Today, we are pleased to present a guest contribution by Steven Kamin (AEI), formerly Director of the Division of International Finance at the Federal Reserve Board. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affiliated with.

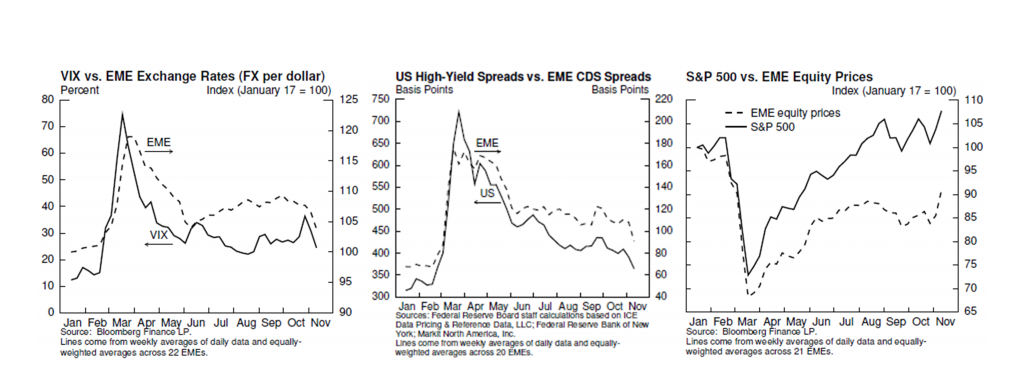

The eruption of the Covid-19 pandemic early last year was a triple whammy for the emerging market economies (EMEs): it directly threatened their public health and economic activity; it pushed the global economy into recession and undercut their export markets; and it triggered a spike in global financial volatility which threatened to cut off their capital flows. The financial spillovers from the turmoil last March are clearly evident in Figure 1. Risk-off swings in U.S. markets led EME currencies to depreciate, credit default swap (CDS) spreads to widen, and EME equities to follow U.S. stocks downward.

Figure 1: U.S. and EME Financial Variables

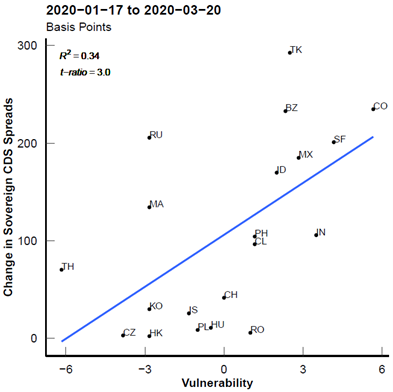

As usual, EMEs with greater fiscal and financial fragility were hit hardest. Figure 2 shows the strong correlation between a measure of this vulnerability developed by Ahmed, Coulibaly, and Zlate (2017) and the rise in EMEs’ CDS spreads between mid-January and mid-March.

Figure 2: EME Credit Risk and Vulnerability

Beginning in mid-March, advanced-economy financial markets rebounded in response to aggressive monetary easing, announcements of fiscal stimulus, and indications the pandemic might be easing. This led to improvement in EME financial markets as well. But the pandemic is not yet over, and with caseloads resurging around the world, there is a question of whether global investors might again pull back from the most strongly afflicted economies.

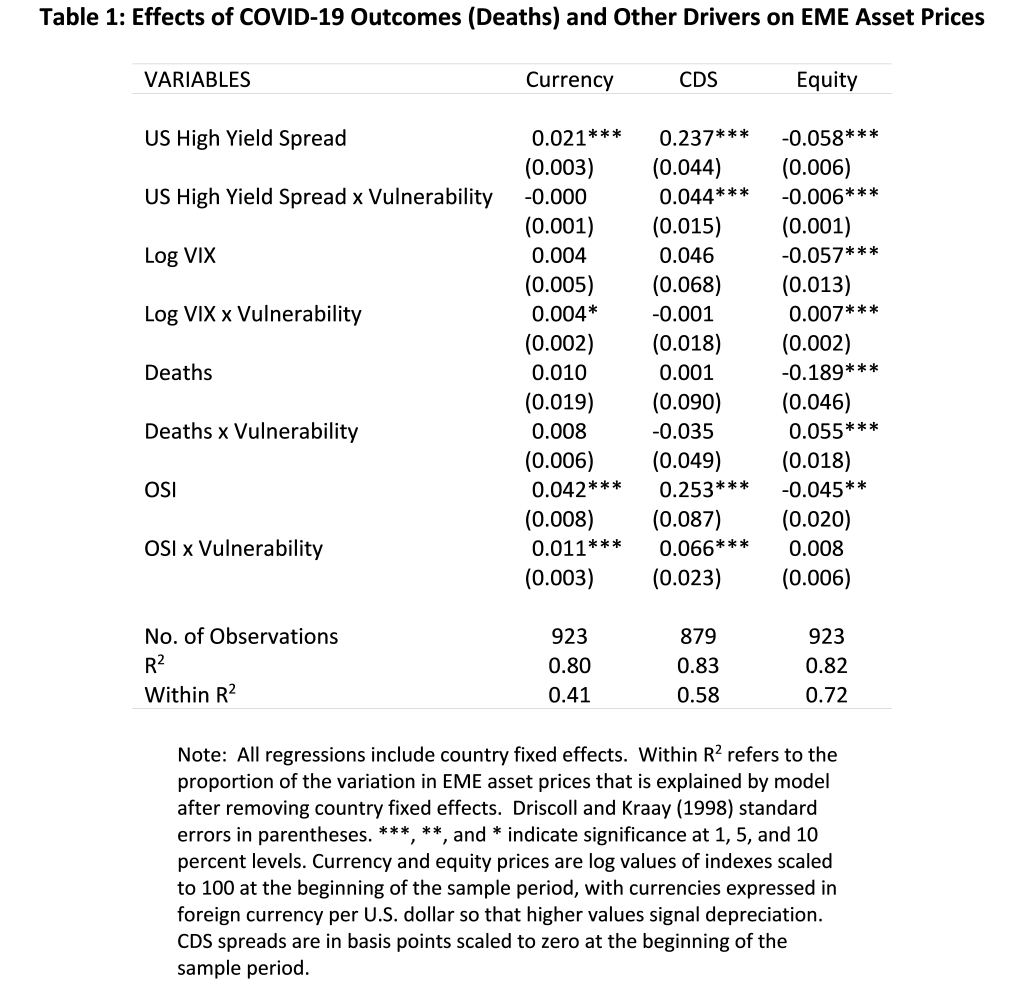

Accordingly, my co-authors – Shaghil Ahmed, Jasper Hoek, Ben Smith, and Emre Yoldas – and I are assessing how much of the evolution of EME financial markets last year owed to spillovers from advanced-economy markets, especially the U.S., and how much to the spread of the pandemic itself. (See our Federal Reserve working paper, “The Impact of Covid-19 on Emerging Market Economies’ Financial Conditions” for more details.) We estimated panel regressions in which exchange rates, credit spreads, and equity prices in 22 emerging market economies were related to: (1) measures of U.S. financial markets (the VIX and high-yield corporate spreads); (2) the Ahmed-Coulibaly-Zlate measure of EMEs’ vulnerabilities; and (3) country-specific measures of COVID-19 cases and deaths from the Johns Hopkins Coronavirus Resource Center and the corresponding measures taken to restrict that spread—the Oxford Stringency Index, or OSI.

Table 1 presents the estimation results (updated from those in the working paper). Wider U.S. high-yield spreads were associated with a weaker EME currencies, rising CDS premiums and lower equity valuations, and such effects generally are stronger for more vulnerable EMEs (as indicated by interaction variable, US High Yield Spread x Vulnerability). Similar observations apply to the VIX index, though it seems less influential. Pandemic deaths generally are not statistically significant; the same is true of equations using pandemic cases (not shown). However, the OSI variable exerts consistent and statistically significant effects on EME financial conditions: More stringent restrictions depreciate currencies, widen CDS spreads, and depress equities.

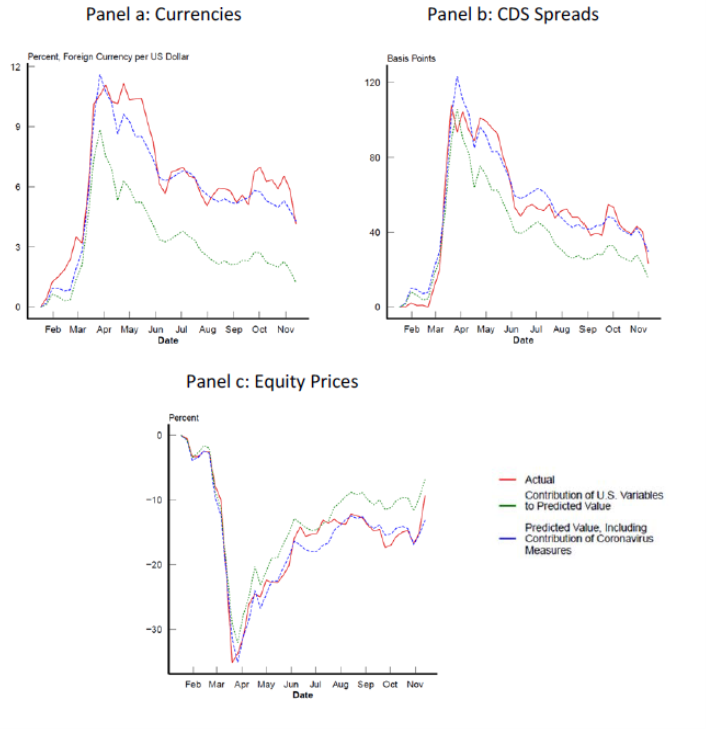

Using the regression results in Table 1, Figure 3 below compares the average actual paths of EME financial variables with (1) the predictions of our estimated regression model, and (2) the contributions to those predictions, based solely on the movements in the U.S. financial variables. The models do a good job of tracking the broad contours of financial market developments in the EMEs. And it is clear that the basic trajectory of those developments largely reflects the movements in the U.S. financial variables. But the gap between the contributions of the U.S. variables (green lines) and the overall predictions of the models (blue lines), which represents the contribution of the coronavirus variables (particularly the pandemic restrictions), suggests that these factors have added to downward pressures in EME financial markets.

Figure 3: Actual and Predicted Changes in EME Financial Variables Since the Outbreak Began. Note: Coronavirus measures come from deaths per hundred thousand and Oxford Stringency Index values.

All told, our findings reinforce concerns that emerging financial markets are vulnerable both to renewed surges in global financial volatility and a worsening of the pandemic in the EMEs themselves.

This post written by Steven Kamin.

Really nice paper.

I am wondering whether the beginning of the Regional Comprehensive Economic Partnership (RCEP) in Asia and the African Continental Free Trade Area (AfCFTA), as well as the Belt and Road Initiative and the Asian Infrastructure Investment Bank may not allow for a significantly better development outcome in the wake of this public health crisis?

Along with the just beginning AfCFTA, the Chinese foreign Minister has finished visiting 5 African nations making investment pledges in each nation as part of the Belt and Road Initiative. There are 46 African nations that are part of the BRI. Also, Chinese coronavirus vaccines are being treated as public goods and will be there for Africans. I know how worrisome South Africa is now, but I would hope South African development prospects will not be undone. The value of the Rand, for instance, has recovered to pre-pandemic levels.

@ ltr

You know, I have said here numerous times, to the point everyone here is no doubt sick of it, I spent some years in China, and really actually, when I’m not drinking and my mind is wandering over certain overly bumpy cobblestone roads (or unmarked deep holes in pedestrian sidewalks, in the metaphorical sense……), pretty willing to extend myself (courtesy-wise) to Chinese people, Chinese Americans, mainland Chinese, Taiwanese, or otherwise. And I’m not against this in the sense, I don’t want Menzie to filter you. But how in the hell you imagine this blathering benefits Chinese interests or advocates for the better treatment of Chinese people, I’ll be damned if I can figure it out.

Most of China’s activities in Africa are of a “loan-shark” nature, or “payday loan outfit” nature, and do not endear Chinese to Americans or ANY global citizen. These are things I try NOT to have my mind wander over very much, for an uneasiness that they might change my deep love and admiration for the average/”typical” Chinese person.

https://www.wsj.com/articles/chinas-sinovac-covid-19-vaccine-is-50-4-in-late-stage-brazil-trials-11610470581

Here’s a message you can send to Beijing ltr~~~Please Beijing, DO THE WORLD A HUGE FAVOR, AND STOP DOING US “FAVORS”, ok???

‘Most of China’s activities in Africa are of a “loan-shark” nature, or “payday loan outfit” nature’

That is one heck of an allegation. I’m not saying that China is getting a great deal for itself but one would hope someone is looking at the actual economic with respect to who benefits from China’s investment into the African economy. Maybe our host knows of some of this research.

Latin American countries have recorded 4 of the 13 highest and 6 of the 25 highest number of coronavirus cases among all countries. Brazil, Colombia, Argentina, Mexico, Peru and Chile.

Mexico, with more than 1.5 million cases recorded, has the 4th highest number of cases among Latin American countries and the 13th highest number of cases among all countries. Peru, with more than 1 million cases, has the 5th highest number of cases among Latin American countries and the 18th highest number among all countries. Mexico was the 4th among all countries to have recorded more than 100,000 and 130,000 coronavirus deaths.

January 14, 2021

Coronavirus (Deaths per million)

US ( 1,199) *

Brazil ( 971)

Colombia ( 928)

Argentina ( 994)

Mexico ( 1,056)

Peru ( 1,161)

Chile ( 901)

Ecuador ( 801)

Bolivia ( 807)

* Descending number of cases

Initially I was pretty angry at the botched distribution and administration of the COVID vaccines, the buck decidedly stopping in Trump’s office.

Then I realized that what the CDC is attempting is pretty remarkable in these times. Despite Trump, they are pursuing an ethical approach to distributing the vaccine first to those who are most at risk—healthcare workers, the elderly, etc. The problem is that there is no distribution system in place, and it has to be developed on the fly.

If this had been a traditional capitalist roll-out, the vaccine would first have been offered at a steep price to those who could most afford it. However, in our system of corporate welfare, it was to be expected that the captains of industry and the 1% would receive vaccines first and at no charge (of course, this may already have happened, unbeknownst to us.) The rest of us would have had to wait our turn, regardless of our vulnerability.

Despite Trump, the CDC’s ethical approach seems largely to have prevailed, and they deserve to be praised.

Now if we could only get the Federal Reserve to adopt a similar approach, instead of just giving low rates to Wall Street banks and letting them lend as they please, first and foremost of course to speculators and to corporations for stock buy backs. A more ethical (and practical) approach would include getting more loans to SMEs and lower rates to credit card holders, who could use what was saved on debt service for increased spending.

I mean, the Fed has only had most of a century to figure this out and many crises in which to develop and perfect a way to widely distribute money and low rates to those who would take advantage of the opportunity to make productive investments and make purchases to help prop up demand in the absence of fiscal stimulus.

If the CDC can do it, why can’t the Fed?

We will have to see how this distribution goes. So far, there have been a lot of hiccups. But of course I knew you were just setting this up for your daily attack on Wall Street. I hope you had you daily cup of orange juice to go along with your usual blather.

Apparently pgl sees nothing wrong with the Fed’s trickle down monetary policy. How predictable!

I love it when know nothings like you spout off. Do a little homework dummy. I wrote just last week that the 30-year mortgage rate was 2.65%.

Back when Amazon bought Whole Foods it took borrowed using 30-year debt and its interest rate was over 4%. OK that was back then and rates are lower today. Amazon just took out some more long-term debt and guess what its interest rate was. Try 2.7%. You can check out its forms 424B5 etc. at http://www.sec.gov.

Oh wait – you do not even know what the SEC even is. Never mind.

Stiglitz commenting on the Fed: “ They should have focused more on improving the channel of credit to make sure that money was going to small and medium-sized enterprises They should have said to the bank—like some other countries have done—if you want access to the Fed window you have to be lending to SMEs. You have to be making sure the money isn’t going to land speculation, real-estate speculation, not going abroad, not going to hedge funds, and so forth. ”

https://www.theatlantic.com/business/archive/2016/04/stiglitz-inequality/479952/

But pgl doesn’t care enough about making low interest rates widely available to even know what small and medium enterprises are!!!

Stiglitz commenting on the Fed: “ They should have focused more on improving the channel of credit to make sure that money was going to small and medium-sized enterprises They should have said to the bank—like some other countries have done—if you want access to the Fed window you have to be lending to SMEs. You have to be making sure the money isn’t going to land speculation, real-estate speculation, not going abroad, not going to hedge funds, and so forth. ”

Interest rates on credit cards in Nov. 2020 were 16.28%. Good job, Fed. Way to make sure that most Americans benefit from low interest rates [not]! https://fred.stlouisfed.org/series/TERMCBCCINTNS

If you’d care to read A Stiglitz rant on how credit cards companies abuse their monopoly power and the Fed accedes to it, I can show it to you.

As for low mortgage rates, they help primarily America’s affluent. Low wage workers mostly pay rent…and get almost nothing from the Fed’s low rates, something that pgl and his ilk seem oblivious to.

“But pgl doesn’t care enough about making low interest rates widely available to even know what small and medium enterprises are!!!”

JohnH hates it when people challenge his serial BS and acts like a spoiled little baby with these petty and dishonest attacks on people’s characters. You think Trump does this petty BS a lot – not as much as the whining we call JohnH. All of this because I showed how home owners can get lower interest rates than Amazon.

More fact free posts JohnH? More acting like a Trumpian child? Give it a rest and do try to facts actual facts for a change.

pgl must think that Amazon is a small and medium sized business!!!

Of course Amazon got loans at really great rates. But per Stiglitz SMEs were being starved for credit in the aftermath of the Great Recession while the Fed looked the other way…just like pgl.

JohnH: Is it really the role of the Fed to overcome collateral constraints that SMEs face, or would that better be addressed by the fiscal authorities, given the risks attendant such direct lending?

Menzie. It’s a good question. Stiglitz seems to think that the Fed has in the past failed to respond to banks’ discriminatory lending. Wall Street banks seemed to be limiting access to credit based on business size. In additional, the 2012 audit of the Fed, if I recall correctly, revealed that it was willing to lend liberally to large institutions, both financial and industrial, all over the world, often using Wall Street banks as their agents.

This time around, the Main Street lending program was introduced but didn’t result in much lending to SMEs, partly because of paperwork and partly because they wanted to maintain credit standards, a high bar for SMEs during an economic crisis. I don’t know how the conflict between credit standards and lack of short term profitability could be resolved, perhaps by taking a portfolio approach to diversify the risk.

Certainly a fiscal approach could be considered, temporarily guaranteeing low interest loans or funding some kind of stop loss for a portfolio.

Initially I was pretty angry at the botched distribution and administration of the COVID vaccines, the buck decidedly stopping in Trump’s office.

Then I realized that what the CDC is attempting is pretty remarkable in these times. Despite Trump, they are pursuing an ethical approach to distributing the vaccine first to those who are most at risk—healthcare workers, the elderly, etc. The problem is that there is no distribution system in place, and it has to be developed on the fly.

If this had been a traditional capitalist roll-out, the vaccine would first have been offered at a steep price to those who could most afford it. However, in our system of corporate welfare, it was to be expected that the captains of industry and the 1% would receive vaccines first and at no charge (of course, this may already have happened, unbeknownst to us.) The rest of us would have had to wait our turn, regardless of our vulnerability.

Despite Trump, the CDC’s ethical approach seems largely to have prevailed, and they deserve to be praised.

Now if we could only get the Federal Reserve to adopt a similar approach, instead of just giving low rates to Wall Street banks and letting them lend as they please, first and foremost of course to speculators and to corporations for stock buy backs. A more ethical (and practical) approach would include getting more loans to SMEs and lower rates to credit card holders, who could use what was saved on debt service for increased spending.

I mean, the Fed has only had most of a century to figure this out and many crises in which to develop and perfect a way to widely distribute money and low rates to those who would take advantage of the opportunity to make productive investments and make purchases to help prop up demand in the absence of fiscal stimulus.

If the CDC can do it, why can’t the Fed?

“A more ethical (and practical) approach would include getting more loans to SMEs and lower rates to credit card holders”

You wrote this twice and neither time could be bothered to tell us WTF SME stands for? Please do. And please pay attention to when our host gets back to interest rate spreads as he has promised to discuss something called credit spreads. Of course dolts like you have no clue what this means so hey!

“If you’d care to read A Stiglitz rant on how credit cards companies abuse their monopoly power and the Fed accedes to it, I can show it to you.”

I have never disagreed with Stiglitz but you would not know this if you believed the liar JohnH. I guess I have to congratulate the fool for finally spelling out Small and Medium Enterprise. His preK teacher will be so proud. And yes credit card interest rates are high which is why no one should use them for long term financing. Of course losers like JohnH have to because no bank is going to extend a loan to such a dead beat.

BTW as a lover of Urban Dictionary, I had to look up SME. Small and medium business did not pop up but Subject Matter Expert did:

https://www.urbandictionary.com/define.php?term=sme

Knows the facts but cannot make a decision. Funny. Of course JohnH would never be accused of being a Subject Matter Expert as he clearly knows NOTHING factual or otherwise.

“JohnH

January 16, 2021 at 3:12 pm

pgl must think that Amazon is a small and medium sized business!!!”

Lord – did you flunk preK reading or what? I noted that a lot of people are getting interest rates on loans as low as what Amazon (an incredibly rich company). That was my simple point which our resident idiot just missed. Please learn to read before commenting again.

This is going to sound like a “backhanded” compliment, and I suppose it has a feature of that. But this may be the first time I’ve skimmed a paper from “AEI” that seemed to be well done. But I’ll also say it’s just a good paper, no matter where the authors work at. It looks for good, if not mentally challenging reading, and I don’t pretend to grasp any more than a small fraction of it yet, but I bet there’s some jewels of knowledge to be had here.

Moses Herzog: It would be better to consider the paper a product of the Federal Reserve Board — all authors were Fed economists at time of paper’s writing.

Fair enough. Looks like a good one. So many variables working simultaneously, certainly looks like a good jog for the mind (my mind anyway).

You know one thought that kind of occurs to me about this paper?? And I kind of understood it better than I thought I would at first. That when “we” (“we” here can mean more general but often times U.S. government policy) do things that help the working man in America, it’s often the case we might be doing things which help EMEs and other nations (the “working man” and blue collar guy in foreign countries). In other words, when we think of things as to how America relates to other countries, we needn’t always think of it as “A zero-sum gain”. Which is a point Menzie has been trying to communicate when we think of bilateral trade with China. That’s not to say it’s all butterflies and rainbows—sometimes one nation’s loss is another nations gain. But we don’t have to lock ourselves in that mindset, as an “automatic/reflexive assumption” when it isn’t always necessary, and even can limit possibilities to find happy middle grounds.

BTW, when I was around college age, or even slightly younger, I probably read just as much Lester Thurow as I did Paul Krugman, and even he was kind of a hero of mine. Thurow kept trying to warn us about some of this stuff. It probably didn’t turn out exactly like Thurow thought it would back in the ’80s and ’90s when he was looking out to the future. But much of what he said has held out, and we see that if we look at the educational systems of Germany now, vs the educational systems of America now. He was a proponent of the apprentice system in Germany (at least at that time) for young people who “weren’t college material”. It doesn’t matter what a nation’s political system is, if they forfeit the education of their children. And if we keep down this road that Republicans have brought us to, where public education is robbed of funding and resources and quality teachers so private school shysters can abscond with the money, this nation is going to go nowhere in very quick order. If donald trump dies choking on McDonalds chicken nuggets the Friday after he leaves the White House, there will be MORE/other “donald trumps”, because an uneducated electorate is this nation’s REAL problem, not the existence of amoral guys like donald trump—the amoral “donald trumps” have ALWAYS been part of America. But in 1955 Americans didn’t vote for them.

You can start this around the 4:55 mark if you wanna watch it:

https://www.c-span.org/video/?26284-1/us-economy-competitiveness

He once did a great interview with CBS’ “60 Minutes” but I’ll be damned if I can find it.

https://www.tandfonline.com/doi/full/10.1080/23792949.2019.1689828

December 6, 2019

A critical look at Chinese ‘debt-trap diplomacy’: the rise of a meme

By Deborah Brautigam

Abstract

In 2017, a meme was born in a think tank in northern India: Chinese ‘debt-trap diplomacy’. This meme quickly spread through the media, intelligence circles and Western governments. Within 12 months it generated nearly 2 million search results on Google in 0.52 seconds and was beginning to solidify into a deep historical truth. Stories can contain truths and falsehoods. Human emotions, including negativity bias, prime us to think in certain ways. This paper retells a series of stories about China’s international involvement, including in Angola, Djibouti, Sri Lanka and Venezuela, that challenge the media’s spin. It concludes with some suggestions about the relationship between academia and the media and policy worlds, and the need for scholars to speak ‘truth’ to ‘power’.

Deborah Bräutigam is the Bernard L. Schwartz Professor of Political Economy and Director of the China Africa Research Initiative at Johns Hopkins University’s School of Advanced International Studies.

For those who think that the US never used debt diplomacy, they should try reading John Perkins’ “confessions of an e economic hit Man.” Perkins job was to foist unsustainable debt onto third world countries to make them beholden to the US.

US officials’ accusations against China are just another instance of their double standards and unabashed hypocrisy, eagerly embraced by the US propaganda echo chamber, AKA the corporate media.

JohnH:

So you’re saying debt diplomacy’s ok?

Wait. So you actually believe Brahma Chellaneye and Mike Pence? I get it is a popular meme in some circles but …

“This man is a frothing conspiracy theorist, a vainglorious peddler of nonsense, and yet his book, Confessions of an Economic Hit Man, is a runaway bestseller.” So wrote a 2014 review in the Washington Post. Just many reviews that accused this book of falsifying history.

But of course a liar like you cannot let us know that.

Funny your BFF Moses is making a similar accusation against China but has provided nothing to back it up.

https://www.reuters.com/article/kenya-railway-china/kenya-should-renegotiate-chinese-rail-loan-parliamentary-panel-says-idUSL5N2GL3T7

https://foreignpolicy.com/2020/04/15/chinas-racism-is-wrecking-its-success-in-africa/

https://chinaafricaproject.com/2019/12/17/chinas-cobalt-mining-giant-in-the-dr-congo-is-in-trouble-again/

https://www.thecable.ng/investigation-how-chinese-miners-endangering-fct-residents-enjoy-police-protection

https://chinaafricaproject.com/2019/12/17/a-zambian-ambassador-issues-forceful-denial-that-senior-lusaka-leaders-involved-in-illegal-timber-racket/

https://qz.com/africa/1915399/kenyas-chinese-built-sgr-railway-racks-up-losses-as-loans-due/

https://www.amnesty.org/en/latest/news/2018/03/mozambique-china-mining-operation-poses-environmental-risk/

What’s the deal here pgl ???? You getting too busy with FemaleNoSpeak blog to keep up on your reading?? I can give you more links if that proves too dense of reading material for it to “register” for your sluggish comprehension. I’d give you a children’s video maybe from PBS, but it’s time consuming for Menzie to check for safe content. What’s the matter, they’re not discussing this at your white-shoe gym??

Tell you what Uncle Moses – when you finally sober up, take this up with ltr.

@ pgl

When someone provides you with links you go wandering off whistling to the sky. Don’t be a sore loser. ltr can’t help your extreme ignorance on China’s activities in Africa anymore than Georgia’s election officials could help donald trump.

If you taught your classes in the same fashion, ignoring reality, I can understand your cohabitation with Barking Dog of Virginia.

https://www.tandfonline.com/doi/full/10.1080/23792949.2019.1689828

December 6, 2019

A critical look at Chinese ‘debt-trap diplomacy’: the rise of a meme

By Deborah Brautigam

A meme is an idea that spreads from person to person within a culture, often with the aim of conveying a particular phenomenon, theme or meaning. On 23 January 2017, a Chinese debt-trap diplomacy meme was born in a think tank in northern India and was furthered by a paper written by two Harvard University graduate students who called it Chinese ‘debt book diplomacy’. The student paper was enthusiastically cited by The Guardian and The New York Times and other major media outlets as academic proof of China’s nefarious intentions. The meme began to take deep root in Washington, DC, and ricocheted beyond Delhi to Japan, all along the Beltway and again into The New York Times and beyond. Later, it was amplified, it was thundered by a US Secretary of State, it walked quietly into intelligence circles, it hovered in the US Congress and it settled in the Pentagon. All these people became very worried about this idea, about this meme. By November 2018, a Google web search generated 1,990,000 results in 0.52 seconds. It was beginning to solidify as firm conventional wisdom and to be accepted as a deep historical truth.

This paper explores this meme, Chinese ‘debt-trap diplomacy’, the claim that China deliberately seeks to entrap countries in a web of debt to secure some kind of strategic advantage or an asset of some kind. It examines the meme’s rise, spread and the underlying phenomena it purports to capture. The paper will also establish the larger context by retelling some of the more well-known myths and narratives about Chinese lending, stories woven to explain things that observers do not understand all that clearly….

Wow Moses and his new BFF JohnH has decided just today to spread unfounded accusations against China similar to those made about the US by John Perkins. BTW – many reviews of Perkins book cast doubt on his claims too.

I’m not sure I would trust a couple of people in India any more than I would trust Perkins book.

https://news.cgtn.com/news/2021-01-10/Wang-Yi-vows-to-build-China-Africa-community-with-a-shared-future-WWCfc8685q/index.html

January 10, 2021

Wang Yi: Joint efforts needed to build China-Africa community with a shared future

Chinese State Councilor and Foreign Minister Wang Yi called on joint efforts in building an even closer China-Africa community with a shared future when taking an interview with People’s Daily after finishing his visit to African countries.

The Chinese foreign minister was on a five-nation tour in Africa, his first overseas trip this year, from January 4 to 9. During his trip, he visited Nigeria, Democratic Republic of the Congo (DRC), Botswana, Tanzania and Seychelles.

Following the 30-year tradition of choosing Africa for the first overseas visit every year, Wang said this year’s visit conveys a clear signal on strengthening ties between China and African countries.

China is using concrete actions to show its special attention to China-Africa ties, Wang noted, reiterating that China firmly supports the development and rejuvenation of African countries and will always stand with all the developing countries.

Wang acknowledged the global outbreak of COVID-19 pandemic as a pressing challenge faced by both China and African countries.

He assured that China will continue providing badly-needed medical supplies, experts teams to its African friends and pledged that China will keep its commitment of striving to make COVID-19 vaccine a public product accessible and affordable to people around the world.

During Wang’s visit, China signed Memorandum of Understanding for cooperation on the Belt and Road Initiative (BRI) with Botswana and DRC separately, making the two countries the 45th and the 46th partner countries in Africa in BRI cooperation….

http://www.xinhuanet.com/english/2020-10/10/c_139430917.htm

October 10, 2020

How one Chinese-built railway is igniting economic growth in Africa

— Chinese-built Benguela Railway, a major project in Angola, constitutes the last part of the east-west transcontinental link that connects the Indian and Atlantic oceans.

— During the railway’s 10 years of construction, more than 25,000 jobs for locals were created and more than 5,000 locals received training for technicians.

— This line, which carries more than 16 million tonnes of freight per year, plays an important role in the economic development of Angola and that of Africa as a whole….

http://www.xinhuanet.com/english/2020-12/15/c_139591843.htm

December 15, 2020

China, African Union break ground on landmark project to advance Africa’s public health

— Construction of the China-aided Africa Centers for Disease Control and Prevention (Africa CDC) headquarters has commenced in the Ethiopian capital Addis Ababa.

— With China’s help, Africa is set to have a stronger public health agency in about two years to advance health initiatives and deal with disease threats.

— The project’s groundbreaking is a concrete example of China’s support for Africa’s health sector and solidarity with Africa in coping with the COVID-19 pandemic….

https://www.nytimes.com/2017/02/07/world/africa/africa-china-train.html

February 7, 2017

Joyous Africans Take to the Rails, With China’s Help

By ANDREW JACOBS

DJIBOUTI — The 10:24 a.m. train out of Djibouti’s capital drew some of the biggest names in the Horn of Africa last month. Serenaded by a chorus of tribal singers, the crush of African leaders, European diplomats and pop icons climbed the stairs of the newly built train station and merrily jostled their way into the pristine, air-conditioned carriages making their inaugural run.

“It is indeed a historic moment, a pride for our nations and peoples,” said Hailemariam Desalegn, the prime minister of Ethiopia, shortly before the train — the first electric, transnational railway in Africa — headed toward Addis Ababa, the Ethiopian capital. “This line will change the social and economic landscape of our two countries.”

But perhaps the biggest star of the day was China, which designed the system, supplied the trains and imported hundreds of engineers for the six years it took to plan and build the 466-mile line. And the $4 billion cost? Chinese banks provided nearly all the financing….

As Deborah Brautigam explained, shortly after the joyous rail opening of Ethiopia to the sea in 2017, an Indian think tank created meme would make an article mildly applauding China impossible for the New York Times. Nonetheless, there are 46 nations in Africa that are part of the Belt and Road Initiative and Chinese development projects have been and are helping to transform the continent. There will be more:

https://www.tandfonline.com/doi/full/10.1080/23792949.2019.1689828

December 6, 2019

A critical look at Chinese ‘debt-trap diplomacy’: the rise of a meme

By Deborah Brautigam

Fascinating, collectively the 46 African governments, along with the governments of Indonesia, Philippines, Sri Lanka, Cambodia, Laos and other developing nations that are part of the Belt and Road Initiative are considered to be benighted, considered to be incapable of understanding the development needs and opportunities they have and that are presented to them. Sort of Rudyard Kipling’s “White Man’s Burden” stuff. What could South Africans or Mauritians or Namibians or Ethiopians or Ghanians know about working on development projects with China. What use could a landlocked Laos or Ethiopia have for a railroad? Does Tanzania need a railroad running along the African coast? Does Mozambique need a bridge linking separate regions and giving all access to South Africa?

After all the Germans had every chance to build a Namibia, * along with building by the other African colonists who controlled all of Africa save for Liberia by 1900. Possibly the Germans and French and the like did not read Kipling. Possibly even the British failed to read Kipling.

The Chinese are helping build developing nations, profoundly so, and more, and ever so many Southern peoples are grateful.

* An explanation conveys to much sadness for me.

Correcting my carelessness:

Fascinating, collectively the 46 African governments, along with the governments of Indonesia, Philippines, Sri Lanka, Cambodia, Laos and other developing nations that are part of the Belt and Road Initiative are considered to be benighted, considered to be incapable of understanding the development needs and opportunities they have and that are presented to them. Sort of Rudyard Kipling’s “White Man’s Burden” stuff. What could South Africans or Mauritians or Namibians or Ethiopians or Ghanaians know about working on development projects with China? What use could a landlocked Laos or Ethiopia have for a railroad? Does Tanzania need a railroad running along the African coast? Does Mozambique need a bridge linking separate regions and giving all access to South Africa?

After all the Germans had every chance to build a Namibia, * along with building by the other African colonists who controlled all of Africa save for Liberia by 1900. Possibly the Germans and French and the like did not read Kipling. Possibly even the British failed to read Kipling.

The Chinese are helping build developing nations, profoundly so, and more, and ever so many Southern peoples are grateful.

* An explanation conveys too much sadness for me.

ltr,

Ehiopia was also not controlled by an outside power in 1900. Mussolini would invade Ethiopia, but that was in the 1930s. Of course while it was not formally a colony, Liberia had very close connections with the US that bordered on being colonial, with the local ruling elites being “Americo-Liberians,” former slaves (or their descendants) who came to Liberia from the US and maintained close links with people and entities in the US.

Correcting:

After all the Germans had every chance to build a Namibia, along with building by the other African colonists who controlled all of Africa save for Liberia and Ethiopia by 1900….

[ https://en.wikipedia.org/wiki/First_Italo-Ethiopian_War

The First Italo-Ethiopian War was fought between Italy and Ethiopia from 1895 to 1896. It originated from the disputed Treaty of Wuchale (1889), which the Italians claimed turned Ethiopia into an Italian protectorate. Full-scale war broke out in 1895, with Italian troops from Italian Eritrea having initial success until Ethiopian troops counterattacked Italian positions and besieged the Italian fort of Mekele, forcing its surrender.

Italian defeat came about after the Battle of Adwa, where the Ethiopian army dealt the heavily outnumbered Italian soldiers and Eritrean askaris a decisive blow and forced their retreat back into Eritrea…. ]

Barkley Rosser:

I appreciate the correction on Ethiopian independence in 1900.

ltr,

You are welcome. Yes, they did invade earlier, and they controlled what is now Eritrea for a long time, with that the basis for Eritrea gaining independence from Eithiopia after a long war many decades later. The Italian influence in Eritrea remains strong today, certainly way stronger than anywhere in Ehtiopia, with many good Italian restaurants to be found in Eritrea reportedly, at least until fairly recently.