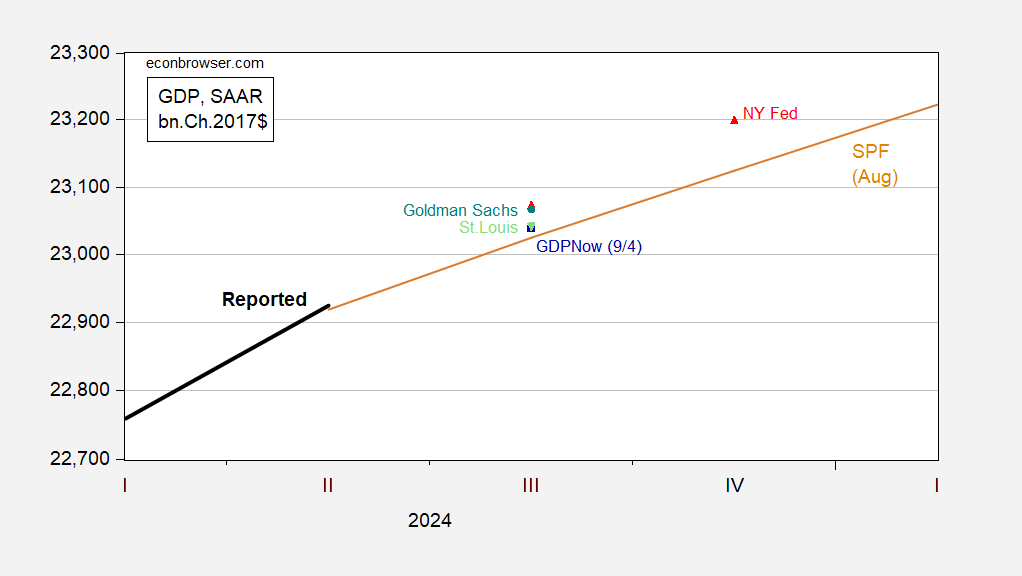

We have plenty of competing assessments as of today. From three Federal Reserve Banks and Goldman Sachs.

Figure 1: GDP (bold black), Survey of Professional Forecasters August median forecast (tan), GDPNow (blue square), NY Fed (red triangle), St. Louis Fed (light green inverted triangle), Goldman Sachs (teal circle), all in bn.Ch.2017$. Nowcasts are as of 9/6 except where noted; nowcast levels calculated iterating growth rate to reported 2017Q2 2nd release GDP levels. Source: BEA 2024Q2 2nd release, Philadelphia Fed for SPF, Atlanta Fed (9/4), NY Fed (9/6), St. Louis Fed (9/6), Goldman Sachs (9/6), and author’s calculations.

In addition, S&P Global Monthly Insights (formerly Macroeconomic Advisers) reports 2.0% growth as of 9/3, slightly below the 2.1% from GDPNow

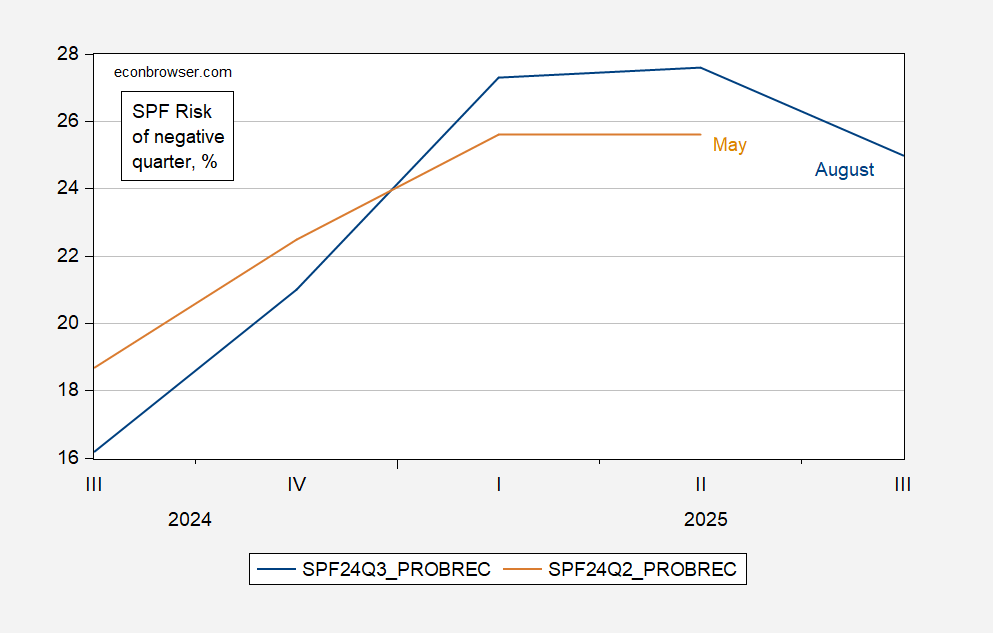

The upwards revision in Q2 GDP plus subsequent information has pushed nowcasts uniformly above the SPF median forecast (reported by early August). It’s hard to see how short horizon assessments of recession likelihoods have increased. For comparison, here are the early August forecasts likelihoods from SPF:

Figure 2: Risk of negative quarter growth, from August survey (blue), from May survey (tan), both in %. Source: Philadelphia Fed.

Recession probabilities down in near quarters (Q3, Q4), up in far (2025Q1, Q2).

Inventories could turn out to be a drag, but it doesn’tlook loke they could be a bid drag just yet. Here are inventory/sales ratios by business category:

https://fred.stlouisfed.org/graph/?g=1txaK

The retail ratio is low relative to the prior business cycle, but high for this cycle. Factory ans wholesaler ratios are fairly high relative to the prior cycle.

Inventories were an addition to GDP in Q2, but not a large addition:

https://fred.stlouisfed.org/graph/?g=1txaO

The risk of large inventory drag is reduced by the small size of the Q2 add.

NFIB, as of July, showed small firms generally I tended to increase inventories. The ISM factory inventory index jumped in July, but only to a neutral reading – no sign of a serious drag or imbalance.

I’ve seen reports that inventories are high globally. That’s a problem for everybody in the medium term, perhaps for U.S. exports in the near term.

“Inventories were an addition to GDP in Q2”

Offsetting the subtraction to GDP in Q1. See Dr. Hamilton’s post on the Q2 GDP release.

One way to think about whether the change in inventories will be a boost v. a drag on Q3 growth is to look at the inventory to sales ratio:

https://fred.stlouisfed.org/series/ISRATIO

It does not strike me as that high. Yea – it may have been lower in periods pre-pandemic but that was when Just in Time Inventories was the rage. Now it is not.