Today, we are pleased to present a guest contribution by Steven Kamin (AEI), formerly Director of the Division of International Finance at the Federal Reserve Board. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affiliated with.

Last week’s FOMC meeting confirmed, if confirmation was even needed, that U.S. monetary policy is about to begin its tightening cycle. As Chair Powell noted in his press conference, the U.S. economy can no doubt handle this tightening: the economic recovery is going strong, household and firm balance sheets are solid, and the Fed is prepared to adjust its policy if circumstances change. But for emerging market economies (EMEs), the spillovers of rising U.S. interest rates pose a more dire threat. Many EMEs suffer from fragile public finances, precarious access to international capital markets, and prior history of defaults. These vulnerabilities have been exacerbated by lower growth prospects and higher debt in the wake of the global pandemic recession. Higher interest rates make it more costly to service higher debt levels and discourage investors from financing these payments.

Moreover, the reason for the rise in U.S. rates matters. A rise in interest rates driven by favorable U.S. growth prospects would likely be relatively benign, since the benefits of higher exports to the United States and stronger investor confidence would help offset the costs of higher rates. But the heightened prospects for monetary tightening this year are being driven instead by a hawkish pivot in Fed policy as it confronts much higher inflation than it had earlier expected. And research I’ve undertaken with two of my colleagues at the Fed, Jasper Hoek and Emre Yoldas, confirms that when higher rates are driven by worries about inflation and/or changes in Fed strategy, spillovers to EMEs are more disruptive.

To identify this effect, we looked at changes in U.S. Treasury yields following meetings of the Federal Open Market Committee (FOMC). We classified its announcements according to whether they primarily conveyed “growth” news (i.e., information about future growth prospects) or “monetary” news (i.e., information about future inflation or the Fed’s reaction function), based on the reaction of the S&P 500 equity index. FOMC announcements were categorized as conveying primarily growth news if the Treasury yield and the S&P 500 index moved in the same direction. For example, an FOMC communication that increased investor confidence about U.S. growth might cause both U.S. Treasury yields and stock prices to rise. Conversely, we classified FOMC meetings as conveying primarily monetary news if yields and equities move in opposite directions. For example, an FOMC announcement referencing rising inflationary pressure might cause yields to rise and the S&P index to fall as higher discount rates weigh on stock valuations.

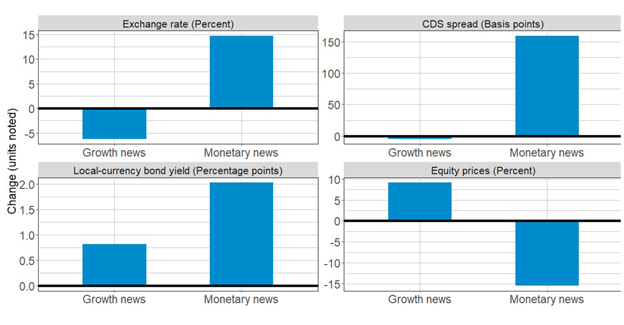

With this classification in hand, we then estimated how asset prices in 22 emerging markets over the past decade responded to movements in U.S. Treasury yields. The results are shown in the figure below, which indicates the effect of a 100 basis-point rise in the 10-year Treasury yield, following an FOMC meeting, on EME asset prices. It is clear that increases in interest rates driven by growth news are much less disruptive for emerging markets than increases driven by monetary news. In response to growth news, currencies appreciate (a rise indicates depreciation), equities rise, CDS spreads are unchanged, and bond yields move up only moderately. Conversely, in response to monetary news, all of these asset prices move sharply and adversely.

Figure 1: Effect of 100 basis point increase in 10−year U.S. Treasury yield on EME asset prices

Returning from these econometric results to the real world, it seems safe to say that the heightened expectations for monetary tightening in recent months represent a monetary shock rather than a growth shock: Since early December, the 10-year yield has risen from about 1.5 percent to 1.8 percent, while the S&P 500 has fallen about 7 percent. This is not good news for EMEs.

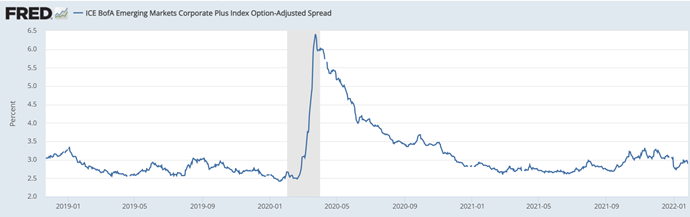

Curiously, despite the churning in U.S. markets, credit spreads for EMEs have barely budged. As indicated in the chart below, they remain near their pre-pandemic levels.

So what gives? The short answer is: no one I’ve talked with seems to know. One possibility is that although the rise in U.S. yields reflects a monetary shock, it’s a pretty small one – 10-year yields of 1.8 percent are still super-low by historical standards. Another possibility is that because U.S. households, firms, and banks are in good financial shape, they are less likely to run from riskier investments like EMEs in response to higher rates—indeed, U.S. corporate bond spreads have remained similarly dormant. Finally, maybe bond investors are simply asleep at the wheel (that happens!), and the run on EMEs will start when they wake up.

Stay tuned …

This post written by Steven Kamin.

This past year commodity and raw material prices have increased broadly, which has and should benefit many developing countries. Early last year, there was substantial debt relief for a range of developing countries. Developing countries along the Belt and Road experienced significantly increasing trade with China, and the Belt and Road, for instance, includes virtually every country in Africa. A number of important infrastructure projects are expanding and improving economic activity and well-being along the Belt and Road.

I would expect developing countries to fare relatively well through at least the initial stage of American interest rate increases.

https://news.cgtn.com/news/2022-01-31/China-Laos-Railway-transported-over-1-million-passengers-since-launch-17gtpecCVeE/index.html

January 31, 2022

China-Laos Railway transported over 1 million passengers since launch

The China-Laos Railway has transported over one million passengers and 500,000 tonnes of cargo since it was put into service in December 2021, the transport authorities of southwest China’s Yunnan Province said.

The cargo transported by the railway includes 100,000 tonnes of cross-border goods, according to the China Railway Kunming Group Co., Ltd.

The China-Laos Railway connects Kunming in Yunnan Province with the Lao capital Vientiane. It is the first overseas railway jointly constructed and operated by the two countries.

As a landmark project of the high-quality Belt and Road Initiative, the 1,035-kilometer line went into operation on December 3, 2021….

Possibly there is a lessening dependence on American financial policy in developing countries, especially Belt and Road, Asian Infrastructure Investment Bank, Regional Comprehensive Economic Partnership or African Continental Free Trade Area developing countries. Why should an Ethiopia, which America is unfortunately sanctioning in any event, a Tanzania, a Zambia, a South Africa, depend as much on American financial policy now as in 2007 or 2017?

Well isn’t that a lovely China-centrict view of the world? Everything depends on China now, does it?

Why should countries which China hopes to make dependent on China be dependent on the U.S.? “Should” isn’t really a question about facts. More a question of dogma. The facts are what Kamin is investigating. Why don’t we see where his investigation leads us and leave China’s hegemonic aspirations out of it for now?

Steven Kamin, a fine paper for which I am grateful.

I’m wondering if this could just be something as simple as central banks becoming better at “playing the game” in their own responses to U.S. rate moves?? Surely, as time goes on and U.S. rate moves become a constant thorn in their side, the nations that are sensitive to U.S. rate moves get better ameliorating the negative effects??

http://www.ipsnews.net/2019/04/russias-first-female-central-bank-governor-challenging-job/

https://news.cgtn.com/news/2022-01-01/RCEP-Asia-Pacific-free-trade-agreement-comes-into-force-16ssZOJYWpq/index.html

January 1, 2022

RCEP free trade agreement comes into force, set to contribute to post-COVID recovery

The Regional Comprehensive Economic Partnership (RCEP), the world’s largest free trade agreement, officially came into force on Saturday….

[ To include developing Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Thailand and Vietnam. ]

https://news.cgtn.com/news/2022-01-01/RCEP-Asia-Pacific-free-trade-agreement-comes-into-force-16ssZOJYWpq/index.html

January 1, 2022

RCEP free trade agreement comes into force, set to contribute to post-COVID recovery

The RCEP covers a market of 2.2 billion people with a combined economic size of $26.2 trillion, or 30 percent of the world’s GDP.

[ With the RCEP and Belt and Road partnerships, the international trade system is dramatically changing, and the way in which changing financial conditions in the United States affect developing countries would seem to be necessarily changing. ]

I have a question for our Lake Wobegone above average readership here. I saw something on ZH blog that confounded me today. Now I got my degree in finance and I normally don’t like to embarrass my alma mater by asking questions I don’t know about my related major. But can anyone tell me what the acronym “FVH2” means?? Is that a 5-year treasury note or what the heck does that abbreviation mean??

FV = CBOT five year Treasury note future

V = March

2 = 2022

March five-year Treasury future.

Much appreciated Sir.

Are these “school boards” going down to the local KKK chapter to get their members or where are these people coming from??

https://www.wsj.com/articles/maus-tops-amazon-bestseller-list-after-tennessee-school-board-pulls-graphic-novel-11643650246?mod=hp_lead_pos11

https://www.theguardian.com/world/2022/jan/31/holocaust-novel-maus-bestseller-after-tennessee-school-ban

You know there are going to be museum exhibits dedicated to Spiegelman’s work when he is no longer amongst the living?? And while Republicans continue to gut public education of funding and resources, those same Republicans drive their kids to “private” schools (funded with public/taxpayer dollars) every morning:

https://www.wsj.com/articles/teachers-are-quitting-and-companies-are-hot-to-hire-them-11643634181?mod=hp_lead_pos5

https://www.readfrontier.org/stories/stitt-wants-changes-to-the-school-funding-formula-and-student-transfer-policy/

https://progressive.org/public-schools-advocate/epic-charter-fraud-oklahoma-thompson-190806/

https://nondoc.com/2020/10/01/very-disappointing-epic-audit-claims-school-owes-state-8-9-million/

Related to the small rise in ten-year yields is the priced-in expectation of limited Fed rate hikes. The current central estimate priced in for the July 2023 FOMC rate decision is a Fed funds target of 1.75% to 2.00%. Given the FOMC’s latest core inflation projection is 2.3% for 2023 (December SEP), the real funds rate is expected to be negative in mid-2023. If the yield curve remains as it is (big if), long-end Treasury yields would be somewhat positive.

Investment-grade inflation-adjusted yields remain negative for now. EM inflation-adjusted yields are positive:

https://fred.stlouisfed.org/series/BAMLEMHBHYCRPIEY

EMs may have bigger problems if investment-grade yields turn positive.

“Investment-grade inflation-adjusted yields remain negative for now.”

Are they negative? It depends on whether you are doing expected v. actual inflation. It depends on what you mean by investment grade, what the term of the corporate debt is, etc. I get that this series represents long-term corporate debt but even AAA credit rated debt is getting 2.93% which seems to be a bit greater than expected inflation.

https://fred.stlouisfed.org/series/AAA

Baa rated corporate bond yields are around 3.7%. Not great but not negative relative to expected inflation.

EIA 914 report (monthly oil/gas producer survey) is out.

https://www.eia.gov/petroleum/production/

US production in NOV21 (report lags two months) was up a healthy 0.244 MM bopd to 11.753 MM bopd. Also, OCT21 was revised up from 11.474 to 11.509 MM bopd. So in a sense, production was up over a quarter million bopd versus (old) last month.

This is the US post covid record. But still over a million below pre covid levels. No apparent reaction by the futures markets to the report release. I expect any gains in DEC to be much more moderate (see regional comments below).

(Federal) GOM was up over 0.107 to just under 1.8 MM bopd. This is expected recovery from hurricanes. Not a real gain in regular production capacity. But sort of hiding and waiting to come back. I expect DEC to be flat-ish.

Rest of US (basically “onshore”, although there is a small amount of Federal Pacific production and some state waters near offshore within TX, LA and maybe MS, AL) was up 0.137M. Some gain gs were going on in the fall also, but were sort of cloaked by temp GOM hurricane impact. I think we’ve been doing something like 0.5-0.6 MM bopd/yr growth. (Or about 0.050-0.060/month growth.)

ND was up 0.054MM (expected from the earlier state data release) to ~1.15 (still well below pre covd record of ~1.5). I can’t recall exactly the reason for the gain. Rig count is pretty anemic up there. I think they might have some shut-in volumes (from flaring restrictions) that came back into the market with gas processing capacity/pipes. We are heading into winter now, so expect drops in DEC-FEB.

NM up 0.045MM to 1.425 and at a record (ever) level. Well ahead of ND as the number two state (at three if you consider FGOM). Still a bit below the ND pre covid record. NM is the hot area. Had a couple slow months that got the peak oilers excited. Back back to gains.

TX up 0.034 MM to just under 5 MM bopd (still about a half million bopd below pre Covid records. Complex state with Permian main driver of gains, but also significant production in the Eagle Ford basin as well as several conventional areas.

Other than that a bunch of states up/down small amounts. Maybe UT is one to keep an eye on. It’s nearing record production levels. They make a waxy crude there, that is quite good, but hard to transport (need special heated cars and the like) so potentially infrastructure can/is helping development. When/if it has a record year, I can add it to the list of states with recent peaks (in contravention to the several James Hamilton articles about states hitting peaks and then production moving to other areas (but states not repeaking).

On the gas side, total withdrawals was up ~2.3 BCF/d. Finally eclipsing the pre Covid record.

https://www.eia.gov/petroleum/production/#ng-tab

Note that 0.9 BCF/d gain was from AK, which I disregard because ~90% is pumped right back into the ground. Looking at the other states/regions, it’s basically a grab bag making up the change. (I’ve ordered them by size, not by delta, just out of expediency).

TX up a bit over 0.1 BCF/d, crossing north of 30 BCF/d. Very close to pre Covid record, but below it still.

PA up 0.5 BCF/d to 21.7. Lot of economic incentives (local consumption) to pump fast in the winter. PA is above pre Covid records (i.e. new record this month), although just a tad over pre covid. It’s amazing what this state has done. Coming from nowhere to number two. Have been hoping they would pass TX. But it is a long slog and TX still growing.

LA up over quarter BCF/d to above 10 BCF/d. New record. The stunning thing about LA is how the Haynesville rebounded (after the peak oilers said it had “peaked” in 2012). It has great proximity to markets. Not perfect infrastructure, but much better situation than App production (where the anti FF advocates may make it impossible to build new transmission pipelines…billions lost on scuttled efforts.

[AK up almost a BCF/D to above 10. But we don’t count them. Still less than LA, but by a hair.]

WV down slightly at 7.6 BCF/d. Still amazing how high it has climbed.

OK down slightly to 7.2 BCF/d. I remember when it was in the 8s.

NM up 0.1 BCF/d to 7.1. In danger of passing OK.

OH up a quarter BCF/d to ~ 6.5 BCF/d.

Hmm, well it does seem that there has not been all that much upward movement of US yields so far. Maybe that will come.

It also may be that the tightening is at least so far taking more the form of ending MBS purchases, and indeed mortgage rates seem to have moved up a lot more than have Treasuries. Slowing a highly booming housing market that may have gone into bubble territory may be the best approach for this tightening, at least at first, and may also have the beneficial effect of not impacting the EMEs in too negative a way.

You seem to greatly enjoy the age old art of name-dropping on this blog, mastered by the late Larry King. Have you ever met Philip Jefferson in person, and if so, what was your impression of him??

No, Moses, I have not met Philip Jefferson. Sorry to disappoint you. No special insights on him personally.

BTW, you are right that I am incompetent about links. There is a cover story in the current JMU alumni mag on me and my wife. Link did not work, but you can find it by googling Rosser Madison Magazine. Of course you should probably inform them of how terribly mistaken they are to have published such an article, given your vast knowledge of my many flaws, :-).

No, I can tell that meant a lot to you. You think I would steal a lollipop from a child?? Validation is important for most everyone. A lot of NFL athletes slam the football to the ground and dance around for 10 minutes. Jim Brown used to just get off the turf and walk over and hand the ball to the referee. Brown said he liked to act like he had been to the end zone before. You need that validation like the modern NFL players need. I “get” it.

The Taxpayers Of Virginia thank you for your kind attention to their interests, Moses. So, really, you need to tell these editors and other types about all that you have found out about me that they just somehow have failed to learn. You are clearly the world’s leading expert on me. What do those people know anyway?

Really no, that’s Virginian’s choice what they want to do with you. I was personally hoping you and Ralph “blackface” Northam could get accompanying statues in the same public square. You deserve this much. It appears wasting public funds is not a big deal to most Virginians, so why not??

BTW, Mose, of course you are right. I need so much validation, just like some football player, I took a football and went to the editor of the Madison Magazine, I hopped around dancing and chanting, and then I slammed the football on his desk and demanded a cover story about me for my validation. He was not going to do it, but then I told him about mean trolls on a blog saying unpleasant things about me, one of them a guy who obsessively picks on older women, the other one who likes to air his genitalia. With that, of course the editor jumped right up and said they would do it.

Moses,

It looks you have not been following VA too closedly. Ralph Northam proved to be an excellent governor, the only MD gov in the nation. We got end of death penalty, legalization of pot, and a lot of Confederate monuments taken down and hauled away, including the big Lee one in Richmond, plus some increased gun control, improved enviro regs, and reductions of restrictions on women getting abortion, one of the most progressive governorships in the history of the state. And the contrast with his successor is genuinely stunning, who is ending mask mandates in schools, and whose AG is ending vaxx ones at colleges, including mine.

Who knew that Treasury had such a heavy investment in MBs—Mohammed bin Sultan? At least now we know who owns whom!

Seriously, it Looks like Goldman Sachs found a way to dump its mortgage backed securities portfolio onto the Fed. I mean, who else would buy them? I doubt that the Fed has to mark to market and write the losses off, so we’ll probably never know the magnitude of the losses.

I’m not a fan of securitization of mortgages. I think there should be a rule the mortgages stay with the originator, and not sold.

my guess is this would result in a decrease in first time and lower income home ownership. that is why the gse’s were created to begin with. you may not like them. and I am not much of a fan myself. but they do serve a purpose if you want to make sure capital is made available to a spectrum of the economy, not simply the upper class. mortgage rates would most definitely rise if the banks had to hold their mortgages rather than securitization.

@ baffling What’s the counterfactual scenario?? And why couldn’t you have GSE’s which originate mortgages but don’t sell them?? The system would be much safer. And there’s ZERO reason to believe you couldn’t have low income groups getting housing. Your statement assumes GSEs wouldn’t exist without the packaging of garbage loans. It’s the banks that benefit from securitizations, not low income groups who have their houses foreclosed on after building up “X” percent of equity to end up with nothing~~~after making how many interest payments?!?!?!?!

You are killing me. Promise me baffling, if you see Tom Selleck in some advert telling you the bank is your “best friend”, change the channel quickly.

moses, what you are then proposing is to socialize the mortgage industry. create a gse that originates and holds mortgages that either are backed by government capital, or are simply not required to hold capital against those mortgages. politically, i am not sure this will fly. in addition, the banks (big and small) simply could not compete economically against this structure, and they would leave the home mortgage business almost completely. you can want a gse that originates and holds mortgages, but that will be trumpeted by those against as simply the growth of big government. you have not convinced me this can actually happen in practice.

i agree with you on the idea that making originators hold the mortgage is safer. but i don’t see how this approach expands mortgage opportunities. it seems to contract them, unless you socialize the risk. i don’t consider that a realistic option, today.

by the way, i liked selleck as magnum. it was a great show, and aspiring lifestyle. but the man has gotten weird over time.

@ baffling The government extends loans to small businesses, farmers, students, and on and on and on and on. We don’t necessarily call that “socialization” unless we only read at a 4th grade level and spend 2+ hours a day watching FOX news.

“We don’t necessarily call that “socialization””

moses, that is exactly what it is. trying to call it something else is putting lipstick on a pig. i dont call it socialization in a derogatory sense, that is simply what it is. the government took over those business activities.

“The government extends loans to small businesses, farmers, students, and on and on and on and on.”

that is a very poor argument for extending the same model to home mortgages. we still have private mortgages. many farmers and small businesses could not get loans, which is why those were socialized.

and if you look at the predicament that student loans have created, maybe you change your view. currently you cannot discharge these loans through bankruptcy, thanks to the gse running the show. so some students are stuck with unpayable student loans, and no way for the market to correct the disbursement of loans to those who should not take them out. you want this to occur in home mortgages as well? as i understand it, in europe many folks are stuck with mortgages they cannot dismiss through bankruptcy either. it is a bad situation.

i dont understand why you get so angry when somebody disagrees or challenges your opinion. the insults are not really necessary. i am discussing these items in good faith with you. i don’t have an agenda, like some others on this blog.

For the perusal of a Mr. JohnH,

https://www.federalreserve.gov/econres/notes/feds-notes/somas-unrealized-loss-what-does-it-mean-20180813.htm

I was trying to find where you could find the actual current numbers. I assume you can find more recent numbers on Fed MBS holdings but my web searching skills are failing me once again.

Moses,

There are plenty of links that show composition of Fed balance sheet, not sure why you could not find one of them.

As it is, MBSs are still over a third of the assets at about $3 trillion. Total balance sheet is somewhat over $8 trillion.

That’s strange because as far as the total balance sheet, all I read is numbers much closer to $9 trillion. It must be your strong math skills had me beat again. Did some hallucinatory skewed distribution take it back closer to $8 trillion?? I should thank you for inspiring me to look a little harder though, and the number they give from MBS from January 27 is~~

$2,660,820,000,000

https://www.federalreserve.gov/releases/h41/current/h41.htm#h41tab3

Moses,

No, not my math skills, my reading ones. I misread the line after MBSs, which is about Unamotized Premiums of Mortgage Securities as also being MBSs, which amounted to 351 plus billioin. This added to the MBS number put the total a bit over 3 trillion, as I said. So, a reading eror, not a math one. And that total would have indeed been over a third of the total.

As it was I was correct that the total was over 8 trillion. If I had said it was “around” 8 trillion that would have been inaccurate, but on that matter I was accurate.

Anyway, I had suegetry to remove a parathyroiod yesterday, so now a bit out of it on pain meds.

The Fed has to report the performance of its assets. It has made billions on its MBS holdings. Which you could have known if you’d bothered to look. But why bother, right?

One of the standard plays in investment is strong accounts buying undervalued assets from weak accounts. It so happened that the Fed is the strongest account going, and so has a natural advantage over weak accounts like Goldman Sachs.

One of JohnH’s regular soap boxes is a call for us to audit the FED. Of course the FED regularly reports its income statements and balance sheets which has never deterred JohnH from jumping back on that soap box. I have to wonder if he even knows what the term audit even means.

“The Fed has made billions”…

Unsubstantiated drivel. And it does not address what happens if the Fed sells a lot of MBS during a substantial taper, though substantial losses would be moot, the Fed being the Fed.

‘JohnH

February 1, 2022 at 8:16 am

“The Fed has made billions”…

Unsubstantiated drivel. ‘

This is a helluva accusation from someone who has not once provided any reliable information on this matter. It must be nice to be living in your little ivory tower world devoid of any need to present actual facts. Which is to say your latest childish rant made macroduck’s basic point.

So JohnH is calling you a liar when you claimed the FED has receiving income from MBS even if this troll cannot provide a lick of data. Go figure. Moses tried to help but Barkley mocked him for not finding the data either. But Barkley must be confusing balance sheets with income statements. This release notes the FED last year had over $100 billion in net income defined as interest income + income from things like MBS – operating expenses:

https://www.federalreserve.gov/newsevents/pressreleases/other20220114a.htm

I bet with a little effort one could produce a detailed income statement over time but folks – this is about income not assets net of liabilities. Not that I’m a CPA but come on!

https://www.federalreserve.gov/aboutthefed/files/combinedfinstmt2020.pdf

OK I did find this document which is the income statement and balance sheet for the FED for 2019 and 2020. So if we can rely on this document, the FED made several billions in those two years. Then again this was prepared by KPMG so maybe it is not to be trusted.

BTW – please thank Moses for finding Barkley’s balance sheet. But could you please inform these two that the spat between you and JohnH is over INCOME flows? After all – this is an economics blog. Or so I thought.

It’s an interesting world that pgl lives in that she thinks the Fed sells all of its MBS at par value when unwinding the balance sheet.

“And it does not address what happens if the Fed sells a lot of MBS during a substantial taper, ”

well, the fed has indicated that a taper will not entail selling a lot of mbs. a taper indicates a reduction in the purchase of new assets, not the selling of existing assets. they have indicated they will simply let those run off of the balance sheet (expire) rather than sell them into the market. the only “unsubstantiated drivel” on this blog today is your comment, Johnh.

I am of the view that when intellectual midgets like Johhny make unsubstantiated claims, the rest of us are under no obligation to substantiate our rebuttals. The toddler hasn’t earned a cookie.

But there he is, whine, whine, whine, and sometimes you just give up and give the punk a cookie to shut him up.

Fed income and expense data 2020:

https://www.federalreserve.gov/newsevents/pressreleases/other20210111a.htm

2019:

https://www.federalreserve.gov/newsevents/pressreleases/other20200110a.htm

Two minutes. That’s how long it took me to locate these documents. But Johnny couldn’t be bothered with facts. He just wants to slam his highchair tray and fling baby food.

The Fed makes money on MBS. On Treasury assets. On loans. It spends money in deposits. Anyone who knows anything about Fed operations knows this stuff in their sleep. Johhny’s pretense to knowledge is just plain dish.

I’m waiting for Menzie to tell me “the Fed doesn’t sell MBS” and already have my “comeback” ready. Go ahead Menzie, make my day. : )

Moses Herzog: I have no idea where this exchange is going. The Fed owns Agency MBS’s. It hasn’t sold them in the past in order to reduce its holdings. But it could decide to do so in the future. It was one of the concerns regarding exit strategy early on in the start of the original LSAPs (so I mentioned that concern in classes).

Selling assets at maturity is a proven method for never having to report a loss on the value of assets…which is why mark to market was instituted for normal financial company.

But the Fed is anything but normal, since they have almost no interest expense except on reserves held at banks. Any idiot could make money that way! Any claim that MBS are enormously profitable to the Fed should come with an asterisk.

The Fed’s purchase of MBS is actually a pretty neat way to avoid the real estate crises that plagued banks whenever short term interest rates rose above those of their mortgage portfolio.

@ Menzie

I am waving the white flag here Menzie. My argument was more than a stretch, I apologize. Zero sarcasm. I mean, it’s a possibility that they would sell MBS assets, but it’s an absurdist possibility. So I was making an absurd argument. Or one of such low probability that it doesn’t hold ground. Throwing my towel into the boxing ring on this. Sorry

As I said, macroduck’s claim was unsubstantiated. MBS income and unrealised gains/losses were lumped together with other income, and the MBS portion was not identified.

Nice try, macroduck! Next time, get your act together and provide some real, relevant data before you claim that the Fed made $billions from MBS.

JohnH: Same press release that pgl noted, see sentence containing: “offset by decreases in interest income on federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS) of $2.7 billion”.

Interesting that the rumor is the ECB is going to pass on raising interest rates this Thursday. I wonder why they would choose such a thing with GDP at a rip-roaring 0.3%?? Obviously not as sharp as lawyer Georgetown Jerome and Larry “Desperate To Be Relevant Again” Summers.

《The short answer is: no one I’ve talked with seems to know.》

Is it too provoking of cognitive dissonance to ask if we are we governed by clueless morons using hammers wildly trying to show everyone how busy they are?

rsm,

Not in the least. Only “clueless moron” here is you, yet again, with this silly remark.

rsm wins….

do you behave like this at jmu?

Anonymous,

I doubt there is anbody else out there who thinks rsm just won.

You can also go read the current cover story about “Man in Motion ” in Madison Magaziine.

After that you can explain to all here how the Ukrainians should be grateful to Stalin and Khrushchev for the Holodmar that starved millions of them. After all, got rid of a lot of those class enemy kulaks.

rsm did win. He indeed the King of Worthless Trolls!

https://fred.stlouisfed.org/graph/?g=AAG8

January 30, 2018

Mortgage Debt Service Payments as a percent of Disposable Personal Income, 2017-2021

https://fred.stlouisfed.org/graph/?g=AApd

January 30, 2018

Mortgage Debt Service Payments as a percent of Disposable Personal Income, 2007-2021

https://fred.stlouisfed.org/graph/?g=rjZk

January 30, 2018

Mortgage Debt Service Payments as a percent of Disposable Personal Income, 1980-2021

[ Mortgage debt service payments are importantly low. ]

https://fred.stlouisfed.org/graph/?g=LwS5

January 15, 2018

Federal Reserve Bank Assets and Mortgage-Backed Securities, 2007-2021

Guess what happens when in true MAGA style, you try to create problems where there are none?? You have USA soldiers bored to tears because nothing to do, away from their families, not getting paid, and committing suicide in large numbers. You wanna know how much Republicans care about American soldiers?? Read about what Republican Greg Abbott is doing to these young men in uniform:

https://www.texastribune.org/2022/01/07/texas-border-national-guard-pay-suicides/

This has been going on over a period of months. But don’t expect Greg Abbott to end this slow torture of American soldiers, if he thinks he can mark a couple political points with the illiterates wearing the red dunce caps. And donald trump will be there, right by Abbott’s side while these guys commit suicide and wonder to themselves why they aren’t getting paid to stand on the southern border counting flower petals and blowing dandelion seeds into the wind.

BTW, don’t expect Nancy Pelosi to mention this in the U.S. House of Representatives. She has a date with Baskin and Robbins. and Yahtzee with the grandkids.

Step away from that bottle.

It’s interesting to me that you can’t state anything about my comment that was non-factual. So I guess you’re the same type person as Greg Abbott and multiple congressional Republicans. You profess love for USA military men who keep our nation free and yawn when hearing they commit suicide in large numbers and can’t get their hands on their paycheck. Maybe you can be like Saint Reagan and start doing propaganda for the Army recruiting men to their deaths while you “guard” the shores of southern California.

I love you, Moses.

I am a VN war veteran and my son is an Afghan War veteran. We both know too much about that which you chose to politicize.

When he came home, I would hear him cursing in his sleep – a lot like what I went [it ebbs over the years] through. The hardest part was a year hoping not to get a call or telegram or walking home from work praying to not see a strange car parked in front of the house.

Soldier and veteran suicides are all too real and tragic; and approx. 16 years of them were suffered under Bush’s and President Obama’s leadership and most all those with Dem controlled Congresses.

It’s OK. Politicize everything. You’re more interesting than most around here.

I feel your pain.

There’s a difference between participating in a war (assuming you’re even telling the truth, seems like every 2 in 3 trolls online in a “VN veteran” whenever losing an argument} and guarding an inactive area of the southern border without a paycheck. We had other idiots on this blog, saying “their farmer friends” were all ecstatic about donald trump ruining the selling price of their crops and sending them into bankruptcy and/or putting them on the MAGA/USDA social welfare dole. DO you think I was dumb enough to believe they even knew a farmer, much less had a “farmer friend”?? How many farmers do you know they are happy to be on USDA social welfare??

You send guys to a vacuous border, with nothing to do, no mission goals, and no paycheck. I strongly suspect if it was a Democrat pulling the crap Greg Abbott is pulling, you’d be on here screaming bloody murder.

https://econbrowser.com/archives/2021/11/business-cycle-indicators-mid-november-2#comment-262388<<——Read the comment of the man who said just above "It's OK. Politicize everything"

Here is the link as it should have been made above

https://econbrowser.com/archives/2021/11/business-cycle-indicators-mid-november-2#comment-262388

https://news.cgtn.com/news/2022-02-01/Chinese-mainland-records-66-confirmed-COVID-19-cases-17i4iYFqnRe/index.html

February 1, 2022

Chinese mainland reports 66 new COVID-19 cases

The Chinese mainland recorded 66 confirmed COVID-19 cases on Monday, with 27 linked to local transmissions and 39 from overseas, data from the National Health Commission showed on Tuesday.

A total of 32 new asymptomatic cases were also recorded, and 814 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 106,139, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-02-01/Chinese-mainland-records-66-confirmed-COVID-19-cases-17i4iYFqnRe/img/62255661ca4e40758580949e6d98848e/62255661ca4e40758580949e6d98848e.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-02-01/Chinese-mainland-records-66-confirmed-COVID-19-cases-17i4iYFqnRe/img/206a40faf19d4cfbabbe1fb9374e078d/206a40faf19d4cfbabbe1fb9374e078d.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-02-01/Chinese-mainland-records-66-confirmed-COVID-19-cases-17i4iYFqnRe/img/5f80a04affcb403bb88ac781dc230416/5f80a04affcb403bb88ac781dc230416.jpeg

https://www.worldometers.info/coronavirus/

January 31, 2022

Coronavirus

United States

Cases ( 76,222,215)

Deaths ( 910,104)

Deaths per million ( 2,724)

China

Cases ( 106,073)

Deaths ( 4,636)

Deaths per million ( 3)

http://www.xinhuanet.com/english/20220131/182fef76b3b14be48b699ae9931627ab/c.html

January 31, 2022

Over 3 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — More than 3 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Sunday, data from the National Health Commission showed Monday.

Am I the only person who is wondering why Democrats don’t force a vote on both the House and Senate floors, related to price controls or price ceilings on prescription drugs?? You could have a common sense number, like no more than a 3.5% annual increase of any drug. Since the beginning of this year, they’ve already raised prices about 6.6% according to an outfit called “Rx Savings Solutions”.

https://www.wsj.com/articles/drugmakers-raised-prices-by-6-6-on-average-early-this-year-11643538782

Push that 6.6% increase since the start of the year out to an annual rate and see what you get. Republicans are all on TV complaining about inflation. The simple way to force Republicans’ hand in seeing how much inflation bothers Republicans is to force a floor vote on price controls on prescription drugs, with a simple annual increase rule (a price ceiling) and make it a very very public congressional bill, go on talk shows and media, and President Biden going on stump speeches in large cities and college towns, talking about moderating annual price increases on prescription drugs. Of course Nancy Pelosi will never do this. It would show a kind of political genius she has NEVER had. She’s too busy trying to figure out why the botox injections make her face look zombie-ish.

See what a kind person I am??~~I’m giving FREE genius-like political advice to a woman I hate. You can’t get this kind of graciousness in a Catholic confessional booth. (notice how I keep the bar low)

I’ve been in and out of Catholic Confessionals for 65 years. Some were gracious – like the time a Father said, ‘Welcome back.’ when I told him it was six years since I’d been inside a Church; and some would yell at me, “You did what?!”

Moses,

Our U.S. Rep., Elissa Slotkin, sent out many emails claiming “her” legislation would reduce the cost of Medicare drugs and limit co-pays to $2,000 per year. When the legislation actually passed, it was all about how doctors would now be able to tell you how much you were going to pay for drugs through a new government site… but nothing about actually reducing drug prices or limiting annual co-pays..

https://slotkin.house.gov/RealTimeBenefits

So, now we have an expensive government version of GoodRX that does nothing originally promised.

http://www.xinhuanet.com/english/2021-06/23/c_1310024183.htm

June 23, 2021

China’s fifth round of “group buying” sees drug prices drop 56 pct

SHANGHAI — Medicines selected through the current round of the Chinese government’s new centralized drug-procurement program will be 56 percent cheaper than normal, on average, for those public health facilities that purchase them, according to the National Healthcare Security Administration.

The fifth round of the centralized drug-procurement program, which took place in Shanghai on Wednesday, saw 201 companies bidding to provide medicines to public health facilities, including hospitals. Of those companies making bids, 148 were successful on Wednesday, with 251 products being qualified.

Among the bid-winning products are 11 products from 10 foreign-funded enterprises….

https://news.cgtn.com/news/2019-11-28/70-drugs-price-down-by-61-under-China-s-basic-medical-insurance-LZBM84qS52/index.html

November 28, 2019

70 drugs price down by 61% under China’s basic medical insurance

70 drugs have been newly included in a list of drugs covered by China’s basic medical insurance on Tuesday, with their prices down an average of 61 percent, according to the National Healthcare Security Administration (NHSA).

Chinese patients can use their state medical insurance to cover a significant portion of the cost of drugs named on the list, which now includes a total of 2,709 drugs.

And the cost burden on patients for the newly added drugs will be cut by more than 80 percent when the new list takes effect on January 1, 2020….

Then I assume you agree with me, that a ceiling on annual price increases (such as a percentage of 3.5%) would be politically popular, and legislation that could shut up Republicans’ fake concern on inflation, and be a way to “play to their base” or “fire up” their political base. It’s a “no lose” proposition for Biden and Democrats. If they put the vote onto the floor and it fails, Republicans still have to explain their vote to keep prescription drugs prices extortionate and unreasonably high for their older constituents.

AARP has provided this informative document:

https://www.aarp.org/content/dam/aarp/ppi/2021/06/trends-in-retail-prices-of-brand-name-prescription-drugs-widely-used-by-older-americans.10.26419-2Fppi.00143.001.pdf

Letting prices rise by 3.5% per year may be too generous especially if we get overall inflation back down to 2%. We have had enough relative price increases already – time to actually get some of these relative prices back down. But yea – we should start somewhere.

This law is basically truth in pricing. I guess being honest with patients is Communism in your little world. When Kelly Anne Conway fired you – did Big Pharma hire you are their new spinmeister? Good luck with that as you first attempt to help them deceive old people has turned out to be your usual total flop.

pgl, are you responding to moi? I can’t believe you would have a snarky comment about something that aligns with your perspective that inexpensive is good and free is better. But let me help you out in case your doctor is technologically inhibited from using the new government search engine.

https://www.goodrx.com

We’ve used it for years. Doesn’t bring the cost of patented medications down, but sometimes you can find a good generic alternative. And as the old saying goes, “prices may vary”. Too bad Elissa’s performance didn’t match her promise.

https://news.cgtn.com/news/2022-01-22/5-Chinese-drugmakers-to-make-Merck-s-COVID-19-pill-at-royalty-free-171ztRqXr2M/index.html

January 22, 2022

5 Chinese drugmakers to make Merck’s COVID-19 pill at royalty free

A U.N.-supported organization announced on Thursday that it has signed agreements with more than two dozen generic drug makers including five from the Chinese mainland, to produce versions of Merck’s COVID-19 pill at royalty free to supply 105 developing countries.

The Medicines Patent Pool said the deals would allow drug companies to make both the raw ingredients for molnupiravir and the finished product itself.

Molnupiravir, developed by Merck and Ridgeback Therapeutics, has been reported to cut the hospitalization rate in half among patients with early signs of COVID-19. Britain, the European Union and the U.S. authorized its use in recent months.

“This is a critical step toward ensuring global access to an urgently needed COVID-19 treatment,” Charles Gore, executive director of the Medicines Patent Pool, said.

The group said 27 generic drug manufacturers in 11 countries, including Bangladesh, China, Egypt, Vietnam, Kenya and South Africa, would soon start producing Merck’s pill….

Tom Velk (Ph.D Wisconsin) and professor of economics (McGill University, Canada) has a related perspective.

https://asiatimes.com/2022/02/how-stagflation-2-0-affects-the-west-and-the-east/

Oh my – you may have found the worst student ever to graduate from Wisconsin. I wonder if Dr. Chinn knows this dude. But I love this paragraph:

“Trump believed (and said so) that the tariffs would be paid by China because President Xi Jinping’s government would cheapen Chinese money, so that US consumers could buy enough Chinese money to avoid themselves having to pay the Chinese price plus the tariff. Trump was correct for a while during his term in office. The exchange rate moved in favor of the US, going from 6.68 yuan to the dollar in February 2019 to 7.17 in September 2019.”

Since he teaches in Canada, I presume he has heard of Robert Mundell who basically pioneered international macroeconomics under floating exchange rate. One of the most basic presumptions of Mundell-Fleming was the tariffs would have no net effect on net exports as they would lead to currency appreciation offsetting the reduction in imports by a reduction in exports. Your dude basically confirms that but then says “Trump was correct”. NO – Trump told us his trade war would improve net exports. On that score – Trump was very, very wrong.

But it seems Bruce no relationship to Robert Hall asks us to read a discussion that bites him in the rear end. No wonder Kelly Anne fired you!

pgl: Until this moment, I’d never heard of him. Iconoclastic interpretation of what’s going on, to say the least.

I know very very little about Canada’s higher education system, but I’ve always heard good things about McGill. I don’t think that justifies his comments as right or wrong, just saying.

BTW – pay attention to Baffling:

‘baffling

February 1, 2022 at 1:01 pm

“And it does not address what happens if the Fed sells a lot of MBS during a substantial taper, ”

well, the fed has indicated that a taper will not entail selling a lot of mbs. a taper indicates a reduction in the purchase of new assets, not the selling of existing assets. they have indicated they will simply let those run off of the balance sheet (expire) rather than sell them into the market. the only “unsubstantiated drivel” on this blog today is your comment, Johnh.’

It seems Dr. Chinn has a whole new post amplifying his point. NOT that you will understand it.

I have known a lot of UW econ grads, and I have also known some members of the McGill econ faculty, but like Menzie, I have never heard of and know nothing about this guy.

Aww, get pgl, I hate to disappoint you, but you know I don’t take you seriously since your modus operandi is snark and no real substance.

But keep entertaining yourself.

Like we take your medical advice seriously? Please tune into Tucker tonight!

We have a new candidate for the dumbest comment ever:

‘Moses Herzog

February 1, 2022 at 11:14 am

It’s an interesting world that pgl lives in that she thinks the Fed sells all of its MBS at par value when unwinding the balance sheet.’

No – it is interesting that I never said anything remotely like this. Then again we have to excuse Moses as he almost got arrested at the ice cream aisle harassing old ladies.

You’re once again becoming a satire of yourself. Your comparison of “any old lady” getting ice cream at Wal Mart as identical to the Speaker of the House of Representatives giggling about premium ice cream on a TV show watched by millions during a recession which had a high probability of being the worst recession since the early 1930s is….. I’m not gonna say it out of respect to Prof Hamilton and Menzie. Just imagine something Rick Sanchez would say to Morty after Morty said things like you do. It brings to mind donald trump saying no one has a right to view his taxes when he is running for U.S. President. ~~~~ Pelosi is the Speaker of the House and a figurehead for her party~~~not a random woman getting ice cream at Wal Mart, you gargantuan A$$.

Lord – you have truly lost it. Please get professional help.

Macroduck calls out JohnH for never providing a shred of FED profit data by noting the usual income statement for the FED which I originally linked to. But JohnH notes that income statement was not that detailed. I guess this lying troll did not notice that I provided a more detailed income statement but our host did:

Menzie ChinnPost author

February 2, 2022 at 7:59 am

JohnH: Same press release that pgl noted, see sentence containing: “offset by decreases in interest income on federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS) of $2.7 billion”.

JohnH is spewing nonsense so fast that he cannot be bothered that the rest of us are doing his home work assignments up. Of course JohnH never backs up his incredible bogus claims, which of course was macroduck’s overarching point.

You know I wish some bright economist would write a thorough analysis of this MBS issue but do not expect JohnH to either (a) write it; (b) cite it if one exists; or (c) bother to read it if someone else provides it. Doing real research gets in the way of his spewing intellectual garbage and then calling the rest of us liars.