One of the puzzles of the post-crisis period is why investment has been so slow. Some would want to resort to stories of uncertainty. Is there something to this idea? Figure 1 depicts the gross investment to net capital stock.

Figure 1: Nonresidential fixed investment, billions of Ch.05$ SAAR (blue line, left scale), and log ratio of fixed investment to net capital stock in Ch.05 (red line, right scale). Net capital stock is annual yearend, interpolated using cubic last match; 2012Q1-Q3 extrapolated using regression of first difference of capital stock on investment, 2000-2011. NBER recession dates shaded gray. Source: BEA, 2012Q3 second release, BEA Table 1.2 (Aug. 15, 2012).

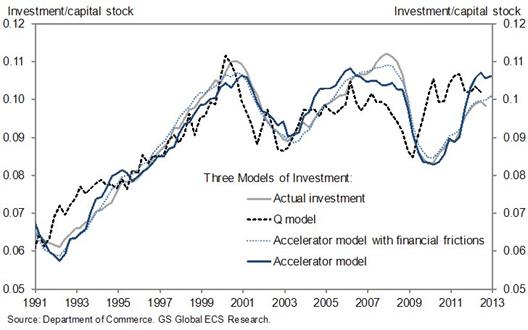

Goldman Sachs (David Mericle, “The Drivers of Capital Spending, December 5, 2012, not online) notes:

Our econometric analysis [of data over the 1991-2012 period] leads us to draw the following conclusions about each class of model:

First, the accelerator model generally fits well. … The model also substantially overpredicts investment during the last couple of years because it implies that the lagged effect of the sharpest downturn phase of the recession should have passed by now.

Second, Tobin’s Q model … is considerably noisier and overpredicts investment during the recovery from the Great Recession much more severely than the other models.

Finally, combining the accelerator model with a measure of credit availability captures investment dynamics reasonably well. … Our analysis suggests that an improved version of the standard accelerator model that accounts for the availability of credit goes a long way toward explaining recent investment patterns.

GS provides this graph (note dependent variable is I/K, not log(I/K)):

Source: David Mericle, “The Drivers of Capital Spending,” Goldman Sachs (December 5, 2012).

Two of these models (as well others) are described in this post. Briefly, the accelerator links the investment/capital stock data to the change in GDP, the Q model implies the investment ratio is linked to the ratio of market valuation to book value, adjusted for tax provisions, and the financial frictions model in the GS formulation augments the accelerator with a proxy measure for the effect of frictions (namely loan officer report on lending conditions).

I find it of interest that policy uncertainty, which some analysts have pointed to as putting a drag on economic activity (including investment), does not make an appearance in this discussion.

To examine this issue a little more closely, I undertake my own analysis. I run regressions over the 1990Q4-2012Q3 period, using error correction models based on these specifications:

log(I/K) = α 0 + α 1 Δ y + u

log(I/K) = α 0 + α 1 Δ y + α 2 z + u

log(I/K) = α 0 + α 1 Δ y + α 2z + α 3 Φ + u

Where y is log real GDP, z is the loan officer lending conditions index, and Φ is a measure of uncertainty; the regression output is here. (Note that there are other ways to incorporate financial frictions [1]; [2] suggests cash flow would be relevant).

I find that for the first two specifications, the change in the log investment to capital ratio responds to the lagged ratio, and that the growth rate of GDP is a statistically important determinant of the ratio. Moreover, adding in the lending conditions produces a coefficient of right sign (investment falls when lending conditions tighten). More importantly, the proportion of variance rises from 0.55 to 0.64.

What about uncertainty? Thanks to the hard work Baker, Bloom and Davis, we have a policy uncertainty index, available here. Augmenting the “financial frictions” specifications with the uncertainty index reduces the estimated responsiveness of the change in the investment-capital ratio to the determinants, and at the same time the coefficient on uncertainty does not show up as significant (except in first differences, just significant at the 10% msl). Taken literally, about 1/3 of the drop in the investment to capital ratio in 2012Q3 is due to the increase in policy uncertainty in 2012Q2. (If policy uncertainty is taken to be weakly exogenous, then it would account for all of the drop.)

This doesn’t mean that uncertainty doesn’t matter for the long horizon. It could be that the loan officers respond to uncertainty by tightening conditions. Alternatively, policy uncertainty could be mismeasured. Or a different specification and/or methodology would yield different results (as in Baker, Bloom and Davis) Or finally, economic uncertainty (rather than just policy) could matter more –- including uncertainty about demand condtions (see discussion in this post). However, the fact that policy uncertainty shows up in the first difference is suggestive that the effects are at the short horizon, rather than the long. Hopefully that will soon be resolved, so that investment resumes growth. [3]

So in the (statistical) long run, tightening of lending standards and slow GDP growth (attributable to fiscal drag) are important determinants of low nonresidential fixed investment. It would be hard to fix the former (since tightening might be rational from an individual bank perspective, and is an outcome consistent with deleveraging after a major balance sheet crisis [4]), but we know how to address the latter: maintain aggregate demand.

The larger factor at work is the IT/internetworking/wireless techno-economic S-curve achieving the “maturation” phase of diminishing returns to fixed cost of build out following the “growth boom” phase.

This results in multifactor productivity peaking, with returns to labor’s share of investment and GDP falling, reducing the rate of growth of employment and consumption of goods and services.

Entraining this secular process is the peak Boomer demographic effects reducing the rate of growth of entrepreneurial activity and new business formation, which is the primary source of growth of new employment.

The result, then, is diminishing returns at high fixed costs of built infrastructure, discouraging risk taking and additional capital investment, reducing the rate of business formation and eventually the number of businesses, which in turn reduces employment and returns to labor share of GDP. Slow or no job growth and falling real wages reduce consumer spending per capita and thus real GDP per capita.

The top cyclical IT infrastructure firms, such as MSFT, INTC, CSCO, DELL, IBM, and ORCL, will experience further slowing of the trend rate of top line revenues with cost of sales remaining high and capacity now global. Margins will contract with high fixed costs of production and their customers’ built infrastructure, requiring mass consolidation, cost cutting, and employee firings by these firms in the years ahead that they have not experienced since the onset of the S-curve “growth boom” in the ’70s-’80s.

Similarly, AAPL, GOOG, AMZN, EBAY, FB, VMW, and related wireless, social media, online commerce, and advertising firms are beginning to experience diminishing returns and slowing growth rates at high fixed costs. It is not that growth will cease but that the rate will slow such that equity valuations will crash and the rate of investment will sharply decelerate and later contract.

Beyond the waning S-curve paradigm’s effects hereafter, the emergent S-curve, consisting of biotech, nanotech, genomics, biometrics, robotics, and smart/intelligent systems, will drive the mass consolidation of the IT paradigm by increasing computational power and speed and scale of interconnectivity, while reducing transactional costs per unit per time to virtually nil by eliminating in the next 5-10 years to within a generation most jobs now being down by humans.

Intelligent systems, nano-electronic sensors, robotics, biometrics, and lights-out manufacturing will render obsolete most jobs in production, agriculture, accounting, fiance, insurance, financial services, order and sales administration, logistics, production planning and control, inventory, computer programming, advertising and marketing communications, education, security and surveillance, and many more, including biometrics and telepresence that will replace much of what doctors and nurses routinely do.

Humans will be unable to compete with increasingly skilled machine intelligence functioning at the speed of light 24/7/365, doing so inconspicuously and utterly transparently.

The diminishing returns of the IT S-curve will drive the increasing acceleration of automation of human labor, which in turn will eliminate paid labor income and purchasing power for literally tens of millions of Americans, i.e., most of us, and hundreds of millions of people worldwide.

Of course, this will mean a plunge in gov’t tax receipts at all levels, precluding the ability of gov’ts to fund social services and transfers as is currently happening. Therefore, we will not be able to rely as a society on the 19th- and 20th-century industrial model of labor taxation to fund public services and the net interest service from increasing public debt from perpetual deficit spending.

In this scenario, the notion of labor productivity will become obsolete, as most human labor will not required. Virtually all productivity will come from financial, physical, and intelligent-systmes capital. Increasingly, economic activity will be dominated by machine-to-machine transactions between the largest firms that can afford the necessary investment to scale.

The dramatic increase in machine intelligence capability and the resulting collapse in costs of transactions and goods and services should be a once-in-history boon to civilization and thus should be encouraged as a kind of Manhattan Project II. What we don’t have, however, is a viable alternative to wage/salary income in order to sustain purchasing power for most of us.

Therefore, a radical reformulation of the concepts of “work”, “money”, “income”, “production”, “taxes”, and the function and funding of “gov’t”. When technology eliminates most jobs and associated incomes and purchasing power, and the top 0.1% of society own the means of intelligent systems society’s production and wealth, an alternative means of income and purchasing power will be required; otherwise, we face eventual collapse.

Growth of debt, gov’t spending, and real GDP per capita is no longer possible under the industrial/post-industrial oil- and auto-based suburban development model of the 19th and 20th centuries. We face a jobless future with falling incomes, spending, investment, tax receipts, and gov’t spending per capita indefinitely unless a radical shift occurs to provide citizen ownership of the intelligent-systems society’s means of production and incomes therefrom.

This is not a dystopian doomer fantasy future; the process is well underway, but economists and politicians are about 30-40 years behind the S-curve in understanding what has happened and why, what is now happening, and the implications hereafter.

As a businessman, to me it’s pretty simple. Demand is too low and interest rates are too high (inflation is too low). With low expected inflation for the foreseeable future, it is very easy to just let cash sit in the bank until demand increases. It isn’t uncertainty about taxes, health care costs or regulations. It’s uncertainty about demand and low inflation makes it easy to just sit back and wait.

I would disaggregate by industry and see if the components of the capital stock are changing in accordance with the shift to service and technology across time. An implication might be that smaller and/or more frequent investment is necessary to maintain a given level of capital.

It’s also possible that changes to accounting rules over time cause financial managers to change the timing and size of their capital expenditures in relation to their capital stock.

Very substantial work ,still needed is to check the value of the economists theories and projections in light of backdated empirical evidences.

Let us visit a world of hiatus:

Fed Saint Louis

Corporate Equities – Assets – Balance Sheet of Households and Non profit Organizations (CEABSHNO)

2012:Q3: 9,794.64 Billions of Dollars against ~ 2trillions USD in 1990

An introduction to Tobin Q

Gross Fixed Capital Formation in United States (USAGFCFQDSNAQ)

2012:Q3: 2,229.6 Billions against 1.4 trillion USD in 1990

When looking at the same items in UK,one may wonder if Tobin Q ever had substantial grounds.

Fed St louis

Debt Outstanding Domestic Nonfinancial Sectors – Business Corporate (Nonfarm) Sector (BCNSDODNS)

2012:Q3: 8,356.38 Billions of Dollars Last 5 Observations

Valuation and debts repayment must be coupled with discounted cash flows that means entering sensitivity interest rates simulations on above debts outstanding.

As an update on the mystery of Tobin Q and the weak GFCF when linked to the profits during the great moderation 30% of the SP profits are derived from the financial corporations, One may look at the differentiation between profits from recurrent business and capital gains.

This time is different none of these variables are valid enough to constitute reliable data for extrapolations. Soon or later the inflation expectation, will have to be recognized as expected.The bubble my neighbour will have loops feedback

The easiest part of the GDP ouptput gap filling has been executed the financial component.

For Rodrigo –

To my point yesterday about accountability:

http://www.bloomberg.com/news/2012-12-11/u-s-schoolchildren-lag-asian-peers-on-academic-tests.html

Overall business investment has been better so far this cycle compared to the last one. After the upward revisions make it more clear, I suspect people will understand the upward revisions to payrolls and sentiment.

Joseph, you could argue there is to much inflation………..at the top and not enough inflation at the bottom(where your demand lag is coming into play). Ending the Bush tax cuts, thus becomes expansionary.

@Bruce Carman

Do androids dream of electric sheep?

Not androids’ dreams but multinucleated intelligent-systems networks using ubiquitous nano-electronic sensors, continuous surveillance and monitoring, orders of magnitude more computational power, speed of response, and near-zero cost versus today.

Once the critical mass of interconnectivity occurs, and we are well on our way, every transaction, interaction, and quantum nanobit of information about each of us will be available for anyone or any intelligent-systems algobot to access and process for whatever reason. Everything that constitutes you, the reader, will be owned and subject to manipulation or erasure if desired.

Cash is rapidly disappearing from circulation, leaving only nano-electronic bits as a medium of exchange. However, without ownership of a share of the means of production of the emergent intelligent-systems super-organism, one will have no income with which to purchase one’s subsistence.

There will be no revolt of the jobless, homeless, cashless masses of redundant human beings. Machine intelligence and the owners of these “humachines” will have no use for most of us, as the top 0.1% will not need a mass-consumer economy and Asian slave labor to purchase mass-produced goods and services. The top 0.1% will be able to fully disengage from the economy and society that now constitutes the work and consumption of the bottom 99.9%.

There will still be a need for the techno-scientific elite who will be required to design, test, install, maintain, and optimize the physical and software components of the intelligent-systems superstructure and supporting internetworked nodes and exclusive enclaves of exchange; but even their numbers will dwindle as intelligent-systems components become self-replicating, self-aware, self-organizing, and repair themselves.

Even though the intelligent-systems society will become much more energy efficient than today, the net energy required to sustain the system superstructure will preclude affordable supplies per capita for the vast majority of us. The prices of goods and services will decline in large part because costs will decline, but also because demand per capita will also collapse.

The 50% of college grads who are unemployed or underemployed today is an emergent permanent structural condition that renders post-secondary “education” too costly for the vast majority of Americans today and into the future, and thus too costly for society. Whereas intelligent-systems will provide access to a university-level of information and instruction at very low cost in the future, the value in terms of returns to occupational income will collapse along with the price. What one will learn will be worth in the labor market what one pays for the “education”: next to zero.

Machines won’t need us to be literate as has been the case since mass public education was implemented in the 19th century, or to know history, economics (AH!), science, higher math, etc., as machine intelligence will perform all computational, analytical, sorting, information retrieval, and storage required. Only the techno-scientific elite will be required to be “educated”, and even they will become increasingly reliant upon the increasing capabilities of artificial intelligence (AI).

Machine intelligence is now being embedded with 10,000 years of tools development and human knowledge and skills.

AI and the emerging “humachine” super-organism will eventually become so much more capable than human apes as to become a super-species, rendering us like single-celled organisms are compared to us today.

The computational and analytical capabilities of “humachine” intelligence will so far surpass those of even the most intelligent and skilled human apes that we will perceive the intelligence as God like or extraterrestrial in nature. We will not even be able to understand in thousands of lifetimes of evolution the science and computational logic involved with the “humachine” super-organism.

This is what we are up against as a species in the lifetime of anyone age 50-55 and younger. No one will be able to compete for resources, income, and purchasing power against the “humachine” super-organism.

It is very unlikely at this point that we can collectively respond sufficiently quickly, as our system is utterly ill-equipped to adapt and assist the masses to transition successfully. We are still operating on the basis of a 19th-century industrial model and highly wasteful and ecologically destructive extractive, exploitative, hierarchical system with gross inequality of income, wealth, and political power.

However, we are perfectly prepared for economic decline, fiscal crises and “austerity”, permanent unemployment, mass-social privation, social instability, and gov’t reaction.

Note, the link to the regression output does not work, could you fix it please.

Henry: Thanks for flagging that; fixed now.

Great post and discussion topic Professor.

http://www.zerohedge.com/news/2012-12-11/so-much-confidence-nfib-small-business-outlook-drops-record-low

This is my equation for the total value of capital goods…

K = (1 + u – UT(squared) – r/d)Y/r

u = unemployment

UT = a measure of total unused available capacity for labor and capital

r = rate of profit

d = rate of profit at productive capacity

Y = net income/total added value

Taking values of…

u = 7.7%

UT = 1.3%

r = 8.30

d = 10.66

Y = 95

K = 3.41 when compared to Y…

K is 3.59% of Y…

What will it take to raise K?

Unemployment rises… not a good option.

Profit rate rises … rate of profit is peaking right now

Profit rate at productive capacity rises… it is bounded by upper limit on capacity utilization.

Net value added rises… ok, is it rising?

Let’s look…

Y = rK * W

W = total wages paid to labor

OK… if r is peaking, and labor share is decreasing, Y is not increasing much, which leaves little room to raise K.

All the formerly investment money is being sucked up in entitlements and military spending. The govt spending on these items are crowding out govt investment, and govt treasuries are crowding out private investment, as the private sector keeps investing in short term T’s to wait it out “until the economy recovers.”

This is happening not only in the US, but in Europe as well, compounding the problem.

Anonymous and Edward, good points.

Consider that US equity market capitalization as a share of GDP is more than 100% of US GDP (50% historical avg.) and 160% of private GDP, of which 40-85% is held by the top 1-10% of households. This is captive savings, investment, production, and consumption that is not occurring because the top 1-10% are hoarding the deferred production and consumption in order to receive a 7-10% return to debt-induced financial capital rather than labor returns of 2-3% society needs to maintain subsistence of the working-class bottom 90% and a socially acceptable level of psycho-emotional well-being.

Gov’t spending as a share of private GDP must then increase to make up for the capital-labor consumption deficit, resulting eventually in a point at which gov’t spending can no longer continue to increase because the private sector cannot grow as a result of increasing cost of gov’t and energy. (Hint: We’re at that point now.)

Moreover, the majority of equity market capitalization is in the Fortune 25-300 firms, i.e., the largest US supranational firms, the revenues of which constitute an equivalent of 40-100% of US private GDP; however, these firms employ fewer than 13% of the US labor force at revenue/employee of $425,000, an equivalent level of income of the top 1% of US households.

Put another way, the US economy can no longer produce a net increase in private sector investment, production, employment, income, and tax receipts because physical and financial capital wealth and ownership of the means of production of goods and services is so concentrated that it costs $425,000 per head to employ one’s labor, which is well over 10 times the average wage/salary position in the US. How many small capitalists can hope to secure that kind of annual income from his capital and labor to remain viable and in business? Nil is a close approximation.

How many economists on Wall St., at Ivy League universities, and state universities can justify their existence at $425,000 per year in revenues or university tuition, fees, and pension payouts and benefits during retirement? Again, none is an accurate estimate.