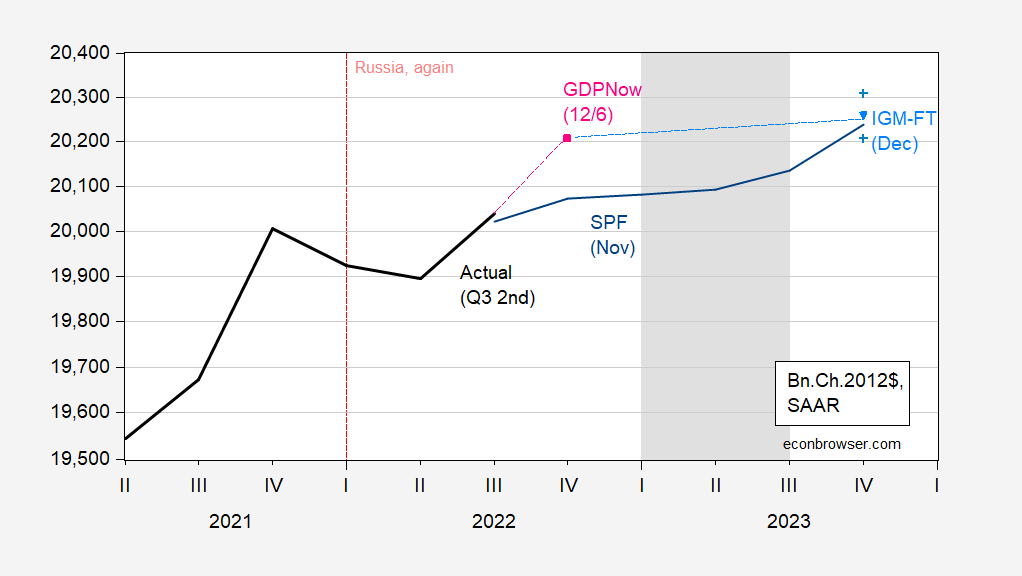

Recession likely, modal response 2023Q1 or Q2. Median forecast q4/q4 2023 growth 1% (Survey responses here; FT article here):

Figure 1: Reported GDP (black), Atlanta Fed 12/6 nowcast (pink square), IGM-FT median forecast GDP level, based on Atlanta Fed nowcast (sky blue inverted triangle), 10th/90th percentile (blue gray +), and median Survey of Professional Forecasters level (dark blue), all in bn.Ch.2012$ SAAR, log scale. Light shading denotes start of recession – modal response from IGM-FT survey. Source: BEA 2022Q3 2nd release, Philadelphia Fed, Atlanta Fed (12/6), IGM-FT December survey, and author’s calculations.

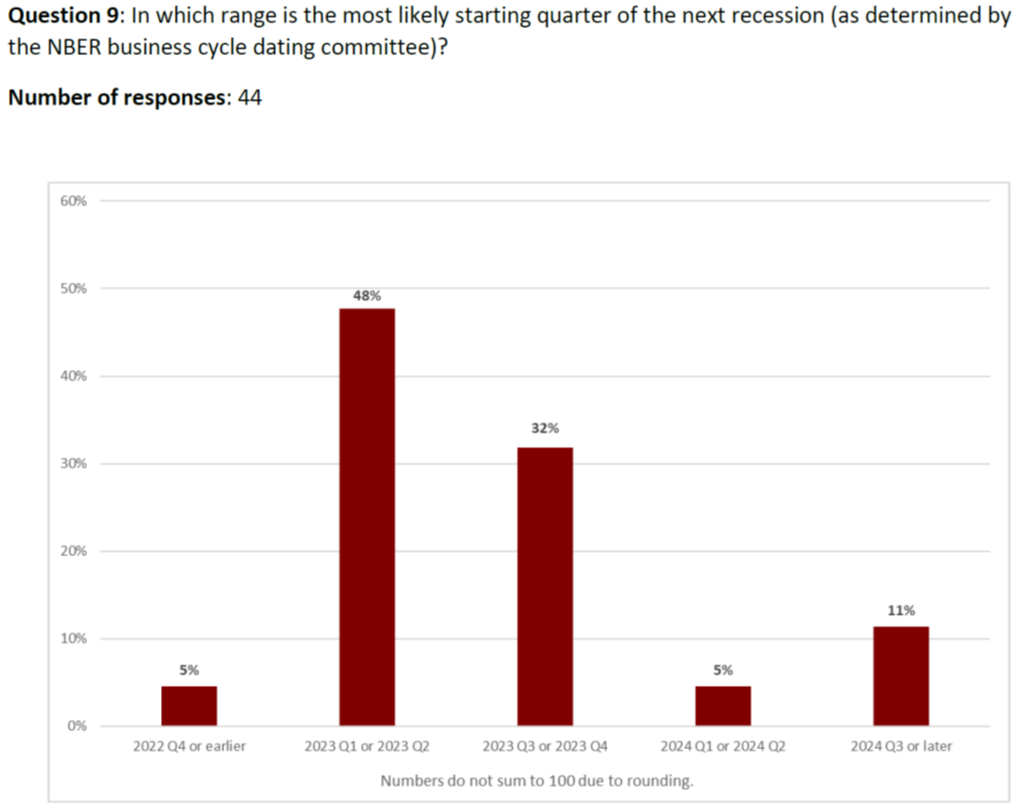

It’s hard to see the predicted recession show up in the time series, but here’s the IGM-FT survey response, showing 48% of respondents indicating 2023Q1 or Q2 as most likely recession start (note – as determined by NBER, not by the informal 2-quarter-rule).

Source: IGM-FT December survey.

The Survey of Professional Forecasters (November 2022 release) does not poll on recession start, but places a high probability of negative GDP growth in 2023Q2 (49.4%) and slightly lesser in 2023Q1 (47.2%), and yet less in 2023Q3 (46.1%).

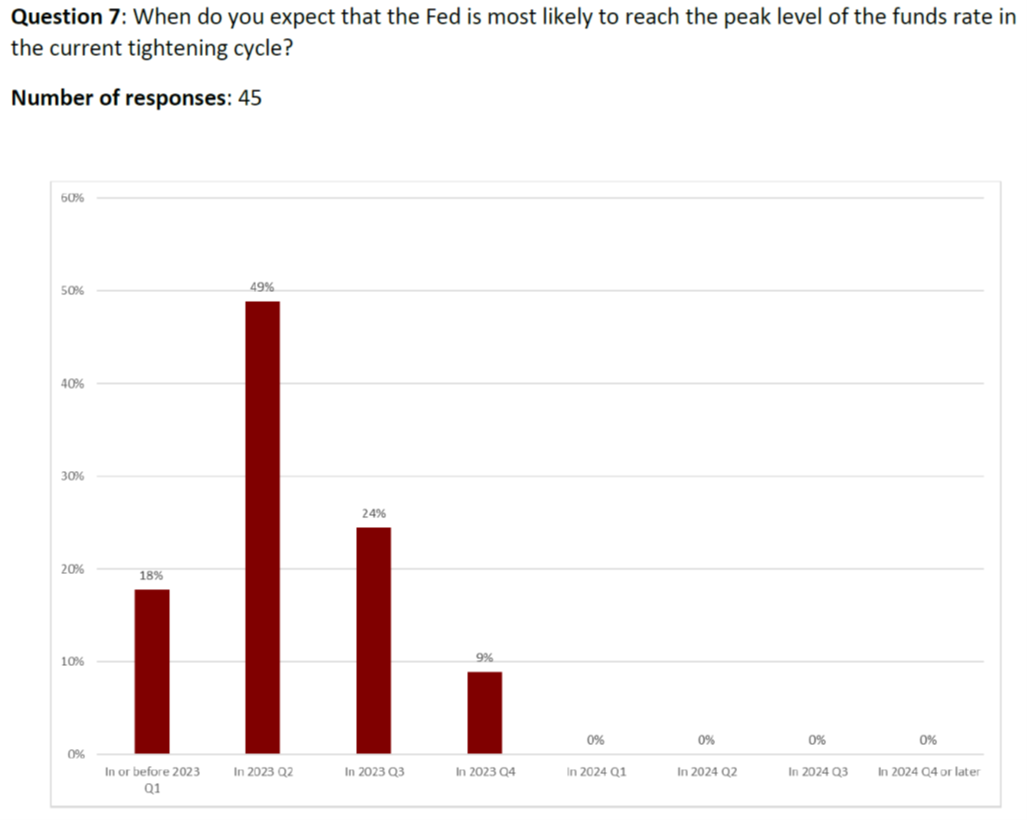

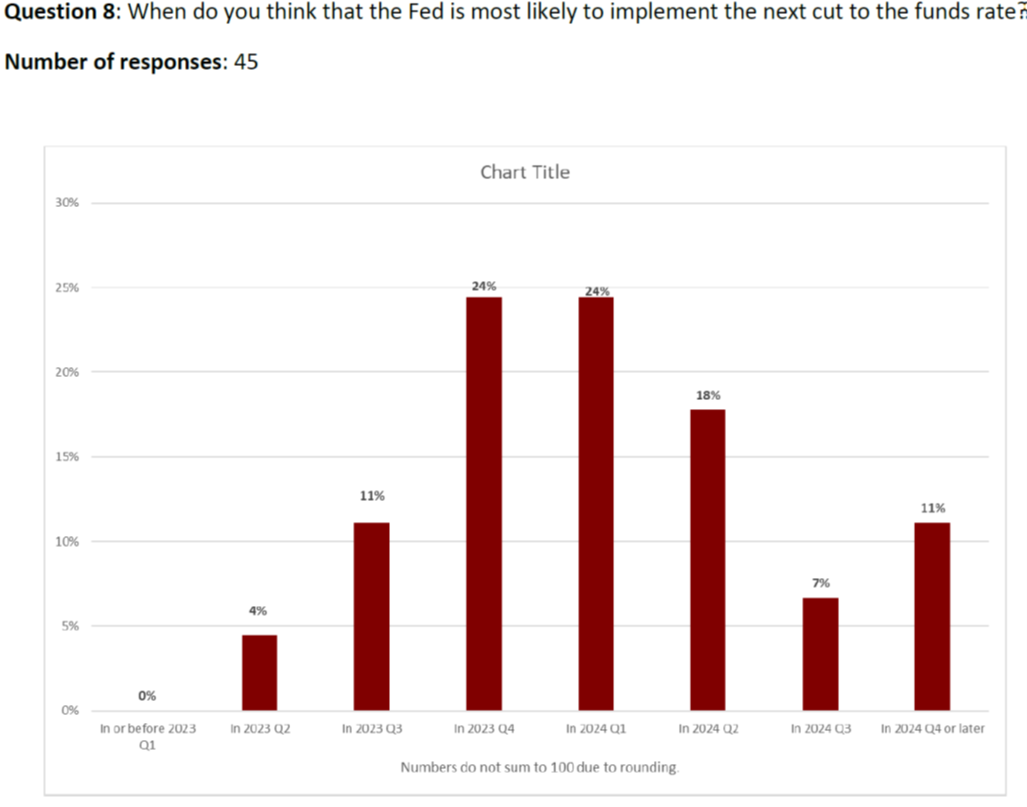

When will the Fed funds rates peak, and then be dropped? Those are questions 7 and 8:

Source: IGM-FT December survey.

Source: IGM-FT December survey.

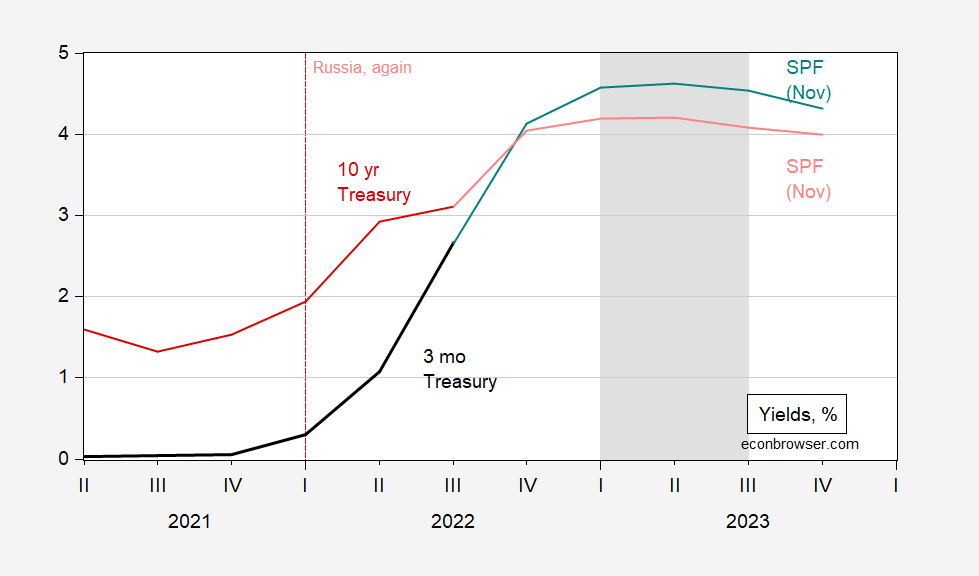

The modal responses indicate a peak at 2023Q2, and drop in either 2023Q4 or 2024Q1. The SPF doesn’t poll on the Fed funds rate, but does poll on the three month Treasury yield which tracks the movements in the Fed funds rate fairly well. Broadly speaking, the SPF median is consistent with the IGM-FT modal response regarding this rate.

Figure 2: Three month Treasury yield (black), forecasted (teal), ten year Treasury yield (dark red), forecasted (pink), all in %. Light shading denotes start of recession – modal response from IGM-FT survey. Source: Treasury via FRED, Philadelphia Fed, IGM-FT December survey, and author’s calculations.

The SPF forecast includes a projection of the 10yr Treasury. The implied SPF forecast is for a 10yr-3mo spread of -0.09% in 2022Q4 (As of the first two months of Q4, is -0.03%). The figure shows a forecasted 5 quarter inversion, which is remarkably long; the inversion before the 2007 recession was only 3 quarters, that before the 2001 recession was less than 2 quarters.

Professor Chinn,

I think this site started talking about the 10yr_2Yr treasury inversion during 2022Q1 or 2022Q2.

I had asked for your professional help to understand the significance of the 10yr_2yr inversion, while the 10yr_3mo. did not show an inversion.

As I recall you mentioned that the 10Yr_2Yr inversion was an appropriate metric to forecast recession at the 1yr to 1.5yr time frame, which may very well may be validated.

AS: It’s hard to say what is “best”, but for a formal assessment (which does not tag 10yr-2yr), see this post.

Thanks, I forgot about the linked post.

I did not mean to imply that the 10yr_2yr was the best, only that perhaps in this case the 10y_2yr was instructive.

If this holds we are may be currently in the peak quarter. Revised HH survey data comes with the January release, revised Establishment Survey data comes in February. As noted many times by Menzie preliminary benchmark revision suggests higher nonfarm payroll employment level. Maybe revised data will show a substantial downward reduction of jobs growth pace and together with visibly slowing inflation it will give a clear signal the Fed is acheaving it’s goal. One weird thing to me is that this recession if occurs will be so well predicted.

https://fred.stlouisfed.org/graph/?g=N741

January 4, 2020

Interest rates on 10-Year Treasury Bond minus 2-Year Treasury Note, 2020-2022

https://fred.stlouisfed.org/graph/?g=zSG6

January 4, 2020

Interest rates on 10-Year Treasury Bond minus 3-Month Treasury Bill, 2020-2022

https://news.cgtn.com/news/2022-12-08/Study-finds-genetic-solution-to-pre-harvest-sprouting-in-rice-wheat-1fAsVAYdFCg/index.html

December 8, 2022

Study finds genetic solution to pre-harvest sprouting in rice, wheat

A new Chinese scientific study has identified a combination of two crop genes that are in charge of controlling seed dormancy and could be used to reduce the costly phenomenon of pre-harvest sprouting (PHS) in crops such as rice and wheat.

Seed dormancy is an important survival tool for plants, allowing them to survive in negative weather conditions. However, excessive dormancy may shorten cultivation time, so many farmers like to plant low-dormancy species of rice and wheat to get a high rate of seed emergence after sowing.

This practice can lead to PHS, a worldwide production problem in which grains germinate on the mother plant before harvest time and often during wet weather, severely reducing grain yield and quality.

Researchers from the Institute of Genetics and Developmental Biology (IGDB) under the Chinese Academy of Sciences have identified two genes, namely SD6 and ICE2, which act in combination to control seed dormancy and have great potential for reducing PHS in rice and wheat.

They found that SD6 and its interaction partner ICE2 can antagonistically control rice seed dormancy by regulating plant hormones. Specifically, SD6 can promote the expression of the catabolic hormones and inhibit the expression of the anabolic hormones, while ICE2 acts in the opposite manner.

In the study, when seeds were at room temperature, SD6 was up-regulated to trigger seed germination. However, at low temperatures, SD6 was down-regulated, but ICE2 was up-regulated to keep the seed dormant.

The researchers edited SD6 in three rice species and found that editing the gene could be a rapid and useful strategy for improving PHS tolerance in rice. They then edited the genes in a wheat variety, showing that this provided a similar resistance to PHS.

The study results * were published in the journal Nature Genetics on Monday.

Lead researcher Chu Chengcai said the findings were crucial to avoiding huge agricultural losses and ensuring food security. He cited China as an example, saying that PHS had damaged about 6 percent of conventional rice acreage and 20 percent of hybrid rice acreage during the harvest season in the south of the country….

* https://www.nature.com/articles/s41588-022-01240-7

In the IGM survey, the highest response for the onset if recession, 49%, is Q2 of next year, same quarter as the highest response for the Fed funds rate peak, 48%. Second highest for both is Q3, 32% and4%, respectively. Almost as if the Fed will only stop once it has induced a recession. Except they won’t know they’ve induced a recession.

The Fed will release ne projection materials at the December meeting. We’ll know a bit more then.

A lot of what I am reading nearly states outright they “want” a recession because they are asinine enough to believe they need recession to stop inflation. Then they wonder why large segments of the public hate them and they have a target sign velcroed on their back for conservative radio/TV jockeys. What would you think if you were economically illiterate and read 3/4s of their “Fed minutes”?? PhDs with a JD leading them who couldn’t pass middle school Mass Communication 101 if someone slapped them upside the head full-force with a cricket paddle.

Oh my – the Kremlin is upset with Time over their 2022 Person of the Year:

https://www.republicworld.com/world-news/russia-ukraine-crisis/russia-calls-times-decision-to-name-zelenskyy-as-person-of-the-year-russophobic-articleshow.html

Russia has said that Time magazine’s decision to award Ukraine’s President Volodymyr Zelenskyy its person of the year award is an example of Russophobia. The statement was made by the Kremlin after Time magazine and Politico celebrated the Ukrainian President Volodymyr Zelenskyy’s leadership during the ongoing Russia-Ukraine war. Kremlin spokesperson, Dmitry Peskov said that “the publication’s editorial line does not go beyond the European mainstream, which is absolutely blinkered, anti-Russian and frantically Russophobic,” as per a report from CNN news.

Putin and his allies are little weenies in my view. The world does not hate the average Russian on the street but we do abhor the war criminal was rules over Russia. Now if some brave Russian found a way of take their government away from the war criminal and his cronies, then the Time Person of the Year for 2023 would be that Russian.