So far, the UK economy is plugging along, according to the OECD Weekly Tracker (through 9/17). But (understatement of the year), challenges have arisen.

Figure 1: Weekly Tracker (blue), in %. Source: OECD, ECRI and author’s calculations.

The OECD Weekly Tracker reading of 1.4 is interpretable as a y/y growth rate of 1.4% for year ending 9/17. How well does the OECD Weekly Tracker do for the UK? Here’re two pictures, for quarterly and for monthly GDP (the monthly is official ONS series, unlike US monthly GDP I’ve been reporting, sourced from IHS Markit).

Figure 2: Year-on-year UK real GDP at quarterly frequency (teal), implied from Weekly Tracker (black), in %. Q3 observation is for data through 9/17. ECRI defined peak to trough recession dates shaded light green. Source: OECD via FRED, OECD, ECRI and author’s calculations.

Figure 3: Year-on-year UK real GDP at monthly frequency (teal), implied from Weekly Tracker (black), in %. Q3 observation is for data through 9/17. ECRI defined peak to trough recession dates shaded light green. Source: UK ONS, OECD, ECRI and author’s calculations.

Based on Q2 negative GDP read, and its own forecasts of GDP, NIESR has already declared the UK in recession (again).

Now, what to think of the (in pretty much everybody’s view ill-conceived) fiscal plan forwarded by the new government? Well, to me, the reaction of financial markets indicates a lack of credibility, insofar as the promised results will actually occur.

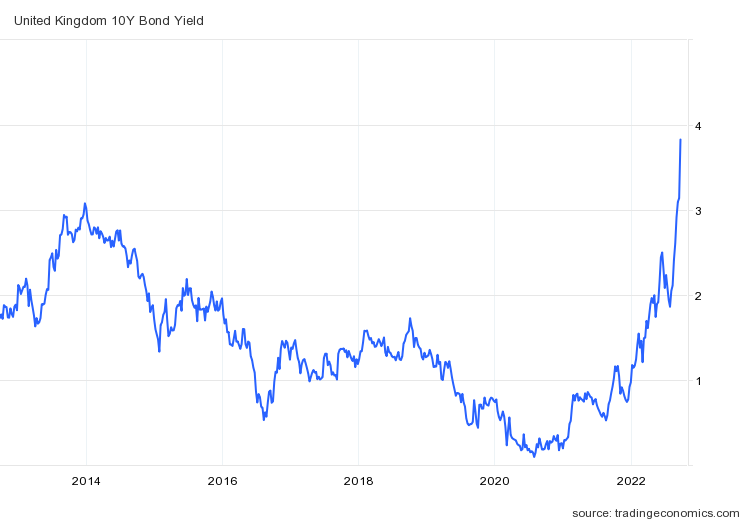

Interest rates on 10 year government bonds spiked — which makes sense to the extent that an increase in borrowing colliding with anticipated tightening monetary policy should increase yields. It’s not clear to me that the increase in yields is purely driven by expectations hypothesis of the term structure; i.e., perhaps some of the increase is due to increase in inflation risk association with nominal bonds (I don’t know where one might get estimates of inflation risk premia for UK gilts).

The drop in the pound’s value against the US dollar is counter-intuitive (at least to me) for a country with government bonds that would be perfectly substitutable with say US government bonds — i.e., a situation where uncovered interest parity would hold. However, if bonds are not perfectly substitutable, then one could resort to a portfolio balance model. The simplest version would indicate a large expected increase in bond supply would then lead to a depreciation of the currency. And that is exactly what we have seen. While the parameters of the so-called mini-budget are not too different from anticipated, it seems that the announcement of two — rather than one — tax cuts in the context of already big budget and trade deficits is eroding credibility.

All I can say: I’m glad I don’t have to sell this fiscal package to anyone…

Oh, while the first self-inflicted wound is obvious, the second can be seen in the 2016 drop in the pound’s value (happening in June of that year). That decline in the real value of the pound means a deterioration in the UK’s terms of trade…

Now, what to think of the (in pretty much everybody’s view ill-conceived) fiscal plan forwarded by the new government?

Apparently Krugman has weighed in. ltr copied his latest under the prior thread.

What’s up in China?

https://www.msn.com/en-us/news/other/military-coup-in-china-xi-jinping-under-house-arrest-general-li-qiaoming-next-president-say-social-media-rumours/ar-AA12cZ7Z?ocid=msedgdhp&pc=U531&cvid=1b8a888ec6904068981e3e3883efa1d1

Social media is abuzz with the rumours of Chinese President Xi Jinping being put under house arrest, and a possible coup taking place in the country, a week after two of its former minister were sentenced for corruption – a highly controversial decision in nation’s history. As per the social media posts, many by experts across the fields from China itself, an unprecedented military movement was seen towards Xi Jinping’s residence in Beijing. Military vehicles were seen making a movement close to Xi’s residence. A few purported videos of such movements have also gone viral on social media. However, their is no official confirmation on the same. A number of social media users from China said that a coup was almost confirmed as the country, without giving any specific reason, cancelled over 9,000 domestic flights. Some even said that military chief General Li Qiaoming is set to become next President.

https://mainlymacro.blogspot.com/2022/09/a-budget-that-harms-everyone-except.html

September 24, 2022

A budget that harms everyone except the very rich

Before getting distracted by the spin put on Friday’s budget, it is important to be clear what the motivation for it is. It’s not a budget for growth, it’s a budget for the rich and those who fund the Conservative party. Abolishing the 45% tax band obviously benefits only the very well off, dropping the increase in corporation tax will mainly benefit shareholders who are mostly at the top of the income distribution, not extending the windfall tax on energy producers will exclusively benefit shareholders, not increasing National Insurance rates benefit the better off far more than anyone else, ending the cap on bankers bonuses benefits the already very rich, and so on. Conservative MPs are much more right wing on economics than Conservative voters or even party members, and this is a budget for them, as long as it doesn’t mean they lose their jobs.

The Resolution Foundation calculates that almost two thirds of the tax gains go to the richest fifth of the population, with almost half going to the top 5%. They also point out that the stamp duty changes mainly benefit richer households in the South East. Of course poorer households will get a small amount of this giveaway, but less than is needed to cover the increased costs of essentials according to the New Economic Foundation. The Institute for Fiscal Studies have looked at all the forthcoming tax changes (including frozen income tax allowances), and they calculate that your income would have to exceed £155,000 before you are better off, and if you earn a million a year you gain £40,000

It is also a budget that is highly likely to mean cuts in public spending after the next election. The Office for Budget Responsibility were not allowed to publish their post-budget forecast, for the first time in their 12 year existence, because if they had been their budget deficit projections would have shouted ‘not sustainable’. Not sustainable is just a shorthand way of saying that taxes will have to rise or spending will have to be cut, unless something very beneficial for the public finances turns up. But of course it’s equally likely that something detrimental to the public finances will turn up. You don’t get to announce the biggest tax cut for 50 years in a deteriorating economic climate without severe implications for future spending….

— Simon Wren-Lewis

https://www.nytimes.com/2022/09/23/opinion/uk-truss-tax-cut-economy.html

September 23, 2022

Wonking Out: The tax-cut zombie attacks Britain

By Paul Krugman

Britain is in a very difficult economic position. The British economy, like the U.S. economy, seems to be seriously overheated, with substantial amounts of inflation driven by high domestic demand. Unlike America, it is also facing the full force of Europe’s energy crisis, driven by the efforts of President Vladimir Putin of Russia to use a shut off of natural gas to bully the West into abandoning Ukraine.

So many of us expected Britain’s economy to go through a rough patch in the months, or maybe even years, ahead. What few foresaw, as far as I can tell, was a policy zombie apocalypse.

I’ve written a lot over the years about zombie economic ideas — ideas that have failed repeatedly in practice, and should be dead, but somehow are still shambling around, eating policymakers’ brains. The pre-eminent zombie in American economic discourse has long been the belief that cutting taxes on the rich will create an economic miracle.

That belief is still out there: Even as its infrastructure was collapsing to the point that its largest city no longer had running water, Mississippi tried to raise its economic fortunes with … a tax cut. But in America, zombie economics has lately been overshadowed by zombie beliefs about election fraud, the impact of immigration and so on.

Britain, however, doesn’t (yet?) have an equivalent of the MAGA movement. What it does have is Liz Truss, a new prime minister who seems to be an ardent believer in economic fallacies from the Thatcher/Reagan era.

Before I get to the economic plan that has produced chaos in Britain’s bond and currency markets, let’s talk about the myths that seem to have inspired her.

The important point to understand is that there isn’t a serious debate about the proposition that tax cuts for the rich strongly increase economic growth. The truth is that there is no evidence — none — for that proposition.

Of course, people on the right, raised on the legend of Saint Reagan, believe that his tax cuts did wonders for the U.S. economy. But the data don’t agree.

Reagan did drastically cut taxes on high incomes. Here are Congressional Budget Office estimates of the average federal tax rate paid by the top 1 percent:

https://static01.nyt.com/images/2022/09/23/opinion/krugman230922_1/krugman230922_1-jumbo.png?quality=75&auto=webp

The ups and downs of elite taxes.

Note both the steepness of the Reagan cut and the rise under Clinton, both of which are relevant to the story….

Krugman and Simon Wren-Lewis are saying very similar things. But that is no surprise as both have proven to be excellent economists.

“…we are in effect getting a test of the market monetarist view right now, with the Fed having adopted more expansionary policies even as fiscal policy tightens. And the results aren’t looking good for the monetarists…” – Krugman 2013. He was dead wrong, but never acknowledged that nor changed his viewpoint.

Excellent economist, true, before he became a shill for the Democratic Party.

Shill for the Dems??? I guess you do not know Krugman’s only position working for the government was helping Feldstein and Poole when they served on Reagan’s CEA.

Since Tuesday’s open, ten-year Gilts have added over 60 basis points. Ten-year Bunds have added around 20 bps.

BoE rate hike expectations have risen in both the immediate near term (75 to 100 bps at the next meeting vs 50 at the prior two) and the longer term. If the government apes Reagan, the BoE is likely to ape Volcker. The BoE has said it sees little economic slack, so sees little room for stimulus to turn into real growth, leaving inflation as the likely outlet for fiscal expansion; well, inflation and worsening international balances. In Q1, the current account deficit already amounted to 7.1% of GDP, excluding precious metals tranfers, 8.3% including tranfers:

https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/bulletins/balanceofpayments/januarytomarch2022

That might contribute to a weakening of the pound sterling. By way of comparison, the U.S. current account deficit amounted to 4.8% of GDP in Q1.

“If the government apes Reagan, the BoE is likely to ape Volcker.”

Much higher interest rates may be the only thing that avoids even more devaluation of the pound given the insanity of the new PM’s fiscal proposal. Right now UK interest rates are lower than US rates but there is talk of UK rates rising to 6%. All we need now is Princeton Steve to add his stupid pet terms such as “pretty stiff”.

My 92-year-old relative, who seems to grasp every economic concept imaginable, without knowing their formal names, has brought up the issue of the wealth effect. How much will financial losses add to recession risk? I never ignore my high-school-educated relative, ’cause her ideas are generally clearer than what’s in the financial press.

Thing is, we groundlings don’t spend much out of financial wealth. We spend out of home equity. As of Q2, mortgage equity withdrawal was still rising, but financing of withdrawal is shifting away from refinancing to home equity loans:

https://calculatedrisk.substack.com/p/mortgage-equity-withdrawal-still

Not healthy, and the acceleration in total MEW corresponds to rising inflation if you tilt your head just right. The next Fed lending officer survey, though backward looking, should give clues as to the durability of this new development.

The well-off are more likely to spend out of financial wealth, often using the same mechanism as homeowners – borrowing against assets. There is some evidence that the better off are cutting back more than the worse off:

https://business.bofa.com/en-us/content/bank-of-america-institute.html

(Scroll down to “It takes two income groups to tango”)

The upper two quintiles of income (so wealth, kinda) account for 60% of consumer spending. The top quintile accounts for 40%. The lower quintiles account for less and cut back less because they are mostly spending for necessities.

FedEx and WalMart have both announced hiring cutbacks ahead of the holidays, anticipating that spending on non-necessities won’t be great this year.

So while not an answer to my relative’s point about the wealth effect, these facts suggest the wealth effect was working in two different directions as of Q2. Housing wealth was supporting spending (in a risky way) while there are hints that financial wealth may be a drag.

Alan Blinder offers hope for a soft landing in the weekend WSJ:

https://www.wsj.com/articles/the-feds-surprising-record-with-soft-landings-from-inflation-11663945174

Blinder identifies exogenous shocks as a factor which lowers the odds of a good outcome, so…

Yes, Alan Blinder, who in the JPE informed us of that most important fact of global macroeconomics: that the Philipps Curve of Japan looks like Japan, :-).

Robert Reich suggests that the US follow the European idea of prices controls.

https://www.washingtonpost.com/world/2022/09/08/europe-energy-prices-gas-war/

https://www.theguardian.com/commentisfree/2022/sep/25/inflation-price-controls-robert-reich

That should work well in a supply-constrained situations that have driven up the prices of various products.

Some current supply shortages:

• beer

• Adderall

• cement

• tampons

• normal (sterile) saline

• semi-conductor chips (we all know that)

• energy (northeast)

• various foods

• EV batteries (expected to worsen)

• resins

• some paints

etc.

Who pays you to come up with such absurd garbage? Yea – Reich is very left wing. Few people in the Biden Administration are about to follow his advice. So unless you get your jollies hanging out with ugly Alternative Facts Kelly Anne Conway – your little childish rants are a total waste of time. Then again George may be about to divorce his ugly treasonous wife – so hey, go for it. But beware – her tampons are used over and over.

Ahem – Reich has a point here but Brucie never bothered to READ his own link before trying to get Kelly Anne all excited:

The underlying economic problem is profit-price inflation. It’s caused by corporations raising their prices above their increasing costs. Corporations are using those increasing costs – of materials, components and labor – as excuses to increase their prices even higher, resulting in bigger profits. This is why corporate profits are close to levels not seen in over half a century.

There is another dumb troll named JohnH who has written some extreme versions of this line. But maybe Brucie failed to follow the conversation once again. Reich is referring to something called monopoly power, which does exist. Yea Brucie – Marginal Revolution may never note this but a real economist blog like this one does a lot. Pay attention.

Now had you learned even Econ 101, you might have learned that price controls on a monopolist actually increasing production of the good. But once again – Bruce Hall is too stupid to get even the most basic points.

“ The underlying economic problem is profit-price inflation.”

Well shiver me timbers…pgl is capable of learning!!! But what about all those other economists surveyed by the University of Chicago last January,, who won’t admit that corporate greed contributes to inflation?

I did not say inflation is caused by monopoly power. I did say Bruce Hall does not understand the basics but do not get overly excited here.

I never said that inflation is caused by monopoly power, either. When will pgl learn to read?

Oh – that was the other JohnH! I guess we need a program to tell who is who here!

Some current supply shortages:

• beerI

Hey I like beer. No I like good beer as in microbrews. So unlike Bruce Hall (who is so cheap he drinks that watered garbage called Budweiser). So let me report that the price of a 6 pack of my favorite microbrew is still at 2019 prices at my neighborhood store. Can they make profits at these low prices, Maybe not but I make enough income to buy really good beer. Hey Brucie – do you need us to subsidize your drinking?

https://www.nytimes.com/2022/09/26/business/factory-jobs-workers-rebound.html

September 26, 2022

Factory Jobs Are Booming Like It’s the 1970s

U.S. manufacturing is experiencing a rebound, with companies adding workers amid high consumer demand for products.

By Jim Tankersley, Alan Rappeport and Ana Swanson

WASHINGTON — Ever since American manufacturing entered a long stretch of automation and outsourcing in the late 1970s, every recession has led to the loss of factory jobs that never returned. But the recovery from the pandemic recession has been different: American manufacturers have now added enough jobs to regain all that they shed — and then some.

The resurgence has not been driven by companies bringing back factory jobs that had moved overseas, nor by the brawny industrial sectors and regions often evoked by President Biden, former President Donald J. Trump and other champions of manufacturing.

Instead, the engines in this recovery include pharmaceutical plants, craft breweries and ice-cream makers. The newly created jobs are more likely to be located in the Mountain West and the Southeast than in the classic industrial strongholds of the Great Lakes.

American manufacturers cut roughly 1.36 million jobs from February to April of 2020, as Covid-19 shut down much of the economy. As of August this year, manufacturers had added back about 1.43 million jobs, a net gain of 67,000 workers above prepandemic levels.

Data suggest that the rebound is largely a product of the unique circumstances of the pandemic recession and recovery. Covid-19 crimped global supply chains, making domestic manufacturing more attractive to some companies. Federal stimulus spending helped to power a shift in Americans’ buying habits away from services like travel and restaurants and toward goods like cars and sofas, helping domestic factory production — and with it, job growth — to bounce back much faster than it did in the previous two recessions.

Treasury Secretary Janet L. Yellen said that the recovery of manufacturing jobs was a result of the unique nature of the recession, which was induced by the pandemic, and the robust federal response, including legislation like the $1.9 trillion American Rescue Plan of 2021….

https://fred.stlouisfed.org/graph/?g=sG2t

January 15, 2018

Manufacturing Employment, 2017-2022

https://fred.stlouisfed.org/graph/?g=uCQD

January 15, 2018

Manufacturing Employment, 2017-2022

(Indexed to 2017)

Locating factories in areas at risk of drought or high heat index (mountain west and southeast, respectively) suggests one of two things:

– Lack of foresight

– Planned lack of permanence

My guess is a bit of both.

MD gives us another hilarious comment: “Locating factories in areas at risk of …(weather effects.) suggests …” Yup, locating businesses where WEATHER OCCURS is a bad move. Let’s move them to ????? the moon?

His comment is representative of the quality of liberal thinking or the lack thereof. MD provides another example of how climate change (actually weather) is blamed for everything while nothing can be done to change it, Short or long term weather that is

WEATHER! WEATHER! WEATHER! WEATHER! WEATHER! WEATHER! WEATHER!

BARK! BARK!BARK!BARK!BARK!BARK!BARK!BARK!

https://fred.stlouisfed.org/graph/?g=KH4x

January 4, 2018

Real Average Hourly Earnings of All Employees in Manufacturing, 2017-2022

(Indexed to 2017)

[ What I do not understand is why the pronounced gains in manufacturing employment have not led to gains in manufacturing earnings. The failure of earnings to gain could be due to employment gains being made in generally low wage regions, but that is not clear. ]

Barkley and I have been in a small debate as to who the dumbest troll here. OK Barkley is right not to make Rick Stryker and Princeton Steve as the winner in this contest as dumb as they may be. Yes – CoRev is much dumber. But no – Barkley’s candidate for Stupidest Person Alive only comes in second. Bruce Hall just reminded us he wins this award hands down.

Robert Reich gets monopoly power. Even JohnH gets monopoly power. But not Bruce Hall!

monopoly power is a cause of broken markets

usa is rife with market failure,

however, on john h list i see little that seem monopoly

especially beer!

can i get in on the race for dumbest troll

i cannot even find the shift key

Bug off racist troll.

why don’t you and barks vote on worst/best troll?

What?

Anonymous, I’d put you near the top of the list of dumbest trolls, but that ole Bark, bark beats you hands down, while he only gives me honorable mention. I wonder if he even realizes the height of his trolling responses? We already know of the frequency of his lies.

Anon.

As far as I am concerned, you are indeed in the competition, although CoRev probably beats you.

https://www.nytimes.com/2022/09/24/business/nonprofit-hospitals-poor-patients.html

September 24, 2022

They Were Entitled to Free Care. Hospitals Hounded Them to Pay.

With the help of a consulting firm, the Providence hospital system trained staff to wring money out of patients, even those eligible for free care.

By Jessica Silver-Greenberg and Katie Thomas

In 2018, senior executives at one of the country’s largest nonprofit hospital chains, Providence, were frustrated. They were spending hundreds of millions of dollars providing free health care to patients. It was eating into their bottom line.

The executives, led by Providence’s chief financial officer at the time, devised a solution: a program called Rev-Up.

Rev-Up provided Providence’s employees with a detailed playbook for wringing money out of patients — even those who were supposed to receive free care because of their low incomes, a New York Times investigation found.

In training materials obtained by The Times, members of the hospital staff were instructed how to approach patients and pressure them to pay.

“Ask every patient, every time,” the materials said. Instead of using “weak” phrases — like “Would you mind paying?” — employees were told to ask how patients wanted to pay. Soliciting money “is part of your role. It’s not an option.”

If patients did not pay, Providence sent debt collectors to pursue them.

More than half the nation’s roughly 5,000 hospitals are nonprofits like Providence. They enjoy lucrative tax exemptions; Providence avoids more than $1 billion a year in taxes. In exchange, the Internal Revenue Service requires them to provide services, such as free care for the poor, that benefit the communities in which they operate.

But in recent decades, many of the hospitals have become virtually indistinguishable from for-profit companies, adopting an unrelenting focus on the bottom line and straying from their traditional charitable missions….

https://www.nytimes.com/2022/09/24/health/bon-secours-mercy-health-profit-poor-neighborhood.html

September 24, 2022

How a Hospital Chain Used a Poor Neighborhood to Turn Huge Profits

Bon Secours Mercy Health, a major nonprofit health system, used the poverty of Richmond Community Hospital’s patients to tap into a lucrative federal drug program.

By Katie Thomas and Jessica Silver-Greenberg

RICHMOND, Va. — In late July, Norman Otey was rushed by ambulance to Richmond Community Hospital. The 63-year-old was doubled over in pain and babbling incoherently. Blood tests suggested septic shock, a grave emergency that required the resources and expertise of an intensive care unit.

But Richmond Community, a struggling hospital in a predominantly Black neighborhood, had closed its I.C.U. in 2017.

It took several hours for Mr. Otey to be transported to another hospital, according to his sister, Linda Jones-Smith. He deteriorated on the way there, and later died of sepsis. Two people who cared for Mr. Otey said the delay had most likely contributed to his death.

“He should have been able to go to the hospital and get the treatment he needed,” Ms. Jones-Smith said. “He should have been saved.”

Ringed by public housing projects, Richmond Community consists of little more than a strapped emergency room and a psychiatric ward. It does not have kidney or lung specialists, or a maternity ward. Its magnetic resonance imaging machine frequently breaks, and was out of service for seven weeks this summer, said two medical workers at the hospital, who requested anonymity because they still work there. Standard tools like an otoscope, a device used to inspect the ear canal, are often hard to come by.

Yet the hollowed-out hospital — owned by Bon Secours Mercy Health, one of the largest nonprofit health care chains in the country — has the highest profit margins of any hospital in Virginia, generating as much as $100 million a year, according to the hospital’s financial data.

The secret to its success lies with a federal program that allows clinics in impoverished neighborhoods to buy prescription drugs at steep discounts, charge insurers full price and pocket the difference. The vast majority of Richmond Community’s profits come from the program, said two former executives who were familiar with the hospital’s finances and requested anonymity because they still work in the health care industry.

The drug program was created with the intention that hospitals would reinvest the windfalls into their facilities, improving care for poor patients. But Bon Secours, founded by Roman Catholic nuns more than a century ago, has been slashing services at Richmond Community while investing in the city’s wealthier, white neighborhoods, according to more than 20 former executives, doctors and nurses….

That 67,000 net increase amounts to 5% of pre-covid factory employment – good, and probably enough to put upward pressure on wages, all else equal. In fact, factory wage gains have been substantial (in nominal terms) but not as good as in service jobs:

https://fred.stlouisfed.org/graph/?g=UcdZ

All else is not equal, of course. New hires tend to be less well paid, and the southeast is a low-pay region. Tennessee is, in fact, about to adopt a right-to-work constitutional amendment.

Yeah, I am a big fan of increasing rates in a structurally strong currency. Decreasing them in a structurally weak currency. Doing the opposite tends to suppress potential and lead to underinvestment. It may be counterintuitive, but money is not linear. IF You think I was mad at the mess that was the 2015-19 Fed, you better believe it.

Rents crested in the spring and began declining in the summer, this will show up this fall/winter in CPI. It won’t be pretty by next year by appearances. I think 400bps for the Fed looks about right. Then the cash from the bond market will go into equity as they are in a holding pattern. Even though the price looks down on equities right now, its a lie. The cash coming in is waiting until a inflection point to squeeze the oversold positions.

The UK is in trouble. Their currency is in the dumps and they are raising rates into a weakening position to service debt.

Enough words, at last. But you have offered a contrarian view of the rates-currency connection without evidence. No reason to believe a contrarian view absent evidence. What do you have?

An oddity about Truss is that she is supposedly modeling herself on Margaret Thatcher, even to the point of wearing similar clothing apparently. Certainly there are some resemblances, such as her tough line on foreign policy.

But her fiscal policy is not that of Thatcher’s. It is often forgotten that Thatcher did not follow the Reaganomics ‘supply side” tax cutting enterprise. She was concerned about budget deficits and instead cut spending on some social safety net things as well as privatizing various firms that had been state owned since the Atlee wave of nationalizations after WW II. Those actions raised revenue.

Thatcher did cut some income taxes on high income people, but she raised other taxes, notably VAT and poll taxes, thus making the system much more regressive. She did not run the budget deficits Reagan did nor that it looks Truss will.

Making Florida’s labor shortage worse again, again

https://www.cnn.com/2022/09/26/business/desantis-florida-business-owners/index.html

Those asylum seekers could have helped with the labor shortage in Florida if DeInsanities had let them out during their stopover in Florida (on their way from TX to MA). I bet it would also have cut the cost (of over $10,000 per person).