Heritage Foundation’s EJ Antoni has been describing the gap between the establishment NFP series and the CPS employment series as the basis for evidence of mismeasurement of employment by the CES. Goldman Sachs notes today (Peng, “Revised Immigration Estimates Will Close Much of the Payroll-Household Employment Growth Gap in January”) that new Census estimates of immigration will imply a big revision in population controls used in the CPS employment series.

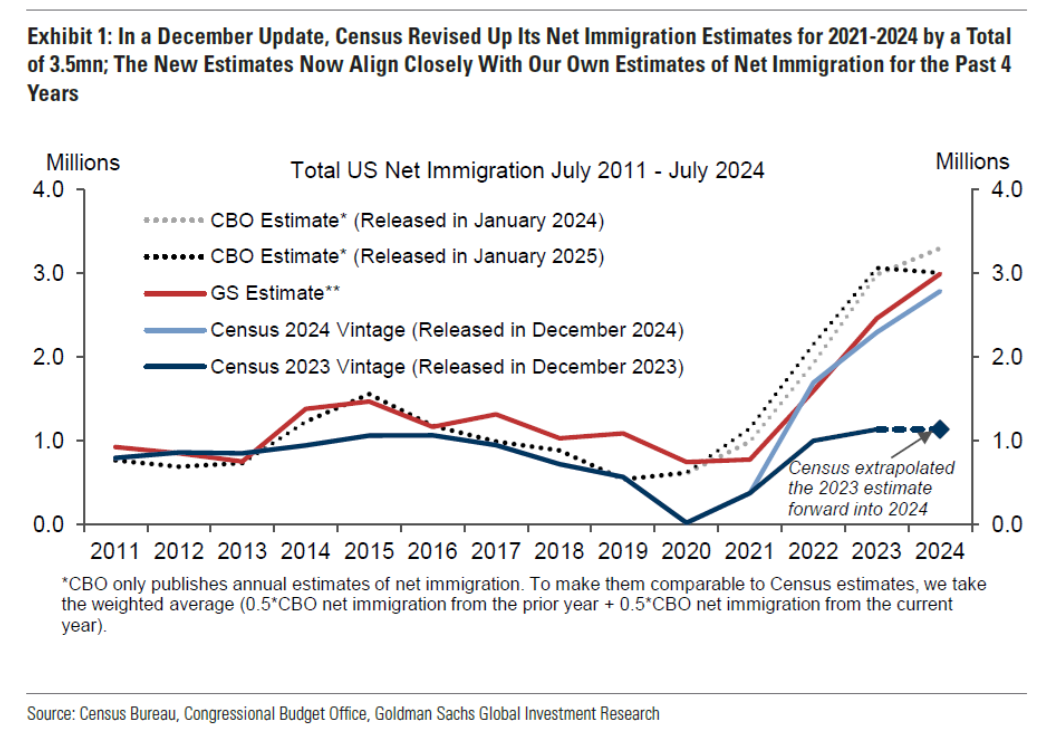

Source: Peng, “US Daily: Revised Immigration Estimates Will Close Much of the Payroll-Household Employment Growth Gap in January,” US Daily, Goldman Sachs, 14 January 2025.

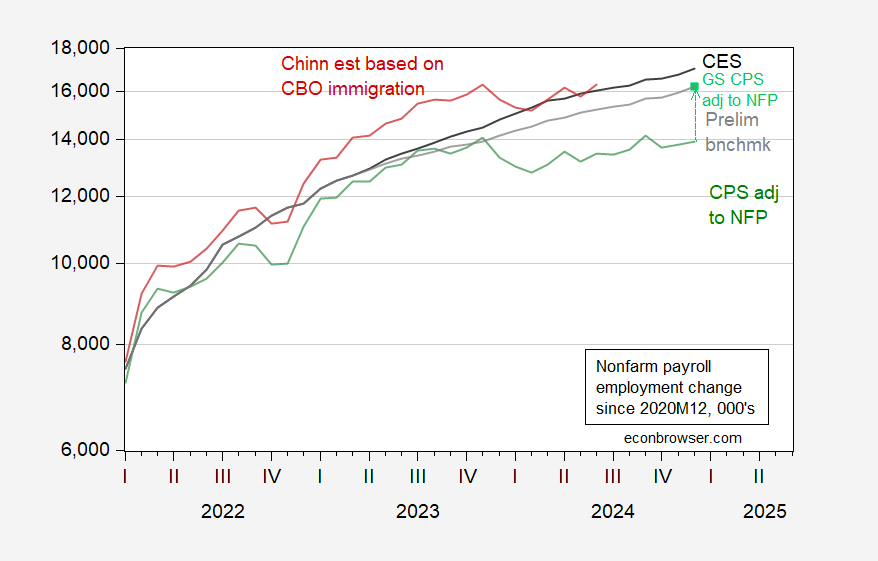

By my calculations on what they report, I was pretty much on the mark for what the revised CPS adjusted to NFP concept series would look like through mid-2024 (I didn’t have the CBO estimates for July 2024-June 2025 at that time). The revised CPS series adjusted to NFP concept should be moved up to roughly where the preliminary benchmark implied NFP is in December.

Figure 1: CES Nonfarm payroll (NFP) employment series (black), implied preliminary benchmark CES NFP (gray), CPS employment adjusted to NFP concept (green), and Goldman Sachs implied revision for December (light green square), all in 000’s, on a log scale. Source: BLS via FRED, BLS, Goldman Sachs, and author’s calculations.

Hence, the majority (3/4) of the gap between the CES and the adjusted CPS series is due to a difference in estimated population controls, with the remainder of the gap essentially accounted for by the overcount in the NFP.

It was recently noted in a comment (which I can no longer locate?) that the yuan is under pressure. Here’s the picture:

https://fred.stlouisfed.org/series/DEXCHUS#

There are other signs of trouble. Here’s China’s credit impulse index, along with housing prices and stocks:

https://en.macromicro.me/collections/31/cn-finance-relative/35559/china-credit-impulse-index

As noted at the link, credit flows in China are more directly linked to housing than to GDP. Housing was a very large part of GDP growth prior to the collapse, so the distinction may be less clear now than in the past. Just eye-balling, it looks like stock prices respond with a lag to credit and housing. The government is intervening to prop up all three, with results not all that positive.

Just to connect these bits and bobs to other recent posts, let’s assume Rhodium Groups is close to right about Chinese growth:

https://econbrowser.com/archives/2025/01/rhodium-group-another-estimate-of-chinese-gdp-growth

The problems reflected in Chinese financial data are on the one hand a reflection of China’s poor economic performance, on the other hand an encumbrance to China’s economy getting better.

China is a benefactor to Russia, and Russia needs help:

https://econbrowser.com/archives/2025/01/impending-systemic-financial-crisis-in-russia

China’s steady deterioration makes any useful aid to Russia less likely. To the extent that China’s slowdown is responsible for reduced demand for Russian oil, harm to Russia is already piling up.

Lastly, we can tie China’s poor prospects to just about anything Menzie writes about the U.S. economy, since China is a big part of the global economy, one if our largest trading partners and one focus of Trump’s tariff crazy.

I’m such a worrier.

Depends. You call it poor. I call it normalization. China needs to start pushing into space and building its military sector to match the US. The US is in far worse shape being a debt based shole. The working class is so retarded. They refuse to accept they are over. China’s coming population reduction will be helpful as well. India will have to be dealt with.

Develooing space technology may help the rest of the economy. Military expansion often doesn’t; it takes resources away from the rest of the economy. Getting in a contest with the U.S. in a low-productivity-enhancing sector doesn’t bode well for China’s properity.

Changing labels from “poor” to “normal” doesn’t change the objective reality. Just the spin. China is suffering from a debt overhang, mal-investment, a balance-sheet shock and unemployment, among other things. Dealing with these problems requires wise policy. It’s not clear that China’s policies are wise. Competing with the U.S. instead of tending to the health of the domestic economy looks like a poor choice.

China’s 90/00’s boom was never going to last. Knowing that, they have been preparing alternate plans since before covid. You just can’t go by “Western” measures of economic activity.

Love to see what plans you think they were preparing for the housing crash, the stall in productivity, bad debt and unemployment.

Putting “Western” in quotes isn’t analysis. It’s the same special pleading that governments everywhere do when their plans backfire. What unbiased measures of economic activity would you prefer? By “unbiased”, I don’t mean “not Western”. I mean unbiased, not jiggered to look better.

I think China’s prospects are pretty good right now, as they look likely to reap the benefits of the entire world’s green energy transition. Their EVs are now so cheap and good they are displacing Western cars outside of EU/US/Japan and look likely to get almost the entire rest of the world market in a few more years. Solar+battery is displacing fossil fuel power at an accelerating rate and China looks likely to get all of that market too. And, finally, because they’re making this stuff they get the cheapest energy on the planet and that’s a big boost to manufacturing profitability in general.

The EU and Japan are not doing well on green energy production, aside from the EU’s windmills. The US had a chance, but Trump is going to destroy it. China’s housing crisis is a huge millstone, but I think producing the world’s energy AND the world’s cars – basically replacing OPEC, Germany, and Japan – is more than enough to carry it.

What you’ve described is China’s potential trade gains, while ignoring China’s domestic troubles. Looking at the positives and ignoring the negatives will pretty reliably produce a rosy forecast, but not an accurate one. China’s trade gains in the current period are a reflection of weak demand at home.

There is no technical barrier to the rest of the world producing its own electric cars. Some of the larger car markets are keeping Chinese cars out. China doesn’t and cannot affordably produce the rest of the world’s electricity. Mostly, countries produce their own electricity.

By the way, China’s alternative energy production is happening right alongside its expansion of coal-fired generation. China and India are, all by themselves, keeping global coal consumption on the rise,

while the rest of the world cuts back. China brags about its “green energy” accomplishments, but is a major source of increase in greenhouse gas emissions. The collapse of residential construction and the resulting slump in cement production, is the only thing that is cutting into China’s greenhouse gas emissions.

What you’ve offered us isn’t how economics is done, despite your pen name.

Oh, and:

https://www.digitimes.com/news/a20240904PD208/saic-2024-revenue-eu-ev-tariff-byd.html

Trump said last week “Because of the death of President Jimmy Carter, the Flag may, for the first time ever during an Inauguration of a future President, be at half-mast. Nobody wants to see this, and no American can be happy about it.”

And so, Republicans have decided to defy an executive order going back to the Eisenhower era and reissued by Biden that flags should be flown at half staff for 30 days after the death of a former President.

Trump has raised the flags at Mar-a-Lago already. House Speaker Johnson has said that he will order flags to be raised even before Trump is inaugurated in direct defiance of an executive order. So much for “law and order”. It starts even before Trump is sworn in. It may be symbolic but it signifies how anxious Republicans are to bow down at the feet of their new Fuehrer.

Oh, and there is precedent. Flags were at half staff during the inauguration of Richard Nixon following the death of Harry Truman. Even Nixon was not as petty and insecure as Trump and that’s saying something.