10 seconds on FRED allows one to see a time series. 20 seconds in a stats package (or even Excel) allows one to see ahead of time if one is going to write something stupid.

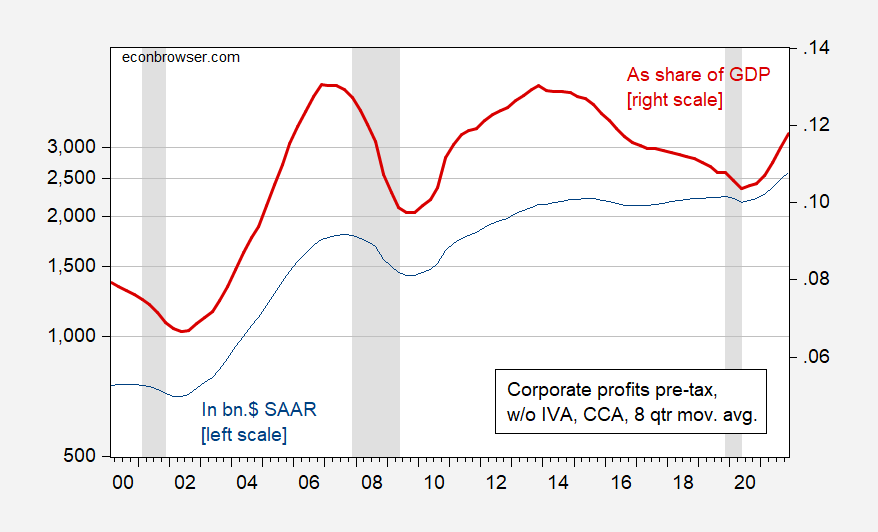

Figure 1: Corporate profits pre-tax, w/o IVA and CCAdj, in bn.$ SAAR (blue line, left log scale), and as share of GDP (bold red line, right scale). NBER defined recession dates peak-to-trough shaded gray. Source: BEA via FRED, NBER, and author’s calculations.

https://fred.stlouisfed.org/graph/?g=EqSq

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2017-2018

(Indexed to 2017)

Increase in labor share of income:

103.0 – 100 = 3.0%

Increase in real profits:

124.9 – 100 = 24.9%

https://fred.stlouisfed.org/graph/?g=sC7n

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2007-2018

(Indexed to 2007)

Decline in labor share of income:

97.3 – 100 = – 2.7%

Increase in real profits:

167.1 – 100 = 67.1%

I guess it depends a lot on the measure you use. This one paints an entirely different picture:

https://fred.stlouisfed.org/graph/?g=1Pik#

(Make sure to extend it out to 2021.)

And then there’s this: “ Corporate America’s profit margins started strong and stayed high all throughout 2021.

That’s according to financial data company FactSet. According to the firm, the second quarter of 2021 saw a 13.1% profit margin among the companies of the S&P 500. The 4th quarter showed a slight dip but a still-elevated level of 12.4%. The numbers stretch 54 quarters — to the middle of 2008 — and reveal that the 4 best quarters for corporate profits in recent history all happened last year.”

https://finance.yahoo.com/news/corporate-profits-surge-2021-184717178.html

What’s to be gained by downplaying corporations’ gigantic profits, particularly when workers’ real earnings are close to stagnating at2020 levels?

“This one paints an entirely different picture”.

Funny thing. You forgot to tell us what was different. Let’s see – both charts shows the often observed fact that profits are procyclical (OK – you do not know what that means….falls during a recession and rises during a recovery). And profits/GDP were 10% in 1950 and around 10% at the end of your graph.

Menzie’s graph shows how profits/GDP rose considerably under Bush43. But guess what little child – the adults already knew that.

” the second quarter of 2021 saw a 13.1% profit margin among the companies of the S&P 500. The 4th quarter showed a slight dip but a still-elevated level of 12.4%. The numbers stretch 54 quarters”

Do you even realize the many differences between this measure and your first one. Your FRED graph makes a big deal of taking the series you choose back to the late 1940’s but this FactSet series goes back to only 2008? So how do we know if this is the highest profit margin over the past 75 years? We don’t based on what this shows.

Also profits/GDP is a very different thing than profits/firm revenues. I guess accounting 101 is another course you flunked.

And also note you choose profits after taxes while Menzie choose profits before taxes.

I bet your mother made apple pie using oranges. GEESH!

Funny how incensed pgl gets every time I document record corporate profits!!!

It’s as if our faux progressive growth liberal feels compelled to defend corporations’ right to profiteer, pillage and abuse their market power!!!

Macroduck called you a teenager. It is pathetic little retorts like this one that suggests you are nothing more than a two year old brat. BTW -incomplete and misleading presentations of basic data document nothing except you are a very dumb troll.

“What’s to be gained by downplaying corporations’ gigantic profits”

NO ONE is denying corporate profits are very high. In particular Paul Krugman has written on this topic many times. But of course Johnny boy has to pretend that he and other economists are either too stupid to get this or too uncaring to write about. But then Johnny boy is one very dishonest troll.

Six years ago, Paul Krugman noted how increasing monopoly power increased profits/GDP as it lowered real wages. Everything you claim he is ignoring he wrote 6 years ago:

https://www.irishtimes.com/business/economy/paul-krugman-monopoly-capitalism-is-killing-us-economy-1.2615956

You know he wrote this as we pointed it out to you many times. And your reply – the Irish Times does not count? Yes – you are one dumb dishonest troll.

Yes, I called this piece to pgl’s attention years ago. But, you know what? He never ran the piece in the US. WTF? Why do the Irishd deserve to get informed about what’s killing the US economy, but not Americans?

And then our dear faux progressive growth liberal hectors us about “everybody already knew” that corporate profits were near record highs…but, strangely enough, never manages to put that into the context of average real hourly earnings, which are back to where they were before the pandemic.

And pgl seems to think that’s just the way things are…and ought to be…defend the status quo, ignore oligopoly’s contribution to inflation and workers’’ loss of purchasing power.

I read this excellent discussion when it first came out. And an Irish-American your insistence that things first published in the US only count is stupid and insulting. The rest of your little rant there is such more of your blatant dishonesty. Have you not figured out that EVERYONE here has grown tired of your incessant BS? No self reflection as our host has noted. None at all.

How many Americans read the Irish Times? If monopoly capitalism is killing the US economy, shouldn’t that have been important enough to have appeared at Krugman)s bully pulpit at The NY Times?

Pgl can whine and rant, bully, and snark as much as he wants, but the fact is that corporate profits are off the charts, figuratively speaking, while workers earnings are stagnating. And pgl’s taking umbrage at those basic facts of life in America today demonstrate what a faux progressive growth liberal he is…a phony making a big racket.

JohnH

April 17, 2022 at 3:40 pm

Johnny boy – EVERYONE has figured you that you are a pointless little whiny boy. It is pathetically STUPID comments that sealed the deal.

“This one paints an entirely different picture”

No it doesn’t.

“20 seconds in a stats package (or even Excel) allows one to see ahead of time if one is going to write something stupid.”

Now, now, you can’t expect just any old body to value non-stupidity. Kinda like truth in that regard.

I may be having one of my mentally slow moments here, but I am assuming this post is NOT arguing the fact that American corporations’ predatory increase of profit margins in “inflationary periods” is in fact a large segment (no, not “all of”) of the consumer price increases (above and beyond covering production costs)?? What exactly is the post refuting?? I’m not being sarcastic here, this is an earnest question.

Moses Herzog: This post is a post showing data in graphical form, instead of someone stating something about a given number. It also highlights the fact that normalization by some variable might be useful, especially in a period of inflation

Appreciate it. : )

I believe there was a comment previously claiming that corporate profits were highest on record. Maybe this is in response to that. I called BS at the time. Maybe it was a response to *that*? I do have access to the Internet after all. My own laziness, even in the comments section of a blog, is my worst enemy. 🙂

Of course JohnH defends his previous comments with an incoherent display of confusing apples and oranges.

《What’s to be gained by downplaying corporations’ gigantic profits, particularly when workers’ real earnings are close to stagnating at 2020 levels?》

Political points?

Will 20 seconds with GDP methodology show you that GDP should have error bars so wide that any story you want to tell can be supported?

I read this quote many many years ago, in my late teens or in college, and can never remember its exact words until I cheat and google it (I should probably type it out in Word sometime and put it on my bedroom door). It is one of my favorite non-Biblical quotes I have ever read in my life and I treasure it very much. When Menzie makes his comment (which he has done more than once here) about “commenter’s confidence in their statements” my first inclination is to get angry, (yes, I am that emotionally insecure, maybe that’s why I need to get sauced on alcohol every 10 days or so)~~~then after the initial anger, feeling as if Menzie was referring to me specifically~~I stop a couple moments and this quote comes rushing back into my head. It is a quote I think that some of our better people here on the blog~~Menzie, Professor Jeffrey Frankel, Ashoka Mody. Macroduck, “A S”, 2slugbaits, our good man Pawel in Poland, Frank in Georgia, and a very few others I am sure to be forgetting would appreciate this quote as well. I like to think if the blog Econbrowser ever took on a “slogan” for the blog itself, this might be it:

“Moral certainty is always a sign of cultural inferiority. The more uncivilized the man, the surer he is that he knows precisely what is right and what is wrong. All human progress, even in morals, has been the work of men who have doubted the current moral values, not of men who have whooped them up and tried to enforce them. The truly civilized man is always skeptical and tolerant, in this field as in all others. His culture is based on “I am not too sure.”

― H.L. Mencken

“ It does seem more than passingly strange that in this an era of great innovation we too seldom hear, “What should an economy do?” or “What should the government do?”. We do often hear, “This is the way it has always been.”, “That is just the way it is.”, and “That is how it is supposed to be.” This, when innovation is all about asking, “How should it be.” We have not come this far by doing things the way we have always done them.”

https://angrybearblog.com/2022/04/because-that-is-just-the-way-it-is#more-88323

I am a big fan of the journalism of Eduardo Porter, he has an article in the Saturday hardcopy NYT about anticompetitive practices if anyone is interested.

I may have to go out and buy this edition of the NYTimes. Funny thing – we have seen lots of discussions of anticompetitive practices on this very blog. Of course whenever Dr. Chinn puts up something on this important topic, Princeton Steve jumps up and down with his hair on fire insisting that such behavior cannot occur.

Hello Moses,

From Frank in (South) Georgia, Thank you very much. I still read Econbrowser, but have not posted in several years.

I did watch the March 17, 2022 video interview of Professor Hamilton on YouTube. It is amazing how much I learn from the PhD specialists in the subject matter.

Back in December 2021, I did a simple linear regression on Brent and average retail gasoline using the data from EIA.

In my dumb-dumb opinion, using that simple linear regression in December 2021, it was obvious that something was going on with oil/gasoline prior to the Russia conflict. I really liked Professor Hamilton’s analysis.

I know I am not very smart, but I think I did get the reference from Professor Chinn about not writing something stupid.

Incidentally, I am expecting Herschel Walker to win the Georgia GOP Senate nomination. The only yard signs in south Georgia I have seen are for Herschel. I think Herschel leads in the early polling.

Also, the 77 year-old disabled lady and her family in the rental house across the street from me were evicted this week. Her daughters were waitresses. They fell behind in rent due to the Covid thing and restaurants for the last 2 years.

Cheers,

Frank

“I know I am not very smart”

You and me both Frank! Probably more me though.

@ Frank

No, honestly, I didn’t get it at first. Because both me and JohnH had made comments about corporate profits recently (which from my view were not “connected”, in the sense that I had made mine semi-randomly from something I had seen on PBS). But I think Menzie made a great point about not just the error of taking a single data point, but looking at data over an extended period of time, which is valid, and which commenters can learn something from. I do NOT think Menzie was labeling any commenters stupid, but rather coaxing readers (probably including me) that if they looked at larger data sets, or over a broader range of time, they would be less apt to make foolish comments. So I view what Menzie said as a service. But initially I was like “is he insulting me??”. But I was just trying to be honest about the true thoughts in my head as I was processing it at the time.

I hope if time allows you Frank, you will make more comments here, as they are way above average and we need more of this type commenter contributing here. You improve the dialogue. I will be watching Georgia and the Senate race from the corner of my eye, and praying for your “salt of the Earth” neighbors, the waitresses, who I honestly admire. Please Let us know if you heard updates from them, or if they had a “GoFundMe” or something.

I’ll share something here I probably shouldn’t because I can never guess how people will perceive these things. But sometimes when you drive “OTR” semi you get pretty lonely. It wasn’t uncommon for me to do 6-8 week stints. Sometimes you might only have 2-3 convos in a day, when you pick up fuel etc. So when you see a semi-attractive waitress at a truckstop or just can “surmise” (attractive or not) she is a single Mom scraping by, you will feel a connection there. These are what I call “salt of the Earth” people (which is said in praise, 0% condescension). Sometimes I would try to surprise them if I was pretty certain no one else would grab it and put a large bill (say $20, this was roughly 20 years ago, on a $12 meal, just peaking out from the ashtray and skip out of the restaurant before she could even say “thanks”, which I know they would have). These people work hard sometimes two jobs, sometimes with more than 1 dependent mouth to feed, often divorced or the guy ran out on them. I wanna tell you Frank, that feeling of imagining those waitresses seeing and being surprised by the large tip in my mind, gave me a lot of juice going down those lonely roads.

Hello Moses,

The tenants were an older lady with health issues and her daughters. Her husband passed away about 8 years ago. I did ask one of the daughters if I could give them any help, but she refused. She did ask me to get the mail for her until the place has new tenants. The daughter said they are looking for another place in the area. I think they are staying relatives until they find another place.

The landlord derives income from his rental properties. He needs his rental income. It was unpleasant watching the deputies with the eviction notice and the landlord’s men move all the contents in the house to the carport.

Predictit is showing Herschel in the mid-90’s in the May primary and the GOP nominee in the mid-60’s for the general election.

Cheers,

Frank

Oh, look kids…….. another story about the benevolent federal reserve.

https://www.reuters.com/business/finance/ex-goldman-executive-banned-banking-over-mishandling-documents-fed-says-2022-04-07/

Don’t forget now kids, Georgetown Jerome is always trying to make the world a better place, and make TBTF bankers accountable to their depositors and small investors. Except when he’s handing out insider goodies to his banker pals and doing window dressing wrist slaps. But, I mean, it slipped the minds of PhD economists who can get a plethora of employment opportunities at the Fed, to mention this one to us. They’re too busy telling us how Georgetown Jerome’s JD helps him execute the Fed’s regulatory and “statutory” functions. I haven’t seen a JD holder this competent at their job since Neera Tanden was tweeting and foreign fund-raising her way to head of the OMB. Goldman Sachs thinks Georgetown Jerome is “one hell of a guy” keeping the staff in line on “the thousands of statutes”.

Um … what?

Professor Chinn,

Risking saying or asking something “stupid”, I see two FRED entries related to corporate profits [pre-tax without ICA and CCAdj].

One entry is in the “National Income” grouping, FRED series, “National income: Corporate profits before tax (without IVA and CCAdj) (A053RC1Q027SBEA)”. https://fred.stlouisfed.org/series/A053RC1Q027SBEA

The National Income entry shows a value of $3,109.433 billion SAAR.

Second entry is in the “Corporate Business” category, FRED series, “Corporate business: Profits before tax (without IVA and CCAdj) (A446RC1Q027SBEA)” .

https://fred.stlouisfed.org/series/A446RC1Q027SBEA

The Corporate Business entry shows a value of $2,581.407 billion SAAR.

I thought it may be interesting to show corporate profits as a percent of GDP in addition to employee compensation as a percent of GDP since about 1950 since there seems to be a lot of discussion related to these two relationships.

AS: I used FRED series A053RC1Q027SBEA. The other series is for *nonfinancial* business.

Thank you.

Professor Chinn,

I can’t seem to get my chart to look exactly like yours. I have tried end of period annual data and average annual data, but the graphical portrayal of the data points seems more angular than yours. Your chart looks to have smoothed values. My 2021 profit to GDP percentage also looks to be a bit different from yours.

Any thoughts you have time to share?

Thanks

Using National Income (NI) as a devisor, is there a percentage goal that is economically or politically preferred for corporate profits, pre-tax, w/o IVA and CCAdj?

Going back to 1948, pre-tax corporate profits were about 15% of NI and employee compensation (COE) was about 59% of NI. For 1986 profits were about 7% of NI and COE was about 66% of NI.

Most recently in 2012 profits peaked at about 15% of NI rising from 7.5% in 2001 and for 2012 COE was about 61% of NI compared with 66% in 2001. From 2014 profits declined from 15% of NI to about 12.3% of NI by the period 2019 to 2020 while COE increased from about 61% of NI to about 65% of NI. For 2021 profits were about 15% of NI and COE was about 63% of NI

FRED data series used:

1. corporate profits, pre-tax, w/o IVA and CCAdj (A053RC1Q027SBEA)

2. compensation of employees (COE)

3. national income (NICUR)

I notice from 1947 to 2021 that the ratio of pre-tax profits to national income has a unit root as does employee compensation to national income. So, I assume this means that there is no regression to an average ratio for either calculation.