Prepping slides for macro, found these interesting correlations.

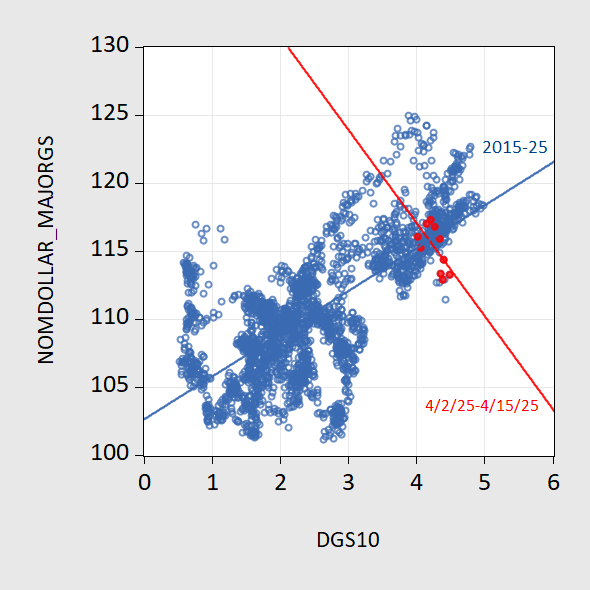

First, how the strength of the dollar correlates with the Treasury 10 year yield, daily 2015-23 April 2025.

Figure 1: Nominal dollar index vs. basket of major country currencies (blue circles), and OLS fit (blue line), and observations for 4/2/2025-4/15/2025 (red circles). Source: Fed and Treasury via FRED, and author’s calculations.

In the two weeks around Liberation Day, Treasury 10 year yields rose as the dollar fell (red circles in Figure 1).

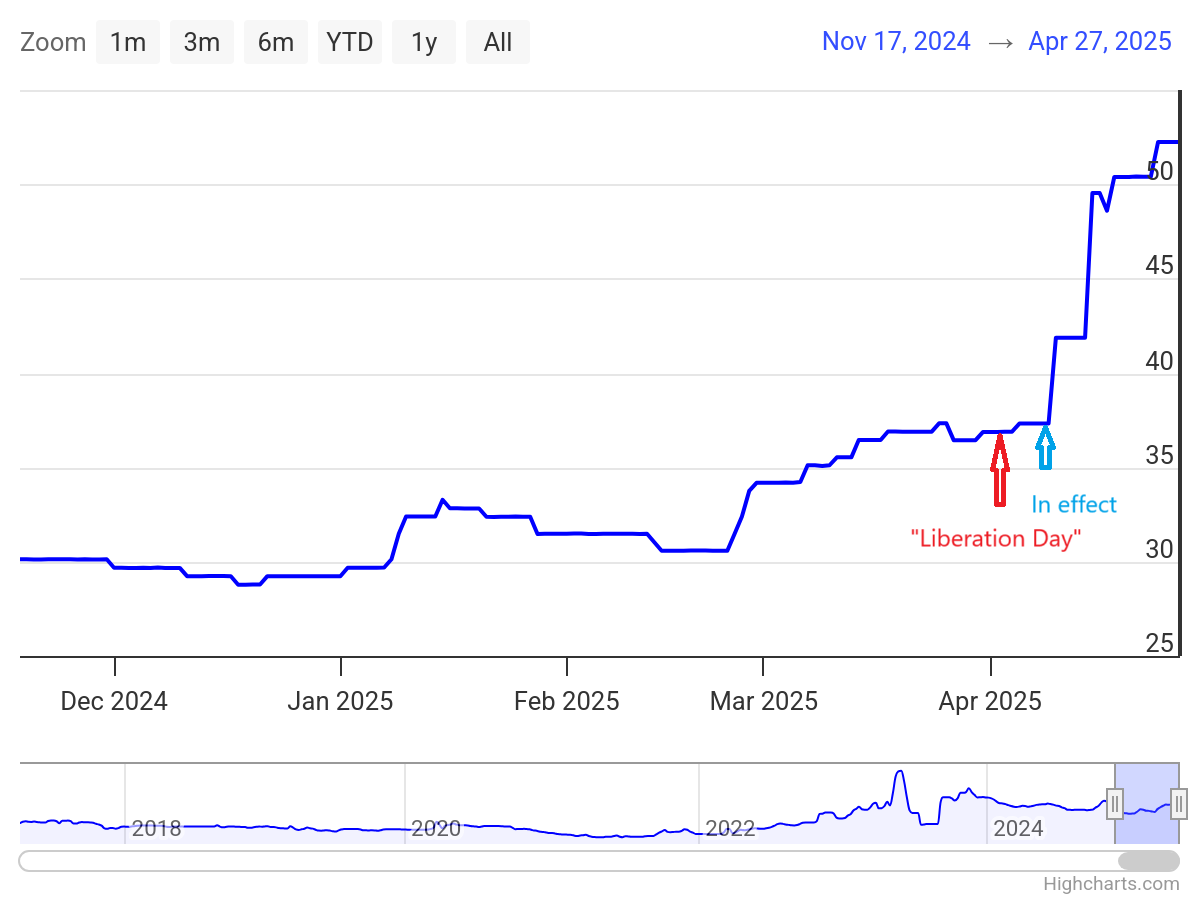

One obvious place to look for a loss in credibility is in credit ratings; however, those are notoriously sticky. I looked at credit default swap spreads, and was surprised, as I thought only in emerging market economies in crisis did I see noticeable movements — such as those since April 2, “Liberation Day”.

Credit default swap spreads on 5 year Treasuries. Source: worldgovernmentbonds.com, annotated by author.

Large movements only in the context of the US. To quote:

As of the latest update on 27 Apr 2025 13:45 GMT+0, the United States 5 Years Credit Default Swap (CDS) value stands at 52.25 basis points. This CDS value translates to an implied probability of default of 0.87%, based on a presumed recovery rate of 40%.

All I can say is, thanks Trump!

Forgive my obsession with this idea, but if market participants are using the felon-in-chief’s actions not only to predict economic outcomes, but also future felon behavior, then default swaps may reflect the risk of “Mar-El-Lago accord”. The accord, as conceived by Miran, involves actual default. During his first term, the felon did discuss default in U.S. Treasury debt as a potential policy choice.

Essentially, if he was dumb enough to do this he’s dumb enough to do that.

Another salient point, I think, is that the Fed appears to be headed toward greater politicization:

https://www.cnn.com/2025/04/18/economy/kevin-warsh-federal-reserve-chair/index.html

We don’t know what Warsh told the felon-in-chief when the felon talked to him about firing Jay Powell. We only know that Warsh is high on the felon’s list as a replacement for Powell, and that Warsh is a political hack with a background in finance.

Oh, and we also know that since being asked about firing Powell, Warsh has gone on the warpath against the Fed:

https://www.ft.com/content/1ff8ca87-3d3a-40c9-abed-a32cc795df74

But then, that’s because he’s a political hack.

I am afraid that trump has found his yes man in warsh. and neither the Supreme Court nor Congress seem capable of standing up to defend this working democracy. we had a good run. but I am afraid that trump and many cowardly republicans are going to give away all that has been built in America over the past two and a half centuries. right now there is not a single republican in America who actually believes in democracy. it is a shame, and something I once thought unthinkable.

Off topic – For those interested in the evolution of the U.S. financial market, as driven by interest rates, regulation and financial market structure, this is a useful article:

https://americanaffairsjournal.org/2025/02/from-investment-to-savings-when-finance-feeds-on-itself/

If “the evolution of the U.S. financial market, as driven by interest rates, regulation and financial market structure” seems daunting, well, yeah. But as a reference, to remind one of changes in the nature of the the financial market over time, it’s a good piece.

The text on the evolution of the market is preface to describing what’s going on between private equity and insurance, particularly with regard to annuities. This bit gives a hint:

“This is an admittedly simplified illustration of the complexity of Apollo’s model, yet it can be reduced to a cascade of leverage,…”

Apollo is the biggest player in the private-equity-cum-insurance-company game, so its model is worth looking at. This is yet another instance in the long history of using leverage to generate higher returns, and of creating financial structures to evade risk limits. As the article points out, we are back in “implicit government guarantee” country in the structures Apollo creates; returns are kept on the books, risks kept off, and potential systemic risks created.

This bit is also troubling:

“Under this model, equity exists to serve the creation of debt.”

Those who paid attention during the mortgage crisis will remember MBS creation driven by the desire to have a asset to short – the goal being furtherance of financial activity, not economic activity. Financial engineering intentionally separates the financial asset from the real economy and risk from return – otherwise, what’s the point?

There is a political angle to all of this. The Obama administration extended existing feduciary requirements to a broader range of financial products; the Trump administration then rolled them back, and Biden in turn warned financial firms that they could be held liable if they behaved as the felon-in-chief’s guidance seemed to allow. Now, the felon is back.

By the way, you can reproduce the results offered by annuities yourself, without fees, at TreasuryDirect.gov. You don’t need to pay some suit, and you can avoid the risk that appears to be piling up in the annuity market.