Data available as of today:

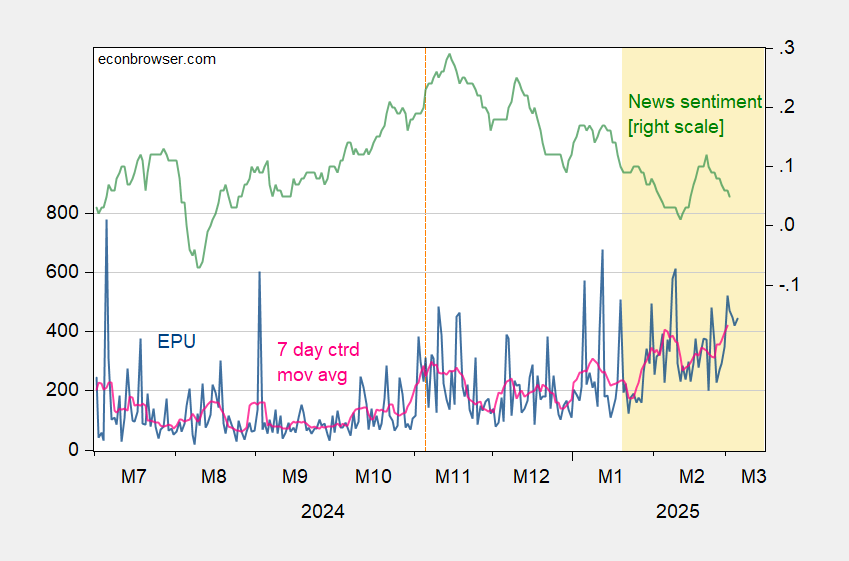

Figure 1: EPU (blue, left scale), and centered 7 day moving average (red, right scale), SF Fed News Sentiment index (green). Source: policyuncertainty.com, SF Fed, and author’s calculations.

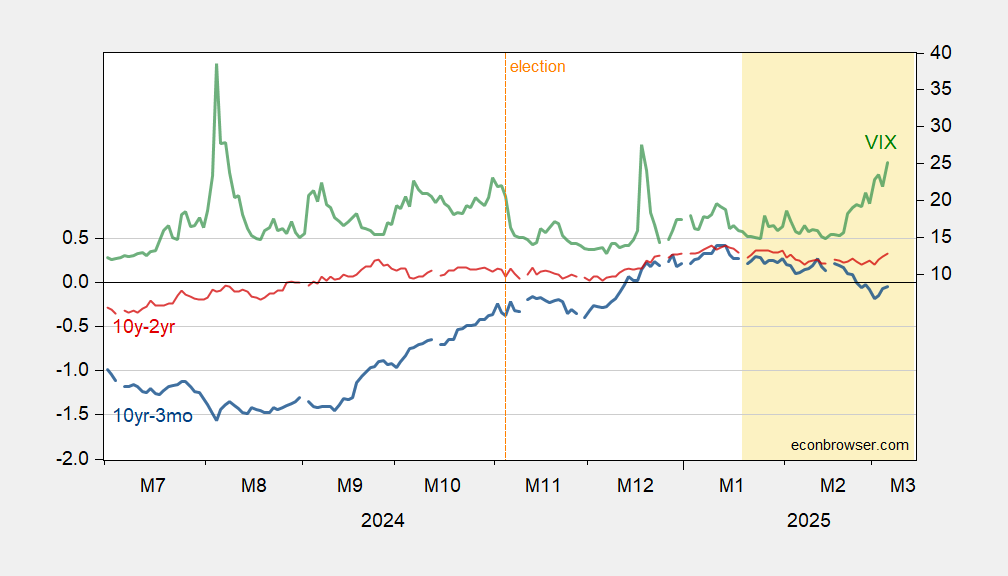

Figure 2: 10yr-3mo Treasury term spread (blue, left scale), 10yr-2yr Treasury term spread (red, left scale), both in %, VIX at close (green, right scale). Source: Treasury, CBOE via Treasury.

Today Trump signed an executive order creating a new Strategic Bitcoin Reserve.

Comforting to know that in case of a national emergency there won’t be a shortage of helium, petroleum or Bitcoin.

the crypto grift cannot succeed unless deep pockets are available to make continued purchases over the next 4 years. not exactly sure why we need a bitcoin reserve for anything other than a grift. or has the conservative republican decided that government should be in the investment and profit making business?

Trump may say that he has no plans to purchase more bitcoin, but just wait. Mark my words, there will come a time when he calls on the Treasury to prop up a falling bitcoin price to protect the value of our precious Bitcoin Reserve. It will be justified on phony “national security” grounds, just like the tariff war.

Canada has a Strategic Maple Syrup Reserve – really – but I doubt we can count on tapping into that with a tariff war going on. Canada could really put the squeeze on the US if push comes to shove.

The business press has quickly gone from “Trump is good for business” to “Oh gee – this may be a period of Trump stagflation” to “will there be a Trump recession?” – and some whispers of a Trump depression. Also I remember when Fox News would complain about the “uncertainty” caused by Obama putting regulations in place. And now not a word as some oligarchs/investment banks enrich themselves from all the stock market volatility.

And – the U.S. economy will soon be hit by taking $1.5 trillion out of local economies with cuts to Medicaid spending to fund tax cuts to the oligarchs. Something the GOP never mentions is that every penny of public benefit spending goes right back into the local economy to pay for housing, food, and healthcare and tax cuts go into share buyback schemes or speculative assets – bitcoin, AI etc. to increase wealth inequality.

Maryland and Virginia are scambling to patch up their budgets. Both rely heavily on income and sales taxes for revenue. Both states have well over 200,000 federal employees as residents – only California has more. Virginia is consistently among the top three states in terms of federal contracts, and lately has mostly been at the top of the heap. Cuts to federal employment and contracts will hit them hard, and uncertainty about revenue is very high right now. There budget agencies and lawmakers don’t have enough reliable information to make budget decisions, but nevertheless have to make those decisions.

Both states cast their electoral votes for Kamala Harris, as did California, so screw ’em. “United” States? Only if you’re a loser, I guess.

Really interesting insights on how EPU and news sentiment can influence market dynamics. I wonder how this will play out in the coming months, especially with the current economic climate!