Numbers released today for 2021Q4.

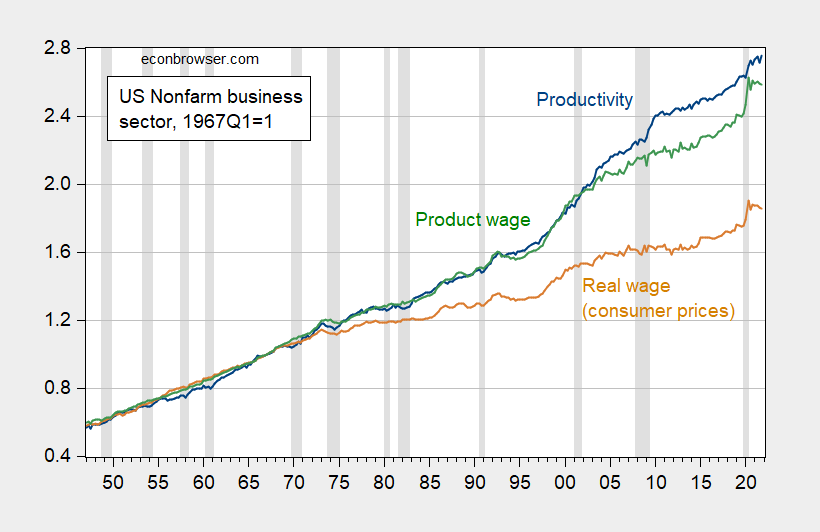

Figure 1: Nonfarm business sector output per hour (blue), compensation deflated by consumer pries (brown), and compensation deflated by nonfarm business sector implicit price deflator (green). All normalized to 1967Q1=1.00. NBER defined recession dates peak-to-trough shaded gray. Source: BLS via FRED, NBER, author’s calculations.

Where NFB output per hour is QNFB/LNFB, real compensation is WNFB/Pcons, and product wage is WNFB/PNFB.

From 2000Q1 onward, productivity has grown 20.1 percentage points more than the real wage, calculated using consumer prices. Theory indicates that the marginal productivity of labor, ∂Q/∂L, (output per hour measures average productivity, Q/L) should equal the product wage, not the real wage (which depends on the consumption basket). Still the product wage has grown 9.1 percentage points less than productivity, since 2000Q1 (in log terms) — and a chunk of the catchup is associated with the pandemic (as of 2019Q4, the product wage was 11.5% less than the productivity gain).

Update, 2/4/2022:

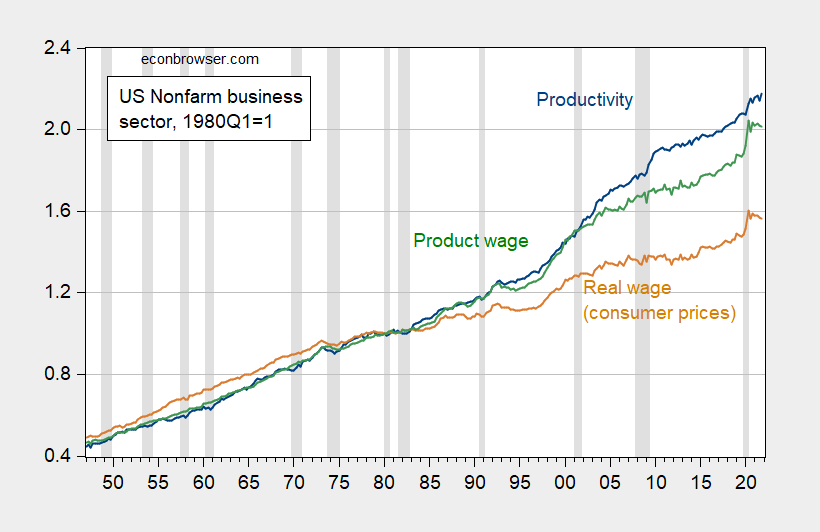

Really, the picture doesn’t change too much if you rebase to 1980Q1.

Figure 2: Nonfarm business sector output per hour (blue), compensation deflated by consumer pries (brown), and compensation deflated by nonfarm business sector implicit price deflator (green). All normalized to 1980Q1=1.00. NBER defined recession dates peak-to-trough shaded gray. Source: BLS via FRED, NBER, author’s calculations.

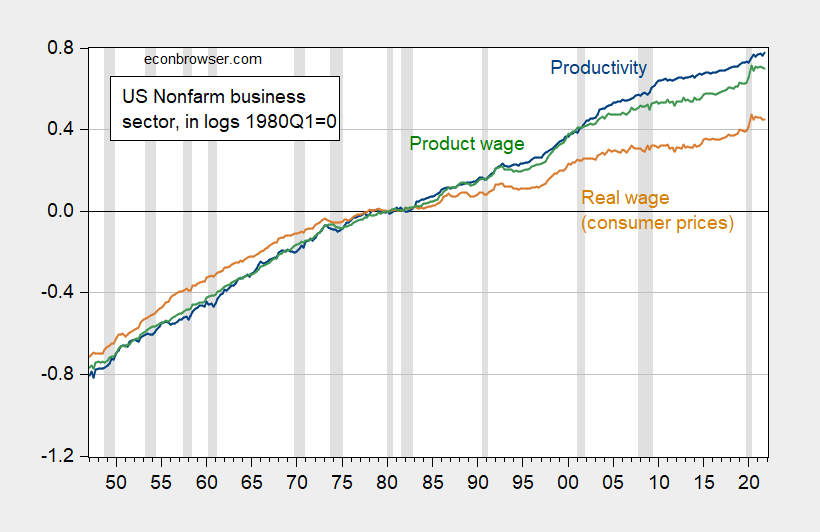

Nor if you log, as is my preference:

Figure 3: Nonfarm business sector output per hour (blue), compensation deflated by consumer pries (brown), and compensation deflated by nonfarm business sector implicit price deflator (green). All in logs normalized to 1980Q1=0. NBER defined recession dates peak-to-trough shaded gray. Source: BLS via FRED, NBER, author’s calculations.

“From 2000Q1 onward, productivity has grown 20.1 percentage points more than the real wage, calculated using consumer prices. Theory indicates that the marginal productivity of labor, ∂Q/∂L, (output per hour measures average productivity, Q/L) should equal the product wage, not the real wage (which depends on the consumption basket).”

An interesting point that harkens back to the early 1980’s when consumer prices rose relative to the GDP deflator. So workers are not better off in part because the US is paying more for the goods we consume relative to the goods we produce. Does this correspond to a real appreciation of the dollar over the last 20 years?

This is usually where paranoid Moses makes some angry comments (possibly including vulgarity). Honestly I don’t know what to make of it other than executives and administrators are taking in more money than they are adding value to the system. If you have a chance to join or support labor unions, do so. Look for the Union labels on your foods/drinks and clothing. The Buffalo New York Starbucks is now union, I think 2 of them anyway. Support candidates like AOC and Bernie who are pro-union. And when places like NYT try to intimidate Unions take them to task and let them know it makes a difference on whether you withdraw support/money for their publication.

In related unionization news:

https://www.npr.org/2022/01/31/1076978207/starbucks-union-push-spreads-to-54-stores-in-19-states

And less related:

https://www.google.com/amp/s/www.cnbc.com/amp/2022/02/02/amazon-workers-in-new-york-file-petition-for-union-election.html

And a reminder of how little labor organizing there is, despite the flurry of headlines:

https://www.bls.gov/opub/ted/2021/mobile/8-major-work-stoppages-began-during-2020.htm

Oh, and by the way, for anyone wiling to do eye-ball econometrics, notice how Menzie’s squiggly lines begin to diverge at around the same time strike activity begins to drop sharply.

Aren’t the margins of error around all these so wide you can say anything?

For example, is it far-fetched to say that the data supports the story that a few financial firm traders are getting paid millions to manufacture money at a very productive rate?

BTW, Wells Fargo had something semi-related to this that I am not certain is legal to link to. But people who are good at internet hunting will know where to find these things, the title of the report is “Wage Growth Expectations Rise to a 50-Year High”. I am not saying I agree with the article, but I do think it’s worth the read if you can access it relatively easy. I’ll give you a hint and tell you it is in a sub-channel of a website that attracts nerdy types and fair share of “incels”. Those who know, know. Think in-between 4chan and Twitter and you’ll probly get it.

https://externalcontent.blob.core.windows.net/pdfs/pdfs/e3feefc3-41d4-46cf-a806-e5efddb1679b.pdf

The report is focused on the expectation that nominal wages will keep growing – which of course is not the same thing as real wage growth.

Strange, I seem to remember wage-price spiral being discussed as well as several paragraphs on inflation. We all appreciate your incredibly deep thoughts though. I don’t know how anyone really could get a long here without your addendums to everything.

It’s also odd how someone who has claimed multiple times on here they “skip my comments” just gravitates to the tag along. Maybe pgl knows what people typed here even though she “skips reading their comments” because she got hit by a “bright light” like Saul on his way to Damascus. Another pgl miracle, here, right on this blog.

Another worthless comment I got to skip.

It’s extremely hard for young people (say under age 35) to recognize what a GIANT and an icon Bill Fitch was in the game of basketball. The only guys I can think of in that class at this moment would be Dick Motta, Jack Ramsey, Don Nelson, and possibly at the college level Abe Lemons.

https://www.yahoo.com/entertainment/nba-world-mourns-death-former-231711338.html

There are those head coaches, who happen to take over a team when Jordan is there, take over the team when a Larry Bird is there, take over the team when a Magic Johnson is there. Etc. And then there are coaches who take unseasoned microwave oatmeal, and turn it into Black Forest Cake with cherries and rum. Those guys above, Bill Fitch, were in the latter group of coaches.

What happened in 1970? I used to think that everything went wrong when Reagan took office, but now I have to blame Nixon? I wasn’t even born then.

PART of the reason is probably because the dollar value is linked to 1967., I don’t know but I suspect if you have the same data and tied the dollar value to 1981, the divergence might change spots a bit. I don’t know that for a fact, I just suspect that would.

Moses Herzog: See figures 2, 3 added to post.

It’s appreciated. Be blunt with me (don’t be afraid of hurting my feelings). Was it a bad theory?? I mean could that happen when you changed the year the dollar was tied to on a very long-term graph, or most the time it’s really not going to effect a graph too much?? I’m guessing you’re going to tell me it depends on variables and how drastic the changes were?? Or you’re going to tell me 95% of the time that’s why log is your ideal??

Moses Herzog: It wasn’t a bad guess. Eyeballing is always a hazardous endeavor, so you were right to ask the question. But it’s easy to check these things yourself with FRED and a spreadsheet program.

I do have “Numbers” on the Mac, but as you know all too well, I am a lazy so-and-so. I may even have Excel somewhere here on one of those card thingies that has probably expired. But I can’t believe “Numbers” wouldn’t do it, it transfers the .xls stuff it just gets a little cranky on fonts for some reason. But I could also use “R”. Anywayz….. depressing do that self-analyzation in the personal industriousness dept.

Energy inflation is also an obvious answer.

It’s not that everything went wrong during Reagan. It’s the lies and hypocrisies, of Reagan’s deficit spending and raising the national debt more than any other president, Reagan’s Keynesian Fiscal stimulus (Which Republicans badmouth whenever a Democrat is in the White House) and claiming to be “looking out for the common man” when he’s killing off trucking unions, air traffic controller unions, and sending in the U.S. military to resolve union strikes the federal government has no business getting into. They have non-unionized nurses doing 16+ hour shifts while (AMA, a doctor’s union, while MDs spend 3/4s of their time insulting unions while they are simultaneously in AMA, a doctors’ union) doctors are snoozing at home and wonder why patient care suffers.

Reagan said the most terrifying word Americans could hear was “I’m from the government, I’m here to help”. Reagan really knew what he was talking about~~when Reagan sent in the military to rob air traffic controllers of their jobs (and by extension threatening semi-truckers jobs and their union rights), He was a lying bastard who screwed around on his first wife with Hollywood pin-cushion Nancy while talking about “family values”. and on and on and on. That’s why anyone paying attention knew none of this “conservative” or “fundamentalist Christian” love for serial fornicator/adulterer donald trump isn’t the least bit surprising at all.

People in the upper stratosphere had a good time in the ’80s, others not so much, and we live with those asinine “Reaganite” shackles on the working man, clear to this day. People can bad-mouth Jimmy Hoffa all day long. I’ll take Hoffa’s “abuse” of the working man over Reagan’s utter disdain for the working man, ANY day of the week.

Are we reading this graph differently? The product wage and the real wage tracked very closely until at least 1975 or so – after Nixon resigned (thankfully). The gap widened under St. Reagan which I would attribute to his toxic macroeconomic mix leading to the appreciation of the dollar, which of course lower product prices relative to consumer prices. So yea – everything went wrong when Reagan took office.

https://fred.stlouisfed.org/graph/?g=lT8Q

January 15, 2018

Real Median Weekly Earnings and Nonfarm Business Productivity, * 1980-2021

* All full time wage and salary workers & output per hour

(Percent change)

https://fred.stlouisfed.org/graph/?g=lT8R

January 15, 2018

Real Median Weekly Earnings and Nonfarm Business Productivity, * 1980-2021

* All full time wage and salary workers & output per hour

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=nilh

January 15, 2018

Real Median Weekly Earnings for men & women and Nonfarm Business Productivity, * 1980-2021

* All full time wage & salary workers and output per hour

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=lSy9

January 30, 2018

Manufacturing and Nonfarm Business Productivity, * 1988-2021

* Output per hour of all persons

(Percent change)

https://fred.stlouisfed.org/graph/?g=lSyd

January 30, 2018

Manufacturing and Nonfarm Business Productivity, * 1988-2021

* Output per hour of all persons

(Indexed to 1988)

[ Notice that manufacturing productivity stopped growing in 2010. ]

So, 467,000 jobs. Not too shabby.

https://fred.stlouisfed.org/graph/?g=r2H7

January 4, 2018

United States Employment-Population Ratio, * 2017-2022

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=Hy9b

January 4, 2018

United States Employment-Population Ratios for Men and Women, * 2017-2022

* Employment age 16 and over

https://fred.stlouisfed.org/graph/?g=sxNb

January 4, 2018

Employment-Population Ratios for White, Black and Hispanic, * 2017-2022

* Employment age 16 and over

Closing on $93.

Which of course made your day. Do we wake up every morning also praying for an increase in COVID related deaths?

What a difference a day makes. You wake up thinking Facebook is worth $1270 billion but then bam – it is worth only $890 billion:

https://finance.yahoo.com/quote/FB/?fr=sycsrp_catchall

Zuckerberg must be cursing up a storm that his little monopoly has some competition.

Monopoly? pgl actually recognizes that monopolies exist? Wow!!!

Yet Facebook does not even have a majority of social media web traffic volume.

But pgl calls them a monopoly. Yet he vehemently fought the fact that TSMC, which clearly dominates the leading edge semiconductor market, has a near monopoly.

It’s typical of the games pgl (and monopolists) play…redefine the market in a way that obscures a company’s monopoly…in this case pgl chose to look at TSMC’s share of all semiconductors as a way to obscure the near-monopoly it holds in a key segment. And then he falsely asserted that I claimed that TSMC had a monopoly, when I had clearly used the words “near monopoly.”

Normally pgl would now proceed tovehemently defend his statement that Facebook has a monopoly in its segment of the social media market, which is also patently false. It only has a near monopoly in that segment.

Pgl’s comments should be accompanied with a warning: “BS alert!”

You have gone BONKERS with your dishonest attacks on what I allegedly said. I have noted the existence of monopoly power as well as monopsony power before a know nothing like you even knew what the terms meant (or maybe you still do not know). Dude – take a chill pill and learn how to do real research sometime.

Oh wait a minute. I get your motivation. Facebook is putting together a team to defend them against charges of market power and perhaps their clear transfer pricing manipulation and you are part of their team. Oh well – Facebook’s case is weak enough already so why not hire a village idiot to shill for them! Have them pay you upfront before they figure out how incompetent your advocacy is.

Gee Johnny boy, the Federal Trade Commission has noticed how Facebook exploits monopoly power:

https://www.ftc.gov/enforcement/cases-proceedings/191-0134/facebook-inc-ftc-v

The Federal Trade Commission has sued Facebook, alleging that the company is illegally maintaining its personal social networking monopoly through a years-long course of anticompetitive conduct. The complaint alleges that Facebook has engaged in a systematic strategy—including its 2012 acquisition of up-and-coming rival Instagram, its 2014 acquisition of the mobile messaging app WhatsApp, and the imposition of anticompetitive conditions on software developers—to eliminate threats to its monopoly.

The FTC has a staff of economists who are truly experts on these issues. But what do they know as Johnny boy is shilling for Facebook and he is the self styled expert on everything!

Apparently pgl, as an alleged economist, does know what a monopoly is…in the textbook. But he certainly has a blind spot when it comes to applying the theory.

To help him understand some of the supply chain and inflation problems in the real world today, I found an article but Matt Stoller clearly explaining them:

https://www.theguardian.com/commentisfree/2021/oct/01/america-supply-chain-shortages

As Stoller notes, “ Production of high-end chips has gone offshore to east Asia because of deliberate policy to disinvest in the hard process of making things. In addition, the firm that now controls the industry, Taiwan Semiconductor, holds a near monopoly position with a substantial technological lead and a track record in the 1990s and early 2000s of dumping chips at below cost.”

Let’s hope this article will serve to help pgl apply his textbook learning in a useful way.

BLS released its January 2022 employment report. The headline news is that the payroll survey showed a 467 thousand increase:

https://www.bls.gov/news.release/empsit.a.htm

The household survey is reporting a strong increase in labor force participation as well as continuing improvements in the employment to population. So what’s up with the negative ADP report?

There has been something brewing in the US Tax Courts that might add to Facebook’s financial woes – that being a major challenge from the IRS with respect to their transfer pricing. Using Google, I find lots of discussions of this issue – many of which were so insulting to our intelligence that I choose not to link them (we’re looking at you Tim Worstall – Fortune’s arrogant but clueless toady). But there is something interesting in this account from a law firm:

https://freemanlaw.com/facebook-irs-audit-facing-irs-transfer-pricing-challenges-facebook-refuses-comply-summonses/

Mark Zuckerberg is running around trying to be the good guy when it comes to taxing digital companies but he is a total fraud. Facebook transferred certain IP from the US to Ireland claiming it was worth $6.5 billion when there are lots of credible evidence that its true value = $21 billion. When the IRS started asking Facebook relevant information, it seems according this discussion Facebook refused to cooperate. Credit to the IRS for going into Court to make Facebook comply.

Zuckerberg has a lot of shortcomings including being a tax cheat and a blatant liar.

It seems Bruce Hall slipped in another comment trying to tell us lockdowns did not reduce the damage from COVID-19 back by some alleged John Hopkins analysis. It seems the right wing has been pushing this paper hard. But there are a few thing Bruce Hall choose not to tell us about this alleged analysis:

https://www.snopes.com/news/2022/02/03/johns-hopkins-study-on-lockdowns/

The discussion I provided to the latest fraud from Bruce Hall has lots of people who get these issues noting some incredible flaws in this little meta analysis. Of course one might understand why the study was so flawed once one reads the section “Who Wrote This Paper?”

This work was conducted by three economists, not epidemiologists: Jonas Herby, Lars Jonung, and Steve H. Hanke. It’s worth noting that Hanke, a senior fellow at the CATO Institute, was at the center of a brief controversy in June 2020 after he erroneously claimed that Vietnam had not reported any COVID-19 data. An open letter from 285 “public health researchers and professionals and concerned citizens” to Johns Hopkins University demanded an apology from Hanke and claimed that his tweet was “more politically driven than evidence based.” Hanke later deleted the tweet. While we can’t say if Hanke’s political opinions influenced the conclusions of this working paper, he has repeatedly posted messages on Twitter equating lockdowns with fascism.

Let me put this as politely as I know how. Bruce Hall continues to spew vicious disinformation with respect to this deadly virus. Wasn’t there a policy of not allowing the spreading of disinformation with respect to COVID-19. And yet Bruce Hall continues to do so.

The product wage started seriously lagging productivity growth starting around 2001. Of course this should be no surprise given how Bush43 sort of gutted anti-trust enforcement while leaning hard against labor unions. The former policy mistake increased monopoly power. Of course the latter policy mistake opened the door to MONOPSONY power even more (I capitalized so Princeton Steve might notice I used one of his banned words, which of course will send him off the rails again).