Today, we are pleased to present a guest contribution by Christopher Otrok, Sam B. Cook Professor of Economics, University of Missouri, and Research Fellow, Federal Reserve Bank of St Louis. The views expressed here are our own and do not reflect the official opinions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Conventional wisdom in some circles is that lowering tax rates on high-income people will result in economic booms that benefit those less well off—trickle-down economics. A half century of tax cuts for those with high incomes accompanied by increasing income and wealth inequality are suggestive that this conventional wisdom is not likely to be true. In recent work my coauthors and I develop a new measure of income tax progressivity. A key feature of our measure is that it conditions on changes in the level of taxes. That is, we view our measure as a pure twist in progressivity that abstracts from changes in the level of taxes. Extant empirical evidence and economic theory generally agree that an increase in the level of taxes (i.e. an income tax increase on everyone) will lead to an economic contraction. Economic theory is less clear on what happens after a change in progressivity. With our new measure, we are able to show that a pure change in income tax progressivity, which is an increase in income tax rates on the highest incomes and a corresponding decrease at the low end such that the changes are revenue neutral, yields an economic boom.

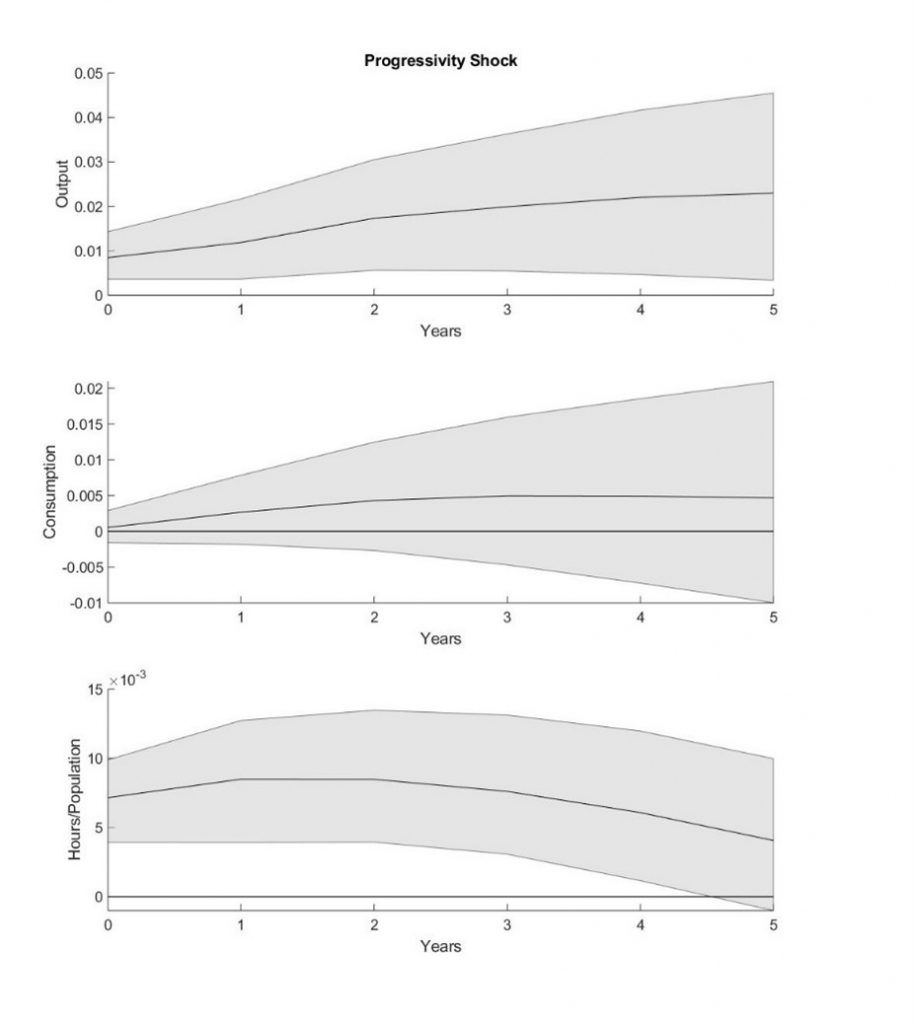

Why would such a change be expansionary? The underlying economic story is that those at the low end of the income distribution are credit-constrained and spend virtually the entire tax cut, leading to a consumption boom. In the language of Keynesians, their marginal propensity to consume out of income (MPC) is close to one. Those with high incomes, who are often wealthy, have much lower MPCs and adjust their consumption spending very little after the tax changes, at least those that we have seen historically. Hence, a pure change in progressivity leads to an overall economic boom. The figure below depicts the response of output, consumption, and hours worked to a positive one-standard-deviation unexpected increase to income tax progressivity. As is clear, there is an economic boom.

Figure 1: The response of output, consumption and hours worked to an increase in the progressivity of income tax rates.

But the story goes deeper than that. This economic boom, the result of an increase in income tax progressivity, results in an increase in income inequality. This is true if you look at the resulting change in the 99-50 or 95-50 percentiles of the income distribution. Interestingly, the change in the 90-10 is essentially zero. This is what we call trickle-up economics. Why would an increase in tax rates on high-income earners, accompanied by a decrease at the low end, result in an increase income inequality? The likely story is the increase in wealth inequality that has accompanied the increase in income inequality (Piketty, Saez, and Zucman, 2018). Raising income taxes of those at the high end of income has little impact on their labor effort because they gain even more as the owners of capital. Inequality increases because the economic booms we have seen in the last 50 years have disproportionately helped those who own the capital.

What then are the policy takeaways? First, we show that an increase in income taxes on those with incomes over $1,000,000 will be expansionary. That is, of course, a good outcome. Raising taxes on those with incomes above $400,000 and $1,000,000 yields a small contraction. The issue of course is that increases in income tax progressivity will not solve the income inequality issue facing society. It is an open question as to what policies will address this issue.

References

Laura E. Jackson, Christopher Otrok, and Michael T. Owyang, “Tax Progressivity, Economic Booms, and Trickle-Up Economics,” St Louis Federal Reserve Bank Working Paper 2019-034A. https://doi.org/10.20955/wp.2019.034

Piketty, Thomas; Saez, Emmanuel; and Zucman, Gabriel. 2018. “Distributional National Accounts: Methods and Estimates for the United States. The Quarterly Journal of Economics, 133(2): 553-609. https://doi.org/10.1093/qje/qjx043.

This post written by Christopher Otrok.

“The underlying economic story is that those at the low end of the income distribution are credit-constrained and spend virtually the entire tax cut, leading to a consumption boom. In the language of Keynesians, their marginal propensity to consume out of income (MPC) is close to one. Those with high incomes, who are often wealthy, have much lower MPCs and adjust their consumption spending very little after the tax changes, at least those that we have seen historically. Hence, a pure change in progressivity leads to an overall economic boom.”

Yes this story has an increase in progressivity reducing national savings which is expansionary if the economy starts below full employment. Interesting to see this modeled out more fully.

But keep in mind that the New Classical types who assume we are always at full employment (me thinks they slept through the entire last 14 years) would use the same argument to suggest progressivity drives up real interest rates via the same inward shift of the national saving curve. Which of course is their argument that it crowds out investment. Of course if they were serious about this argument they would have to conceded raising taxes in general might lead to lower interest rates and more investment – in at least their New Classical view of the world.

Interesting and largely reasonable. My only question is about the argument that this increase in tax progresivity will lead to greater inequality. The argument seems to be fairly clear that it might lead to increased wealth inequality, but will it also lead to actual post-tax income inequality? Of course presumably rising wealth should reflect the increase in capital income claimed will occur. But is that the argument here, that the increase in capital income will be sufficient to increase post-taxe income enough at the top end to increase income inequality as well as the more likely wealth inequality?

Just to add to this, I note that indeed wealth dynamics and income dynamics operate quite differently. Wealth dynamics behave like capital income dynamics, which behave like asset return dynamics. The follow power law distributions like the Pareto distribution, which exhibit the classic kurtotic “fat tails,” in short, grey swans. However, labor income, and the bottom 97% or so of the income distribution, follows a Gibbs-Boltzmann distribution with the distribution being Gaussian, thus no fat tails. However, the top end is dominated by capital income and follows a power law distribution like wealth does.

This means that it will not be surprising if we indeed see more motion for both wealth and at the top end of the income distribution than we shall see for the lower levels of in the income distribution.

I shall shamelessly report that I just finished earlier this evening proofreading a section of my new book covering these matters, which I have published articles on , one of them back in 2009 with Victor Yakovenko in the Reviews of Modern Physics, one of my most cited papers, with another published last year in Macroeconomic Dynamics, “The Minsky Moment and the Revenge of Entropy.”

Raising income taxes of those at the high end of income has little impact on their labor effort because they gain even more as the owners of capital. Inequality increases because the economic booms we have seen in the last 50 years have disproportionately helped those who own the capital.

So is the argument here that capital’s share of income (a flow variable) has increased (it has); or is the argument that scarcity rents for owners have capital have increased wealth (a stock variable)?

“Conventional wisdom in some circles is that lowering tax rates on high-income people will result in economic booms that benefit those less well off—trickle-down economics.”

I believe you are being too kind. No circle that I have had some familiarity, and I have wheeled around more than a few, really believes that is the case.

sigh…

I am always reminded when sober sided folk speak of the thinking and beliefs of the economic elite of Anatole France’s now classic line:

“The law, in its majestic equality, forbids rich and poor alike to sleep under bridges, to beg in the streets, and to steal their bread.”

“Raising taxes on those with incomes above $400,000 and $1,000,000 yields a small contraction.”

I wish economists would get over their obsession with GDP growth. Growth should be far down the list as a secondary objective. The real problem isn’t that we don’t have enough income. The problem is that most of the income goes to those at the top.

The economy is rigged to redistribute income upwards. We should tackle that problem first and growth should be secondary. Dean Baker is one economist who points out that trying to tax income is a endeavor with diminishing returns. The more you tax, the more money the rich are willing to spend to avoid taxation — a dead-weight loss transfer to tax lawyers, CPAs and financial manipulators.

Instead, of trying to tax income back, change the rules of the economy that give them that excess income in the first place. There’s plenty of money for everyone if it doesn’t get all get shoveled to the few at the top. This inequality isn’t some natural result of the economy. It is a result of deliberate rigging of the economy.

@ Professor Chinn

Was this a kindhearted and amicable answering of my request of a blog post related to John Taylor’s recent garbage WSJ editorial??? If so, THANK YOU. If not, it’s a great blog post either way.

Moses Herzog: No, this guest post was in response to a long-standing invitation.

: ) Glad he took you up on it.

My usual off-topic gunk

I thought this is important for economists to be aware of these things.

https://www.politico.com/news/2021/01/18/census-bureau-director-stepping-down-460218

Because many economists use Census numbers to do calculations. Republicans are often complaining about the “politicization” of things. Has anyone heard Republicans complaining about donald trump’s politicization of the Census Bureau?? Something tells me if I had watched C-Span broadcasts of the House and Senate floors for the last 18 months straight I wouldn’t have heard one single Republican say a damned word about it. Happy if someone wants to correct me on that contention.

I’ll tell you, I try to stick closer to economics things and numbers things, but you can imagine what my mind will be on for the roughly next 36–48 hours. Sometimes you’re just kind of rote learning the news and sometimes you’re turning things over in your head. And although I am certain this is not an original thought on my part~~it’s a thought I think many people are missing in this very weird moment. A feeling of emotional relief, a feeling of surreality, a kind of feeling of Vertigo, mixed and contradicting feelings about Biden and his staff, etc etc etc…… but one thought really hits me. Let’s say Republicans “get what they want” over the next few weeks/months—the orange abomination does not get impeached. 17 votes needed to be turned to get impeachment, if you’re a Vegas odds maker, you’re gonna put that where??~~3%–5% chance to get impeachment. It’s just not going to happen.

Now…….. fast-forward 3 years. I put it at 75% trump (health, age, and NY Southern District Courts containing that 25% he won’t run) would make another run in 2024. But where does that put it, if we think back on Ralph Nader, Ross Perot, Pat Buchanan (ideologically the closest to trump), the “Tea Party Revolution”??? The Republicans better think long and hard while they got a chance to “turn the page” on donald trump in their party. He’s going to cannibalize enough intra-party votes to cause the “RNC” a major migraine headache in 2024. We know donald trump loves and needs attention, and we know he will run for office even when he is fully aware his probabilities of winning are minutely small (as they were in 2015, Hillary may remember).That window to rid themselves of donald trump is small, and Republicans are in that window of opportunity now.

Republicans better gnaw on that possible predicament in their minds a little. Because Democrats may get the last laugh when donald trump cuts that nomination vote straight down the middle and the 2024 Republican Convention is staring the RNC right in the face. Because donald trump doesn’t “give a F—” if he creates chaos at the 2024 Republican convention. The thought of it, just like watching violent MAGA thugs destroy the U.S. Capitol on live TV, is very much apt to put a large grin on his face.

Isn’t the obvious answer here (not saying it is the best answer, just the obvious answer) inheritance taxes?? This is apt to effect/change base ownership of the capital itself, vs just the moving around of the income (or cash flows) from the capital. I’m sure the selling off or redistribution of some of the assets after death would get complex, but human beings tend to find solutions to pretty complex problems when they have the desire to do so.

“Isn’t the obvious answer here (not saying it is the best answer, just the obvious answer) inheritance taxes??”

We have an inheritance tax. You may want to change the statutory tax rates but note this tax is horribly gamed by some shady lawyers and corrupt expert witnesses. Not sure if my Angrybear post is available but I once explained how the family business can be really worth $100 million but some paid for hack could claim it was worth only $20 million. Gift and Estates valuation is a pathetic joke. We need a better team of IRS valuation experts.

I went searching for the Federal schedule on gifts and estate taxes and Google gave me a bunch of confusing junk but maybe this helps:

https://www.forbes.com/sites/ashleaebeling/2020/10/26/irs-announces-higher-estate-and-gift-tax-limits-for-2021/?sh=6f2874d1459e

So under Trump, the upfront exemption jumped to $23.4 million which is too high. After that, there seems to be a 40% tax rate. But that applied to the ‘estimated’ value of the estate which of course (as I noted) might be far less than the true value.

@ pgl Thanks for the considerate reply (no sarcasm there).

I realize it would never be “enacted”. Lucky if it would get flown up the flag pole. Still I think it’s fun to toss out ideas. Genuinely appreciate you humoring me. Or Maybe I’m just happy drinking this crap “sparking wine” and listening to the Death Wish 2 soundtrack. Only enough alcohol here to give me the feeling of the flu at the end of it. Aaah very annoying. There’s actually very few other ways of forcing people not to horde capital. Maybe a law to make it mandatory to give X percent of your assets to charity upon death if your net worth was upwards of “X amount”. I mean I just don’t know how many other ways you can solve that if it’s actually a capital issue?? Not much coming to me on that one.

https://www.cnn.com/2021/01/16/politics/lauren-boebert-communications-director-resigns-capitol-attack/index.html

Why would a Republican House Representative’s communications director quit their job only days after getting that same job?? ANOTHER Communications director for a Senator…..wait for it…… wait for it……. wait for it…… Ted Cruz has resigned their job as well. Well, it’s probably because he was tired of explaining why Ted Cruz literally ate his own nose booger during a live nationally televised debate. Not because Cruz thinks treason against a standing elected government is a cool thing or something. When Cruz was waving his hands around at the U.S. Capitol he was probably just helping flight crews land a commercial plane, not telling psychos and nutjobs where to go to be violent or murder anyone. No. “freedom loving” Republicans would never do that

Folks, do Colorado voters know a “winner” when they see one, or what??

https://nypost.com/2021/01/16/gop-rep-lauren-boebert-and-husband-have-racked-up-arrests/

https://www.nytimes.com/2021/01/18/opinion/minimum-wage-us.html

January 18, 2021

Who’s Radical Now? The Case of Minimum Wages

Evidence has a well-known liberal bias.

By Paul Krugman

Most Americans, myself included, will be deeply relieved when Joe Biden is finally sworn in as president. But almost everyone has a sense of foreboding, not just because of the specific threat of right-wing terrorism, but also because Biden will take office in a political environment polluted by lies.

Most important, of course, is the Big Lie: the claim, based on nothing whatsoever, that the election was stolen. Has there been anything in U.S. history like the demand from leading Republicans that Biden pursue “unity” when they won’t even say publicly that he won fairly? And polls showing that a large majority of rank-and-file Republicans believe that there was major election fraud are deeply scary.

But not far behind in importance is what I think of as the Slightly Smaller Lie — the almost universal insistence on the right that the mildly center-left leaders of the incoming administration and Congress are, or at least are controlled by, radical socialists. This allegation was almost the entire substance of Republican campaigning during the Georgia Senate runoffs.

One response to this bizarre claim — and it’s not a bad response — would be a Bidenesque “C’mon, man. Get real!” But I’d like to do a somewhat deeper dive by focusing on one particular issue: Biden’s call, as part of his economic recovery plan, for an increase in the minimum wage to $15 an hour.

Republicans raising objections to Biden’s plan have singled out the minimum wage hike as a prime reason for their opposition, although we all know that they would have found some excuse for objecting no matter what he proposed. What’s striking about this fight — let’s not dignify it by calling it a debate, as if both sides were making real arguments — is that it shows us who the real radicals are….

One thing you have to admire about China, their ability to finish construction projects very quickly:

https://www.cnn.com/2021/01/20/asia/china-shijiazhuang-covid-quarantine-intl-hnk-scli/index.html

How Beijing is going to blame this on the Japanese remains to be seen. Or after the Huawei ruckus are Canadians the evil Laowai delectable “of the week”?? It’s kind of hard to keep track of which girl is in the Beijing carnival dunk tank this week. I’m sure Beijing will figure it out. They’ll have to cut ice cream imports from New Zealand or something.

https://cepr.net/trump-crazy-and-intellectual-crazy/

January 18, 2021

Trump Crazy and Intellectual Crazy

By Dean Baker

It’s hard not to be appalled and scared by the reality denial of Donald Trump’s followers. Their willingness to insist an election was stolen, with no evidence whatsoever, is difficult to understand for those who like to think that people respond to facts and logic.

I don’t have any easy answers to get these people to start thinking clearly, but I will point out that it is not just ignorant and/or crazed Trumpers who have trouble dealing with reality. Many of our leading intellectuals and their major media outlets have similar difficulty dealing with reality when it doesn’t fit their conceptions of the world.

In particular, I am referring to my standard complaint about the unwillingness to acknowledge the ways in which the economy has been structured to redistribute income upward. I will focus on the two simplest routes, which are often described as “technology” and “globalization.”

The Technology and Inequality Lie …

The Globalization Lie …

The essay by Dean Baker is introduced poorly, but offers a fine discussion of the making of inequality. I decided not to edit away the introduction, but the rest is important and directly relevant.

January 18, 2021

Coronavirus

US

Cases ( 24,626,376)

Deaths ( 408,620)

India

Cases ( 10,582,647)

Deaths ( 152,593)

UK

Cases ( 3,433,494)

Deaths ( 89,860)

France

Cases ( 2,914,725)

Deaths ( 70,686)

Germany

Cases ( 2,059,314)

Deaths ( 48,105)

Mexico

Cases ( 1,641,428)

Deaths ( 140,704)

Canada

Cases ( 715,072)

Deaths ( 18,120)

China

Cases ( 88,336)

Deaths ( 4,635)

January 18, 2021

Coronavirus (Deaths per million)

UK ( 1,320)

US ( 1,231)

Mexico ( 1,085)

France ( 1,082)

Germany ( 573)

Canada ( 478)

India ( 110)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 8.6%, 2.6% and 2.4% for Mexico, the United Kingdom and France respectively.

https://news.cgtn.com/news/2021-01-19/Chinese-mainland-reports-118-new-COVID-19-cases-XaDBtk2JNu/index.html

January 19, 2021

Chinese mainland reports 118 new COVID-19 cases

The Chinese mainland on Monday recorded 118 new COVID-19 cases – 106 local transmissions and 12 from overseas, the National Health Commission said on Tuesday.

Among the domestically infected cases, 43 were reported in northeastern Jilin Province, 35 in northern Hebei Province, 27 in northeastern Heilongjiang Province and 1 in Beijing.

A total of 91 new asymptomatic COVID-19 cases were recorded, while 811 asymptomatic patients remain under medical observation. No deaths related to COVID-19 were registered on Monday, and 32 patients were discharged from hospitals.

The total number of confirmed COVID-19 cases on the Chinese mainland has reached 88,454, and the death toll stands at 4,635.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-01-19/Chinese-mainland-reports-118-new-COVID-19-cases-XaDBtk2JNu/img/df8978c8276a431491eaf58bdc8504ea/df8978c8276a431491eaf58bdc8504ea.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-01-19/Chinese-mainland-reports-118-new-COVID-19-cases-XaDBtk2JNu/img/28f05bbb783f4631b912df5434af4158/28f05bbb783f4631b912df5434af4158.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-01-19/Chinese-mainland-reports-118-new-COVID-19-cases-XaDBtk2JNu/img/1e79678e1a954d769111a59058150820/1e79678e1a954d769111a59058150820.jpeg

Folks, if you’re in need of a laugh, I got one for you. Just do the old google thing. Type in these keyword search words in quotations or a very close rendition:

“Elizabeth from Knoxville sings with Piano, they maced me the musical”

I promise you won’t regret it. She’s one of the Republicans who decided to commit treason inside our nation’s capital. Does it mean I’m sadist if I got a huge laugh out of this?? Well, it is what it is people. There’s a separate story about a young woman who stole Pelosi’s laptop. Not as humorous, but still an interesting case study on mental health.

I am very heartened my this guest contribution. Over at economistsblog, when I tried positing exactly the point that, instead of funding stimulus only with debt, we could raise taxes on top incomes and use the money to fund economic stimulus, I was met with nothing but howls of derision.

Of course, this line of thinking is not all that new. Jeffrey Sachs, back in 2015: “ I believe that we do need more government spending as a share of GDP – for education, infrastructure, low-carbon energy, research and development, and family benefits for low-income families. But we should pay for this through higher taxes on high incomes and high net worth, a carbon tax, and future tolls collected on new infrastructure. We need the liberal conscience, but without the chronic budget deficits.

There is nothing progressive about large budget deficits and a rising debt-to-GDP ratio. After all, large deficits have no reliable effect on reducing unemployment, and deficit reduction can be consistent with falling unemployment.

Krugman is a great economic theorist – and a great polemicist. But he should replace his polemical hat with his analytical one and reflect more deeply on recent experience: deficit-cutting accompanied by recovery, job creation, and lower unemployment. This should be an occasion for him to rethink his long-standing macroeconomic mantra, rather than claiming vindication for ideas that recent trends seem to contradict.”

https://www.fuw.ch/article/paul-krugman-and-the-obama-recovery/

Unlike Sachs, I am not opposed to debt, even substantial debt. But why relay solely on debt, when there are good, probably even better alternatives?

At the time I also pointed out that people who presumably backed tax progressivity, Democrats and liberal economists, needed to repeatedly counter Republicans’ incessant nonsense about the economic benefits of tax cuts on the wealthy with a narrative touting the economic benefits of increasing taxes on the wealthy, a narrative that has been sorely missing in the public arena. Hopefully opinion influencers will finally start taking note and make this case.

JohnH: Guess I don’t count as one of those “Democrats and liberal economists” you allude to. I (and many of my like-minded academic macroeconomists) have thought that higher taxes and a more progressive system made sense. I wrote an entire Council on Foreign Relations Report on that point back in 2005, a book (with Jeff Frieden) back in 2011, etc. etc. etc. There are many citations in those documents. I really don’t know where you have been…

JohnH is lying as usual. Or maybe he is just utterly confused as usual. BTW there was never an “economistsblog”. EconomistView was Thoma’s place.

Funny! When I made my point about raising taxes on the wealthy to fund stimulus, pgl repeatedly accused me of advocating tax CUTS!!!

WTF? Yes you have truly gone insane.

“Large deficits have no reliable effect on reducing unemployment, and deficit reduction can be consistent with falling unemployment.”

The subtitle of Sachs 2014 discussion. Look I agree with a lot of what Sachs writes but this attack on Krugman was beyond disingenuous. Much of what Sachs wrote here is consistent with what Krugman has written. Now in 2009 we needed a larger short-run fiscal stimulus. But over the long-run chronic fiscal stimulus can crowd out long-run investment. So paying for a progressive agenda with more taxes on the rich over the long-term is a good idea. If this is Sachs point – Krugman would agree was he had made this point many times before Sachs made it.

Of course JohnH is not bright enough to get all of this. No he frets about deficits even in the middle of deep recessions and then he falls for a complete misrepresentation of what Krugman has said.

Funny! When I made my point about raising taxes on the wealthy to fund stimulus, pgl repeatedly accused me of advocating tax CUTS!!!

This was a bozo comment the 1st time and you repeat it??????

There is a critical distinction between advocating higher taxes and a more progressive tax system as matter of fairness and the idea that taxing the wealthy could be used to fund stimulus and promote economic growth via government investment and redistribution. It is this latter justification that has been around for a very long time and for which I find precious little advocacy among Democrats and public intellectuals such as Krugman. Having said that, I was pleased and surprised to see that last Fall Krugman put in a sentence about raising taxes on the wealthy in the midst of a discussion about increasing debt. While I’m sure that this is standard practice in his academic work, it seems to to have been rather unusual occurrence from his bully pulpit at the NYT.

The conservative echo chamber has been very successful in making it “established fact” that tax cuts pay for themselves as a result of extra economic growth. If there is any hope of ever countering this nonsense, then Democrats and liberal economic pundits must be much more aggressive and forceful, not just in countering the nonsense, but also in promoting a rational, positive alternative, something I do not see happening as yet.

JohnH: You write: “The conservative echo chamber has been very successful in making it “established fact” that tax cuts pay for themselves as a result of extra economic growth.” It has not been an established fact among academic economists — even conservative ones — for a long time if ever. You must be referring to some think-tank economists, and some op-ed page writers.

@ Menzie

VERY RESPECTFULLY~~~ You do have to concede it was a pretty popular talking point in the ’80s and even the ’90s. And it wasn’t just the anchors. And it wasn’t just FOX either. There were A LOT of folks propped up as “experts” selling that on CNBC. Remember at that time Bartiromo was on CNBC, not FOX, and she was on the “market floor” telling everyone what the fund managers thought was best. You don’t think they try to pass off Joe Kernan and Santelli as “experts”?? The average guy cannot decipher the difference between when Santelli tells them something and when Alan Blinder tells them something~~other than Santelli is telling them something they believe~~taxes are too high~~ and Blinder is telling them the last thing on Earth they want to hear in their ears~~~that some Americans aren’t paying their fair share. They’re assuming the rich guy is probably getting screwed as much as they are (they don’t know Mitt Romney pays less than 20% as he’s lecturing them, because personal experience isn’t telling them any different. CNBC don’t package Santelli every day as “Here is the guy who made his reputation making his commissions and salary on selling debt instruments~~to tell you how horrible debt is”. They package him as the guy who “Is way smarter than that liberal Krugman guy”. Until economists are willing to actively go after guys like Santelli instead of smooching up to them to sell books, you’re going to have people like JohnH telling you those things which they sincerely and genuinely believe to be true. “You” (the academic economist community) have to “call out” people like Santelli, Kernan and Bartiromo for their LIES. It’s not enough to sheepishly say you’ve got a Google Scholar page and “you can go read it”.

Moses Herzog: It is a fools errand to try to correct all those who don’t want to be corrected (or have a financial interest in not being corrected) on CNBC. Pretty much all you can do is to make sure on Bloomberg they understand.

So, I compare what I saw written in the 1980s and what I see on CNBC, well the crazies and craven are still there, but there are a lot more critics of the fantasies than there were before.

I put “established fact” in quotation marks to indicate allegedly or supposed.

https://www.grammar-monster.com/lessons/quotation_(speech)_marks_meaning_alleged_so-called.htm

I am glad that even conservative economists do not buy in to this nonsense. They should be first in wanting to counter an echo chamber that misrepresents the effects of tax cuts.

However you look at it, the conservative narrative has taken root and there is at most barely audible narrative to counter it, except for the token piece saying that it all BS. Unfortunately, George Lakoff has shown that simply responding and refuting to a false claim only strengthens it. This is where I fault many of Krugman’s NYT pieces. The argument needs to be framed differently, which is where Otrok’s contribution may play an important role by indicating the right direction.

Beyond that, Lakoff states that “You need (1) to build an effective communication system, (2) to communicate the general progressive value system, (3) repeat the truths that reveal what is right about those values, (4) act with courage to promote the sense of courage, confidence and hope that allows the truth to be meaningful and powerful.”

https://georgelakoff.com/2014/11/29/george-lakoff-in-politics-progressives-need-to-frame-their-values/

If academic economists are to have relevance to the public debate, not just in academia and policy circles, they must find a way to have their voices heard, debunk the nonsense of the pundits and think-tank economists, and promote a logical, compelling alternative narrative.

“If academic economists are to have relevance to the public debate, not just in academia and policy circles, they must find a way to have their voices heard, debunk the nonsense of the pundits and think-tank economists, and promote a logical, compelling alternative narrative.”

Excuse me but Krugman writes a weekly oped in the NYTimes and all those NYT blog posts. OK you serially misrepresent what he is saying. But now you talk about a logical compelling narrative? PLEASE. You would no clue what that even would look like.

I could say so many contradictions so little time but I think our host has already addressed your latest incoherency. Look – have a beer on me and get a good night sleep.

So, Finanz und Wirtschaft published Sach’s commentary in January, 2015. They picked it up from Project Syndicate, where it had appeared one week earlier. Sachs is criticizing Krugman for opposing fiscal austerity by noting that the federal budget deficit had fallen during the previous three years while the unemployment rate had decreased from 8.6% to a glittering … 5.8%??? I think Krugman’s point that we should have been doing better, and that austerity likely held the economy back, is well-taken. Plus, Krugman is an expert on what he calls depression economics; why, he even wrote a book with that title!

Even if Sachs had had a valid point then, it was still five years ago, and the economic situation (not to mention the political situation) was very, very different from the current situation. I think a recession due to a pandemic shock is sui generis, and policy comparisons drawn from a financial recession are inapt at best, especially when there is a very strong argument to be made that it was Sachs, not Krugman, who was wrong.

BTW, while Krugman’s policy recommendations now are very similar to the ones during the Great Recession, they are somewhat different, and his reasoning to support them is different as well, because today is not 2009, or 2015 either, and because the economics profession has learned a lot from the Great Recession.

It is also important to remember that Democrats are not the only political actors with power, not then and not now, and especially on the state level.

My apologies as it has been a long day for me so I’m not totally bringing all of this in – so let me just say WELL SAID!

“Over at economistsblog, when I tried positing exactly the point that, instead of funding stimulus only with debt, we could raise taxes on top incomes and use the money to fund economic stimulus, I was met with nothing but howls of derision.”

Gee – there was some obscure economistsblog? Now over at EconomistView the host (Mark Thoma) often advocated progressive taxation as did the rest of the commenters. Now if you are claiming you were meant with derision for things the host and the rest of us advocated, you are either lying again or in your usual state of utter confusion.

BTW Yellen’s testimony today strongly advocated Federal revenue sharing. Something our current host might take up as a blog post.

You have made a name for yourself insulting Krugman so it is good you finally saw the light. Of course there are literally millions of JohnH comments over at Thoma’s old place (which of course you cannot even give the right name to) screaming to the high hills how bad a high government debt to GDP ratio is. Again – it is good that you finally saw the light.

https://talkingpointsmemo.com/news/mcconnell-trump-fed-lies-mob-capitol-riots

McConnell tears into Trump for his incitement of the January 6 riots. OK Mitch that was cool but now do the right thing and lead at least 17 Republican Senators to vote for conviction.

Kevin Drum notes what McConnell said as well as what he did not say:

https://www.motherjones.com/kevin-drum/2021/01/mcconnell-denounces-trump-but-not-fox-news/

It seems McConnell cannot admit to the blame that should be placed on Fox News.

January 18, 2021

Coronavirus

Israel

Cases ( 565,629)

Deaths ( 4,080)

Deaths per million ( 444)

———————————–

July 4, 2020

Coronavirus

Israel

Cases ( 29,170)

Deaths ( 330)

Deaths per million ( 36)

Having apparently approached a containment of the coronavirus in June, the Israeli government incautiously opened schools and businesses, and the result has been a persistent community infection spread contributing to what are now 565,629 cases in the small country as compared to 88,336 in all through all of mainland China. Israel unfortunately now has more than 6 times the number of coronavirus cases in mainland China. Paul Krugman noticed the Israeli “disaster” on September 14 when there were 160,000 coronavirus cases.

January 18, 2021

Coronavirus

Sweden

Cases ( 533,265)

Deaths ( 10,591)

Deaths per million ( 1,045)

Denmark

Cases ( 190,619)

Deaths ( 1,837)

Deaths per million ( 317)

We are going to here a lot about “budget reconciliation”. I’m not expert on the Senate rules so I’m not sure what fiscal bills can bypass Republican filibusters. But I would presume a clean spending bill or a clean tax rate increase on rich people would fall into this procedure. Of course one might have to hold all 50 Democrats and get the VP to break any tie if all Republicans vote no.

Then again maybe there is some scope to pull moderate Republicans into a package of sensible fiscal policies. I just hope we can get further than we did back in 2009.

An early test will be the $15 minimum wage, which Biden has put into his relief bill. Can all Democrats be convinced to support it? I’m very, very doubtful.

Krugman argues that it is Republicans who are the radicals who will oppose it, but he glosses over how often Democratic candidates in many states like Florida refused to ride a wave of popularity for a higher minimum initiative, preferring to lose an election instead. And, just last year, Pelosi was reluctant to push a $15 minimum wage until the squad embarrassed her by pointing out that, counter to her rhetoric, she was ignoring kitchen table issues.

JohnH Is a $15/hr minimum wage the hill you want to die on? Can you make a strong claim why the minimum wage shouldn’t be $14/hr? Or $13/hr? Or $10/hr? Your posts here on the $15/hr minimum wage seems to be your great white whale. It will likely end no better for you than it did for Captain Ahab. I agree that we should raise the minimum wage, but how high it should go is a matter about which reasonable people can disagree. Meanwhile, President Biden is going to have a lot more critical issues on his plate. And note that he’ll only be “President Biden” not “King Biden”; he’ll still have to negotiate with 535 other views. Do you think a $15/hr minimum wage is more important than COVID relief? Or climate change? Or bringing some semblance of sanity to immigration policies? Or civil and voting rights? Or wage theft?

I’m sure that they are plenty of Democrats in Congress who can be found to torpedo Biden’s proposal using objections like yours…and many more.

$15 may not be perfect—in my state it won’t reach that level for a couple years yet and even then the wage is tiered according to major metro area vs. rural. There is room for negotiation.

As Obama once said, “don’t let the perfect be the enemy of the good.”

ltr left this out of her coverage of what Krugman said but this is important:

“It’s true that once upon a time there was a near-consensus among economists that minimum wages substantially reduced employment. But that was long ago. These days only a minority of economists think raising the minimum to $15 would have large employment costs, and a strong plurality believe that a significant rise — although maybe not all the way to $15 — would be a good idea.

Why did economists change their minds? No, the profession wasn’t infiltrated by antifa; it was moved by evidence, specifically the results of “natural experiments” that take place when an individual state raises its minimum wage while neighboring states don’t. The lesson from this evidence is that unless minimum wages are raised to levels higher than anything currently being proposed, hiking the minimum won’t have major negative effects on employment — but it will have significant benefits in terms of higher earnings and a reduction in poverty.

But evidence has a well-known liberal bias.”

Notice how JohnH does his usual Krugman bashing totally unaware of what Krugman’s real message was. Yes JohnH is lazy. He also is dishonest to the core. Of course we should excuse him for all of this as he is too damn stupid to even know the economics of labor markets.

Krugman glosses over ??? You glossed over the economics on this issue which his oped noted. So I provided the key quote as a comment to 2slug. Try reading it before you lie like this again. Lord you are truly a very dishonest troll.

Why you think 2009 matters, blows me away. Reconciliation is what drives fiscal packages. I suspect a good deal of the Trump era tax cut to be replaced. I also suspect a nice infrastructure package. Both of these were a Biden promise to the northern working classes.

Amazon did its best to shut down the Trumpian terrorists and racists down on Parler. But it seems the Russians are helping the Parler crew to keep up their communications of hate, division, and calls for domestic terrorism:

https://www.aol.com/parler-partially-reappears-support-russian-235732994-102858023.html

I guess our Usual Suspects will applaud this as free speech even if it is Putin’s continuing attempts to destroy the American Republic. MAGA.

What then are the policy takeaways? First, we show that an increase in income taxes on those with incomes over $1,000,000 will be expansionary. That is, of course, a good outcome. Raising taxes on those with incomes above $400,000 and $1,000,000 yields a small contraction. The issue of course is that increases in income tax progressivity will not solve the income inequality issue facing society. It is an open question as to what policies will address this issue.

So, in conclusion, we can’t fix what is perceived by some to be a problem by raising taxes on some others. Now, some, like Moses, would like to significantly raise inheritance taxes. Sounds wonderful, but there are some drawbacks to that. In order to pay those taxes, some inheritors will have to dispose of those assets. This may result in loss of employment for workers, but even if that doesn’t happen, those acquiring the assets will now be able to depreciate those assets against their taxes. So, the government gets money up front and loses some a little later. The lower income workers don’t benefit. That’s not a scheme to fix the to “fix” problem of income inequality; it a fairly poor way to generate tax revenue. Not only that, but in some ways the outcome could be just the opposite of what is intended if the forced sale of the assets is to a competitor who simply wants to eliminate some competition. The ensuing “consolidation” could result in significant job losses.

Oh sure, that’s never happened. Uh, huh. But other countries love inheritance taxes, sooo…. https://iea.org.uk/blog/how-high-tax-sweden-abolished-its-disastrous-inheritance-tax

Bruce Hall In order to pay those taxes, some inheritors will have to dispose of those assets. This may result in loss of employment for workers

Think about that for two seconds. When ownership of financial assets are sold, there is no necessary loss of employment. The names of the owners change, but the physical capital is still there. In fact, far from hurting the economy’s productivity, the overwhelming consensus view among economists is that inheritance taxes shift ownership and control away from idiot heirs and towards smarter investors. Inheritance taxes also discourage heirs from retiring earlier than they otherwise would have. The empirical evidence on this is pretty convincing. The ONLY argument against inheritance taxes is that they might demotivate economic activity for those who are building up wealth while still alive. You have to balance that against the negative growth you get when heirs inherit money. In any event, given that someone has to pay taxes, most of us would prefer that the dead pay those taxes rather than the living. At least the dead don’t vote.

So much rightwing gibberish so little time. So let me pick this out:

“some inheritors will have to dispose of those assets.”

No they will not. This is a popular rightwing talking point but there has never been a case of this actually happening. Not one. Why? I would ask you to think about it (even though you are incapable of thinking). Take my favorite example. Old dude owns a business generating $10 million a year which has a fair market value = $100 million but his estate some lying “expert” to say the value should be $30 million. Under the current law – the kids must come up with $2.5 million to pay off the estate tax. They could easily borrow that much at say 4% interest. An interest expense of only $0.1 million per year is not going to bankrupt them.

Even an utter moron like you should get this. But I may be wrong.

“some inheritors will have to dispose of those assets.”

As you said, rightwing gibberish. And I hear it a lot. It’s based on a double meaning of “assets.” The estate (in the case of the estate tax) or the heirs (in the case of an inheritance tax) might have to sell some of the financial assets, but those financial assets simply assign ownership. The physical assets behind those financial assets still remain intact, but simply belong to a new owner. And usually the new owners will put those assets to more productive use.

The real reason conservatives hate estate and inheritance taxes is for the same reason that conservatives in Old England fought tooth-and-nail to preserve entailments; viz., it’s a desire for a kind of immortality and allowing the dead hand from the grave to still direct the lives of the living. The pure economics of inheritance and estate taxes is solid and supported by tons of empirical literature. Just search the NBER data base. And it was the same with efforts to abolish English entailments during the late Middle Ages. Entailments were bad economics but appealed to old conservatives that refused to admit that it was time for them to leave the stage.

I read your article on SWDEN! I presume you really did not read it (your usual). A 70% tax rate is a lot higher than the US tax rate. Plus in the US the 1st $23.4 million of assets escape the tax wherease in SWEDEN your own article notes:

‘The classic example of the destructive impact of inheritance tax was the surviving spouse who could no longer afford to live in the heavily taxed family home because all assets were tied up in the property.’

Come on Brucie boy – how many houses in your state are worth say $50 million? Your attempt at international comparisons is why we call you Bruce no relationship to Robert Hall.

I would ask if you could be more stupid but we know you will be.

“Inheritance and gift taxes were never a substantial source of income for the Swedish state. Revenue from inheritance and gift taxes reached its zenith in the 1930s at about 0.3 percent of GDP. When the inheritance tax was repealed, the income equaled about 0.15 percent of GDP.”

As usual Bruce Hall forgot to note his source was some right wing advocate who writes such stuff without a shred of insight as to WHY this tax collected less than 0.2% of GDP. Could it be that Sweden’s other progressive taxes have kept income inequality low? The World Bank notes its Gini coefficient is only 0.28. Of course Bruce Hall would have no clue what that means so let’s note another issue, which I have raised many times.

The way the US at least administers the estate tax is to allow dishonest lawyers hire appraisers who literally lie for their clients as to the value of the estate. Now if the IRS got around to hiring competent valuation experts, we could collect a lot more from our estate tax. Then again I need to apologize for raising issues Bruce Hall would never grasp.

https://fred.stlouisfed.org/graph/?g=A86h

January 30, 2018

Federal Interest Payments as a share of Gross Domestic Product, 1948-2020

https://fred.stlouisfed.org/graph/?g=u1po

January 30, 2018

Federal Government Debt and Interest Payments as shares of Gross Domestic Product, 1966-2020

The problem with higher tax rates on the rich is that the money doesn’t get redistributed to the lower tiers. It disappears into the maw of the Federal government.

Such an examination quickly yields a striking fact: most redistribution by government is not from the rich to the poor. Instead, government takes from the relatively unorganized (e.g., the general taxpayer) and transfers to the relatively organized (lobbying groups with common interests or characteristics, such as the elderly and farmers). Moreover, the most important factor in determining the pattern of redistribution appears to be political power, not need. Of the more than $500 billion a year spent on public assistance and social insurance programs, only about 25 percent is allocated through means-tested programs. The other 75 percent—more than $400 billion a year—gets distributed regardless of need. Social Security payments shift approximately $270 billion of income a year to the elderly regardless of their wealth, and on average the elderly possess about twice the net worth per family as does the general population. And because qualifying for Medicare requires only that one be 65 or older, most of the more than $100 billion in annual Medicare benefits go to the nonpoor.

https://www.econlib.org/library/Enc1/RedistributionofIncome.html

sammy Good to know that Mitch McConnell and the GOP are out there fighting hard for the poor and downtrodden much to the chagrin of Charles Koch and his fellow plutocrats.

Bruce Hall: “In order to pay those taxes, some inheritors will have to dispose of those assets. This may result in loss of employment for workers, but even if that doesn’t happen, those acquiring the assets will now be able to depreciate those assets against their taxes.”

I get the feeling you don’t understand business at all, taxes in general and depreciation in particular.

You have to forgive Bruce. He needs to take his shoes off to count past 10.

Pretty strong words:

https://www.politico.com/news/2021/01/20/pelosi-trump-accessory-murder-capitol-riot-460590

I’m curious, could the orange abomination be charged in Washington D.C. courts with a kind of “state level” crime~~accessory to Murder?? The obvious reason I’m asking is, couldn’t it be similar to trump’s charges in the Southern District of New York, where if he gets charged he can’t “pardon” himself because the charges are at the state level and he can only pardon federal level crimes??

Don’t you just hate it when you rent that truck-style limousine that’s going nowhere??

https://deadline.com/2021/01/donald-trump-pardons-steve-bannon-breitbart-news-money-laundering-charges-1234676797/

Some other corrupt people got their get out of jail free card, there could be more in between now and 12noon Wednesday.

https://www.nytimes.com/2021/01/20/us/politics/trump-pardons.html