One of the interesting things about the current debate over whether we’re about to go into a recession or not is the multitude of indicators that different people glom onto — without any expressed formal rationale for picking one over the other. See this list of people in the recession camp, here.

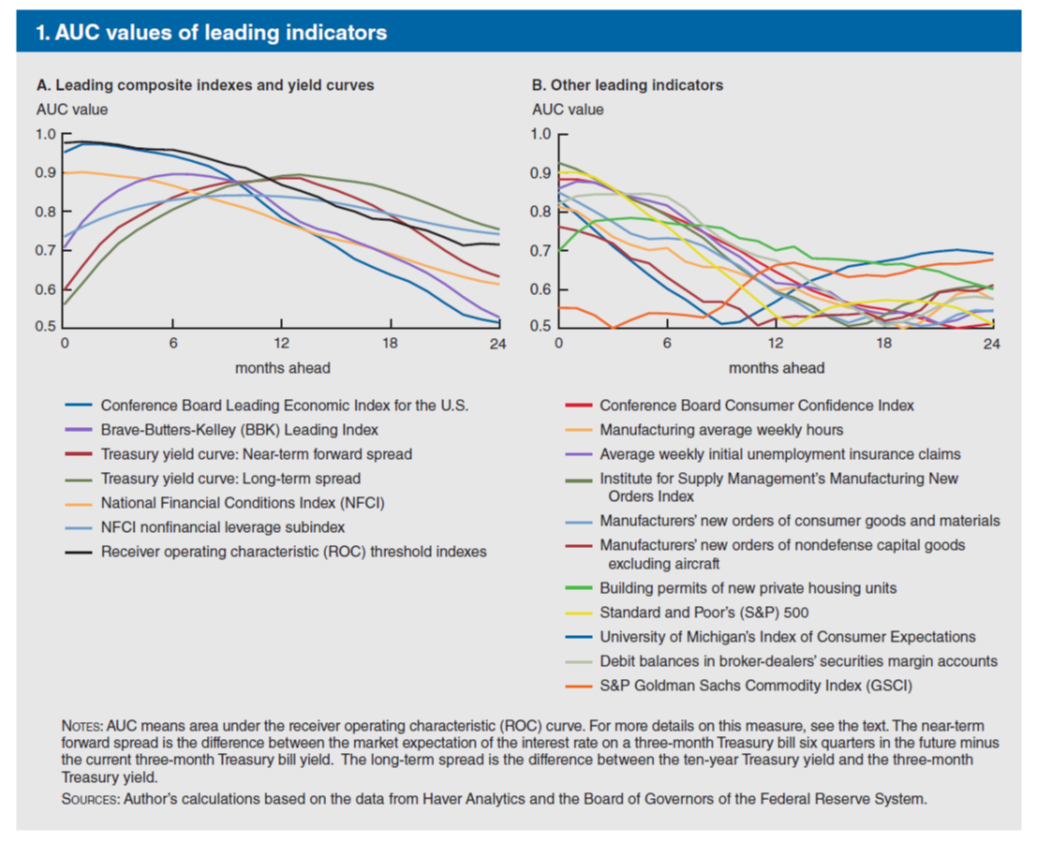

That’s why I found this (pre-pandemic) systematic comparison of the predictive content of indicators, by David Kelley of interest. The key figure is reproduced below.

The Conference Board’s Leading Economic Index is best at very short horizons. A literal reading of the August reading indicates we’ve been in a recession for a while. That being said, the 10yr-Fed funds spread is one of the components of the index, and one of the main drivers of the change over the last six months. If one is skeptical of this spread, one might be skeptical of this reading (the other main drivers have been consumer expectations of business conditions, and ISM new orders).

The 10yr-3mo spread (used in this post) is best at horizons of a year.

From the conclusion:

The results of this article show that at horizons roughly one year ahead and longer, the long-term Treasury yield spread has historically been the most accurate available “predictor” of recessions. That said, leading indexes have been better than individual leading indicators or financial data at signaling recessions in the near term. The ROC threshold indexes constructed here have also performed well as recession predictors in the near term because they are also effectively leading indexes that combine the information in the inputs to provide a more accurate measurement of coming economic activity.

Note these are predictors. They’re not indicators of whether we’re in a recession (e.g., Sahm rule).

Different topic – South Korean foreign direct investment into the US:

https://www.msn.com/en-us/money/companies/south-korea-is-going-big-on-american-manufacturing-the-battery-belt-could-benefit-the-most/ar-AA1r3Iui?ocid=msedgdhp&pc=U531&cvid=6cd9eb0ca38f4dcaa5071b84e991be80&ei=18

South Korean companies are investing billions of dollars in the US to take advantage of two big laws meant to boost American manufacturing.

A Financial Times analysis of United Nations data found South Korean companies invested $21.5 billion in US projects in 2023, more than any other country. South Korea overtook Taiwan, which held the top spot in 2022. Samsung, LG, and Hyundai are among the South Korean companies committing billions of dollars to build facilities in the US to make electric vehicles, batteries, and semiconductor chips. Much of the money is flowing to Southern states, boosting jobs in the so-called Battery Belt. Yeo Han-koo, South Korea’s former trade minister and a senior fellow at the Peterson Institute for International Economics, told Business Insider that US and South Korean interests in emerging technologies were perfectly aligned. Amid geopolitical uncertainty, the Biden administration aims to decouple US supply chains from China to compete in the EV and chips races. Meanwhile, South Korea — a longtime US ally — hopes to build its global profile in high-tech and auto manufacturing. In particular, Yeo said, the 2022 Inflation Reduction Act and CHIPS and Science Act provide financial incentives for companies to invest in green technology in the US, bolstering South Korean commitments. “In addition to these new geopolitical factors, these massive subsidies and tax incentives from the IRA and the CHIPS and Science Act really provide a good motivation for these Korean companies to invest in the US,” Yeo said.

The Biden/Harris approach to industrial policy is building our manufacturing base in ways the Trump administration couldn’t have comprehended. We are already being the beginning of the jobs growth but unfortunately the bulk of the created jobs will take another year or two.

I always thought glom was part of Lord of the rings!

Donald Trump To Offer Foreign Companies Tax Cuts and Federal Land

https://www.newsweek.com/donald-trump-foreign-companies-us-busisness-2024-election-1958570

Former President Donald Trump is set to announce a plan that will provide tax cuts and federal land to foreign companies operating in the U.S.

On Tuesday, Trump is expected to deliver a speech where he will discuss plans to stop U.S. businesses from outsourcing jobs, but also to bring jobs and factories from other countries back to the United States. One of Trump’s key proposals includes offering foreign companies access to federal land as an incentive to bring their operations to the U.S. He hinted at the plan earlier this month, alongside a proposal to cut the corporate tax rate from 21 percent to 15 percent—but only for companies manufacturing domestically.

Biden is already getting foreign direct investment into the US without all these goodies for rich foreigners. But hey – more tax cuts for the rich!

Look 15% is way too low but something tells me that Trump has not thought this through. Let’s say a Swiss based multinational decides to set up a US contract manufacturing affiliate. What’s to stop them for paying the US affiliate a profit markup far below the arm’s length standard? Oh – the IRS transfer pricing team of course. But the Republicans are underfunding this important program too. MAGA!

The official economic prediction dowsing stick that I use when the cloudy plastic crystal ball is in the shop says we are doing OK economically. We are not in boom times like before the wheels came off under Trump, but things are slowly coming back to normal. Commercial real estate seems to be seriously distressed here in Seattle at the moment, but everything else is doing well and getting cleaned up. There’s more apartment construction than there was, and the real estate vultures put offers on pretty much every house in every neighborhood on a regular basis. Money is flowing somehow, whether the interest rates are perfectly optimal or no. I cannot say much about manufacturing, but shipping and construction both seem to be doing well. And traffic sucks. That’s always a tell.

Gundlach in the recession camp now. I think he is very talented but the problem with Gundlach is you never know if/when he is “talking his book”.