That’s the title of a GJ Collins article on SeekingAlpha today — but it’s not what you think it means…

The resolution of the inverted 10-year and 3-month yield curve usually signals a recession down range.

Well if inversions precede recessions, than this kind of makes sense, although the question is then how much do dis-inversions precede recessions (or do they occur during the recession).

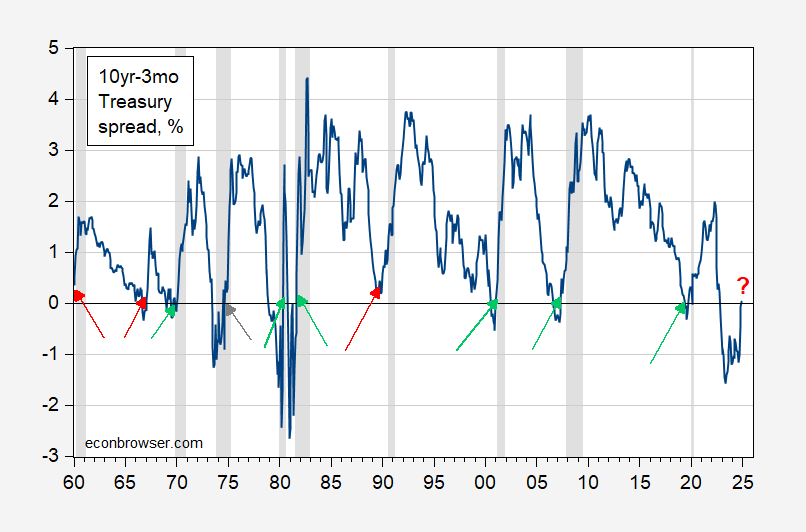

To evaluate this formally, consider the 10yr-3mo term spread from 1960 onward.

Figure 1: 10yr-3mo Treasury term spread, % (blue). NBER defined peak-to-trough recession dates shaded gray. Green arrows indicate events consistent with disinversion signal. Red arrows indicate events not consistent. Source: Treasury via FRED, NBER, and author’s calculations.

I create a disinversion dummy taking on a value of 1 in the first month the spread is positive after being in the negative range. Hence, increases in the spread when no inversion has taken place do not register a 1 value for the dummy.

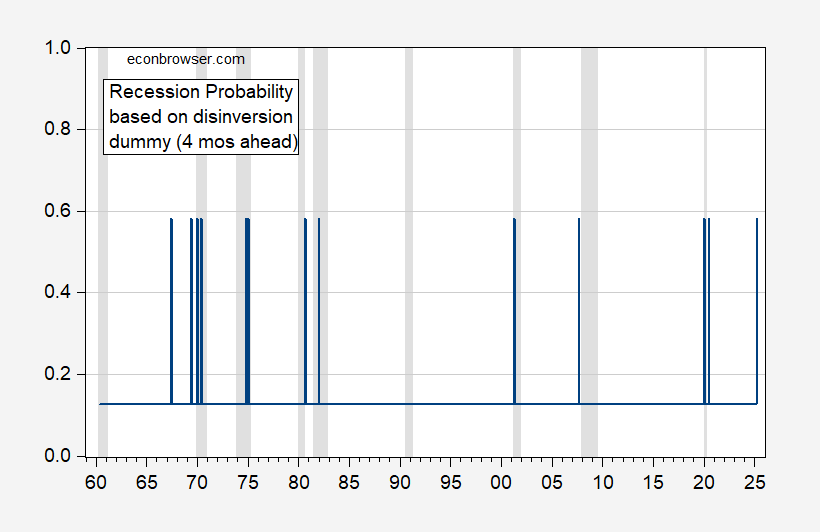

The maximal pseudo-R2 is obtained for a spread of 4 months, over the 1960-2024 period (assuming no recession took place in 2024) is about 0.023. Using this specification (a probit on a binary dummy) yields these recession probabilities.

Figure 2: Estimated recession probabilities using 4 month lead of recession on disinversion dummy (blue). NBER defined peak-to-trough recession dates shaded gray. Source: NBER, and author’s calculations.

The 1960-61 and 1990-91 recessions are missed (although a 10yr-2yr disinversion might catch the latter), while a recession is predicted for April 2025. Of course, if the inversion failed to predict the 2024 recession, is there reason to believe the disinversion will predict well?

The observation about disinversion is not new. It is a trivial sophistication of the yield-curve-inversion forecasting tool. If a positive term structure is the common condition, then disinversion follows inversion as night follows day; not much to see here. As your figure demonstrates, disinversion isn’t a good timing tool – it’s not always a leading indicator of recession. It fails altogether as a predictive tool if inversion fails.

I’ve made the same error myself, in writing. Shame on me. Once you think through the sequence, the only value disinversion could have is as a timing tool, and it fails as a timing tool.

This is something I looked at and wrote about considering a wider array of spreads at Seeking Alpha a few months ago:

https://seekingalpha.com/article/4721361-beware-reliance-on-the-10-year-minus-2-year-treasury-un-inversion

Here is the concluding part of that analysis:

“Ultimately, the logical basis behind this alleged indicator is that yield curve inversions are 100% accurate. If that is true, then – by definition! – the only question is *when* the spread un-inverts. The only three choices are (1) before, (2) during, or (3) after the *necessarily* ensuing recession occurs. As I have shown above, even if we grant the premise, then all we can say is that the un-inversion happens before the recession ends.

“But even more importantly, if we don’t grant the premise (see 1965-66 and 1998), and consider a wider array of term spreads, it all but completely falls apart.”

….”Consider the full history, and it is just as likely that the un-inversion indicates that constrained conditions will shortly begin to ease,” I.e., that an ongoing recession will soon end.

I’d argue that 1960 and 1990 probably deserve yellow arrows. They are pretty close to supporting the inversion argument, even if the low point does not cross zero. If you don’t think we get a recession now, then you’re probably arguing the recession-v-suppression thing, ie, this time is different.

It’s interesting to contemplate a recession in Trump’s first year, with a budget deficit already at 6% of GDP….

“I’d argue that…”

That’s a bad start, after the mess you just made in a previous term spread discussion:

https://econbrowser.com/archives/2025/01/150-years-of-ten-year-treasury-yield-100-years-of-the-10yr-3mo-spread

You don’t really have the chops to draw conclusions about fixed income, as evidenced here by your effort to work “suppression” into the discussion.

Textbook pseudoscience. When the statistics and data analysis don’t fit your conclusion, look for reasons to tweak or ignore the data. “Oh, this one doesn’t count for random reason X”. When you only have 10 or so data points, you can quite efficiently remove all outliers that don’t support your conclusion with just a couple of semi-plausible exceptions.

It matters how the yield curve disinverts. The typical pre-recession disinversion happens in a bull steepener, where short rates are falling faster than long rates. The short end falls fast because recession is perceived to be imminent – the market expects the Fed to cut rates. So it shouldn’t be surprising that recession follows that sequence of events.

What’s happening today is a bear steepener, where long rates are rising faster than short rates. That would appear to be the market pricing in faster NGDP growth, some due to rising inflation expectations and some due to rising real growth expectations. The question is how much of each? And, or course, it might not last. If the econ data softens long rates will likely fall. The first few months of the new administration is going to be interesting.

Nicely argued.