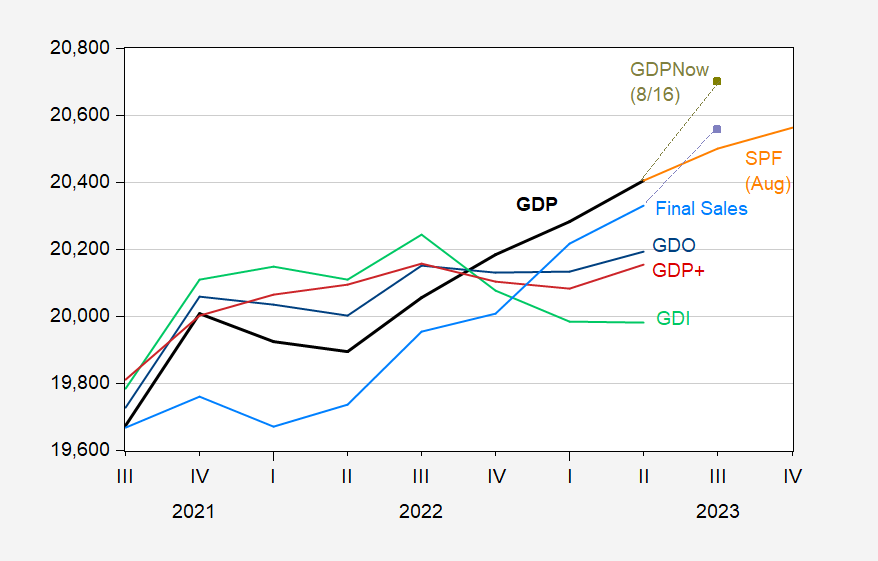

To see how dramatically this bean counting approach deviates from consensus, consider this graph:

Figure 1: GDP (bold black), GDPNow as of 8/24 (chartreuse square), GDI (light green) GDO (blue), GDP+ (red), final sales (light blue), final sales GDPNow as of 8/24 (lilac square), Survey of Professional Forecasters August survey median (orange), all in bn.Ch.2012$ SAAR. GDO assumes net operating surplus drops $100 bn SAAR in Q2. GDP+ level GDP+ growth rates iterated on 2019Q4 GDP. Source: BEA 2023Q2 advance, Atlanta Fed (8/24), Philadelphia Fed (7/28), Philadelphia Fed, and author’s calculations.

GDI is not available for 2023Q2, but all but one major component of GDI (net profit) is reported. Assuming net profit falls by $100 billion (SAAR) in Q2, I estimate Q2 GDO in Figure 1.

Note that final sales are also forecasted to be rising, so the outsized GDP nowcast is not primarily due to inventory accumulation. Over half of the growth is attributed to consumption growth.

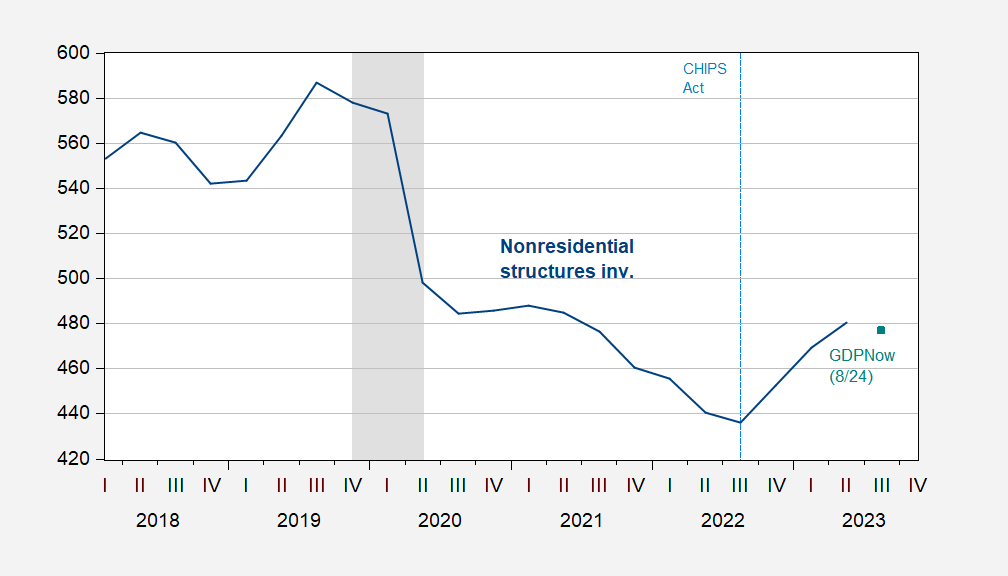

One interesting aspect of the results is the (predicted) end of the nonresidential investment boom.

Figure 2: Nonresidential fixed investment in structures (blue), and GDPNow of 8/24 nowcast (teal square), all in bn.Ch.2012$, SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Atlanta Fed (8/26), NBER.

“GDI is not available for 2023Q2, but all but one major component of GDI (net profit) is reported. Assuming net profit falls by $100 billion (SAAR) in Q2, I estimate Q2 GDO in Figure 1.”

When will see net profit reported. As you know – assuming that it will continue to fall goes against everything JohnH has been saying about profits – even if Jonny boy is cheering weak GDI growth for some odd reason.

Even if profits decline a bit, corporate profit margins will still be near record levels, several percent above any margins seen before the pandemic…a result of corporate price gouging.

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

Apparently such a decline spooks pgl because of its potential impact of his stock portfolio.

Liar. And a predictable liar, at that.

Johnny keeps pretending to know what people think and why they think the way he says they do. If Johnny had a string position, he could argue that position. Johnny relies on made-up nonsense because he doesn’t have anything else.

So, what we have in Johnny is a guy who insists on views that he can’t support, who lies in support of his positions, who regularly takes Putin’s side in debates about Russia’s attack on Ukraine. Enjoy the show.

Dr. Chinn recently had two Russian stories. One on the ruble and the other in its declining current account. Lots of adult comments but odd – nothing a peep from Putin’s pet poodle JohnH.

I guess both discussions were over Jonny boy’s little head. But yea – when this lying clueless troll is silent, the discussions are much better.

Maybe Ducky would deign to show the honorable reader just how much of a difference $100 billion affects the profit margin. But he can’t do that, because it would validate my point that corporate profit margins would still be near record levels, several percent above any margins seen before the pandemic.

Buck Ducky (or is it really pgly?) is too lazy to do the math. It’s easier to just resort to name calling.

And while we’re at it, maybe Ducky (or is it really pgly?) could explain to the esteemed reader why it is that he is downplaying the extraordinary profitability of Corporate America and its recent price gouging?

Hey troll – why are you ducking the economic news re Russia? Are you afraid if you did – Putin would poison your dog food?

“Maybe Ducky would deign to show the honorable reader just how much of a difference $100 billion affects the profit margin. But he can’t do that, because it would validate my point that corporate profit margins would still be near record levels”

I realize you cannot even add 2 + 2 and you refuse to read the excellent discussions from Dr. Chinn but I do. And if there is ANOTHER drop in corporate profits as Dr. Chinn suggests then they would be only 85% of where they were as of 2022QII. That would be a significant decline. But of course Jonny boy does not realize that. Why? Because little Jonny boy is really STOOOPID.

Johnny, lying is your forte.. You should stick to that. This weird business of demanding that people to do stunts at your command is just weird.

Why do I need to do math for you? What does it have to do with my earlier comment, which was to call you out for lying about knowing what pgl thinks?

So no, I don’t do math stunts just because a twerp like you wants to change the subject.

“Why do I need to do math for you?” – Macroduck

The answer to his question is rather obvious – Jonny boy flunked preK arithmetic. Yea – this moron does not even know what 2 plus 2 equals.

Yea once again little Jonny boy goes off on a childish emotional temper tantrum. I guess little Jonny has to do that as he is incapable of making an honest factual contribution to any discussion.

Presumably consumption is still strong but consumers have switched from purchase of products to purchase of services (vacations etc.). I am not capable of judging how big or solid that switch is. However, if that is true then we may end up with an extra push for reducing prices of things – and further reduction in inflation. It will be interesting to follow.

Here’s one way to compare:

https://fred.stlouisfed.org/graph/?g=185YC

Still looks heavy on goods consumption in this view.

Thanks – indeed it does. Never underestimate the US consumers appetite for crap. So the main thing driving down inflation in the near future will likely be housing.

“Never underestimate the US consumers’ appetite for crap.”

Zero sarcasm, a pinch of irony~~~Hall of Fame Economics Blog comment

I have it on word from low level authorities, that humans do participate in positive and life-affirming (constructive?? rather spend the money to feed India’s hungry) activities from time to time.

https://www.space.com/india-chandrayaan-3-moon-mission-what-next

Beats East Europe war footage. Congrats India.

Thought I’d share this for any astronomy fans out there. IT’S TONIGHT!!!!!! (Thursday night)

https://www.space.com/moon-eclipses-antares-red-star-august-2023

Rascals don’t say what time. Could mean many mosquito bites waiting around.

Fortunately:

https://in-the-sky.org/news.php?id=20230825_16_100

Much appreciated Sir. I don’t keep up on these things, but for some reason this one fascinated me. The “15th brightest” star in the sky. I figure I might be able to figure it out thanks to your site link. It looks like S-SW sky at very close to 21:20—21-25 local. I mean it’s close to the moon at that time anyway, so…… I’m afraid the pretty girl next door might take me for a peeping Moses, but she’s probably got me nailed for a sicko by now anyway.

; )

The KC Fed’s Jackson Hole gathering is underway. This year’s theme is “Structural Shifts in the Global Economy”, which could have been the the theme at just about any Jackson Hole meeting ever held, but is certainly apt now.

I propose a drinking game. Every time a speaker or panel member mentions the quantity theory of money, we take a shot of Saar Goldcap. Any mention of divisia monetary measures gets a double shot.

Ready?

I wish I had some Compari in the house, then I would take a swig any time a media person asks a Fed member or a Fed person themselves brings up R* or “R star”.

Aaaaaaahh, who am I kidding?? I would french kiss the mouth of that Compari bottle for 2 minutes straight when the first person said “Welcome to Jackson Hole”

I don’t think the bastard has ever looked so magnanimously beautiful in his entire God-forsaken life:

https://images.app.goo.gl/JAMhzAG4E8SN6WXU8

He got to write down his weight rather than have a real weigh in. He claimed he weighs only 215 pounds. Seriously?

He meant 21.5 stone. Perfectly reasonable.

I had to look up what a stone was. 14 pounds. So just over 300 pounds.

I heard that the betting types had the over/under at 278 pounds. I guess you took the over!

It’s time for true confessions that are actually quite embarrassing to me (I don’t know why I always reveal semi-embarrassing things about myself on this freak’n blog, and I’m not even drinking right now. It’s like I’m Woody Allen on a couch and Menzie is my psychologist) , I weigh about 240 now (the highest I ever have in my life. I am the laziest man on planet Earth, and it’s got so bad, I am thinking of taking up Chi Running when the autumn turn in the weather comes. I’m 5’11”, but this orange ape bastard is way larger than me. He is 300lbs EASY, trust me.

I seriously doubt he’s much more than 6′-0″ tall without his lifts, either. So, one more lie on a government form. Whatever.

He looks like Churchill – if Churchill had been arrested for drunk driving. For the next decade they will be selling Mugs and T-shirts with this picture and funny sentences under it. And that will burn Trump because he will not make any money from it. As a matter of fact I hope some flaming liberal organizations will begin selling them for fund raising. Maybe as a fundraiser for specific TV election adds against MAGA candidates. “Buy this mugshot mug and support our efforts to get this [YouTube link] aired in Bobert’s district.

I like you Ivan, I do, but please don’t mention these two names in the same sentence. PLEASE.

grist for “listless vessels “

A tale of how China is not really helping Africa develop:

Doumbouya pressures Emirati firm GAC over alumina refinery

The leader of the Guinean junta has decided to reduce Guinea Alumina Corporation’s bauxite production to force the Emirati giant to respect its pledge to build a local refinery.

https://www.africaintelligence.com/west-africa/2023/06/08/doumbouya-pressures-emirati-firm-gac-over-alumina-refinery,109991962-art

Bauxite is what comes out of a mine. It first needs to be processed to come up with alumina. Alumina is next refined to give us various aluminum products. China has been consuming a lot of aluminum some of what it imports from Australia.

Guinea produces a lot of bauxite. Now one would hope Guinea would at least be the processer as well so it could at least sell alumina to Chinese refineries. But that is not how it works.

Now this particular story involves a UAE base multinational that buys bauxite from Guinea mines while the UAE does the higher value added processing and refining. And its promises to let Guinea do more than mine bauxite have not been fulfilled.

This is how this works for Chinese multinationals exploiting Ghana for their vast bauxite reserves.

Takes about 4 pounds of bauxite to produce 1 pound of aluminum. (For metric types, that’s 4 kilograms of bauxite to produce one kilogram of aluminium.)

There is thus a 4-to-1 differential in shipping cost. All else equal, mine-adjacent refining is the cheapest and least polluting alternative.

All-in costs have to take account of shipping fuel or transmitting electricity to smelt the aluminum. Here’s a look at relative energy inputs to aluminum production by region, but the Middle East is left out, so not much use to this discussion. Sorry.

Interesting point. This is why Australia refines the bauxite out of its mines. Guinea is further from China than is Australia. So it would make sense to have Guinea refine their bauxite before shipping. But remember – the Chinese overinvested in shipping so they likely want to prop up this bloated sector.

I think you nailed it. Overall processing cost in UAE must be lower to at least partially compensate for the cost of shipping the raw material to UAE. However, there could also be political considerations (a UAE company bringing jobs to UAE). I am glad they are not getting away with braking their promise. They must have forgotten to bribe the right officials.

It may be the case that Guinea has not yet learned how to efficiently process bauxite.

But couldn’t the Chinese teach them without charging huge royalty fees? After all ltr keeps telling us that the PRC is the leading good guy in the North/South debate. OK – I don’t buy her spin.

But thanks for moving this interesting conversation forward!

Guinea almost certainly don’t have the capital and technology to do the processing themselves. That is why these third world countries make deals with foreign companies to build processing plants for their rich natural resources. As a matter of fact that was the main excuse for China to demand that western countries move factories/technology to China. They did not want to be exploited, they wanted development.

Let’s back up a moment and think about what this economic performance really is. I am struggling to remember the last time economic growth approached 6% annual growth for a quarter. Maybe I’m getting old and failing to remember things, but as I recall, Mitt Romney was promising something like 4% growth forever and a day and was laughed at by people who understood the economy in a manner that didn’t just fit on a bumper sticker. The current growth rate is little short of astounding. Am I missing something here?

In the post-Grwat-Recession expansion, there was exactly precisely one quarter of real GDP growth in excess of 5% (SAAR):

https://fred.stlouisfed.org/graph/?g=187vM

In the post-Covid-recession period, growth above 5% has been more common, but that was mostly when the output gap was WIDE. Growth above 5% now really is pretty surprising.

“I am struggling to remember the last time economic growth approached 6% annual growth for a quarter.”

Well, real GDP as of 2020Q3 was a lot higher than it was as of 2020Q2. But that was quite the outlier.

https://www.statista.com/statistics/188185/percent-change-from-preceding-period-in-real-gdp-in-the-us/

Annualized growth of real GDP in the United States from the first quarter of 2013 to the second quarter of 2023

2021 had a couple of quarters with really high growth. Then again – we started off 2021 still below full employment.

@ Willie

5.9% is the Atlanta Fed forecast I think the actual is lower. Is that what you are asking?? I think your question is intelligent for whatever it means coming from me.

I felt that was part of Menzie’s point/message of the post was, He thought the Atlanta number was a tinge unrealistically optimistic. I may have misread Menzie’s point.

Nikki Haley’s Social Security idea:

https://www.msn.com/en-us/news/world/nikki-haley-claims-65-is-way-too-low-for-retirement-and-people-are-confused-we-get-12-years-of-retirement-and-they-think-that-s-too-much/ss-AA1fMkzI?ocid=msedgntp&cvid=412608bad0e54ba4a3e3ef2898b26110&ei=7

Nikki Haley claims 65 is “way too low” for retirement, and people are confused: “We get 12 years of retirement, and they think that’s too much?” Haley was called out for saying that 65 is “way too low” for retirement age, though she explained, “Any candidate that says they’re not going to touch entitlements means that they’re going to go into office and then leave America bankrupt.”

OK – Haley is full of BS. Yes there is a funding issue after 2035 but everyone with an ounce of brains and a modicum of integrity knows raising taxes a wee bit addresses this issue. But it is not just Nikki Lightweight. Krispy Kreme Chris Christie is also saying we need to cut Social Security benefits. After all raising taxes on rich people would be SOCIALISM.

Your modern Republican Party!

pgl wants news on Russia? How about this?

NY Times: “Ukraine’s grinding counteroffensive is struggling to break through entrenched Russian defenses in large part because it has too many troops, including some of its best combat units, in the wrong places, American and other Western officials say.”

https://www.nytimes.com/2023/08/22/us/politics/ukraine-counteroffensive-russia-war.html

OMG! The US proxy is not following orders from the best and brightest in Washington…reminiscent of the corrupt US proxy in Saigon!

Sounds like a lot of grumbling and finger pointing…similar to what we heard in 2004 when that misbegotten war was headed to being recognized as pointless and futile.

No dumbass – I asked to address Dr. Chinn’s two posts. Oh wait – you can’t as you are too stupid to know what they were about.

“Noneconomist

August 23, 2023 at 11:32 pm

No doubt, as I post, JohnH is hoping Seymour Hersh will prove the U.S. government was behind this to cast more blame on Putin, further tarnishing his good name and his desire to end the pointless war begun by NATO.”

Yep he has your number. Now little Jonny boy – have you not figured this out yet? EVERYONE here is mocking you. And so are the other kiddies in your preschool.

@ pgl and @ Noneconomist

I’m still kinda pissed NONeconomist is a better humorist than I am. Damn…. What up wid dat man?!?!?!?

Of course this pointless and futile war begun by Putin could be quickly concluded. Russian troops return home. Deaths and casualties cease..you continue wringing your hands to show your anti war concerns. (Everyone here gets a good laugh while you continue your usual babbling)

Economic “growth” is when GDP and the incomes of the top 10% grow nicely while incomes of the bottom 9% stagnate.

No. But thanks for posting this sour little puddle of bile. Because this is you, distilled – gnashing your baby teeth without making an actual point. Your paymasters must be so гордый.

Let’s see. Little Jonny boy looks at the top 10% and the bottom 9% and he thinks he has covered everything.

10 plus 9 equals 100 only for someone who flunked preK arithmetic.

According to the Doomsayers, we should be in a recession…now. Where is the recession doomsayers, This includes Bloomberg who was not aware of the 2008 recession nor the 2001 recession as it was happening and claimed that we were going to be in a recession this year.

Where is the accountability!