Today we are pleased to present a guest contribution written by Ayhan Kose and Franziska Ohnsorge, respectively Director and Manager in the World Bank’s Prospects Group. The findings, interpretations, and conclusions expressed in this blog are entirely those of the authors. They do not necessarily represent the views of the World Bank, its Executive Directors, or the countries they represent.

The COVID-19 pandemic has already triggered deep recessions in many countries. These recessions are likely to leave lasting scars that depress potential output for years to come through multiple channels, including lower investment, erosion of human capital, and a retreat from global trade and supply chains. The long-term damage will be particularly severe if recessions are accompanied by financial crises.

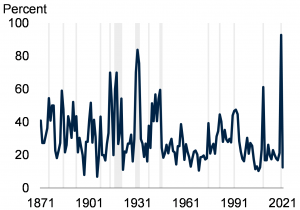

The COVID-19 pandemic has tipped the global economy into its deepest recession since the Second World War. In 2020, the highest share of economies is expected to experience contractions in annual per capita GDP since 1870 (Figure 1).

Figure 1. Economies in recession

Source: Bolt et al. (2018); Kose, Sugawara, and Terrones (2019, 2020); World Bank. Note: Data for 2020-21 are forecasts. Shaded areas refer to global recessions. Figure shows the proportion of economies in recession, defined as an annual contraction in per capita GDP. Sample includes 183 economies, though the sample size varies significantly by year.

If history is any guide, COVID-19 and the resulting global recession will leave lasting scars. Deep recessions have been associated with highly persistent output losses in both advanced economies and emerging market and developing economies (EMDEs). A wide range of factors led to these losses during recessions: depressed capacity utilization discouraged investment and led to a legacy of obsolete capacity; elevated uncertainty and expectations of weak growth became self-fulfilling and depressed investment; weak investment delayed the adoption of capital-embodied productivity-enhancing technologies; and protracted unemployment caused losses of human capital and reduced job-search activity.

The COVID-19 started as a health crisis but it quickly turned into an economic crisis. For now, massive policy stimulus has prevented the economic crisis from morphing into a financial crisis despite the serious disruptions caused by the measures needed to stem the spread of the pandemic. When recessions are accompanied by financial crises, they tend to cause even more severe and longer lasting output losses. In addition to the damage caused by deep recessions generally, financial crises tighten credit conditions—including for productivity-enhancing technologies embodied in new investment, and for research and development spending—and they curtail access to bank lending for creative firms.

To quantify some of these effects, we analyze the impact of recessions and financial crises on activity in our latest Global Economic Prospects report (World Bank 2020). Specifically, we present estimates of the impact of recessions and financial crises on potential output—the output an economy can sustain at full employment and full capacity—several years after the event by using a local projections model (Jordà 2005). Our study extends earlier work on the implications of recessions for potential output by examining the combined impact of recessions and financial crises (World Bank 2018).

We employ a sample of 75 EMDEs for 1982-2018. Potential output is measured based on the production function approach (Kilic Celik, Kose, and Ohnsorge 2020). Recessions are defined as years of negative output growth. Financial crises include banking, currency, and debt crises (Laeven and Valencia 2018).

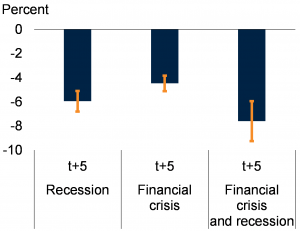

Our findings indicate that past recessions left a legacy of lower potential output: five years after the average recession, potential output was still about 6 percent below baseline in EMDEs. Financial crises—including those which were not associated with outright recessions—were also associated with lower potential output over the medium term, but the effects were more modest: potential output was about 4 percent below the baseline five years after the crisis (Figure 2).

Figure 2. EMDE potential output after recessions and financial crises

Source: World Bank. Note: Cumulative potential output response five years after the event, based on local projections model. Bars show coefficient estimates, vertical lines show 90 percent confidence bands. The dependent variable is cumulative slowdown in potential output after the beginning of event. Sample includes 75 EMDEs.

Recessions that were accompanied by financial crises, however, were associated with larger potential output losses in EMDEs than recessions without financial crises or vice versa: Five years after a recession-cum-crisis, potential output in EMDEs remained almost 8 percent below baseline (Figure 2).

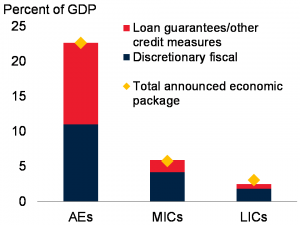

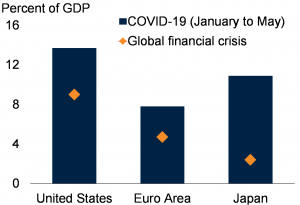

Thus far, thanks to the unprecedented policy support, the global economy has averted financial crises. After the WHO declared the COVID-19 a pandemic in March, financial markets went through a period of exceptional volatility. Global equity markets declined abruptly. Flight to safety resulted a sharp increase in the volume of negative-yielding debt, while spreads on higher-risk debt markedly widened. Capital flows to EMDEs turned sharply negative and spreads on sovereign and corporate bonds soared. Policymakers responded these developments and the pandemic with overwhelming fiscal and monetary policy support (Figures 3 and 4). Their early actions have stabilized financial markets and prevented worse economic damage of the pandemic so far.

Figure 3. Fiscal support measures

Source: International Monetary Fund, World Bank. Note: AEs, MICs, and LICs refer to advanced economies, middle-income countries, and low-income countries, respectively. Announced measures are as a share of nominal GDP and are derived from the IMF Policy Responses to COVID-19 and World Bank estimates, and are subject to change. Aggregates calculated with 2019 nominal GDP weights. Discretionary fiscal stimulus includes expenditure and revenue measures. Data are as of June 12, 2020 for most countries, and up to July 9, 2020 for others.

Figure 4. Unconventional monetary policy measures

Source: International Monetary Fund, World Bank. Note: COVID-19 reflects recent increases in central bank balance sheets since January 2020 and is expressed as a share of 2019 nominal GDP. Global financial crisis reflects the increase in central bank balance sheets between August 2008 and December 2009 as a share of 2008 nominal GDP. Last observation is May 2020.

However, the COVID-19 pandemic can be expected to trigger even steeper long-term output losses for three reasons. First, this pandemic is, by its very nature, global and, as noted above, is affecting a record share of economies around the world. Second, the global economy entered this global recession on a weak footing, with global growth at a post-crisis low and debt at a record high in 2019 (Kose and Ohnsorge 2019; Kose et al. 2020). The pandemic has increased financial fragilities that may yet tip countries into financial stress. Many countries will face much larger debt burdens going forward due to the costs of necessary stimulus measures they put in place this year. Third, the global economy was already experiencing a trend slowdown in potential growth prior to the pandemic. The pandemic may exacerbate this slowdown by disrupting schooling, lowering investment, and chipping away at important engines of long-term EMDE growth, including trade integration and global value chains.

The likely long-term consequences of the pandemic highlight the need to lay the foundation for stronger potential growth. As the global economy recovers, policy makers need to do considerably more to improve future growth prospects. They need to credibly undertake comprehensive reform programs to improve institutions and policy frameworks that can ensure an eventual return to robust growth. In addition, they need to expand investment in education and public health.

References

Bolt, J., R. Inklaar, H. de Jong, and J. L. van Zanden. 2018. “Rebasing ‘Maddison’: New Income Comparisons and the Shape of Long-Run Economic Development.” GGDC Research Memorandum 174, University of Groningen, Groningen.

Jordà, Ò. 2005. “Estimation and Inference of Impulse Responses by Local Projections.” American Economic Review 95 (1): 161-182.

Kilic Celik, S., M. A. Kose, and F. Ohnsorge. 2020. “Subdued Potential Growth: Sources and Remedies.” In Growth in a Time of Change: Global and Country Perspectives on a New Agenda, edited by H.-W. Kim and Z. Qureshi. Washington, DC: Brookings Institution.

Kose, M. A., P. Nagle, F. Ohnsorge, and N. Sugawara. 2020. Global Waves of Debt: Causes and Consequences. Washington, DC: World Bank.

Kose, M. A., and F. Ohnsorge, eds. 2019. A Decade Since the Global Recession: Lessons and Challenges for Emerging and Developing Economies. Washington, DC: World Bank.

Kose, M. A., N. Sugawara, and M. E. Terrones. 2019. “What Happens during Global Recessions?” In A Decade after the Global Recession: Lessons and Challenges for Emerging and Developing Economies, edited by M. A. Kose and F. Ohnsorge, 55-114. Washington, DC: World Bank.

Kose, M. A., N. Sugawara, and M. E. Terrones. 2020. “Global Recessions.” Policy Research Working Paper 9172, World Bank, Washington, DC.

Laeven, M. L., and M. F. Valencia. 2018. “Systemic Banking Crises Revisited.” IMF Working Paper 18/206, International Monetary Fund, Washington, DC.

World Bank. 2018. Global Economic Prospects: Broad-Based Upturn, but for How Long? January. Washington, DC: World Bank.

World Bank. 2020. Global Economic Prospects. June. Washington, DC: World Bank.

This post written by Ayhan Kose and Franziska Ohnsorge.

Jubilee.

Leviticus 25-27???

Seems like some good ideas in there.

Or we could just start off by making payday loans illegal, along with usury rates of any kind.

The initial Q2 numbers came out. I don’t think there’s much likelihood that we will get revised away from two consecutive quarters of falling output. If the nonsense over how to deal with the pandemic continues, we will have three consecutive quarters or more. But, that’s a different discussion.

As far as recovering from this mess, we can either pull our heads in like turtles and hope to muddle through, or we can think of this as a non-shooting war and go after it. Rebuilding infrastructure, building alternative energy sources, and all kinds of other, similar collective projects that raise the potential output of the economy long term, while providing demand in the short term make a whole lot of sense in the next few years. Yeah, it’s Keynes. But it’s also Adam Smith, because demand is demand. It sure seems like an opportunity to build for the future, should we choose to see it that way. Address the coming replay of the Great Depression with a version of World War II, only without the guns and bombs and dead people.

Terrific guest post by the authors.

I like how they overlay the bright orange and red colors over the dark black for the comparisons in their visual presentations. It makes it so much easier for the eyes to swallow the information.

Now we know how these two good people got their jobs at IMF, World Bank, etc, aye??

This Mets vs Red Sox game is just what the doctor ordered for me. Just that tiny feeling of “normalcy”. They say they’re going to do double-headers to make up for the recent lost games. It’s probably not going to work and they will end up cutting the whole season short, but they’re TRYING. and I think with empty stadiums and dogging the players to be cautious, this isn’t a horrible thing.

And for the record, Fauci has even said he’s not totally against this as long as the fans are not going to the stadium. I’m pretty dogged on most of this stuff, but I think this is worth trying. It just feels so good to watch these damned games.

For any big baseball fans out there–let’s say you miss a “live” game or your working hours don’t work on it, You can catch large segments of these games on Youtube. They had a large ending section of a Cardinals vs A’s game that was pretty good—many others. I mean, to me, if you haven’t seen it and don’t know the result, it’s pretty damned close to a “live” feeling/sensation. They have crowd sounds and from a distant camera shot it “kinda” feels like fans are there.

Mets vs. Red Sox? Blasphemy in the regular season.

Was pulling for the Mets. Different game/teams Saturday evening on FOX.

I’m fickle and don’t have a favorite team. If you held a gun to my head I guess I’d say the Twins are my team.

You all often discuss a “V” recovery. How about a “K” recovery, where some sectors take off (say internet related businesses) while some continue down (say retail or travel/leisure)?

15.8 million people are employed in retail, 16.3 million are in leisure/travel. Let’s say 10 million in support of those two = 42.7 million employed. Let’s say employment levels are 50% of 2018 in those industries at the end of 2020, that = 21.35 million relatively permanently unemployed. Divide that by the 161 million jobs at the end of 2018 and you get 12% unemployment + say 3% structural and you get a 15% unemployment rate at the end of 2020. I don’t think it will be that easy for these unemployed to switch to the upper part of the K.

https://www.bls.gov/emp/tables/employment-by-major-industry-sector.htm

Is that any different from any other recession and recovery? It’s the overall growth rate that is represented by the “V” or “W” or whatever shape you choose. There are sectors that get left behind and sectors that don’t get hit so hard in nearly every recession so far as I know. Displacement of “unqualified” workers was a big theme in the recovery from the Great Recession. Why would this be different, and why would the standard issue rhetoric change at all?

No one here ever believed in a “V”-shaped recovery, except our “usual suspects” on this blog, and a certain “mathematical economist” of Shenandoah Valley fame. Soon to gain more fame for his 2nd Quarter SAAR GDP number call.

Expert translation of Great Shenandoah “mathematical economists” 2nd Quarter GDP “Menzie, I can’t believe they’re digging in their heels more on this” call:

“Oops!!!! This number I gave looks like crap, and I can’t find 2 people on planet Earth who agree with my 2nd Quarter GDP numbers, uhm er, I’ve been doing this for over 3 decades, uhm, er, I didn’t mean SAAR!!!! I didn’t mean SAAR!!!! I meant, uhm, er, the often less quoted number even though, uhm, er, the professional economists I was bashing, uhm, er, were ALL quoting SAAR!!!! Yes, that’s what I meant!!!! Wait , er uh, uhm, which one makes me look more like a dumb A__?? Uhm, er, Giving a horrendously bad forecast, or telling people I didn’t know they were ALL quoting SAAR GDP??? OK, uhm, er, get back to me on which one makes me look like less of a dumb A__ and then I’ll tell you which I meant. OK?? Got it??”

sammy, your argument really supports the idea that we need increased unemployment support for those people currently out of the work force. and less stimulus checks for those still working as before. and we need some leadership that helps to get those unemployed back into the workforce safely. based on your argument, creating incentives (ie reduced unemployment payout) will not help the unemployed switch to the upper part of the k.

Baffling and Willie,

I agree and think the K will be more pronounced than other recessions. It really just hastened the trends already extant. I also don’t understand why give stimulus checks to people that are unaffected even benefitted by the shutdown. It’s going to be hard to move chefs, waiters , flight attendants etc. to the upper part of the K. Best spend the money on them.

Then we have to consider if unemployment is too lucrative to motivate people to move. There is a fine line, but politics and policy is a giant paintbrush.

For the first time in a while, I agree with you. Except the last paragraph. The number of free riders is minimal compared to the number of people your mean spirited attitude would harm, or even kill in this pandemic if aid ends.

“ Then we have to consider if unemployment is too lucrative to motivate people to move. There is a fine line”

In the middle of a pandemic is NOT the time to mistake towards austerity with the unemployed. Reducing their benefits right now serves no purpose other than punishment and political gamesmanship towards somebody’s base. Foolish and mean spirited.

Trump held a coronavirus yesterday where the theme was “resurgence”:

https://www.bing.com/videos/search?q=trump+coronavirus+briefing+today&&view=detail&mid=7954ACBC109EC3009FB77954ACBC109EC3009FB7&&FORM=VDRVSR

He actually claimed the only nation with adequate testing was the US. He also tried to suggest the virus was worse in other nations than here where of course he also claimed we did the right thing. So much disinformation and denial.

That’s why only politicians are allows at the reboot of his press conferences. Doctors and public health scientists kept contradicting him.

Jim Jordan continues his campaign to be the biggest arse of all time:

https://talkingpointsmemo.com/live-blog/fauci-top-health-officials-testify-at-house-coronavirus-hearing

CRISTINA CABRERA

|

10:47am

Jordan attempted to bully Fauci into saying that the federal government ought to crack down the anti-police brutality protests in the name of preventing the spread of COVID-19, but Fauci didn’t play ball.

“I don’t understand why you’re asking me as a public health official to opine on who should get arrested or not,” the visibly irritated doctor snapped as Jordan repeatedly pushed him on the issue. “I’m not going to answer it.”

CRISTINA CABRERA

|

11:02am

Fauci defended himself again after Jordan, still blatantly trying to politicize the hearing and smear Fauci, submitted for the record the doctor’s previous comments about rallies and protests to claim Fauci’s position on crowds has “changed.”

“Any crowd, any crowd, whether it’s a protest, but any crowd in which you have people close together without masks is a risk, and I’ll stick by that statement,” Fauci told the Ohio Republican in response. “It’s a public health statement. It’s not a judgment on why you are there in the crowd. It’s a statement related to the fact that you’re in a crowd.”

CRISTINA CABRERA

|

11:40am

In response to Jordan’s push for the federal government to shut down the ongoing Black Lives Matter protests, Clyburn recalled first meeting the late Rep. John Lewis (D-GA) during the Civil Rights movement.

“I’m glad the government did not limit our protests,” the Democrat said.

CRISTINA CABRERA

|

11:57am

Jordan’s grandstanding continues: The GOP lawmaker bizarrely asked Fauci if he was tracking specifically police officers’ exposure to COVID-19 during the protests and whether or not he was “concerned” about said exposure, prompting Fauci to remind Jordan yet again that 1) he’s concerned about crowds in general and 2) he isn’t in charge of tracking infections.

The live blogging does not give full justice to how much of a rude a$$hole Jordan was.

Jim ‘wrestler molester’ Jordan has no shame.

Does Jordan wear his mask when he forces college athletes to have sex with him?

This is a little far even by my standards. I doubt if he partook in the act. Now you can argue not telling law authorities is the “moral equivalent” of that (and I would agree). But….. I don’t think he has committed the act.

There’s an NBER paper that looked at the question of whether or not the BLM protests increased coronavirus infections. The authors concluded that while it probably increased the number of infections among the protesters, it also decreased the number of infections in the stay-at-home population because the stay-at-home population did just that in order to avoid the protests. So on balance it was a wash, with no NET increase in coronavirus infections. The study used cell phone data to monitor movements in 315 metro areas that saw BLM protests.

https://www.nber.org/papers/w27408

Dr. Fauci should have asked Jim “No Jacket Required” Jordan if the NCAA should have wrestling this year.

Apparently Jim Jordan constituents admire “conservative” men who cover for friends who sexually abuse multiple college student athletes. I wonder how many of them call themselves “Christian” evangelicals?? The Evangelicals part is easy to believe Jordan has vast support, how many of those Evangelicals are actually true Christians, past a self-identification, is where I have some doubts.

https://www.cnn.com/2020/03/06/politics/jordan-osu-wrestlers-strauss-invs/index.html

https://www.wkyc.com/article/sports/college/osu/another-ohio-state-wrestler-claims-rep-jim-jordan-knew-of-sex-abuse-scandal-tried-to-get-him-to-change-his-story/95-96b17fcc-589a-491a-8e55-12d8713bf3b5

https://www.washingtonpost.com/politics/jim-jordan-accused-of-begging-former-ohio-state-wrestler-not-to-support-reports-of-sexual-abuse/2020/02/12/395e7314-4ded-11ea-bf44-f5043eb3918a_story.html

It’s such a shame, those “open secrets” that some Universities love so much, just keep being so damned open.

“The idea that I wouldn’t stand up for these athletes is ridiculous,” Jordan said. “I feel sorry for these guys, the fact that they aren’t telling the truth. I mean these are guys I trained with, these are guys I worked out with, I ran with, wrestled with, and the idea that now they are saying what they are, it’s just not true.”

Deny, deny, deny. And then turn on the victims saying they must be lying. Jordan is and has always been slime.

My odds of getting comments cleared are obviously much better with one of the hosts here. Apparently ironic comments on the VP choice are a sensitive area for some people. Apparently personality types of former VP choices is a real over the line area. Be that as it may, I hope this doesn’t offend the sensitivities of the apparently more liberal/tolerant blog host. Cross your fingers.

https://www.nytimes.com/2020/08/02/us/politics/virus-china-ppp-small-business-loans.html

Moses,

I don’t think Biden will be the nominee. I think it will be Hillary.

Not sure what this comment’s intended subtext is. As Colonel Klink might say, Carry on.

This guy was one of my favorites. The ones I remember him most from are John Carpenter’s “The Thing”, “The China Syndrome”, both of the “Cocoon” movies, and my personal favorite (of his roles) was as the manager in ‘The Natural” (which also had Richard Farnsworth in it, an underrated character actor who died in 2000). I still get tingles on the back of my neck and spine when Redford hits the final home run with the kid’s bat.

https://www.nytimes.com/2020/08/01/obituaries/wilford-brimley-dead.html

What does that have to do with Economics?? Not a damned blasted thing.

You know what I really like about Deborah Birx?? She has this keen insight (women’s intuition??) into the future. And I’m really really baffled at how she has this sixth sense ability. It’s amazing. This is Deborah BIrx from 3 weeks ago. Menzie, I am doing my best here to limit these, this is 1 minute and 40 seconds, I give you my personal promise Deborah didn’t wear:

https://www.youtube.com/watch?v=531FWOWwm1I

OK, so no one is making this stuff up. The advantage of video is, (and I concede I have put video links up for much more frivolous reasons) is the sammys, and the Bruce Halls, and the CoRevs, and the Ed Hansons can’t falsely claim NYT or MSNBC made it all up. We still live in times where video footage is pretty hard to deny as fact. Now here is a link to Birx’s most current thoughts, compared to roughly 21 days ago:

https://www.nytimes.com/2020/08/02/world/coronavirus-covid-19.html?action=click&module=Top%20Stories&pgtype=Homepage#link-4c637647

I’m here to tell you kids, If I ever need to know what the weather was like the month before because I’m having “a Joe Biden moment”, the first person I am going to call, is Deborah Birx.

*didn’t swear,

Heads up. One of our two gentlemanly (for the most part) blog hosts was mentioned in a July 31 FT article. Along with the picture of one of his mentors.