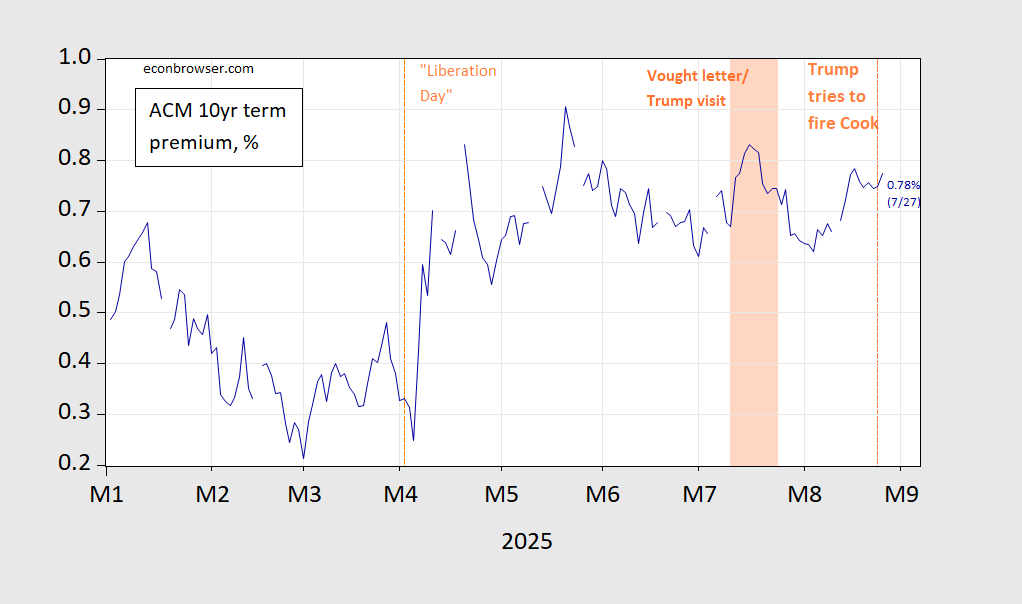

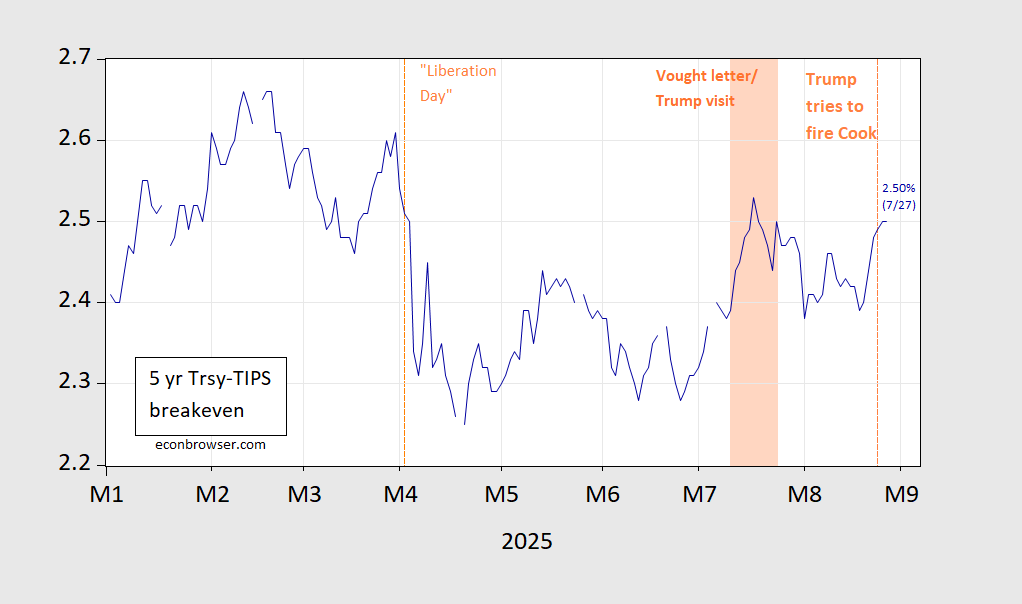

The 10yr term premium has risen, as has the 5yr TIPS-Trsy breakeven, in the wake of Mr. Trump’s campaign to subjugate the Fed.

Figure 1: Ten year term premium, in % (blue). Light orange shading denotes period between Vought letter to Powell and Trump’s visit to Fed. Source: NY Fed.

Figure 2: Five year Treasury-TIPS breakeven, in % (blue). Light orange shading denotes period between Vought letter to Powell and Trump’s visit to Fed. Source: Treasury via FRED.

If Trump continues to browbeat the Fed into lowering the fed Funds rate, then the path of future nominal rates may be lowered, but higher expected inflation will tend to increase the term premium. Which dominates? That’s ambiguous. Believers in the Fisherian relation know the answer.

The Treasury market might have responded more strongly to the latest affront from the felon-in-chief if not for a couple of things. One is that a good bit of risk has already been priced in:

https://www.worldgovernmentbonds.com/cds-historical-data/united-states/5-years/

Five-year credit default swaps are down from their “Liz Trust Day” spike in April, but are still 9.6% wider than a year ago. CDS in the felon II era are quite wide relative to earlier periods.

The other, as Krugman has just pointed out, is that financial markets are slow to price in changes in risk:

https://paulkrugman.substack.com/p/why-arent-markets-freaking-out

Krugman invokes the Keynesian beauty contest to explain the slow response of markets to changes in risk, Wiley Coyote to desribe what happens when market participants realize that other market participants have begun to realize risks have risen. There’s a literature on overshoot in which Mr. Coyote plays a prominent role.

Comparing the 5-year TIPS breakeven to the 10-year and the 5yr/5yr inflation calculation, it looks like investors expect any inflation problem to be corrected in time:

https://fred.stlouisfed.org/graph/?g=1LSSx

That does not read like a permanent politicization of monetary policy. That’s also not new to the felon II era. Same old view that inflation outbreaks can happen, but won’t be allowed to persist.

Menzie, et al, tops today’s Hutchins Center (Brookings) Roundup of new research:

https://connect.brookings.edu/hutchins-roundup-dollar-reserves-tax-rates-and-more

Anybody can easily tally up the risks of the Trump arbitrary policies and how the U.S. economy can fall into a stagflationary recession: weaker growth from trade disruption, deportations, and policy uncertainty; higher inflation from tariffs, labor shortages, and climate shocks; and higher long-term rates from fiscal dominance. Also, Trump’s dictates against renewables in a high-demand era mean higher electricity prices, weaker competitiveness, and greater inflationary drag, just as AI/crypto/electrification surge. This compounds other arbitrary policies and accelerates the risk of a policy-driven stagflationary recession.

His attack and attempt to block US from being competitive on energy prices (by building out the cheapest type) is going to be as stupid and destructive as his tariffs on base materials such as metals. Basically making US an even more expensive place to make things. I am nor sure how much of AI will migrate out of US to Canada and Mexico – but they have an opportunity to grab some of that since they will be able to beat us on prices for the main input in that product of the future.

texas energy prices just got hiked again. one of the main reasons? the state has decided to build out natural gas plants, which will only be used as backup sources and sit idle most of the days. using an energy source that will only get more expensive with time, especially if we continue to export our natural gas. rather than battery backups that come on during peak hours and store free wind and solar the rest of the time, our political leaders in texas have chosen the most expensive energy path to follow.

Good point. AI needn’t be a productivity boost in the economy as a whole in order to generate profits for server farms. If AI turns out to be less that its cheerleaders claim, there is still money to be made, until there isn’t.

If AI is the next internet, then getting a chunk now could mean good things in the future for Mexico and Canada.

How does one impose tariffs on the output of AI?

AI using large language models/machine learning in work flow already doing data analytics may or may not be marginally useful.

A particular application requires a “use case” with alternative states to suggest the investment and project implementation.

Whether useful or not, LLM/ML applications do not require massive data farms, in fact a business putting its data outsourced is a risk.

The massive data farms are for the U.S. government.

Both DOD and DHS are running for AI data farms.

As long as Congress puts AI in the National Defense Authorization Act (NDAA) and appropriates NVDA won’t tank.

AI in DOD has been slowly roasting since 2018, with a lot of language in the 2022 NDAA.

The huge data centers will hold massive video surveillance.

Off topic – another climate tipping point is looking really tippy:

https://www.nature.com/articles/s41586-025-09349-5

Y’all have heard of the AMOC – the Atlantic Meridional Overturning Corculation – and the risk that its climate-driven slowing may reach a tipping point which will cause an acceleration in climate change. Yes? A devastating positive feedback system caused by burning fossil fuels.

The link above is to a new study which finds that the a similar risk exists for the Antarctic Overturning Circulation. The risks asociated with a slowing in the AMOC include severe cooling in the Northwest of Europe (cooler by an average of 18 degrees F in London, 27 F in Bergen) and drying for much of Europe, as well as a rise in sea level along the East coast of North America.

The risk associated with a slowing of the Antarctic Overturning Circulation is a big rise in sea level and big habitat loss for sea life. The Artic Overturning Circulation is less well understood than the AMOC, but this new study suggests a sudden melt of Anarctic ice sheets may be nearer than for Arctic ice.

Here’s a less sciency write-up of the same research:

https://www.sciencealert.com/study-confirms-abrupt-changes-in-antarctica-and-the-world-will-feel-them.

Soooo, turns out, those tariffs are illegal:

https://www.motherjones.com/politics/2025/08/trumps-tariffs-are-basically-all-illegal-federal-appeals-court-rules/

Who’d have guessed?

Tariffs through June amounted to $108 billion, which will have to be refunded. That amount, and future tariff revenues, will be unavailable to reduce the deficit, so PAYGO sequestration will increase by an equal amount.

Any investment planned in response to tariffs now probably won’t occur. Whether trading partners will withdraw their retaliatory trade barriers is unclear. New trade deals among our trade partners which exclude us will probably go forward.

Oh, and DC federal district Judge Cobb has ruled that fast-track deportation is illegal, and Cobb is also presiding over Governor Cook’s case against the felon-in-chief’s order hiring her. So it looks like the felon lacks the power to enforce pretty much his entire second-term agenda.

His approach since the good old NY mafia real estate days has always been to brake the law then drag the case out until the other party gets ready to meet him halfway. Not sure he understands that such an approach may not work the same way in politics (national or international).

which is why he is setting the stage for incarcerations, legal and illegal.

Oh, and the wars in Ukraine and Palestine aren’t over; they’re worse. India says the felon-in-chief lied when he claimed credit for the end of their recent conflict with Pakistan. Trump is no Jimmy Carter.

Breaking news. The internet is posting that donald trump is dead, and the white house is covering it up in essentially a coup! Vance must resign immediately. Show us proof that donald is alive, and not a musk built robot bent on worldwide destruction!

In the court argument regarding tariffs, Secretary Bessent cited the little known Embarrassment Clause in the Constitution that says enforcement of tariff laws should be ignored if they cause embarrassment to the President.

Trump also cited Article 2 which says the US Constitution gives the him the power to “do whatever I want as president”.

It will be interesting to see what convolutions Judge Roberts will go through to split the baby on these issues.

Off topic – but it rhymes:

https://www.yahoo.com/news/articles/frances-francois-bayrou-tables-confidence-142303949.html

Nine months since the last government fell, the current French government seems likely to collapse in a no-confidence vote that PM Bayrou has called for September 8.

The issue which divides French politics is the budget deficit, which reached 5.8% of GDP last year, while the Maastricht Treaty caps deficit/GDP at 4%. Bayrou, and President Macron, support cuts to social spending to reduce the deficit. Most political parties, even those in Bayrou’s coalition, disagree.

France’s debt/GDP ratio is 113%, less than the U.S., Italy or Japan, more than Spain, Canada or the UK. French 10-year credit default swaps are up a bit since the decision to call a confidence vote, but not relative to earlier this year. This year’s CDS prices are the highest since the early days of Covid:

https://www.worldgovernmentbonds.com/cds-historical-data/france/5-years/

Today, economist Peter Navarro says that if the Supreme Court strikes down Trump’s tariffs “it will be the end of the United States.”

Today, DHS Secretary Kristi Noem says that “L.A. wouldn’t be standing today if President Trump hadn’t taken action.”

These people are dangerously mentally ill.

Trumpism is a doomsday cult.