Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers.

What does international trade have to do with US jobs? Surely the US trade deficit in manufacturing has reduced employment? Not as much as you would think, on net. Especially with regard to overall employment, which in the long run is determined by the size of the labor force. But even if manufacturing jobs are considered more important than service jobs, trade policy has not been the main reason for their decline. Perhaps the raw statistics can be made more intuitively convincing if one makes comparisons with other sectors.

Consider long-term job loss in three sectors: Manufacturing, Coal, and Agriculture.

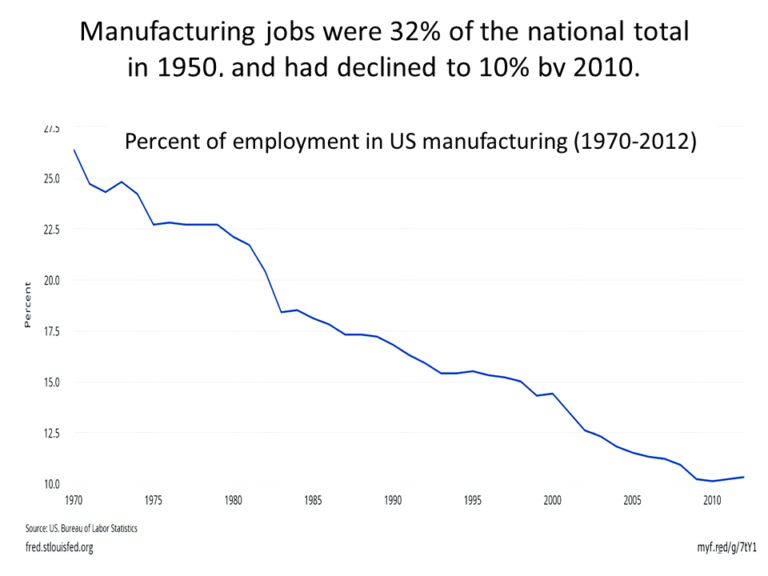

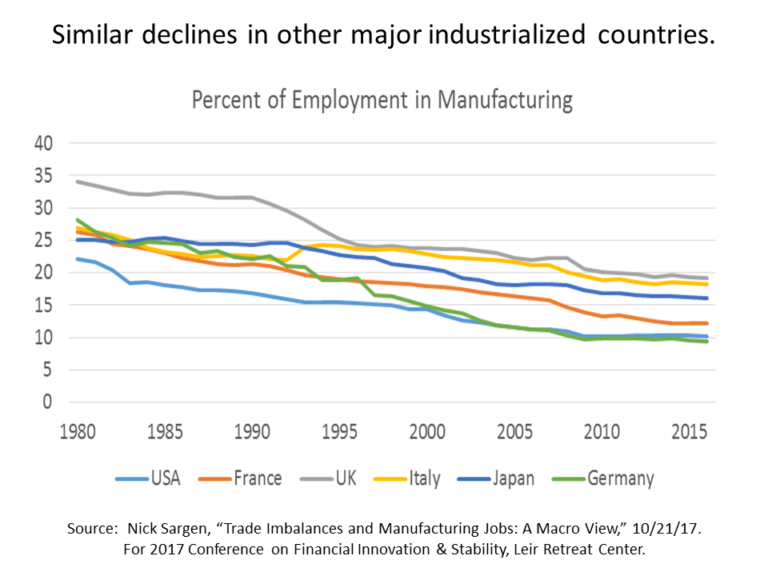

- Manufacturing employment has fallen steadily, from 32% as a share of total US employment in 1950, to 10% in 2010, as shown in Figure 1. (It recovered slightly thereafter.) But similar declines have occurred in other major industrialized countries (as shown in Figure 2), including those like Germany which runs a big trade surplus in manufacturing. Furthermore, US manufacturing output has continued to rise. That means productivity has gone up a lot. It takes fewer workers to make an auto than it did 65 years ago.

- By analogy, agricultural employment fell from 90% in 1790, to 2% today. Technological progress and rising productivity are the explanation. Not trade, which is a big “plus” for American farms.

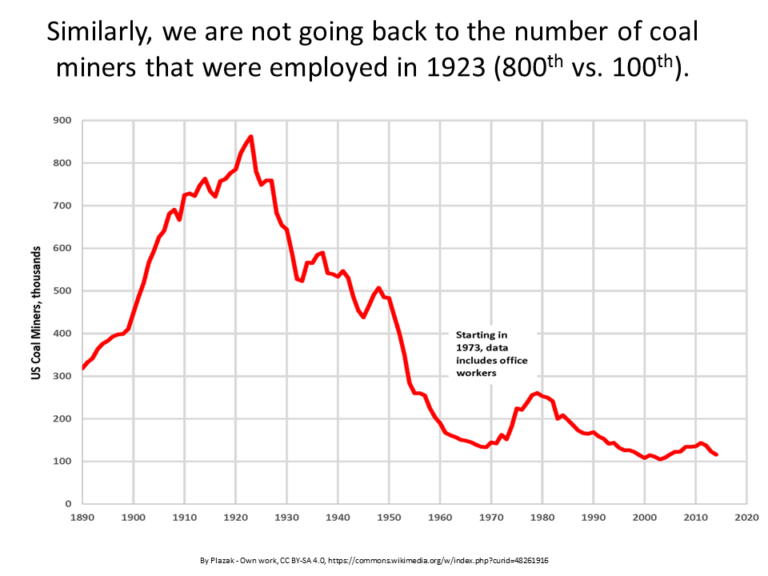

- Coal mining jobs have fallen from 800,000 in 1923, to 100,000 now. (See Figure 3.) Again, a shift in mining techniques is the reason. Trade is, if anything, on the plus side again.

The loss in manufacturing jobs is analogous to the lost agricultural and coal jobs, in five important respects:

- The jobs are not coming back.

- In the long run, they have been offset by jobs gained elsewhere, particularly services.

- There have been long and painful adjustment costs for some individuals and communities, in all three sectors. Think of individual communities that have been left behind in the Great Lakes states for manufacturing, in the upper Plains for farming, and in Appalachia for coal.

- The primary cause of the job shift is not trade but technological progress and productivity growth. The globalization of the last 60 years has admittedly been a net minus for manufacturing (though not necessarily individual trade policies like NAFTA) and a net plus for other sectors. In all three cases, trade has a much smaller impact than technology.

- The list of good policies to deal with individual job loss and stagnating real wages and median family incomes is similar regardless of whether the cause lies in trade, technology, or other factors.

This post written by Jeffrey Frankel.

“There have been long and painful adjustment costs for some individuals and communities, in all three sectors. Think of individual communities that have been left behind in the Great Lakes states for manufacturing, in the upper Plains for farming, and in Appalachia for coal.”

Hmmm. Sort of like Wisconsin? Oh, wait. Preliminary September BLS data has Wisconsin manufacturing employment up by 2.7% over September last year. In fact, other than mining and logging, manufacturing was the strongest employment growth sector for the state. The U.S. total employment in manufacturing was up only 1.0% for that period.

On, Wisconsin!

Manufacturing employment has fallen significantly faster than Federal employment since 2001. But for the whole second half of the 20th century, the two ran almost neck-and-neck. Manufacturing employment and Federal employment fell at almost the same rate. But no one speaks of such things.

https://fred.stlouisfed.org/graph/?g=euyx

The primary cause of the decline in Federal employment is … probably not trade.

In manufacturing, the U.S. offshored older industries with declining prices, imported those goods at lower prices and higher profits, and shifted limited resources into high-end manufacturing, along with facilitating growth in emerging industries.

The U.S. leads the world in the agricultural-industrial-information-biotech revolutions. We cannot move from one economic revolution into another without freeing-up limited resources. And, offshoring has allowed the U.S. to consume more than produce in the global economy and in the long-run.

International trade may be the biggest factor, since 2000.

Chart – Employment

https://fred.stlouisfed.org/series/MANEMP

Chart – Real Output

https://fred.stlouisfed.org/series/OUTMS

Yes, we lost high-paying manufacturing jobs and gained low-paying retail jobs, which helps explain wage stagnation. Nonetheless, everyone gains from lower prices.

There will always be wage inequality. Microsoft created 10,000 millionaire employees, while many retail jobs don’t pay much more than minimum wage.

“All Employees: Manufacturing/All Employees: Government: Federal”.

Curious – what to Federal employees manufacture? Is it weapons of war perhaps? The fall off in this series may be due to DoD rules to outsource production thanks to Dick Cheney.

PGL,

In line with Frankel’s numbers, All Manufacturing Employees at FRED fell from 30.95% of All Employees in 1950 to 13.4% in 1999. The 1999 value is 43.3% of the 1950 number.

All Federal Employees as a percent of All Employees shows a comparable decline. The 1999 value is 48.0% of the 1950 number.

It is commonly said that manufacturing employment is too low and Federal employment is too high. I think that’s funny, given the similarity of the declines. I was going for funny in my earlier comment. I didn’t mean to be confusing.

Arthurian: Thanks for the informative links to the FRED charts.

Jeffrey Frankel: Thanks for a concise but most excellent blog post.

A passing reflection: these are the kinds of information and charts that parents should present their children in order to impress upon them the importance of getting an advanced education. The alternative is competing for entry-level jobs in the service sector.

Passing reflection number two: these trends are occurring in many different sectors, particularly the resource sectors. Why then do workers and owners in some industries push back through political lobbying and in other sectors, workers and owners do not?

Mr Sargens numbers in Figure 1 are self referencing, dishonest and obviously wrong

genauer: (1) Who is Sargen? (2) Are the numbers wrong in Figure 1?

Hey Jeff,

Very interesting post. However, a few thoughts:

(1) If you extrapolate forward on the US Man. Emp. as a share of total, it becomes negative within several decades. Obviously, it can’t be negative, and thus the slope needed to flatten out at some point. Instead, in the early 2000s, it looks to have been below trend. By contrast, the pace of decline for agriculture did flatten out. But, since there is no clear counterfactual, I’m not sure this series tells us that much, in the end. Another problem is that the sudden loss of 3 million manufacturing jobs may have been part of the reason for the slow growth in overall employment after 2000, which is the view of Ben Bernanke. If Detroit loses 80% of its tradable-sector jobs, and as a result, 80% of its retail and government jobs, then it’s share of tradable-sector jobs wouldn’t change. Then we could conclude that the loss of manufacturing jobs is not what hurt Detroit.

(2) I think it would be good to separate factors affecting the long-run decline as a share of employment, which is mostly fast technological growth and to a lesser extent sectoral shift toward services, and factors affecting the level of manufacturing employment in the early 2000s. Trade really does seem to be a dominant factor in the collapse of the level in that period. And the shock does seem large enough to have had macro effects and helped push the economy into a liquidity trap, as Ben Bernanke seems to think.

(3) If you do another international comparison, between US manufacturing output as a share of world output, things don’t look as good. Especially vis-a-vis countries like Germany and Korea, much less China.

I agree with you that protectionism now isn’t the right policy solution. However, US-China relative prices have been set in Beijing for the last 30 years, with China having a clearly undervalued exchange rate during much of that period. Why wouldn’t we have been better off with a free trade regime, with prices set by market forces? Also, if you believe prices matter, why wouldn’t this undervaluation have caused a decline in tradable sector jobs over this period? And, after a long period of the US being overvalued, why do you think the US tradable sector wouldn’t be smaller than it would have been otherwise?

I discussed these issues on this blog previously, and on my own blog:

https://econbrowser.com/archives/2014/08/guest-contribution-the-cause-of-secular-stagnation-relative-prices-trade-and-the-peoples-republic-of-china

http://douglaslcampbell.blogspot.ru/2017/11/did-rise-of-china-help-or-harm-us-lets.html

http://douglaslcampbell.blogspot.ru/2017/05/is-us-manufacturing-really-great-again.html

All the best,

Doug Campbell

the Germany and the UK lines in the Sargen graph look off. Perhaps they were flipped? No way only 10% of German employment is in manufacturing —

and, do think the share of employment in manufacturing today is pretty correlated with different advanced economies manufacturing trade balances — Germany has a large surplus, and (in the correct numbers) over 20% of workers in manufacturing; UK and US have large deficits and around 10% of employment in manufacturing.