Doesn’t look like a recession in that month, nor in previous.

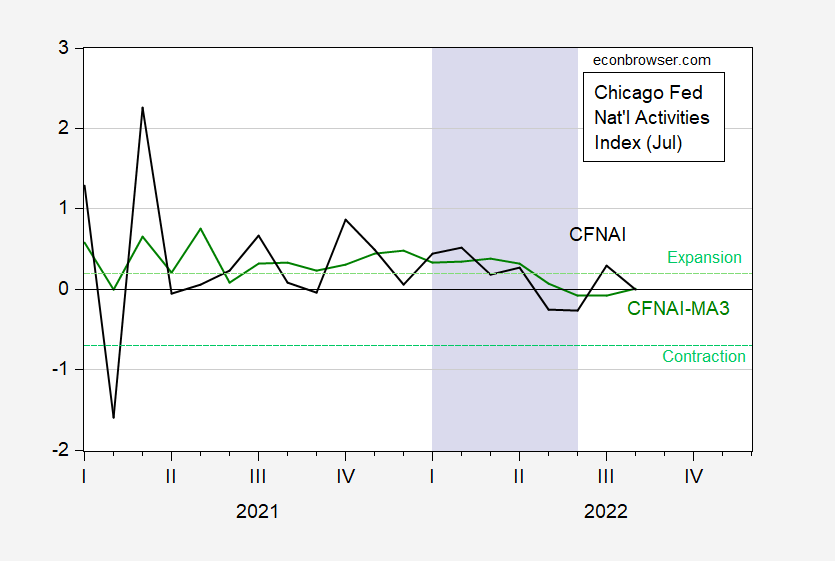

Figure 1: CFNAI, in standard deviation units (blue), CFNAI 3 month moving average (green). CFNAI normalized at 0 for trend growth rate. Green dashed line denotes threshold for expansion after period of contraction, and contraction after a period of expansion, for CFNAI 3 month MA. Lilac shading denotes a hypothetical H1 recession. Source: Chicago Fed, August release.

The three month trailing moving average is very slightly above zero, indicating growth at historical trend growth. It is far above the level consistent with contraction (i.e., recession). The CFNAI-MA3 tracks pretty well with NBER defined recessions (see the Chicago Fed website for the requisite graphs), except for the 2007 recession, where the CFNAI-MA3 passes the threshold in April 2008 (rather than Jan 2008, the month after the NBER defined peak).

In fact, CFNAI 3 month moving average has been above the contraction threshold for the entire period shown in the graph, so — contra some observers’ assertions — I don’t see a recession in the first half of 2022, nor as of August. This point is further reinforced by the CFNAI diffusion index.

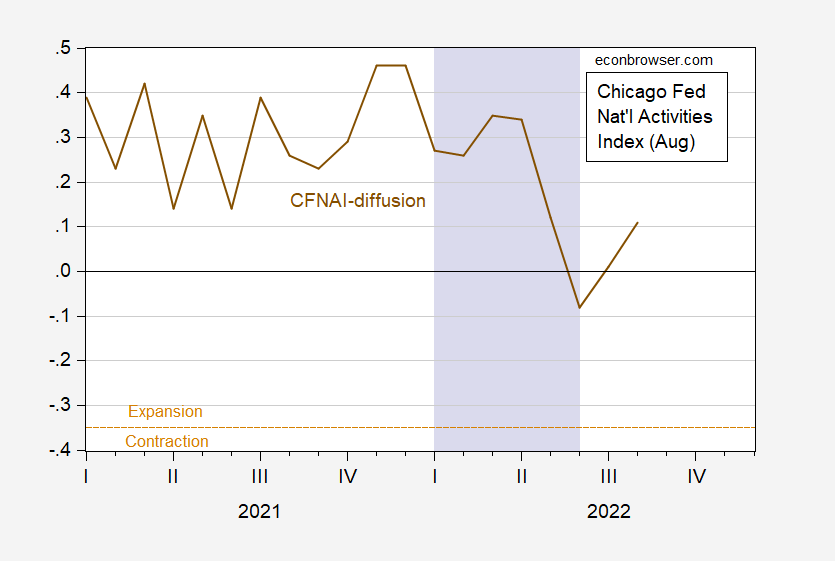

Figure 2: CFNAI diffusion (brown). Below tan dashed line indicates contraction, above indicates expansion. Lilac shading denotes a hypothetical H1 recession. Source: Chicago Fed, August release.

The diffusion index is also above the level consistent with contraction, after a period of expansion. This measure also works pretty well, with the exception of signaling a recession start in December 2000 rather than the NBER contraction starting in April 2001.

Hence, the CFNAI, a weighted average of 85 indicators of economic activity (described here), suggests we are not as of August 2022, nor have we within the past year, been in a recession.

not yet

GDPNow shows inventories as a drag on GDP again in Q3. We only have one month’s data for Q3, but it’s pretty convincing:

https://fred.stlouisfed.org/graph/?g=Uczr

The drag from residential construction is expected to be larger in Q3 than in recent quarters. Again, we have just one month’s data for Q3. Again, it’s pretty convincing:

https://fred.stlouisfed.org/graph/?g=UcAw

So for recession fans, we have one component of final demand that looks like a drag on GDP. The rest are positive. But don’t give up hope. We’re only a third of the way into the quarter with monthly data, about halfway through with weekly data. If you wish really hard, you might get an actual contractionary quarter.

Speaking of which, Walmart’s announcement of curtailed hiring plans gives a hint of weak Q4 hiring. After seasonal adjustment, 100,000 fewer seasonal hires amounts to something like a 100,000 loss of jobs. FedEx is cutting. If less headline-grabbing firms are doing similar things, seasonal could produce a job loss in at least one month of the quarter.

That would, of course, be made up in Q1 because seasonal layoffs would be smaller than anticipated by seasonal adjustment factors.

“The drag from residential construction is expected to be larger in Q3 than in recent quarters. Again, we have just one month’s data for Q3. Again, it’s pretty convincing”

While rents are still incredibly high, they have started falling. Plus the cost of capital has shot up. So yea the fundamentals for housing have finally turned negative.

Of course uber troll Princeton Steve started telling us the housing market was overvalued when the fundamentals were telling us housing prices should be high. Yea he has been banging to the drum about a cratering housing market all year. I guess since a stopped clock is correct twice a day, we should chalk up Stevie’s claims are finally bearing a wee bit of reality.

Off topic, Europe, Energy and investment –

Seems to me, Europe’s energy shortage raises fundamental issues of economic structure. Among the questions to be answered are:

1) Will Europe’s energy prices return to something like world prices over a reasonable investment horizon?

This depends on things like substitution away from fossil fuels, replacing Russian supply with other sources of supply and resumption of supply from Russia. There are plenty of opinions on each of these points. To some extent, public policy will drive the results.

2) Will Europe move away from energy-intensive industries in response to higher-than-world prices for energy?

The longer-term answer to this question depends very much on the answer to the first question. Setting the marginal this equal to the marginal that is pretty much an iron law over the long term. Europe may well do less manufacturing in the future if it faces a long period of energy prices above world prices.

3) What do European firms do in the less-than-long-term?

Until answers about energy prices (and reliability of supply) over the long-term are cleared up (as much as the long term is ever clear), it’s tough to make decisions. When it’s tough to make decisions, the natural tendency is to not make them. That means a reduction in capital investment.

The long term is really just a series of short terms (remember that graph in micro?), so the longer there is elevated uncertainty about Europe’s energy price future, the greater the likely dent in capital investment and the greater the likely damage to Europe’s economic future. It is possible there won’t be much investment in energy-intensive industries, or in transitioning away from energy intensive industries, until there is some greater clarity about longer-term energy prices. The longer clarity is delayed, the more capital investment that will be foregone.

Of course, in the near term, it will be hard to distinguish between reduced investment due to energy uncertainty and reduced investment due to higher borrowing costs, weaker demand, cash-flow concerns and the other effects of nascent recession.

It seems to my poor little pea brain that certainty about Europe’s longer-term energy future depends very much on policy makers’ decisiveness in dealing with energy choices. Committing to public spending on conservation, on LNG terminals, on nuclear power generation, on pipelines – anything that makes the European energy future clearer – will make choices about capital spending clearer for the private sector. Europe can have higher or lower private capital spending, more or less wasted capital expenditure, depending on how quickly policy makers decide on public energy infrastructure spending. No rash decisions, please, but no dithering, either.

Countries’ exposure to energy supply and price risks depend on more than just manufacturing as a share of GDP, but that’s at least a start on assessing exposure. The EU average is 15% of GDP. Countries with average or higher exposure (not all EU members) include:

Ireland 39%

Czech Republic 23%

Slovenia 21%

Switzerland 19%

Hungary 19%

Germany 18%

Austria 17%

Poland 17%

Romania 17%

Finland 15%

Italy 15%

https://data.worldbank.org/indicator/NV.IND.MANF.ZS?name_desc=true&locations=

There is also a bunch of intra-Europe current account rebalancing implicit in the outcome of all this stuff, and all the political strain that such rebalancing creates.

Meanwhile, big lending errors by Credit Suisse are being compounded by more general problems of falling capital values and worsening credit quality, putting CS in a position that it may become a drag on growth:

https://www.wsj.com/livecoverage/stock-market-news-today-09-23-2022/card/credit-suisse-gets-booked-by-investors-7XqdY3m6FfuqwlfhwvdS

CS is big, so influential, and may need to cut back on lending because of its own weakness. Other lenders may be in a similar situation, but not as bad, or as big. The ECB, while hiking rates, may need to arrange transfusions of cash or sales of loan portfolios to keep lending from contracting more than planned.

There has been no recession as yet. After all, how could there be a recession with so robust employment-population ratios and unemployment rates so remarkably low? The problem I have is understanding how inflation is significantly reduced with the economy running so hot, while slowing growth will likely mean significantly limiting employment and that would seem to mean recession.

Lawrence Summers has evidently been correct so far, while the only alternative to significantly limiting employment as Summers anticipates would seem to me to be taking the price control approach of Isabella Weber and James Galbraith and that is not going to happen. So, I worry about a recession beginning with the new year.

Also, a reader complained that Margaret Thatcher was not a tax cutter as the new British Prime Minister has decided to be. However my reading on British data, shows dramatic tax reductions under Thatcher. Thatcher tax cuts apparently spurred significant property price gains and residential investment that was enough to generate growth for Britain through the Thatcher years that was close to or at the best level in Europe. British growth through the Thatcher years, allowed for important real general earnings gains.

The popularity of the Thatcher government makes sense to me, though Paul Krugman would argue otherwise.

ltr,

She did cut income taxes, especially on high income people, looking like Truss in that, although not be as much. But then she raised other taxes, such as VAT and poll taxes. She did not run big budget deficits. Truss is not raising any other taxes to offset her income tax cuts.

https://fred.stlouisfed.org/graph/?g=nFYx

January 15, 2018

Real Residential Property Prices for United Kingdom, 1980-2022

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=Ud49

January 30, 2018

Real Weekly Earnings for the United Kingdom, 1980-2021

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=Ud4N

January 30, 2018

Real Hourly Earnings in Manufacturing for United Kingdom, 1980-2022

(Indexed to 1980)

Lumber Prices Fall Back to Around Their Pre-Covid Levels

Rising interest rates have taken an ax to one of the pandemic’s hottest commodities

That is the headline of a WSJ report. Kevin Drum notes how far lumber prices have fallen (uh oh uber troll JohnH is going to get so angry at all of this but Kevin says this is not entirely to blame on the FED:

https://jabberwocking.com/the-cost-of-lumber-has-plummeted/

A month ago pgl assured us that mortgage rates were not rising and called anyone who thought otherwise a liar.

Today Mortgage News Daily reported 30 year mortgage rates above 7%. pgl was the liar.

Back in August 2021, I asked why lumber prices at retail were not coming down as fast as spot prices. (pgl took this to mean that I thought that retail lumber prices were never coming down!!!)

In any case, I suggested that retail prices [ of lumber] were sticky because of pricing power at wholesale. Seems that I’m not alone in suspecting a non competitive market: “ While the price on the wholesale side is back to 2018 levels, that hasn’t happened yet on the retail side. The price tag of two-by-fours in the aisles of big-box stores like Home Depot and Lowe’s is falling, but nothing close to a 68% markdown.

“They have the pricing power. They don’t have to lower their price,” Ashley Boeckholt, cofounder of MaterialsXchange, tells Fortune. Many of those retailers and lumberyards, he says, bought wood during the historic spring run and are hesitant to offload inventory below that price. But at some point, the wholesale drop will get passed onto retail.” https://fortune.com/2021/08/02/lumber-prices-down-cash-market-wholesale-retail-home-depot-lowes/

Funny how no one here noticed that or had any ideas. But there are no lumber industry experts here, either. So what would you expect? But of course, most economists refuse to acknowledge the contribution of corporate greed to rising consumer prices, either!

This whole parade of yours is beyond childish, stupid, and dishonest. What I did say was at the time Freddie Mac was reporting 5.13%. I did note every Thursday since then what the new reporting said. Now if you want to call me a liar for telling the truth that only shows what a pathetic POS you truly are. Then again we all have known that dating back to the days where your intellectual dishonesty polluted Mark Thoma’s blog.

I would suggest you one day grow up but then I am not your mother.

“I suggested that retail prices [ of lumber] were sticky because of pricing power at wholesale.”

Maybe it would help if you even remotely knew the difference between wholesale v. retail. But you don’t. But do babble on incoherently as that is what excel at.

I guess you did not notice the date of your latest link. I did:

August 2, 2021

But that is OK since that story linked to something back in May 2021. Way to stay current Johnny boy!

“They have the pricing power. They don’t have to lower their price,”

exactly what is your problem, john? this is a free market capitalist system, not your preferred communist system. are you arguing against a free market capitalist system?

I love it when two right wingers go after each other. Eric Bolling calls out Tucker Carlson!

https://www.msn.com/en-us/news/world/tucker-carlson-called-alleged-american-by-newsmax-host-over-russia-stance/ar-AA12hZBG

Newsmax’s Eric Bolling criticized Tucker Carlson in response to Russian state media using clips from the Fox News host’s show that allegedly show support of Russia’s war on Ukraine. Newsmax’s Eric Bolling criticized Tucker Carlson in response to Russian state media using clips from the Fox News host’s show that allegedly show support of Russia’s war on Ukraine.

Bolling’s suggestion that Tucker is an alleged American is funny. Look – Tucker is an alleged human being.

Mitch McConnell teams up with Bernie Sanders to do the right thing?

https://www.msn.com/en-us/news/politics/manchin-surprised-by-mcconnell-opposition-you-can-be-a-hero-one-day-and-a-villain-the-next/ar-AA12h17B?ocid=msedgdhp&pc=U531&cvid=92bbb72d7e5f4b7ea94d2815bc51e624

Joe Manchin (D-W.Va.) admitted Monday that he was caught by surprise when Senate Minority Leader Mitch McConnell (R-Ky.) and other Senate Republicans decided to oppose his permitting reform bill, which means it will likely fail on the Senate floor this week.

Sen. Joe Manchin (D-W.Va.) admitted Monday that he was caught by surprise when Senate Minority Leader Mitch McConnell (R-Ky.) and other Senate Republicans decided to oppose his permitting reform bill, which means it will likely fail on the Senate floor this week.

Manchin said he expected Sen. Bernie Sanders (I-Vt.), an outspoken progressive, and other “far-left” liberals to oppose his legislation to limit federal agency authority to review new energy projects but was stunned when Republicans also came out in opposition last week.

Can we speak plain English? Manchin got a few Democrats to help him with his drill baby drill BS and figured all Senate Republicans would go along with the drill baby drill BS. But McConnell and a few Republicans decided to do the right thing and the Bruce Hall fake energy policy will not pass the Senate. A very good thing even if we have to endure more Bruce Hall BS.

i made this comment previously regarding people like manchin. you need them in order to get your own agenda completed, so sometimes you have to pinch your nose and swallow the medicine to get what you need today. but you do not have to support those losers into the future. this is an example. the democrats do not need to resist, just get out of the way. manchin simply cannot get the support necessary to pass his agenda. you don’t have to stop him from trying-let him do it. then he cannot hold a grudge against you for obstruction. now he can vent his frustration for lack of support from his fellow republicans, leaving the democrats out of the argument.

The global politics of semiconductors:

https://www.msn.com/en-us/news/world/vp-harris-seeks-computer-chip-partners-in-tokyo/ar-AA12jB2z?ocid=msedgdhp&pc=U531&cvid=fc945532aefa4d8a8e4358046806d5da

Armed with a new law that boosts U.S. support for computer chip manufacturing, Vice President Kamala Harris is seeking new investments and partnerships as she sits down with Japanese technology executives. Harris was meeting with the CEOs on her last full day in Tokyo on Wednesday, a reflection of the administration’s focus on boosting semiconductor manufacturing and expanding the supply chain for critical materials. With China investing in computer chips of its own, the U.S. is working to solidify its technology relationships with South Korea, Taiwan and Japan.

South Korea, Taiwan, and to a smaller degree Japan are major players in this sector so this is smart. But so is China. The mighty Intel had plans to set up one of his fabs in China but Biden go in the way. My view is that we need to set up fabs in all nations including China but yea I get the need to avoid IP theft.