Today, we are pleased to present a guest contribution by Steven Kamin (AEI), formerly Director of the Division of International Finance at the Federal Reserve Board. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affiliated with.

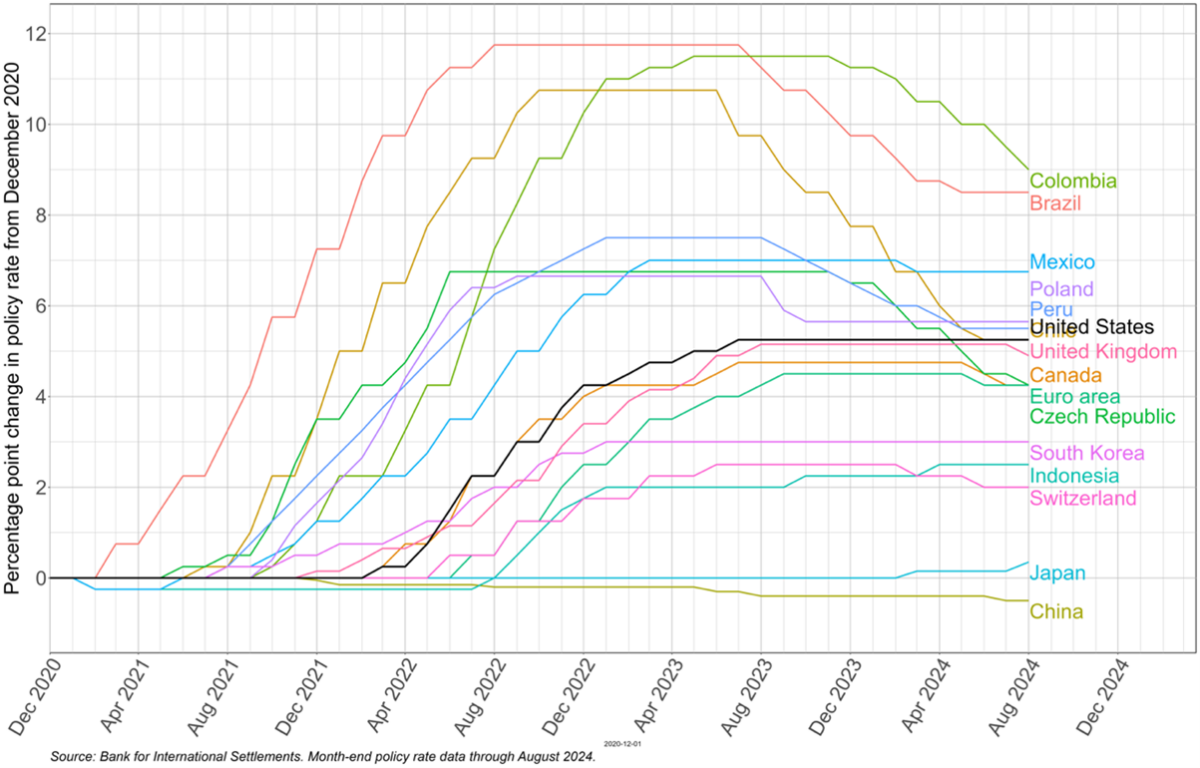

In response to the surge in inflation that followed the pandemic recession of 2020, Latin America’s central banks responded much more aggressively than authorities in other regions, as may be seen in Figure 1 below.

Figure 1: Changes in Policy Interest Rates Since December 2020

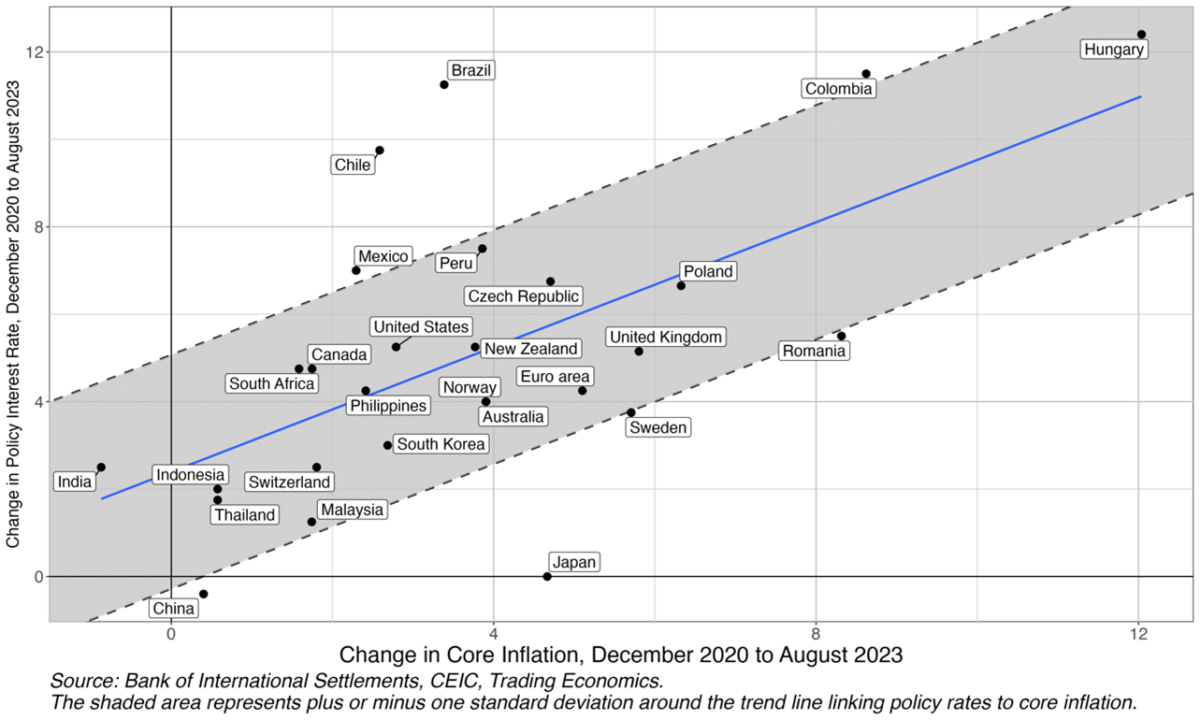

The relative hawkishness of Latin American central banks was also evident conditional on the rise of inflation, as shown in Figure 2. The horizontal axis shows how much core (excluding food and energy) inflation has increased in each country since December 2020, just before inflation started picking up worldwide. The vertical axis measures each country’s increase in policy interest rates over that period. Clearly, as indicated by the blue regression line, countries experiencing larger increases in inflation have boosted policy interest rates by more. The central banks of Latin America lie close to or above the shaded region (representing a 68% confidence interval).

Figure 2: Increases in core inflation and policy rates from December 2020 to August 2023

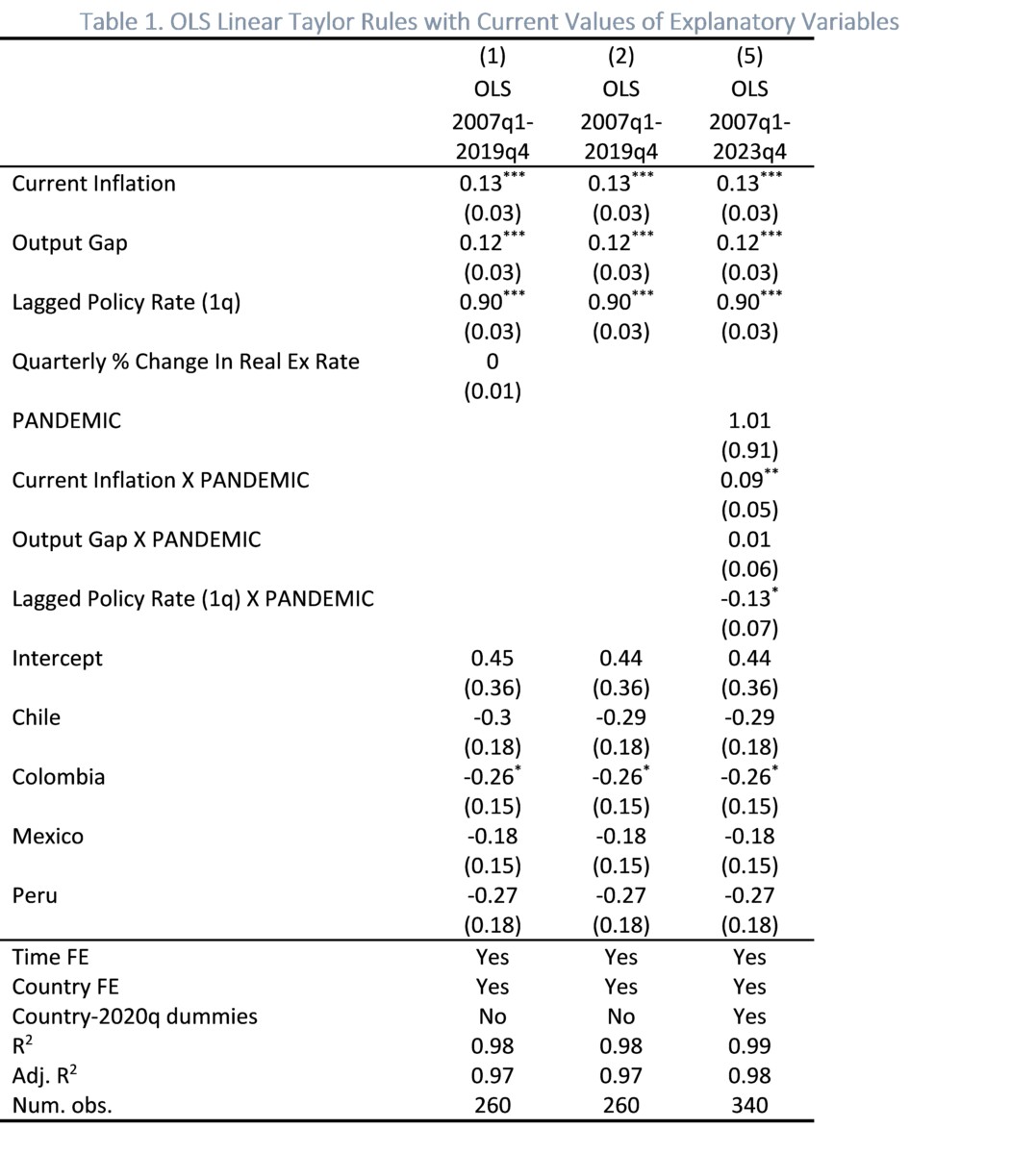

My colleagues Rafael Guerra, John Kearns, Christian Upper, Aatman Vakil, and I wanted to know whether Latin American central banks have always been very aggressive in their response to inflation, or whether they had become more hawkish in recent years. We started by estimating a panel Taylor Rule regression for policy rates of the five main inflation-targeting central banks—Brazil, Chile, Colombia, Mexico, and Peru—during the pre-pandemic period. Column 1 (which includes a real exchange rate—not significant) and column 2 (which doesn’t) show that in the pre-pandemic period, both inflation and the output gap influenced policy rates, and with reasonably-sized coefficients. But column 3, which extends the estimation through 2023 and includes dummy variables for the post-2019 period, shows that the coefficient on inflation rose significantly and the coefficient on the lagged policy rate fell, indicating less interest-rate-smoothing.

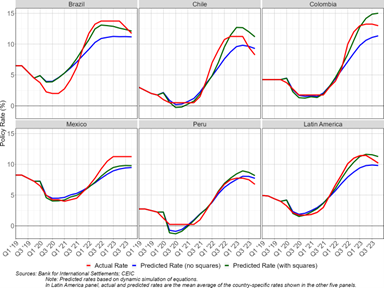

Moreover, as shown in Figure 3 below, projections of the pre-pandemic estimated Taylor Rule into the pandemic period showed that most of the Latin American central banks tightened policy much more sharply (the red line) than predicted by the pre-pandemic model (the blue line). This suggests, again, that Latin American central banks had become much more hawkish toward inflation after 2019.

Fig. 3. Simulations of Linear Taylor Models Estimated 2007-2019, based on Tables 1 and 2, Column 2

However, we were not convinced that the Latin American central banks’ reaction functions had truly changed. Instead, we conjectured that Latin American monetary policy may have exhibited a non-linear response to inflation, with the sensitivity of interest rates rising as inflation becomes especially pronounced. Such behavior could reflect concerns that the higher inflation rises, the greater the likelihood that inflation expectations become unanchored, and therefore the greater the need to reverse the rise in inflation.

So we re-estimated the Taylor rule model described above, but adding interaction terms with inflation, as shown in Table 2. The coefficient on the level of inflation is now insignificant, while the coefficient on its square is positive and significantly different from zero. This configuration indicates that during the pre-pandemic period, the sensitivity of interest rates to inflation grew larger as inflation itself rose. In other words, interest rates exhibited a non-linear response to inflation.

In column 3, we extend the estimation through 2023 and include the interaction terms with the pandemic dummy. The coefficients on both the output gap and the square of inflation are unchanged during the 2021–23 period from their values in the pre-pandemic period. This suggests that this non-linear version of the model may better capture the behavior of monetary policy over both pre- and post-pandemic periods. Notably, the non-linear model still shows a significant decline in the coefficient on the lagged policy rate from the pre-pandemic period; this is worth exploring in further research.

We now return to Figure 3 above. The green lines in Figure 3 compare the out-of-sample predictions of the non-linear model to the actual paths of interest rates (in red) and the predictions of the linear Taylor rule models (in blue) described above. As may be seen, the non-linear models come much closer to tracking the sharp rise in interest rates during 2022 and 2023 in Brazil, Chile, and Colombia.

Therefore, the aggressive response of monetary policy to inflation in 2021–2023 appears to have been less of a break from previous behavior than it might appear from the perspective of a linear Taylor rule. That aggressive response was consistent with earlier responses of Latin American central banks to sharp surges in inflation. Our results are robust to different definitions of prices and output and different econometric specifications. We intend in future research to see if this conclusion holds for monetary policy in other parts of the world.

This post written by Steven Kamin.

Not all Latin American central banks practice inflation targeting. See if you can pick out one that doesn’t:

https://fred.stlouisfed.org/graph/?g=1ujZx

Latin America has a reputation for periods of very high inflation. It comes to mind that a history of high inflation could lead to higher central bank sensitivity to above-target inflation.

Here’s a picture of inflation in Brazil, Mexico, Colombia and Chile, along with Indonesia, Hungary and Poland:

https://fred.stlouisfed.org/graph/?g=1uk7G

No particular reason for the choice of countries outside the Americas. Poland stands out for once-upon-a-time high inflation, but doesn’t stand out for increased sensitivity now. Colombia isn’t a member of the high-inflation club, but is sensitive. Chile’s bout of high inflation was mild and long ago, but Chile appears to behave like other Latin American inflation targeters.

I’m too lazy to keep going, but my suspicion that earlier high inflation could increase central bank sensitivity isn’t looking good in this small sample. Dang it.