Today we present a guest post written by Lindsay Jacobs, Assistant Professor at the Robert M. La Follette School of Public Affairs, at the University of Wisconsin, Madison.

Since 2021, Social Security retirement benefits have exceeded the revenue generated by payroll taxes. The shortfall has been covered by drawing from the Social Security Trust Fund, which is projected to be depleted by 2034. At that time, we’ll face a “fiscal cliff” for this self-funded program where payroll taxes will only cover about 80% of the benefits, resulting in an automatic 20% reduction in payments to retirees.

Nearly all workers and retirees will be affected, so there is broad interest in reforms that would avert this sudden drop in benefits. However, this outcome is in the future, so the dilemma is that while any reform is better than inaction, each comes with immediate costs. Considering this, the limited legislative momentum seems unsurprising.

The Social Security Administration (SSA) has published updated projections showing how various reforms could impact the program’s solvency. You can find a summary here, and more detailed analyses here. There are dozens of possibilities, most being variations on either benefit reduction or payroll tax increases. Two frequently discussed reforms are raising the retirement age and raising or eliminating the payroll tax cap. Other, less prominent proposals involve adjusting how benefits and earnings histories are calculated to account for inflation and real wage growth.

In my view, successful reform will likely involve a mix of approaches in order to maintain the program’s objective of poverty reduction in old age while preserving the broad public support that Social Security has enjoyed.

Here’s how I am thinking about the tradeoffs of four particular reform possibilities—not as a policymaker but simply as an interested researcher. It’s more of a novel than I had expected, but it turns out there’s a lot to consider!

Reform 1: Raising the Full Retirement Age

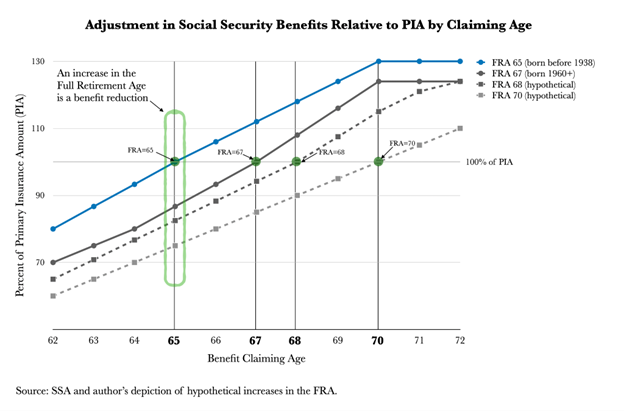

The Full Retirement Age (FRA)—the age at which beneficiaries can receive their full Primary Insurance Amount (PIA)—was gradually raised from 65 to 67 following significant reforms in 1983. Surprisingly, these were the last major changes to the program. Since then, proposals have surfaced to gradually raise the FRA further to 68, 69, or even 70, with the rationale being that increases in life expectancy justify a later retirement age.

This change would be quite effective in improving Social Security’s solvency. For example, raising the FRA gradually to age 69 would reduce the program’s shortfall by about 38% over the next 75 years. (Scenario C1.4 in SSA’s projections.)

I would argue that there are additional distributional effects of increasing the FRA across occupations, given the differences in claiming age behavior and there being an even greater penalty on groups of people who tend to claim early. In particular, people in blue-collar jobs, regardless of their income level, tend to retire earlier and would be more negatively impacted by an FRA increase. I discussed this in a past EconBrowser article and this paper further explores the issue.

Raising the FRA is not an especially popular reform. While it is effectively a benefit cut, as shown below, it doesn’t require delaying benefits altogether; the option to claim benefits before the FRA—at the Early Eligibility Age (EEA) of 62—would still remain, albeit at reduced levels. If this point were emphasized, I think the idea might face less resistance.

An increase in the earliest eligibility age would be a far worse outcome for those who are already claiming as soon as possible—notably many blue-collar workers. Raising the EEA would likely also have the effect of directing more people toward applying for Social Security Disability Insurance (SSDI).

I wouldn’t be in favor of increasing the FRA dramatically or the EEA at all because they make benefits far less progressive in practice, and less in line with the purpose of the program. A moderate increase in the FRA to 68 seems agreeable, at least when considering the alternative of across-the-board benefit cuts that would come with insolvency.

Reform 2: Increasing the Taxable Wage Base

The wage base for Social Security payroll taxes includes all income up to the current annual maximum of $168,600, and is taxed at 12.4%, split between employers and employees. Any income above this cap is not subject to the tax, and no additional benefits are earned. Today, about 6% of workers earn more than this threshold. While benefits are highly progressive, payroll taxes alone are somewhat regressive.

One of the more ambitious proposals to expand the wage base is to lift the cap entirely, taxing all income while maintaining the current benefit formula. This could eliminate about 60% of the projected funding shortfall over the next 75 years (as shown in Scenario E2.17 in SSA’s projections). A variation of this proposal was included in the Social Security 2100 Act (H.R. 4583), which would subject income above $400,000 to the payroll tax, while excluding income between $168,600 and $400,000. This creates a “donut hole” that would shrink over time as the taxable maximum increases with wage growth.

Eliminating the payroll tax cap altogether would certainly strengthen the Social Security program financially but would come with many downsides. A real concern would be the unknown but likely very large labor market effects; high earners and their employers would surely seek ways to restructure compensation to avoid the tax. Even if one were sympathetic to higher tax rates for higher earners, is Social Security solvency the highest priority use of those revenues?

Another issue is the possible decline in support for the program. The program is currently very popular, in part because benefits are broadly seen as fair—highly progressive, but still linked to taxes paid. Removing the cap would weaken the connection between contributions and benefits, which may erode support among higher earners. Even if additional benefit credits were offered to those paying higher taxes, this wouldn’t be very appealing to wealthier individuals who have other preferred savings options.

One way to mitigate some of these concerns might be to impose a lower tax rate on income above the current cap, which could soften the impact on high earners and make the reform more palatable.

There’s a convincing argument for expanding the taxable wage base, but such a reform would likely need to be tempered. Currently, 83% of total labor earnings are subject to Social Security taxes, down from over 90% in the years following the 1983 reforms. Although the taxable maximum adjusts for wage inflation, income inequality has grown, meaning a greater share of earnings now exceeds the cap. A reform that could address this issue would be to raise the maximum income taxed to cover 90% of taxes, instead of indexing to growth in average wages. This would put the cap at about $300,000 currently. A good argument against doing so is that what has pulled up the average earnings is not so much the top 10% of earnings but rather the share at the very top.

Reform 3: Reducing the Real Growth of Benefits

One subtle but highly effective reform would involve adjusting Social Security benefits using changes in overall price levels instead of wage levels to calculate past earnings and corresponding benefits. While average wages have outpaced inflation—reflecting real productivity growth and resulting in benefits that grow faster than the cost of living—this reform would slow that growth. According to the SSA’s projections (Reform B1.1 in their projections), this change alone could eliminate 85% of the Social Security shortfall over the next 75 years.

To see why this would have such a large effect, it helps to think about how benefits are calculated. Benefits are based on a person’s birth year, the age at which they claim, and their top 35 years of earnings. These past earnings are adjusted for wage inflation to determine a person’s Average Indexed Monthly Earnings (AIME), which is then used to calculate their Primary Insurance Amount (PIA)—the monthly benefit they would receive at Full Retirement Age (FRA). Adjustments are made if someone claims earlier or later than their FRA. Because nominal wage growth is nearly always higher than price inflation due to rising real productivity, the cumulative effects of transitioning to price inflation-based adjustments would significantly slow the growth of benefits over time. While we would all prefer more salient reforms, the complexity of this reform might—however unfortunate—actually make it more politically feasible.

The conceptual argument for this reform is that the current wage-level adjustments to benefits are excessive, increasing retirees’ benefits well beyond purchasing power.

An argument against it is that as productivity rises, retirees should share in the gains from rising living standards through benefits linked to wage growth. After all, if people could have instead invested what they paid in Social Security taxes over the years, their returns would be higher than inflation.

I’m partial to both lines of reasoning. However, I think the primary advantage of this reform is that it’s simply very effective at improving solvency while also disbursing costs over time.

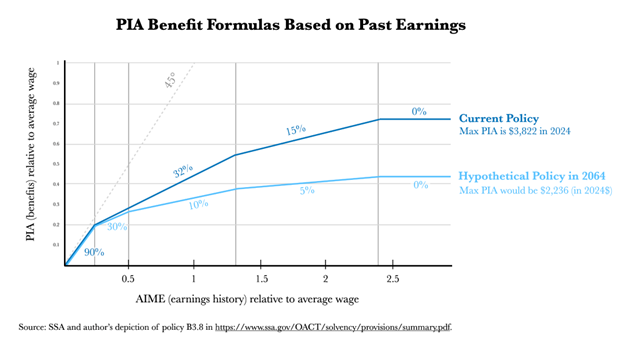

Reform 4: Modifying the PIA Formula to Reduce Benefits for Higher Earners

Another potential reform is to modify the Primary Insurance Amount (PIA) formula in a way that reduces benefits for all but the lowest earners. This would protect lower-income retirees from across-the-board benefit reductions, whether those result from raising the Full Retirement Age (FRA), changing how past earnings are calculated, or any number of other reforms. It would also significantly improve Social Security’s solvency.

To see what this looks like, I graphed the current PIA “bend points” and factors, alongside the reform projection in B3.8, which would gradually adjust the PIA formula over four decades and eliminate 29% of the program’s shortfall over the next 75 years.

This would make the program even more progressive, which would understandably reduce support as it weakens the link between the taxes people pay and what they can expect to receive.

Despite this, it seems reasonable on the grounds that it would go a long way in improving solvency, while aligning more closely with the program’s original purpose of reducing poverty at older ages.

Moreover, implementing the changes over a longer time horizon would give those who are capable of saving to adjust their plans well in advance of retirement—very desirable when considering the alternative of sudden and uncertain drops in benefits.

Choosing the Least Worst Options

Ultimately, I think the goals of Social Security reforms should include:

- Achieving solvency to meet current obligations and provide certainty for future retirees.

- Ensuring income replacement and protection against poverty in old age, in alignment with the program’s original goals.

- Preserving the broad support Social Security has traditionally enjoyed.

Given these objectives—and considering the reality that the alternative is no reform, which will lead to sudden benefit cuts—I would advocate for a combination of the following: reducing benefits for high earners over time (Reform 4), adjusting how past earnings are indexed (Reform 3), and moderately increasing the taxable wage base (Reform 2). Taken together, a more tempered version of each could be implemented to achieve solvency.

Of these, the most effective in achieving these goals would likely be reducing benefits for higher earners (Reform 4), implemented gradually. Some form of this would align Social Security more closely with its original intention as a “safety net” aimed at preventing poverty in old age, rather than a full retirement savings program. Because people with higher earnings histories tend to save far more privately, a reduction in benefits might be preferred to payroll tax increases that might otherwise arise.

A moderate increase in the taxable wage base, covering closer to 90% of total earnings, contributes very effectively to the program’s immediate solvency. Since changes to the benefit formula would take time to phase in, at least some near-term tax increases are necessary. Adjusting how past earnings are indexed—moving toward a measure between wage and price inflation—would also help achieve solvency while being more neutral than other forms of benefit reductions.

With these options available, I wouldn’t favor raising the Full Retirement Age (Reform 1), as it disproportionately affects those who for various reasons claim earlier, particularly those in physically demanding jobs, and would likely increase reliance on Disability Insurance (SSDI), which I’ve looked at here.

The last significant reforms in 1977 and 1983 occurred within a year of insolvency—so is that what we should expect? Perhaps, but the sooner reforms come, the better. For legislators, however, advancing unpleasant but necessary reforms are a mostly thankless job with many downsides. This could change if a sizable share of voters show concern. But this would require accepting the reality of no reform: Our current policy is an immediate reduction of 20% in benefits for all in only 10 years, a reduction that will only grow over time. Without this unfortunate alternative in mind, of course no reform looks appealing!

So, what do you think?

This post written by Lindsay Jacobs.

“Even if one were sympathetic to higher tax rates for higher earners, is Social Security solvency the highest priority use of those revenues?”

I mostly like this article, but is the quoted rhetorical question really helpful? Aren’t rhetorical questions usually just a way of avoiding accountability for the views they express? Hasn’t the author done his readers a disservice by declining to list priorities that he considers more important than financial support for the elderly?

Apologies to the author. “Her readers”.

Rather than making up “facts” or passing along received wisdom (received from Pete Peterson), how about we just ask the public about support for various policies? From a decade ago:

“About 8 in 10 (77%) say it is critical to preserve Social Security even if it means increasing the Social Security taxes paid by working Americans. An even higher percentage (83%) say it is critical to preserve Social Security even if it means increasing the Social Security taxes paid by wealthy Americans. These findings hold true across party lines, age groups, race and ethnicity, and income levels.”

https://www.nasi.org/learn/social-security/public-opinions-on-social-security/

This is very much contrary to the claim made here that public support is lacking for increasing FICA payments by the rich. It even belies the assertion that the rich wouldn’t hold still for paying more.

But that was a decade ago. Perhaps opinions have changed? They have not. From this year:

“The in-depth survey of a representative sample of more than 2,500 registered voters found that large majorities of Republicans and Democrats favored proposals for increasing revenue (increasing taxes on the wealthy, raising the payroll tax) and trimming benefits (raising the retirement age, trimming benefits for high earners), as well as increasing the minimum monthly benefit for low-income earners.

“Together, these steps would eliminate 95% of the shortfall. The SSA calculates the shortfall based on what is needed to maintain solvency for 75 years.

“More modest majorities, with bare majorities of Republicans, favored increasing benefits for those in their 80s and increasing the cost of living adjustments. With these additional provisions, the amount of the shortfall eliminated would be reduced to 78%.”

https://publicconsultation.org/social-security/large-majorities-of-republicans-and-democrats-agree-on-steps-to-drastically-reduce-social-security-shortfall/

Oops! Looks like there is still support for taxing the rich, as well as support for trimming benefits for the rich, while boosting benefits for the poor and those over 80.

Yes, raising the retirement age also received support, but deceptive reductions in benefits did not. (Perhaps it’s time to review “money illusion”.) The point I want to demonstrate is that Jacobs has substituted her own views – which are fairly closely aligned with the policies Pete Peterson spent millions promoting – for the actual state of our knowledge regarding public support for Social Security.

So I retract my earlier statement. I don’t “mostly like this article”. I believe Jacobs has misrepresented the state of public opinion and of politics in order to boost her preferred policy outcomes.

By the way, this attempt to misrepresent public opinion is in some degree a slight to democracy. The public wants something. The public is willing to pay for what it wants. In an effective democracy, we would end up with what the public wants. Misrepresenting public opinion serves to circumvent the public will.

I honestly think the question is posed as just a way to encourage thought. As a kind of brainstorming state of mind. “Is this the best avenue??” Kind of thing.

I’ll reply according to your sections.

“Raising the Full Retirement Age”

Raising retirement age is just a gimmick to sell an unpalatable benefit cut. As your own first chart shows, all you have done is lower the benefit curve, which you could do without changing the claiming age. But obvious and transparent benefit cuts are a hard sell while lies about increasing life expectancy have been a long time Republican myth.

Republicans use misleading figures for life expectancy from birth, which has been greatly increased due to reductions in infant and neonatal mortality. That has nothing to do with life expectancy at retirement. While life expectancy at birth has increased by 20 years since the inception of Social Security in 1939, life expectancy at age 65 has only increased by 8 years in the last 8 decades. And for low income workers is has been almost flat.

So please drop the “increase the retirement age” lie. It’s a Republican trope. If you want to decrease benefits, be honest about it and just say “we’re cutting your pension” as shown in your chart and see how well an honest argument sells.

Your comments caused me to rethink. I was initially too kind. Thanks.

i agree. it is one thing to say to a white collar worker, you will need to work 5 more years before you can retire. its another thing for 65 year old roofer to add another 5 years to their working life. i just had a guy about that age do some work on my roof. he was very competent in his work. but there is no way that man should be climbing on top of roofs carrying material and equipment for another 5 years. he will never make it to retirement. a reduction of benefits is more equitable than raising the retirement age. who would keep bruce employed until he was over 70 years old? nobody.

I appreciate such openness to logical — rather than combative — argument. Thank you.

“Increasing the Taxable Wage Base”

“Removing the cap would weaken the connection between contributions and benefits, which may erode support among higher earners.”

Well, you know what, screw those higher earners. They are 1% or 0.1% of the voters so it shouldn’t matter. Oh, but I take your point that the billionaire techbros have outsized influence and can buy politicians, but then that isn’t a Social Security finance problem. That’s a corrupted democracy problem.

“High earners and their employers would surely seek ways to restructure compensation to avoid the tax.”

Well then, if you are going to rewrite the tax code to cut Social Security benefits, why don’t you rewrite the tax code to eliminate these loopholes. The simplest would be to tax all income including dividends and capital gains, and not just earned income. Then there are no incentives to restructure income to avoid the tax. There is no logical reason to limit pension taxes to “earned” income instead of just “income.”

Exactly. Income should be taxed. For now FICA is regressive in the worst way possible. I don’t much care what high income earners think. I qualify under some definitions even though my income is barely median in Seattle where I live. If I pay a bit more tax, it won’t break my heart or my bank account.

so this would hit me, but i can certainly live with it. it really makes no sense to have a cap on the fica taxes. most of those high earners probably started out at lower salaries, in which social security pays out more than it collects. so by taxing the high end of the income, you are simply balancing out so that for career high earners, they are not profiting from what is supposed to be an insurance program anyways. not everybody is supposed to fully collect from an insurance program. will this decrease my household take-home pay? sure. but if i am unable to accommodate that tax, it is my own fault for living way too large.

as an aside, there are a lot of public employees who paid into both a state pension system and fica, but rules made it ineligible for them to collect both SS and pension. although they should be able to do just that. they were penalized because they are not high earners with powerful lobby. why are republicans so concerned about he wealthy being taxed, but have no concern for the middle class not getting their dues? the laws against double dipping were republican dogma.

“Reducing the Real Growth of Benefits”

“One subtle but highly effective reform would involve adjusting Social Security benefits using changes in overall price levels instead of wage levels to calculate past earnings and corresponding benefits.”

This is insane. What you are basically proposing is that retirees be locked into a standard of living of 1936. Or at best, locked into a current standard of living that makes them poorer over the next 30 years.

This is yet another gimmicky way of cutting benefits while fooling the public as to what it really means.

Instead of obscure gimmicks like raising the retirement age or changing the wage index, just be honest and come right out and tell people what you really mean and that is “We are going to cut your Social Security benefit by $xxx dollars per month. What do you think about that?”

You call it “subtle” reform. I call it deliberate deception.

Modifying the PIA Formula to Reduce Benefits for Higher Earners

Now we are getting somewhere, but the lowest bend point should be beefed up to provide 100% income replacement and not just 90%. And the upper bend point at 0% replacement should remain at the current cap of around $160K but the income cap itself should be entirely removed.

In summary, the obvious and simplest answer is just to remove the tax cap completely but keep the 0% PIA bend point at the current level and you are done. No need for benefit reduction gimmicks like increasing the retirement age or changing the wage index.

“A moderate increase in the taxable wage base, covering closer to 90% of total earnings, contributes very effectively to the program’s immediate solvency.”

This is just nuts. Why cap the tax at the 90% level. As you point out previously, that leaves out the ultra rich 0.1%. If you are frightened of the utra rich, just say so, but there is no logical reason to exempt them from the tax. They are making millions and will never feel any hardship. Why do they, of all people, need a tax break?

It’s incredibly annoying to see economists and political academics reining in and tempering their options to appease the ultra rich. If you feel that they just have too much influence, maybe address that problem directly.

Joseph,

Economics in service of policy analysis often creeps over into political analysis. Remember Summers telling Obama that a trillion dollar stimulus was good economics, but bad politics? He had no particular claim to special knowledge of politics, but he got his way.

I don’t think that can be avoided. However, anyone who steps over that line ought to declare that they are doing so.

It is received wisdom that broad-based support for Social Security will fall apart if the rich are called upon to pay more. Received wisdom is not analysis, nor is it independent thought. We don’t need Jacobs to smuggle received wisdom into the discussion, but if she insists, she ought to flag it as outside her area of expertise.

Frankly, an enormous amount of inertia in politics comes from thinking that something cannot be done. It had been decades since Congress had done much infrastructure spending, but Biden decided it was time. Even with slim margins in both chambers, we now have money for infrastructure.

Bush Jr. wanted to cut taxes, but the public wanted to reduce the debt. He went on a crusade to convince the public that tax cuts were a good idea, and succeeded.

Franklin Roosevelt passed the New Deal. Lyndon Johnson passed the Great Society.

But somehow, a country with a highly skewed distribution of income and wealth cannot risk trying to balance the scales even for those late in life. Dealt a bad hand during your earning years? Too late for you. Because received political wisdom, as dispensed by economists, says so.

“Remember Summers telling Obama that a trillion dollar stimulus was good economics, but bad politics?”

Christina Romer had this right. Too bad she did not demand that Larry shut up and sit down!

Yeah, I agree, but it is annoying that Democrats always start off what they know will be a rough negotiation with Republicans by handing over half a loaf before they even begin, apparently thinking Republicans will be nice and reward them for giving in.

Obama made that mistake more than once — in his going along with Summers in 2009 and again with his “Grand Bargain” in 2011. I mean, Obama literally wanted to cut Social Security, Medicare and Medicaid. The offer was on the table. The only thing that saved us is that Republicans refused the deal because it didn’t include tax cuts for the rich.

You need to at least start with where you eventually want to go, not with some halfway measure that you think the “moderate” Republicans will agree to – because they won’t. You give them an inch, they will take a mile.

It has been noted here that immigration will actually improve the finances of the Social Security fund. Why – because a lot of these immigrants will find jobs and contribute to the system. Especially in the Texas construction sector:

https://www.texasmonthly.com/news-politics/border-crisis-texas-solutions/

The Border Crisis Won’t Be Solved at the Border

If Texas officials wanted to stop the arrival of undocumented immigrants, they could try to make it impossible for them to work here. But that would devastate the state’s economy. So instead politicians engage in border theater.

An important discussion which admittedly is rather long. Let me skip to this:

Many industries have slowly recovered from the COVID-era labor crisis. Economists generally agree that the surge in immigration played a huge role in that recovery. But across the country, employers still say they can’t fill vacancies, even as some have increased wages to varying degrees. “America is facing a worker shortage crisis: There are too many open jobs without people to fill them,” the U.S. Chamber of Commerce warned in September. According to the chamber, Texas has just eighty workers for every hundred open jobs. The deficit in construction is historic, by some measures. Associated Builders and Contractors, a trade association, reported that in 2022 the industry averaged more job openings per month than it had ever recorded. Texas building executives are speaking in apocalyptic terms about the labor shortage they’re still facing. Behind closed doors, they bluntly acknowledge that countless new projects won’t get off the ground unless they hire workers who are in the country illegally. In a survey conducted this September by another trade group, 77 percent of construction firms with job openings, and 74 percent of those in Texas, reported that they were struggling to fill them.

Ah but little JD Vance has declared that we don’t need any stinking Hispanics for construction. After all – white people could be filling these jobs. But the story notes the following economics of the JD white only solution:

The obvious economic solution for a tight labor market is to raise wages. But here some in the construction industry are hobbled by long-entrenched attitudes. Since at least the eighties, when Ronald Reagan led a crackdown on unions, firms have become addicted to cheap undocumented labor. Blue-collar wages had, for decades, failed to keep up with inflation, though that trend started to shift in 2020.

Hey – I’m all for higher wages but it seems Trump is not. MAGA!

Off topic – solar enegy prices:

We are often treated in comments here to claims that alternative sources of energy are inferior to greenhouse gasses themselves or greenhouse-gas-producing fuels. Often, cost is part of the purported logic. Here, from 2011, is an analysis showing that home solar power had already arrived at cost parity with utility-provided electricity:

https://www.sciencedirect.com/science/article/abs/pii/S1364032111003492?via%3Dihub

That was over a decade ago, so it’s awfully suspicious that we are still occasionally harangued about the inferiority of alternative energy sources. Since that study was published, solar energy costs have continued to fall, so that today, solar energy is, in some applications, the cheapest energy in history:

https://www.popularmechanics.com/science/a34372005/solar-cheapest-energy-ever/

Of course, Popular Mechanics is a left-wing rag, so is probably exaggerating.

A review of solar photovoltaic levelized cost of electricity

K. Branker M.J.M. Pathak J.M. Pearce

This paper has been noted here many times. When it was in the past, CoRev would predictably blow a casket and inflict the comment section with all sorts of nonsense.

And you have overlooked one of the Republican favorites for gimmicky benefit reduction — changing the COLA index. Initial benefits are indexed to the average wage up until age 62. This ensures that the benefit keeps up with the rising standard of living.

But after age 62, your benefit only increases by CPI-W which means you may keep up with the current standard of living but may lag behind the rising standard of living. But for some, that lag isn’t enough and they want to change the COLA to the Chained CPI-U which runs lower than CPI-W. Which is funny because Republicans typically hate Chained CPI because they think is understates “Real” inflation. But in this case they like Chained CPI because it is a stealth benefit cut.

There is some controversy over the aptness of chained vs unchained CPI, but what the advocates for the change only care about is that it reduces benefits and does it obscurely. Whether it is appropriate or not is irrelevant.

If the Chained CPI advocates honestly wanted a more accurate index for Social Security benefits, then they would advocate for a Chained CPI-E (Elderly) index. But they don’t because it isn’t really about accuracy. It’s about cuts.

Enjoyed reading this guess post very much, and found it edifying. I have nothing terribly insightful to add. I only hope, similar to Prof Jacobs, that the better parts of her proposed reforms are enacted by U.S. legislators a bit before 2034 (maybe 2028 would hit a “sweet spot” between pragmatism and a spoonful of sugar to help the medicine go down??). But Prof Jacobs and all of us know how that political timeline generally goes, don’t we??

Glad to see more feminine input here on the blog, and we need more.

Lindsay,

How about Reform 5? Maintain the design of social security as an enforced saving program rather than a redistribution mechanism.

The less you put into social security, the higher your internal real rate of return. People who put the least into the system are getting real returns in the 5% range while those who put the max in may end up with less than a 1% real return. We should start any reform of the system by equalizing the real rates of return across income categories.

Yes, that means cutting the level and rate of growth of benefits most of people who put the least into the system with the smallest or no changes for people who put in the most. We already have so many other redistribution schemes. Why should we add yet another one? I realize of course that Reform 5 will outrage people like Joseph who want people like me to subsidize him because he decided to enjoy leisure in his younger years while I was working hard.

@ Dick Stryker

Your statement about Joseph seems rather presumptive. Should we be presumptive about you as well, and deduce that, as is often the case with folks of your ilk, you were born on third base and think you hit a triple???

https://www.yahoo.com/finance/news/the-us-retirement-system-gets-a-c-in-global-study-230119976.html

pgl: “As an aside, there are a lot of public employees who paid into both a state pension system and fica, but rules made it ineligible for them to collect both SS and pension.”

That is not true. People who spend part of their career in both the public sector and private sector collect from both their public pension and their Social Security pension. However, there is an adjustment to their Social Security benefit called the Windfall Elimination Provision (WEP).

This adjustment accounts for the fact that lower earners get a larger percentage of their average wage as benefit than than high earners. This is the progressive feature of Social Security benefits. Someone who spends most of their career in the public sector and only a short time in the private sector paying FICA will look like a low earner for Social Security that should get a bigger benefit even though they are not. So there is an adjustment to their Social Security benefit to calculate it as being on top of their public pension instead of standing alone.

People who pay into both a public pension and a Social Security pension collect from both, although their Social Security pension will be WEP adjusted.

Oh, I should add that you need at least 10 years of Social Security credits to qualify for a pension. This is true for everyone, not just those who also collect a public pension.

Let the system fail. OASDHI should never have been created in the first place. This would penalize some of the free-riding done by the Baby Boomers, as they will get less. It will deal somewhat with the intergenerational account issues, and will encourage people to save privately.

OASDHI discourages people from marrying and having children, as their support comes from a broader base. This sows the seeds of its own destruction, and this is happening globally, as every nation is having fewer kids than they did 20 years ago.

You know what would improve the system? It’s simple. Don’t base SS payments on you own income. Base SS payments on the total income of their children. Then the system would be actuarially sound. Apply the same formula to DI and HI, and guess what? It would work. OASDHI will eventually fail regardless of what is done; FDR did not want it to be welfare, but proposed changes will turn it into that, and it will lose political legitimacy.

AN option you didn’t mention which is viable. Sunset the program beginning now. New births are allowed unlimited tax free savings in 401k OR IRA. All people alive today get it on a declining scale but in all cases declining SS income is 100% tax free. As people die off they are not replaced on SS roles. Those that qualify for SS still pay into the system to keep it solvent but their benefit is that SS income is no longer subject to IRMAA or any SS taxes.Those on SS continue to get it. The Govt would need to subsidize until sunset is reached.

People would need to understand the Govt will NOT be there for SS beginning in 62 years from now.

Since the USA’s high earners & ALL their accumulated wealth & retirement plans & assets are all protected by USA social network & USA military, then all their protected income and assets should be taxed due to the cost of protection. The wealthy can only eat three(3) meals a day… & only drive one Porche or Ferrari at a time .. so they should help feed the lower income levels & their children who are deprived of fair earnings due to corporate greed & political powerlessness of the grossly underpaid/ & low paid citizenry that provide the “Affluent Class” their military and social protections and customer base. Absurd for USA to pay billions & trillions of dollars for foreign aid & then begrudge US workers that faithfully paid-in for the SSA benefits they earned so those at the top can squander money while less affluent worker’s family’s suffer from malnutrition, inadequate housing & exorbitant medical and prescription costs.