That’s the title of my “No Jargon” podcast on the Scholars Strategy Network, posted yesterday.

I talk about “the biggest economic trends of the past year and explains how rising tariffs are shaping prices, business decisions, and household budgets.”

Source: Pawel Skrzcpynski.

From the transcript:

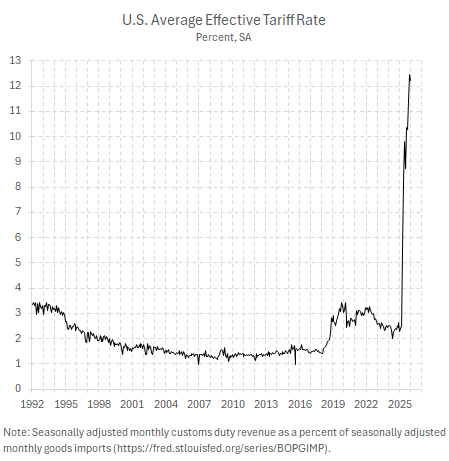

We have gone from having a tariff rate that is a tax rate on imported goods that was about one and a half percent. To, you know, in those mid, 2010 or so, to, let’s say 3% under Trump in the first trade war. And now it’s at about 12.5%. And that’s a number that you have to go back to the 1930s, in the Hawley-Smoot tariffs, in order to see.

Now that’s done several things. It’s really made importing stuff into America a lot more expensive. It’s forced companies to quickly readjust how they’re doing business and how much they’re interlinked with the rest of the world. It’s also forced our major trading partners to say, we’re not sure we can trust any commitments for the United States in trade or otherwise going into the future. So, should we be dependent upon the US anymore in the way we have been in the year of globalization? And finally, and perhaps most importantly, for the macroeconomics, it’s introduced tremendous policy uncertainty so that governments and companies and consumers have a really hard time deciding what to do and when you have a hard time trying to figure out what is the best route forward, a lot of times people just opt to put off decisions.

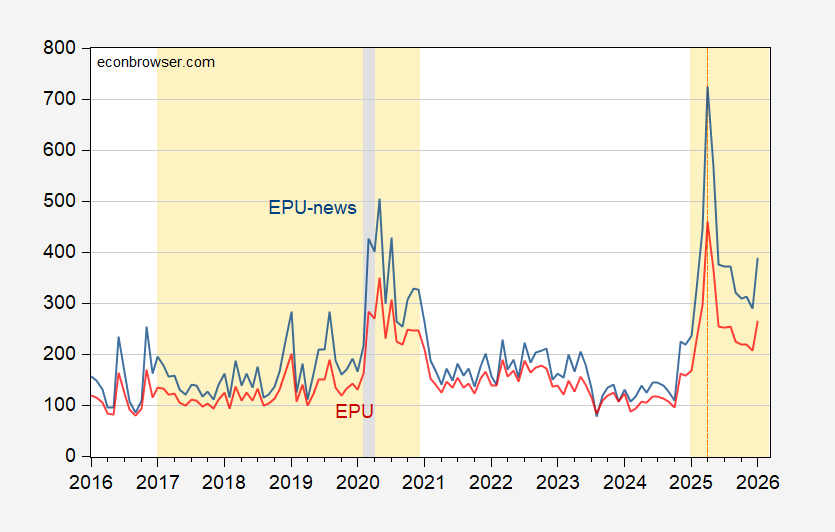

In terms of policy uncertainty, it’s clear that — while it’s subsided — it’s nowhere near pre-Trump 2.0 levels. It’s also risen lately.

Figure 1: EPU news index (blue), EPU index (red). Light orange shading denotes Trump administrations. Source: policyuncertainty.com.

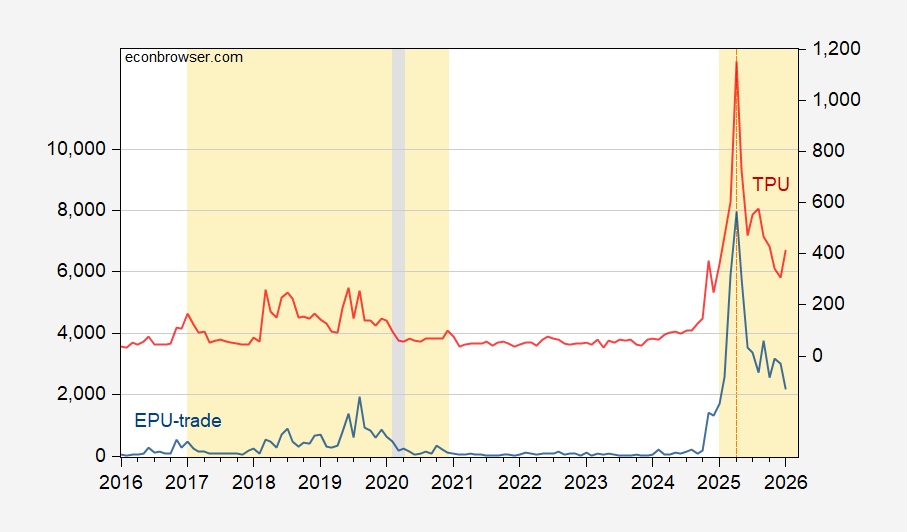

Trade policy uncertainty — measured using newspaper text or more broadly based information — has remained elevated, above levels recorded under Trump 1.0.

Figure 2: EPU – trade category index (blue, left scale), Trade Policy Uncertainty (red, right scale). Light orange shading denotes Trump administrations. Source: policyuncertainty.com.

I neglected to mention the costs of tariffs per household. The Tax Policy Center estimates $2100 for 2026. It’s also important to recall that’s an average; the taxes on imports imposed are regressive in nature.