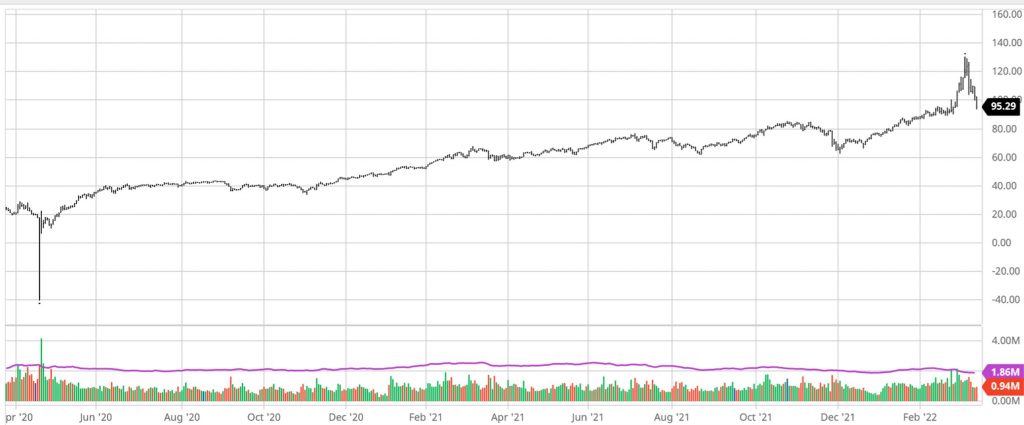

After a wild ride up to $130 a barrel, the price of oil has come back down to its level from before Russia invaded Ukraine. Russian oil may be finding buyers despite the sanctions, and U.S. production continues to recover. But the situation remains very uncertain, and a big disruption in the quantity of Russian oil that reaches world refineries is a very significant possibility. In my previous post, I examined the causes of the run-up in the price of oil that had already occurred before the invasion and discussed the implications for U.S. inflation. Today I comment on the possible implications of further supply disruptions for U.S. real GDP.

Price of April 2022 crude oil futures contract, from Barchart.com.

Russia accounts for 13% of the world’s field production of crude oil and 17% of the world’s natural gas. While gas is a relatively local commodity, oil is readily transported. Although different grades of crude sell at different prices, to a first approximation it is a world market for oil with a single world price. Disruptions in production anywhere in the world change the price for everybody in the world. What would be the consequences if the U.S. and the rest of the world suddenly had to reduce our consumption of oil by 13%?

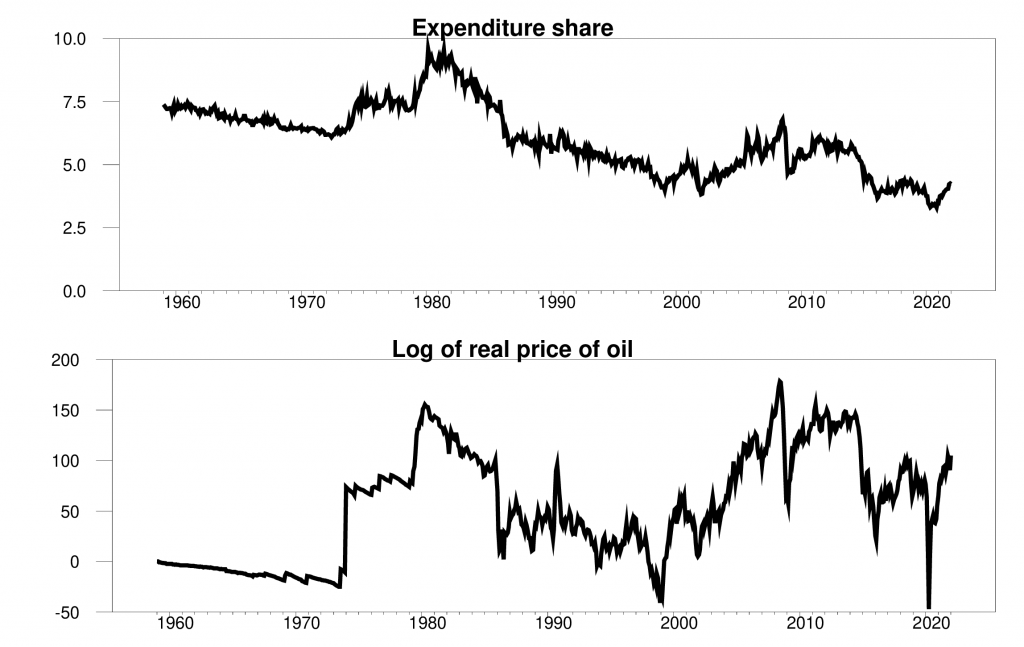

The total retail value including taxes of refined petroleum products sold in the U.S. amounts to about 4% of U.S. GDP. Thirteen percent of 4% is (0.13)x(0.04) = 0.005, or half of 1%. Thus the dollar value of a 13% reduction in the use of petroleum products only amounts to half of one percent of GDP. For comparison, in a typical U.S. recession, real GDP falls 5% below trend — ten times as much. Moreover, the value share of energy in the U.S. economy has been falling over time, leading some to conclude that we are less vulnerable to a supply disruption today than we were 40 years ago.

Top panel: dollar value of consumer purchases of energy goods and services as a percentage of total consumer spending, monthly, Jan 1959 to Jan 2022. Bottom panel: 100 times the natural logarithm of ratio of spot price of West Texas Intermediate to the overall consumer price index.

But the expenditure share did not follow a steady trend down. When the relative price of oil goes up rapidly — as it did, for example, in the 1970s — the expenditure share goes up. This is a result of the low price elasticity of the demand for oil. If despite a doubling in the price of gasoline you buy the same number of gallons of gasoline this month as last, the share of your spending devoted to gasoline doubles. If there is a significant reduction in Russian oil production, we will see a big increase in price, and that expenditure share will go up. In calculating the economic value of the lost oil, which share should we use — the share before the supply disruption, or the share after?

A recent paper by Baqaee and Farhi (2019) develops an approach that deals with this issue, and a new paper by Bachmann, Baqaee, and many others applies those insights to the current situation in Europe. They analyze the consequences of a complete cessation of German imports of oil and natural gas from Russia. They conclude that the economic cost would amount to 0.5 to 3.0% of GDP, with the range depending on the extent to which Germany can make substitutions. Even the upper end of this range is manageable, and less than the output lost in a typical recession.

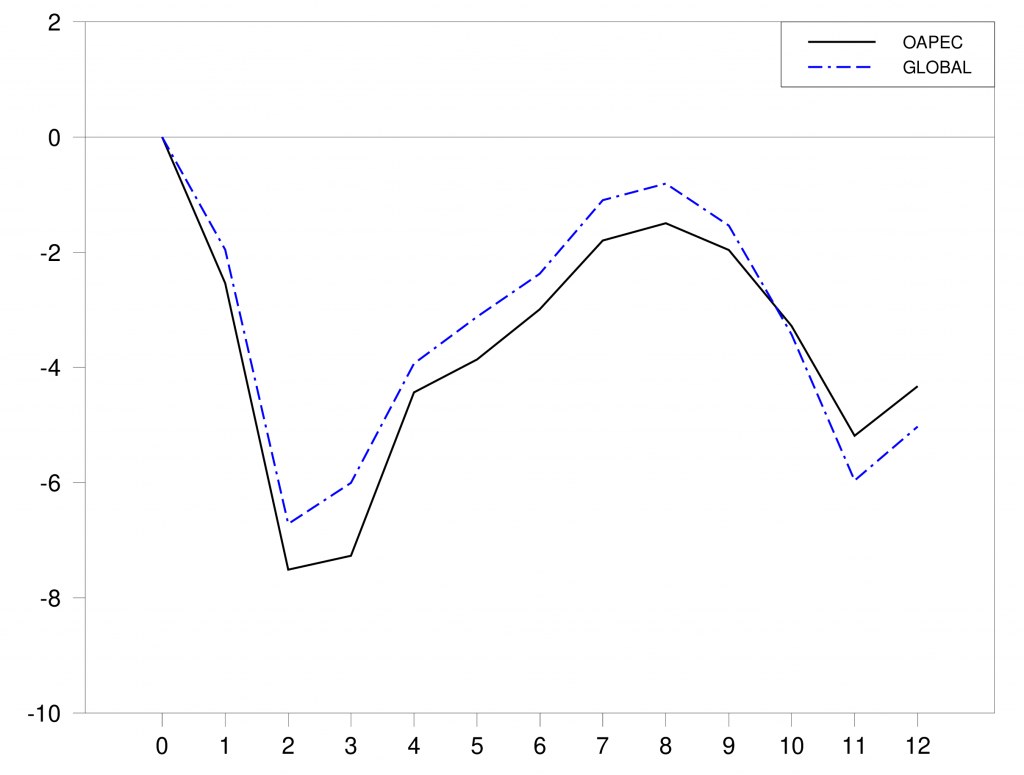

Another way that we might try to answer this question is to look for historical precedents. In October 1973, the Arab members of OPEC announced an embargo on oil sales to the U.S. and other countries that were seen as supporting Israel. The black line in the graph below plots the decrease in oil production from the Arab members of OPEC as a percent of total world production. The maximum shortfall reached 7% of world production. There was some increase in production from other countries at that time, but not much. The total decline in global production from all countries is shown in blue.

Oil production after the 1973 Arab-Israeli War. Dashed blue line: change in monthly global crude oil production from September 1973 as a percentage of September 1973 levels. Solid black line: change in monthly oil production of Arab members of OPEC from September 1973 as a percentage of global levels in September 1973. Horizontal axis: number of months from September 1973. Source: Hamilton (2013).

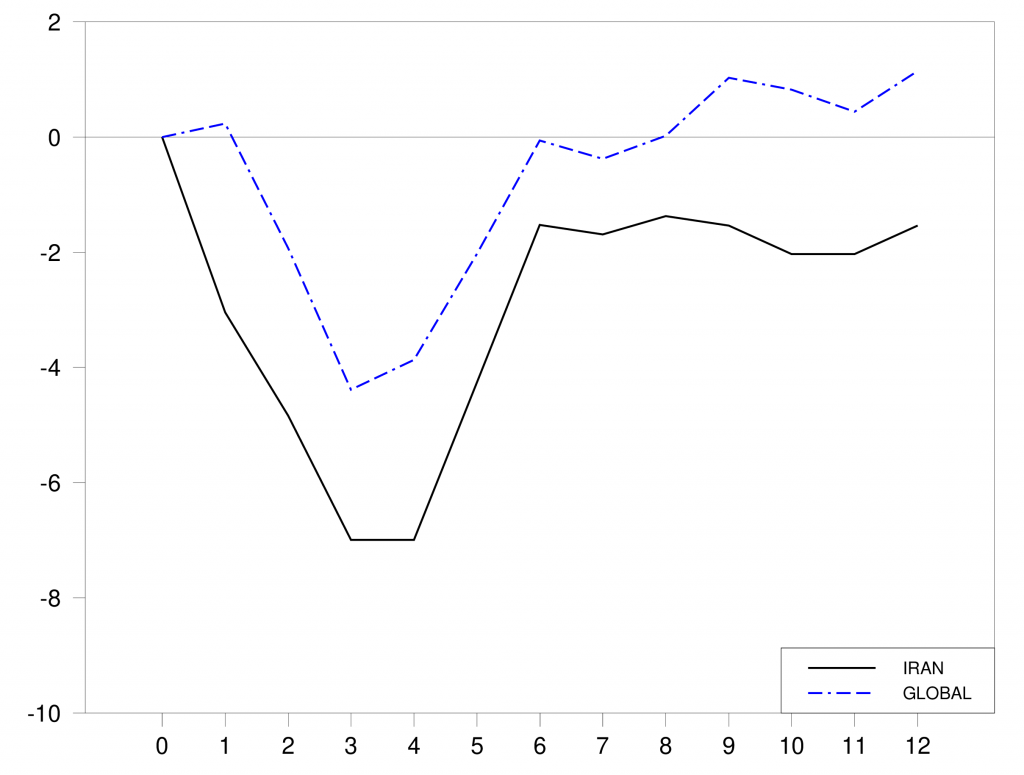

Another example comes from the Iranian revolution in 1978. This also knocked out about 7% of world oil production. But in this case, increased production from other countries limited the global shortfall to about 4%.

Oil production after the 1978 Iranian revolution. Dashed blue line: change in monthly global crude oil production from October 1978 as a percentage of October 1978 levels. Solid black line: change in monthly Iranian oil production from October 1978 as a percentage of global levels in October 1978. Horizontal axis: number of months from October 1978. Source: Hamilton (2013).

The table below summarizes these episodes along with two other historical examples of significant oil supply disruptions. In each of these episodes we saw a decrease in world supply of around 5%. If there were a 50% reduction in the amount of Russian oil that reaches the market, it would represent a shock as big as any of these four examples. A complete cessation of Russian production accompanied by shutting down natural gas as well would be the biggest energy supply disruption in history.

| Date | |||||

|---|---|---|---|---|---|

| Nov 73 | |||||

| Nov 78 | |||||

| Oct 80 | |||||

| Aug 90 |

Each of the above oil supply disruptions was followed by a recession in the United States. If the quick calculation above of the economic value of lost oil is correct, we would conclude that the fact that these episodes were followed by recessions must just be a coincidence and that the major cause of the economic downturns is to be found elsewhere.

A defining feature of economic recessions is underutilized factors of production. In a recession, we see the unemployment rate spike up as people who had been working lose their jobs and can’t find new ones. Factories that had been busy operate at less than full capacity. If underutilized resources are one consequence of an oil supply disruption, then the economic cost would be far greater than the above simple calculations that assumed that the only thing we lost could be measured by the market value of the oil itself.

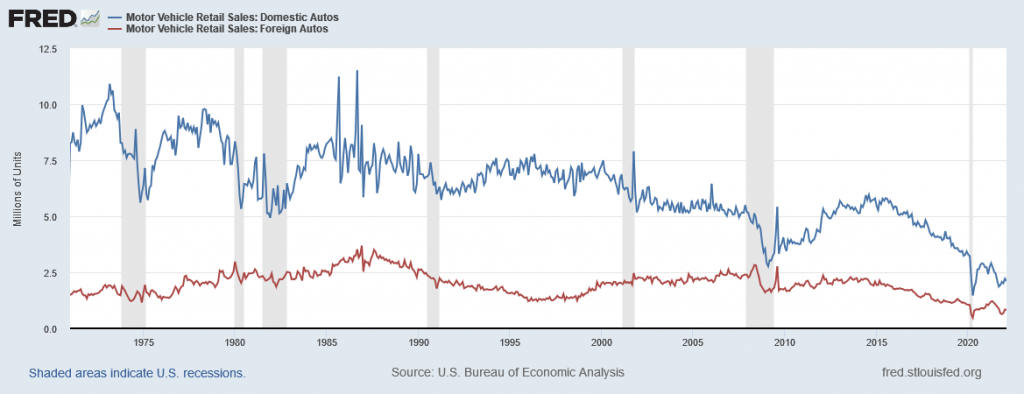

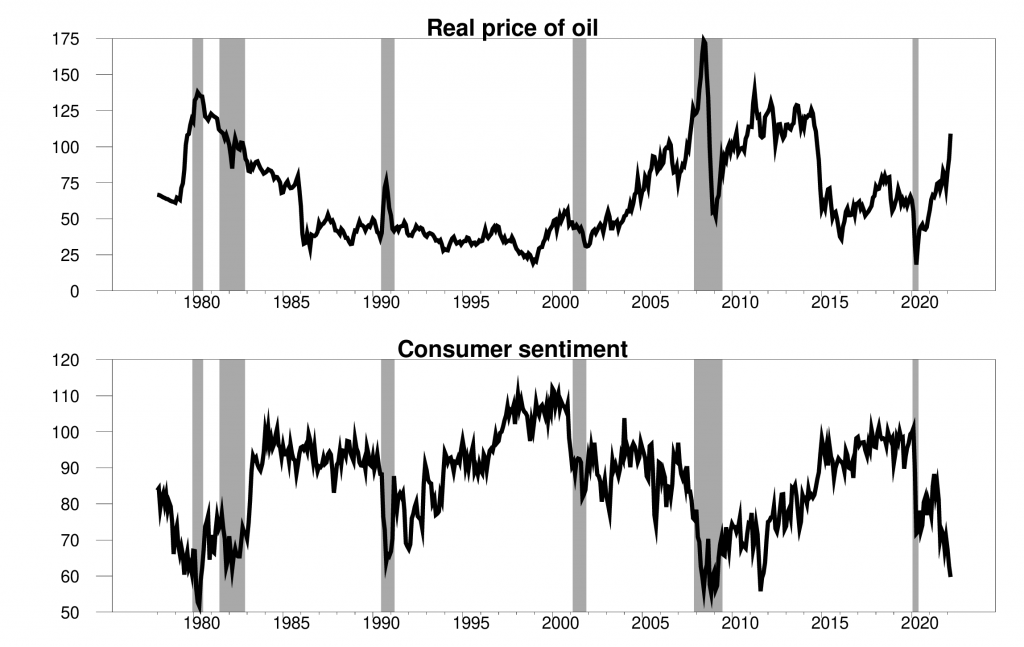

Automobile production is surely one part of the story. There was a big drop in auto sales and production in the above four episodes, and also in other episodes in which the price of oil increased very sharply over a short period of time. Auto workers were laid off, and the factories turned out far fewer vehicles than previously. Perhaps the hit to autos came from factors other than gas prices. But we usually see auto sales begin to fall when oil prices start to spike, and often this is many months before the recession begins. For example, gasoline prices were rising dramatically in 1973 and car sales were falling well before the embargo and well before the official start of the recession. Price increases and falling auto sales associated with the Iranian revolution also both started well before the recession. Moreover, we often see sales of more fuel-efficient vehicles go up at the same time as sales of gas-guzzlers is declining. It seems hard to argue that gasoline prices played no role in these developments.

And although gasoline expenditures are a relatively modest part of average consumption expenditures, the situation can be very different depending on which individual you’re looking at. Kuhn, Kehrig, and Ziebarth (2021) found that 10% of U.S. consumers spend no money at all on gasoline, while a different 10% devote more than 10% of their budget to gasoline. The median U.S. household spends 4%. Many of those households try to keep buying the same number of gallons of gasoline when the price doubles, meaning they have to cut back on spending somewhere else. We see a strong correlation in the data between gasoline prices and consumer sentiment. It seems likely that big changes in gasoline prices cause significant cutbacks in other categories of spending. Lower demand for these products again leads to unemployed workers and underutilized capital in those industries.

The conventional view of the way in which abrupt changes in spending patterns can lead to a drop in real GDP emphasizes the failure of nominal prices to adjust sufficiently quickly in response to a decrease in demand. If this is the mechanism, we could counter some of the effects of an oil shock with monetary and fiscal stimulus to try to keep aggregate demand high.

My view is that the reason changes in demand lead to underutilized resources is because of technological barriers to changing production methods quickly. The factories cannot instantly shift from making the large cars that people no longer want to making the small cars that they now desire. Fiscal or monetary stimulus cannot fix this problem. I develop this idea in more detail in a recent paper.

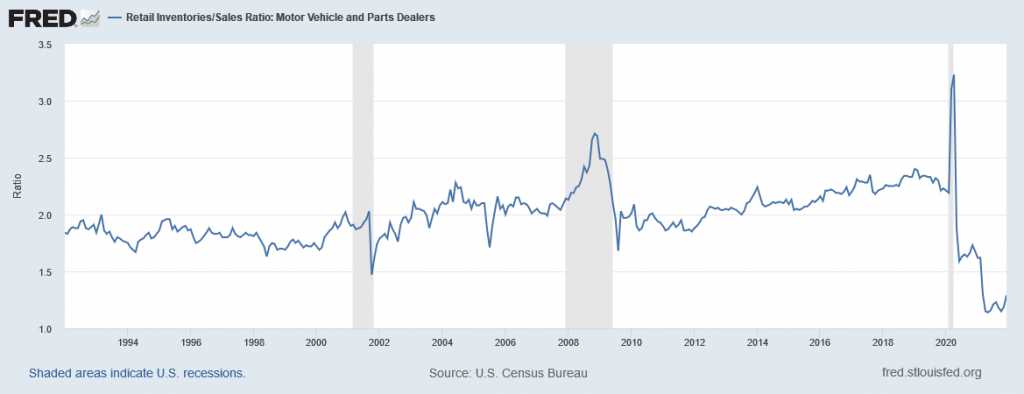

Where do things stand right now? The above graph shows that consumer sentiment is sinking in the current episode, just as it did in previous oil price spikes. However, the situation with the auto industry today is quite different from earlier episodes. Auto production has been depressed not because of inadequate demand, but instead because of problems with supply, for example, problems obtaining computer chips. This by the way is another example of the broader argument I’m making. You can’t judge the size of the disruption caused by the chip shortage by just looking at the dollar value of the chips. If you can’t build a modern car without them, then the resources lost go far beyond the dollar value of the chips themselves. But the fact that supply rather than demand has been a key limiting factor means that a drop in demand for cars will not have the same aggregate implications as it would have in a normal market environment. I had been anticipating a big boost to GDP as auto dealers restock depleted inventories. That won’t happen to the same degree now, which lowers my growth forecast for 2022. But it’s not going to bring auto sales below the levels of 2021.

Based on what has happened so far, I don’t think the U.S. is currently headed for a recession. But I have a significantly more pessimistic view than some other economists of the likely effects if we do see a big drop in shipments of Russian oil and natural gas. Given the localized market for natural gas, I think Europe faces some real challenges if the supply suddenly stops.

Let me close with one final comment. I have been discussing here only the economic consequences of the tragic events currently unfolding in Europe. But the situation in Ukraine is much more frightening and horrific than any of the concerns I have been talking about. My personal view is that we should push hard for stronger sanctions to take away the revenue that Putin is using to finance the ongoing misery and bloodshed.

We should have no illusions about what the costs of doing that could be for everybody. But the costs to all of us if Russia succeeds are far greater.

Why hold fast to the assumption that supply and demand for oil has anything to do with the spot price of oil? Why not admit that it is supply and demand for paper contracts, which is determined by fickle, arbitrary trader sentiment, that actually sets prices? Are oil prices currently being driven by short coverings and profit taking, with actual prices determined by contracts sold weeks or months ago?

Why maintain the fiction that prices are set rationally? And once you let that rational pricing myth go, what meaning does GDP have? Why not maintain real purhasing power by indexing nominal income to nominal inflation, and solving real shortages with engineering not financial momentum trading?

rsm,

Maybe people think that supply and demand play a major role in determining the price of oil because we have seen the price of oil rise, often quite sharply, when there have been disruptions of supply. This is a main theme of this post by Jim, and he documents this pattern well.

He did not go further back in time, but we have seen sudden changes in the price of oil after clear changes in supply and demand for it in earlier eras. Thus the price of oil fell sharply in 1930 as the Great Depression was getting going, reducing demand, but more dramatically there was a sudden increase in supply as the great East Texas oil pool was discovered.

The record is really quite clear, even if at times we have seen prices overshoot briefly one way or another arguably due to speculative behavior by traders. Those overshoots one way or the other have usually been undone fairly quickly as the supply and demand fundamentals have asserted themselves.

If we are intellectually honest, mustn’t we acknowledge at least that prices are a highly nonlinear response to (perceived) supply events? So nonlinear that even direction is often opposite? Supply easily increases with price, or vice versa, depending on arbitrary, fickle, irrational, emotional trader guesses about the future, which are often based on chatroom rumors?

So, why not admit there is no equilibrium price, and instead establish a floor in today’s prices on access to basic resources, then maintain that floor income with continuous indexation?

Doesn’t the private sector already know how to hedge inflation with inflation swaps?

Tl;dr: aren’t current oil prices really determined by hedge fund call buying last year, and concomitant inflation-mongering in chatrooms that conveniently made their bets profitable? Is it easier to trade options and throttle supply right now, so momentum traders are riding this wave?

Is it so hard to see current gas prices as yet another example of artificial scarcity?

Doesn’t economics fail to predict shocks caused purely by human irrational psychology? Is war’s real purpose to destroy surplus?

rsm,

I should not even waste my time with you, your arguments are so weak. Of course nobody can forecast supply shocks, which is why all last year I maintained that crude oil prices could quite easily go either above $100 per barrel or fall below $40 per barrel, with several people (one most vociferously and idiotically) denouncing me for this. Several possible supply shocks were quite possible that could push prices one way or the other, and right now we are experiencing the one I noted could happen and push the price of crude oil over $100 per barrel.

However, that we cannot predict supply shocks, aside maybe from warning about their possibility as I did (and still do), does not mean that there is no equilibrium at a particular time. Now that there is an equilibrium at particular time does not mean that prices are always at whatever the equilibrium is. There can be short term overshoots and bried speculative movements and episodes, especially when the situation is unclear, which it most certainly is right now. But just because situations arise where the supply and demand conditions are unclear, as we see right now, does not mean that they are unclear most of the time or that it is useless or meaningless to think in terms of equilibrium of supply and demand.

You have not remotely proven your point, rsm.

What good is equilibrium analysis, if at every point, prices could double or halve, based on arbitrary, fickle human emotions like Putin deciding to build empire? Remember when oil prices spiked over Libya? Then fell? Was that about real supply and demand, or momentum trading and emotion?

Can you insert your own gratuitous personal insult here, since I suspect that’s really what you want out of this exchange (not that there’s anything wrong with that)?

An article about gasoline prices and recessions. Prof. Hamilton is cited.

https://finance.yahoo.com/news/gas-could-top-5-per-231146709.html

There he goes again – ahem!

So……. this computer chips for autos & GVC stuff…… you’re saying if I stand up a bunch of dominoes down on a flat surface in sequence, and I push down the first domino, I’m not really just pushing down that first domino…… ?? hmmmmm…… Interesting. This sh** is interesting.

I’m sorry, I can’t resist being a smart-A.

I think the natural gas issue is going to hit Europe harder than the oil issue (what you have just said above in a very superb manner so joe six-packs like me can digest it). America and other nations can try to find solutions (extremely hard to pull off logistically, but I think it is doable). I especially appreciate the sentiments of the very last portion of your post and how you made a semi-complex topic easier to comprehend. Wow, I never knew the gas prices were so closely tied to consumer sentiment. Who needs the Michigan survey now eh??~~~just check the price change on the local gas station sign. I mean really.

NG in Europe has risen roughly 10x in price since its lowest point in 2020 (depends on which data point you choose). Say something 5x-6x on average.

This will absolutely hit Europe:

– the marginal price of electricity in many markets is set by the gas-fired power plant price. So you are seeing *wholesale* prices of electricity of 200-400 Euros/ mwhr (so say 20-40 cents/ kwhr)

– many countries source their domestic heating from gas (France is very low due to large amount of electric home heating (using nuclear generated electricity)

– industry uses a lot of natural gas – particularly heavy industry like steel, cement, plastics, fertilizer etc

We would already be in an awful mess but the average temperature for western Europe for February appears to be +5 degrees C (12 F) above the long term average. If we had had another “Beast from the East” (akin to your polar vortex) in March, we would have been sunk.

The increase in road fuel prices is painful. Because fuel taxes are much higher than the USA, the percentage increase in prices is smaller. Distances and miles driven are shorter. Vehicles are more economical. But it’s not critical.

So I agree with you. It’s going to be a tough year in Europe – forward prices are now suggesting little relief before Spring 2023.

It would require an extraordinary act of political courage to stop buying Russian gas & oil.

Yet as the Russian shells and rockets keep falling on Ukraine’s cities, we get closer to that moment of political courage. I would never have believed the changes I have seen in German politics, that have taken place since 14 Feb. Like a sleeping dragon suddenly roused …

This is the moment of Autocracy v Democracy in the world. I can’t think of a similar one since the 1930s. The democracies have slept late, but perhaps they have awakened …

” the marginal price of electricity in many markets is set by the gas-fired power plant price. So you are seeing *wholesale* prices of electricity of 200-400 Euros/ mwhr (so say 20-40 cents/ kwhr)

– many countries source their domestic heating from gas (France is very low due to large amount of electric home heating (using nuclear generated electricity)”

The prices were high already before the Russian invasion. E.g. Germany 2021

https://energy-charts.info/charts/price_spot_market/chart.htm?l=de&c=DE&interval=year&year=2021

The second argument in respect to French NPPs does not work. France had end of last year real issues, 13 GW import end of November with moderate temperatures indicate real problem with their NPPs. In 2020 the capacity factor of NPPs dropped by 13% (!), i.e. 8 or 9 reactors did not produce for one year.

Moses,

Thanks for the article link on previous post. There was no reply link below your name available to comment.

I need to read it several times to follow the math.

Sure would like to see actual data from the 1970s-80s analyzed compared to today.

I like macroduck’s comment about necessary but not sufficient.

@ AS

I am very happy if it helped you. Again, I would suggest don’t get to “tied up in” the math. If you can grasp that math you are way above me at this point, but I think the math (if it becomes a kind of frustration grasping it all) can take away from many of the important messages of the paper. We don’t necessarily need to know thay high levels of monetary aggregates do not necessarily add much to inflation. We have past economic events which we can make a solid judgement from without detailing all those equations. Obviously if you can get the math it.s better, but don’t let the math “subtract from” (see what I did there??) other pretty solid conclusions and reasonings to be had in the paper.

Personally I don’t not think money growth is always needed for inflation. If Menzie had thoughts on that I’d love to hear them. But it’s not a hill I want to die on arguing right at present.

I literally do not know what happens sometimes, it’s like an internet gremlin. I suspect it’s something to do similar with streaming, where it pauses and when I’m typing the letters don’t transmit for 5-6 seconds. But the above sentence in the above comment should read:

* We don’t necessarily need to know that (“that” being the math equations) to know that high levels of monetary aggregates do not necessarily add much to inflation.

Hard to swallow emotionally. One of the best war reports I have seen from Ukraine. Could be upsetting to some people. I don’t consider myself a emotional type person but I got a lump in my throat at the last part of this.

https://twitter.com/OrlaGuerin/status/1503852561513824266?cxt=HHwWlIC-ufv74N4pAAAA

my concern from the beginning. if Putin feels he cannot actually win the war, he will lay siege and destroy what remains of Ukraine before taking his ball and leaving. the modern world does not know how to deal with such a person, when they hold nukes. when he lets the nuke plants melt down, you know this is the path he is taking. spiteful.

I haven’t been paying close attention to the nuclear reactors. But the last I heard, the one they had in the north, I think Chernobyl, has 3 weeks to get the electricity going or the reactor will start heating up, if the reactor starts heating up that is not “the point of no return” but at that point you have a small window of time before a very dangerous series of events starts to occur. We’ve observed how the Russian invaders handle these things. Do we believe they will get electricity going inside of a 3 week time~~in a war zone?? We might as well start the stopwatch on repeat disaster in Chernobyl. Maybe not as severe as the first—but still very bad.

i think all they have to do is get diesel fuel to the backup generators; it seems unlikely that Russia would let Chernobyl melt down again; too close to Belarus and to Russia itself…

they are impacting daily operations. that is a fools errand. I don’t think Putin is worried about whether it affects Belarus or Russian proper or not. if he did worry, he would not be interfering with their operation. just like he has no concern for the loss of innocent civilian life.

biden is using ukraine lives so that vindman and fionna hill do not do him like trump.

this has nothing to do with self determination or democracy.

ukraine is being given the weapons that russia sees as threat.

zelenskyy and his former private militia army is not thomas jefferson.

they do not need to be in nato to be safe, that is why fdr had the un, if only fdr had gotten a nit of his vision….

if you think a country with a parliamentary system, and oligarchs has a jeffersonian democratic right to be in a hostile alliance next door to that alliances main target you have a recondite sense of self determination, and i propose you get ready for the nukes.

Wow, you’ll say anything in service of your masters, won’t you?

You really lean heavily on verbal trickery, too. Who said “Jeffersonian”, other than you? But mostly, you rely on repetition of nonsense propaganda. Nothing to do with self-determination? A foreign power INVADED Ukraine, comrade. It has everything to do with self-determination.

If you want to show your masters how loyal you are, I suppose this unhinged sort of stuff works as well as anything. If you are actually trying to be persuasive, well, I don’t think you’re the right guy for that job.

I agree fully with Macroduck. You are being more and more a completely unhinged and unabashed spouter of utterly indefensbile propaganda swill from Putin.

Ukraine is being given weapons because Russia is invading it in blatant violation of both the UN Charter and the Budeapest Memorandum. I remind you Ukraine has actually been a separate member of the UN since its founding.

The claim that the Ukrainian military is just some foemer private miitia of Zelenskyy’s is also just false. A few units were private militias that got absorbed into the military, notably the notorious Azov battalion Putin is fixated on. But otherwise most of the Ukrainian miliratary started as a regular military, and none of it was ever Zelenskyy’s private anything. What nonsense.

Oh, and I do not think Biden is doing this because of any fear of Hill of Vindman. After all, Biden is not getting impeached like Trump was for trying to use weapons shipments to bribe Zelenskyy into providing ditt on political rivals, which is what Hill and Vindman testified against him about in Trump’s impeachment trial.

You really do not seem to know what is going on in the US, do you, aside from what you read in EIA reports you sometimes quote here. You botness is becoming all too apparent, “Anonymous.” Really, you should have made up some all-American fake name for yourself.

propaganda is easy to refute, you should try it,

refuting that is.

Anomnymous,

Oh, Biden was accurately forecasting that Russia would massively invade Ukraine out of fear of Hill and Vindman when Zelenskyy was saying that was baloney and people like Trump and all of Fox News were ridiculing him? You are out of your mind, Anonymous.

“they do not need to be in nato to be safe”

well comrade, it appears as though they do. unless you and I have a very different understanding of safe, being militarily invaded with siege laid to your cities does not meet my definition of safe. Ukraine is not in nato, and yet Russia attacked unprovoked. in fact, Russia had signed on to protect Ukraine if they gave up their nuclear weapons. so much for Russian integrity in that regard. Russia is simply reinforcing the need for nato.

” i propose you get ready for the nukes.”

very threatening. but you won’t win that battle. everybody may lose if that occurs, but Russia will never exist again if we go down that route. Putin propaganda.

People will not forget:

https://twitter.com/LucasFoxNews/status/1503761800533364736?cxt=HHwWgMC-uf3Yt94pAAAA

https://twitter.com/Foxyonat/status/1503765402857394181?cxt=HHwWisCy7dSqud4pAAAA

Hi James,

a (sad) “proof” of the key role of energy is that Europe will very probably let the oil and gas flow from Russia, as the economic consequences would be tremendous, especially for Eastern Europe, and German industry. EU did a “energy stress test” on Russian O&G in 2014 after the previous invasion, but with no follow-up …

You rightly explain the time lag for shifting industry processes. It is even worse for natural gas, with huge infrastructures, long-term contracts, international treaties (like the Energy Charter Treaty).

As I have been studying the 1970s oil crisis for years, I spent a little time on the 1970s US gas crisis. Fascinating ! When the “peak conventional gas” happens in 1970/71, there is no escape : the warnings are clear from 1969, and curtailments and shortages follow. And it is even hard to find a “US price of gas” in those years …

there is scarce lng to divert to northern europe, and if there were the infrastructure available to handle and transport it is very tight. 5 years to getthat part of the lng supply chain up, in that time maybe usa and uae can increase supply, but would suggest investments in usa/uae. where the uae might go to china for the infrastructure work as is a recent trend. usa would ahave quite a lot more fracking…

You do know we have a lot of natural gas which could be converted to LNG if the effort were put in. And you pretend to be an energy expert.

capacity happens over night….

non!

we are converting the maximum amount of gas that we can right now; some weeks we actually run over 100% capacity utilization….even though a number of new facilities are permitted, it will take 3 to 5 years to build more capacity (based on historical construction times)

Have you considered the possibility that the West wins WWIII and controls Russia’s gas?

rsm,

I just suggested that Anonymous might be out of his mind, but you definitely are with this suggestion. Do you come up with lunacy like this because of what happened with your late brother? Sorry.

Why do I keep thinking of Slim Pickens in Dr. Strangelove: “Nuclear combat, toe to toe with the Russkies”?

More excellent analysis. This sentence alone clears up some confusion in the comments of some of Dr. Chinn’s previous posts:

‘While gas is a relatively local commodity, oil is readily transported.’

‘Vitol sold the cargoes at a discount of $20-$25 a barrel to dated Brent’. Indian Oil Corp, the country’s top refiner, bought three million barrels of Russian Urals from trader Vitol for May delivery, trade sources said, its first purchase of the grade since Russia invaded Ukraine on February 24. Western sanctions against Russia have led many companies and countries to shun its oil, depressing Russian crude to record discount levels.

Now if Vitol purchased this oil at $100 a barrel but ended up selling it at $75 a barrel, doesn’t Vitol suffer the loss from these discounts with the Russian oil company still getting high market prices? This episode should make for an interesting parable about the incidence of economic sanctions.

Urals, the Russian crude benchmark was offered at $30 under Brent 2 days ago. So, it’s unlikely Vitol took a hit on this. And it means Russia is getting the lower price. Also, the IEA came out today saying that they think 3mmbpd of Russian crude is going to get shut in (i.e. limiting production and thus sales). That’s a lot of oil, and a lot of money.

For reference, at the end of Feb22 the OECD had 2,639mm of commercial crude and product inventory and Brent traded >$100/b. During Covid, that ballooned to 3,211 and we saw oil briefly trade below zero. That spread of 572mm would be wiped out in 191 days if the shut-ins persist (572mm / 3mm per day = 191 days). What would price do? There is a reason the WH is releasing from the SPR and trying to increase production domestically and in Iran and VZ.

I tried to get financial data on Vitol but it is a privately held Swiss traded that puts out very little information. They did say back in 2019 that they traded over 3 billion barrels of oil raking in over $225 billion in revenue when oil prices were hovering in the $70 to $75 range. I would love to see its income statements over the past say 15 years. All I know is that the Glencore energy marketing division has had about half of that revenue with operating margins near 1%. Of course 1% of $225 billion in revenue for a year is a boat load of profits.

“U.S. shale oil production in the seven most prolific shale basins are set for their biggest rise since March of 2020, according to new EIA data. The Energy Information’s Drilling Productivity Report is estimating that the total production in the seven major U.S. shale basins will rise by 117,000 bpd next month, to 8.708 million bpd, according to the EIA’s latest version of the Drilling Productivity Report. The news comes as U.S. crude oil production finds itself in the spotlight as to the reasons they are not producing more.”

And we told by certain MAGA hat wearers that Biden’s alleged policies were suppressing US oil production. But no – it was the general workings of the market place. I guess letting the market work is considered SOCIALISM for those wearing MAGA hats.

I was going to write about the other prime movers of the coming recession.

But, why waste my time?

The 500 lb. gorilla in the room is extremely low – 67.2 – UMich consumer confidence .

In February 2020, when Trump was President it was 101.

How long will it take to get US oil production back [from 11.4 million] to 13 million bbl a day, like under President Trump?

“The 500 lb. gorilla in the room is extremely low – 67.2 – UMich consumer confidence. In February 2020, when Trump was President it was 101.”

An honest rewrite is required. Before COVID, this index was 101. Now unless you are a Putin troll, you will tell us what this index was in October 2020.

It was 71.8 is April 2020, oog. It was 88.3 a year later, three months into Biden’s presidency, just before the delta variant hit.

While the price of oil is used as a proxy for the inflationary impact on consumers, the most visible impact is the price of gasoline. Currently, the national average is about $4.30/gallon according to AAA.

https://gasprices.aaa.com/state-gas-price-averages/

There is hope that with oil prices retreating a little that gasoline prices will soon follow. But there is one fly in that ointment, at least in the next few months: EPA summer blend requirements.

Cost for your wallet: According to NACS, this higher-grade fuel can add up to 15 cents per gallon to the cost of your fill-up. This excludes the increased cost due to summer fuel demand, which can vary between 5-15c/gal, depending on region. More stringent requirements (like California) can mean an even higher cost.

Fortunately, this requirement only affects a small portion of the US geography, mainly urban areas and the west coast, so the economic impact will be minimal because not much of the US population are in those areas, right? One might reasonably ask: how much impact will this have on the leisure and hospitality sector this year?

https://www.gasbuddy.com/go/summer-blend-and-winter-blend-gasoline (See map).

“According to NACS, this higher-grade fuel can add up to 15 cents per gallon to the cost of your fill-up.”

It seems once again you have confused high prices with Inflation (rising prices). Dr. Hamilton has often written on what drives the price of gasoline, which I will summarize with a version dumbed down just for you.

Price of a gallon of gasoline = 0.25(price of a barrel of oil) plus a, where a captures excise taxes, refinery margins, and distribution margins.

This post is noting the impact of the price of a barrel of oil, which has risen. Now “a” can vary by region (higher in California than in say Oklahoma) for various regions such as the one you raised. But you offer nothing to suggest that things like the cost of refining has risen. So you have offered nothing new on the inflation front.

Now Robert Hall would get the difference between high prices v. rising prices but we know such distinctions are lost on Bruce Hall.

What you wrote:

It seems once again you have confused high prices with Inflation (rising prices).

What I wrote:

While the price of oil is used as a proxy for the inflationary impact on consumers, the most visible impact is the price of gasoline. Currently, the national average is about $4.30/gallon according to AAA.

https://gasprices.aaa.com/state-gas-price-averages/

There is hope that with oil prices retreating a little that gasoline prices will soon follow. But there is one fly in that ointment, at least in the next few months: EPA summer blend requirements.

Cost for your wallet: According to NACS, this higher-grade fuel can add up to 15 cents per gallon to the cost of your fill-up. This excludes the increased cost due to summer fuel demand, which can vary between 5-15c/gal, depending on region. More stringent requirements (like California) can mean an even higher cost.

Now let’s see how “inflation” is calculated”:

Another way to think about inflation is in the context of the value of a country’s currency, like the U.S. dollar. As prices rise, each dollar you hold buys fewer goods and services. As the purchasing power of each dollar declines, the general cost of living goes up. Why? Because now the public spends the same amount of money but gets fewer things for it.

https://www.forbes.com/advisor/investing/how-to-calculate-inflation/

So, as you might have known, it is not the price level, it is the change (increase) in prices that is relevant.

You’re welcome.

“While the price of oil is used as a proxy for the inflationary impact on consumers, the most visible impact is the price of gasoline. Currently, the national average is about $4.30/gallon according to AAA.”

Thanks for reminding us that you wrote a sentence that confused price levels with inflation rates. Like I said. QED!

Thanks for reminding us that you wrote a sentence that confused price levels with inflation rates. Like I said. QED!

If you parse something enough and refuse to accept the whole, then you can make the Constitution appear to be a declaration of authoritarianism.

The rest of the quote:

There is hope that with oil prices retreating a little that gasoline prices will soon follow. But there is one fly in that ointment, at least in the next few months: EPA summer blend requirements.

Cost for your wallet: According to NACS, this higher-grade fuel can add up to 15 cents per gallon to the cost of your fill-up. This excludes the increased cost due to summer fuel demand, which can vary between 5-15c/gal, depending on region. More stringent requirements (like California) can mean an even higher cost.

Quick quiz: what do the word “add” and “increased cost” infer?

1) absolute price level

2) change in price levels

I have to conclude that either you are a very poor reader or your friend Jen Psaki has been working with you in a spin class.

You are relying on Forbes to define inflation? This is why we call you Bruce “no relationship to Robert” Hall! Next you will tell us some kid who just started piano lessons is Chopin.

You are relying on Forbes to define inflation?

No, Lucy, just trying to make things very simple and clear for you.

“Typically expressed as a percentage that indicates a year-over-year rate of growth, the inflation rate gives you a quick and ready measure of the changing purchasing power of consumers and businesses.”

Whoever wrote this has more on the ball than you ever will but this sentence is a laugh riot unless a business sees zero growth in nominal revenue (please consult with JohnH on that laugher as he thinks their revenues always rise relative to the price level) and workers agree to fixed nominal wages.

Come on Bruce – do you ever bother to actually READ the excellent posts here. Apparently not.

Bruce H.,

So last time crude was where it is now, gasoline prices were about $3.60. So, gosh, they might only decline back down to about $3.75. Yeah, super inflationary for sure.

I’m pretty certain you are being sarcastic here, but for whatever it’s worth some relatively clever people are saying around $5 a gallon is where it starts to effect marginal demand in America. Not sure if Professor Hamilton gave his best guess dollar figure on this.

As I attempted to point out to our snide associate, we are entering the “summer blend” season which typically increases prices 15-30 cents per gallon. If… and that’s a big if… the worst case scenarios mentioned here develop then there could, indeed, be trouble right here in River City.

https://finance.yahoo.com/news/gas-could-top-5-per-231146709.html

Obviously, static prices, even if somewhat high at say $4 per gallon, would not much cause additional inflation, but there probably would be a short period of general price adjustments carried over from the movement of $3 to $4 per gallon. You know, temporary inflation.

The world keeps experiencing “peak oil” and then it doesn’t. Oil in the ground isn’t necessarily the issue. Rather oil between the ears of some politicians can lead to supply disruptions that we all will pay for in higher prices. One estimate of “proven” oil reserves: https://www.worldometers.info/oil/#oil-reserves

filled up my tank yesterday, and gas already down over 20 cents a gallon from last week when I filled up. and lines were MUCH shorter.

Oh gag. It is pretty bad when I have to reply to both Moses Herzog and Bruce Hall. I think I may need to pay a visit to the vomitorium.

Moses, yes I was being sarcastic. Note that all those forecasts of possible $5 per gallon retail gasoline later this year assume an ongoing war and a renewed upward move of crude oil prices, with those people calling for them to go above their old nominal peak of $147 set back in 2008, as I have noted on numerous occasions here. Could that happen? Sure. Might it not? Sure. And no, I am not going to make a specific forecast which will happen, although I know you are dying that I do so so you can play gotcha if I am wrong and reprint it here in emboldened letters numerous times.

I do note that apparently Ukrainians have successfully counterattacked towards Kherson, which if it holds may mean that Odessa will be spared from attack, a city we both like. I hope those reports are true nd if so that they can hold or even advance further and retake Kherson. That would be a body blow to Putin’s invasion.

Yeah, Bruce, we got it that the summer blends matter might add 15 cents per gallon to the retail price. Wow! That will push the prices above $5 per gallon!!!!!! Just how trivial and silly can you get?

Obviously all this depends on what happens in the war situation, as well as in some side market elements that are a lot more complicated than you are willing to admit or discuss, such as how much can Russia still sell through other parties despite the sanctions, assuming that the war continues into the summer. But then, if that counterattack in the South turns into a trend that Putin cannot reverse, this may be all over a lot sooner than many are expecting. We simply do not know, although indeed high retail gasoline prices this summer are a serious possibility, although the summer blend issue is a total nothingburger in this matter. That you think it is shows you are not as smart as you like to present yourself as here, duh.

“Bruce Hall

March 17, 2022 at 7:43 am

As I attempted to point out to our snide associate, we are entering the “summer blend” season which typically increases prices 15-30 cents per gallon. ”

This moron did it again. If the summer blend issue adds the same 15 cents each year, its contribution to inflation over the 12 month period is mathematically ZERO. Poor Bruce – he clearly is struggling with preK arithmetic.

I have not been able to verify further the details of the supposed counterattack towards Kherson by the Ukrainians. Something is going on there, and it appears there has been at least some sort of attempted counterattack. But that one report I saw on Daily Kos looks maybe to have been exaggeratedly positive.

I also see reports of the ships in Black Sea near Odessa making some shelling of the shore near Odessa. I fear that despite an optimistic statement made here, Odessa may still be in danger of serious attack.

prof hamilton, great post. given the significant drawbacks to sudden shortages of oil, and the fact that much of it is sourced from what would not be geopolitical friendlies, would you think it is better to look for alternative sources? “My view is that the reason changes in demand lead to underutilized resources is because of technological barriers to changing production methods quickly. ” why invest to overcome technological barriers that keep that very important geopolitical risk in place?

T. Shaw: “How long will it take to get US oil production back [from 11.4 million] to 13 million bbl a day, like under President Trump?”

That’s funny. When Trump left office US oil production was down to 9.7 million bbl per day. Oops.

I bet Bruce Hall has been told by Kelly Anne Conway that this low production was in anticipation of Biden socialism – even if there were no socialist policies being proposed.

Lucy, I’m sure your close friend and ally, AOC, has told you that Joe Biden would never do anything to jeapordize US energy production. So, don’t listen to everyone else who says Biden’s policies contribute to the reluctance of producers to invest more in US oil.

https://www.instituteforenergyresearch.org/fossil-fuels/gas-and-oil/despite-crisis-bidens-agenda-against-u-s-oil-and-gas-continues/

Uh, uh, uh… no snide comments about the source of the article allowed. Disagreements with the data are allowed with substantiation.

Another classic on IER. Who founded it, who funds it, and its insane climate change denials!

https://www.desmog.com/institute-energy-research/

But Bruce Hall says we should not know any of this as what IER writes has to be the gospel truth!

Thanks, you just proved my point about you.

Uh, uh, uh… no snide comments about the source of the article allowed. Disagreements with the data are allowed with substantiation.

You wish to discredit the data because you find the source objectionable to your ideology.

Boy the stupidity of this is staggering:

“What Biden is probably referring to are leases, not permits. A mineral lease is the exclusive rights to the mineral resources under a tract of land or seafloor that are awarded to the high bidders in competitive lease sales. Federal leases generally have 5 to 10 year primary terms, in which the winning lease holder pays rents to hold the lease. Once the lease holder receives permission to perform the appropriate exploratory tests and sets up the required infrastructure for drilling, the leaseholder applies for further permits to drill wells. Permits are good for two years, with the possibility of a two-year extension. Once the wells are producing, the leaseholder must pay royalties on the product(s) produced.”

So we have 9000 leases which currently allow firms to produce oil. And these guys worry about permits to test whether something might produce oil in the future. How is that going to increase production today? It won’t. This is akin to doing vaccine research only after COVID hit which would have been a disaster. Moderna had been doing its research an entire decade before COVID hit, which is why it took only a year to get effective vaccines approved.

Hey Bruce – I have to thank you for your latest as it proves you know nothing about oil exploration and production. But please keep those right wing publications coming as it getting really, really funny!

Of course actual new leases won’t bring production online immediately. No one debates that. A lease is nothing more than the opportunity to explore and develop any oil finds.

But there is more to that then the superficial suspending of leases and you should know that. When the government comes out and declares a product to be a threat to the world (climate change) and takes actions to limit or reduce future growth, only a stupid day trader is going to take that as a signal to pour more money into something some bureaucrat is poised to squash.

But thanks for your comment. It shows that you have a fixed point mind that can’t be inflated with logic and related information..

I get that Bruce Hall never follows through on any of his links but IER’s little graph was from an AP story which noted this:

“To undo the late-term awarding of so many permits, a former senior Interior Department official said the Biden administration could be forced to pay millions of dollars to companies to get them to relinquish drilling rights. Such a scenario played out in pristine areas of Montana where officials spent decades trying to buy out companies with drilling leases near Glacier National Park.

“This is classic, end of administration stuff, but for the Trump administration it’s on steroids,” said Jim Lyons, deputy assistant secretary of Interior under Obama.

Houston-based EOG Resources amassed the most permits this year — 1,024 — including 549 since September, according to AP’s analysis.

In total, EOG has about 2,500 federal permits approved or in progress. “If he (Biden) tries to impose some regulations on how new federal permits are issued, we certainly already have an inventory, a large inventory, of existing federal permits that will sustain activity for several years,” company CEO Lloyd Helms told a November investors conference.

Oklahoma-based Devon Energy collected the second-highest number this year. As the presidential campaign wore on this summer, Devon executives assured investors that the company was amassing permits. By October, Vice President David Harris said the company had enough “federal drilling permits in hand that essentially cover all of our desired activity over the next presidential term.”

Devon’s more than 500 permits secured this year resulted from a long-term business strategy, not a political calculation, said spokeswoman Lisa Adams. “It was something in the works for years,” Adams said.”

So these fracking companies used their connections with a corrupt Trump Administration to make sure they could continue with drill baby drill no matter what the next White House did. Which means two things: ((a) the blatant lies from Bruce Hall that high oil prices came from some alleged Biden socialism are just that – lies; and (b) the sheer corruption inflicted on us by the last Administration still plagues us.,

Ah, so your logic is that a lease = future oil production regardless of the political climate and whether or not that leased geography contains any economically recoverable oil. Got it.

You refuse to admit that under Trump, oil exploration and production flourished because opportunities were opened up (instead of shut down like Biden is doing) and that the investors understood that the US government wasn’t going to be an obstacle and cause their investments to wither away. The data are there; I’ve provided the links. Your ideology simply makes it impossible for you to accept the reality. You want to believe that the suddenly increasing trend of gasoline prices beginning (coincidentally) the month after Joe Biden took office after remaining stable for a year was simply because the Trump administration was somehow corrupt and caused it to happen at that moment. BS.

Biden was keeping his campaign promise to kill oil until he was forced into a corner by the Russian invasion of Ukraine. He didn’t want to sanction Russian oil because it would shine the light on Biden’s own adversarial relationship with US oil producers, but Biden was forced into those sanctions by public pressure. So now he runs off to Venezuela and Iran begging them to make up the shortfall and, once again, trying to hide his campaign promises, executive orders, and stated antipathy toward oil because of the huge prices increase in gasoline to consumers. I’ll give Biden credit for this: he knows which way the wind is blowing.

So these fracking companies used their connections with a corrupt Trump Administration to make sure they could continue with drill baby drill no matter what the next White House did. Which means two things: ((a) the blatant lies from Bruce Hall that high oil prices came from some alleged Biden socialism are just that – lies; and (b) the sheer corruption inflicted on us by the last Administration still plagues us.,

Applying that reasoning to the Biden Administration, no matter who is elected president in 2024, it won’t matter because Biden has made it clear that people in the oil industry are personae non gratae in his administration.

Thanks for the sterling lesson in logic.

I know you manage to miss the key element of an article as you search for something about which to be contrary.

However, while the Biden Administration continued to approve drilling permits, the rate of approval declined most likely due to an agency pivot toward Biden’s climate agenda and a continuation of his Administration’s war on the oil and gas industry. The drop was especially dramatic in August, according to BLM data. BLM issued 171 drilling permit applications in August—a 75 percent drop since April, when it approved 671 permits. The approvals remained more than 50 percent less than the April approvals for the rest of the calendar year as the graph below shows.

https://www.instituteforenergyresearch.org/fossil-fuels/gas-and-oil/despite-crisis-bidens-agenda-against-u-s-oil-and-gas-continues/

But I know, I know…. Look over there; the source! the source! (Ignore the data).

Total liquids production should be back to pre-pandemic levels during Q2. Shale oil production at the current pace should regain previous highs by year end.

So, when the recession occurs, will you say it’s ‘unexpected,’ ‘transitory,’ ‘good for America,’ ‘Putin’s Fault?’

The post was about oil prices – not the business cycle. So please try to address what Dr. Hamilton and others have said rather than your usual straw man silliness.

T.S.,

Well, Jim is forecasting that US will not enter another recession. What is the basis of your disagreement with him?

Note that in real terms the crude price of oil was higher during 2010-13 than it is now. While we had a slow rate of growth then, we did not have a recession. Which brings us back to what is it that you know that Jim does not that has you forecasting this recession?

Overall recession risk amounts to whatever risk is imposed by the energy shock plus risks from other sources, plus any interaction between them. Fortunately, the U.S. was in good economic shape prior to the oil shock other than the fading effects of Covid and of contractionary fiscal policy.

But the Covid flare-up in China is a separate supply shock, one which may account for the rapid fall in energy prices. Europe’s recession risk is higher than ours, and China’s probably is too; we may run into a demand shock from abroad. Mortgage purchase applications were down 8% from a year earlier in the latest week, a reflection of the rapid rise in mortgage rates, so housing may loose steam. The yield curve is now a bit less scary than a week ago.

T. Shaw wants us to believe that consumer confidence foretells doom, but that’s just another instance of either ignorance or bad faith. Consumer confidence measures are coincident. They have little predictive power.

Oh, add BA.2 to the list of risks. Don’t know how hard it will hit, but it’s working on Europe now, and what happens in Europe happens here.

The Federal Reserve has started a process of raising short-term interest rates, which have been near zero to what might be 2% next year. Before the MAGA hat wearing crowd here freaks out, let’s remember that this rate went from 0.4% in November 2016 to 2.4% by the beginning of 2019:

https://fred.stlouisfed.org/series/fedfunds

Yea Obama left Trump a strong economy. Of course Trump: (a) took credit for something he had nothing to do with; (b) bashed the FED for doing the right thing; and (c) managed to get the FED to lower interest rates by totally screwing up the economy.

If covid shuts down china (it is spreading quite a bit there. I dont think it will be effectively contained) and russia continues with war (and suffers the european economy), i dont think the fed reaches 2% in the next year.

If the curve steepens and credit spreads widen, the Fed’s estimates of monetary conditions may tell them not to go to 2%.

Bless your counterfactual heart.

“(a) took credit for something he had nothing to do with;” Trump cut taxes and regulations and gave positive signals to markets. He got unemployment down to 3.5% in February 2020. Biden has u/e at 3.8% after adding huge amounts of debt [$2.4 trillion] and Fed assets purchases [$1.5 trillion] from January 2021 to January 2022. Since January 2021, M1 is up $2.6 trillion. Still, total NFP employment is two million below the 2020 high and labor participation is only 62.3. And, inflation is Putin’s fault . . . .

With 62.3% labor participation, can you call it full employment?

“(b) bashed the FED for doing the right thing;” Not saying Fed was wrong [can’t say it was right] to the extent Powell wanted ‘arrows in the quiver’ to lower short rates if the economy slowed. From November 2008 to December 2015, FF rates were repressed at 0% – 0.25%. In December 2015 and December 2016, it was twice raised 0.25%, to 0.50% – 0.75%. Then, between March 2017 and December 2018 seven rises brought the FF target to 2.25% – 2.50%, and the equities markets dropped. Powell didn’t cut the FF target by 0.25% until July 2019 and FF target was still 1.50% – 1.75% in September 2019. Then, in March 2020 they cut them to zero – again – and kept them there [too long] until March 2022. Similarly, Fed TA decreased $300 billion during Trump’s fabulously successful first tree years.

“and (c) managed to get the FED to lower interest rates by totally screwing up the economy.” See above. Do you mean the CCP virus attacks and lock downs which crashed the economy and removed Trump?

Fabrications everywhere.

your reference to the “CCP virus attacks” is inappropriate, tshaw. the evidence shows that is not correct. I am no fan of the CCP, but such language obfuscates the issues. this was not some type of political hit job on the world. was their response careless and irresponsible? perhaps. but your description is meant to incite rage. and I will point out, if you want to call the CCP response to the virus poor, then you need to say the same thing about trump’s response. he chose to ignore it, and actually encouraged people to go out and spread the virus. trump had knowledge of the lethality of the virus very early on. in fact, it almost killed him.

china has plenty of issues that should hold it accountable: tibet, the uighyers, etc. this virus propaganda is intentionally meant to sow divisions and incite rage, and those who conspire in it lose credibility with the real issues.

https://www.huffpost.com/entry/ukraine-hospital-hostages-russian-troops_n_6231bb3ee4b0b628202ad2e9

I hate to go off topic but the depravity of Putin’s war criminals invading Ukraine may have hit s new low. Capture a hospital and divert its purpose so the Russian troops can abuse the facility as a military base. All the while making the patients and health care facilities stay and act as human shields. When Putin is defeated, he and all of his military leaders must be dragged to Hague to stand trial for these horrific crimes.

thank you for the view of oil impact on the economy.

i follow stock movements: usa total crude is <1,000 million barrels since late january 2022 and is trending down modestly since.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

usa gasoline, is leveled off and seasonally not worrisome low

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

usa distillate fuel seems not to be leveling off its decline (most of this is transport goods and people):

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

usa kerosene (most of it jet fuel) rebounding off a secular low stock level:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

usa refineries should put out more distillate, but that will lower (build stocks) kerosene prices and could drag both crude inventories and gasoline stocks down….

iea says 3 mbbl/day could be off market soon w/sanctions. that is ~3% reduction when stocks are not favorable.

Here’s how you know Inflation is a serious problem:

https://www.theonion.com/oil-companies-lament-rising-price-of-joe-manchin-1848656304

They reached out to Sinema for comment and all she said was “Amateur!!!” in a voice of disdain:

https://www.politico.com/news/2021/10/15/sinema-campaign-money-pharma-finance-516110

“Sen. Kyrsten Sinema (D-Ariz.) raised more campaign money in the last three months than in any quarter since she became a senator. And she hit that $1.1 million haul with a big assist from the pharmaceutical and financial industries, whose political action committees and top executives stuffed her coffers in the middle of negotiations on Democrats’ massive infrastructure and social spending bills.”

Charles Koch isn’t giving her money too? Oh yea – he is spending his lobbying money on the Institute for Energy Research, which Bruce Hall has told us is an unimpeachable source for energy analysis!

LOL! If you cite the EIA, that’s “data”. If IER cites the same source, that’s “misinformation”.

Oh, look! Crude futures were down yesterday. Oh, look! Crude futures are up again this morning. Come on, man! You just love to bounce around for the sake of arguing. Contribute something. Let’s see your prognostication for 6-months out. Step up and be brave.

And be careful about picking on Democratic Party Sen. Sinema. The LBGTQP crowd is not going to like that abusive language. Why should you be quoting something that has the strong appearance of misconduct or unethical behavior because she got support from the manufacturers of those vaccines you want everyone forced to have? Playing both sides again, eh?

Yeah, I know, Sinema doesn’t have a 100% favorable rating from your hero, AOC.

I do not normally cite Wikipedia but Bruce Hall needs to read up on what the EIA is:

https://en.wikipedia.org/wiki/Energy_Information_Administration

The U.S. Energy Information Administration (EIA) is a principal agency of the U.S. Federal Statistical System responsible for collecting, analyzing, and disseminating energy information to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy and the environment. EIA programs cover data on coal, petroleum, natural gas, electric, renewable and nuclear energy. EIA is part of the U.S. Department of Energy. The Department of Energy Organization Act of 1977 established EIA as the primary federal government authority on energy statistics and analysis, building upon systems and organizations first established in 1974 following the oil market disruption of 1973. EIA conducts a comprehensive data collection program that covers the full spectrum of energy sources, end uses, and energy flows; generates short- and long-term domestic and international energy projections; and performs informative energy analyses. EIA disseminates its data products, analyses, reports, and services to customers and stakeholders primarily through its website and the customer contact center. Located in Washington, D.C., EIA has about 325 federal employees and a budget of $126.8 million in fiscal year 2021. By law, EIA’s products are prepared independently of policy considerations. EIA neither formulates nor advocates any policy conclusions. The Department of Energy Organization Act allows EIA’s processes and products to be independent from review by Executive Branch officials; specifically, Section 205(d) says: “The Administrator shall not be required to obtain the approval of any other officer or employee of the Department in connection with the collection or analysis of any information; nor shall the Administrator be required, prior to publication, to obtain the approval of any other officer or employee of the United States with respect to the substance of any statistical or forecasting technical reports which he has prepared in accordance with law.”

But Bruce Hall thinks that the EIA is not be trusted while he also thinks IER is the unbiased reliable source for energy information. I never thought any person on this planet could be that DUMB. But Bruce Hall proved me wrong.

Bruce Hall’s incessant incoherent chirping may have left you confused. Well we know Bruce is confused but let me summarize his latest nonsense.

Now most sane people would attribute the rise in oil prices to an increase in demand that was accompanied by the delayed impact of an inward shift of the supply curve from those really low prices back in 2020. In other words, the market place.

No says Bruce – it was all Presidential policy. After all Biden has to be the blame for everything. But wait – Bruce is mansplaining to us that Trump’s policies back in 2019/2020 gave us more leases and permits which I guess he thinks shifted the supply curve outwards. Yes – he actually believes an outward shift of the supply curve from Trump’s policies gave us a spike in prices. After all – he relies on the Charles Koch sponsored IER for his “economics”.

LOL! Remember how the economic problems during the initial year of COVID were all Trump’s fault because… well, he was POTUS? Same holds true now for Biden. Besides, he’s been in office for over a year so time to move on. Let’s be consistent, man! You can’t keep parroting AOC. Well, you can, but that’s self-defeating.

No, I remember that the public health response to Covid was Trump’s fault. I think you have projected your own way of thinking onto others.

Biden didn’t cause the shift to goods demand which led to inflation. He didn’t cause the rapid turn-over in the labor market or wage increases (to which I say “hallelujah”).

The snakey wiggle from actual economic cause to blame to public mood is a favorite trick of partisan hacks. Never can pin them down. Brucey is among the worst offenders.

《Now most sane people would attribute the rise in oil prices to an increase in demand that was accompanied by the delayed impact of an inward shift of the supply curve from those really low prices back in 2020. In other words, the market place.》

Is it so hard to see that traders over-reacted on both the downswing and upswing, vastly exaggerating any possible real supply and demand factors?

https://uproxx.com/viral/russian-ukraine-war-soldier-death-toll/

At least 7000 Russian soldiers have died with around 20,000 wounded. Now one would think all those body bags returning to Russia would be an awful sight. But it seems Putin has ordered that his own soldiers be cremated in Ukraine to avoid this embarrassment. Putin is committing war crimes against his own people.

https://americanmilitarynews.com/2022/03/video-entire-column-of-russian-tanks-gets-stuck-in-ukrainian-mud/#:~:text=Russian%20T-80%20tanks%20were%20abandoned%20after%20becoming%20stuck,after%20becoming%20stuck%20in%20thick%20mud%20in%20Ukraine.

That column of Russian tanks is in trouble. It seems a lot of them have become stuck in the mud and their crews have just abandoned their tanks. Putin is a monster but thankfully as a military leader he seems to be incredibly incompetent.

Food prices are more important to the household budgets of the poor than of anyone else. There is a deadline approaching which may have a very large effect on the poor – Ukrainian farmers need to plant soon. Before they plant, they need supplies. Ukrainian farm organizations have warned that their members may not have the supplies they need. I’m not aware of the financial arrangements of Ukrainian farmers, but I wouldn’t be surprised if they need credit in order to pay for planting. They are probably considered high-risk borrowers right now.

Europe and the Middle East may face outright supply shortages, with the rest of the world facing higher prices for wheat and wheat substitutes. So higher prices for protein, as well.

I don’t know what intervention could improve the odds of successful planting season, but we (the world) should be looking into it.

Farmers outside Ukrainian will take up some of the slack, facing substantial expense if Ukraine’s Farmers come through with a sizable harvest. Risky time for food and everybody who makes it or eats it.

Apologies. Ukraine plants mostly winter wheat. It is the harvest, not planting, which is at risk. Nearer-term food security problem.

Egypt, Indonesia, Turkey, Pakistan and Morocco are the top importers of Ukrainian wheat.

Very interesting analysis.

Regarding consumers’ response to gasoline prices, in a recent article, I document substantial heterogeneity in consumers’ responses to gasoline prices depending on: (i) whether the consumer lives in rural or urban areas, and (ii) in the short vs long run.

In particular, in the Chicago urban area, short-run analysis predicts that the gasoline expenditure shares increase in the short run. The opposite is true when using the long-run responses: gasoline expenditure shares decrease. This is a consequence of the elasticity estimates being inelastic in the short run, but elastic in the long run. Moreover, low-income consumers are more price sensitive in the long run and, therefore, more responsive to gasoline prices than middle- and high-income consumers. A gasoline tax is less regressive after accounting for such long-run substitution behavior.

Donna, Javier D., “Measuring Long-Run Gasoline Price Elasticities in Urban Travel Demand,” RAND Journal of Economics, 52: 945-994, 2021, https://doi.org/10.1111/1756-2171.12397

Javier,

Well, congratulations on publishing your paper in the prestigious RAND journal. However, as a longtime journal editor I note that the point you report here has been totally known for a very long time, with Jim Hamilton showing this decades ago. I gather you were able to publish because of the originality of your discrete choice model and finding some differences in long run elasticities from studies based on other models, so congrats. But otherwise, you are not telling ua anything not already long known here.

Off topic – I know I keep doing this, but there are many, many things in flux:

China’s response to Russia’s invasion of Ukraine has been a big secondary issue these past three weeks. One thread in pundit-speak has been that China will benefit by being a pillar of stability while Russia and the West tussel, benefit from greater access to Russian resources, benefit from Russia needing stronger alliance with China. Could be true. Could be a “China ascendant” bias driving pundit views before any serious assessment had occurred.

Anyhow, a new theme may be cropping up. Xi I fumbling the economy:

https://www.google.com/amp/s/www.wsj.com/amp/articles/rollback-of-xi-jinpings-economic-campaign-exposes-cracks-in-his-power-11647354449

At the same time, China loses international influence by snuggling up to Russia just before Russia became a pariah:

https://www.google.com/amp/s/www.foreignaffairs.com/articles/china/2022-03-16/xi-jinpings-faltering-foreign-policy%3famp

Maybe China Xi is feeling a draft coming through the door it opened for Russia.

Worth considering is whether China’s shoring up of its construction credit system can hold together in the face of a nascent recession. It’s an important question, because China has turned to relation in the real estate sector to stave off recession.