So be prepared. From Feng, Han, and Li (2023):

As noted in the article, machinery, electronics and optical equipment accounted for a lot of imports as a share of total US imports for these categories, so these pass-through coefficients pertain to substantial amounts of imports.

Now, I can’t say the high pass-through estimates are a surprise, given Cox and Russ (2020) and references cited therein, but for some people, it bears repeating (over and over and over again).

Now, Zerohedge in a rare moment of coherence, notes the possibility of Beijing devaluing the CNY in response to tariffs. Well, duh! Of course, depreciation wouldn’t be costless, given fears that this would spur capital flight. Still, maybe useful to consider what happened the last time Mr. Trump started a trade war with China.

Figure 1: CNY/USD, in logs 2018M04=0. Source: Federal Reserve.

The CNY depreciated over 12% against the US dollar.

Addendum:

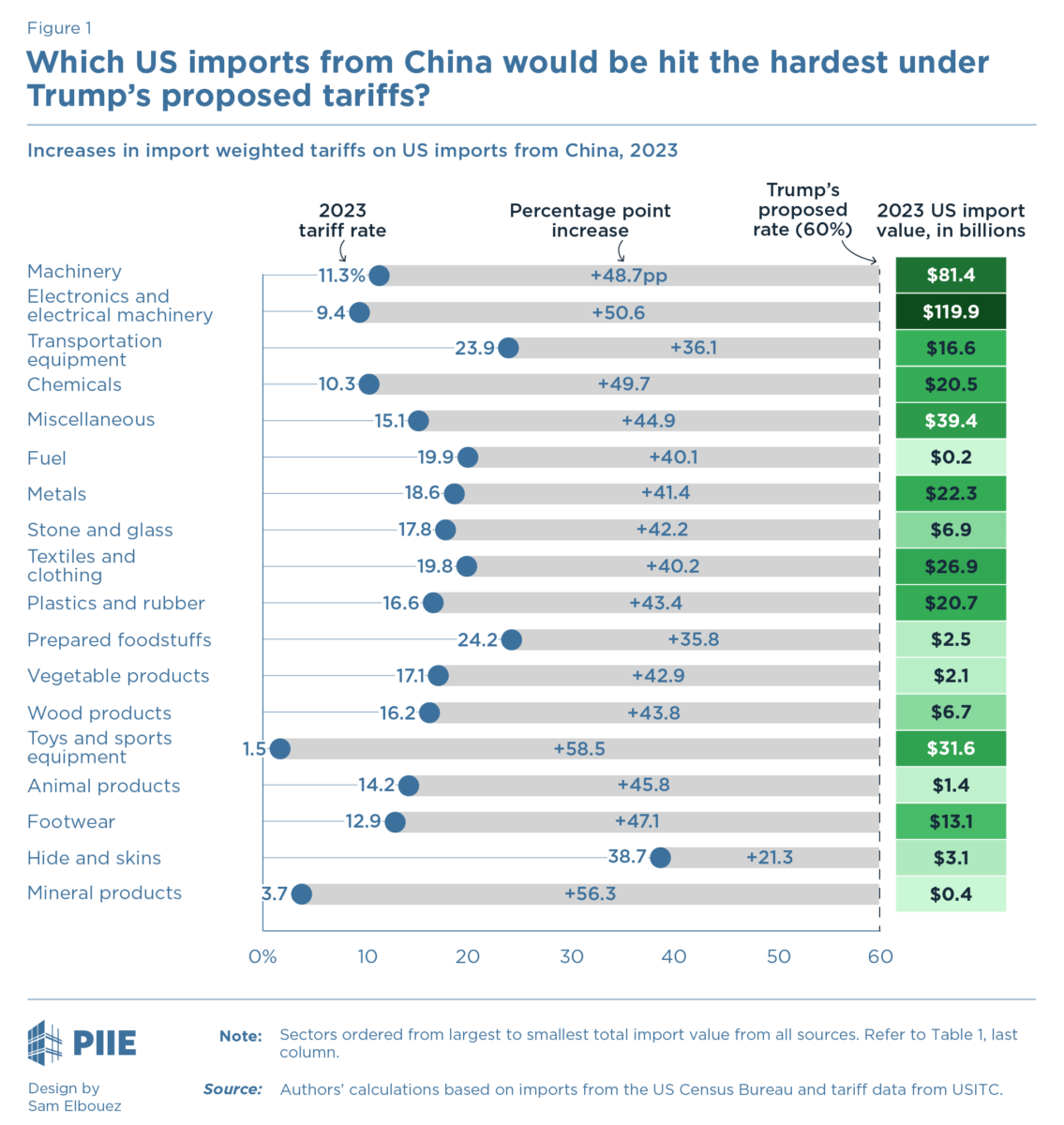

Contreras, Lovely and Yan provide a more detailed assessment of hits under 60% tariffs.

From the Peterson People, in general agreement with Feng, Han and Lee:

https://www.piie.com/blogs/realtime-economics/2024/no-trade-tax-free-trumps-promised-tariffs-will-hit-large-flows

“Goods likely to see the largest proportional price increases are those facing currently low applied tariff rates and those that are sourced disproportionately from China.”

“…machinery and electronics and electrical machinery will face the largest import tax burden if the incoming administration implements Trump’s promised duty hikes. These two sectors account for a large share of US total imports, currently face low tariff rates, and are disproportionately made in China.”

“If tariffs are levied on all US trade partners as well as China, large flows of machinery, electronics, transportation equipment, and chemicals will also be subject to new taxes, with much of the burden falling on US-based businesses. Consumers…will also see higher costs for imported final goods, including electrical devices, toys and sporting goods.”

China is talking up its economic stimulus plans for next year:

https://www.cnbc.com/2024/12/12/china-stresses-plans-to-boost-growth-at-top-agenda-setting-meeting.html

It’s not clear that anything new was decided at this week’s policy meeting. It looks like an effort to repackage decisions that had already been announced.

It also appears that this week’s meeting would normally have been held in March of next year. So, hurry up and do nothing? That seems unlikely – not sure what’s going on. Insiders talking to insiders, of course, but to what end?

The NYT has a longer article on China’s economic meeting this week, indicating “more” stimulus, but with no details:

https://www.nytimes.com/2024/12/12/business/china-economy-2025-priorities.html

Not-ready-for-prime-time policy?

Speaking of China, the press often carries stories on China’s “leadership” in alternative energy production. Sceptical as I am of China’s claimed virtues, even I was surprised at a graphical comparison of CO2 emissions over time of the U.S., EU and China from Our World In Data:

https://ourworldindata.org/grapher/annual-co2-emissions-per-country

China’s rate of increase in CO2 emissions is unprecedented. China is adding more to emissions than the rest of us are reducing, almost single-handedly keeping CO2 emissions rising in 2023. India is helping, a distant second. There is some evidence that economic troubles cut into China’s emissions this year, but that’s still an open question.

Here’s an article from Carbon Brief, noting that China is way above its pre-Covid trend for CO2 emissions, contrary to all the “Green China” hype:

https://www.carbonbrief.org/analysis-record-drop-in-chinas-co2-emissions-needed-to-meet-2025-target/

The Rhodium Group estimates that China’s greenhouse gas emissions exceeded those of the entire developed world in 2019 and were roughly equal to that of the OECD countries even on a per capita basis:

https://rhg.com/research/chinas-emissions-surpass-developed-countries/

Yes, the U.S. still tops China on a per capita basis. The U.S., however, is headed in the right direction, while China is not. China’s accelerating pace of greenhouse gas emission is making it impossible for the rest of us to cut emissions fast enough to do much good.

Hey, where is ltr these days? She routinely told us how the glorious leader was leading by cutting greenhouse gas emissions. Turns out, that isn’t the case, at all.

As I was reading this, I was also thinking about ltr! My worthless guess is she got fired by the CCP because she posted about how China would never do something that Xi in fact said China would do, or vice versa.

Here’s a broader update, from the IEA in 2023: https://www.iea.org/reports/co2-emissions-in-2023/the-changing-landscape-of-global-emissions . Grim stuff. The U.S. will come close to its goal of a 50% reduction in C02-equivalent emissions by 2030, but China and, soon, India, have to turn things around in order for global warming to be a small catastrophe instead of a big catastrophe.

The whole situation with China is mindbogglingly complex to me. Tariffs are almost a gnat on an elephant. China currently has the market more or less cornered on certain elements used in making semi-conductors and the like. I recently saw a report that China was going to use that market dominance to exert their will on the rest of the world. Then you have the ongoing Russo-Ukrainian war and how China fits into that to sort out. They support Putin, more or less, but are playing both ends against the middle to avoid too much friction with their main trading partners. Then there’s the internal economy in China, which isn’t so great. I don’t have even a blurry, cloudy, cheap plastic crystal ball idea of what that might lead to. Then there’s the fact that China is a huge country with a number or less than happy areas and ethnic minorities. Finally enough for me for now, there’s the current bellicose behavior by Xi in the South China Sea and their enormous naval buildup and space program. Trump’s tariffs will just stir the pot but I don’t see them having much of an effect except to throw a wrench in the US economy in odd places.