Today, we present a guest post written by David Papell and Ruxandra Prodan, Professor and Instructional Associate Professor of Economics at the University of Houston.

The Federal Open Market Committee (FOMC or Committee) raised the target range for the federal funds rate (FFR) by 3/4 percent (75 basis points) from 2.25 – 2.5 percent to 3.0 – 3.25 percent at last week’s meeting and projected a range between 4.25 and 4.5 percent by the end of 2022. Following two years at the effective lower bound (ELB) of 0.0 – 0.25 percent and a liftoff of 25 basis points in its March 2022 meeting, the Committee has now implemented one 50 and three 75 basis point rate increases.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022 with headline-grabbing rate increases and market gyrations. Why did this occur? The “we didn’t know” explanation is that the Fed did not predict that inflation would rise so much in 2021 and, if they had, they would have raised rates earlier. The “they should have known” explanation is that the Fed should have known that inflation would not be transitory and raised rates sooner.

Most of the discussion of the Fed being behind the curve depends on subjective analysis of when liftoff from the ELB should have occurred. We propose a different explanation. If the Fed had followed its own policy rule, it would have started to raise rates in 2021:Q3 instead of 2022:Q1. With about twice as many meetings to implement the same total rate increase, each individual rate increase would have only needed to be about half as large. Since the policy rule uses inflation and unemployment data rather than forecasts, it makes the “we didn’t know” explanation irrelevant and the “they should have known” explanation unnecessary.

In an earlier paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” and Econbrowser post, “The Fed Fell Behind the Curve by Not Following its Own Policy Rules,” we use data from the Summary of Economic Projections (SEP) from September 2020 to June 2022 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual FFR.

The Taylor (1993) rule with an unemployment gap is as follows,

where is the level of the short-term federal funds interest rate prescribed by the rule, is the inflation rate, is the 2 percent target level of inflation, is the 4 percent rate of unemployment in the longer run, is the current unemployment rate, and is the ½ percent neutral real interest rate from the current SEP. We use real-time inflation and unemployment data that was available at the time of the FOMC meetings.

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

The FOMC adopted a far-reaching Revised Statement on Longer-Run Goals and Monetary Policy Strategy in August 2020. The framework contains two major changes from the original 2012 statement. First, policy decisions will attempt to mitigate shortfalls, rather than deviations, of employment from its maximum level. Second, the FOMC will implement Flexible Average Inflation Targeting (FAIT) where, “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

We analyze Fed policy by using an inertial version of the balanced approach (shortfalls) rule introduced in the February 2021 Monetary Policy Report (MPR) in response to the Revised Statement. The rule mitigates employment shortfalls instead of deviations by having the FFR only respond to unemployment if it exceeds longer-run unemployment,

If unemployment exceeds longer-run unemployment, the FFR prescriptions are the same as with the balanced approach rule. If unemployment is below longer-run unemployment, the FOMC will not raise the FFR solely because of low unemployment.

While most of the attention following the Revised Statement focused on FAIT, the large rise in inflation in 2021 and 2022 has made that part irrelevant. With unemployment below 4.0 percent, however, mitigating shortfalls rather than deviations of employment remains an important aspect of policy.

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We also specify an inertial version of the balanced approach (shortfalls) rule based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target level of the federal funds rate prescribed by Equation (3). We set as in Bernanke, Kiley, and Roberts (2019). equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

At its September 2020 meeting, the Committee approved outcome-based forward guidance, saying that it expected to maintain the target range of the FFR at the ELB “until labor market conditions have reached levels consistent with the Committee’s assessment of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.” The key word is “and”. While the Fed’s inflation goals were met by December 2021, liftoff from the ELB did not occur until its maximum employment goals were met in March 2022.

If the Fed had followed a policy rule using inflation and unemployment data from the FOMC’s quarterly SEP’s instead of the FOMC’s forward guidance, they could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022. The rules prescribe liftoff from the ELB in 2021:Q2 or 2021:Q3 and a much smoother path of rate increases through the end of 2022 than that adopted/projected by the FOMC.

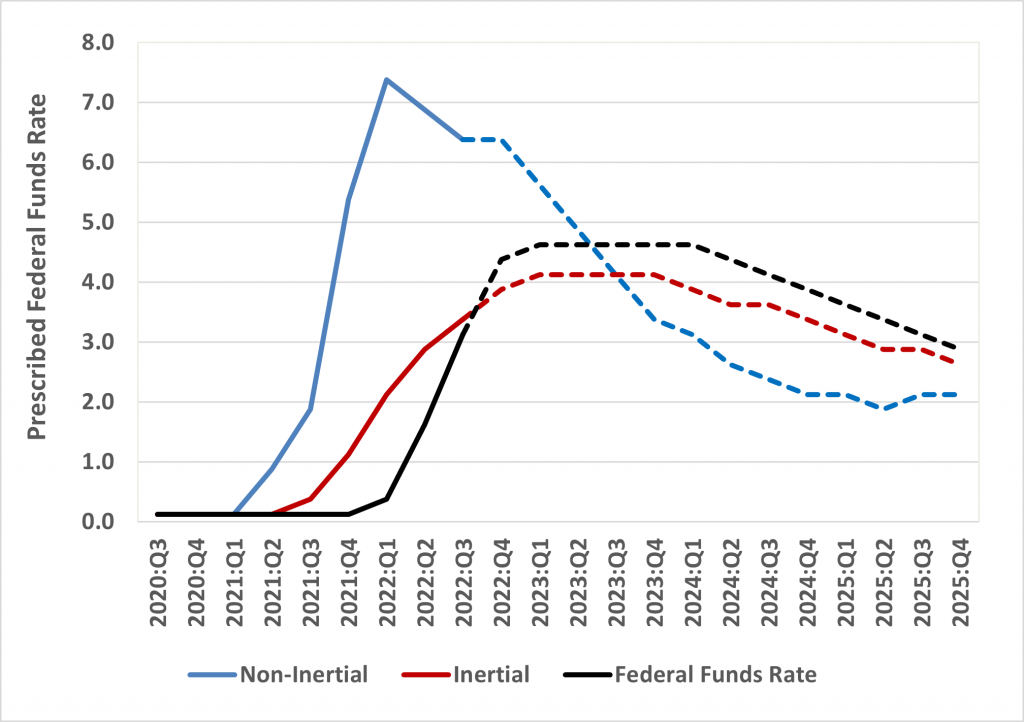

Figure 1 depicts the actual FFR for September 2020 to September 2022 and the projected FFR for December 2022 to December 2024 from the September 2022 SEP. Following the exit from the ELB to 0.375 in March 2022, the FFR rose to 1.625 in June 2022 and 3.125 in September 2022 and is projected to rise further to 4.375 in December 2022 and 4.625 in March 2023 before starting to fall in June 2024.

Figure 1: Balanced Approach (shortfalls) Rule: Non-Inertial and Inertial

The prescribed FFR with the non-inertial balance approach (shortfalls) rule is also illustrated in the figure. The prescribed exit from the ELB is in 2021:Q2, three quarters before the actual exit. Following liftoff from the ELB to 0.875 in 2021:Q2, the prescribed FFR sharply increases to 7.375 in 2022:Q1 before starting to fall in 2022:Q2. These prescribed rate increases are a completely unrealistic guide to policy as the prescribed FFR rises by over 100 basis points per meeting for the six meetings between June 2021 and March 2022.

Figure 1 also shows the prescribed FFR with the inertial balance approach (shortfalls) rule. The prescribed exit from the ELB is in 2021:Q3, one quarter after the prescribed exit with the non-inertial rule and two quarters before the actual exit. Following liftoff from the ELB to 0.375 in 2021:Q3, the prescribed FFR slowly increases to 3.375 in 2022:Q3, only 25 basis points above the actual FFR.

The Fed’s pivot can be seen by comparing the prescriptions from the balanced approach (shortfalls) rule with the FFR through September 2022 and the projected FFR thereafter. At the time of liftoff from the ELB in March 2022, the FFR was 175 basis points above the prescribed FFR. With the subsequent series of rate increases, the FFR is now only 25 basis points above the prescribed FFR. Starting in December 2022, however, the projected FFR rises to 50 basis points above the prescribed FFR and, with occasional exceptions, remains 50 basis points above the prescribed FFR through June 2025.

Policy rules provide a framework for monetary policy evaluation. Using the rule most in accord with the Fed’s objectives, the inertial balanced approach (shortfalls) rule, the Fed fell behind the curve in September 2021 and has just gotten back on track. Instead of staying on track, the Fed now projects that the FFR will be above the policy rule prescriptions for the next three years. Has the Fed pivoted too far by completely switching focus from unemployment to inflation? While it is obviously far too early to answer that question, following its own policy rule starting in 2021 would have enabled the Fed to balance both parts of its dual mandate and provided predictability for its future actions.

This post written by David Papell and Ruxandra Prodan.

Kevin Drum notes the rise in mortgage rates:

https://jabberwocking.com/mortgage-rates-just-keep-going-up-up-and-up-some-more/

For a while, when rates skyrocket like this, people rush to buy houses before they go up even more. But eventually rates get too high and mortgages simply become unaffordable for many people. But it takes a while. Back in the bad old days of 1981 mortgage rates rose to nearly 20% and there were still people buying houses. I should know: I rented out a room from a couple who were ponying up that much. Eventually, of course, rates went down and they refinanced at a more reasonable rate.

But wait – Kevin makes the awful sin of using Freddie Mac data. Except our RECESSION CHEERLEADERS to go beserk calling him a liar. It is what they do.

The authors describe a Taylor Rule of some variety as the Fed’s “own rule”. I think that is a misstatement of fact. The FOMC runs on discretionary decisions, not rules.

Powell and others have lately taken to talking about labor market tightness in explaining forward guidance which anticipates further rate hikes. While one could talk up some elaborate set of linkages which says it is inflation risk resulting from labor market tightness, not labor market tightness per se, that is intended in this forward guidance, that would be slicing the baloney pretty thin. In reality, it appears that the FOMC has returned to the “deviation” scheme recommended by the authors, belatedly. If policy will now aim at avoiding a tight labor market, perhaps it would have been best to have maintained that policy all along.

In general, the authors seem to be approaching policy making in a vacuum, ignoring the shocks which created an inflationary environment. Yes, in hindsight, hiking rates starting in Q3 of 2021 might have been preferable to waiting. That is not proof that, in the absence of food and fuel price shocks due to Russia’s invasion of Ukraine, rule-based policy would have been superior to discretionary policy.

Taylor’s 1993 paper tried to model the discretionary decisions of the FED in a very straight forward exercise of what William Poole described as optimal monetary policy in a 1970 QJE paper. It only later became known as a “rule”.

Taylor’s original paper was descriptive, not prescriptive. He simply used back testing to find the best fit to previous actions of the Fed. He did nothing to determine whether those previous decisions were good or bad — and they were pretty bad.

But since then a “rule” derived from a period of brutal monetary anti-inflation policy has been used as a cudgel to beat wage earners into submission for the last 30 years.

Take it out back and shoot it.

“a period of brutal monetary anti-inflation policy has been used as a cudgel to beat wage earners into submission for the last 30 years”

There are many reasons that have driven the shift from labor’s share to capital’s share, but I don’t think the Fed is one of them. Real growth increases real returns to capital, while high inflation does not do good things to the standard of living of people at the bottom of the wage ladder once they have a job.

Besides, market and policy rates have been *falling* for those three decades. It’s what they call secular stagnation.

We can argue about anti-union policies, technology, offshoring and other kinds of outsourcing, and taxes that are too low on the rich. But I seriously doubt the Fed belongs on this list.

This is a common trick in relevant macro papers: You use a Taylor rule to summarize Fed decision-making. It’s not an assertion that the Fed does in fact follow a rule. Remember also that the “rule” can be as flexible as you want (or as flexible as the data allow). In the end, it’s just a way to set a benchmark and compare it to other possible “rules”.

And here we also get the fudge-factor between discretion and forward-looking-ness on one hand and using a Taylor rule. Technically, we could build those into rules too. It’s just that actual, practical rules are too rigid and (hilariously) cause more volatility than discretion (think: gold standard). Also, there’s a lot of politics that might go into the determination of a rule that might make things worse.

A hawkish discretionary policy (which is what Gita Gopinath was suggesting) could be driven by the risks being too hot when a shock does in fact happen. There’s no point making policy with zero weight on the possibility of a supply shock.

“If policy will now aim at avoiding a tight labor market, perhaps it would have been best to have maintained that policy all along.”

That seems entirely fair, and also (in my opinion) an entirely fair reading of the paper.

https://www.nytimes.com/2022/09/29/opinion/columnists/federal-reserve-inflation.html

September 29, 2022

Is the Fed Braking Too Hard?

By Paul Krugman

If you’ve ever found yourself driving in stop-and-go traffic, you know that there’s a strong temptation to overreact to changes in the flow. When the cars in front of you finally start moving, you floor the gas pedal, then you slam on the brakes when traffic slows down again, and if you’re a normal human being, you probably do this over and over.

Overreacting to traffic conditions wastes fuel and annoys your passengers. More important, it creates real dangers: Accelerate too fast and you may rear-end the car in front of you; brake too hard and you may be hit by the car behind you.

Well, setting economic policy in difficult times can be a lot like driving on a congested road. And I’m hearing growing buzz, both from economists and from businesspeople, to the effect that the Federal Reserve — which clearly kept its foot on the gas too long last year — is now braking too hard in compensation. And the risks of an accident are growing.

The story so far: Last year, as inflation began to accelerate, many people — myself included — wrongly minimized the risks, asserting that much of the inflation was transitory, the result of temporary kinks (such as disrupted supply chains) as we emerged from a pandemic economy. Over time, alas, inflation didn’t just rise; it broadened, spreading from a relatively narrow range of goods to much of the economy. It was hard to avoid the conclusion that the U.S. economy was running significantly too hot.

So the Fed began hitting the brakes. It didn’t start raising the interest rates it controls until March, but long-term interest rates — which are what matter for the real economy and reflect not just current Fed actions but expectations of Fed actions — have been rising since the beginning of the year. They’re now up about two and a half percentage points, which is a lot by historical standards and well above the levels that prevailed on the eve of the pandemic; mortgage rates are higher than they’ve been since the 2008 financial crisis.

These rate rises will surely cause a major economic slowdown, quite possibly a recession….

A very insightful review of the recent data and its macroeconomic implications. The FED needs to ease up on its hawkish stance.

Funny! “These rate rises will surely cause a major economic slowdown, quite possibly a recession…” assuming, of course that we’re not already in a recession…following the major economic slowdown! Of course, the Recession Deniers try to not believe the GNP numbers–“Don’t worry; be happy!”

You have misrepresented the views of pretty much everybody who comments here outside your little troll choir. If misrepresentation is the only thing you can manage, you’ve got nothing. The fact that you’ve got nothing is not really news, though, is it?

JohnH often misrepresents his own prior comments. His latest – he now claims he never said monopoly power causes inflation. Yea – this troll lies for a living.

I have to agree with you. the argument many of us made was that this spring was not a recession. we are not arguing there will also not be a recession going forward. only the data indicates that we were not in a recession in the past. it is hard to argue for a recession with the labor numbers we saw earlier in the year.

I have already said the fed should have reduced to 50 bp increase in the last meeting. and in the future meetings, it should not exceed this amount. there is still the potential for a soft landing, or minor recession, if the fed does not overdue it. but at 75 bp per hit, a recession will be inevitable if this pace continues. if inflation reduces to the 5-6% range, you can take the foot off the pedal. we do not need to return to 2%.

Hey Johnny boy. When Dr. Chinn posted a discussion of real GDP and real GDI – what gave you the idea that the discussion was about real weekly earnings? Are you really THAT STUPID? Or do you take great pride in being a rude worthless loud mouth?

Very interesting post, thank you for this.

Of topic but ….

https://www.msn.com/en-us/news/politics/judge-again-sides-with-trump-in-mar-a-lago-documents-fight/ar-AA12poxu?ocid=msedgdhp&pc=U531&cvid=fa4c842f8f9c452b847b9100d41ae303

The judge overseeing Donald Trump’s challenge to the FBI’s seizure of documents from his Florida estate again sided with the former president Thursday in the ongoing showdown with the Justice Department. U.S. District Court Judge Aileen Cannon issued an order extending the timeline of an outside review Trump demanded of the documents and other materials the FBI seized from Mar-a-Lago in Palm Beach on Aug. 8 as part of an investigation into alleged unlawful retention of classified materials and other government records as well as obstruction of justice. She also overruled some of the procedures proposed by the independent reviewer, senior U.S. District Court Judge Raymond Dearie, whom she appointed to the role at Trump’s request.

I have suggested that Aileen Cannon is a bimbo but this has gone beyond absurd. Is this bimbo judge having sex with Trump?

pgl,

More likely hoping to get appointed to the SCOTUS if Trump manages to become president again.

the republicans have been playing the court packing game effectively for quite some time. democrats need to wisen up. this is why midterms can matter.

https://fred.stlouisfed.org/graph/?g=lJSB

January 15, 2018

Thirty- & Fifteen-Year Fixed Rate Mortgage Average and 10-Year Treasury Rate, 2007-2022

https://fred.stlouisfed.org/graph/?g=qVRw

January 15, 2018

Thirty- & Fifteen-Year Fixed Rate Mortgage Average and 10-Year Treasury Rate, 2017-2022

DeSantis was against FEMA before Ian:

https://www.msn.com/en-us/news/politics/after-hurricane-ian-msnbc-analyst-predicts-ron-desantis-is-about-to-become-a-big-government-republican/ar-AA12pqVQ?ocid=msedgdhp&pc=U531&cvid=a382f3773ae1436d99e3205d97ee09f3

David Jolly argued on “The ReidOut” that Gov. Ron DeSantis, R-Fla., will have to change his “anti-Washington” stance to for his state to recover after Hurricane Ian. After the Category 4 storm first hit Florida on Wednesday, over two million Florida citizens reported losing power after millions had already evacuated. In response, DeSantis confirmed his administration was working with FEMA and the Biden administration for federal assistance.

Jolly, who previously served as a Republican Florida congressman alongside DeSantis, argued that the governor’s acceptance of federal aid after the disaster will force him to turn back on his conservative leanings. “He’s about to have to justify doing something that is antithetical to his entire ideological narrative, his entire story as a conservative Republican, as anti-Washington, that people should absorb their own risk and people should take care of their own lives. In a time of tragedy, people need help. And where Ron DeSantis is a no government conservative, he’s about to become a big government Republican,” Jolly said.

pentagon resources are made available to states during a disaster such as ian through a national guard/pentagon/fema standing establishment and pentagon agencies assign emergency preparedness liaison officers (i was one for a short time, 25 years ago) to coordinate pentagon resources with the state national guard and fema.

i am not sure that the regulated militia getting access to the “raised army” is big government…..

taking billions of dollars from FEMA is big government. and “big government” desantis will do exactly that. it is not just the pentagon involved here.

In the process of selling a house as my Mom died. Mortgage rates have gone up a lot in last year.

So much for the Menzie comments from a year ago that inflation worries were a blip. Mr. Market seems worried.

Of course if you disagree, hope you are betting on it. Forces a Bayesian insight. Often get something different when people put money on the line. (Same thing I would say to James Hamilton when he complained in late 2014 about oil prices being irrational because they did not follow his “hundred dollars here to stay” peak-oil flavored shale-skeptic views.)

Who knows, maybe rates drop. Hard to predict the future, lots of variables. Could go up also.

But…you would have lost money last year if you used Menzie as your hedge fund advisor. Of course, maybe his views would be different with money on the line, versus just opinion/chat on a left-leaning blog/community.