IHS-Markit’s monthly GDP now down seven months. Some key indicators followed by NBER BCDC:

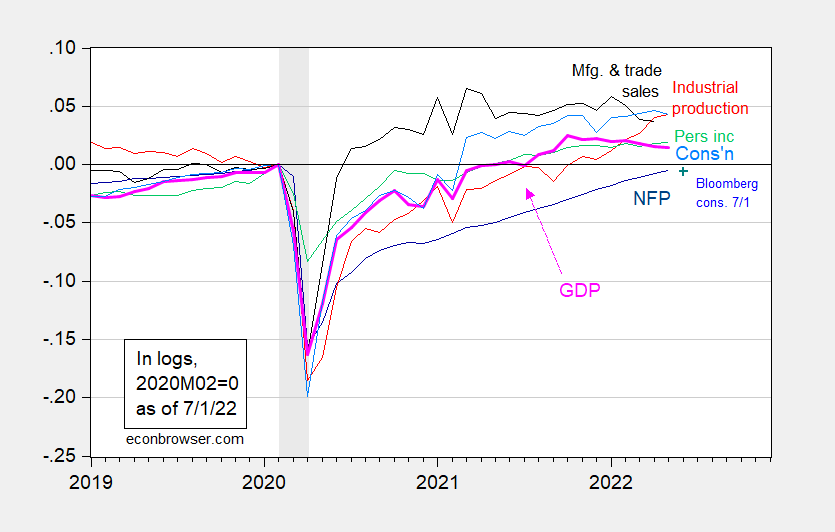

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for NFP (blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (7/1/2022 release), NBER, and author’s calculations.

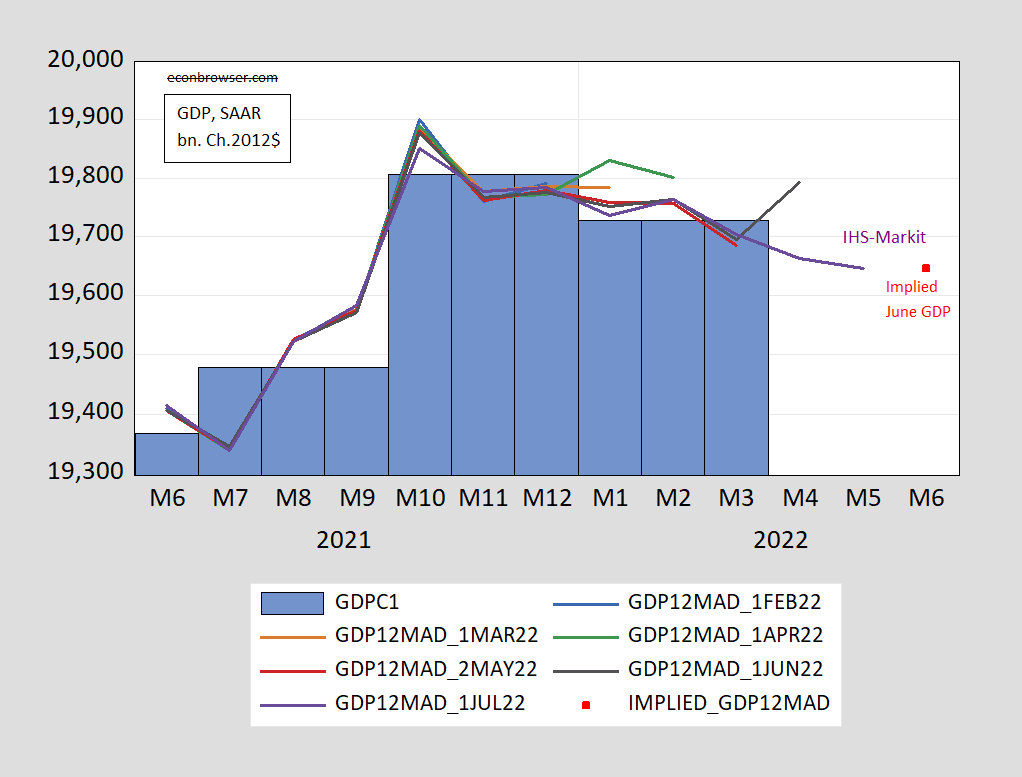

We now have two out of five key indicators falling in May. Monthly GDP is down for seven months. Figure 2 shows the path of monthly GDP according to various vintages,

Figure 2: Official GDP (blue bar), IHS-Markit monthly GDP (lines), implied IHS-Markit June 2022 monthly GDP (red square), all in billions Ch.2012$ SAAR. Source: BEA Q1 3rd release, IHS Markit various releases.

Notice the variation in estimates of monthly GDP.

IHS-Markit notes in today’s Weekly Commentary:

We estimate that GDP fell in both the first and second quarters at nearly identical rates. The Bureau of Economic Analysis estimated that GDP fell at a 1.6% pace in the first quarter; we estimate, following the latest monthly data on international trade, consumer spending, inventories, and other sources, that GDP fell at a 1.5% rate in the second quarter. A two-quarter decline in GDP meets the popular definition of recession. However, the first half was not as weak as portrayed in the GDP figures (including our estimate for the second quarter) and we think it unlikely that the official arbiter, the NBER Business Cycle Dating Committee, would deem the estimated declines in GDP in the first and second quarters as satisfying their definition of a recession that involves “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

ZH blog is saying “the US is now technically in recession”. I assume this will be enough verification for ExcelKopits.

Initial verification comes on July 28 with the BEA’s advance release of Q2 GDP. Having said that, the Atlanta Fed is now at -2.1% for Q2. Uglier and uglier by the day.

https://www.atlantafed.org/cqer/research/gdpnow

If I read the recession dates correctly, it looks like the only two consecutive quarter GDP decline not called a recession since 1947was 1947.

NBER Business Cycle Dating Procedure: Selection of FAQ shown below

https://www.nber.org/business-cycle-dating-procedure-frequently-asked-questions

Q: What indicators does the committee use to determine peak and trough dates?

A: The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers (PILT), nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions.

Q: Where does the committee obtain the data for the indicators that it generally consults in determining the dates of its monthly and quarterly chronologies?

A: Data for all indicators can be found and downloaded from “FRED”, the data website maintained by the Federal Reserve Bank of St. Louis. These are the search terms that will bring up each monthly series listed in the earlier FAQ:

FRED real personal income less transfers

FRED nonfarm payrolls

FRED real personal consumption expenditures

FRED real manufacturing and trade sales

FRED household employment

The dating of the quarterly turning point dates also considers the average of real Gross Domestic Product (GDP) and real Gross Domestic Income (GDI):

FRED real GDP

FRED real GDI

Q: The financial press often states the definition of a recession as two consecutive quarters of decline in real GDP. How does that relate to the NBER’s recession dates?

A: Most of the recessions identified by our procedures do consist of two or more consecutive quarters of declining real GDP, but not all of them. In 2001, for example, the recession did not include two consecutive quarters of decline in real GDP. In the recession from the peak in December 2007 to the trough in June 2009, real GDP declined in the first, third, and fourth quarters of 2008 and in the first and second quarters of 2009. Real GDI declined for the final three quarters of 2001 and for five of the six quarters in the 2007–2009 recession.

Q: Why doesn’t the committee accept the two-quarter definition?

A: There are several reasons. First, we do not identify economic activity solely with real GDP, but consider a range of indicators. Second, we consider the depth of the decline in economic activity. The NBER definition includes the phrase, “a significant decline in economic activity.” Thus real GDP could decline by relatively small amounts in two consecutive quarters without warranting the determination that a peak had occurred. Third, our main focus is on the monthly chronology, which requires consideration of monthly indicators. Fourth, in examining the behavior of production on a quarterly basis, where real GDP data are available, we give equal weight to real GDI. The difference between GDP and GDI—called the “statistical discrepancy”—was particularly important in the recessions of 2001 and 2007–2009.

Thank you, AS. Tells us that if Q2 GDP is materially less than zero, then the recession will be called as starting in Q1 in all likelihood.

Now Stevie pooh is cheering for a large recession. I guess you are desperate for another appearance on Fox and Friends.

Since industrial production FRED series, INDPRO, is one of the NBER items it reviews to determine a recession, it is interesting to note that (if I have not made a mistake) every recession since 1947 has shown an end of quarter Y/Y negative percentage change in INDPRO. The end of 2022Q1 Y/Y percent change in INDPRO was 4.9%.

For April 2022 and May 2022, the Y/Y percent changes using monthly data were respectively, 6.1% and 5.4%. The m/m changes for April and May 2022 were 1.3% and 0.1% respectively. The 2022Q1 INDPRO index ending value was 103.7. The 2022m05 INDPRO index was 105.2. The 2021Q2 INDPRO index value was 100.2. So, it looks like the Y/Y end of quarter value of INDPRO must be less than 100.2 for a Y/Y negative percent change for 2022Q2. The drop from 105.2 to less than 100.2 as of June 30, 2022, does not seem likely.

Maybe the lack of a negative INDPRO Y/Y ending quarter for 2022Q1 and 2022Q2 may be a signal that the business cycle has not reversed and thus no recession call, unless 2022Q2 has a material GDP decline as mentioned. A probit model using INDPRO seems to indicate no recession within a month. FRED seems to forecast no recession in near sight. https://fred.stlouisfed.org/series/RECPROUSM156N

“macroduck

July 1, 2022 at 6:20 pm

A bunch of you kiddies want a recession.”

He was referring to you. Now – please tell us who the chief economist for Goldman Sachs is and why you think he is incompetent.

A bunch of you kiddies want a recession. The grown-ups keep explaining about what recessions are and how to know i you are in one or likely to get into one, but some of you kiddies just can’t stand it you want a recession!!! And suddenly, the Atlanta Fed’s headline GDPNow estimate is your best friend. Well, kiddies, didd you know that the Atlanta Fed also offers estimates for GDP components? Well, they do! And some of then really matter!

OK, did you know, for instance, that only once in the twelve recessions since WWII have real final sales not fallen during a recession? It was in the 1960-1961 recession:

https://fred.stlouisfed.org/graph/?g=Rf9x

Those cheering for recession right now point to the Atlanta Fed’s GDPNow estimate for Q2, which points to a second consecutive quarter of GDP contraction.

A look at the components of the GDPNow forecast show that real final sales are not expected to fall in Q2, having not fallen in Q1:

https://fred.stlouisfed.org/graph/?g=Rf9x

Any idea how easy it was to find this out? Seriously, there is no reason to remain ignorant when facts are this easy to find.

So unless real final sales suddenly turn negative for Q2 (or are revised to negative – remember, kiddies, that’s why the NBER waits to declare recession timing) or the NBER decides that inventory adjustment matters more than final demand (which it has only ever done once), then the data don’t line up with recession now.

Now, for anyone actually interested in economics rather than politics (or whatever it is that has addled Johnny’s wee pate), inventories are an interesting issue. One characteristic of the “Great Moderation” was a reduction in the volatility of inventories. Just look at the first link, with1984 as a dividing line.

We had this familiar old story about producers guessing wrong about future demand, which meant having the wrong level of inventories, which meant adjusting orders in a hurry, which caused business cycles. Tighter inventory control after 1983 meant smaller swings in the economy as a whole. It turns out some of that inventory control was off-shoring and it turns out that control over housing inventory is another matter altogether. Still, we moderated greatly when we got better control of (domestic) business inventories.

Now take qnother look at the right-hand end of that first link. Inventories are volatile again. There is the obvious reason, that businesses lost control over inventories due to bottlenecks and shipping tie-ups. However, there are two other possible reasons for swings in inventories – 1) firms have again made mistakes about future demand and 2) firms have increased inventories held for precautionary purposes.

Mistakes about future demand are part of that old recession story. Precautionary inventories make inventories larger relative to output, so can have their own business-cycle implications, but not as large as mistakes about demand.

So, if inventory overshoot leads to recession through firms cutting orders in a hurry, we might want to look at orders, both new and existing. Those of you convinced were in recession, you’ve checked orders, right? Only a idiot would squawk about recession without checking orders, but for your convenience, here’s the picture:

https://fred.stlouisfed.org/graph/?g=RfgI

Pretty good looking, for now, right? But you knew that.

Today, the ISM new orders index fell to 49.2. Uh, Oh! Just remember kiddies, ISM data are valued as much for their timeliness as their predictive ability. If you really, really want to point to a subcomponent of the ISM report while ignoring the positive headline index, maybe you have more problems than can be addressed in blog comments. If you want to make a call based on solid evidence, one month’s barely sub-50 reading from a single component of a single survey isn’t a good idea.

By the way, want a forecast built on more than wishes? Durables orders are going to slow in the next few months. Because inventories are high. See, that’s what ee know about how an inventory cycle works. No wishful thinking needed.

Bonus: Watch for news of order cancellation. And don’t, please, charge into comments as soon as you find that one headline about one firm cancelling orders. Just don’t. Orders are cancelled every day. Large-scale, continuing cancellation of orders across construction and manufacturing would be bad. Seen that yet? No, you haven’t. If you do, feel free to mention it.

“And suddenly, the Atlanta Fed’s headline GDPNow estimate is your best friend.”

We had been spared the usual MAGA chirping from Bruce Hall for a while until he decided he cannot let Princeton Stevie pooh be the only recession cheerleader. So he decides to inform us of the latest from this crew AFTER Dr. Chinn posted on it. Of course Brucie follows Stevie by just ignoring the Goldman Sachs forecast. After all their chief economist is only the most celebrated forecaster of our day.

I suggest dialing back the passion a bit. With Paul Krugman joining the chorus, the idea that we are at least close to recession is I think a mainstream opinion.

I do not believe the economy has been in recession in either Q1 or Q2. I agree with your comments on GDP. Further, the NBER has *never* called a recession while both industrial production and nonfarm payrolls which (pending revisions) they both were through May.

But while I believe the best reading of the broad data remains that the economy is expanding weakly, my second choice between mild recession and moderate expansion would be mild recession. The consumer makes up 70% of the economy. A negative YoY real retail sales reading has been a very good indicator of recession with no false negatives and only a few false positives going back 75 years – and for the last two months they have been negative. I have discounted that because the year-ago reference period is the spring stimulus spending spree of 2021, but even measured since last October they have basically been flat. Real personal consumption expenditures are also flat measured from last October.

I also disagree about the new orders subindex of the ISM manufacturing index. It is one of the 10 components of the Index of Leading Indicators and also has a 75 year track record. It also has some false positives, but usually if it falls below 50 and remains there, a recession has started within 6 months. But on three occasions – 1950, 1974, and 2007 – it did not fall below 50 before the first month of the recession.

No single indicator is perfect. And I specifically disagree with the over-reliance on gas prices as a single indicator (in fact, by my favored metric, gas prices divided by average hourly wages we haven’t quite crossed into oil price shock territory).

But the Treasury term spread is now the *only* straight positive long leading indicator, and many of short leading indicators have retreated from their peaks/troughs (ISM new orders, stock prices, average weekly hours in manufacturing, number unemployed less than 5 weeks, initial jobless claims, industrial commodity prices, US$ inverted).

Again, I don’t think a recession has already begun. One good composite measure, whether the 6 month moving average of the 6 month rate of change in the Index of Leading Indicators, hasn’t turned negative yet.

But with the composite long leading indicators so negative, so many short leading indicators weakening or even having turned negative, and even a few coincident indicators essentially flat, I suggest dialing back on dunking on those whose views are after all a little more negative than the mainstream.

The problem with this new deal is the economy overgrew in 2020-21 due to covid packages. Your lover, real retail sales chart is still above the pre-covid trendline.

NDD,

I have considerable regard for you economic writing, but feel free to keep any advice about ” passion” to yourself. There is a purpose to what I do.

I don’t know if you bother to keep up on who has written what in comments here. Certainly there is no requirement to do so. If , however, you want to correct my views on the economic outlook, you need to familiarize yourself with those views. I have expressed concern about recession risk for some months. I have discussed a number of the indicators you now see fit to lecture me about.

Other commenters here have declared us to be in recession now, because of consumer confidence, petroleum demand, petroleum prices, public polling and such. Many of these same commenters have made clear that they want to blame one political party – the one in your on-line monicker – for all the problems in the world and have shown themselves eager to spread the notion that the U.S. is in recession now, ahead of the November elections. I have not seen you lecturing them. For that matter, I have not seen you lecturing our host when he informs those same trolls that they have their economics wrong, not that I’d recommend it.

For some of us, economics is more than just a dry exercise. Economics informs policy and policy is made through politics. You are not required to take sides. However, since you have seen fit to tell me how to behave, I will do likewise; Stay on the sidelines, or don’t. The occasional drive-by critique means you’re in the brawl, even if you want to stay out.

MD finally make a meaningful statement: “For some of us, economics is more than just a dry exercise. Economics informs policy and policy is made through politics.”

The result of those policies are evident in today’s economy. Do you agree or not?

You got no bites so you took this garbage to the next post’s comment section? CoRev – our favorite little troll.

Liberals/Dems here, the tone and tenor of the articles and comments lately point to your fear of a recession being called just before the elections. Conservatives do not: ” want a recession. The grown-ups keep explaining about what recessions are and how to know i you are in one or likely to get into one, but some of you kiddies just can’t stand it you want a recession!!!” Nor are we kiddies, but many of us are pragmatists versus ideologies.

Conservatives do not trust governments. Liberals/Dems seem to trust inherently in government. Liberals/Dems also seem to not understand or be taught history. If they were they would be conservatives. The conservative corollary to this observation is that many if not most conservatives do not trust Liberals/Dems and their policies.

Another observation for why Liberals/Dems are so emotional/angry lately is that sandwiched between the past two Liberals/Dem presidents has been a conservative. The actual comparison of results from the implementation of the two sets of policies is evident to the most casual voter. These voters don’t need to look at the minor internals of economic progress s they have inflation and threats of a (if not an actually occurring) recession for comparison.

If the polls are any where close to representing the voters feelings, the next elections will show which policy sets are the winners. The economic results are already obvious.

Understanding how ugly bad your for years proposed policies are must be dishearteningly mind numbing. Certainly several commenters here appear mind numbed.

CoRev,

Oh hilarious. “Liberals/Dems ,,,seem not to understand history, if they did they would be conservatives.” Really? I have not seen you exhibiting much knowledge of history here, wrong about all kinds of things. You want to claim you know more history than I do? You want to have lots of people here laughing very loudly, probably even including a few of the “conservatives”?

CoRev: all knowing, all seeing self styled master of history, economics, agronomist, climatology.

In his own words, a “Citizen of the world”. He’s no blip on the knowledge radar. Just ask him.

CoRev “Friend of the soybean farmer”

https://thehill.com/policy/finance/417803-us-farmers-letting-crops-rot-as-storage-costs-rise-due-to-china-trade-war/

I believe that was what CR termed a “blip.” As Dr. Phil might have asked the farmers who then had to depend on government bailouts, “How’d that work out for ya?”

Funny because CR said he doesn’t trust the government that doled out billions to save those farmers who were waiting for the end of the, uh, blip.

Funny, I seem to remember you loved donald trump

https://www.acslaw.org/expertforum/trumps-unconstitutional-view-presidential-power/

https://www.washingtonpost.com/opinions/2020/08/10/trumps-executive-actions-are-overreach-next-president-will-likely-do-worse/

https://www.youtube.com/watch?v=o3hrN0cP58Y <<— 4 minutes

https://www.politico.com/news/2022/06/30/jan-6-hutchinson-meadows-mystery-messages-00043638

“Hutchinson told the committee at the time that, on the eve of her earlier March 7 deposition, an intermediary for former White House chief of staff Mark Meadows contacted her to say that her former boss valued her loyalty.”

“[A person] let me know you have your deposition tomorrow,” read a slide that the Jan. 6 committee broadcast at the end of Hutchinson’s hearing, which Vice Chair Liz Cheney (R-Wyo.) characterized as pressure on a key witness. “He wants me to let you know that he’s thinking about you. He knows you’re loyal, and you’re going to do the right thing when you go in for your deposition.”

“I think most Americans know that attempting to influence witnesses to testify untruthfully presents very serious concerns,” Cheney said after presenting the messages. “We will be discussing these issues as a committee and carefully considering our next steps.”

Imagine, the person who is your Chief of staff, has his own Chief of Staff (Hutchinson), and you pretend you “don’t know her”. But before her testimony, trump asks Meadows to get an intermediary to threaten her not to testify.

CoRev you’ve made it clear on this blog that donald trump is your hero, but you claim you’re not trusting of government?? It sounds like you are kind of like the dope motorcycle rider not wearing a helmet, telling the guy in the car he needs to put his safety belt on.

Corev, I dont need a lecture on reality from somebody who believes in ghosts and ufos.

Wow – if word salad were counted in GDP, you just guaranteed we would avoid a recession. I would ask if there is a real point in all of that but we know you never provide one. Ever.

CoRev You’re right that many intelligent voters (i.e., liberal Democrats) are worried that a recession could result in a big GOP victory. The GOP has always appealed to downscale, low IQ voters who are easily persuaded by the rantings of Sean Hannity and his ilk. It’s an unfortunate truth that half the electorate has an IQ under 100 with little to no understanding of economics. You’re a prime example.

You mentioned history. Well, if history has taught us anything it’s that a GOP Congress will flirt with defaulting on the debt, as they did during the Obama years. The difference between then and now is that back then there was at least a handful of more-or-less sane Republicans who saw the foolhardiness of defaulting on the debt. But the post-Trump GOP is too crazy and too ignorant to be trusted. Afterall, Donald Trump made a career out of defaulting on personal debt. Other than cutting taxes for the rich and defaulting on the debt, what economic policies do you think a GOP Congress would pursue.

As to that “president” in-between Obama and Biden, what Democrats and Independents fear most was revealed in all its shameful antics on January 6th. We saw an unhinged sociopath on a rampage who couldn’t accept the reality of having lost an election. As even the Washington Examiner admitted, Trump is unfit to serve. But yet you still won’t admit that Trump was a disaster for the country. Face the facts. You voted for and still support a megalomaniac with a Napoleonic complex. The big difference being that at least Napoleon had genuine talent. Your support for Trump and the Proud Boys tells us just about all we need to know about what you would demand from a GOP Congress.

2slugs finally admits: “CoRev You’re right that many intelligent voters (i.e., liberal Democrats) are worried that a recession could result in a big GOP victory.”

I should have probably lead instead of just closed with this: “Understanding how ugly bad your for years proposed policies are must be dishearteningly mind numbing. Certainly several commenters here appear mind numbed.”

CoRev Funny that you didn’t include the very next sentence: The GOP has always appealed to downscale, low IQ voters who are easily persuaded by the rantings of Sean Hannity and his ilk. In case that was too subtle, I was talking about you.

And I’ll note your silence regarding Trump’s sedition and his Proud Boys minions. I suspect that if Putin were on the ballot you’d volunteer to be his campaign manager.

Trump’s sedition? Sounds just like more Russia, Russia, Russia.

Rating for the hearing are abysmal. Let’s compare rating after the election.

Still your fondest policy wishes are being implemented. I do remember you saying Biden hasn’t quite met your expectations re: energy policy.

You had plenty of opportunity to tell us which of Biden’s policies are successful. I’ll wait for you to enlighten us.

@ CoRev

“You had plenty of opportunity to tell us which of Biden’s policies are successful. I’ll wait for you to enlighten us.”

All of the regulars here know you are a very dumb man. But I’m gonna give you the benefit of the doubt CoRev. Click the link I give below, then click on the button near the upper right that says “5Y” (that’s 5 year for dumb people). Is anything dawning on your soybean sized brain there CoRev??

https://fred.stlouisfed.org/series/UNRATE

https://www.c-span.org/video/?c4979010/president-biden-receives-covid-19-booster-shot

CoRev,

Uh oh, MR. I Know History. Wrong, Wrong Wrong. The Jan. 6 hearings have been getting massive ratings, especially Hutchinson’s, even though Fox News is not showing them and Trump is as usual lying that they are not getting good ratings. With your “Russia, Russia, Russia” bs you show that you get your information from Trump, caught lyingover 30,000 times in his presidency. Senate Intel comm plus Mueller Report showed Russia stuff was very real. You really have become a pathetic Putin troll.

CoRev, a supposed conservative, apparently would join Gen. Flynn in taking “the 5th” on the importance of the peaceful transfer of power, preferring instead to suggest the storming of the capitol was no more than idle, unproven gossip. (Russia. Russia)

Worse, this conservative who doesn’t trust government—but who should be a fan of law and order—rejects the findings of multiple courts in multiple states staffed by justices of multiple political persuasions. He prefers instead the unhinged (and proof deprived) antics of Giuliani, Powell,Bannon,Eastman and the rest.

Then the best comment of all: ratings for the hearings are down as if the search for truth depended on those viewing the proceedings rather than on the evidence presented in the hearings.

That’s some conservatism you got there, CR. Long ago, I read Barry Goldwater’s “Conscience of a Conservative.” You could really use a conscience and an understanding what it means to be a real conservative.

Moses, you have repeated Barkley’s response re: unemployment, but can you tell which policy was responsible? From the chart it looks like a continuation of the Trump policy which was at a lower rate than Biden’s. That is with exception of the Covid recession.

Masking and vaccines you moron, that’s why I put the C-Span link up. But I forgot you need things spelled out for you like a child. Along with the fiscal spending bills.

Here’s some other news for you SoybeanBrain:

“An audience of at least 20 million people watched the first prime-time hearing of the House Select Committee’s investigation into the Jan. 6 attack on Thursday night, according to Nielsen.

By scheduling a congressional hearing for 8 to 10 p.m., committee members and Democrats were hoping to make the case to the biggest audience possible. ABC, CBS and NBC pre-empted their prime-time programming and went into special-report mode to cover it live.

Though the Thursday night figure pales next to presidential debates (63 million to 73 million) or this year’s State of the Union address (38 million), it’s still much larger than the audience that would normally watch a daytime congressional hearing. And it’s in the ballpark of television events like a big “Sunday Night Football” game or the Macy’s Thanksgiving Day Parade.

ABC attracted the biggest audience, with 5.2 million viewers. NBC and CBS each had an audience of more than three million. MSNBC averaged more than four million, and CNN drew 2.7 million. (The 20 million figure did not yet include PBS, so the total audience was most likely a bit bigger.)

Viewers who tuned in mostly stuck around for the entire congressional proceeding. Viewership on each of the broadcast networks remained steady between 8 and 10 p.m., according to half-hour Nielsen breakdowns.

While the broadcast networks gave up their prime-time entertainment offerings and CNN and MSNBC gave the hearing wall-to-wall coverage, there was a conspicuous outlier among the cable news networks. Fox News, the most-watched network in cable, did not carry the hearings live, instead sticking with its usual prime-time lineup.”

https://www.nytimes.com/2022/06/10/business/media/jan-6-hearing-ratings.html

Good lord, CoVid! Do you really thing NBER is going to announce a recession before the elections? Do you have any idea the typical period between recession’s end and NBER announcing the timing of the recession?

Nobody who actually know how things work is worried about a recession being “called” before the elections. The worry is that ill-intentioned hacks like you will spread recession talk ahead of the election in an effort to scare voters. That’s why I point out your lies about recession timing.

I’m happy to believe you don’t know how NBER determines recession timing. I’m absolutely certain you don’t care. For you, the truth doesn’t matter.

MD, just smiling at the desperation and denial.

Maybe you can add to that ole list of successful Biden policies.

many of us are pragmatists versus ideologies.

You pragmatic? When Webster defines ideologues – there is a picture of CoRev right next to the definition.

I just saw a story noting how beer prices have not risen that much even if the cost of hops are rising. I am grateful I can buy a six pack of Samuel Adams at a decent price but I was curious as to the financials for Boston Beer. For 2021 their net sales finally passed $2 billion but their operating margin was less than 1%. And that is before Putin invaded Ukraine. Their 10-Q for the 1st quarter of 2022 showed an operating loss.

So expect beer prices to rise alas. At least gasoline prices are coming down. And running Putin’s pigs out off of Snake Island might help. After all I refuse to switch to Budweiser. YUK!

The other day i saw beer up about a dollar per 12 pack.

@ Baffling Quiet you heretic!!! Or you will be deported!!!! The Great Oz is talking to you from behind the curtain!!!!! [ cue deafening thunder sounds ]

I’m getting the large cans of brand name 8% alkyhawl for $2.58 a can (again the large tall can). You think that’s bad compared to about 3 years ago?? “relative respected” (not premium) 1.5 liter wine, roughly 12% alkyhawl for $9–$12. Again, I’m not noticing a difference there yet. And trust me, I’m looking/watching.

Then again, i mostly drink imports from ireland and mexico. Or whatever the special is on tap at bw3. Used to have a locally brewed pilsner, but they went under. And any good hefenwiezen you want to put in front of me.

Modelo is really good but there is a local Brooklyn microbrew that is making some excellent beers.

We keep wondering why America has become so inefficient. I think this is a good example of what “free markets” in America have become. It’s no longer about providing the best possible product or the best price. It’s about suckering the functionally illiterate:

https://www.contxmedia.com/dominos-pizza-50m-on-ads-bragging-about-100000-donation/

I can go down to my grocers, get a pizza between $2.75 and maybe $5.50 (my $5.50 example is like Menzie’s model set-up for Kopits). Places like dominoes think that a pizza for $7 is a “great deal”. They spend $50 million in marketing to brag about only $130,000 they gave to local business in THE ENTIRE NATION. So tell me, what does that $50 million in marketing add to American efficiency (resources and time wasted for what??)?? Who in America didn’t know you can get a grossly greasy sub-bar pizza at Dominoes for $7+tax?? Who exactly didn’t know that?? Where was the “asymmetric info” in that transaction??

“Good guys with guns” win again

https://www.yahoo.com/news/several-police-officers-wounded-eastern-052252084.html

“To protect and serve”

“As a Law Enforcement Officer, I do solemnly swear that my fundamental duty is to serve the community; to safeguard lives and property; to protect the innocent against deception, the weak against oppression or intimidation, and the peaceful against violence or disorder; and to respect the constitutional rights of all people to liberty, equality and justice.

I will keep my private life unsullied as an example to all and behave in a manner that does not bring discredit to me or to my agency. I will maintain courageous calm in the face of danger, scorn or ridicule; develop self-restraint; and be constantly mindful of the welfare of others. Honest in thought and deed in both my personal and official life, I will be exemplary in obeying the laws of the land and the regulations of my department. Whatever I see or hear of a confidential nature or that is confided to me in my official capacity will be kept ever secret unless revelation is necessary in the performance of my duty.”

Remember, the “men in blue” are 100% C-L-A-S-S. Don’t ever forget it folks.

https://www.yahoo.com/news/family-vancouver-cop-died-suicide-203637736.html

We have been conned and propagandized for decades to the lie that Republicans are “business friendly”. Does this trike the typical American reader here as “business friendly”?? This is so anti-business I think Democrats would be wise to take the offensive and run political advertisements on this. Take the initiative and take the offensive for once in their lives, instead of laying back for the next attack by Republicans:

https://apnews.com/article/biden-technology-health-congress-climate-and-environment-0cec1d533e7b9ea99927656f83e6589b

Is that a tenable position for Republicans??~~”We are going to obstruct one pro-business piece of legislation by obstructing another piece of pro-business legislation”. Are Democrat party strategists going to pounce on this in TV campaign adds, or, like usual, slouch back sloppy in the ice cream parlor booth like Pelosi???

“Let me be perfectly clear: there will be no bipartisan USICA as long as Democrats are pursuing a partisan reconciliation bill,” McConnell tweeted, referring to the shorthand name for the computer chips bill that passed the Senate last year.

I think McConnell is afraid we might ask his fat cat friends to pay a wee bit more in taxes to cover this needed expenditure. After all he sees the only good tax is a tax on the poor.

Not sure why we have this huge concern for whether we truly are (or not) in a recession. Why would we care whether we are just on one side or just on another side of the mysterious and poorly defined line called for a recession. For those who define it as two quarters of negative GDP in a row tell me what difference it makes if we have two quarters of 0.1% positive or 0.1% negative growth? There are parameters going into GDP that are of little consequence for economic “feeling” of regular people. Who cares if inventories are increasing or decreasing – some for export/import balance. Most people just care about the big one – consumer spending. A recession based on reduced consumer spending numbers feels bad, whereas one called in spite of increased consumer spending is a nothing burger for the burger flippers. A recession called when everybody can find a new job is different from one when most people go over 6 months without being able to find a job if they lose the one they have.

Ivan,

Actually what people care about is employment, especially theirs, along with their real income. Inflation has been damaging the latter for lots of people, which is why Biden’s popularity is low. Whether or not we are officially in a recession or have had two quarters of negative GDP growth will not matter to people at all if employment remains strong, which, so far it appears to be doing. If we are in a recession, it is certainly a very strange one.

As it is, it looks that if GDP declines the more important driving force will be a sharp decline in investment. I do not know if the negative projections on that are just for fixed private capital formation, the largest part of investment, or all of investment, which also includes residential construction and net changes in inventories. Again, there is reason to expect the latter to be rising for Q2, but perhaps not enough to offset other elements of GDP that appear to be declining.

By this line of reasoning, if 55% of the population thinks we’re in a recession, we’re probably in one. And that’s what they think, with consumer sentiment also at all time lows per the Michigan survey.

90% of the population is in favor of balancing the budget annually. Look dude – if you are this desperate to go back on Fox and Friends, call them as your BS is insulting here.

Of course, that line of reasoning would be wrong.

Steven Kopits If you’re a voter, then it probably doesn’t matter, just as it doesn’t seem to have mattered to voters that Reagan’s economic performance wasn’t anywhere near as great as the legend. Voters are gonna believe what they’re gonna believe. But if you’re an economist, then the definition of a recession matters a lot. This is an econ blog despite the occasional pollution from some clueless MAGA types, so it’s entirely appropriate to use the NBER definition of a recession.

38% of the population thought the economy was in recession of January 2000. When gas prices plunge this late summer Kopits, what then????

Source?

YOU asking for a source? You routinely makes claims with zero basis in reality providing no source whatsoever.

Well, SK, a fairly substantial majority of Republicans believe the 2020 election was stolen. Based on that line of reasoning—no matter the reality—it probably was?

“The number of people overall who believe the election was fraudulent has hovered around 35% since November 2020, but this percentage has not increased significantly as the claim purports.”

https://www.politifact.com/factchecks/2022/feb/02/viral-image/no-most-americans-dont-believe-2020-election-was-f/

55% of the US public in total believes were in recession, including independents by a margin of 55:21. If independents thought the election were stolen by that margin, I would say that there were probably substantial substantive problems with the election process. But they don’t, because there weren’t.

In the current case, most Americans thought we were in recession a month ago, and given that a recession is comprised of the aggregate experiences of the public at some level, that a notably majority should think we are in recession can be taken, at the least, as a measure of elevated economic stress in the country, and at the worst, as a recession.

Since you never bothered to open a single economics text book, I guess we should not be surprised that you use the political polls to judge economic conditions. I would say this proves you are a VERY STUPID person but everyone here already knew that.

I said Republicans, not all voters. Politifact: ‘About 70% of Republican voters suspect election fraud.” That’s what’s shown in various polls: Quinnipiac, CNN, UMass Amherst, WaPo, Economist/YouGov..

Again, using your line of reasoning, election fraud is accepted truth by a majority of Republicans. Does that make it so? Maybe in the alternate facts universe, but notin the real world.

“Well, SK, a fairly substantial majority of Republicans believe the 2020 election was stolen.”

Stevie?

““The number of people overall who believe the election was fraudulent has hovered around 35% since November 2020”

Stevie’s ability to READ is almost as pathetic as his ability to WRITE.

Dude – stop bloviating until you take the time to READ what others have written.

Steven,

Yeah, 55% of population thinks we are in a recession, but it is probably because they do not like inflation cutting their real wages. They do not actually know what a recession is. Do they think we are in a recession because they or people they know are losing jobs or having trouble finding them? So far that has not happened yet. May, but not yet. Still one of the hottest job markets ever.

“They do not actually know what a recession is.”

By now – even you have to concede that Stevie has no clue what the term recession even means. No clue at all.

ANSWER: Because if we don’t make a big production of this word, “recession”, the economics profession doesn’t have to face the fact that there’s a significant percentage of people in this world that just don’t give a crap what economists think:

https://www.wral.com/who-decides-if-the-us-is-in-a-recession-eight-economists-youve-never-heard-of/20354674/

It also fills newspaper space so that people who subscribe to “FT” don’t realize they’re mostly getting screwed over at $629 subscription rate per year to read TBTF banker propaganda and how oligopolistic price mark-ups are “wild fire out-of-control” “inflation”.

Eight White economists you’ve never heard of?

Oh wait – our Usual Suspects want a Supreme Court made up of only 8 white guys and their token black Clarence Thomas.

In fact, I don’t mean to give the NBER BCDC that rough of a time, I only hope to temper their egos a little, and maybe even some economists’ near blind religious devotion to them.

But, is it not interesting that you have 9 Supreme Court justices and 8 BCDC members. 2 of 9 of the justices are Black= 22%. 4 of the 9 Supreme Court Justices are Women= 44%. This is on a conservative court. So, 2 of 8 women for BCDC 25%. 0% Blacks. 0% Asians. I would think that might make the NBER (assuming James Poterba isn’t running the NBER Putin style) to take a couple steps back as they look at the picture, and reassess how those optics make them (or specifically how it makes Mr James Poterba look) in the year 2022?? I think to college age people, it makes Mr. Poterba look~~at best like a dinosaur~~at worst like~~you fill in the blank. Like the word Recession, one descriptive noun that pops into mind begins with an “R”.

Moses Herzog: If BCDC were addressing issues of policy, diversity in all dimensions would be good. If it’s the technical question of timing a business cycle, I agree diversity is good — the question is what kind of diversity. Here I’d say intellectual diversity is important. Skipping the ones who have been on since 1978, I see 2 macroeconomists, 1 economic historian (with Bob Gordon also having a call on being an economic historian as well), and 2 time series econometricians (Poterba’s specialty is public finance, but I assume he’s there in ex officio capacity). Seems like a pretty good mix there.

Like I said, I don’t wanna be too harsh. They are all probably well-intentioned and very capable individuals. But my two suggestions would be thus. 12 seems like a nice round number yes?? You could “grandfather in” current members so no one gets their feathers ruffled. Open up 4 new memberships for your BCDC. Maybe 3 of the 4 new committee memberships women, with a strong tilt to American based minorities (East Indian, Southeast Asian, Black, and maybe Latin, although I know some view Latin as “white”. Purple people, who cares??). Then (again outside of those “grandfathered in”) you put a 10 year limit on terms, with maybe individual terms “reviewed” every two years.

Let’s say a person/economist loves BCDC and feels they do a admirable job. (As an obvious layman I’m relatively neutral on it, it’s not like I think they do a horrible job defining recessions by characteristics or timespan). But even if you love BCDC, the optics are pretty bad to have mainly “a bunch of old white people”. And I think you know by now I’m not exactly a person obsessed with “PC” or “wokeness”. But even I gotta say 8 out of 8 looks pretty bad, and I’m not even gonna touch the married couple thing, which has a faint smell of cronyism to it.

One of the thingies I am reading, I won’t give the source as I am not 100% this is ok to share, is that Europe will lose 2/3rds of it’s natural gas supply from Russia and that would in turn would mean a 100 bcm loss total (40 bcm lost in addition to the 60 bcm already lost). They said this was their most probable storyline. This would make for a pretty rough winter for Europe. They said a lot of this could be responded to with a gas-to-coal substitution. They have another worse case storyline where Europe then has to turn to “demand destruction” and more pricing pressures on coal.

You know Menzie had mentioned Ahmad’s tool with foreign yield curves. If these things kind of invert Europe’s yield curve, or however you want to look at it, in the current context this might make Ahmad’s finding on foreign yield curves more “relevant”, based on the fact energy pressures in Europe could/would certainly increase recession chances in America. That’s not a prediction on my part, just saying you’d have to think that increases the chances of American recession.

I know I go on a bit about financial risk, but with the Fed hiking, borrowing costs up sharply and spreads widening, we don’t need any sudden additional shocks.

Europe’s troubles involve a good bit of uncertainty. Not only is Russian behavior uncertain, but we don’t know where all the weak links in Europe’s economy and finances are. A sudden shortage of Euros, banking trouble, money maket plumbing issues – any of those could spill over to the rest of the world. Fuel shortages could be the trigger, but the fastest transmission of shock is usually financial. Fast like before we have time to wake up that morning.

Borrowing costs up sharply…..not really. Normalization of assets.

As MD says: ” Fuel shortages could be the trigger,” and this is a self made trigger. A policy Biden is blindingly following and which most of you support in trying to save the world. But who is saving the people from the world savers?

The dumbest thing ever written has to be repeated thousands of times. Hey CoRev – keep reminding us that you own the award for STUPIDEST MAN ALIVE!

@ Macroduck

It’s interesting how the Russian aggression into Eastern Europe has caused “fragmentation” to surge back into the lingo again.

I am certain many people will tell me I’m wrong and blather on about how Lagarde is an incredible woman, but after her fiasco handling of the Greek debt crisis, if fragmentation of the debt indeed becomes an issue, nothing I have seen from her makes me believe she is up to the task. The reverse in fact.

Moses,

Lagarde was nor ECB president at the time of the Greek crisis. Not on her plate all that much.

The Greek debt crisis was over multiple years, Lagarde was very much involved with at least two (of three) of the bailouts, and the terms of the bailouts. Every time you desperately attempt to “correct” me you only embarrass yourself. Take your shit-show over to CoRev, Bruce Hall, and your “BFF” Kopits. You need to find someone at your same basement level IQ. Is there a grade school near your house?? Go on the playground and explain to the first graders how Russian soldiers lined up along another nation’s northern border are playing Uno.

Anyone can do a Google search “Lagarde Greek debt crisis”. I guess the PhD who can’t copy/paste links has now lost his ability to Google search.

I finally figured out why Menzie tolerates my nonsense on this blog—to correct all the Virginia s***-head’s errors in fact.

Moses Herzog: Lagarde and IMF clearly made mistakes – see the IEO’s report. However, I do wonder how much more the IMF could’ve done given EC intransigence (given the stakeholders, understandable) position on restructuring and on size of packages.

Yes, that’s a very fair and astute point. Even Yanis Varoufakis (not exactly an IMF/EC cheerleader) had said what you are saying (or near to such), mentioning that Lagarde and Draghi were between a rock and a hard place.

But….. she seems more interested in scarves and the appearance of being a technocrat than the hard details. She was busted multiple times contradicting her own staff (you can read David Marsh’s editorials on that at Marketwatch).

https://www.yanisvaroufakis.eu/2015/08/04/vindicated-while-lagarde-emerges-a-loser-david-marsh-in-marketwatch/

But she has made multiple gaffes, some of them one might argue some of your undergrads wouldn’t make Menzie. Recent example, March 2020 AFTER she moved over to the ECB:

“…… but we are not here to close spreads . This is not the function or the mission of the ECB. There are other tools for that, and there are other actors to actually deal with those issues.”

https://www.ecb.europa.eu/press/pressconf/2020/html/ecb.is200312~f857a21b6c.en.html

WOW….. Menzie, that statement is as dumb as it gets. What does she think ECB does?? What does she think the ECB’s Pepp “anti-fragmentation tool” is all about?? She thinks Pepp is about lowering CO2 levels?? She’s in for “real fun” over the next 2-3 years if/when Mario Draghi loses to the populists and she doesn’t figure out what Pepp is for and HOW she is going to get it to do what it should be designed to do~~get it to work. And that has nothing to do with fashion or what color scarf Lagarde put on that day or getting on 3 European air flights per day.

Uh oh, another powerful woman has joined the list of those that Moses Herzog irrationally hates. Lagarde’s scarves now join Pelosi’s ice cream as signature items for hate-filled ridicule.

One possibility is that the Russian army collapses before winter. Russia has pretty much exhausted its supply of modern missiles. There are UK reports that almost two-thirds of Russian missiles are duds and those that aren’t duds are apparently missing their targets by a wide margin. And how much life is left in Russian artillery that’s been operating near the Full Equivalent Charge threshold? If NATO can speed up delivery of some frontline weapons, the Russian army might be toast before next winter.

2slugbaits,

Hopefully you are correct about Russian army collapse since Russian cannon shells and missiles are reducing Ukrainian cities and shopping malls to rubble. I think Putin’s strategy is if Russia can’t defeat Ukrainian forces in the field, then destroy its cities and shopping malls even if missiles are perhaps not accurate as you mention. Can we talk about evil insanity that many of us thought ended in Europe with WWII? My uncle volunteered with the first group of 506 PIR attached to the 101st and made it back to the USA after participating in Normandy, Market Garden and Battle of the Bulge where he like others endured frozen feet, but no other physical wounds. Band of Brothers was Company “B” he was part of Company “D”. I wonder what he would think if alive.

AS, I had an uncle who participated in the Battle of the Bulge and lost toes. I too wonder what he would think if alive.

“Why can’t my nephew read above a 4th grade level?? This has ended up being a bad trade. God, I want my toes back now.”

US blows Russia away in terms of gas. Overproduction is looming.

You do know that is very expensive to convert natural gas into LNG and then ship it to Europe I hope. Our host has discussed this before so please pay more attention.

I should have spelled his name Ahmed. I’m sorry for that. No disrespect intended.