Or more precisely, Ryanomics as interpreted by the Heritage Foundation/Center for Data Analysis.

The Tax Policy Center yesterday noted:

In last night’s debate, Mitt Romney repeated the idea that he could pay for much or all of the 20 percent rate reduction and other tax cuts in his tax plan by capping itemized deductions at $25,000. He had previously suggested a $17,000 cap in an interview and, in the first debate, $25,000 or $50,000 caps—and possibly phasing deductions out entirely for high-income taxpayers. Capping deductions would raise revenue in a highly progressive way but how much revenue and how progressive depend on the cap.

…

Eliminating all itemized deductions would yield about $2 trillion of additional revenue over ten years if we cut all rates by 20 percent and eliminate the AMT. Capping deductions would generate less additional revenue, and the higher the cap, the smaller the gain. Limiting deductions to $17,000 would increase revenues by nearly $1.7 trillion over ten years. A $25,000 cap would yield roughly $1.3 trillion and a $50,000 cap would raise only about $760 billion.

…

Suggesting limits on deductions was Governor Romney’s first public statement about how he might offset the revenue lost by cutting tax rates. Without more specifics, we can’t say how much revenue such limits would actually raise. But these new estimates suggest that Romney will need to do much more than capping itemized deductions to pay for the roughly $5 trillion in rate cuts and other tax benefits he has proposed. [emphasis added — MDC]

The Tax Policy Center provides an interactive webpage where you can pick your option. The outcomes are summarized in the Table below:

Now, before one jumps on the TPC as a biased institution, it should be remembered that Governor Romney was for TPC before he (or at least his advisers) were against TPC [1].

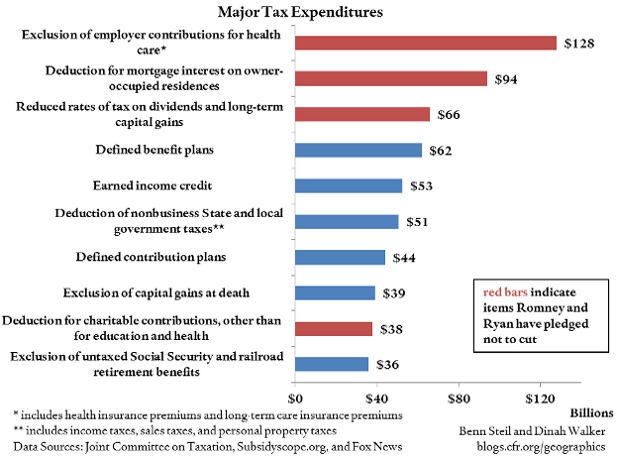

Of course, since Governor Romney has a fairly malleable set of policy positions, he might revert to earlier positions on eliminating some subset of deductions, and drop the deductions cap. The Council of Foreign Relations Geoeconomics Center has produced an interested graph which shows the value of various tax expenditures (deductions), indicating in red which ones Governor Romney has exempted. This is shown in the figure below.

Benn Steil and Dinah Walker write in “There’s a $1 Trillion Hole in Romney’s Budget Math”:

In last week’s vice-presidential debate, Republican Paul Ryan defended the fiscal prudence of lowering top marginal income tax rates by arguing that it would be accompanied by “forego[ing] about $1.1 trillion in loopholes and deductions .. deny[ing] those loopholes and deductions to higher-income taxpayers.” The $1.1 trillion he refers to is actually an amalgam of specific “tax expenditures” – benefits distributed through reductions in taxes otherwise owed – identified by the Joint Committee on Taxation. …

The red bars indicate items that Romney and Ryan had previously promised not to touch: exclusion of employer contributions for health care, deductions for mortgage interest, reduced tax rates on dividends and long-term capital gains, and deductions for charitable giving. These four items constitute a massive 30% of the $1.1 trillion. Therefore the Ryan pledge to cut loopholes and deductions cannot, mathematically, be worth more than $770 billion.

And note some of the other big-ticket “loopholes and deductions” on the list. Social security and other retirement income constitute three of the top ten items, together making up 13% of the total, and the earned income credit, which benefits the poor, represents another 5% of the total. Would Romney and Ryan eliminate those deductions? We’ll speculate here: no. A quick skim of the remainder shows that few of these items constitute “loopholes” in the public’s mind – they are items few imagine could or should be taxed.

In short, Romney and Ryan cannot, logically, keep the pledge to cut $1.1 trillion in tax shields for the rich, because (1) they have already ruled out eliminating the biggest of such shields, and (2) much of the $1.1 trillion is actually derived from tax expenditures targeted at lower and middle income taxpayers – not tax shields for the rich. This almost surely means that only a small fraction of the $1.1 trillion is actually in play.

On to economics. As I have noted before [2] [3], the circle can be squared if one is sufficiently imaginative. And I don’t mean almost-reasonable elasticities [4] — which won’t do –, I mean truly imaginative. And the bounds of imagination were pushed to the interstellar realm when the Heritage/Center for Data Analysis “analyzed” the Ryan plan back in April 2011. Then, it turned out that the Ryan plan could hit the employment, output and revenue targets enumerated if sufficiently high labor elasticities are assumed, along with capital elasticities with respect to user costs of capital about 10 times the usually assumed values. I reverse-engineered these elasticities based upon the (now “disappeared”) Heritage/CDA analysis of the Ryan plan, discussed in gruesome detail here.

Note that the shortfalls noted above pertain only to the tax side; there are additional defense related commitments that make the shortfall (conditional on the promised balanced budget) even larger. Once again, I am confident that with sufficient imagination, Governor Romney’s advisers can square the circle on that count as well.

In other words, the Governor should just dispense with trying to appeal to reality, and make up the economic numbers to make the tax numbers work, just as Representative Ryan/Heritage have.

For more, see Bruce Bartlett.

At least I know what Romney intends to do. I have no idea what Obama’s plan is for the next for years. All he and his supporters have done is criticize Romney’s ideas. Does Obama even have a plan?

Brian: You know what Romney says he intends to do. Events will determine much of what he actually does.

Past experience suggests that Obama will continue to seek compromise that will avoid disruptions.

The candidates do appeal to different audiences. That is all we can know about what they will do if elected.

Actually, Obama does have a plan. You could look it up. It’s on the Obama website. It has significantly more detail than Romney’s.

My favorite Romney thing is the 85 word plan for dealing with financial institutions, including government entities and guaranteed entities.

A less partisan “economist” might also note that Obama’s tax plans are equally absurd, and that raising taxes only on those making over $250,000 can in no way come close to paying for Obama’s spending.

If Obama wants to keep spending 24% of GDP, he’s going to have to disembowel the middle class with a rusty knife.

If you want the details of Romney’s tax plan you and see them here. 🙂

http://www.romneytaxplan.com/

Menzie,

The tax policy center is not the last word.

Harvey Rosen shows how the math adds up here:

https://www.princeton.edu/ceps/workingpapers/228rosen.pdf

See also the analysis by the tax foundation here:

http://taxfoundation.org/article/simulating-economic-effects-romneys-tax-plan

Jonathan,

What are you referring to when you talk about Obama’s website. If I go to barackobama.com I find virtually no details about the president’s future agenda. The web site notes what has already been done in very short sentences and to the extent that it refers to the future offers simple platitudes. I don’t see anything else. Where are you looking?

Pfffftt

Why need a plan? This is the problem people have. They can’t seem to get around it.

If you aren’t going to make major changes to the economic structure, plans like Mitt Ryan’s are useless. They just prime the pump of the same old structure……minus social programs of course.

The whole nature and failure of Laissez faire is the international and totalitarian construct it is to nature. Remove Paul Romney’s cronyism and you still have that totalitarian construct. It is why voting for Libertarian Johnson in the election. He is anti-nature and anti-soul. Everything is based on the material well-being of property owners over all other caste’s. This kind of behavior is very similiar to other materialist over the years who provide totalitarian constructs regarding economic class.

That is why I moved into traditional school studies with Evola, Spengler and Guenon. It transcends these useless materialistic blatherings and gets into the real spirtual side.

I see the usual suspects are being rounded up in support of the Romney-Ryan Early Dementia Bizarro World Economic Plan; specifically the Rosen and Tax Foundation studies. Both of these studies use Dynamic Scoring (read, Wishin’ and A’Hoping). If these implausible growth scenarios are so successful then please answer these questions (via Brad DeLong who says it better than I):

If raising the net-of-tax rate for the upper class from 65% to 72%–an increase of 10% in the natural log–raises national income by between 3 and 7 percent, then wouldn’t…

Reagan’s ERTA raising the net-of-tax rate for the upper class from 30% to 50%–an increase of 51% in the natural log–have raised national income by between 15 and 35%?

Reagan’s raising in 1986 of the net-of-tax rate for the upper class from 50% to 72%–an increase of 36% in the natural log–have raised national income by between 11 and 25%?

Clinton’s lowering in 1993 of the net-of-tax rate for the upper class from 72% to 60%–a decrease of 18% in the natural log–have raised lowered national income by between 5 and 12%?

Bush’s raising in 2001 of the net-of-tax rate for the upper class from 60% to 65%–an increase of 8% in the natural log–have raised national income by between 2 and 5%?

We simply do not see such supply responses in the historical record, do we? To propose that they exist is wholly inconsistent with the fact that American growth 1938-81 was faster than since 1981, right?

I guess it’s better than saying that the Romney Plan has nothing supporting it, but in the business world this is called “betting on the come”. It is usually to be avoided unless one wishes the pleasurable experience of Chapter 7 or 11 Bankruptcy.

I think that the major problem is not the plan itself, but the fact that he can change it after his election, without having any vertical or horizontal responsibility to voters or legislature/judiciary. I´m so enraged when I see people still arguing about the same things and then realizing they were conned by the same party machine over and over again. I´m pretty sure there will be from little to no changes in the life of the middle and low classes. Talking about particular details of the proposed plans makes us forget about more important stuff, like immigration to Canada, homelessness, foreclosures, and crime.

Romney and Obama are backed by the same machine that makes the average American poor, fat and lazy. Romney and Obama are just perfect brand that is put on the same product, which is being sold to you over and over again.

Here’s a summary of the Obama plan:

http://www.taxpolicycenter.org/UploadedPDF/tax_plan_matrix_transition.pdf

There is a lot of retail politics in this stuff.

Bottom line: Romney sees spending at 20% of GDP, Obama at 22.5% of GDP. At some point you have to raise taxes to cover expenses.

With Romney, we have some chance of a proper restructuring of federal revenues and outlays, the risk being primarily the willingness of Congressional Republicans to agree tax increases in the range of 2-3% of GDP (and I may be optimistic here).

With Obama, we continue as we have been: very high deficits and political stalemate, with a likely reckoning from bond markets somewhere in the next four years.

An example of a specific Obama plan is the American Jobs Act. You can read a fact sheet here:

http://www.whitehouse.gov/the-press-office/2011/09/08/fact-sheet-american-jobs-act

I can pretty easily find others, as well as criticisms. So for example, you can find Obama’s plan for reducing the debt by $4T and criticisms that it counts some things unfairly. But it is a plan, which is more than Romney has put out at all.

This by contrast is the entire Romney / Ryan plan for financial / housing reform, all 85 words:

“The Romney-Ryan plan will completely end “too-big-to-fail” by reforming the GSEs. The four years since taxpayers took over Fannie Mae and Freddie Mac, spending $140 billion in the process, is too long to wait for reform. Rather than just talk about reform, a Romney-Ryan Administration will protect taxpayers from additional risk in the future by reforming Fannie Mae and Freddie Mac and provide a long-term, sustainable solution for the future of housing finance reform in our country.”

This at best is just an announcement of a plan that doesn’t exist.

The pro-Romney argument goes something like this:

(1) Obama spends too much

(2) Romney won’t spend as much

(3) Romney is therefore more likely to repair the US balance sheet.

But, history shows that

(1) GOP Presidents spend as much or more than Dems, with a priority on military spending instead of social programs.

(2) GOP leadership is absolutely unwilling to raise taxes in any way and will cut taxes even if it means increased deficits.

(3) Romney plan is consistent with this history as he’s indicated increased military spending, no major cuts to key social programs and large tax cuts.

(4) Romney is unlikely to decrease the national debt.

The real decision as it relates to budget/tax policy is do you prefer wasteful government spending on military programs or social safety nets?

@ Justin

and this is what I have been saying. Electoral promises are not real politics. Therefore this article just is pure speculation (which is not mistake of the author but of the candidates).

Rick Stryker: Harvey Rosen’s analysis is of the “high supply elasticies” approach, so not as egregious as Heritage/CDA, but of similar philosophy. Note also, Rosen did not account for ending AMT and estate tax. [1]

W.C. Varones and Brian: Gee, I wonder what that CBO document was scoring…It is called “An Analysis of the President’s 2013 Budget”. And since you seem so keen on dynamic scoring, remember CBO didn’t include stimulative effects in the official scoring. Resulting deficits would likely be smaller than CBO projects — but how much smaller depends on your model (or lack of model).

The Rosen analysis also includes the elimination of the municipal bond deduction. That does not eliminate a tax expenditure. It simply transfers an expense from the federal budget to state and local budgets, with no net change for taxpayers. Federal expenses go down but state and local expenses go up. Yet Rosen counts this as savings for Romney.

quote

before one jumps on the TPC as a biased institution, it should be remembered that Governor Romney was for TPC before he (or at least his advisers) were against TPC [1].

if you got to the link, it takes you to a WaPo page that give unsourced the a quote from a supposed MRomney press release.

no link for the PR

other google links will take you to talking points memo, which also asserts that there is a romney press release, again with no link

summary is a gigantic liberal lazy scrwup, with noone bothering to do the *absolute minimum* of checking, which is to actually read the supposed (we have never seen it) press release.

Justin –

What’s Romney’s track record? He came into a dysfunctional Salt Lake City Olympics and made order. So he understands what finance and restructuring are all about.

But do the Congressional Republicans? That’s a harder question.

ezra colbert: Since the Romney campaign has never deigned to deny the existence of this press release, one can surmise it exists. After all, if the report had been incorrect, denying the existence would have been a lot easier than doing the verbal gymnastics that have been employed by the Romney campaign to discredit (by attack — no analysis I can tell) TPC. Or are you asserting the Romney campaign is incompetent?Please elaborate.

By the way, I have checked for this press release. I do not find it on the official online list of press releases (you can start looking through the November 2011 releases here). Maybe it was never online; maybe it was “disappeared” like the original Heritage Foundation/CDA analysis of the Ryan plan.

Steven Kopits: What’s Romney’s track record? He came into a dysfunctional Salt Lake City Olympics and made order. So he understands what finance and restructuring are all about.

Yes, he does understand. Romney’s first act for the Olympics was to spend $4 million hiring lobbyists. He even registered himself as a lobbyist. He then managed to get $1.6 billion in taxpayer subsidies for the Olympics. Yes, he understands what finance and restructuring are all about — corporate welfare on the backs of taxpayers.

Menzie

Can you please stop talking about these minor details and get back to the real issues like binders and big bird? 😉

I look at Obama’s plan that was rejected by his own party, and Romney’s plan described above, as the starting points for bipartisan negotiation.

It’s going to take a bipartisan effort to solve our fiscal problems. Romney has a record of reaching across the aisle. Obama spent all his poltical capital on Obamacare during his first year+ instead of jobs, immigration, etc.

I lean toward Romeny being a better choice for cobbling together some bipartisan fiscal solutions. He has already thrown a bone to the left by promising to means test entitlements and reduce tax deductions by a greater amount for those with higher incomes.

Here’s an article from the LA Times on Romney and the Salt Lake Olympics:

http://articles.latimes.com/2012/jul/27/nation/la-na-romney-olympics-20120727-1

Would I hire this guy if I needed to restructure an economy? Yup, I might.

Rick Stryker Did you read those two reports, or just auto-link to something that you thought might support your position? Try reading them. Both of them are crapola. The Rosen paper describes a Romney plan that Romney himself has already rejected, so I don’t know how you can pretend that it supports Romney’s position. And it’s full of sketchy assumptions about labor elasticities. For example, he uses an elasticity that is plausible for high income folks, but orders of magnitude absurd for middle and low income folks. In the real world the elasticity of labor supply depends on income. But notice that he’s really describing a plan that is irrelevant to today’s problem. Both Romney and Rosen are trying to sell us a “revenue neutral” plan. Even setting aside the question of whether or not these plans are in fact revenue neutral, the larger point is that “revenue neutral” leaves us at revenues of 16% of GDP…way short of any plausible estimate of what we’ll need to cover the primary deficit nevermind the total deficit.

The Tax Foundation paper is even worse. Bill McBride embarrassed himself with this amateurish effort. Where to begin??? In the first paragraph he admits that his plan is irrelevant to today’s problem because it will only have an effect over the 5-10 year horzon. And note that he baselines his numbers at 2008 and assumes that the economy is operating at full-employment! His paper assumes away the very problem that has voters most concerned. And like Rosen, his elasticity of labor supply estimates are laughable. Notice that he assumes labor hours will increase without inflation even though he explicitly says that he is assuming a full employment economy. Please explain that one. No prior slack in the economy, but people will work significantly more hours. And apparently they won’t take any of that higher income and buy more leisure time with it. Just dumb.

And look at how McBride deals with government spending. Basically he doesn’t. He applies the lower deadweight losses that come from lower taxes and increases baseline GDP (actually, it should really be welfare). But nowhere does he reduce government spending. If he did, then he would have to subtract that lost government spending from GDP. He just pretends that you can remove $5 trillion in goverment spending with zero impact on aggregate demand.

He also gets the corporate tax all wrong. Much of what he says is true if corporations fund capital expansion with equity; but if they fund capital expansion with debt and if the interest payments are deductible, then cutting the corporate tax rate has no effect on the capital stock (see Rudy Dornbusch and Stanley Fischer on this). He also might want to check out “Taxing Capital? Not a Bad Idea After All!”, NBER Working Paper #12,880. The argument here is that if you introduce overlapping generations but finite-lived individuals with different skill sets, and if you want to maximize social utility, then the optimal corporate tax rate should be positive and significant (approx 36%).

And what about the estate tax? McBride seems to think that eliminating the estate tax will have positive supply side effect. This is nonsense. I can’t count how many studies have found that inheritances reduce the labor supply and encourage early retirement.

I could go on, but I’ll just leave it where I’m at.

I have no idea why you thought those two studies were convincing. Both of them read like something that a Romney hack whipped out in 20 minutes and the only intent was to provide a link for suckers who are looking for something to post on a blog site.

Steven Kopits Why do you think his accomplishments in the Olympics qualify him for President? Herber Hoover was a superstar businessman with extraordinary CEO skills. He was a great Commerce Secretary. He did wonderful things organizing relief for the Belgians after World War I. He knew nothing about government and even less about public finance. He tried to apply his business instincts to macroeconomics and ended up making a hash of things. Look at the business leader types who post here. I’m sure that many of them are very successful and damn good wheeler-dealers. But try reading their nonsense comments on macroeconomics.

When I was in college I always thought it was interesting that business majors did pretty well in microeconomics; but they were totally at sea when it came to macro. Consistently at the bottom of the class. Coincidence? I don’t think so.

It is certain that the sun will rise on November 7.

Some time after that our majestic elected officials will deal or not deal with our various economic problems to a greater or lesser degree. The economic approach taken will depend upon external circumstances, electoral results, accidents and the venal requirements of Congress.

Any forecasts above and beyond these identify the forecaster as a partisan or fantasist. Or as the most pathetic sort of academic.

‘Governor Romney was for TPC before he (or at least his advisers) were against TPC….’

Entirely understandable, given that

the TPC used to sound a lot like Romney;

My message is simple: the income tax is riddled with tax preferences. These preferences narrow the tax base, reduce revenues, distort economic activity, complicate the tax system, force tax rates higher than they would otherwise be, andare often unfair. By reducing, eliminating, or redesigning many of these preferences, policymakers can

§ Make the tax system simpler, fairer, and more conducive to America’s future

prosperity;

§ Raise revenues to finance both across-the-board tax rate cuts and deficit

reduction; and

§ Improve the efficiency and fairness of any remaining preferences.

2slugbaits,

Of course I’ve read the studies I’ve linked to. And as usual you are ranting, without showing specifically what you disagree with. Since you seem more hysterical than usual, I suspect it’s because you sense Romney is winning.

Harvey Rosen is hardly a Romney hack who took 20 minutes to write his piece. He’s a chaired professor at Princeton and a leading public finance economist who is author of the market-leading textbook “Public Finance,” which has introduced countless undergraduates to the economics of taxation. He was also Chairman of the Council of Economic Advisors under Bush.

If you look at his tables, I don’t see how you can claim that he’s making sketchy assumptions. For example, in his analysis of taxpayers over 100K relative to 2012 law, of the 679 billion currently collected, he calculates that Romney’s tax cut will subtract 158 billion without any adjustment. He then adjusts for tax avoidance and makes that number 144 billion instead, a $14 billion dollar change. That doesn’t seem outlandish at and can easily be supported by the studies he cites. Moreover, he assumes a macro benefit of the tax cut of $25 billion, again not very large and easily justifiable in light of the Romers’ research or others. Thus, you subtract 25 from 144 to get 119 billion for the net revenue loss from the tax cuts. Then, Rosen shows that elimination of itemized deductions plus taxable interest will net 112 billion, so almost a wash. As for the idea that this isn’t Romney’s plan, 25K in deductions is about what the average taxpayer over 100K claims. So, Rosen’s analysis is consistent with Romney’s statement.

As for the tax foundation paper, they say correctly that Romney’s plan is not discretionary fiscal policy and is designed to have long run effects from changes in incentives. So, they are completely right to analyze its long term consequences.

Steven Kopits says “With Obama, we continue as we have been: very high deficits and political stalemate, with a likely reckoning from bond markets somewhere in the next four years.”

“political stalemate” is mainly caused by the Republicans. As we all know it’s Mitch McConnell’s stated policy.

So, therefore, to end political stalemate we should elect Romney.

Nice.

Why do Republicans always want to reward rapists?

Rick Stryker: You’ve made my point. If you assume a sufficiently large supply side response, after tax cuts have implemented — in his case 3%, then yes (plus ignore AMT and estate tax eliminations). And assume effects pretty much right away. Fine for long run analysis, not certain that makes sense for medium term.

So, let me just put you in the true-believer camp, along with Jude Wanniski.

‘So, let me just put you in the true-believer camp, along with Jude Wanniski.’

Now there’s a powerful argument.

Patrick R. Sullivan: You believe 3% acceleration in short to medium run growth is plausible, for the stated reductions in marginal tax rates, and elimination of unstated deductions.

Rick Strkyer Let me repeat. Romney has already rejected Rosen’s plan. As was the case with Feldstein, Rosen had to reach down to the $100K income level. Romney explicitly rejected that. Romney threw Feldstein under the bus. Poor hapless Marty came back for more. Rosen also ignores the revenue loss from a 20% tax cut on those making less than $100K.

The Tax Foundation plan is trying to solve a non-problem. The last time I checked industry wasn’t running at full capacity. There is plenty of slack in the economy right now. This isn’t 1979. Giving us a long term plan to push out the aggregate supply curve (even if it was based on sound economics, which the Tax Foundation plan isn’t) is at best a quaint but otherwise irrelevant document. It’s as though someone is in a car wreck and comes into the emergency room with a fractured spine and in a coma. The doctors at the Tax Foundation would recommend a low fat diet and regular exercise.

Patrick R. Sullivan Good to know that if Romney is elected President he will end tax breaks for people who hide savings in Cayman Island accounts, Swiss bank accounts, and create $100 million IRAs.

But returning to planet Earth, what is Romney’s plan for stimulating aggregate demand?

One other point about these labor elasticity estimates floating around. If the central problem is weak aggregate demand, then it really doesn’t matter what the labor supply elasticity might be if the economy were at full employment and workers had a viable opportunity to increase hours worked. Substitution effects are things that rich people with cushy jobs worry about. And really, given their track records maybe some of those titans of industry should do us all a favor and work a little less.

2slugbaits and Menzie

Is it possible to solve our fiscal/entitlement issues without bipartisan support?

I think not.

Which candidate has a higher probability of championing solutions that garner bipartisan support?

(Hint: Look at their records.)

Obama:If you don’t have a record to run on, then you paint your opponent as someone people should run from. You make a big election about small things.

tj: “Which candidate has a higher probability of championing solutions that garner bipartisan support? (Hint: Look at their records.)”

I looked at Romney’s record and he issued 844 vetoes, 707 of which were overridden. Many of the overrides were unanimous so I guess you could say he achieved bipartisan disgust.

A record that includes 844 vetoes and 707 overrides doesn’t sound like a picture of comity. Romney is currently losing by 15 points in his home state where they know him best.

tj So Romney of the 800 vetos is suddenly Mr Bi-Partisan??? Who knows what Romney is. The guy changes his political persona almost daily.

But to answer your question, yes, we could go a long way towards addressing our long run fiscal problems without bi-partisan support. Just let the Bush tax cuts expire at the end of the year. Problem solved.

Now I don’t doubt that Romney could push through some piece of legislation with some Democratic support. There are plenty of cowards in the Democratic party. But I think you qualified your question with the word “solutions” and nothing that Romney has proposed meets that criterion. His fiscal plan does not address the long term fiscal problem. At best his goal is only to establish “revenue neutral” tax cuts, even if you assume that his numbers work…which they don’t. A fiscal policy that only serves to fix revenues at 16% of GDP is not a solution.

As to making a big election about “small things.” I think that’s what Romney is trying to do. What else do you call the Benghazi flap?

tj: That’s your most persuasive argument? I say better to let the Bush tax cuts expire, mitigate the debt accumulation problem, and then when the Republican party learns to do math, then maybe we can solve the entitlements (health care) problem without throwing grandma from the train.

Menzie when the Republican party learns to do math

You’re asking a lot. Remember, many of the GOP party leaders believe Adam and Eve road around on the backs of dinosaurs.

joseph

Romney is currently losing by 15 points in his home state where they know him best.

LOL – 2008: Obama 62, McCain 36.

The trend is your friend.

http://www.boston.com/news/politics/2008/election_results/us_president/

Menzie

That’s your most persuasive argument? I say better to let the Bush tax cuts expire…

(I accidentally hit “enter” and posted part of this before it was complete. delete my prior post if needed. thanks moderator!)

Menzie

That’s your most persuasive argument? I say better to let the Bush tax cuts expire…

That’s what you say, but Obama says something different, unless he isn’t telling the truth to the middle class.

2slugs

So Romney of the 800 vetos is suddenly Mr Bi-Partisan???

We all know things are not the same at the federal level. Who has the better shot at establishing a bipartisan policy?

As to making a big election about “small things.” I think that’s what Romney is trying to do. What else do you call the Benghazi flap?

Really? Big Bird = Benghazi? Wow. I am floored that you equate those issues.

Riddle me this – why did the media spend days on Romney’s early 1960’s “alleged” incident with a fellow student, Ryan’s marathon time, etc, yet ignore Jake Tapper’s report that Joe Biden lied when Biden implied he played an important role in crafting a social security fix with Reagan and Oneal? In fact there is no recollection or record of Biden even being there!!! Why isn’t the MSM running this story day after day? Just sayin….

http://abcnews.go.com/blogs/politics/2012/10/in-vp-debate-biden-seemed-to-overstate-his-role-in-social-security-reform/

Menzie,

I haven’t made your point for you and neither have you made your own point.

Your point was that implausible parameter values for the dynamic effects of tax cuts have to be used to make the math add up. I linked to Rosen as an example that shows the math can add up using standard models. And you have replied by asserting without any evidence that Rosen’s 3% assumption is implausible, comparing it to something Jude Wanniski would do. Patrick R. Sullivan is right that that’s not much of an argument.

Jude Wanniski of course believed that tax cuts were completely self-financing, so that the $158 billion loss in Rosen’s analysis would be offset by a $158 gain in revenue from GDP growth. In contrast, Rosen is assuming that the initial $158 billion loss would be offset by only a $25 billion gain from GDP growth. Not the same thing at all.

You imply that the 3% parameter is “assumed.” However, Rosen did not pull this number out of thin air. He is relying on Diamond’s analysis of an overlapping generations computable general equilibrium model. That model yields a value of 5% higher economic growth. Rosen reduces this value to 3% to avoid overstating the effect. Rosen also notes that his 3 percent growth value is consistent with the results in Mankiw and Weinzierl, who use a neoclassical growth model to estimate the effects of a tax cut on economic growth.

You also say that maybe these values are fine for the long run but not in the short or medium term. But Mankiw and Weinzierl estimate the transition path, showing that 3/4 of the effect occurs immediately with the other 1/4 accruing slowly over time.

Rosen has backed up his parameter values with evidence. All you’ve done so far is just to assert ex cathedra that these parameters are implausible.

Anonymous,

Romney did not “reject Rosen’s plan.” Rosen does not have a plan; he has an analysis of Romney’s plan. Also, Rosen did not “have to reach down the the $100K income level.” If you read

Rosen’s paper, you’ll see that he analyzed both the 100k and 200K case under 2012 and 2013 tax law. Finally, Rosen didn’t ignore the case of

2slugbaits,

You say: “Remember, many of the GOP party leaders believe Adam and Eve road around on the backs of dinosaurs.”

Of course, you don’t name any names but just leave the innuendo hanging out there.

It might be instructive to look at some real documented examples of the foolish beliefs of some prominent political leaders.

Here is a video of Al Gore claiming that the temperature of the interior of the earth is several million degrees:

http://www.youtube.com/watch?v=zMrxC-qEHb8

Here is a video of Joe Biden asserting to Katie Couric that FDR went on television after the stock market crash of 1929 to calm the people:

http://www.youtube.com/watch?v=0Jf17Yo7hBM

And here is a video of Barack Obama claiming that Austrians speak Austrian:

http://www.youtube.com/watch?v=Tr7zhnctF4c

I don’t know which prominent GOP leaders think Adam and Eve rode on dinosaurs and I don’t think you do either. But I’m pretty sure the 3 guys in the videos above need to go back to elementary school for a basic knowledge refresher course.

Rick Stryker: Let me say it again, paraphrasing Professor Rosen: He did not consider the losses associated with the corporate tax rate reductions, nor the estate tax nor the AMT terminations. Hence, the numbers do not add up, except for a portion of the $5 trillion total revenue loss ($1.27 trn eliminating all deductions, limited to $25K; $0.74 trillion dynamic response a la Mankiw-Weinzerl interpreted by Gale et al.). Wait for Monday night’s post to see a graphic example, if you cannot do the math for the requisite additional supply side response implicit in Governor Romney’s revenue neutral promise.

Rick Stryker There are at least two examples of Republicans believing Adam & Eve rode dinosaurs. The first refers to a Republican display at the Iowa State Fair that had Creationist mock-ups of Adam & Eve sitting astride saddle broken dinosaurs. My wife went to the fair and laughed her butt off. The second is more serious because it involves a GOP Congressman (Paul Broun, R-GA) who is also head of the science committee and claims to be a medical doctor. Even worse, in his view Jesus rode dinosaurs too.

http://onlineathens.com/local-news/2012-10-05/broun-evolution-big-bang-theory-are-lies-straight-pit-hell

Good luck dealing with fact-challenged idiots like that.

Maybe you need to study German. When I took it in high school we learned the difference between Deutsch spoken in Germany, Deutsch spoken in Switzerland, and Deutsch spoken in Austria. For example, the “r” and “ch” pronunciations in German is unpronounceable for the American tongue, but the Austrian pronunciations are easy.

Back to your comments.

Romney did not “reject Rosen’s plan.” Rosen does not have a plan; he has an analysis of Romney’s plan.

Romney specifically rejected the things that Rosen said Romney had to include in order to make the Romney plan work. Is that better?

he analyzed both the 100k and 200K case under 2012 and 2013 tax law.

And note that the 200K numbers don’t work. They didn’t work in the Tax Foundation paper either, as the authors admitted.

Rosen has backed up his parameter values with evidence

No he did not. Nowhere did he cite studies that estimated the elasticity of labor supply response to a tax cut in the context of signficant labor market slack. All of his evidence assumed that labor markets were at full-employment and that there would be no income effect offsetting the substitution effect. And he used a single labor supply elasticity that was based on high income earner responses. Labor supply elasticities for people in the lower quintiles is next to zero. Both Rosen and the Tax Foundation assumed that lower taxes would increase capital accumulation (nevermind the current excess capacity) and that all of the increased labor productivity would show up as higher wages. The Tax Foundation comes to this conclusion because they used a neo-classical Cobb-Douglas model with factor shares totally 1.0 and assuming full-employment. See their footnotes. In what way does this describe reality? Over the last dozen years labor productivity has gone up quite dramatically, but where are the higher median wages? Neither Rosen nor the Tax Foundation seem to be aware of rent-seeking behavior and how plutocrats are capturing productivity gains as rents rather than labor seeing those gains as higher wages.

Rick Stryker: In re: Austrian. 2slugbaits hat es recht. Sie sollen zu Deutschland, Osterreich and Schweiz gehen. Denn verstehen sie.

I find it peculiar that no one seems to be examining the spending side of the equation. I agree with Romney/Ryan that spending on social programs is much too high. I agree with Obama/Biden that spending on the military side is much too high. Plus there is ample opportunity to not implement new programs and to eliminate waste and fraud in older ones.

Seems like there is grounds for a bi-partisan agreement that nicely smooths out the bumps in the road… and then we can all have our tax cuts.

Nah, not when everyone wants their cake and eat it, too.

All of this is good fun but do the contributors seriously believe – when they are alone in the dark of night or wherever – that any of it has the slightest connection with the likely economic outcome of the next five or ten years? Or that after the election the venal mess we call our government will pay two seconds of attention to Rosen, regressions or learned economic worthies?

‘Sie sollen zu Deutschland, Osterreich and Schweiz gehen. Denn verstehen sie.’

Sie alle sprechen eine Vielfalt von Deutsch.

Especially since radio and television was invented.

My Mexican friends all knew immediately that Paz Vega wasn’t Mexican, but they enjoyed ‘Spanglish’ anyway.

c thomson: “All of this is good fun but do the contributors seriously believe – when they are alone in the dark of night or wherever – that any of it has the slightest connection with the likely economic outcome of the next five or ten years?”

Do you think that the country would be in a different place if Bush vs Gore had turned out differently and we had not had the Bush tax cuts and two wars on the credit card? Greenspan and Bernanke might not have been at the Fed sitting idly by in a Randian trance as a real estate bubble blew up the economy. You could even imagine that 911 might never have happened if the competent Clinton security team had remained in place instead of the asleep-at-the-switch Bush neocons. Elections have consequences.

2slugs Good luck dealing with fact-challenged idiots like that.

2slugs, good luck with the idiot that is a breath away from becoming commander in chief. What does it say about Obama’s intellect when he chooses Joe Biden as a running mate?

Here is another lie from Biden. Why isn’t the media blasting Biden the same way they would blast Romney or Ryan?

From The U.S. Conference of Catholic Bishops (USCCB) regarding Biden’s claim in the VP debate:

Joe Biden says “With regard to the assault on the Catholic Church,let me make it absolutely clear. No religious institution– Catholic or otherwise, including Catholic social services, Georgetown hospital, Mercy hospital, any hospital – none has to either refer contraception, none has to pay for contraception, none has to be a vehicle to get contraception in any insurance policy they provide. That is a fact. That is a fact.”

… USCCB reply – This is not a fact. The HHS mandate contains a narrow, four-part exemption for certain “religious employers.” That exemption was made final in February and does not extend to “Catholic social services, Georgetown hospital, Mercy hospital, any hospital,”

or any other religious charity that offers its services to all, regardless of the faith of those served.

http://www.usccb.org/news/2012/12-163.cfm

The only way our system of government works is with a free and unbiased press. We can handle

MSNBC because they are an opinion based outlet and don’t claim to be a news outlet. But where is CBS, NBC, ABC, NPR, etc? Why do they push stories that refelct badly on the right, but ignore or provide only brief attention to stories that reflect badly on the left?

Just sayin…

Yes, Joseph – elections have consequences. They just can’t be foreseen in advance.

Except, perhaps, by you?

2slugbaits,

You said “GOP party leaders” and I asked for examples of prominent GOP leaders who believe Adam and Eve rode around on dinosaurs. Your examples were a state fair and a minor congressman with strong religious views.

Unfortunately, belief in strict creationism seems to be widespread and cuts across party lines as this recent gallup poll shows:

http://www.gallup.com/poll/145286/Four-Americans-Believe-Strict-Creationism.aspx

Very likely, Congressman Broun had many approving Democrats sitting in the audience when he made his comments.

In contrast, I gave you examples of serious gaps in knowledge in a sitting President and Vice President and in a former VP and presidential candidate. They are party leaders.

You can’t dismiss the President’s belief that Austrians speak Austrian so easily. Austrian is not a language. In Austria, people speak a variety of German that is mostly the same as standard German with differences in accent and in some vocabulary, especially culinary terms. Saying that Austrians speak Austrian is like saying that people speak British in the UK, or Canadian in Montreal, or Brazilian in Brazil. This is not a slip of the tongue but rather fundamental ignorance.

On your other points I won’t comment since I’d just be repeating myself. However, I would like to point out that Rosen did not agree that the 200K case doesn’t work. He did say that the 200K case with the 2013 law would be challenging but not mathematically impossible.

c thomson: “elections have consequences. They just can’t be foreseen in advance.”

Seriously, you don’t think that it is possible to foresee the consequences of an election? I believe that in general, Presidents do pretty much what they promise in their campaigns as their most important goals and consequences are clear.

For example, Bush pledged to cut taxes for the rich. Now he lied about that to the general public somewhat, insisting that the cuts would primarily benefit the middle class, but his plan as described by Bush and analyzed before the election by people such as Paul Krugman clearly showed his real intent, so there should have been no surprise. As Dick Cheney said after the election, this is our due. Bush embraced and staffed his foreign policy team before the election with neocons. The neocons, including Donald Rumsfeld and Paul Wolfowitz, signed a letter in 1998 as part of the Project for a New American Century (PNAC) pledging to remove Saddam Hussein from Iraq through military force. These things were well known before the election, so no one should have been surprised that Bush did exactly as he promised. The consequences were exactly as foreseen.

Likewise Obama has done what he promised in his campaign — Obamacare, re-tool Detroit, get out of Iraq, go back to Afghanistan, get Osama, women’s equal pay, repeal of don’t-ask-don’t-tell, invest in alternative energy, economic stimulus bill. No one should be surprised because these were his key campaign policies. The consequences of his election were easily foreseen.

If Romney is elected, I expect him to do exactly as promised. He will cut tax rates by 20 percent. He is lying about the deficits and so did Bush, but he will keep the only promise he has been specific about and that is the tax rate cuts. He will bring back the neocons to foreign policy — they are already advising him — as will be evident in the Monday debate, so more aggressive military action in the middle-East should be expected. He will overturn Roe v Wade if he gets the chance as promised. He will appoint justices like Scalia as promised. He will convert Medicare to vouchers. No one should be surprised by these things. The consequences of the election can easily be foreseen.

Rick Stryker: Is Senator Todd Akin a minor character in the Republican Party? I would like to know if his views on biology are, in your view, mainstream. This would allow me to determine what your worldview is.

Joesph – if you are so sure that you can forecast the consequences of elections, what about a few 2015 bets on the level of US interest rates or on the level of the stock market or on whether we will bomb Iran? Or the US high school drop out rate?

Try and get your mind off your petty political hobby-horses and reflect on the fact that the world moves briskly along whatever our little local politicians do or don’t do.

c thomson, I can’t tell if you are trolling or just suffering from toxic cynic syndrome.

You don’t think it is important whether Obamacare is repealed or implemented? You don’t think it is important whether justices like Scalia or justices like Sotomayer are appointed? You don’t think it is important whether Roe v Wade is overturned? Maybe you don’t think these things are important but for many people they critically affect their lives. Your attitude trivializes these important issues which suggests that you are fortunate enough to be insulated from their effects. Not everyone is so fortunate.

As for Iran, Romney’s foreign policy advisors have pledged to bomb Iran. It is much more likely for that to occur under a Romney administration than an Obama administration. I wouldn’t bet against it, just as I wouldn’t have bet against a Bush invasion of Iraq in 2000. They say that’s what they will do and I believe them.

Romney has pledged to cut the federal budget to 20% of GDP. This will require across the board cuts to things like education, so yes, it could affect the high school dropout rate.

I have no idea what the stock market will be in 2015, but I have a pretty good suspicion that GDP growth will be less if Romney’s austerity policy is implemented, just as we have seen in the UK and Europe.

If the only thing that matters in your life is the stock market and interest rates, I could see why you have no interest in who is elected. That is like worrying about the weather in 2015. The rest of us work to change the things that we can and those things aren’t trivial.

I wish I felt more positive about my impending 20% tax rate cut, seeing as how I don’t have any deductions to speak of except, perhaps, the health care plan thing. That is, no dependents, no mortgage, so it’s a straight 20% deal which should, for someone like me who gets most of my income from a job, ammount to a gift from El Presidente somwehere in the lower 5 figures. A new car! But honestly, I can’t make the math add up either.

Nice strategy pitting the 90-99% against everybody else but the top 1% – the jawb creaturs. Very clever. I like what Bill Clinton said…do they think we’re stupid? Evidently so. And it looks like we are!

Trivial or not in their potential consequences, political promises are just pious mouth noises, like promising to close Guantanamo. Romney or Obama may promise to do this or that about oil for example. Events may decide otherwise.

Gee – its wonderful that someone still believes that, if someone talks about the audacity of hope, it means something above and beyond mere TV babble. Be careful crossing streets on your own, Joseph.

Menzie,

First, Todd Akin is a congressman, not a senator, although he’s running for senator. And he’s a minor figure who has been repudiated and marginalized by the Republican establishment for his comment that rape produces spontaneous abortion.

As to the merits of his claim, we can look at the evidence. A women is fertile about 2 days out of 28. Moreover, sperm can survive as much as 5 days in the womb but probably 3 days is a reasonable estimate. Given that an egg is fertilized in the presence of sperm perhaps 1/4 to 1/2 the time, the probability of a pregnancy from a single act of intercourse could be estimated to be (1/2)(3/28) or about 5%. We also know from this study

http://www.ajog.org/article/S0002-9378(96)70141-2/abstract

that rape victims get pregnant about 5% of the time. So, it appears the rate of pregnancy from a rape is about the same as non-rape. Thus, Akin is wrong if you interpret his remark to mean that women don’t get pregnant from rape.

That study also measures the rate of spontaneous abortion among rape victims to be 11.8% while this article from the NIH

http://www.nlm.nih.gov/medlineplus/ency/article/001488.htm

claims the miscarriage rate is 15-20%. Thus, however you interpret Akin’s statement, he is wrong.

Now let’s go back to Al Gore, who believes that the interior of the earth can somehow be several million degrees and yet the earth does not explode into a fireball. Gore recently speculated that perhaps the high Denver altitude might have accounted for Obama’s performance in the first debate. I would like to know if his views on biology are, in your view, mainstream. This would allow me to determine what your worldview is.

Rick Stryker: Apologies, you are correct that it’s Representative Akin. Still scary enough since he is on the House Science, Space and Technology Committee.

I don’t look to Al Gore for my science; I look to NAS.

Rick Stryker: “Todd Akin is a congressman, not a senator, although he’s running for senator. And he’s a minor figure who has been repudiated and marginalized by the Republican establishment for his comment that rape produces spontaneous abortion.”

Let’s see, since his statement, Todd Akin has been endorsed and had standing at his side at campaign stops:

Newt Gingrich

Mike Huckabee

Rick Santorum

Sen. James Inhofe

Sen. Roy Blunt

Sen. Kit Bond

Sen. Jim DeMint

Cong. Michelle Bachman

Cong. Steve King

Cong. Pete Sessions

Phyllis Schlafly

Don Wildmon

Tony Perkins

James Dobson

among many others.

Recently, the Republican Senatorial Committee Executive Director Rob Jesmer said that the committee hopes “Todd Akin wins in November, and we will continue to monitor this race closely in the days ahead.”

That Republican establishment repudiation must be just killing him.