That’s the title of a symposium in The International Economy, with Anders Åslund, Scott K.H. Bessent, Lorenzo Bini Smaghi, Jill Carlson, Stephen G. Cecchetti, Menzie D. Chinn, Lorenzo Codogno, Tim Congdon, Marek Dabrowski, Mohamed A. El-Erian, Heiner Flassbeck, Takeshi Fujimaki, Joseph E. Gagnon, James K. Galbraith, James E. Glassman, Michael Hüther, Richard Jerram, Gary N. Kleiman, Anne O. Krueger, Mickey D. Levy, Thomas Mayer, Jim O’Neill, Adam S. Posen, Holger Schmieding, Derek Scissors, Mark Sobel, Makoto Utsumi, and Chen Zhao.

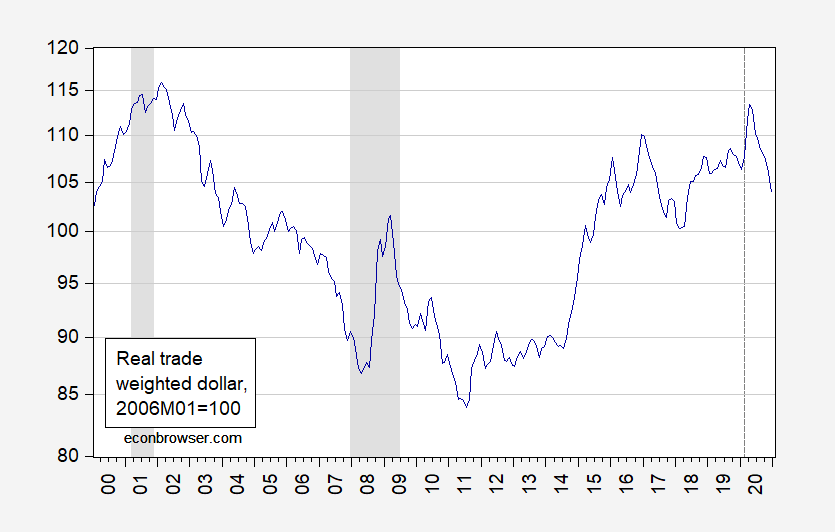

Figure 1: Real trade weighted US dollar against a broad basket of currencies, 2006M01=100 (blue). Goods & services weighted spliced to goods weighted at 2006M01. Source: Federal Reserve Board via FRED, and author’s calculations.

My conclusion here:

The foregoing does not mean the dollar’s role might not be eroded by the rise of regional currencies. In fact, that outcome seems inevitable, eventually. Nor does it mean that the value of the U.S. dollar might not decline as macro factors wax and wane—risk appetite increases, or U.S. interest rates fall relative to foreign interest rates—but in the absence of one that is sharp and persistent, that’s not a crash. In fact, a moderation in the dollar’s value is to be expected, and would encourage net exports, thereby boosting U.S. economic growth and employment.

Joe Gagnon (PIIE):

The correct metric for excessive debt is not to compare the stock of debt to the flow of income but instead to compare the interest expense to the flow of income. Debts need never be paid down, but they do have to be serviced.

On that metric, the advanced economies are in good shape. Government interest burdens, in particular, have fallen despite rising debt stocks. Indeed, a true inflation-adjusted accounting would show a negative burden, meaning that higher debt reduces a government’s budget deficit. That is the market’s way of saying “please borrow more.”

Of course, this beneficent situation may not last forever. At some point, real interest rates may return to positive territory. That is why it is important to use the debt wisely and invest in human and physical capital (education and infrastructure) that will yield high returns to society for years to come. Any increase in real interest rates likely would be gradual and would result from good news for economic growth, making it easier to undertake the needed fiscal consolidation.

And from Mark Sobel (OMFIF):

The RMB is a good candidate for appreciation. But China has an extremely weak financial system and is increasingly authoritarian. Despite increased inflows into Chinese bonds and stocks, major capital account opening runs the risk of massive outflows, depreciation, and financial instability. Chinese property protections leave much to be desired.

A major U.S. policy mistake undermining macro stability or the dollar’s reserve currency properties could sow the seeds of dollar demise. Excessive unilateral use of financial

sanctions could weaken the dollar over the longer haul.But there are now no alternatives. One day the soothsayers of doom may prove right. In the meantime, the repeated prophesies are tired.

But Adam Posen (President, PIIE) warns:

What would make the U.S. dollar crash beyond this downward adjustment in its international financial role is domestic political breakdown. Public debt levels and even current account deficits do not matter much for a large high-income democracy in and of themselves, so

long as people believe that taxes can be raised if needed. That probability is what has kept the Japanese economy afloat even as public debt levels went above 200 percent of GDP. If due to a contested election or a divided partisan Congress the United States repeatedly cannot pass budgets in 2021, that portends badly for the dollar, just as it

would for any other economy.

“The correct metric for excessive debt is not to compare the stock of debt to the flow of income but instead to compare the interest expense to the flow of income.”

Some would write this as

The correct metric for excessive debt is not to compare the stock of debt to the flow of income but to the present value of expected value of the primary surplus (taxes – noninterest spending). This captures the argument about real interest rates as well as that last quote about our politics and the possibility that we might raise tax rates enough to cover spending plus interest.

I was in part referring to Posen who also wrote:

“That probability is what has kept the Japanese economy afloat even as public debt levels went above 200 percent of GDP.”

I seem to recall someone over at Mark Thoma’s place named JohnH freaking out over Japan’s debt/GDP ratio. Of course markets have not been freaking out as evidence of Japan being able to keep its interest rates low. Then again market participants often know basic finance.

Japanese interest rates have gotten so low, the Japanese Ministry of Finance is on the verge of actually making money on its national debt, if it is not in fact already doing so.

Actually I saw Japan as a good predictor of where the US is heading, giving us 5 years of advanced warning. Many were disparaging Japan because its GDP growth is low. But it’s per capital GDP was rising due to a declining population. Unfortunately, because of poor distribution of income, Japan has long regarded itself as a “rich nation, poor people.”

JohnH,

Latest Gini coefficient for Japan was estimated in 2018 at 29.9, which is quite low by global standards. There has been some increase in inequality in Japan over the last several decades, but Japan is not a nation that can be characterized as you do here as having a “poor distribution of income,” not compared to most other nations anyway.

Please do not bother this troll with facts. He just gets angry and starts hurling pointless insults.

The World Bank has this handy 2019 list of Gini coefficients by nation:

https://data.worldbank.org/indicator/SI.POV.GINI

It took me all of 5 seconds on Google to find this but actual research is something JohnH refuses to do.

A very good discussion on Japan’s approach to insure that more equal distribution of income that you noted:

https://www.weforum.org/agenda/2015/03/why-inequality-is-different-in-japan/

Something else that JohnH never read before spouting off his usual stupidity.

pgl,

That WB Gini for Japan is 32.9 but from 2013. In general the nations more equal than it are mostly the more egalitatian western European ones as well as some of the former or communist ones, which are sharply bifurcated, with some among the most equal, like Czech Republic at 24.7, but others highly unequal with some of those among the former or current communist ones, with both Russia and China at 38.5, although last numbers I saw for them had both of them with the US over 40.

You foresaw this? Please. Where did you publish this prediction. Unless your name is Paul Krugman.

Minzie,

I am unable to access the Symposium, link not working for me at least. I am curious what Jamie Galbraith’s position is.

Also, were there any of these folks who are predicting a major dollar crash, or are they all more nuanced like you are?

Barkley Rosser: Sorry – link is now fixed.

Thanks, Menzie. Looks that a few think there is a possibility but the most pessmistic and forecasting a possible crash seems to be Congdon, who dragged out a full-blown monetarist argument. I did not know he was such a monetarist. Wow, claiming Milton Friedman was right about money and prices, whew, how out of date can one get?

https://fred.stlouisfed.org/graph/?g=sc98

January 15, 2018

Real Broad Effective Exchange Rate for United Kingdom, Euro Area, United States and China, 2007-2020

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=sc96

January 15, 2018

Real Broad Effective Exchange Rate for United Kingdom, Euro Area, United States and China, 2000-2020

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=q7oy

January 15, 2018

Advanced and Emerging Country Trade Weighted Price of an American Dollar, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=q6BD

January 15, 2018

Real Advanced and Emerging Country Trade Weighted Price of an American Dollar, 2007-2020

(Indexed to 2007)

Kevin Drum just gave us the sad news that his time blogging for Mother Jones ends in a couple of weeks. Kevin has been giving us an informed COVID19 updates on a daily basis plus some insightful information on a host of other issues including the data showing the police are a lot more brutal to leftwing protesters than to rightwing racist protestors. But on the economic front, here is an interesting tidbit that economists should look into. Market valuations for not only Tesla but also the entire automobile sector is up. I get higher interest rates and low gasoline prices but what else could be driving this?

https://www.motherjones.com/kevin-drum/2021/01/raw-data-the-auto-industry-doubled-in-value-last-year/

pgl,

Gasoline prices have been rising noticeably very recently, with this reflecting the substantial recent rise in crude oil prices. After sitting for a long time around $40 per barrel, Brent crude is pushing close to $60 now, and WTI is now over $50 as well.

At least Drum’s profile picture, he’s still a young cat, so surely he’s going to another publication/website?? I can’t imagine he’s stopping altogether. Unless he’s going to a “premium” site behind a paywall. That’s what really bummed me out when Torsten Slok went to Apollo. I’m happy for Torsten if that means career progression, but it kinda sucks when you like reading his writings.

He told us he would go back to his original independent blogging. Maybe he will bring back Calpundit!

Drum says he’s going to start a blog. Interesting coincidental timing since I see a lot of other writers doing that lately–and no I am not trying to be funny on that.

Starting a blog? Lord – you need a refresher on the history of blogging. Kevin started something called Calpundit back in 2003 which got noticed by some of the big shot economist bloggers as this journalist was very good at knocking down the supply side BS from Bush43’s “economists”.

So in 2004 he was hired by Political Animal where he continued to write some great blog posts, which later landed him at Mother Jones.

Kevin Drum was one of the pioneers among independent bloggers and is now retiring to his roots.

Right, but back then they didn’t have patreon, paypal etc where it turns into a money operation for the guys who have a good following. I suspect that’s why he’s making the change. There’s been too many big name guys doing that lately for me to buy the health timing etc.

And I doubt he’s going to call it “Calpundit” nobody cares about that crap now. That’s why you see things like “Medium” now instead of the old clunkers like Blogspot. They wanna get paid.

As long as other nations think of these things as kosher behavior:

https://www.voanews.com/east-asia-pacific/voa-news-china/hong-kong-publisher-democracy-advocate-arrested

https://www.newyorker.com/culture/the-new-yorker-interview/alexey-navalny-has-the-proof-of-his-poisoning

https://www.wsj.com/articles/north-korean-leaders-slain-half-brother-was-said-to-have-been-a-cia-informant-11560203662

https://www.theguardian.com/world/2020/dec/28/wuhan-citizen-journalist-jailed-for-four-years-in-chinas-christmas-crackdown

…….. then the USA dollar will reign supreme. If we decide we want MAGA crony-capitalism and to decimate our own public education system by robbing it of funding and resources and well-paid teachers, then we can expect people will find other places to park their money and asset values.

January 16, 2021

Coronavirus

US

Cases ( 24,306,043)

Deaths ( 405,261)

India

Cases ( 10,558,710)

Deaths ( 152,311)

UK

Cases ( 3,357,361)

Deaths ( 88,590)

France

Cases ( 2,894,347)

Deaths ( 70,142)

Germany

Cases ( 2,038,645)

Deaths ( 47,121)

Mexico

Cases ( 1,609,735)

Deaths ( 139,022)

Canada

Cases ( 702,183)

Deaths ( 17,865)

China

Cases ( 88,118)

Deaths ( 4,635)

Keep up the good work. And even though WHO says it’s complete erroneous info, please avoid ice cream. I’m sure it will be KFC or some other popular western food outlet next at the center of contagion, so please, celebrate ignorance and xenophobia OK?? We wouldn’t expect anything less from Beijing:

https://www.abc.net.au/news/2021-01-18/china-reports-109-new-covid-19-cases-ice-cream/13066672

Also be careful, pale ghost western man likes sugary food, man bringing dessert is sign of evil white man ghost. If your children like McDonald’s french fries it’s an omen white devil has captured their soul. If your child has craving for sugar, bring them Bing Tanghulu to eat– QUICKLY!!!!!

https://images.app.goo.gl/fXbLCHedxPEG2Z3Z8

…….. or white ghost devil man will inhabit your home on the 4th of every month!!!!! Quick!!!!! Head to “hospital” which looks like a mobile home style constructed warehouse where you will lay 2 feet from other Covid-19 patients, before it’s too late!!!!

January 16, 2021

Coronavirus (Deaths per million)

UK ( 1,301)

US ( 1,220)

France ( 1,073)

Mexico ( 1,072)

Germany ( 560)

Canada ( 471)

India ( 110)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 8.6%, 2.6% and 2.4% for Mexico, the United Kingdom and France respectively.

https://news.cgtn.com/news/2021-01-17/Chinese-mainland-reports-109-new-COVID-19-cases-X7kHkdSxyw/index.html

January 17, 2021

Chinese mainland reports 109 new COVID-19 cases

The Chinese mainland on Saturday recorded 109 new COVID-19 cases – 96 local transmissions and 13 from overseas, the National Health Commission said on Sunday.

Among the domestically infected cases, 72 were reported in northern Hebei Province, 12 in northeastern Heilongjiang Province, 10 in northeastern Jilin Province and 2 in Beijing.

A total of 119 new asymptomatic COVID-19 cases were recorded, while 746 asymptomatic patients remain under medical observation. No deaths related to COVID-19 were registered on Saturday, and 17 patients were discharged from hospitals.

The total number of confirmed COVID-19 cases on the Chinese mainland has reached 88,227, and the death toll stands at 4,635.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-01-17/Chinese-mainland-reports-109-new-COVID-19-cases-X7kHkdSxyw/img/9b3ff10d5c68471bad962a7e83f4a1b1/9b3ff10d5c68471bad962a7e83f4a1b1.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-01-17/Chinese-mainland-reports-109-new-COVID-19-cases-X7kHkdSxyw/img/9e4da1aa772b4a758ba4d5d83886c291/9e4da1aa772b4a758ba4d5d83886c291.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-01-17/Chinese-mainland-reports-109-new-COVID-19-cases-X7kHkdSxyw/img/2381e3b9bcf049e19f4c9cb75737d377/2381e3b9bcf049e19f4c9cb75737d377.jpeg

January 16, 2021

Coronavirus

Massachusetts

Cases ( 465,726)

Deaths ( 13,583)

Deaths per million ( 1,971)

—————————————

January 16, 2021

Coronavirus

New York

Cases ( 1,261,668)

Deaths ( 40,800)

Deaths per million ( 2,097)

[ Branko Milanovic writes of “apathy to death,” but there is a sore need to examine and understand these apparent public health failings. ]

Maybe Mose would like to chew on this Guardian story?

https://www.theguardian.com/us-news/2021/jan/17/were-on-the-verge-of-breakdown-a-data-scientists-take-on-trump-and-biden

@ dilbert dogbert

I think it’s an interesting article. I might not 100% agree with all of it, but Turchin has got some strong arguments that I personally find persuasive. I appreciate you pointing me to it. Were your thoughts positive or negative on Turchin’s contentions?? It seems to be a slight criticism of those of us who were pro-Brexit. Which I was/am. Not because I’m anti international trade, but I don’t like how the EU is slowly debilitating democracies and national sovereignty. What the EU did to Greece and Spain is extremely dangerous. And what the EU did to Greece and Spain still hasn’t registered with a lot of semi-bright people.

And we can go back to the currencies arguments again if we like, the old Barkley and pgl “you dare to disagree with me, so that means you don’t understand”. But what people here were failing to get is, yes the UK had its own currency which gave them more power to finance their national debts—that doesn’t mean that the EU wasn’t still bullying them through trade leverage, and that can also be a very dangerous thing. Including eventually bullying them into forfeiting their own currency. Which—anyone with a brain knew is where it was going before Brexit.

Dilbert,

I have known Peter Turchin for a long time since way back when nobody knew who hw was. I have mixed feelings about his arguments here, although think his cliodynamics somewhat oversold, if still interesting.

As for Moses’s remarks, well, sure enough the bully does not understand. The euro folks had hopes for a long time of getting the UK to drop the pound , but they gave up on that a long time ago, a complete dead duck since certainly the Great Recession, if not before, and they knew that. So, no, “where it was going before Brexit” was most definitely not the EU “bullying” the Brits into “forfeiting their own currency.” Sorry, but Moses indeed does not understand that this claim is indeed just rank nonsense, something nobody with a brain would attempt to maintain or claim.

These are terribly worded sentences:

“The foregoing does not mean the dollar’s role might not be eroded by the rise of regional currencies. In fact, that outcome seems inevitable, eventually. Nor does it mean that the value of the U.S. dollar might not decline as macro factors wax and wane…”

Way too many uses of the word “not”. It’s not clear what you mean. I think you meant to say:

“The foregoing does not mean the dollar’s role might be eroded by the rise of regional currencies. In fact, that outcome seems inevitable, eventually. Nor does it mean that the value of the U.S. dollar might decline as macro factors wax and wane…”

I removed the second “not” in both sentences. Is that the meaning you are trying to convey? Of course, I might not not be correct.

You are reminding me of Mrs. Lewis my 5th grade English teacher. Not that good grammar is unimportant but mind you I hit my first home run ever when a team mate suggested I pretend the baseball was her head. BAM!

SteveW: Pretty sure I meant what I wrote.

It’s only confusing if the “not” (or “two” nots) refers to the same thing. The “not” is not referencing the same thing. For example, “It is overcast today. That does not mean that the sun might not peak out from the clouds.” I think most people understand those two sentences perfectly.

i.e. I see nothing wrong with what Menzie wrote, or the way he wrote it.

Latin American countries have recorded 4 of the 13 highest and 6 of the 25 highest number of coronavirus cases among all countries. Brazil, Colombia, Argentina, Mexico, Peru and Chile.

Mexico, with more than 1.6 million cases recorded, has the 4th highest number of cases among Latin American countries and the 13th highest number of cases among all countries. Peru, with more than 1 million cases, has the 5th highest number of cases among Latin American countries and the 18th highest number among all countries. Mexico was the 4th among all countries to have recorded more than 100,000 and 140,000 coronavirus deaths.

January 16, 2021

Coronavirus (Deaths per million)

US ( 1,220) *

Brazil ( 981)

Colombia ( 943)

Argentina ( 997)

Mexico ( 1,072)

Peru ( 1,164)

Chile ( 908)

Ecuador ( 805)

Bolivia ( 814)

Panama ( 1,089)

Costa Rica ( 472)

* Descending number of cases

https://news.cgtn.com/news/2021-01-17/RMB-clearing-bank-launched-in-the-Philippines-X7qjlqEZEs/index.html

January 17, 2021

RMB clearing bank launched in the Philippines

By Tao Jiale

A RMB clearing bank in the Philippines was launched in a ceremony held in capital city Manila on Saturday.

Chinese State Councilor and Foreign Minister Wang Yi, Philippine Foreign Secretary Teodoro Locsin, Chinese Ambassador Huang Xilian and Philippine Central Bank Governor Benjamin Diokno were among those present at the ceremony.

The Bank of China Manila has been established as the country’s RMB Clearing Bank to support the growing local RMB market. The initial memorandum of understanding was signed by the People’s Bank of China (PBOC) and the Bangko Sentral ng Pilipinas in 2018.

The Bank of China Manila can process the settlement of accounts and other core RMB services, such as remittance, foreign exchange, liquidity support and banknotes for local participating banks.

It can also provide local market participants with access to Chinese yuan (CNY) rate as an alternative to the China Offshore Spot (CNH) rate.

CNY is an onshore RMB currency traded within the Chinese mainland or internationally through clearing banks appointed by the PBOC, while CNH is an offshore RMB currency traded outside the Chinese mainland.

By making it easier to trade with counterparties in the Chinese mainland, Bank of China Manila can help improve the economic and trade partnership to promote development between the Philippines and China, the bank said in a notice….

My first thought as I watched the events of 06 January unfold was that in any other country, the currency would have slipped hard and financial markets would have tanked. My second thought was how hard it is explain the value of such resilience to folks without a background in relevant social sciences such as economics and political science. Or how hard it is explain the value of reputation capital and the vulnerability of said reputation capital.

It is odd how the Trump regime hurt US manufacturing in so many ways, but that by provoking an mini-insurrection and constitutional crisis, the Trump regime could end up helping the manufacturing by driving the value of the US dollar down.

“Excessive unilateral use of financial sanctions could weaken the dollar over the longer haul” (Mark Sobel, OMFIF)

I would argue that excessive and silly use of financial sanctions is already weakening US hegemony. Repeated calls that NATO allies should increase military expenditures to support US foreign policy goals threatens to further weaken US hegemony. By US foreign policy goals, I mean US special-interest group foreign policy objectives.

https://fred.stlouisfed.org/graph/?g=mGFd

January 30, 2018

Total Reserves excluding Gold for China, United States, India, Japan and Germany, 2007-2020

https://fred.stlouisfed.org/graph/?g=lwgj

January 30, 2018

Total Reserves excluding Gold for China, 2007-2020

https://www.globaltimes.cn/page/202101/1213104.shtml

January 18, 2021

China’s GDP grows 2.3% in 2020, staging robust recovery after containing virus

Chinese economy in 2020 expanded 2.3 percent, the country’s statistics bureau said on Monday, boosted by a strong recovery in the second half after consumption, investment and export all gained pace.

That made the country the only major economy in the world to eke out an expansion, while others, facing a voracious virus onslaught, contracted.

China’s accelerating economic rebound, largely owing to the government’s drastic measures to contain the virus, will help boost the confidence of all other economies where a resurgence of infection cases is still taking tolls. However, the broader rollout of Covid-19 inoculations is expected to stifle a wild spread of the contagion, economists said.

The country’s total GDP reached 101.60 trillion ($15.68 trillion) in 2020, an astonishing achievement in a depressing year.

Retail sales, a reflection of nation-wide consumption, dipped 3.9 percent year-on-year to 39.20 trillion yuan last year. Industrial added-value expanded 2.8 percent, while fixed-asset investment rose 2.9 percent to hit 51.89 trillion yuan, the NBS said on Monday.

The unemployment rate was 5.2 percent at the end of December, the same as the previous month, indicating the country needs to maintain a moderate level of fiscal and financial stimulus in 2021 to pump up the economy and shore up employment.

The world’s second largest economy returned to its pre-Covid19 trajectory of growth, by an impressive 6.5 percent from October to December, picking up momentum from an expansion of 4.9 percent for July-September, and 3.2 percent for April-June. The economy plunged 6.8 percent in the first three months last year, battered by the Covid-19 outbreak, according to data released by the National Bureau of Statistics (NBS).

“The government’s strong anti-coronavirus measures that help effectively contained the spread of the virus, the flexible counter-cyclical macro-economic policies, as well as the efforts taken to deepen reform and opening up to the outside world, have all contributed to the better-than-expected economic results in 2020,” Cao Heping, a professor at the School of Economics of Peking University, told the Global Times on Monday….

there is no dollar crash coming because countries who want to sell to the United Stated need strong $ vis a vis their currencies to be able to sell here. Ergo US trade deficits around the planet.

Ergo, the Chinese buy US treasuries to able to sell here and maintain those factories busy, and by definition those factory workers busy working rather than trying to rise up against the Chinese Communist party.

There doesn’t seem to be any imminent trigger for a dollar crash. As long as overall inflation remains relatively low or energy costs do not rise dramatically, there doesn’t seem to be a lot of pressure for more imports or exports versus today and perhaps the /Biden push to increase more domestic production may eventually improve U.S. competitiveness in areas where imports dominate now.

If the U.S. economy suddenly tanks, for any number of reasons, perhaps that affects the dollar in the basket of world currencies, but it would seem that with the availability of vaccines developed last year and governors allowing their state economies to recover, there should be a continuation of the moderate growth that was interrupted by COVID-19.

If inflation from massive stimulus programs triggers a sharp rise in interest rates, then debt servicing may require some rethinking about spending and taxes. It’s pretty obvious that, given Biden’s plan to mandate an electric plug-in fleet for America, that gasoline taxes will not be adequate to fund road infrastructure and that some form of weight-based vehicle tax might have to be implemented. Perhaps there might be a sharp rise in electricity taxes as well. Regardless, Biden’s plans look to mandate fundamental change in many sectors of the economy which may have unforeseen consequences including the relative strength of the dollar.