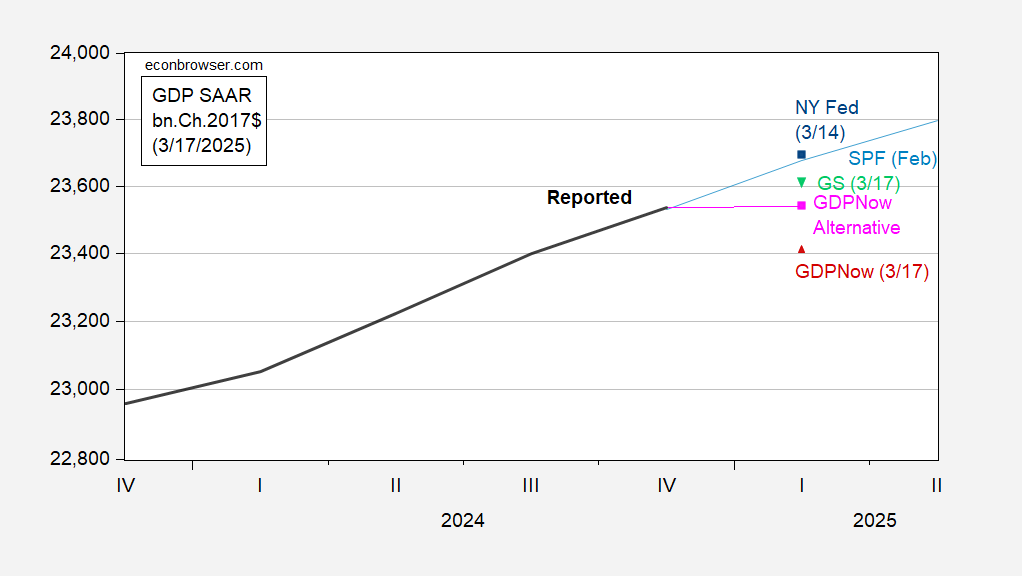

That’s from today’s GDPNow release (Calculation: As of the 7 March release, the reported GDPNow was -1.6%, while adjusted was +0.4%; a 2 ppts difference). Here’s the implied GDP levels.

Figure 1: GDP (black), GDPNow (red triangle), GDPNow adjusted for gold imports, using Atlanta Fed adjustment for March 7 applied to March 17 (pink square), NY Fed (blue square), Goldman Sachs (inverted green triangle), Survey of Professional Forecasters (light blue), all in billion Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, NY Fed, Goldman Sachs and authors calculations.

The 0.5 ppts downward move in the GDPNow since March 13th is due to the retail sales release, wherein m/m retail sales came in at +0.2% vs Bloomberg consensus +0.6%.

trump may go down as the single greatest economic destructor of all time. he is a champion at wealth destruction. rick stryker, you have done well in choosing such a loser as your champion. will you teach him more wonderful economics over the next four years? can you kick some children and spit on a few veterans as the two of you tank what was a solid biden expansion?

And he will have completed the destructor triple crown! Not only will GDP fall, but it looks like inflation will shoot up AND the budget deficit will increase BIGLY even with DOGE destroying 60% of the US Government’s agencies.

When retail sales data for January were released, they dragged the GDPNow estimate down sharply. Many of us saw the possibility that January sales were depressed by weather, and that some of the loss would be made up in the rest of Q1. A 0.2% rise in retail sales in February, probably no better than flat after inflation adjustment, means no catch-up so far.

In the Covid era, inflation-adjusted retail sales (PCE goods deflator) have gone negative on a quarterly basis more often than in prior expansions, and a negative quarter for real retail sales wasn’t always associated with recession even before Covid. However, as of Q4, we had gone 6 straight quarters without a negative reading. The current quarter could easily go negative.

Weather wasn’t the whole story in January; weakness carried forward into February. Press reports continue to tell of consumers trying to cut spending. There’s less eating out, more food at home. Restaurant sales have fallen in 2 of the past 3 months and were flat in the other – they are now weaker vs year ago than at any time since February 2021. Sporting goods, books and musical instrument sales are at their lowest level since last July.

Brucie will tell us a one-week drop in wholesale egg prices will save us, but I wouldn’t believe him if I were you.

The NY Fed’s Empire State factory survey for March is out. You won’t be surprised to learn that it’s squishy. Here’s the summary paragraph:

“Business activity dropped significantly in New York State in March, according to firms responding to the Empire State Manufacturing Survey. The headline general business conditions index fell twenty-six points to -20.0. New orders and shipments declined. Delivery times and supply availability held steady, and inventories continued to grow. Employment levels and hours worked continued to move slightly lower. Input prices increased at the fastest pace in more than two years, and selling price increases also continued to pick up. Optimism about the outlook waned considerably for a second consecutive month.”

In prior cycles, a -20 headline index would scream “recession”. Not so in the Covid era. March is fifth month so far in this expansion with a headline Empire reading of -20 or worse. It ain’t good, but it’s not a reliable recession indicator.