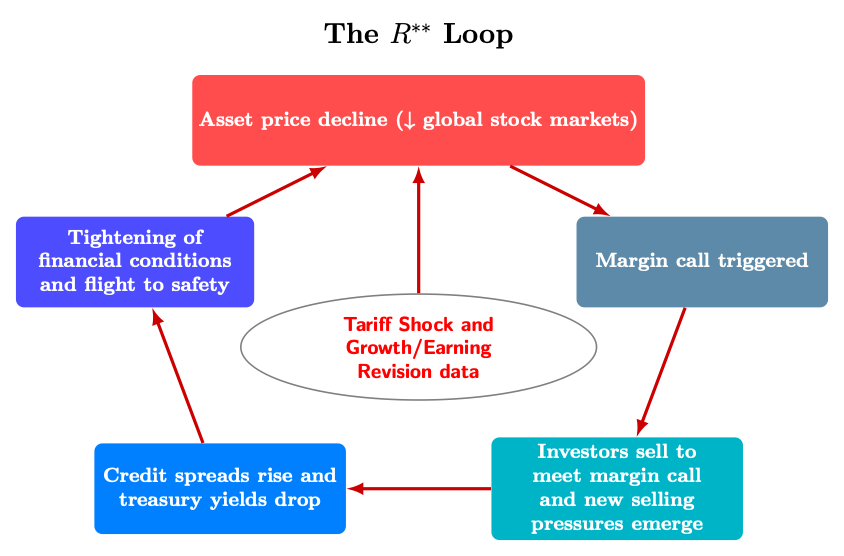

Gianluca Benigno points out that large and pervasive tariffs will have macro implications that spur deleveraging and a decline in R** in a pernicious (my word) feedback loop.

Source: G. Benigno (2025).

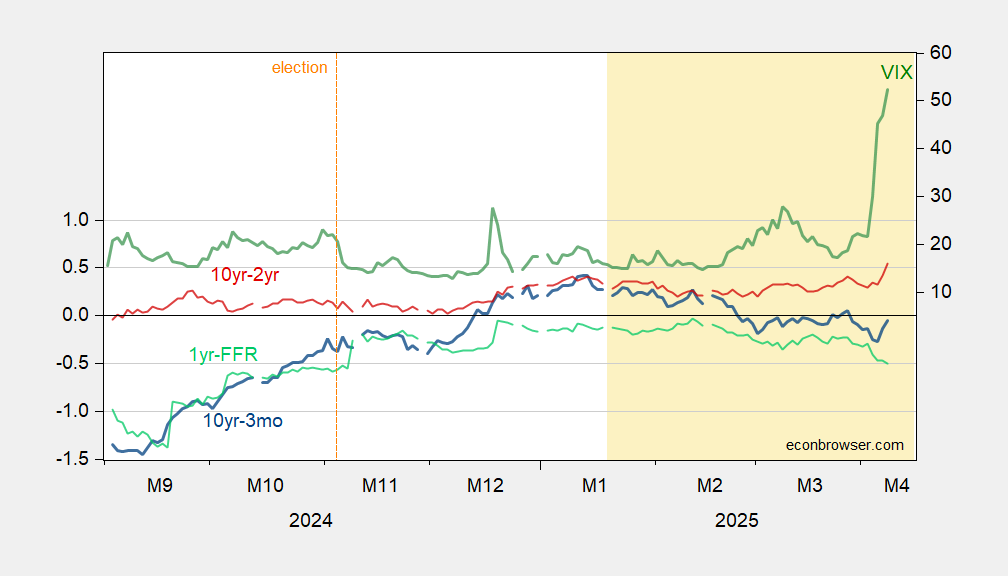

The 10 year yield is surging, so some spreads are steepening.

Figure 1: 10yr-3mo Treasury term spread (blue, left scale), 10yr-2yr Treasury term spread (red, left scale), 1yr-Fed funds (light green), all in %, VIX at close (green, right scale). Source: Treasury, CBOE via FRED.

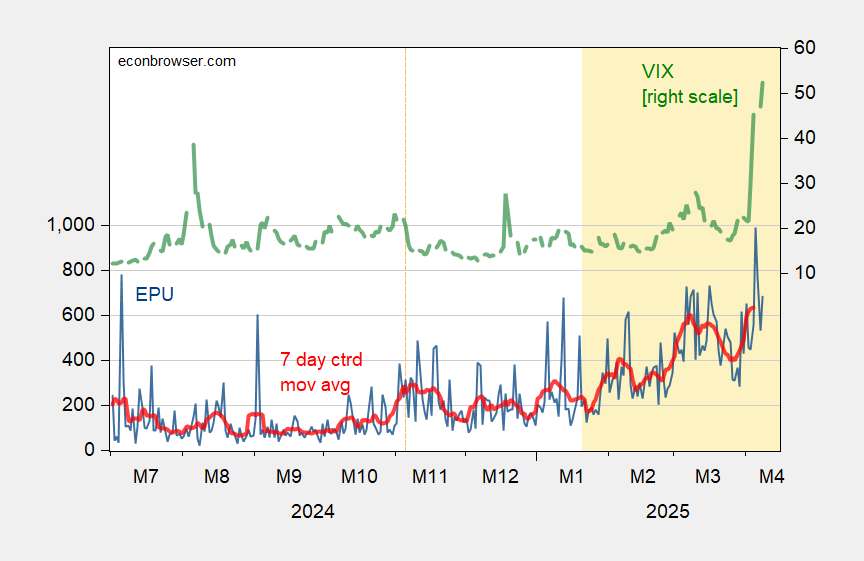

And the VIX is rising, as measured policy uncertainty is rising.

Figure 2: EPU (blue, left scale), and centered 7 day moving average (red, left scale), VIX (green, right scale). Source: policyuncertainty.com, CBOE via FRED, and author’s calculations.

Interpreting uncertainty shocks as negative demand shocks means that the model I used for analyzing the trade war is missing a piece. The IS curve shifts inward, on net, adding in depressed investment and consumption on top of retaliation effects.

With the dollar losing safe haven status, even if limited, the dollar will depreciate rather than appreciate (as I had expected).

This should place additional upward pressure on import prices (both inclusive and exclusive of tariffs).

In short, we are moving toward a financial disruption on top of a macro hit. Where it will all end up is a big question mark, bigger than I thought just a week ago.

Kalshi records recession odds at 66% right now, up 23 percentage points from just a week ago.

I got a request elsewhere for my take on the spike in the UST 10 year yield.

As usual, I looked for historical comparisons, and also to see if this was US-specific. Here’s what I found:

1. There were similar Treasury interest rate spikes approaching the bottom of stock market moves in both the beginning of 2009 and March 2020. There was also a similar move over about 10 days a month ago.

2. Interest rates in the last several days have spiked higher in Canadian, UK, German, and Japanese long term bonds as well. So this isn’t a case of investors fleeing the U.S. for other safe haven bonds.

Bottom line: the hard data doesn’t appear to support any geopolitical reason for the spike in 10 year Treasury yields – at least not yet. The most plausible hypothesis I have right now is investors facing margin calls have had to sell their winners – in this case, Treasury’s – to pony up.

In economic theory terms, in what ways does a tariff shock resemble the oil shock of the 70s, especially in terms of its causing stagflation?

F: Think of an AD-AS framework; oil price increase and increase in price of imported goods (inclusive of tariffs) constitute a price-cost shift (i.e., the short run aggregate supply curve shifts up).

Of course – we have to bail out the Great American Welfare Recipients – the Commodity Farmers growing corn/soya to ship to other countries for animal feed: https://www.bloomberg.com/news/articles/2025-04-09/us-weighs-farmer-bailout-as-china-retaliation-threatens-exports

Whenever I think about American Commodity Producers – I always think about farmers in Ukraine bringing in a crop while looking out for land mines and drones.

Despite having every advantage – American Commodity Producers can’t be profitable without subsidies and federally funded crop insurance. To say nothing of all the federal research $ going to land grant universities – although I hear the GOP is cutting that.

The felon-in-chief blinked, and stocks are roaring. Y’all knew that, but it seems germaine to the discussion.

Today’s other news is that, despite pressure on Treasuries in general, the ten-year auction went well, much better than yesterday’s 3-year mess. That’s points against the idea that there has been an abrupt loss of confidence in U.S. assets.

So, a few more thoughts. Tens have added about 35 basis points since Friday’s close. Twos have added nearly that much. At the same time, stocks are up sharply today, but had been pretty icky. Something other than convention risk on/risk on seems to be going on. If Treasuries are weak because of some global change in sentiment toward he U.S., it should show up in Treasury term premium. Here’s term premium at one, two and ten years:

https://fred.stlouisfed.org/graph/?g=1HXNz

After the election, term premium widened at the long end vs the short end. Any factor other than inflation and funding cost (Fed policy) ends up reflected in term premium, including increased uncertainty about inflation and funding cost. The felon-in-chief made the economy less certain. Term premium plunged in the final two days of last week, which kinda looks like a safe haven bid. FRED doesn’t yet have data on term premium for this week, so we don’t know that the safe haven bid has faded based on term premium, but it sure looks like it from the behavior of Treasuries.

Is the trouble with Treasures loss in confidence in the U.S.? See NDd’s comment above. Bear in mind, though, that a general rise in rates doesn’t mean there isn’t a loss in confidence in the U.S. It just means that you can’t tell by just looking only at rising U.S. rates.

We need official data on Treasury purchases, data on money flows, data on spreads. As I noted yesterday, recent data show the dollar out if favor. Consider, though, that the dollar index is still higher than it was last September; this isn’t a dollar route. As of Friday, there was no sign of serious cracks in market activity; such cracks would be a symptom of a big swing in sentiment against U.S. assets or the dollar.

My guess is, there is no abrupt, five-day collapse in confidence in U.S. assets. Because of the dollar’s special role in the world, we aren’t likely to see evidence of a collapse in confidence in the short run. Sudden collapse in assets and currencies tends to reflect liquidity problems. Changes of mind work themselves out more slowly.

U.S. stocks trade at a higher P/E than the rest of the world. The U.S. gets away with bigger deficits than most similarly-priced sovereign debt, excepting Japan. Those facts represent big risks if the world changes it’s mind about us on a wholesale basis. We really need to keep global confidence in the U.S. firmly in mind because of that risk, especially while monkeys with clubs are running Washington.

thanks for keeping up with all of this. i saw the problem because i expected rates to drop and i could refinance some debt. apparently that is not going to happen. i appreciate your detailed look into this. still not sure what has been going on. my guess is a little bit of a lot of things transpiring at once, and maybe not one big item. at least i hope so, because if its one big problem that would be problematic for world economy.

been thinking of a way out of this trade war. and i think trump has an out. he should not be hostile to the gameplay of congress taking back tariff control. let congress take back control and eliminate (or significantly reduce) overall tariff rate. do not veto the congressional bill. then he gets an out from this sticky tariff situation, without losing any face since he is not the one who rescinded the tariff. trump does not capitulate, but he gets to blame congress (mostly democrats i would imagine) for giving in to china. he will play it like a political win, which is all he really wants. the economics of tariffs mean nothing to him, since he is not really worried about the dogma of economic policy. and he can move on to some other form of chaos that may interest him in the future.