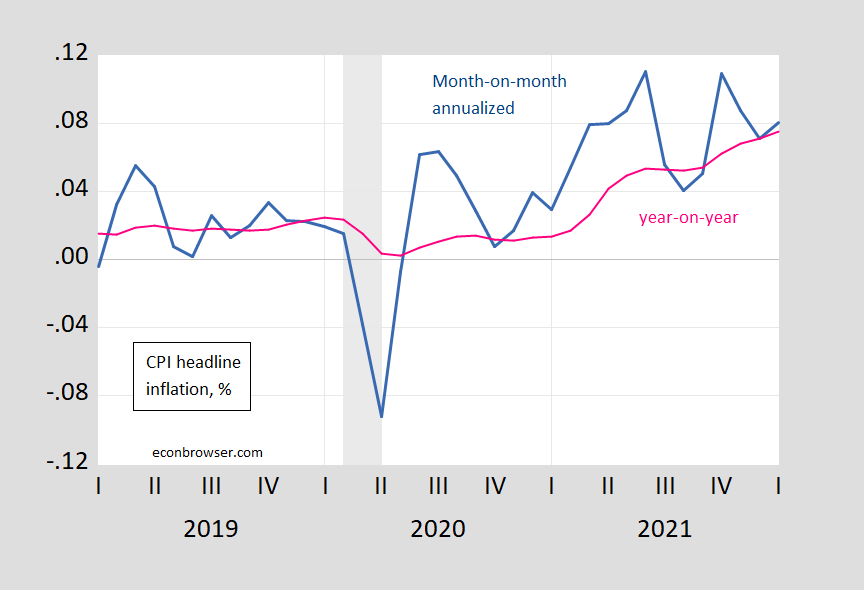

Headline and core both surprise on upside, 0.6% m/m vs. 0.5% Bloomberg consensus. You’ll hear lots about “records”, which are accurate, but focus on y/y inflation. Here’s some context:

Figure 1: CPI month-on-month inflation rate, annualized (blue), 12 month or year-on-year inflation rate (pink), in decimal form (i.e., 0.05 means 5%). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

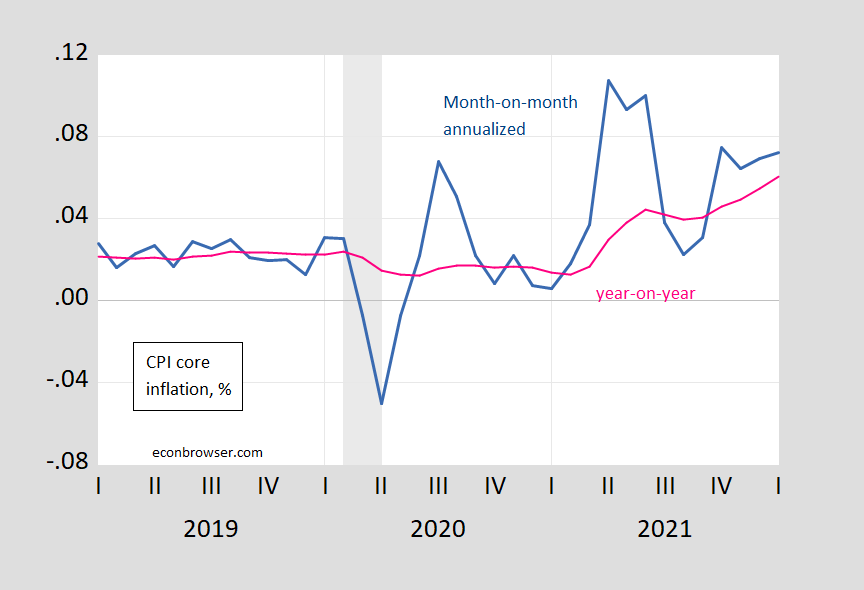

Figure 2: CPI core month-on-month inflation rate, annualized (blue), 12 month or year-on-year inflation rate (pink), in decimal form (i.e., 0.05 means 5%). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

Month-on-month headline is down relative to November, even if it surprised on the upside; core is not declining, which is a bit more worrisome for y/y core inflation going forward.

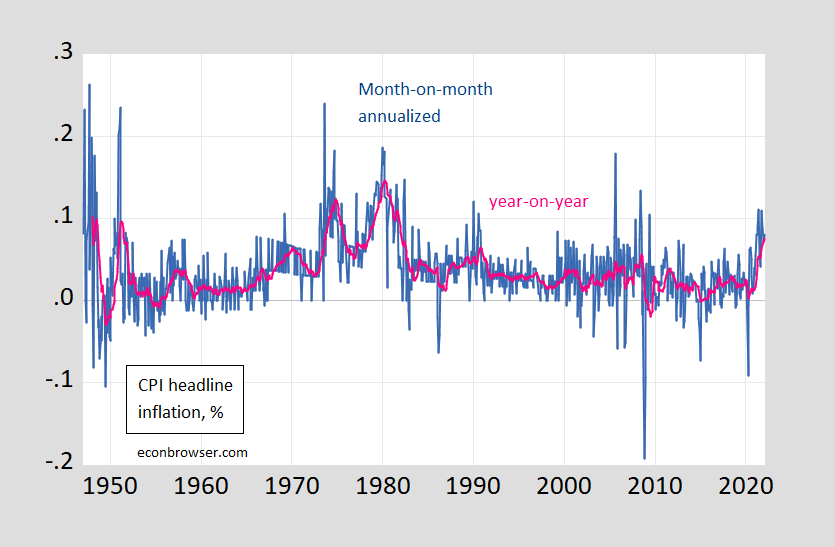

For the long perspective, here’s headline over 65 odd years:

Figure 3: CPI month-on-month inflation rate, annualized (blue), in decimal form (i.e., 0.05 means 5%). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

CEA twitter thread here. More on trimmed mean and sticky price inflation coming.

Peter Navarro is on the TV talking about his grand plan to keep Trump in the White House a little over a year ago – The Green Bay Sweep. I guess he is really looking forward to the SuperBowl as he campaigns for letting Dr. Lisa Cook become an NFL head coach in lieu of serving on the FED.

I’m sort of hoping Green Bay hires Navarro. Did I ever say I cannot stand the Packers?

Navarro may well end up in federal prison for his conspiracies. Quite an outcome for a Harvard PhD in Economics.

I would be happy to see him spend time in jail. he is an entitled, spoiled brat. and he was part of an insurrection against the United States of America. he is a traitor.

Could the March FF target hike be 50 basis points?

Will the Fed run an ’emergency’ rate increase before the March hike?

Someone on FOX Business uttered such.

You waste your time listening to Faux Business?

I don’t waste my time reading your nonsense replies when they’re more than nine words. Like whatever you typed below.

Same at ya troll!

LOL

Speaking of the Federal Funds rate, the FED increased it quite a back from 1/2017 to the summer of 2019:

https://fred.stlouisfed.org/series/fedfunds

They should have as the economy was doing OK until Trump’s stupid trad war and other forms of incompetence began the undo the strong economy he inherited from Obama. Of course Trump railed at the FED’s action wanting a more dovish monetary stance.

Of course the economy weakened in 2020 and still trying to get back to full employment. Dr. Cook got the need for a dovish stance under these new circumstances. Of course the right wing hacks that we all in for Trump has decided to oppose Cook getting on the FED and now they want a hawk.

Go back to 2004-06 to see another period where the Fed decided to cool things down… and then had to scramble to correct their “correction”. Deciding how much pressure to put on the brake pedal is a tough call.

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

Given the rise in energy prices and the likelihood that they will stay high for awhile, it’s probable that we won’t see any rollback in prices this year. The real question is how much more other prices are going to react to those high energy costs. Of course, that depends on how much of the energy price inflation has been factored into the prices of other goods.

In January, Goldman Sachs analysts said they expected Brent prices to reach $105 by 2023 due to “the reluctance to invest in oil during the energy transition and the gradual depletion of shale’s geological, midstream and service capacities.” — Financial Post 2/2/22

In China, prices of goods at the factory gate rose to a record high last month because of soaring energy costs. The world’s biggest exporter suffered an arguably worse energy shortage than Europe this autumn, with supply so tight it led to factory closures and blackouts.

In Europe, media are reporting that Germany is facing the highest inflation rates in three decades because of higher energy prices. The situation is not much different in the rest of Europe either. Prices are climbing in tune with the price of energy, regardless of where this energy comes from.

“The surge in energy prices poses significant near-term risks to global inflation and, if sustained, could also weigh on growth in energy-importing countries,” said the chief economist and director of the World Bank’s Prospects Group, Ayhan Kose, as quoted by Reuters. The Group produces the World Bank’s Commodity Markets Outlook. oilprice.com — 11/11/21

This is sort of a perfect storm of COVID induced restrictions on production, government fueled stimulus spending, rapid wage increases in some sectors, and supply chain logistical problems.

I’m not sure why Trump is still living in your head… especially regarding inflation. Not much changed during Trump’s administration from the last year of Obama’s.

https://www.usinflationcalculator.com/inflation/current-inflation-rates/

Other than the first year of Obama’s administration and the last year of Trump’s, both caused by factors outside of the control of those administrations, the economic growth of the U.S. was pretty much unchanged.

https://www.statista.com/statistics/188165/annual-gdp-growth-of-the-united-states-since-1990/

The real issue is how the Biden Administration will address the current problem. Will Biden’s policies and programs be at odds with the Fed’s actions?

https://www.cnbc.com/2022/02/10/biden-touts-wage-growth-slower-inflation-forecasts-after-another-surge-in-prices.html

The CME Countdown to FOMC Fed Watch Tool shows about an 80% estimate of a 50 to 75 basis point increase in the fed. funds rate at the March 16, 2022, meeting.

I am not certain if the link will work properly.

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

there is nobody credible arguing the fed will hike 50 points. the only people saying this are those looking for ratings or clicks. they may consider something like that later in the year, if inflation persists. but I can’t see them doing it in march.

the effectiveness of monetary policy depends on expectations, and fed funds futures imply a 50 bp hike in march. i think the fed will do what the market expects. the perception from market participants is that the fed is already behind the curve, and being more dovish than the market expects would hurt their credibility towards the inflation mandate.

could the market be reacting to the possible ending of the bond buying by the fed? I don’t think the fed stops the buyback and raises rates at the same time. they have been pretty clear this should be a two step process. at least that was the message I was receiving. its all a matter of how entrenched you (or the market) think inflation is.

Yes, the swap market currently prices slightly above 50 bps hike for the 16 March meeting. So seems like the currently fair valued expectation. I would rather expect the more conservative 25 bps.

Menzie,

How would you suggest when one should focus on yoy rather than m/m? I view both as important but I ask because today you state…

“Headline and core both surprise on upside, 0.6% m/m vs. 0.5% Bloomberg consensus. You’ll hear lots about “records”, which are accurate, but focus on y/y inflation.”

Whereas in December you seemed to suggest one should focus more on m/m…

“Beware the headlines — month-on-month inflation is (again) down, even if up year-on-year…. First, recall 12 month inflation rates (aka y/y rates) are largely backward looking. Month-on-month measures are more reflective of current conditions, albeit more noisy… Beware of “records”. On a month-on-month basis, inflation has been higher over the past 20 years.… So, on a month-to-month basis, inflation is now nowhere near record highs.”

This month you even decided to omit some of the m/m graphs that you felt worthy of including in your Dec “analysis”. These graphs included sticky price CPI which I had to point back in January as largely increasing despite your suggestion back in July that its decline at that time was “suggesting easing pressures”.

Econned: I still think m/m more relevant to thinking about where we’re going. When I posted, sticky price CPI had not yet been posted. That’s why it’s not there. see last sentence, which says more is coming.

“More on trimmed mean and sticky price inflation coming.”

Yep and in very plain English!

why do you continue to whine?

He reminds me of my neighbor’s rooster. Crows just about every day. Same sound. Nothing new. Wants everyone to know he’s there. Just a loud irritant.

I want to write “baffling, Why do you continue to show you can’t read?” But I know that you can’t read.

You continue to prove his point.

https://news.yahoo.com/trump-endorsed-gubernatorial-candidate-dan-155600852.html?fr=sycsrp_catchall

Trump toadie calls for the impeachment of the Governor of Maryland Larry Hoga (Republican). Now Hogan has been very effective at dealing with this virus and maybe Cox is not happy about that. Oh wait – Hogan has called out Trump when appropriate, which of course is an unforgivable sin in MAGA world.

“dealing with the virus”….. aka non pharma interventions.

plummeting economic activity observed in spring 2020 and an lackluster, overheating recovery were caused by government actions..

a lot of politicians need to take the walk

quit using the virus

Lackluster??? You mean robust.

plummeting economic activity would have occurred whether we had lockdowns or not. most people were not willing to go out, lockdown or no lockdown. don’t blame the government for people acting with self preservation.

who closed non essential…. whatevers?

tommy sees and remembers

“who closed non essential…. whatevers?”

do you think if those had not closed down, people would have gone out on their own? sure, as we have seen, there are some maga hatters that would have done that anyway you can’t fix stupid. but the majority of the population actually understood the possible dangers, and would have stayed home. that is why all the business that could, went to remote working.

are you one of those folks who likes to rewrite history? it would have been a matter of fact, if we had left things open throughout the pandemic, the number of deaths would have been in the millions. that is plural. even the idiot Navarro told this to trump. the outcome would have been a lot worse. that is why even TRUMP supported lockdowns during the pandemic.

https://www.federalregister.gov/documents/2020/03/18/2020-05794/declaring-a-national-emergency-concerning-the-novel-coronavirus-disease-covid-19-outbreak

here is a nice timeline of the actions and comments from trump. other than helping to start the lockdown, you will notice he was wrong on just about EVERYTHING during the pandemic.

https://doggett.house.gov/media-center/blog-posts/timeline-trumps-coronavirus-responses

Tommy sees and remember, but it appears that memory is rather faulty. or you need glasses.

Most of that was the gasoline driven, with exgasoline declining a tad. Interesting what Feburary will be that gasoline surged in February 2021. Should be some reversal. Producers need to watch it. Some of these hikes in some corners will be construed as anti-American, globalist and push some in Congress for intense onshoring and post wwii style price controls. Final demand is correcting and it may be smart to freeze price hikes.

Gasoline is down over the past few months.

https://fred.stlouisfed.org/series/APU00007471A

No, it was up 116% in January, making up a huge chunk of the total. Ex-fuel was slowed.

He clearly said the last few months. Dude – get a grip. Prices for commodities are volatile.

Looking to the distant past, the CPI-all Y/Y percent started to increase significantly in the US around 1916m03 peaking at 24% in 1920m06 before dropping to -16% in 1921m06. I assume WWI played a part. The US entered WWI as of April 1917. However, how much of the inflation in 1918,1919 and 1920 was caused by perhaps supply shortages due to the flu? Are we having a rhyming repeat today? I doubt we will see a decline similar to 1920m06.

Consumer Price Index (CPI) Databases : U.S. Bureau of Labor Statistics (bls.gov)

I always enjoy historical perspectives!

Trimmed Mean up 5.4%. interest rates should be at normal levels not where they are now.

If your income increased by the same amount month/month, would nominal prices even matter?

If your income increased by the same amount month/month, would nominal prices even matter?

Personally, of course not. Although I could understand if someone felt like they were treading water, particularly if they had to work longer/harder to have that increased income. And of course, there is the issue of the asymmetrical distribution of income change. Aggregate numbers, like rates of inflation, tend to gloss over non-heteronormative distributions.

But that is a matter more for behavioral economists to consider than econometricians.

Well no if the nominal value of your net wealth was also indexed. The old adage that expected inflation is neutral is a nice class room exercise but the issue is how does this all work in the real world.

“If your income increased by the same amount month/month, would nominal prices even matter?”

if your income equals expenses, no. but outside of that, either benefit or lose.

https://fred.stlouisfed.org/graph/?g=IL8t

January 15, 2018

Sticky Consumer Price Index, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=FvUs

January 15, 2018

Sticky Consumer Price Index less Shelter and less Food & Energy, 2017-2022

(Percent change)