Transportation and warehousing boomed. Federal government workers on leave, taking buyouts not included yet (per convention).

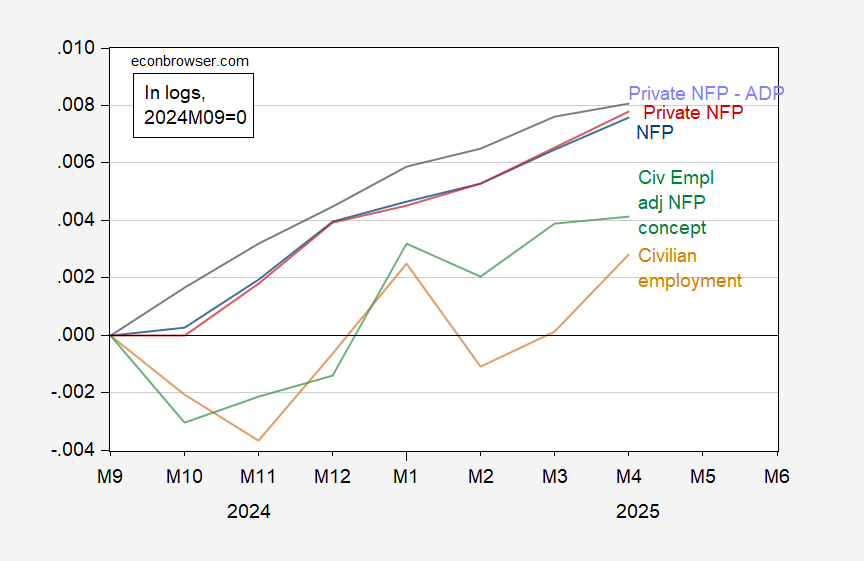

Figure 1: Cumulative log change since September 2024 in NFP (blue), private NFP (red), private NFP from ADP (lilac), civilian employment (tan), civilian employment adjusted to NFP concept (green). Household series are experimental series using smoothed population controls. Source: BLS, ADP via FRED, BLS, and author’s calculations.

Notice that the household series adjusted to NFP concept is flat, March to April.

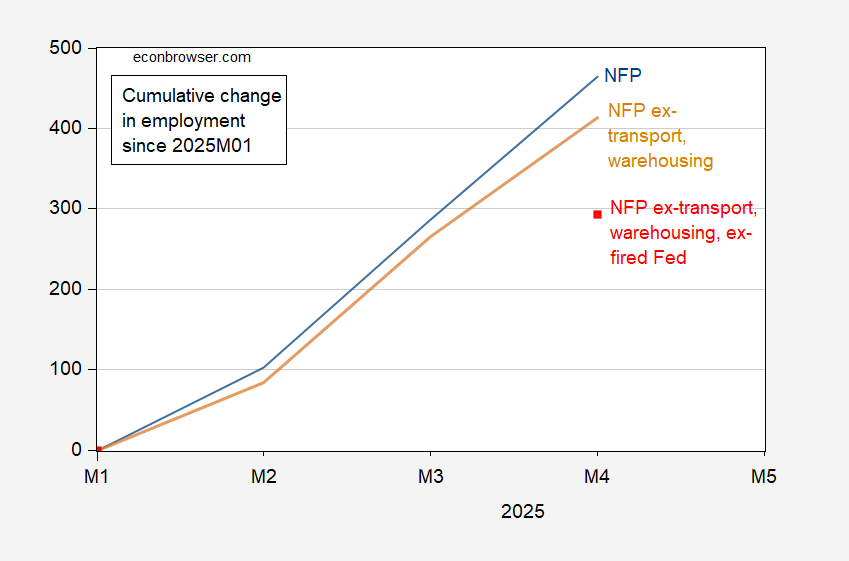

What about taking out transportation and warehousing employment, presumably booming relative to what post-tariff levels will be, look to be on a lower trajectory. Taking into account the fact that Federal workers on leave/furloughed and taking buyouts will eventually be counted as not employed suggests a lackluster employment growth rate since January.

Figure 2: Cumulative change in NFP since January 2025 (blue), ex-transportation and warehousing employees (tan), ex-transportation and warehousing, and Federal workers on leave, furlough, buyout, low estimate by CNN (red square), in 000’s. Source, BLS via FRED, CNN, and author’s calculations.

The low estimate from CNN is 121K, while the high estimate of Federal government workers on leave, furloughed, fired or took buyouts is 280K. Some portion of the workers are probably not counted as jobs, so the red square is a guess.

Taken literally, using the red square, underlying net job creation is on the order of 100K — rather than 155K — over the last three months.

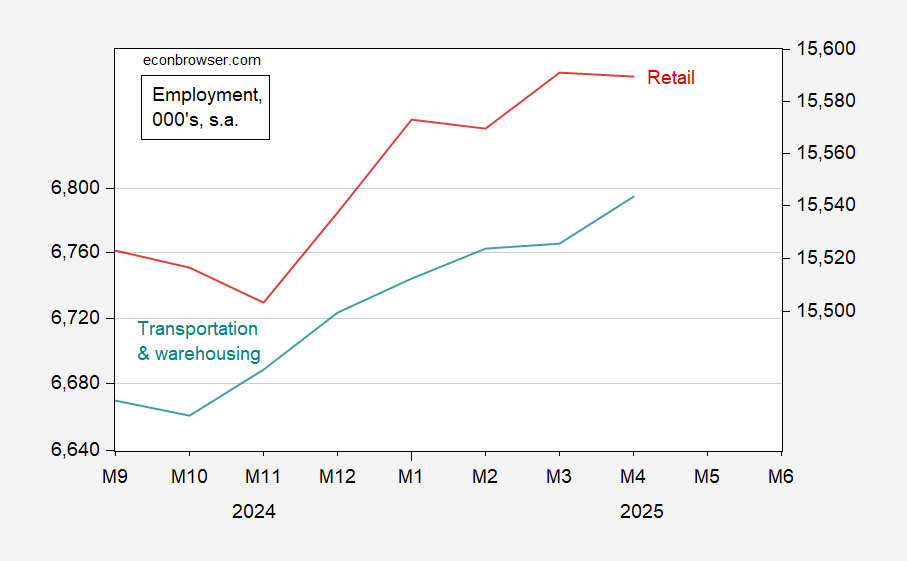

Looking at transportation and warehousing and retail explicitly is of interest. Note that retail employment is flat going from March to (preliminary) April.

Figure 3: Transportation and warehousing employment (teal, left log scale), and retail employment (red, right log scale), in 000’s, s.a. Source: BLS via FRED.

Helpful point of view. Thank you.