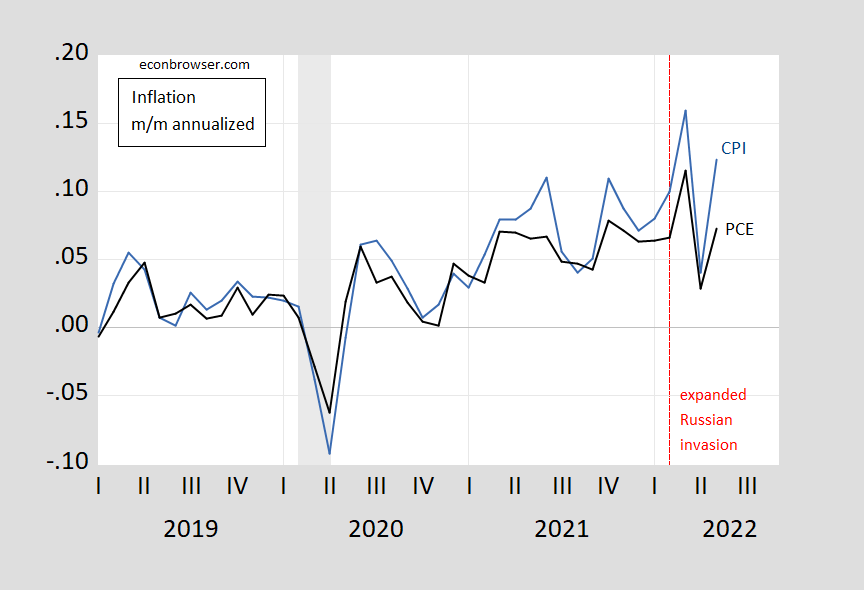

Month-on-month indicators down, particularly core PCE:

Figure 1: Month-on-month CPI inflation (blue), PCE inflation (black). NBER defined peak-to-trough recession dates shaded gray. Source: BLS and BEA, and author’s calculations.

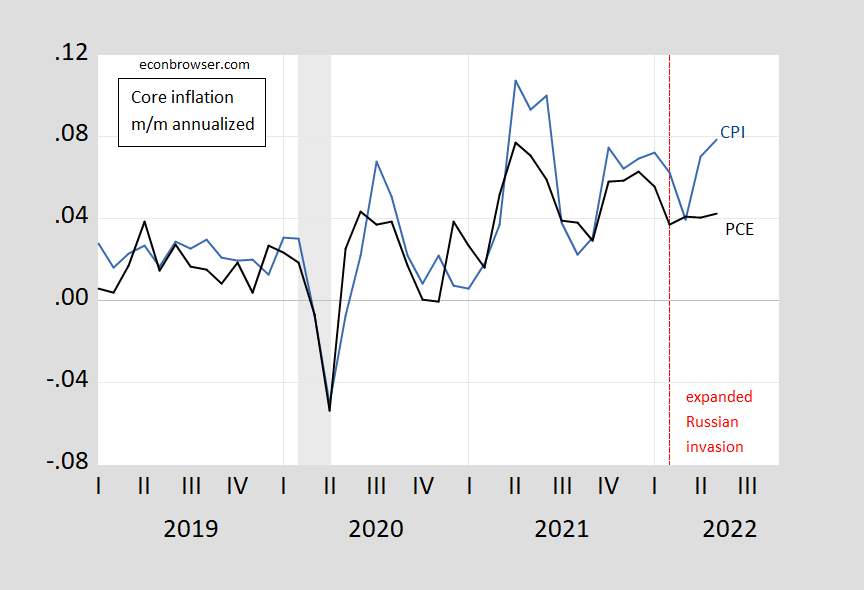

Figure 2: Month-on-month core CPI inflation (blue), core PCE inflation (black). NBER defined peak-to-trough recession dates shaded gray. Source: BLS and BEA, and author’s calculations.

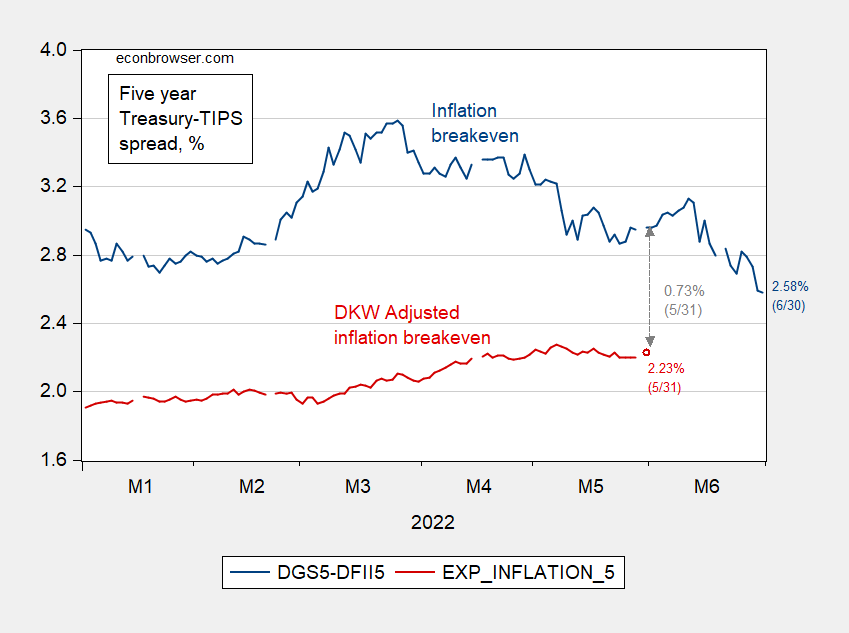

Partly as a result, the 5 year inflation breakeven has continued to decline.

Figure 3: Five year inflation breakeven, 5 year Treasury minus 5 year TIPS (blue, left scale), 5 year breakeven adjusted for both inflation risk and liquidity premia, per DKW (red, left scale), both in %. Source: Treasury via FRED, KWW per DKW, and author’s calculations.

this at 0830 this am

https://www.bea.gov/news/2022/personal-income-and-outlays-may-2022

while atlanta niw says 2q 2022 gdp is -1%,

we wait for 13 jul.

In the FWIW category, looking at the Core CPI-All price level data, my AutoARIMA tool tells me that the best Schwarz-Bayesian and Hannan-Quinn information criteria point to an ARIMA (9,2,4) model w/o constant. The dynamic prediction for the mean price level for May 2023 is 309.766. The May 2022 price level is 292.289. That works out to about a 6 percent year-over-year inflation rate. The predicted May 2023 annualized month-over-month rate is 4.85 percent. There is a wee bit of GARCHiness in the residuals.

Yooh damnded durned show-off ‘nd yer AutoARIMA. Yooh mehst be one uhv them thar fantsy panse northeasternerz. Yooh think yooz special ‘cuz yooz gawts theh Zaxby’s and Sbarro pizza dernt yeh?? Weez gawt theh Stuckey’s in the South. Nyaaa Nyaaa.

No I mean, I’m joking with you. I’m envious you got that R stuff going. Maybe even a tinge jealous, Don’t tell anyone 2slugs, it’s our secret. Thumps the mic with my knuckle. Is this thing on??

2slugbaits,

Thanks for the FWIW. I find it interesting to see what others forecast and the method used.

Another FWIW, trying to avoid the long stretch of a dynamic forecast from June 2022 to May 2023, I used annual data for May of each year from 1974 to 2022 to forecast May 2023. After taking the second difference I was presented with a stochastic series (if I am using the correct phrase). Using the model, d(cpilfesl,2) c, the forecast for May shows an index forecast of 309.17. Although the constant “c” is not statistically significant the U2 statistic is 0.30. A U2 statistic value of “1” is no better than using the prior actual and a value of “0” is the best one can do.

AS Okay, so we’re both in the same neighborhood. You wouldn’t ordinarily want to use a constant in a (p,2,q) model. The second difference can be thought of as the calculus version of the second derivative in a continuous model, so it implies changes in the rates of change. Of course, these are all unconditional forecasts, which is why they get the “FWIW” tag. If CoRev’s buddy Putin blows up the world, then all bets are off.

2slugbaits,

Thanks for the response and comment about “c” and second difference. I had not thought about the second derivative analogy.

I did a monthly model from 1980m01 to 2022m05 but seem to have a different model from yours. The model I used is d(cpilfes,2) AR(1) AR(2), AR(3) MA(1) MA(2). The 2023 May forecast result is 310.33. Other time periods seem to show a similar model and similar forecast. Not questioning your model, just thought I should be able to arrive at the same model.

I notice that the 2nd difference data from 2020m01 to 2022m05 seem to have a much larger variance compared to previous data. I made a model using the 2020m01 to 2022m05 data, but still seemed to show a similar forecast for 2023m05, which is 311.9.

my unscientific forecast has been between 4% and 5% in the next year or two. it got a bit higher than i thought it would, but the time period for the overshoot will be months, not years. the fed is raising rates, and there is some slowing of growth to help temper the inflation rate. i actually think the fed over reacted with the 0.75% hike, and that increases the likelyhood of a mild recession. but that will also be a drag on inflation.

https://www.msn.com/en-us/news/world/ukraine-big-victory-at-snake-island-could-be-a-turning-point/ar-AAZ2sKR

Russian troops withdrawing from Ukraine’s Snake Island in the Black Sea, after repeated bombardments, could have wide-ranging significance, current and former Ukrainian officials have said. Snake Island became globally famous thanks to the now-legendary “go f*** yourself” response of the defending garrison when told to surrender to a Russian warship. Moscow has explained the withdrawal as a “gesture of goodwill” that shows Russia is “not impeding [United Nations] efforts to organize a humanitarian corridor to ship agricultural products from Ukraine,” and avoid catastrophic global food shortages. But Ukrainian officials have dismissed Russia’s explanation and declared the regaining of the island after 127 days of occupation as a significant strategic and symbolic victory.

Either way – Ukraine exports of grain could mean lower prices for bread!

To Putins claim of “gesture of goodwill” we can only repeat the famous exclamation from the Snake Island heroes “go ……

I hope they manage to get export of Ukrainian Ag products started soon. The biggest losers of increased world food prices are the poor countries – and even Putin must have seen that it would not be of any benefit for Russia.

The ability of Ukraine to kick Russia off Snake Island is a good sign. So is Russias bumbling departure. They evacuated the island in speed boats then tried to bomb and burn it (to destroy equipment they had left behind intact). Talk about disorganized and incompetent retreat. Unfortunately, at this point Ukrainian troops in Donbas are firing 1 shell back for every 20 they suffer from Russian forces. That has to be fixed; and when it is they will be able to turn it around and gain (rather than lose) ground slowly.

For non economists who are fans of this blog, can you kindly explain in plain words what the esteemed economists are talking about? Is inflation going higher, lower or not as simple. Retailers have too much inventory and need to liquidate. How will that liquidation impact headline inflation figures (if at all). Cleveland Fed had a very interesting paper where they highlighted how consumers use different weights in forming their inflation expectations vs what are used by CPI (e.g. food away from home carries a much higher weight vs Shelter used in CPI). Would appreciate your thoughts (if possible) on this topic.

I think the “heterodox” opinion on that, at the moment, of as what Menzie might call a “fluid” situation, is that Inflation is rising, but it is rising at a lower rate, than maybe it was 2 months ago. But maybe others are paying closer attention than me and have differing thoughts on it.

I read something recently that said the inflation is super bad in Europe, possibly worse than here. I guess Republican campaigners can figure out a way to blame Biden for inflation in Europe and Britain?? If Biden helps defend Ukraine then he”s the cause of inflation?? I don’t know how they think Biden caused inflation. He released the oil reserves, which admittedly is like spitting in the ocean, but he is trying to better the situation. More than Republicans are doing. Maybe if donald trump had given Ukraine more military assistance we wouldn’t be here right now, but trump thought he could extort a European nation for his personal gain. Our village idiots here don’t want to discuss that last part.

*Excuse me, orthodox opinion. Damn I don’t know how I managed that one. I told you people the summer heat fries my brain. It’s been slightly over a week since I lubricated my brain’s ball bearings with alcohol, so……..

Menzie,

I’m confused, the data show m/m May PCE has risen slightly. So when you proclaim “Month-on-month indicators down, particularly core PCE”, are you referencing that core m/m for May 2022 is lower than core m/m for May 2021 (although headline is higher so maybe there is a different plural “indicators” you’re referencing)? If so, is that a common practice?

A recent paper from two Fed economists provides new evidence that declining labor bargaining power accounts for declning inflation in the pre-Covid era:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4118173#

Nothing about off-shoring or imports, but those factors are wrapped up in the loss of bargaining power. The upshot is that we have been relying on the wrong Philips curve, one which ignores bargaining power.

What’s that antiquated phrase that only old obsolete white guys like me say?? “One good turn deserves another”

https://rooseveltinstitute.org/wp-content/uploads/2022/06/RI_PricesProfitsPower_202206.pdf

Highly recommended to our good blog hosts and our more cerebral commenters.

Very interesting paper – thanks. The end of their abstract gives one a little hope:

Since markups are unusually and suddenly so high, there is room for reversing them with little economic harm and likely societal benefit, including lower

prices in the short term, and less inequality and potentially more innovation in the medium term. We believe the evidence presented in this brief points to an all-of-government administrative, regulatory, and legislative approach to tackling inflation that includes demand, supply, and market power interventions.

Policy makers – pay attention. I for one would love to see a renewed anti-trust push.

Excellent. By the way, the paper I linked to cites Kalecki:

https://equitablegrowth.org/must-read-michael-kalecki-1943-political-aspects-of-full-employment/

He equated mark-ups with market power, and not just in the product market. Labor market power determines who gets the mark-up, and how large it will be.

See? We can have grown-up discussions when only grown-ups chime in.

Meanwhile, Turkish inflation is getting worse:

https://fred.stlouisfed.org/graph/?g=RdGA

Which of our commenters (mercifully absent lately) lecture us aboutthe genius of Erdogan’s monetary policy? Never mind…best forgotten.

BBVA recently increased to ts stake in Turkish bank Garanti to 86% of Garanti shares and has now decided to employ accounting rule IAS 29 to its reporting of Garanti results:

https://www.marketscreener.com/quote/stock/BBVA-69719/news/BBVA-Implementation-of-IAS-29-to-BBVA-Turkey-Financial-Statements-40846884/

IAS 29 is a rule used to deal with accounting under hyperinflation. There is dispute over the exact definition of “hyperinflation”, but 73.5% y/y is enough for BBVA’s accountants.

Erdogan hasn’t indexed the minimum wage to inflation, and this little gesture leaves low-income households in bad trouble:

https://www.ft.com/content/5352a116-499f-4043-b7c0-9557e067a1a6

Ted Cruz attacks Elmo for taking the COVID19 vaccine? Didn’t he attack Big Bird? Oh yea – check out SNL’s version!

https://www.youtube.com/watch?v=IAZKwuNvt8c

The shipping industry press is writing about a supply-chain bullwhip effect:

https://www.freightwaves.com/news/the-supply-chain-bullwhip-is-doing-the-feds-job-on-inflation

This particular article anticipates disinflation as the result of the inventory overhang. Makes sense. Meanwhile, we are looking at a second quarter of inventory drag on GDP, with shipping industry chatter suggesting three in a row:

https://fred.stlouisfed.org/graph/?g=RdMC

I know some of our commenters really, really want a recession before the election, but inventories are not among the NBER recession indicators. Sorry, boys.

Md,

I keep pointing out that this large increase inventories is going to add to GDP in Q2,. I do not know if the new forecast from the Atlanta Fed of a negative 2.1 % change in GDP for Q2 takes that inventory change into account or not. It looks like their forecast is heavily driven by a supposed sharp decline in investment, which may be happening, although technically net inventory changes are part of the broader category of investment.

pgl,

Steven has been loudly forecasting negative GDP growth for this quarter. But I would be cautious about saying he is happy about it. He has stated that he is very upset about Putin’s invasion of Ukraine and he has stated that he is worried that a bad US economy, however measured, will produce a US Congress that will stop supporting the Ukrainians against Putin’s invasion. Again, lots here keep thinking or assuming he supported Trump, when he did not, despite his generally pretty conservative views.

In a three ideology model, my views are split about evenly between liberal and conservative ideologies. I am not much of an egalitarian, though.

Voters will not much care what the economy is called, save that if the NBER is saying everything is fine when voters are being trashed economically, they will once again think it’s time to drain the swamp.

Rather, I see the potential for the twilight of the Democratic Party, much as happened in Hungary after 2010, or more recently in the UK. The Democrats positioned as progressives will cease to be a national party. They must be positioned as liberals, that is, as fiscal conservatives, if they want to stay relevant on then national stage. I would add that the sales pitch of the fiscal conservative, ie a classical liberal, is boring competence. Right now, the Biden administration is light years from any notion of competence.

The only upside of a serious recession could be the removal of Xi. That would be worth three depressions, much less a recession. Xi remaining in power quite literally puts civilization at risk.

“I know some of our commenters really, really want a recession before the election”

Princeton Steve has certainly been banging that drum. He also did not like the most recent forecast from Goldman Sachs so he basically called into question their forecasting record. Excuse me but Jan Hatzius is their chief economist who has a much better forecasting record than Stevie boy could ever even comprehend.

Barking Bierka – the NYC Jerks quotes MD: “I know some of our commenters really, really want a recession before the election.”

Actually that should have said: I know some of our commenters are really, really afraid of a recession before the election. Many of us think we are already in a recession. If we do slip by this quarter the next quarter, Q3, will be a disaster, and the NBER will reduce Q2 to show us being in recession starting Q1 2022 if not late 2021.

I did not call into question Goldman’s record, but rather their methodology. As I worked in an investment bank, I am somewhat skeptical about the enthusiasm of management for spending money on these sorts of things. Analysts are cost centers, not profit centers, and every dime spent on analysis comes out of some trader’s bonus. That’s the reality of working for an investment bank.

“I did not call into question Goldman’s record, but rather their methodology.”

I see – you think they are just throwing darts and just getting lucky. This from someone whose methodology is to fish for anything to get you on Fox and Friends. OK, I’m calling my friends at GS on Tuesday to let them know what insulting garbage you are saying. Get yourself a good lawyer as you will need one.

“Analysts are cost centers, not profit centers”

Marketing departments are cost centers. And we know you are all about marketing your stupid BS. I guess that is why your consulting firm is such an utter failure.

Cost centers are the earliest to be cut during times of economic stress. Who here may not be safe? Because from the comments there may be more than just a few.

https://news.cgtn.com/news/2022-07-01/Caixin-China-manufacturing-PMI-rises-to-13-month-high-1bjdlYjE82Q/index.html

July 1, 2022

Caixin China manufacturing PMI rises to 13-month high

China’s June Caixin manufacturing Purchasing Managers’ Index (PMI) rose to 51.7, its highest since June 2021, as factory activities quickly recover from the COVID-19 pandemic.

The figure beats a market expectation of 50.1 by raising 3.6 percentage points from May. The 50-point index mark separates growth from contraction every month.

The Caixin survey focuses on more export-oriented and small firms in coastal regions. The relative strength in the private gauge tallies with an official survey released on Thursday.

A sub-index for output bounced to the highest level since November 2020, while new orders, bolstered by the first increase in export orders in about a year, snapped three months of decline and posted the fastest growth in four months.

Delivery times for suppliers stabilized in June amid easing supply chain snags, after worsening for the past two years.

“Manufacturing supply surged, and demand improved. As COVID restrictions were loosened, production in the manufacturing sector gradually moved toward normality,” said Wang Zhe, senior economist at Caixin Insight Group….

https://english.news.cn/20220701/1bf0f9b834f84d7b803bd8dd4a9316f7/c.html

July 1, 2022

Eurozone’s June inflation surges to record 8.6 pct

BRUSSELS — Inflation in the eurozone surged to a fresh record high, with consumer prices pumping 8.6 percent in June from a year earlier, according to figures released on Friday by Eurostat.

The European Union’s statistics agency said the increase in consumer prices in the 19 countries that use the euro currency had increased further from the previous record of 8.1 percent logged in May. Inflation is at its highest level since recordkeeping for the euro began in 1997.

The jump was driven by soaring food and energy costs as Russia’s conflict with Ukraine and threats on gas supplies continue to push bills through the roof.

Nearly half of the 19 eurozone countries have reached double-digit inflation, the data shows. While inflation in Germany and the Netherlands dipped slightly in June, Spain set a record, hitting double digits. Estonia is expected to register the highest inflation rate with 22 percent, followed by Lithuania at 20.5 percent.

A breakdown of the main components of inflation shows that energy prices rocketed 41.9 percent compared with 39.1 percent in May while prices for food, alcohol and tobacco were up 8.9 percent, up from 7.5 percent in May….

https://www.msn.com/en-us/news/us/supreme-court-justice-clarence-thomas-repeated-misleading-claims-that-covid-19-vaccines-were-made-using-cells-of-aborted-children/ar-AAZ3t2u?ocid=msedgdhp&pc=U531&cvid=32ffd2c3c731426dab7f999a1c922b78

“SCOTUS declined Thursday to take up a challenge to New York’s vaccine mandate for healthcare workers.”

That is the good news but here is what is getting a lot of attention:

‘In his dissenting opinion, Justice Thomas repeated misleading claims that vaccines were developed using cells of “aborted children.”‘

This statement is false. Why is Clarence Thomas still on the bench?

Interesting chart on the 5-year breakeven inflation rate:

https://fred.stlouisfed.org/series/T5YIE/

On March 25, 2022 this reached 3.6%. It is now 2.6%.

Krugman noted this in has recent oped which ltr cites in the comment section under the next blog post.