jobs, Leisure and Hospitality 17.9 million jobs, wholesale trade (to support retail) 5.8 million jobs, Professional and Business services 21 million jobs, Construction and Manufacturing 21 million jobs (how long do you think these will hold up without retail?). https://www.bls.gov/emp/tables/employment-by-major-industry-sector.htm

That’s 81 million jobs out of a total of 149 million (55% of the total US jobs) for how long? 2-3 months, 18 months? that we’re going to replace the salaries of for a virus that may be no worse than a flu? Bad cost-benefit analysis.

And, like our really, really Christian President, you’re pro-life Sammy? Right? Can’t wait for Easter for that econ restart? Great holiday to connect with cost-benefit analysis.

i have noticed many of these compassionate conservatives devalue life when they must incur the cost. the lt governor in texas basically said this the other day. and yet i don’t see that lt gov going into the field to assist and possibly become exposed. but he is pretty good about volunteering others, while he stays safe inside. in the past, we had a “draft” that volunteered the life of the younger generation. now we have folks effectively creating a “draft” to risk the life of older folks.

Sammy – I’m shocked. Your cost benefit analysis skipped the only important consideration. Trump’s poll numbers. Do get in line with your “fearless” leader.

“that we’re going to replace the salaries of for a virus that may be no worse than a flu?”

sammy, it has already been established that this is a false statement. why do you continue to repeat this, ignorance? get out of the conservative talk echo chamber.

sammy, it must be assumed from your comments that you are against the $2 trillion dollar response package. if we are simply going to reopen the economy, we really have no need for any corporate bailouts. so please step up and declare your position.

sammy, i also must assume you are willing to forgo any medical treatment in the near term. it would be reckless to intentionally expose yourself to the virus but expect health care workers to risk their lives on your behalf, or the insurance companies to spend money on your health care when you intentionally took a risk that is MUCH greater than jumping out of an airplane with a parachute, which is not covered by many insurance companies.

sammy, your comments almost expose you as a foreign internet troll intentionally spreading false and misleading arguments.

sammy You’re unhinged as well as innumerate. A lot of folks in manufacturing will still be able to work. And construction workers tend to work outside, so the risk of transmitting the virus is relatively low. And we’ll still need plenty of people in retail & wholesale trade who work in essential businesses; e.g., grocery stores, pharmacies, gas stations, etc. And while a lot of food service workers will be unemployed, a not insignificant number of them will be able to keep working as delivery and carryout services expand. No one is talking about 81 million people being unemployed for 18 months. The point of shuttering down all nonessential businesses for a few weeks is to stop the rate of spread. Every year we shut down the economy one day for Xmas. If we can manage a one day shut down in order to exchange presents and eat too many treats, then I’m pretty sure we can handle two or three weeks. Acting as though this is no big deal and no worse than the flu is guaranteed to devastate the economy.

a virus that may be no worse than a flu

You’re clueless. This virus is at least an order of magnitude more deadly than the flu. And not only is it more deadly, it leaves a significant number of survivors permanently disabled. If you have any medical professionals in your family, I would urge you to talk to them instead of listening to Fox Noise and AM radio. But quite frankly, given some of the stuff that you’ve been posting across all kinds of topics I rather doubt that your family mingles with that kind of professional socioeconomic group.

Was it one of Nathan Hale’s patriotic grandchildren who said “I regret I have but one grandparent to sacrifice for my country!” ?

Living people can get back on their feet. Dead people cannot. Have you signed the DNR order and do you plan to refuse treatment if you get sick?

Folks you and us will experience a depression, a fall in output of over 10%.

The recovery wil not be sharp either. Supply chain problems and people boosting savings again will mute everything.

We are in Keynes’ world now: $2.2 trillion of fiscal stimulus and $1 trillion of monetary infusion. As Neel Kashkari said, the Fed has infinite money and is prepared to use it to counteract the crisis. We are far beyond TARP and the timid approach of 2008. Keynes would approve.

Ironic, isn’t it? The party that was so wound up about “socialism” in 2009 is now all about socialism. Good thing, too. The spike in unemployment claims this morning was way beyond expectations in anybody’s analysis that I have read over the last week or so.

Epidemiologist Neil Ferguson, who created the highly-cited Imperial College London coronavirus model, which has been cited by organizations like The New York Times and has been instrumental in governmental policy decision-making, offered a massive revision to his model on Wednesday.

Ferguson’s model projected 2.2 million dead people in the United States and 500,000 in the U.K. from COVID-19 if no action were taken to slow the virus and blunt its curve.

However, after just one day of ordered lockdowns in the U.K., Ferguson is presenting drastically downgraded estimates, revealing that far more people likely have the virus than his team figured. Now, the epidemiologist predicts, hospitals will be just fine taking on COVID-19 patients and estimates 20,000 or far fewer people will die from the virus itself or from its agitation of other ailments, as reported by New Scientist Wednesday.

Ferguson thus dropped his prediction from 500,000 to 20,000.

https://www.dailywire.com/news/epidemiologist-behind-highly-cited-coronavirus-model-admits-he-was-wrong-drastically-revises-model

sammy You obviously didn’t read the Imperial College report. Ferguson and his team did not just provide a single estimate. The provided a range of conditional estimates based on the extent to which countries were willing to engage in suppression efforts. Go to page 13 of the Imperial College report and look at the table. The 550,000 figure was the worst case “do nothing” track that Britain and the US were on at the time the report was written. In other words, the lower numbers reflect doing the very aggressive suppression efforts that you’ve been complaining about! Geez…you’re hopeless.

That works out to, oh, only another 100,000 or so deaths here. At minimum. ONLY 100,000 must warm a pro-lifer’s heart.

Putting people back to work county by county by Easter will surely mean it will be a great day for those counties where there are limited—or any—cases never having to worry about contracting the virus. And, there won’t be that many deaths anyway. Brilliant!

“ONLY 100,000 must warm a pro-lifer’s heart.”

Aaaahahahahahaha!!!! You got a dark sardonic laugh out of me on that one dude. You’ve won this thread for best comment as far as I’m concerned. Eeehhehehehe. That one’s going to have me chuckling on reflection of it 5 days from now.

Sammy, We could have had a much better handle on the situation if we had properly prepared our testing ability. As it was, we have been flying blind for about a month. This has led to more infections and faulty data upon which to base a response. Our lack of testing capacity has been deadly and expensive-and could have been avoided.

I’ve criticized both China and Russia for underreporting (I view China slightly more harshly, because I have personal experience with how much the government (province level and Beijing level) LIES regularly, and.because of the “wet markets” being the birthplace of the virus, and Beijing authorities having since the SARS mess (about 2002-2203??) to fix the “wet markets” problem. This is our second round here on “wet markets” in China triggering these situations. Does that mean I think COVID-19 should be tagged with a regional name?? NO, I am strongly against that. But I think if we really want to “score” this one, it’s 60% Beijing’s fault, 40% “ROW” blame. OK, that is how I feel on it.

Having said all of the above, there are systemic problems, inherent to the U.S.A nation ALONE, which are making the problem worse, and which America has no one to blame, but herself.

https://www.buzzfeednews.com/article/nidhiprakash/coronavirus-update-dead-covid19-doctors-hospitals

*I obviously intended to type SARS was roughly around the 2002-2003 time frame, sorry for the crude error. I guess it would have been like the Black Plague if it went that long, eh??