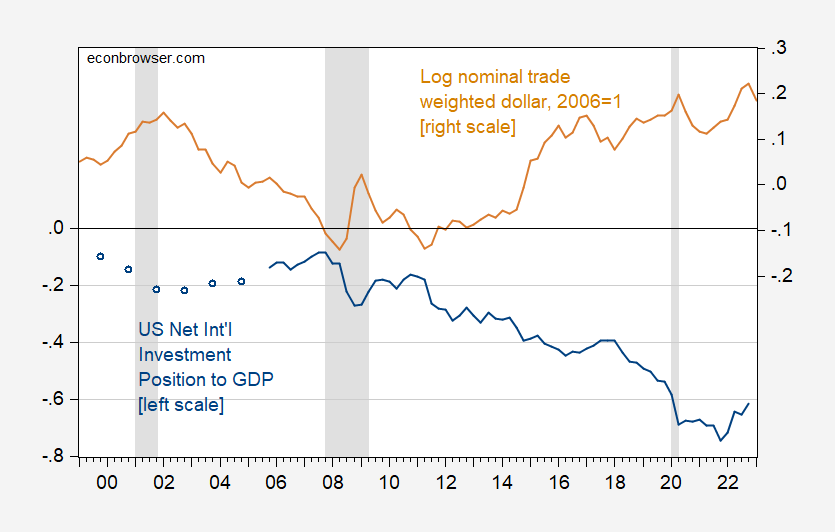

Larger and larger gross cross-border holdings lead to bigger swings in the NIIP to GDP ratio.

Figure 1: Net international investment position to GDP ratio (blue, left scale), and nominal value of US dollar against broad basket of currencies (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Federal Reserve via FRED, NBER, and author’s calculations.

This is because US assets held abroad are denominated in foreign currency; expressing everything in US dollars incorporates those swings in the dollar’s exchange rate to asset valuations.

For more discussion of the US NIIP, see this discussion of a CBO working paper.

I’m curious if the “dark matter” issue persists:

https://apps.bea.gov/papers/pdf/GEI_DarkMatter_Kozlow.pdf

Perspectives on “Dark Matter”

There has been a large amount of recent interest in how the United States can be the socalled world’s largest debtor nation and at the same time have a persistent surplus on income in its balance of payments accounts. This is not a new question. The U.S. net international investment position first turned negative either in the mid or late 1980’s (depending on which method is used to value direct investment positions in the United States and abroad) and has remained negative ever since. In contrast, the annual balance on investment income has persistently been in surplus (although it has been negative from the fourth quarter of 2005 through the second quarter of 2006, reflecting the most recent 3 quarters of data). Based on BEA’s published data, two factors explain the incongruence between negative net investment positions and positive income balances. First, there is a difference in the composition of U.S.-owned assets abroad compared to foreign-owned assets in the United States, with direct investment being more heavily weighted in the former than in the latter. Second, U.S.

investors earn a much higher rate of return on their overseas assets, particularly on direct investment abroad, than what foreign investors earn on similar classes of assets invested in United States.

Yes this was a 2006 paper. I put a few updates on this issue over at Econospeak but it has been a while. Does anyone know if there is an update on this issue?

In other words, current swings in the NIIP/GDP ratio can be viewed as a measurement issue if I understand correctly.

On a personal note, it was bittersweet reading Barkley Rosser’s comments in the September 28, 2021 blog post.

I would be curious to see the net corporate profits to GDP ratio updated for 2022 and 2023 when the underlying data is eventually released.

I would be most curious to see time series of corporate profit flows from countries such as Venezuela and Russia that have been hit by US economic and financial sanctions. The underlying hypothesis is that US-sponsored sanctions are not only largely ineffective in regards to stated policy goals but costly to the US economy.

Sorry, whose underlying hypothesis? Some hypotheses are worth more attention than others.

Great question. I suspect you’ll get either no answer or a very poor answer.