From an email from Tim Congdon, at the International Institute for Monetary Research (9/20):

I suggest that a more plausible figure for end-year PCE annual inflation is between 5½% and 6%. (The consumer price index – up by 4.5% in the first seven months of 2021 – may finish the year with a rise somewhere in the 6½% – 7½% area.)

The conclusion is based on the following reasoning:

In the background here is the huge overhang of excess money balances. In the year to mid-May 2021 the M3 measure of broad money increased by 35%. The evidence over many decades is that – in the medium term – the growth rates of money, broadly-defined, and nominal gross domestic product are similar. So – unless that 35% number is now followed by a big contraction in the quantity of money – the US economy will continue to be affected by two conditions, specifically,

• ‘too much money chasing too few assets’, and

• ‘too much money chasing too few goods and services’.Of course the two conditions are interrelated and also interact with each other. Our research emphasized last year that rapid money growth was likely to boost asset prices first, and that has been right. (Incidentally, to attribute the behaviour of the prices of US tech stocks to bottlenecks and supply shortages would be daft. Does one have to say these things?)

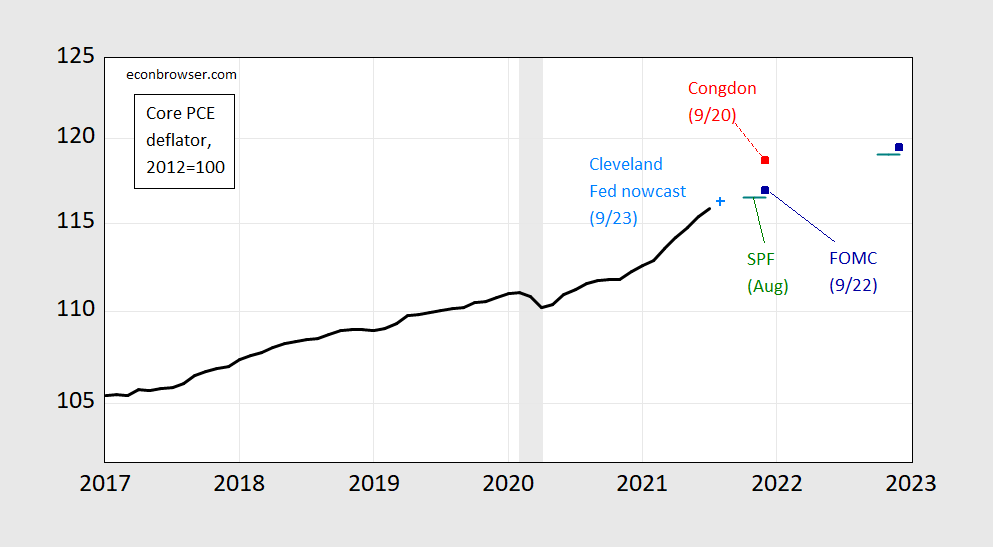

What’s the implied path of the PCE deflator, relative to nowcasts and forecasts? See Figure 1, where I’ve used the mid-point of Congdon’s forecast (5.75% December y/y), shown as the red square.

Figure 1: Personal Consumption Expenditure deflator (black), Congdon midpoint forecast (red square), Cleveland Fed nowcast as of 9/23 (sky blue +), Survey of Professional Forecasters August median forecast (green line), FOMC 9/22 projections (blue square). Source: BEA, Cleveland Fed, Philadelphia Fed/SPF, Federal Reserve, and author’s calculations.

The FOMC median forecast is surprisingly similar to the Survey of Professional Forecasters’ median forecast from the preceding month (mid-August). The FOMC members then still perceive a deceleration in inflation in the last half of 2021.

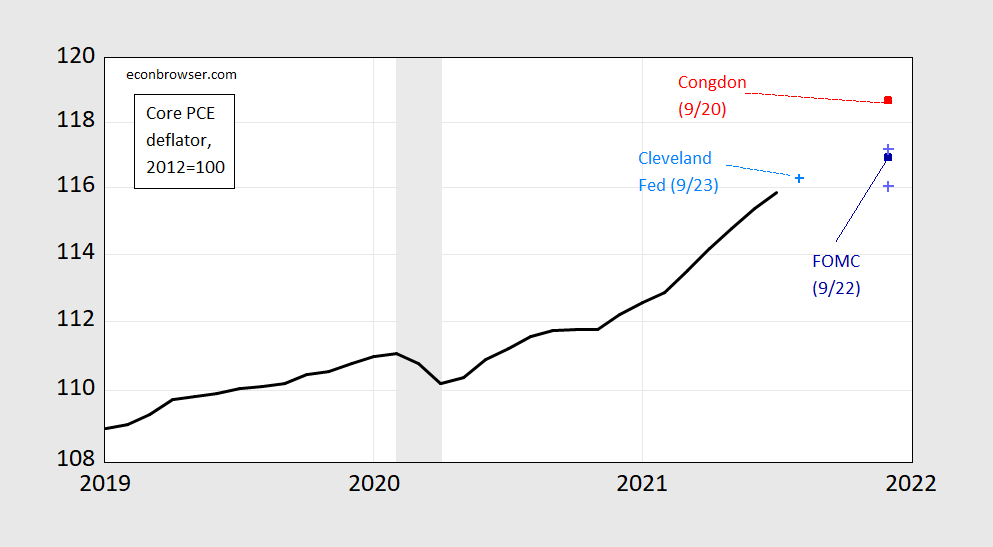

Congdon’s forecast looks plausible given the August PCE deflator nowcast (and even more using the September). However, it’s far outside of the range projected by the FOMC, as shown in Figure 2, which includes the high/low inflation forecasts.

Figure 2: Personal Consumption Expenditure deflator (black), Congdon midpoint forecast (red square), Cleveland Fed nowcast as of 9/23 (sky blue +), FOMC 9/22 projections (blue square), high and low forecasts (dark blue +). Source: BEA, Cleveland Fed, Federal Reserve, and author’s calculations.

In other words, the monetarist view (if I can use Congdon’s view as a proxy) differs from both a mixed bag of mainly mainstream economists (proxied by the Survey of Professional Forecasters) and policymakers (the FOMC).

https://fred.stlouisfed.org/graph/?g=EJsH

January 15, 2018

Consumer Price Index and Personal Consumption Expenditures Price Index less food & energy, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=DaZv

January 15, 2018

Consumer Price Index and Personal Consumption Expenditures Price Index less food & energy, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=EEyN

January 15, 2018

Global Price Index of All Commodities and Industrial Materials, 2017-2021

(Indexed to 2017)

http://www.news.cn/english/2021-09/24/c_1310206862.htm

September 24, 2021

Means of production prices rise in China

BEIJING — Most of capital goods monitored by the Chinese government registered higher prices in mid-September compared with early September, official data showed Friday.

Of the 50 major goods monitored by the government, including seamless steel tubes, gasoline, coal, fertilizer and some chemicals, 40 reported rising prices during the period, eight registered lower prices, while two saw prices remain unchanged, according to the National Bureau of Statistics.

Hog prices dropped 8.1 percent in mid-September compared with that in early September.

The readings, released every 10 days, are based on a survey of nearly 2,000 wholesalers and distributors in 31 provincial-level regions.

The chip shortage is ending. My Whirlpool contact told me they are now back to full production and going downstream to a HVAC company I am related to, all chip shortages ended in late summer.

Auto will be over by Halloween. Production of new cars will surge into 2021. Creating deflationary pressures. People like Condon don’t anticipate, they create intellectual fantasies.

And this means we will see deflation? Or did you not get what the post was about again?

“Production of new cars will surge into 2021.”

Can someone buy this bot a calendar. It is already fall of 2021!

While anecdotes from market folks are always interesting, they ought never to be taken as gospel:

https://www.washingtonpost.com/us-policy/2021/09/23/chip-shortage-forecast-automakers/?tid=ss_tw

my understanding that some of the bottlenecks have been released, but there is still a delay in obtaining chips because of the significant backorder. apparently some old chip manufacturers went offline. those machines either were difficult to bring back online or were repurposed to more valuable chips. it takes a couple of years for a new chip boundary to come online, from what i understand. anybody who has been ordering tech products over the past few months should understand this delay is still happening in real time.

Tim Congdon has never been shy about predicting high inflation. Has anyone documented the reliability of his forecasting model?

This is from one of John Cuckrant’s recent posts. See if you can find the Osmium dense irony in the following excerpt:

” Just you wait. There is the story of the hypochondriac, who when he died at 92 had inscribed on his tombstone “See, I told you I was sick.” More serious stories have been told of the 1980s high interest rates, worried for a decade about inflation that could have come but never did. Or the famous “Peso problem,” persistently low forward rates that eventually proved to be right.”

https://johnhcochrane.blogspot.com/2021/09/interest-rate-survey.html

I wonder if John “Grumpy Economist” Cuckrant has ever heard of the concept “self awareness” and/or how that relates to his continual and never ending whimpering about inflation over, oh, what, the last 20 years??? I’m guessing not.

A hypothetical… would Cochrane saying something similar to the following make him self-aware in your book?

“I must at confess that I have not been, technically not forecasting, but i have been completely doom and gloom about a drastic rise in interest rates for just as long as these forecasters have been. And the graph from Slok showing a continued poor forecasting of interest rates has not yet changed my mind. Maybe I face the same problem of a value investor who every time an equity goes down has an inclination to suggest, “now it’s an even better deal!” I guess I have company in the fact that apparently I am as sick as the man with the descriptive tombstone.”

Seriously, is that being self-aware?

Cuckrant says he’s “not forecasting”. What does that mean when Johnny Cuckrant has indeed been saying inflation would rise for the last 10 years (at the very least, probably in fact longer). I’ll give you the short-version answer sans vulgar nouns referring to Cuckrant. Claiming those weren’t “forecasts” is the coward’s way of saying “I wasn’t really wrong, because I wasn’t forecasting’ or “I wasn’t really wrong, because, well, I haven’t been forecasting” It’s like a 9 year old child refusing to pay off a football bet with his classmate because “we never shook hands on it”.

I bet the same politicians (the only people Cuckrant can find dumber than himself on the economic future of America) Johnny Cuckrant throws darts at wish they had the same luxury of being 100% wrong about inflation for 10 years running and then saying “Well, I wasn’t really forecasting”. Sounds like a man who knows he wouldn’t last 3 days at an investment bank trading desk.

So is that a “yes” or a “no” for being self-aware if Cochrane had said something similar to the above?

You’re killing me. That would be a NO.

Not self-aware enough. He is chewig the same cud as anyone who spends time thinking about money growy and price dynamics, but has not come to a conclusion. Value investors are right when they say the decline in n the price of an asset makes it a better buy. Even if the price continues to fall, the investor is better off for having avoided some of the decline. That’s not how inflation works, so poor choice of metaphor. Poor choice of metaphor does not suggest self awareness. Self-awareness would be more like “the decoupling of monetary aggregate growth from inflation over an extended period means I may simply be wrong.” Find a quote like that, qnd you’ve uncovered real self-awareness.

Moses – Cochrane is admitting he has been wrong regarding his expectations of the path of interest rates. To me he is basically saying his tombstone should read “see, I told you rates drastically rise” because he’s been wrong for so long.

macroduck – see above. Also I think you have mischaracterized Cochrane’s views. Could you point to evidence that Cochrane is coupling the threat of inflation to growth in monetary aggregates? Much of his work seems to suggest support of fiscal theory of price level.

See, this as recently published in the National Review “ For ten years, the Fed ran massive quantitative easing after quantitative easing. Inflation just sailed along slightly below 2 percent. This episode suggests the Fed has a lot less power than it thinks. But that is also a cheery view, as if the Fed’s interest-rate and bond-purchase tools are relatively powerless, then not much of what the Fed is doing will cause inflation either. In the current economy, fiscal policy and fiscal anchoring seem the greater danger to inflation than even the monetary mistakes of the 1970s.”https://static1.squarespace.com/static/5e6033a4ea02d801f37e15bb/t/605cdcfae907746a9b9e153f/1616698622428/Cochrane-NRO-inflation.pdf

And this NYTimes article from 2012: “ The Fed has created about two trillion dollars of money, set interest rates to zero, and promised to keep them there for years. It has bought hundreds of billions of long-term government bonds and mortgages in order to drive those rates down to levels not seen in a half a century… The fact is, the Fed is basically powerless to create more inflation right now… Inflation remains a danger, but not so much because of what the Fed is doing. U.S. debt is skyrocketing, with no visible plan to pay it back.” https://www.nytimes.com/roomfordebate/2012/08/21/should-the-fed-risk-inflation-to-spur-growth/inflation-should-be-feared

Cochrane even stated the following in an interview with the 5th district back in 2013…

“ I’ve been searching all my professional life for a theory of inflation that is both coherent and applies to the modern economy. That might sound like a surprising statement, especially from someone at Chicago, home of MV=PY. But although MV=PY is a coherent theory, it doesn’t make sense in our economy today.”

Cochrane is also big on expectations – maybe the recent article making a ton of buzz from a Fed staff member trashing inflation expectations is more relevant.

“And the graph from Slok showing a continued poor forecasting of interest rates has not yet changed my mind.”

Nice lecture. Lecturing always means your view is the right one. Not self aware enough – see quote above.

macroduck – apologies if you think I was lecturing by quoting Cochrane to show you he isn’t really a monetarist. I’m hopeful you’re self-aware enough to acknowledge you might’ve misattributed his theories of inflation. As to your selected quote, it seems more a case of stubbornness than lack of self-awareness (although I certainly hesitate to bring up definitions on this blog). In fact, your quote of Cochrane is hyper-awareness as he’s acknowledging his errors. But, I can tell you see it differently. Appreciate the discussion with you!

From an Alan Rappeport written NYT article on the debt limit:

“Tony Fratto, a Treasury official during the Bush administration, lamented that Ms. Yellen is operating without any leverage. Democrats, he said, appeared to have miscalculated when they thought that Republicans would be too ashamed to block a debt limit vote after supporting a suspension of the borrowing cap when President Donald J. Trump was in office.”

Strange how that works, isn’t it??? I hope this hasn’t wrecked Nancy Pelosi’s childlike innocence.

why vote ‘yes’ on anything while your adversary is making all the mistakes….

not that i accuse any gop to know who napoleon was……

I have posted on Econospeak that Schumer bungled this by taking it out of (or not putting it in) reconciliation in August, thinking he could pressure McConnell and GOP to go along. Big mistake. It will now take some time to put it back into reconciliation.

Trusting McConnell on anything is a big mistake. I would not let this turtle to even take out the trash.

The party who bungled here is Schumer, not Pelosi. It is the Senate where reconciliation matters. Schumer is the one who foolishly thought he could expect McConnell et al to be responsible. But you are just obsessed with your sexist hatred of certain older powerful women, especially Pelosi. What was it your mother did to you again, Moses?

So, if one were to tootle over to fred, call up M3 and nominal GDP and index both to, say, January 1990, one would see a chart very congenial to Mr. Congdon’s thinking. Until the 2008 recession.

His chit-chat about evidence over many decades is a way of avoiding the past decade, during which “the growth rates of money, broadly-defined, and nominal gross domestic product are” not similar. He’s cherry-picking his timeframes to make things he way he likes ’em, and not telling us.

So while Congdon may ge the inflation he wants, he has not offered a legitimate argument to back up his forecast. He has instead offered up a bunch of words to obscure the real evidence of M3 and nominal GDP going their separate ways for a decade.

Medium term my eye.

And do you know what would be great? It would be great if fred added a log function to the drop-down menu for its charts. It would save downloading data into a spreadsheet. Fred has spoiled me and I’ll be dipped if I’m gonna use a spreadsheet without complaining.

FRED has this capability built in under edit graph and then you can change units which includes ln(x).

That’s interesting. I’m slightly embarrassed to say I never noticed that before.

I think Menzie has noted this before but the FED no longer publishing M3 but here is GDP/M2:

https://fred.stlouisfed.org/series/M2V

Yea it did hover around 1.8 through 2008 but since then it has been falling like a stone. I wonder if a stone fell on Congdon’s head a few years back!

I’ve just realized what’s going on with Congdon. He’s pretty obviously thinking M3=PT. I’ve never seen it written that way before, but maybe he’s on to something…

Depends on what “T”. The usual story is money times velocity = P times real output with velocity being a constant. But velocity has plummeted as money has soared. Econned has insisted Cochrane has been searching his whole life trying to make this “theory” work. And I am still looking for a unicorn.

It’s almost always a joke when PaGLiacchi posts again. Please explain how my quoting Cochrane as saying

“ I’ve been searching all my professional life for a theory of inflation that is both coherent and applies to the modern economy. That might sound like a surprising statement, especially from someone at Chicago, home of MV=PY. But although MV=PY is a coherent theory, it doesn’t make sense in our economy today.”

Is me insisting that Cochrane has been searching his whole life trying to make this theory work??? It’s Cochrane’s words and he’s denouncing it. Read the entire article where he lists various theories and why he was ultimately driven to FTPL. You’re seriously such a clown it’s ridiculous.

P.S. – if you want me to teach you yet another lesson on how FRED works, there’s a free tip above. HonkHonkHonkHonk

The long awaited Cyber Ninja report has finally been leaked and it notes that Biden’s lead in Arizona was actually wider than what was officially reported:

https://www.msn.com/en-us/news/politics/maricopa-county-draft-of-cyber-ninjas-election-review-says-biden-won/ar-AAOLvUT?ocid=uxbndlbing

Team Trump is so utterly incompetent that they cannot rig a secretive vote recount.

https://www.nytimes.com/2021/09/21/opinion/child-tax-credit-poverty.html

September 21, 2021

Why not make the kids alright?

By Paul Krugman

Americans love rags-to-riches stories, tales of people who transcended childhood poverty to achieve adult success. Unless you’re totally oblivious to reality, however, you surely realize that such stories are the exceptions, not the rule. The disadvantages of growing up in poverty — poor nutrition, poor health care, an impoverished environment, the cognitive burden that goes along with never having enough money — can and often do hobble children for the rest of their lives.

That much is or should be obvious. What you may not know is that economists have actually quantified the damage from childhood poverty.

You see, America’s anti-poverty programs, such as they are — notably food stamps and Medicaid — weren’t rolled out all at once. Food stamps became available in some parts of the country earlier than in other parts; so did Medicaid, which was also expanded in a series of discrete jumps. This stuttering, haphazard approach to helping poor children amounted to an unintentional form of human experimentation: We can compare the life trajectories of Americans who received crucial aid as children with those of their contemporaries or near-contemporaries who didn’t.

And a number of researchers, notably Hilary Hoynes and Diane Whitmore Schanzenbach, have used this evidence to show that childhood poverty has huge adverse effects.

Last week almost 450 economists, led by Hoynes and Schanzenbach, released an open letter to congressional leaders making this point. “Children growing up in poverty,” the letter declares, “begin life at a disadvantage: on average they attain less education, face greater health challenges, and are more likely to have difficulty obtaining steady, well-paying employment in adulthood.”

In response, the letter calls on Congress to lift millions of children out of poverty by making permanent the 2021 expansion of the Child Tax Credit, which gives most parents $300 a month for every child under 6 and $250 a month for each child aged 6 to 17.

This is a really good idea….

JohnH wants us to believe economists never cover these issues. Oh wait – it is that no important economist cares about these issues. Well maybe Krugman writes about this stuff on some obscure academic forum. Wait, wait Krugman wrote this in the NYTimes? Say WHAT?!

Pgl doesn’t know the difference between “never” and “rarely.” When was the last time Krugman addressed poverty? OK…so maybe he talks about it every year or two, as befits a highly prosperous, Clinton-style limousine liberal (like pgl.) As I said…rarely.

Heck, poverty didn’t even make the list of economistsview categories! And Thoma often highlighted Krugman’s pieces. But pgl would have us believe that poverty is right at the top of liberal economists’ concerns!?!

Mark Thoma never talked about poverty? You are pathetic.

https://economistsview.typepad.com/economistsview/2013/08/poverty-and-economics.html

Two seconds on Google and a Thoma post called Poverty and Economics.

Come on folks – tell this troll to stop up with his incredibly stupid and pointless lies.

Anything research having to do with income distribution is research into poverty. Development economics is about the alleviation of poverty. A good bit on economic history touches on piverty. Malthusian economics is poverty economics.

I’ve said this before, but I guess in need to be repeated: there is lots of room for criticizing economics as it has been practiced, but you are the wrong guy for the job. You don’t know enough about economics to generate legitimate criticism. The Woody Allen word for it is “jejune”.

Your replies getting dumber and dumber. It is like talking to a rock – a really dumb rock.

Another willful misrepresentation by pgl. I never said that Thoma never talked about poverty. What I said was that the topic was never talked about enough by the economists he tracked to be worthy of a separate category at his blog. That’s a pretty good indicator of its importance to establishment economists.

Misrepresentation is pgl’s game.

And yes, poverty can be subset of income distribution but discussions of income distribution do not necessarily include poverty. Often they are about middle class vs. 1%. Poverty is something that many economists, like many affluent Americans, prefer to ignore.

https://news.cgtn.com/news/2021-09-23/El-Salvador-s-Bitcoin-folly-13Nn9YBooAo/index.html

September 23, 2021

El Salvador’s Bitcoin folly

By Jeffrey Frankel

El Salvador this month became the first country to adopt a cryptocurrency – in this case, Bitcoin – as legal tender. I say the first, because others might follow. But they should think twice, because the idea is highly dubious – and likely to be economically dangerous for developing countries in particular.

I will admit that I don’t understand the need for cryptocurrencies at all. Like many economists, I fail to see what problem they solve. They aren’t well designed to fulfill any of the classic functions of money – a unit of account, store of value, or means of payment – because their prices are so extraordinarily volatile. This volatility is not surprising, because cryptocurrencies are backed neither by reserves nor by the reputation of a well-established institution, such as a government or even a private bank or other trusted corporation.

In fact, Bitcoin and its fellow cryptocurrencies were born from an anarcho-libertarian distrust of central banks. True, many central banks, especially in developing countries, have a history of debasing their currencies. But adopting Bitcoin as legal tender makes little sense for El Salvador.

In 2001, El Salvador adopted the U.S. dollar as legal tender to ensure the monetary stability that the country’s national currency, the colón, had historically failed to deliver. The reform worked: the country’s annual inflation rate, which had substantially exceeded 10 percent between 1977 and 1995, has declined markedly since the adoption of the dollar. It has been below 2 percent since 2012, and close to zero since 2015 – a rarity in Latin America.

Giving up the monetary independence afforded by issuing one’s own currency carries costs – particularly, the loss of the ability to adjust monetary policy in response to local economic conditions. El Salvador already accepted this when it adopted the dollar. The costs would be even greater if a currency as unstable as Bitcoin were the sole national currency. But President Nayib Bukele instead decided to designate both Bitcoin and the dollar as legal tender. The logic behind that decision is surreal.

Bitcoin has not been well received in El Salvador. Domestic residents don’t want to be obligated to accept it. International markets also are unenthusiastic. Moody’s downgraded El Salvador’s debt in July, and S&P could follow suit. The spread between the interest rate that the government must pay on its debt and the U.S. Treasury rate has increased sharply since the plan to Bitcoinize was first announced in June.

There is one function that cryptocurrencies do appear to serve: facilitating illegal transactions. Needless to say, this is not a use that should be encouraged. Even worse in terms of the general welfare, “mining” cryptocurrencies like Bitcoin – which relies on so-called blockchain technology to verify transactions – requires staggeringly large amounts of energy and thus harms the environment….

https://www.globaltimes.cn/page/202109/1235018.shtml

September 24, 2021

Chinese authorities say cryptocurrency-related businesses illegal, urge exit of cryptocurrency mining

The Chinese authorities said on Friday that all cryptocurrency-related businesses are illegal and they urge the exit of cryptocurrency mining projects, as the country doubles down efforts on virtual currency regulation to fend off financial risks and facilitate improvement of the industrial structure for reaching carbon peak and neutrality goals….

https://news.cgtn.com/news/2021-09-24/Chinese-scientists-synthesize-starch-from-CO2-in-global-first-13O9q0InKlG/index.html

September 24, 2021

Chinese scientists synthesize starch from CO2 in global first

Chinese scientists have become the first in the world to develop an artificial method of synthesizing starch from carbon dioxide (CO2).

The study, * published online in the journal Science on Friday, was conducted by the Tianjin Institute of Industrial Biotechnology of the Chinese Academy of Sciences.

Starch, a storage form of carbohydrate, is the major component of grain as well as an important industrial raw material.

At present, it is mainly produced by crops such as corn and rice by fixing CO2 through photosynthesis. The process involves about 60 biochemical reactions and complex physiological regulation, with an energy conversion efficiency of only about 2 percent in theory.

The new approach makes it possible to alter starch production from traditional agricultural planting to industrial manufacturing, and opens up a new technical route for synthesizing complex molecules from CO2, said Ma Yanhe, corresponding author of the study.

“The artificial starch anabolic pathway (ASAP), consisting of 11 core reactions, was drafted by computational pathway design, established through modular assembly and substitution, and optimized by protein engineering of three bottleneck-associated enzymes,” the authors wrote.

“In a chemoenzymatic system with spatial and temporal segregation, ASAP, driven by hydrogen, converts CO2 to starch at a rate of 22 nanomoles of CO2 per minute per milligram of total catalyst, an 8.5-fold higher rate than starch synthesis in maize,” they elaborated.

Cai Tao, lead author of the study, said that the starch sample synthesized in the new method is “exactly the same as naturally produced starch in terms of its composition and physical and chemical properties.”

Theoretically, given enough energy supply, based on the current technical parameters, the annual production capacity of starch in a one-cubic-meter bioreactor equals the annual yield of starch from one-third of a hectare of corn, the team said.

If the overall cost of the system can be lowered to a level economically comparable with agricultural planting in the future, it is expected to save more than 90 percent of arable land and freshwater, according to the researchers.

In addition, it would also help to avoid the negative impact of using pesticides and fertilizers on the environment and ease food shortages, they said.

* https://www.science.org/doi/10.1126/science.abh4049

https://www.science.org/doi/10.1126/science.abh4049

September 24, 2021

Cell-free chemoenzymatic starch synthesis from carbon dioxide

By Cai Tao et al

Abstract

Starches, a storage form of carbohydrates, are a major source of calories in the human diet and a primary feedstock for bioindustry. We report a chemical-biochemical hybrid pathway for starch synthesis from carbon dioxide (CO2) and hydrogen in a cell-free system. The artificial starch anabolic pathway (ASAP), consisting of 11 core reactions, was drafted by computational pathway design, established through modular assembly and substitution, and optimized by protein engineering of three bottleneck-associated enzymes. In a chemoenzymatic system with spatial and temporal segregation, ASAP, driven by hydrogen, converts CO2 to starch at a rate of 22 nanomoles of CO2 per minute per milligram of total catalyst, an ~8.5-fold higher rate than starch synthesis in maize. This approach opens the way toward future chemo-biohybrid starch synthesis from CO2.

Chinese scientists synthesize starch from CO2

Cell-free chemoenzymatic starch synthesis from carbon dioxide

[ My understanding of this work, after carefully reading the Science paper, is that there has been a most important advance. After all, the sun synthesizes starch but the synthesis however beautiful the growth is terribly inefficient. Imagine multiplying the efficiency of production of so important a product as starch in a laboratory. The work is surely exciting, and technological development of the process would seem reasonable. ]

https://fred.stlouisfed.org/graph/?g=H4vD

August 4, 2014

Real per capita Gross Domestic Product for United States, Guatemala, Honduras, El Salvador and Nicaragua, 1980-2020

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=H3kN

August 4, 2014

Real per capita Gross Domestic Product for United States, Guatemala, Honduras, El Salvador and Nicaragua, 1971-2020

(Indexed to 1971)

Jeffrey Frankel is correct in concern about the adoption of Bitcoin as a currency for El Salvador, but what is troubling about the country and surrounding countries is the relative poorness and lack of meaningful growth year after year. Development policy – Washington Consensus development policy – simply has not worked for El Salvador and needs to be completely reexamined.

I bet no one could guess what I’m listening to tonight just as a ruse for entertainment?? Alex Jones. He’s a kooky as ever for anyone wondering, at least what I’m listening to tonight he’s not quite as pro-trump as he was. He’s going on about chemicals and fluoride toothpaste and fluoride in tap water. I have to confess to being slightly sad we can’t watch Lee Ann McAdoo on YT anymore. That was always fun.

I found out while clicking around some of these weird crazytown sites that Lara Logan (former correspondent for “60 Minutes”) is working for FOX Nation now. There’s a “shocker”. After wandering around the MidEast ignoring the cultural rules on hijabs I really thought Logan’s career would skyrocket.

https://thehill.com/homenews/media/475474-former-60-minutes-reporter-lara-logan-files-25m-lawsuit-against-new-york-media

https://twitter.com/NikkiMcR/status/1436481285254524928

I bet “60 Minutes” misses her a lot. She’s suing Media Matters for in essence quoting something a QAnon person said about her hosting something. My question is, wouldn’t the natural target for a lawsuit be the QAnon person who actually said it (assuming it was false) rather then the outfit that simply reported what the QAnon person had claimed??

She has an Emperor’s New Clothes problem, and the laughter has begun. So the only question now is “Deep pockets , no pockets. Mouse or megaphone. Hmmm…who should I sue?”

There was always something about her, that struck me as very disingenuous. And then after the MidEast incident where she was mass attacked by “fingers” it was just too much for me. I don’t think the story carries weight. The question arises—why would men attack en masse with their “fingers”?? Of course that’s rather convenient if a person was making false claims, which apparently could only be backed by 1 person of her team (who also was separated from her during the largest time stretch of her “finger” attack). What is certain is that bodily fluids are much easier to prove an attack with than “multiple mens’ fingers”.

Now before everyone jumps in to tell me what a horrible human being I am for questioning this (which, I’m sure, I am a very very horrid horrid human being), please ask yourself, what woman who had gone through such experiences, who after she had worn out her welcome at CBS, goes directly to Sinclair Broadcasting Group and FOX Nation?? Not exactly an outfit known for its friendliness to women. Is that where you would go after going through such an attack?? From MidEastern men with erogenous “fingers”?? Does tucker carlson strike anyone as “pro-woman”?? Because I’m not getting that vibe off the man. Nor multiple other men who have worked at FOX News. That’s your first choice of employer after being penetrated by force multiple times??

https://www.thedailybeast.com/tucker-carlson-sneers-at-alexandria-ocasio-cortezs-fear-of-being-raped

She’s sat down for on-air interviews with tucker carlson and even filled in as show host for carlson. Just ask yourself who does that after such an experience?? Roughly one person on planet Earth would do that after experiencing what she says she experienced.

Just for fun I was trying to look for interesting games to play if you’re into friendly wagers. The Vegas Line has Oklahoma State beating Kansas State today by at least 5 and 1/2 points. I like Kansas State to beat the 5 and 1/2 point spread. Good luck kids!!!!! And don’t take any wooden nickels.

Missed that one. K State lost by 11. Starting off 0-and-1 on 2021 football predictions. Horrid