Gavin Ekins argues that it’s Time to Shoulder Aside “Crowding Out” As an Excuse Not to Do Tax Reform. From the introduction:

Government budget deficits do absorb a portion of national or global saving, diverting the saving from supporting private investment. This is known as “crowding out.” However, saving is flexible both in magnitude and where it is invested. It can grow as household income increases and move in response to higher borrowing needs and higher returns to investment. Much of a tax reduction feeds directly into saving, especially cuts in business taxation. Furthermore, the United States is an open economy closely integrated with world financial markets. Even relatively large budget deficits are dwarfed by huge levels of global saving. It takes only a minute change in interest rates to attract additional risk-averse world saving to the United States.

Consequently, government budget deficits have only a small effect on private investment.

I agree that the effect on investment is likely to be small, under current macroeconomic conditions of ample foreign savings, and low capital barriers. However, I think “crowding out” is more properly construed as the reduction of interest sensitive components of aggregate demand — and this includes net exports. That’s a conventional treatment; consider Robert E. Hall and David Papell’s Macroeconomics textbook (2005, p.242) for instance (algebra here).

Ekins argues that the impact of increased government debt on interest rates is small. In light of the experience over the last twenty years, that is a plausible argument. However, what matters for crowding out of net exports is the product of (1) the sensitivity of the exchange rate to the interest rate, and (2) the sensitivity of net exports to the exchange rate (as well as the sensitivity of imports to income in the short run).

The estimates I obtained for industrial countries in a period extending up to 2015 indicates that each one percentage point of GDP increase in the budget balance results in 0.5 to 0.6 percentage points increase in the current account balance. So (since for industrial countries the current account equals the inverse of the private financial account) global savings can finance the budget deficit — but this implies substantial crowding out of net exports.

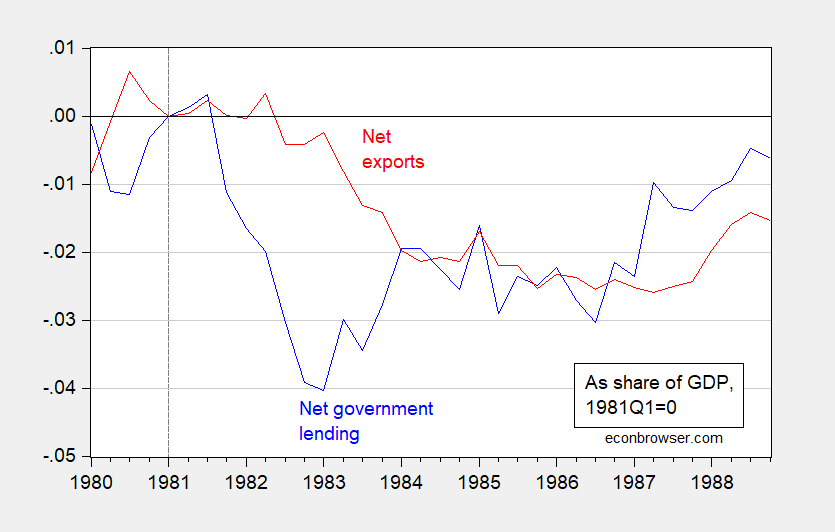

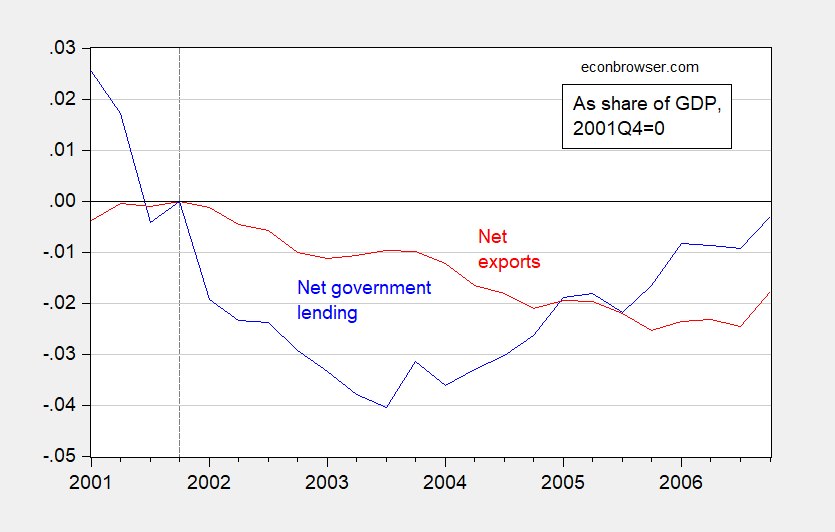

I depict two episodes of US budget deficits and trade deficits.

Figure 1: Government net lending (blue), and net exports (red), as a share of GDP, 1981Q1=0. Source: BEA, author’s calculations.

Figure 2: Government net lending (blue), and net exports (red), as a share of GDP, 2001Q4=0. Source: BEA, author’s calculations.

Ballpark estimates. Suppose the tax cuts reduce revenue by $1.5 trillion over ten years, so the deficit increases by $1.5 trillion relative to baseline (not relative to current policy, so this is conservative). $150 billion is about 0.8 percentage points of GDP in 2017Q3. I can see roughly 0.4-0.5 percentage points of GDP deterioration of the current account.

Note that the deterioration in the current account implies accelerated erosion of the US net international investment position, so that the US has to pay more of its income to foreign residents. (This is Krugman’s point — instead of reducing investment over time and hence the capital stock, we accumulate debt to the rest of the world, so that we retain less of the income generated by production, i.e., GDP and GNP deviate).

Of course, maybe the intention is to sell off the country to foreigners…

“instead of reducing investment over time and hence the capital stock, we accumulate debt to the rest of the world, so that we retain less of the income generated by production, i.e., GDP and GNP deviate). Of course, maybe the intention is to sell off the country to foreigners…”

Touche! Hey China will not mind owning New York City real estate and charging me rent to live here. I could get snarky and note Russians already own Brighton Beach. I just hope I will be able to buy sushi!

If you assume that the federal budget is in balance at zero savings have exceeded investment every year since 1980 except for a few years during the 1990s investment boom when the federal budget was in surplus. In other words the savings-investment gap was due to the federal deficit. So maybe the decline of US manufacturing was due to the republican tax cuts.

Are we about to repeat the Reagan policies that converted the US from the world’s largest creditor nation to the world’s largest debtor nation?

Spencer: I would not disagree that a portion of the decline in manufacturing employment is due to Republican tax cuts.

Who is we? Does it matter when an American renter pays a rich American or a rich foreigner?

Yes, the U.S. has been pulling in foreign capital, but it has also been pulling in the foreigners themselves.

Foreigners, particularly from China, India, Mexico, Canada, and Britain, in this wave, have been buying U.S. residential real estate. Many moved into those homes, with long-term visas, some are investments, some are vacation homes (tourism is an export). Many of their children live in those homes, while their parents pay for a U.S. college education.

https://www.google.com/amp/s/www.cnbc.com/amp/2017/07/18/foreigners-snap-up-record-number-of-us-homes.html

PeakTrader: Well, if the rich American has a consumption bundle more oriented toward American goods and services than a rich foreigner does (i.e., there is home bias in consumption), then it does matter for aggregate demand.

The U.S. is doing well in international income flows:

“Income Flows from U.S. Foreign Assets and Liabilities

Federal Reserve Bank of New York

November 14, 2012

Foreign investors placed roughly $1.0 trillion in U.S. assets in 2011, pushing the total value of their claims on the United States to $20.6 trillion. Over the same period, U.S. investors placed $0.5 trillion abroad, bringing total U.S. holdings of foreign assets to $16.4 trillion. One might expect that the large gap of -$4.2 trillion between U.S. assets and liabilities would come with a substantial servicing burden. Yet U.S. income receipts easily exceed payments abroad.

As we explain in this post, a key reason is that foreign investments in the United States are weighted toward interest-bearing assets currently paying a low rate of return while U.S. investments abroad are weighted toward multinationals’ foreign operations and other corporate claims earning a much higher rate of return.

U.S. investors earned a much higher rate of return on multinationals’ foreign operations and similar corporate holdings than did foreign investors here, 10.7 percent versus 5.8 percent, respectively.

The superior U.S. rate of return on FDI, as well as the greater tilt in U.S. foreign investments toward FDI, accounts for the $322 billion income surplus recorded in this category in 2011…The United States has earned a substantial premium on FDI investments at least since the 1960s.

peak, i appreciate the posts to references you make throughout this blog. however, i do have a request. many of your posts are 2005-2012 vintage. could you please make a concerted effort to update your selections to, say, the past five years? you may have valid points in these articles, but the reader is often left with questions on whether the article is actually valid in today’s economic environment. thanks

Your are referring to this:

“Income Flows from U.S. Foreign Assets and Liabilities

Federal Reserve Bank of New York

November 14, 2012

Google “Dark Matter” and you will see I was writing about this at Angrybear back in 2006. I did update this over at Econospeak in reference to a piece on China (something I call Dark Anti-Matter). How the world’s largest debtor nation can run a surplus in its net income from abroad is an interesting issue – missing intangible value or transfer pricing manipulation.

But http://www.bea.gov allows us to check the international accounts and last I checked this surplus continues.

Here’s a more recent article on the international investment balance. It should be noted, the U.S. economy has been relatively stronger than the rest of the world, even in this weak recovery. The article states:

“…because the economy has performed strongly, foreign investors in America have booked bigger paper gains than Americans invested overseas, despite generating less income.”

https://www.economist.com/news/finance-and-economics/21709549-exorbitant-privilege-looks-greater-ever-net-debt-big-returns

PeakTrader: This differential in returns is well known. The question is whether we could have more net income if we hadn’t sold off so much.

Menzie Chinn, it seems, smaller current account deficits, because of the weak recovery raises net investment income. And, given the dollar is the world’s predominant reserve currency, demand for dollars strengthens the dollar, to reduce exports and boost imports. It seems, foreigners rather trade their goods for U.S. paper assets than U.S. goods. Anyway, I’m for limiting federal spending to 18% of GDP, except in recessions.

PeakTrader: The differential in returns existed even before the financial crisis and ensuing recession, at which times the US CA deficit was at record levels. It was oft discussed (on this weblog even) during the mid-2000s.

The U.S. economy is under-producing, perhaps by over $1 trillion a year, likely because of part-time jobs, discouraged people dropping out of the labor force, and lower paying jobs. So, larger budget deficits may not raise interest rates much, to crowd out private investment.

You are asserting that the GDP gap is around 5%. Brad DeLong suggests the same as do I. We actually agree on something? Well stated!

I’d be interested to see how that applies to China.

Chinese tax rates:

http://www.reuters.com/article/us-china-economy-tax/china-to-expand-corporate-tax-cuts-for-hi-tech-services-firms-nationwide-idUSKBN1DA093?il=0

http://www.worldwide-tax.com/china/china_tax.asp

https://en.wikipedia.org/wiki/National_debt_of_China

Note: U.S. national debt ~106% GDP; China national debt ~46% GDP

Note: U.S. average GDP growth rate since the end of the recession has been less than 3%; China’s average GDP growth rate been over 6% since 2010.

Federal debt held by the public as percent of GDP is about 75% and that should be held below 90% for faster growth:

https://fred.stlouisfed.org/series/FYGFGDQ188S

And, China has a growth-at-any-cost policy, which overstates improvements in living standards, because the costs are very high.

Moreover, a larger economy grows more slowly. For example, a 3% increase of $50,000 is $1,500. A 6% increase of $5,000 is $300. Furthermore, unfortunately for China, the demographics from its one child policy will soon result in a large aging population, and a disparity worse than Japan, without reaching Japan’s level of wealth.

https://www.bloomberg.com/graphics/2016-us-vs-china-economy/

On a per capita basis, the U.S. economy is much larger than China’s, but on an absolute basis… watch out. Of course, there are risks. https://thediplomat.com/2017/10/how-fast-is-chinas-economy-really-growing/

It’s a matter of time before China and India become the two largest economies, because of their large populations. China’s GDP growth has already slowed from 10% a year, and will likely to continue to slow, while India’s growth should be relatively higher. China is a communist command economy and some of its economic data don’t add up. I’d like to see slower U.S. population growth, because of the strain on resources in Western states (half to two-thirds of China is uninhabitable). Anyway, I expect the U.S. to lead in technology and innovation. Currently, the U.S. leads the rest of the world combined in the Information and Biotech Revolutions, in both revenue and profit.

Why 90%? Reinhart anf Rogoff?

There’s been many subsequent studies that show 90% to 100% reduce growth.

So, “crowding out” is a mere financing effect? Who cares, then?

john: I don’t think a “mere financing” issue makes it unimportant. In both cases, investment or net exports and hence NIIP are below the counterfactual, implying a lower level of income per capita than would otherwise occur. Or am I missing something in your enigmatic comment.

I would also say that the impact on reduced income can differ between lower investment and hence capital stock as opposed to lower NIIP.

But I’ll tell the folks in the business school here that we shouldn’t care about who finances…they seem to be concerned about such matters.

I guess this is the definition to start with from the top:

“Government budget deficits do absorb a portion of national or global saving, diverting the saving from supporting private investment.”

I note that in the subsequent discussion there is no measure of expected return on the various projects, government and private. Only aggregates and one of three financing options. If gov’t ROI exceeds private ROI, crowding out is a good thing. And the surprising time when that is most likely true is sometime like 06 when private investment is being made at big losses because of rosey expectations and high return public investment is in neglect.

There’s lots more on this topic, but I’d just say I would like to see actual detrimental crowding out.

Krugman’s latest is a must read. This Tax Foundation’s model international sector? It does not have one!

https://krugman.blogs.nytimes.com/2017/11/11/the-tax-foundation-has-some-explaining-to-do

Although, a change in the corporate tax rate affects the economy in many ways, the economics literature shows a negative correlation between corporate tax rates and wages, and a positive effect on GDP.

That is, a lower corporate tax rate raises GDP.

Lower corporate and income taxes, along with less regulation, make it easier for businesses to absorb a higher minimum wage, which should be part of the tax cut.

Theory might imply better growth and higher wages from corporate tax cuts. “The literature” is vast and does not strongly support that conclusion. Some one way, some the other.

I think, most of the literature shows some magnitude of the negative correlation between corporate taxes and wages. Of course, some believe government is better at allocating capital than the private sector or the spending multiplier is higher than the tax multiplier.

It’s been shown, military spending generates spin-offs that benefit the private sector. However, the high level of entitlement spending creates a lot of waste, leaves less money for the truly needy, causes enormous fraud (e.g. the earned income tax credit), etc..

We need to put people back to work by lowering taxes and raising the minimum wage to make work more attractive, generate more tax revenue, and reduce entitlement spending.

There’s a lot of waste in military spending. And the bookkeeping is so bad the military does not even know where all it’s money goes.

As far as EITC fraud is concerned, that fraud can’t compare to the fraud rich tax cheats get away with.

PeakTrader

We need to put people back to work by lowering taxes and raising the minimum wage to make work more attractive, generate more tax revenue, and reduce entitlement spending.

You forgot to mention ending world hunger and fostering world peace. Comments like yours makes me wonder if you aren’t auditioning for one of Trump’s beauty pageants.

And if you’re looking for fraud then allow me to recommend the financial sector. According to a Univ of Chicago study the Big Six accounted for $132B (that’s billion with a “b”) in fines and penalties for bank fraud over a two year period. But I’m sure the apologists for Wells Fargo will assure us that there’s nothing to see here…just move along.

lxm

the bookkeeping is so bad the military does not even know where all it’s money goes.

You hear this a lot, but I don’t understand where it comes from. There’s certainly plenty of waste in DoD spending. And it’s certainly the case that DoD financial management is orders of magnitude more byzantine than what you’re likely to find in the private sector; but I’ve never seen where DoD analysts don’t know where the money goes. I’ve seen plenty of cases in which outside auditors have problems navigating their way through DoD accounting; and I’m sure most general officers see it all as an opaque enigma, wrapped around a riddle, surrounded by a mystery. My advice is that if you want a detailed, technical answer, then don’t ask a general officer. Instead, ask some nerd with an eyeshade and pocket protector working in the bowels of “C” ring.

2slugbaits, after our wonderful politician-lawyers waste tremendous amounts of taxpayer money, they need to go after deep pocket corporations to maintain their voracious appetites.

You’re a strong candidate for the fat lady contest.

When Ekins wrote this:

“Chinn and Ito (2007) echo the findings in Chinn and Prasad. Using only industrialized countries, Chinn and Ito found stronger responses from private saving, which increased by 80 cents per dollar of government borrowing, while foreign financial flows increased by 15 to 20 cents per dollar borrowed. Chinn et al. (2011) found similar results among developed countries with 52 cents of increased private saving and 29 cents of increased financial flows. In most of these estimates, more than 80 cents in saving offset are generated for each dollar borrowed.”

I bet he figured no one would read Menzie’s papers. I did. These papers do not give support to some sort of fixed response that Ekins claims. In fact, these papers carefully go through a host of considerations that Ekins never bothers to mention.

Here’s a more recent article on the international investment position:

http://voxeu.org/article/external-debt-us-no-cause-concern-yet

Recent U.S. history does not support “crowding out” because there is no such correlation between the Current Account Balance and the Federal Budget Balance.

Thus, from 1991 through 2006, the Current Account Balance as a % of GDP went from zero to negative 5.8%. https://fred.stlouisfed.org/series/BPBLTT01USQ188S#0

Simultaneously, the Federal Budget went from negative 4.4% of GDP in 1991 to negative 1.8% in 2006.

https://fred.stlouisfed.org/series/FYFSGDA188S

So did cutting the federal budget deficit in half between 1991 and 2006 cause a massive deterioration of the current account balance? OTOH, between 2006 and 2009 the current account balance improved from negative 5.8% of GDP to negative 2.65% while the federal budget deficit exploded from negative 1.8% of GDP to negative 9.8%. So was this another example of reverse “crowding out?”

Do real world facts matter, or are we just discussing can-openers?