July WEO update:

In China, further lockdowns and the deepening real estate crisis have led growth to be revised down by 1.1 percentage points, with major global spillovers.

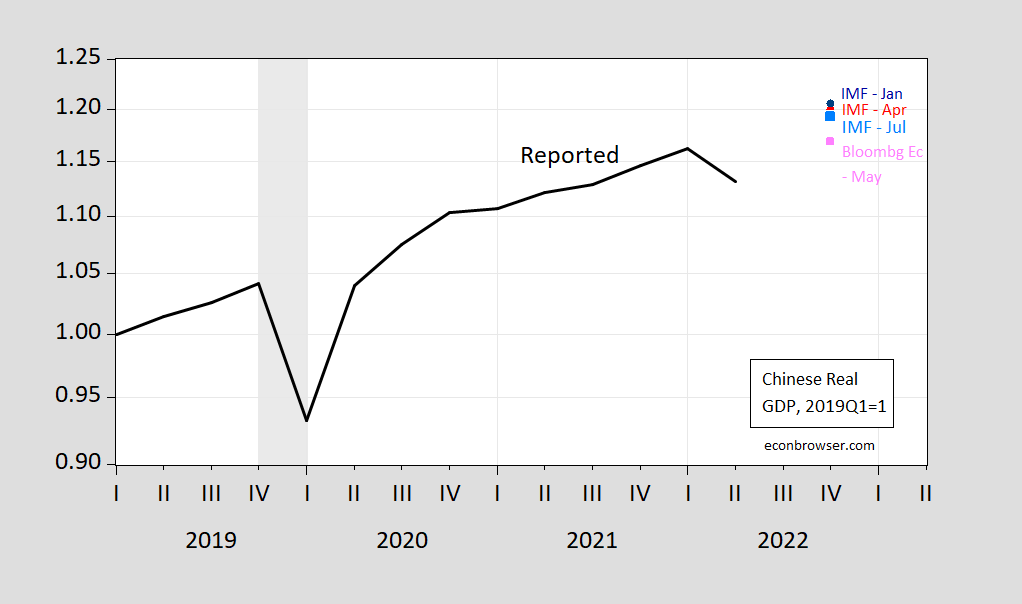

This shows up in the following graph as the most recent in markdowns in forecasted growth rates and implied levels of GDP:

Figure 1: China real GDP, 2019=1 (black), and forecasts from IMF World Economic Outlook, January (blue circle) April (red triangle), July (sky blue square), and Bloomberg Economics (pink square). GDP calculated by cumulating q/q reported growth rates. ECRI defined peak-to-trough recession dates shaded gray. Source: NBS, IMF WEO (various issues), Bloomberg Economics, ECRI, and author’s calculations.

The latest WEO forecast is implies the same end-2022 level as in the Deutsche Bank and Goldman Sachs May forecast (see this post).

Further details:

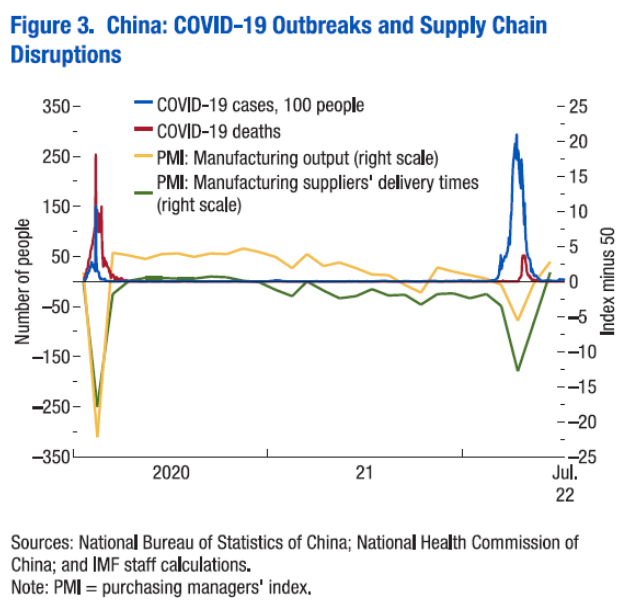

COVID-19 outbreaks and mobility restrictions as part of the authorities’ zero-COVID strategy have disrupted economic activity widely and severely (Figure 3). Shanghai, a major global supply chain hub, entered a strict lockdown in April 2022, forcing citywide economic activity to halt for about eight weeks. In the second quarter, real GDP contracted significantly by 2.6 percent on a sequential basis, driven by lower consumption—the sharpest decline since the first quarter of 2020, at the onset of the pandemic, when it declined by 10.3 percent. Since then, more contagious variants have driven a worrisome surge in COVID-19 cases. The worsening crisis in China’s property sector is also dragging down sales and real estate investment. The slowdown in China has global consequences: lockdowns added to global supply chain disruptions and the decline in domestic spending are reducing demand for goods and services from China’s trade partners.

Figure 3 shows the impact on manufacturing activity of the pandemic and the government’s response.

https://news.cgtn.com/news/2022-07-26/Chinese-mainland-records-148-new-confirmed-COVID-19-cases-1bYvJXqAlZ6/index.html

July 26, 2022

Chinese mainland records 148 new confirmed COVID-19 cases

The Chinese mainland recorded 148 confirmed COVID-19 cases on Monday, with 98 attributed to local transmissions and 50 from overseas, data from the National Health Commission showed on Tuesday.

A total of 828 asymptomatic cases were also recorded on Monday, and 6,972 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 228,946, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-07-26/Chinese-mainland-records-148-new-confirmed-COVID-19-cases-1bYvJXqAlZ6/img/f1fccbbe22794ffba9214338d3b5a096/f1fccbbe22794ffba9214338d3b5a096.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-07-26/Chinese-mainland-records-148-new-confirmed-COVID-19-cases-1bYvJXqAlZ6/img/03a7685afb3a4374b85ee65f8b4d9d4d/03a7685afb3a4374b85ee65f8b4d9d4d.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-07-26/Chinese-mainland-records-148-new-confirmed-COVID-19-cases-1bYvJXqAlZ6/img/fb4faeac496847d19ca1a7d09ed172c8/fb4faeac496847d19ca1a7d09ed172c8.jpeg

https://www.worldometers.info/coronavirus/

July 25, 2022

Coronavirus

United States

Cases ( 92,339,925)

Deaths ( 1,052,467)

Deaths per million ( 3,166)

China

Cases ( 228,798)

Deaths ( 5,226)

Deaths per million ( 4)

Between your posts and what the WEO sensibly wrote, we have been provided with a rather detailed and balanced view of what is happening with the Chinese economy. Which allows us to skip two rather routine things:

(1) The world is coming to end rants from Princeton Steve; and

(2) China has the greatest economy ever rants from ltr.

Now can you just imagine these two on a date?

OH NOOOOO – pgl – why did you have to plant that image in my mind???

Well, I rather like ltr, assuming she is a she.

I think being a professional propagandist is a difficult job, particularly for someone who is clearly educated and no fool. I know the world of such people, and it is a difficult place to inhabit. Still, to be here on Econbrowser is to inhabit, at least for a time every day, the world of knowledge and ideas.

https://news.cgtn.com/news/2022-07-23/China-to-boost-effective-demand-for-stronger-economic-recovery-1bTQrHC0DQc/index.html

July 23, 2022

China to boost effective demand for stronger economic recovery

China will continue to roll out more policies to expand effective demand and strengthen the driving force for economic recovery and growth, according to the decisions made at the State Council’s executive meeting chaired by Premier Li Keqiang on Thursday.

The meeting noted that China’s economy is at a crucial stage of stabilization and recovery and that the third quarter is of vital importance. It is essential to efficiently coordinate COVID-19 response with economic and social development, and further deliver the policy package for stabilizing the economy.

The meeting called for greater efforts to consolidate the foundation of economic recovery, stabilize overall economic performance and keep major economic indicators within a proper range, giving priority to job security and price stability.

There is still ample room for bringing out the effects of the policy-backed and development-oriented financial instruments and special-purpose bonds. These measures will help draw a large amount of private investment and should be executed in accordance with market principles.

Effective investment must be fully utilized to strengthen weak links, facilitate structural adjustments, spur consumption and create jobs, so as to leverage its key role in economic recovery and growth.

The meeting decided to establish a coordination mechanism to promote major investment projects. To ensure consistency and efficiency, competent departments will conduct a joint review of the projects before final approval.

The approved projects should deliver both immediate and long-term benefits, help underpin the economic and social development, conform to the 14th Five-Year Plan and other plans, generate economic returns and the operations should start as soon as possible.

The quotas on land use and energy consumption for major projects will be set separately in accordance with related regulations. The development of competitive industries will still be guided by market rules.

The meeting urged expediting the use of special-purpose bonds and guiding commercial banks toward supportive financing. The newly-added credit line from policy banks should be delivered in a timely manner.

Governments at all levels should make sure that the projects are implemented at a faster pace and meet quality requirements. They will make sure that operations at construction sites will not suspend and related industrial and supply chains stay uninterrupted, in an effort to generate more physical gains in the third quarter. More job opportunities will be provided for migrant workers through public works programs wherever possible.

Inter-agency working groups will be sent in due time to supervise and facilitate project delivery. Management and audit will be strengthened to ensure project quality and forestall corruption.

The meeting noted that consumption is closely related to people’s lives and should still serve as a major engine for growth….

https://english.news.cn/20220720/809c8aa53e4147a7a5e174436222e86f/c.html

July 20, 2022

China secures economic growth while mitigating epidemic impact

BEIJING — By effectively coordinating epidemic prevention and control with economic and social development, China has ensured positive economic growth so far this year, mitigating the impacts of COVID-19 outbreaks at home and complex international situations.

The number of daily civil aviation flights since the beginning of July has exceeded 10,000 and cross-provincial tourism in many parts of the country is resuming rapidly.

Electricity consumption in Shanghai hit a record high on July 8, roughly a month after the city fully resumed the normal order of production and living. Starting July 12, Beijing resumed offline sporting events in an orderly manner.

Containing the highly infectious Omicron variant and ensuring public well-being while maintaining economic development momentum is no easy task.

In late May, the State Council rolled out 33 measures in six areas to bring the economy back on a normal track. Some taxes and fees were scrapped or deferred to reduce the burden on businesses, digital coupons were given to residents to encourage consumption, and job creation was boosted to maintain employment stability.

More than 11.51 million new market entities were established nationwide from January to May, of which nearly 8.06 million are individual businesses.

An index tracking the country’s logistics market performance stood at 52.1 percent in June, climbing above the boom-bust line of 50 percent for the first time after staying in the contraction zone for three months, according to the China Federation of Logistics & Purchasing (CFLP).

The improving data showed that businesses at both supply and demand sides tended to be more active, according to CFLP.

“In the face of the impact of domestic and overseas periodic and unexpected factors, the Chinese economy has stabilized and rebounded in a relatively short period of time, demonstrating its strong resilience and huge potential,” Yuan Da, an official with the National Development and Reform Commission, China’s top economic planner, told a press conference last week….

Now can you just imagine these two on a date?

Now can you just imagine these two on a date?

Now can you just imagine these two on a date?

[ Repeated bullying harassment, replete with sexual innuendo, is unfortunate. ]

You really need to lighten up. Then again I see Stevie as a sexual harassment so maybe I should never mention him on a date with anyone.

Repeated posting of government-authorized Chinese propaganda is also unfortunate, but you keep doing it.

You want kid-glove treatment while you support a repressive, hegemonic, racist regime? Oh, poor, sensitive baby!

ltr, why can you post racist commentary against me? that is bullying on your side. i still expect an apology from you. or does your sh!t not stink?

Speaking of China, one guy at a prominent think tank recently made the case for “getting” China if it got too uppity on Taiwan by closing down TSMC, the world’s premier company fabricating leading edge chips, thereby depriving China of those critical components. I argued that that was a terrible Idea, since the US depends heavily on those chips as well. It would be just another case of shooting yourself in the foot. But pgl went ga-ga over the idea.

So now it turns out that “China is leading the world in building new chip factories, a step toward achieving more self-sufficiency in semiconductors that could eventually make some buyers reliant on China for many of the basic chips now in short supply.”

https://www.wsj.com/articles/china-bets-big-on-basic-chips-in-self-sufficiency-push-11658660402

And it turns out that “SMIC, China’s largest foundry has slowly been catching up to TSMC, Samsung, and various western foundries in process technology. They are rapidly approaching position as the world’s 3rd largest foundry and have higher margins than the current number 3, GlobalFoundries. SMIC has achieved this through a combination of large subsidies from the state, poaching TSMC talent, and tremendous home-grown expertise. Their chips ship in large volumes to a variety of use cases from smartphones to the world’s fastest supercomputer…

To be abundantly clear, China’s SMIC is shipping a foundry process with commercially available chips in the open market which are more advanced than any American or European company.” And they are fast closing in on TSMC.

https://semianalysis.substack.com/p/chinas-smic-is-shipping-7nm-foundry

So not only was it a really stupid idea to potential shutting down TSMC , but it was also pointless and futile…like so much of the US’ behavior lately. Isn’t it time for the US to start co-operating instead of for ever trying to be the king of the mountain like a middle schooler drunk on testosterone?

“Speaking of China, one guy at a prominent think tank recently made the case for “getting” China if it got too uppity on Taiwan by closing down TSMC, the world’s premier company fabricating leading edge chips, thereby depriving China of those critical components. I argued that that was a terrible Idea, since the US depends heavily on those chips as well. It would be just another case of shooting yourself in the foot. But pgl went ga-ga over the idea.”

I guess you have a weird need to LIE about what I said. You are now brining up what I said back then – there are other suppliers of semiconductors that can eventually develop what TSMC has accomplished. And you want to take credit for what I already told you? You are a true weasel.

How long do you suppose it will take Intel to ‘eventually” develop what TSMC has already accomplished. China is already producing 7 nm chips, and the best Intel has done is 12 nm. Maybe intel can use all that government pork to get to where China is in a decade? Meanwhile China will have moved well beyond.

But pgl thought it was a brilliant idea to sabotage TSMC to deprive China of its chips!!!

When I repeat what pgl said, his default response is to take credit for saying something he never said and then accuse me of lying about what he actually said. A true weasel.

“They are rapidly approaching position as the world’s 3rd largest foundry and have higher margins than the current number 3, GlobalFoundries.”

I bet you have never looked at the financials of these 3 foundries. Global Foundaries profits do not even cover a normal return to tangible assets. But yea I get reading financial statements have never been something you are capable of doing.

“SMIC has achieved this through a combination of large subsidies from the state, poaching TSMC talent, and tremendous home-grown expertise.”

Every nation that tries poaches from someone else’s talent – a point I made back in the day. New flash moron – Biden has a package passed in the House and gaining bilateral support in the Senate for similar efforts on our part. Something I suggested back in the day.

But what did you claim I said? Oh yea – your disgustingly dishonest opening line.

we could start by passing the semiconductor bills languishing in congress.

“Some guy at a prominent think tank recently made the case for “getting” China if it got too uppity on Taiwan by closing down TSMC”

Of course JohnH cannot be bothered to tell us what think tank this was or provide a link to what they really said. I wonder why? Oh yea because we would read what they really said and realize this lying troll LIED about what they said. He is that kind of dude.

Both the real estate crisis and Covid Omicron B5 are potential severe problems and we have not yet seen the full potential of either.

The original Covid lock-downs and the recent Shanghai lock downs were fairly limited geographically. Covid OB5 has the potential to hit a large part of the country at the same time. If that happens and they still go “zero Covid” on it, they could sink their economy. Alternatively, a “Shanghai” style lock-down every 3 months would also be very disruptive. Question is how long will they ignore the science and act as if “zero Covid” is a viable option against OB5 (and whatever comes next).

We all know their real estate market is insane. People do not trust placing their savings in banks or stock markets so they use real estate (yes, weird). This has produced an insane overbuilding with large numbers of apartments, complexes and even cities that are not inhabited, but simply serve as a bank account. Real estate is 30% of their economy and that is just not sustainable. The first shoe to drop is likely the idea that you have people take out the mortgage loans and start paying on them even before the building has been finished. It’s a way of having little guys fund the building projects, but little guys are not able to judge what is sound or not. However, they will act in panic as a response to certain triggers. If that gets the apartment owners to panic sell, then its total meltdown – like China Syndrome.