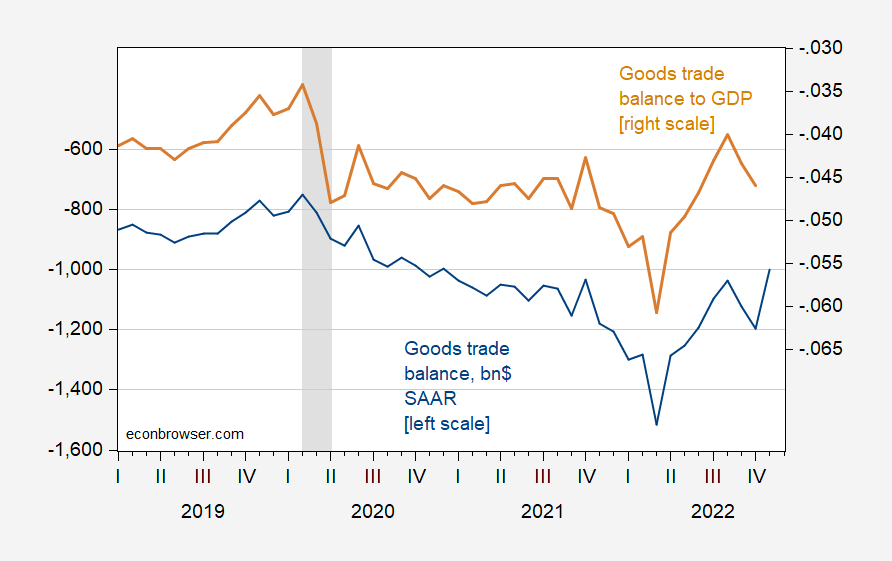

Advance indicators for the goods trade balance came in today, at -$83.35 bn above consensus of -$96.90 bn.

Figure 1: Trade balance in goods in bn$ SAAR (blue, left scale), and as share of monthly GDP (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. BEA/Census, and Advance Economic Indicators, and IHS Markit, NBER, and author’s calculations.

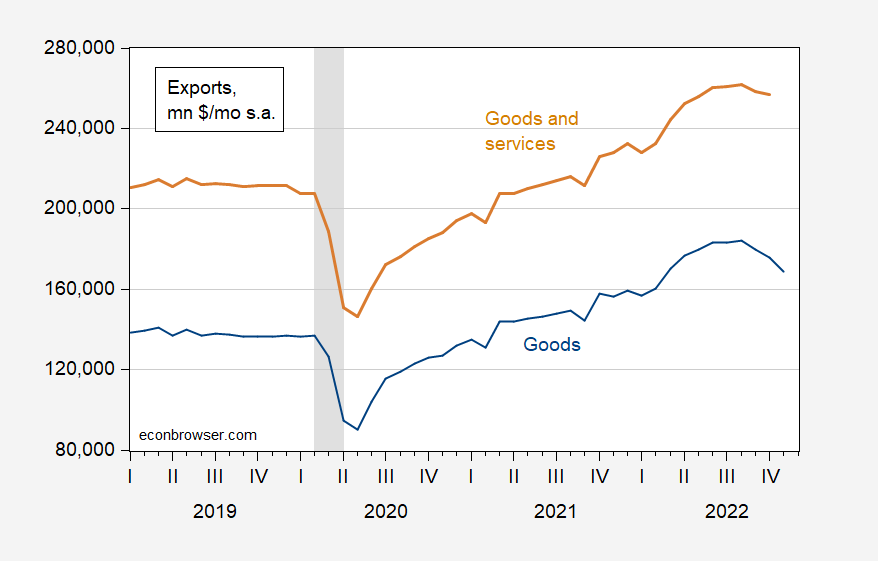

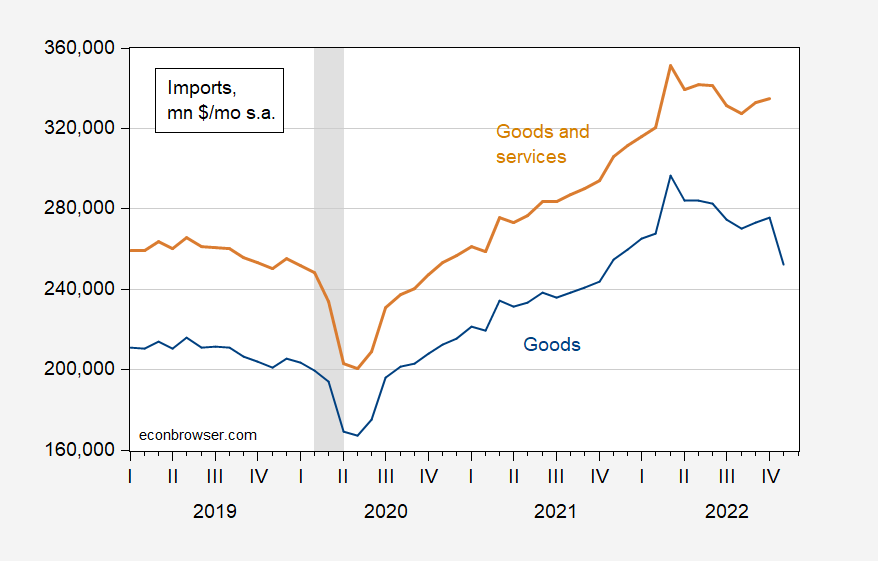

Exports fell by 3.1%, imports by 7.6% in value (dollar) terms (seasonally adjusted, m/m). Drops in both were broad based, with consumer goods leading the drop in both, and and automotive and related goods also leading in drop in imports.

Note that for both imports and exports, the goods movements dominate goods and services.

Figure 2: Exports of goods in bn$ SAAR (blue), and of goods and services (tan). NBER defined peak-to-trough recession dates shaded gray. BEA/Census, and Advance Economic Indicators, and NBER.

Figure 3: Imports of goods in bn$ SAAR (blue), and of goods and services (tan). NBER defined peak-to-trough recession dates shaded gray. BEA/Census, and Advance Economic Indicators, and NBER.

Goldman Sachs increased their tracking estimate for Q4 GDP to 2 ppts q/q SAAR, by 0.3 ppts, on the basis of the sharp drop in imports.

Note that while a smaller than expected imports raises the nowcast of GDP conditional on other indicators (i.e., in an accounting or “bean counting” sense), falling imports behaviorally implies slower economic growth (holding constant expenditure switching effects — but the dollar has been pretty consistently strong for months).

“Exports fell by 3.1%, imports by 7.6% in value (dollar) terms (seasonally adjusted, m/m).”

Not sure I would call this good news. Are we importing less because there is a concern that US real income is falling? That we exported less may be a reflective of decreased aggregate demand abroad.

Please tell me that I’m reading this wrong.

pgl: No. A decline in goods imports might show slowing of economic activity at home – but then the boom in goods consumption should be waning as the economy continues to normalize. As for the decline in exports, it’s hard to figure out a positive story there.

While JohnH is insulting Paul Krugman for no good reason, Moses treated us to a Stephen Colbert skit with Dr. Krugman shared a meal with Bootsie in NYC’s Chinatown. To return the favor, here Stephen Learns Macroeconomics On A Roller Coaster from Dr. Krugman:

https://www.youtube.com/watch?v=ir7lwqnPlrg

There is clear evidence from container ports that imports are falling fast:

“Imports through the top ten container ports in the U.S. marked the largest overall monthly decline since the financial crisis and likely the largest single month contraction ever, according to industry veteran John McCown.

“Inbound volumes dropped a whopping 17.5% year over year in November led by a “staggering” 26% decline for West Coast ports—quite possibly the biggest decline ever for the West Coast, McCown says in his monthly U.S. ports report.”

“November now marks the third consecutive month of rapidly expanding year over year declines that began in September and have only gotten worse, as the 17.5% drop marks an acceleration from October’s -10.3% and September’s -5.3% year over year drops.”

https://gcaptain.com/u-s-imports-accelerate-declines-in-november-led-by-staggering-drop-for-west-coast-ports-report/

It seems likely that inventories are still weighing on import demand. That shows up in GDP, and is reason to track final domestic demand data. Preliminary data show retail inventories down in November, wholesale inventories up, for what that’s worth. We’ll see a fuller story on the interplay between impots and inventories on January 18.

West Coast ports suffered the largest drop by far. China has reported export declines in the past couple of months, but not of the same magnitude as the drop in West Coast ports. There may be supply problems in China, but that doesn’t look like the biggest cause ofdecli e in U.S. imports.

Terrific comment and informative link. A lot of nuggets there from my view. I mean like at least 5 important points there. Maybe my fav is your very last sentence. And not that I would be very good at reading them, I’d very likely need you or Menzie’s tutoring~~“It seems likely that inventories are still weighing on import demand. That shows up in GDP, and is reason to track final domestic demand data.”

That would be in the BEA tables on the next release?? I wanna know if there’s an BEA RSS feed so my lazy bones don’t have to go to BEA website to do everything but it might be plopped into my RSS reader. If anyone knows the answer to that RSS problem I’d be grateful to hear it.

This link:

https://www.bea.gov/data/gdp/gross-domestic-product

Then click under Current Release, click on Table Only. Then Table 1, line 31. The same table in nearby lines has GDI, GDO, GDP and a bunch of other aggregates which let you know what’s going on.

Or FRED: https://fred.stlouisfed.org/series/A713RX1Q020SBEA

By how many orders of magnitude did financial capital dwarf real trade? Can you not see the forest, for the trees?

Some good news on the inflation adjusted price of gasoline:

https://jabberwocking.com/for-new-years-the-price-of-gasoline-dropped-yet-again/

Since 2010, the average inflation-adjusted price for a gallon of regular is $3.61. Right now gasoline is selling for 50 cents less than that.

Ted Cruz is the only person who go on vacation during a storm?

https://www.newsweek.com/ted-cruz-mocked-comment-about-bidens-vacation-during-winter-storm-1769996

enator Ted Cruz’s response to President Joe Biden’s holiday trip to St. Croix in the U.S. Virgin Islands has been met with a wave of online criticism, with some using it as an opportunity to resurface a highly criticized vacation the Texas Republican took during a winter storm last year. The White House announced Tuesday that Biden had departed Washington for the islands, where he is set to spend several days with family through January 2. The president has faced his own wave of criticism from conservatives over the timing of his travels. The U.S. is still dealing with the aftermath of a deadly winter storm that swept the nation, killing over 30 people in Buffalo, New York, as well as holiday weather–induced flight cancellations and delays that have left many Americans stranded.

Critics who interpreted this as a dig against the president were quick to note that Cruz traveled to Cancún, Mexico, in February 2021 as Texas was hit with a severe winter storm that left scores of residents without access to power, food and water. The Texas Republican later admitted that the vacation was a “mistake” and said that he booked the trip because his daughters had asked for it after school was canceled for the week. “It’s crazy but when you do your job, you can take a vacation,” writer Tony Posnanski tweeted in response to Cruz’s post about Biden’s St. Croix trip. “Now tell us again how was Cancun when thousands of your Texas constituents had no power and were freezing?”

my first thought when i saw that big drop in imports was ‘China lockdowns’ – of course we don’t know yet because advance figures don’t provide those details, but if true we could be looking at a new round of supply chain problems…