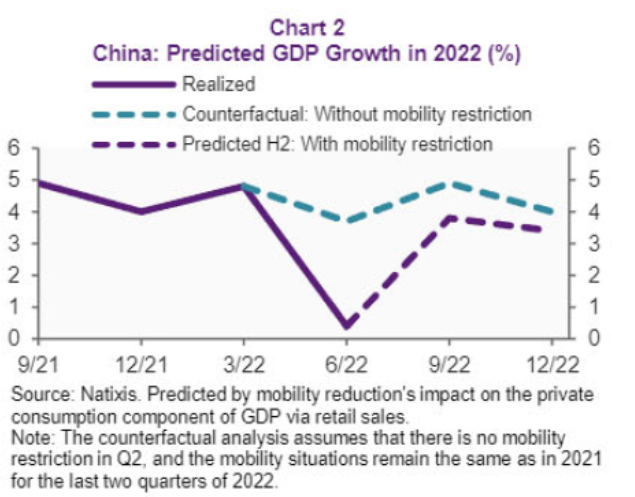

Garcia-Herrero and Xu, “China’s Covid Restrictions May Slash More than Two Percentage Points of Growth in 2022,” (Natixis, Sep 27, 2022):

[Assuming] Covid-related mobility restrictions in 03 to remain similar for 04, the overall reduction in China’s GDP growth in 2022 could be 2.3 percentage points.

Note that this calculation pertains to consumption effects adduced via mobility-consumption correlations. It does not incorporate any other effects, such as investment response to consumption reduction.

Note the end-July World Economic Outlook projected 4.1% q4/q4 growth for 2022.

https://news.cgtn.com/news/2022-09-29/Chinese-mainland-records-170-new-confirmed-COVID-19-cases-1dInSWIq0yk/index.html

September 29, 2022

Chinese mainland records 170 new confirmed COVID-19 cases

The Chinese mainland recorded 170 confirmed COVID-19 cases on Wednesday, with 106 attributed to local transmissions and 64 from overseas, data from the National Health Commission showed on Thursday.

A total of 629 asymptomatic cases were also recorded on Wednesday, and 10,820 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 250,293, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-09-29/Chinese-mainland-records-170-new-confirmed-COVID-19-cases-1dInSWIq0yk/img/91fcee24d32a43d5ae2fa189e6a97826/91fcee24d32a43d5ae2fa189e6a97826.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-09-29/Chinese-mainland-records-170-new-confirmed-COVID-19-cases-1dInSWIq0yk/img/767b70aba15842639d48a924bc3214e0/767b70aba15842639d48a924bc3214e0.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-09-29/Chinese-mainland-records-170-new-confirmed-COVID-19-cases-1dInSWIq0yk/img/f46bba0c0d8b49e687bc25cf85e77b3b/f46bba0c0d8b49e687bc25cf85e77b3b.jpeg.

https://www.worldometers.info/coronavirus/

September 28, 2022

Coronavirus

United States

Cases ( 98,104,113)

Deaths ( 1,083,798)

Deaths per million ( 3,237)

China

Cases ( 250,123)

Deaths ( 5,226)

Deaths per million ( 3.6)

America BAD, China GOOD

https://www.aap.org/en/pages/2019-novel-coronavirus-covid-19-infections/children-and-covid-19-state-level-data-report/

November 22, 2022

Cumulative Number of Child COVID-19 Cases

Over 14.7 million children are reported to have tested positive for COVID-19 since the onset of the pandemic according to available state reports; over 289,000 of these cases have been added in the past 4 weeks. Approximately 6.85 million reported cases have been added in 2022.

14,737,867 total child COVID-19 cases reported, and children represented 18.4% (14,737,867 / 80,030,437) of all cases

Overall rate: 19,581 cases per 100,000 children in the population

American Academy of Pediatrics

Children’s Hospital Association

https://www.nature.com/articles/s41591-022-02001-z

September 22, 2022

Long-term neurologic outcomes of COVID-19

By Evan Xu, Yan Xie & Ziyad Al-Aly

Abstract

The neurologic manifestations of acute COVID-19 are well characterized, but a comprehensive evaluation of postacute neurologic sequelae at 1 year has not been undertaken. Here we use the national healthcare databases of the US Department of Veterans Affairs to build a cohort of 154,068 individuals with COVID-19, 5,638,795 contemporary controls and 5,859,621 historical controls; we use inverse probability weighting to balance the cohorts, and estimate risks and burdens of incident neurologic disorders at 12 months following acute SARS-CoV-2 infection. Our results show that in the postacute phase of COVID-19, there was increased risk of an array of incident neurologic sequelae including ischemic and hemorrhagic stroke, cognition and memory disorders, peripheral nervous system disorders, episodic disorders (for example, migraine and seizures), extrapyramidal and movement disorders, mental health disorders, musculoskeletal disorders, sensory disorders, Guillain–Barré syndrome, and encephalitis or encephalopathy. We estimated that the hazard ratio of any neurologic sequela was 1.42 (95% confidence intervals 1.38, 1.47) and burden 70.69 (95% confidence intervals 63.54, 78.01) per 1,000 persons at 12 months. The risks and burdens were elevated even in people who did not require hospitalization during acute COVID-19. Limitations include a cohort comprising mostly White males. Taken together, our results provide evidence of increased risk of long-term neurologic disorders in people who had COVID-19.

America BAD

what makes you say that, Andrew?

Oh, it’s just something I keep hearing in a round-about way.

https://www.nytimes.com/2022/09/30/business/economy/inflation-fed.html

September 30, 2022

The Fed’s Preferred Inflation Measure Remains Stubbornly High

Inflation remains far above the Federal Reserve’s goal, and prices climbed more quickly than economists expected in August.

By Jeanna Smialek

The Federal Reserve’s preferred inflation gauge remained elevated in new data released on Friday, further evidence that the central bank is contending with a stubborn problem as it tries to choke off the worst inflation in four decades.

The Personal Consumption Expenditures inflation measure, which is produced by the Commerce Department and is the measure the Fed officially targets as it tries to achieve 2 percent annual inflation, climbed by 6.2 percent in the year through August. While that was a slowdown from 6.4 percent in July, it was higher than the 6 percent economists in a Bloomberg survey had expected.

The details of the report were even more concerning. While price increases have been moderating somewhat on an overall basis, that is partly because gas prices have been declining. After stripping out volatile food and fuel prices to get a sense of underlying inflationary pressures, the index climbed 4.9 percent in the year through August, an acceleration from 4.7 percent the month before. And on a monthly basis, the core index picked up by 0.6 percent, a rapid pace of increase that was the fastest since June.

The data underlined what a rocky road the Fed faces as it tries to guide the U.S. economy toward slower inflation. Consumers continued to spend in August, the report also showed, suggesting that the economy still has momentum even as central bankers raise interest rates to try to cool demand, slow hiring and eventually weigh down inflation. Because growth has been resilient, the Fed has become steadily more aggressive in its efforts to constrain spending and temper inflation.

“Inflation is very high in the United States and abroad, and the risk of additional inflationary shocks cannot be ruled out,” Lael Brainard, the Fed’s vice chair, said in a speech on Friday….

https://www.nytimes.com/2022/09/30/business/eurozone-inflation.html

September 30, 2022

Eurozone Inflation Sets Another Record, Hitting 10 Percent in September

Jumps in energy and food prices again pushed inflation in the 19 countries that use the euro to the highest annual rate recorded since the currency was created.

By Patricia Cohen and Melissa Eddy

Consumer prices in the countries that use the euro as their currency rose at an annual rate of 10 percent in September, again reaching the highest level since the creation of the euro more than two decades ago, the European Commission reported on Friday.

The double-digit pace was a big jump from 9.1 percent in August, the previous record.

Energy prices, which rose at an annual rate of 40.8 percent in September, were again the main contributor to accelerating inflation in the eurozone, driven higher by the invasion of Ukraine by Russia, which previously supplied most of Europe’s natural gas. Food prices rose 11.8 percent in September, from 10.6 percent in August.

Of the 19 eurozone countries, 10 recorded double-digit overall inflation, including the largest economy, Germany, which released its own inflation result the day before — 10.9 percent. That was the highest rate of inflation that Germany had seen since 1951, well before the reunification of the former East and West….

don’t know if you caught this one, ltr:

The typical Chinese adult is now richer than the typical European adult, a new wealth report finds

A major new report from investment banking and wealth management giant Credit Suisse has found that the average Chinese adult is now wealthier than the average European.

Although North America and Europe together account for 57% of total household wealth globally, China is squeezing out Europe in rankings of wealth per median adult.

Credit Suisse’s annual Global Wealth Report, which was released this month, estimates the average wealth of households around the world.It found that Chinese median wealth per adult, at $26,752, now outstrips Europe, where the average adult has a wealth of $26,690. The European figure takes into account the whole of the continent, which includes many less wealthy nations in its southern and eastern regions.

Median wealth in China was more than four times greater than in Russia, where median wealth was $6,379 in 2021.

A major new report from investment banking and wealth management giant Credit Suisse…

[ Thank you so much:

https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html

2022

Global Wealth Report 2022

By Credit Suisse Research Institute

I will slowly work through the report. ]

Europe BAD

Eh, nope. PCE inflation dropped in September 2021. Come back after October….you may be surprised Braindumb. From a pure monthly report, not impressed.

That article was not talking about US inflation. We are part of the Eurozone. Besides PCE in rose 0.6% this month according to the BEA. Oh you said September 2021. Dude the calendar says 2022.

America BAD

https://fred.stlouisfed.org/graph/?g=twwl

January 30, 2018

Personal consumption expenditures price index and Personal consumption expenditures less food & energy price index, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=OFYz

January 15, 2020

Consumer Price Index and Personal Consumption Expenditures Price Index less food & energy, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=SMjc

January 4, 2018

Consumer Prices and Consumer Prices less food & energy for Euro Area, 2007-2022

(Percent change)

https://www.nytimes.com/2022/09/30/business/uk-mortgage-markets.html

September 30, 2022

‘You Can Feel the Fear’: U.K. Borrowers Face Up to a Broken Mortgage Market

The financial turmoil in Britain has led to soaring interest rates, prompting many lenders to withdraw products and stoking worry among homeowners about rising costs.

By Isabella Kwai

LOUGHTON, England — After nearly two decades of renting in one of the world’s most expensive cities, the Szostek family began the week almost certain that they would finally own a home.

Transplants to London who fell in love as housemates, Laetitia Anne, an operations manager from France and her husband, Maciej Szostek, a chef from Poland, had long dreamed of being homeowners. They had waited out the uncertain pandemic years and worked overtime shifts to save up for the deposit for a mortgage on a three-bedroom apartment in a neighborhood outside London. Their 13-year-old twins were excited they could finally paint the walls.

That was before British financial markets were upended, with the pound briefly hitting a record low against the dollar on Monday and interest rates soaring so rapidly that the Bank of England was forced to intervene to restore order. The economic situation was so volatile that some mortgage lenders temporarily withdrew many products.

By Tuesday evening, the Szostek family learned the bad news: The loan that they were close to securing had fallen through. Suddenly, they were scrambling to find another lender as interest rates climb higher.

“It’s so hard even for us to become owners,” said Ms. Anne, 40, who said it felt like all of their years of hard work were evaporating in that moment. “Why should I carry on like this?” …

https://fred.stlouisfed.org/graph/?g=oSIJ

January 15, 2018

Real Residential Property Prices for United States and United Kingdom, 1992-2022

(Indexed to 1992)

UK BAD

Eh, nope. PCE inflation dropped in September 2021. Come back after October….you may be surprised Braindumb.

Eh, nope. PCE inflation dropped in September 2021. Come back after October….you may be surprised Braindumb.

Eh, nope. PCE inflation dropped in September 2021. Come back after October….you may be surprised Braindumb.

https://www.nytimes.com/2022/09/30/business/economy/inflation-fed.html

September 30, 2022

The Fed’s Preferred Inflation Measure Remains Stubbornly High

Inflation remains far above the Federal Reserve’s goal, and prices climbed more quickly than economists expected in August.

By Jeanna Smialek

https://www.nytimes.com/2022/09/30/business/economy/inflation-fed.html

September 30, 2022

The Fed’s Preferred Inflation Measure Remains Stubbornly High

Inflation remains far above the Federal Reserve’s goal, and prices climbed more quickly than economists expected in August.

By Jeanna Smialek

The Federal Reserve’s preferred inflation gauge remained elevated in new data released on Friday, further evidence that the central bank is contending with a stubborn problem as it tries to choke off the worst inflation in four decades.

The Personal Consumption Expenditures inflation measure, which is produced by the Commerce Department and is the measure the Fed officially targets as it tries to achieve 2 percent annual inflation, climbed by 6.2 percent in the year through August. While that was a slowdown from 6.4 percent in July, it was higher than the 6 percent economists in a Bloomberg survey had expected.

The details of the report were even more concerning. While price increases have been moderating somewhat on an overall basis, that is partly because gas prices have been declining. After stripping out volatile food and fuel prices to get a sense of underlying inflationary pressures, the index climbed 4.9 percent in the year through August, an acceleration from 4.7 percent the month before. And on a monthly basis, the core index picked up by 0.6 percent, a rapid pace of increase that was the fastest since June….

https://fred.stlouisfed.org/graph/?g=twwl

January 30, 2018

Personal consumption expenditures price index and Personal consumption expenditures less food & energy price index, 2017-2022

(Percent change)

REPEAT: America BAD

You’re very easy to interpret, ltr. I give you that.