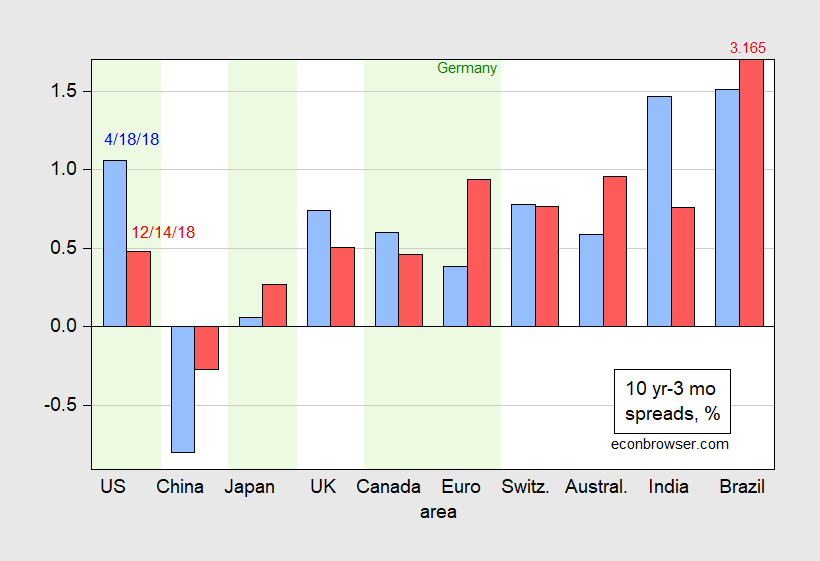

Around the world, some 10 year-3 month government bond yield spreads are shrinking.

Figure 1 shows ten spreads as of 4/18/2018 and 12/14/2018.

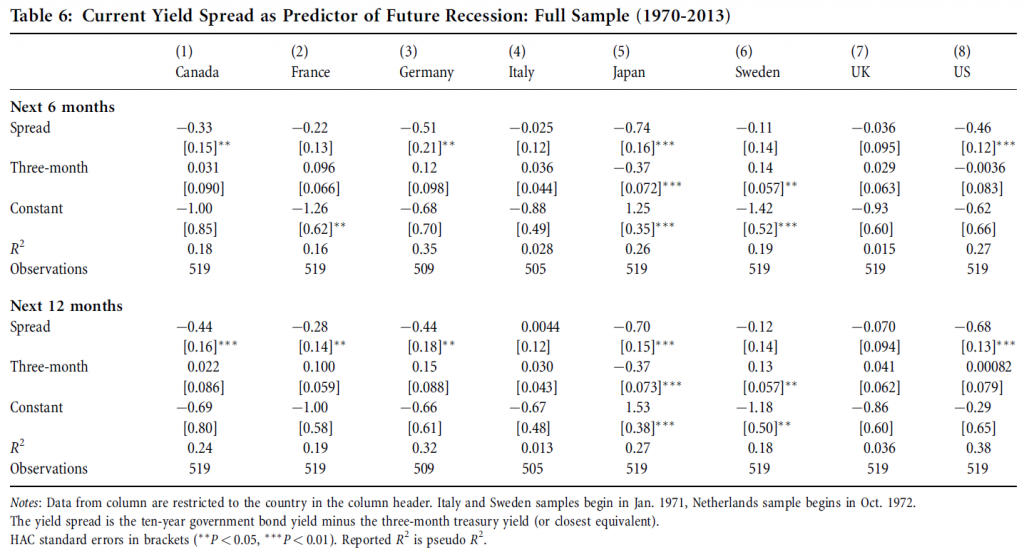

Notice that the predictive power of the yield curve slope for subsequent recessions is not apparent for some countries, and not known for others. Chinn and Kucko (2015) (Table 6, see end of post) indicates that the yield curve has significant predictive power for the US, Japan, Canada and Germany (and France). No such evidence is found for the UK, so the recent flattening does not clearly imply an imminent recession (inspection of the entire yield curve shows an inversion over the 6 months-3 years maturities).

Mehl (2009) finds that the domestic Indian yield curve predicts Indian economic activity and inflation. In contrast, the US yield curve forecasts Brazilian variables. As for China, which has had an inverted curve for over a year, there’s a dearth of academic work on the subject, but inversions do seem to be associated with industrial production growth slowdowns.

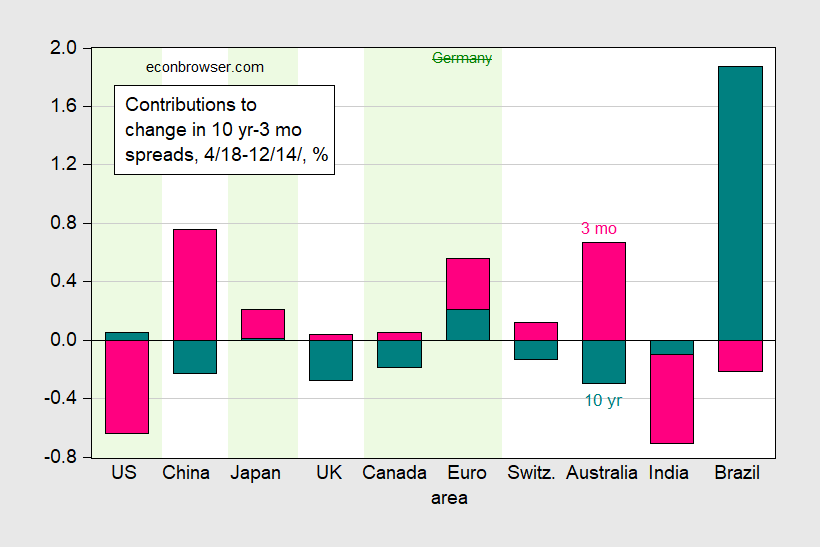

What has been driving spread changes? Figure 2 decomposes the spread changes since April 18th.

Figure 2: Changes from April 18 to December 14 in ten year – three month government bond spreads arising from ten year rates (teal bar) and from three month rate (pink bar), both in percentage points. China three month rate is CHIBOR, Australia is interest rate swap rate, euro area data is for Germany. Light green shading indicates statistical power according to Chinn-Kucko. Source: Economist for April, Bloomberg for December, author’s calculations.

Only in the US and Indian cases do short rate changes drive down the spread, and even in the US case, long rates have risen — rather than fallen — since April. In the pure expectations hypothesis of the term structure (EHTS), this would suggest higher short rates anticipated for the future; however, the increase could be due to the rebounding of the term premium as quantitative easing is unwound.

I thought that was red at first and that Menzie had purposely given us some Christmas colors for the last graph. IF that is pink it is what my Grandma and aunt (on my Mom’s side of family) used to call “hot pink” when they were making yarn decorations for “Uffda” bazaars in the North Midwest USA.

https://goo.gl/images/hr592s <<——(an example of a similar type craft and not the color)

https://goo.gl/images/1KXeNi <<——–example of the color "hot pink" here

We have little Scandinavian ancestry in our blood, maybe none, but my Grandma and Aunt did it because they knew those "Uffda" items would sell at those bazaars. Now, Uffda is not an English word, and I am not certain anyone who said that word at those bazaars was physically threatened and told to "go back to their home country" if they couldn't speak English when they spoke or used the word "Uffda" in their crafts at those bazaars that were quite popular in those days.

I tend to doubt it though.

Sometimes when I find these I semi-want to keep it to myself because I'm am kinda a jerk. Here is the un-gated link to Mr. Mehi's paper, which I am certain Menzi had high confidence we could find on our own:

https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp691.pdf Happy sifting!!!!! And don’t take any husks of corn that I wouldn’t take. Or even let someone knock you in the head with a flying corn husk. I have heard through some elder parties it hurts like hell when you let a flying corn husk hit you in the head. No, it wasn’t Barkley Junior (of “skewed” distribution infamy) who told me that. Although sometimes I suspect Barkley Rosser Junior may have been hit in the head by a flying corn husk on more than one occasion in his burgeoning years.

Back in 2014, the ECB ran some easy monetary policy which led to a devaluation of the Euro. Of late, this exchange rate trend has basically reversed.

https://fred.stlouisfed.org/series/DEXUSEU

A German recession is bad enough. The negative aggregate demand effects from this reversal could intensify the disaster in southern Europe.

According to OECD data Germany might be in a recession already. GDP growth for 2018Q3 was a negative 0.2 percent.

Interesting. Does it matter than interest rates on German government bonds are still really low? Of course they used to be negative.

“According to OECD data Germany might be in a recession already. GDP growth for 2018Q3 was a negative 0.2 percent.”

And at the same time the companies, who faces a drop of exports on one habd hire like hell on the other, the number of open positions is still with a high rate increasing. Therefore, the reality on the ground is more relaxed despite the fact that Germany may technically be in a recession.

Most interesting is Figure 2 for the US. The closing of the spread is due to the short term going up, not the long term going down. In fact the long term rate is going up slightly. That isn’t what you would normally expect as the precursor to a recession. It seems entirely engineered by the actions of the Fed on the short end rather than market pessimism about long term growth. Or is the lack of rise in the long term as a response to the short term itself a sign of pessimism.

It this an anomalous case or are there other inversions preceded by the long term rate rising or steady?

joseph: QE was supposed to bring down term premium. Unwinding of QE should have the reverse effect. That explanation relies upon your belief in QE effectiveness.

Although your explanation is good, I suspect “unwinding” is a very confusing term to those who don’t follow Monetary policy regular or have a hard time conceptualizing it. Maybe I am being condescending to the general populace, or even the regular readers of the blog, who I suspect only about 40% of the readers “get it” (40% actually being my high-end guess). Most of them only know the abbreviation “QE”, and all the negative connotations that have been Elmer’s glued to that acronym.

Here, I think “unwinding” simply means no longer purchasing bonds or treasuries, or simply “inactivity” of market purchases by the Fed. How many people “got” that?? Hard to pinpoint a percentage on that, but I would say with pretty hard certainty, less than half.

https://www.stlouisfed.org/open-vault/2018/july/how-fed-reducing-balance-sheet

I thought part of the reason for QE was to reduce this spread:

Moody’s Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity

https://fred.stlouisfed.org/series/BAA10Y

It was incredibly high in late 2008 and early 2009 but it came down to a more normal level. Alas, it is creeping upwards.

Menzie, did you forget a term (short/long) in your comment?

I think maybe a couple people have put a site like this up before in here, but I had forget the address. Can someone show me a FREE website where you can kind of name the maturity terms you wanna compare (maybe 2–4 different term rates) and have the interest rate lines OVERLAY on top of each other on the graph for you, with reasonably current numbers?? Thanks beforehand. I’m basically talking domestic USA rates here, but if the site can do others that would be doubly awesome as well.

ZeroHedge blog has some more good posts tonight. Obviously you have to ferret them out a little in between the FOX News monkey see monkey do links. But they are pretty easy to ferret out. I swear to God, I’m starting to think ZH’s best posts are on Sunday night vs their usual crap. Which is great because Sunday Night Football isn’t what Monday Night Football was in the 80s. Too polished and commercialized. I’m getting to the point I almost miss the grade school type arguments Dan Dierdorf was always trying to fester up because he couldn’t stand the fact that Al Michaels was educated and could speak the English language correctly. I can’t even watch pro football anymore and enjoy it. Another sign I’m becoming more like my father in all the worst ways.

Here is an interesting graph off of the ZeroHedge blog. I admire many of the people at the ECB for their abilities, but I’m wondering, assuming this is accurate and I think it is, when they make these kind of projections (the dashed blue line) and they get it wrong X number of times, when does that start to become a joke??

https://www.zerohedge.com/sites/default/files/inline-images/ECB-Inflation-Estimates.jpg?itok=XLZl0M-S

Wow – actual inflation hovering around 1% but expected inflation has soared to almost 25! Weimer Germany – hyperinflation!

Of course – I’m kidding but I could not resist!

I know it’s all in good fun. But my point wasn’t where ECB had helped “guide” actual inflation, which if you ignore the other costs, arguably the ECB and Mario Draghi did a good job with. My point was with how the ECB had multiple projections of that rate rising that never occurred. And also it’s worth noting, in an “ideal” world, they might want the inflation rate closer to 2%–2.5% in the sense it’s probably a price you have to pay for higher growth. I’m splitting hairs here—but still thought the point is worth making.

I wonder why the supreme “c-word” betsy devos would intentionally try to hide Loan-Debt data of certain colleges?? Maybe because betsy devos owns shares and equity in the same aforementioned for-profit “schools” that bilk low-income people and white trash from bad backgrounds desperately trying to get out of their “vicious cycle” circumstances?? I tell you, if I thought Menzie would let me get away with it, I would let the vulgarity rip on this woman until I had convinced ALL I was the worst misogynist on planet Earth. She makes me literally physically ill when I think of this [ fill in worst most vulgar word you would use on ANYONE here ]

http://blogs.harvard.edu/clinicalprobono/2018/12/13/trump-administration-stymies-release-of-salary-loan-debt-data-from-certain-colleges-advocates-say/

Think of a word you would use to describe an animal with no soul that likes to bury its nasal passages in feces and dead animals. Then think of an animal that is 20 levels lower than that, and then right below that animal, is a breed of animal called “the betsy devos”. She plans on marrying Satan one day if he can ever exhibit that he has her level of sadism.

it is pretty hard to let a free market in education exist if we are going to withhold information. how is a poor performing school going to fail if we cannot disclose their failures? but the goal of folks like devos is to keep the pressure on the poor and underprivileged. remember, wealth is not really measured in absolute terms, but in relative terms.

Barry has been revealed as part of The Plot To Destroy The President!!!!

https://ritholtz.com/2018/12/market-turmoil-blame-trump/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+TheBigPicture+%28The+Big+Picture%29

I’m not sure the regressions or historical extrapolations make sense given the variable term premium. Both of the term premium models maintained by the Fed show the term premium going negative over the last 5+ years. So even if expectations were for a stable short rate, the yield curve would invert.

Those term premium are kinda interesting. Someone is paying a premium to hold long bonds. Why? (Fun fact: seems to be true for EU as well as US.)

@ tom

I find your comment to be one of the more interesting/fascinating ones exclusive to the comments section on this blog. You leave that very open-ended. Did you yourself have a theory?? Not being a smart aleck, honestly curious your own thoughts on it.

“Someone is paying a premium to hold long bonds. ”

i would imagine many, if not most, baby boomers are now purchasing (or their retirement funds are purchasing) long term bonds to provide income over their retirement years. even if you do not have enough money in an account to last your retirement, most of those folks need to move into conservative income generating streams now and into the longer term future. although i am not sure if this logic would hold for bonds in the EU as well. would love to hear other thoughts on this issue.

Actually, I’m not sure. Long bonds may be a hedge against negative demand/inflation shocks so more like insurance? Or it may be pension funds with long term liabilities? Kinda hoping the experts running this blog might respond. . . . .

Anyway, this is useful: https://www.bis.org/publ/qtrpdf/r_qt1809h.htm