Distortion versus effective subsidy.

On Monday afternoon, I’ll be Econoblogging on WSJ with Kash from The Street Light on the implications of a dollar decline, but this piece of news from China provides a nice segue into that topic. From FT:

“Ben Bernanke, chairman of US Federal Reserve, stepped into a political minefield on Friday when he released remarks branding China’s undervalued currency an “effective subsidy” for its exporters which was distorting patterns of production and trade.

In what looked to be a last minute bid to avoid controversy, Mr Bernanke then dropped the phrase from his speech to the Chinese Academy of Social sciences, using the less inflammatory term “distortion” instead.

Mr Bernanke’s original text talked about “the effective subsidy that an undervalued currency provides for Chinese firms that focus on exporting rather than producing for the domestic market.”

This phrase — even though not finally uttered by the Fed chief — is likely to be seized on by US manufacturers who have long pressed US government agencies to make the same determination in trade cases.

A Fed spokeswoman said Mr Bernanke’s decision to drop the word “subsidy” was “a spontaneous decision” aimed at enhancing the clarity of his remarks.

She said the Fed had not been asked to drop the term by anyone in the US administration delegation in Beijing for the final day of the high-level strategic economic dialogue.”

The Fed is standing by the language of the original text, which is posted on its website, and has not repudiated the view that the currency regime does amount to an “effective subsidy.”

As in the prepared text, Mr Bernanke called on China to embrace “further appreciation of the renminbi, combined with a wider trading band and with the ultimate goal of a market-determined exchange rate.”

He said this would “allow an effective and independent monetary policy” that would help promote “growth and stability.”

The full text of the speech is on the Fed’s website here.

Personally, I think that both descriptions are, from an economic perspective, apt. But “effective subsidy” provides ammunition to protectionists, and that’s not in the world economy’s interests. After all, effective subsidies are everywhere, including the United States and other developed countries (just teach a course in trade policy, and you’ll get a feeling for that; or take a look at Boeing — or Airbus, to be balanced).

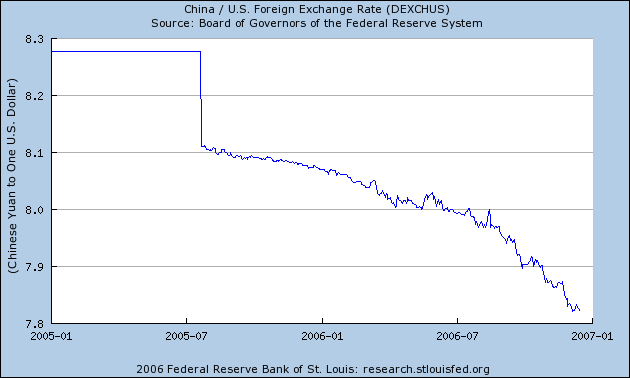

So (going out on a limb), I think that Bernanke did the right thing in his talk — provide intellectual support for the position that it is in the interest of both the United States and China (overall, although not necessarily the exporters) to allow more rapid yuan appreciation (which already appears to be happening — see Figure 1 below).

Figure 1: CNY/USD, daily. Source: St. Louis Fed FREDII.

I say this, still believing that faster revaluation of the yuan will not come anywhere near remedying the U.S. trade deficit, in the absence of fiscal consolidation. It’ll largely re-allocate the deficit to other (primarily East Asian) countries. But it will serve to facilitate global rebalancing, and to still some of the protectionist voices in the United States.

But more of that on Monday.

More coverage: WSJ Washington Wire, WSJ, Reuters via NYT, and a trade related article from Reuters.

Technorati Tags: China,

Ben Bernanke,

effective subsidy,

yuan

What is amazing is how low mortgages have gone even with the accelerating Yuan appreciation. When that one-time revaluation happened last year, the effect in mortgages was something like three times the magnitude of the change in currency rates.

Other financiers must have stepped in; either that or China cares even less about how much money it throws into US agency and private bond market securities and the return it gets.

I’m sorry but this whole debate seems disingenuous to me. The Chinese link their currency to the dollar. If we determine that the yuan should be devalued, then should the dollar be devalued even more than it has been the past 60 days (see dollar/euro)? From what I have heard the Chinese have in essence told our delegation to go pound sand.

If there is any currency mismanagement it is the dollar not the yuan. Bernanke needs to come home and take care of the dollar and just leave the Chinese alone. Their command economy will ultimately stop their growing economy not any actions by the US or the monetary authorities.

When Kash announced the econoblog, I commented that you two would be interesting to listen to ( I guess it really is to read) but I was wondering if you and he would disagree on anything. Well it seems the new Angrybear (Steve Kyle) posted something that has a nice debate between him, Dean Baker, myself, and Kash. Hopefully, the back and forth will be of some assist as you prepare for Monday. The rest of us will sit back and enjoy!

Sorry Dick but you are way off.

The Yaun should be much stronger based on fundamentals like the trade balance and public debt. Sure it has appreciated since they let it “float” but it is still way too far regulated. The Chinese are still getting a huge export advantage not just against the United states, but against the whole world.

You mention the Euro, and what is completely absent from even Menzie’s expert analysis is how undervalued the Yaun is against the Euro. Sure the Yaun has strenghtened against the dollar of late, but what hasn’t (except the Yen, the world’s laggart)?

When you look at fundamentals, the Yaun should probabaly be something like twice as strong as it is now, or even more. That is what floating currency markets do: they balance the inequities of comparative advantages quickly and without remorse.

I live in the Czech Republic and run a business that relies on 80% export. Our currency has appreciated 100% against the dollar in the last five years, and we run huge budget deficits.

Compare that to the Yaun where all the fundamentals should be pushing the Yaun even further to the upside against the dollar and yet remains for all intents and purposes pegged to the dollar.

This is the most arificial regime in the currency market, and the Europeans are getting killed because of it, thus having to resort to extreme measures like dry docking containers of sweaters just to survive.

Sorry for the long post, but we are getting killed by the artificial Chinese currency regime and I feel it is high time that it floated and they as a result should have to play ball like the rest of us.

Anyone?

praquetwin,

Are you not aware that the yuan is linked to the dollar? The Chinese have determined that since the US is the largest trading block in the world that they will keep their currency on a par with the dollar so that they can maintain a balance of trade relative to their production.

All this mumbo jumbo about trade balances and public debt as just a smoke screen to try to get the Chinese to slow their growth through currency manipulations. It is like France and Germany whinning about Ireland’s low taxes giving them an unfair advantage rather than lowering their own taxes and stop confiscating wealth from the productive people.

I do feel for you because most of the governments in the European block are so intertwined with business that it is hard to tell the difference. I know that you are better off now than when the government ran everything openly, but moving from a socialist/communist regime to an economically Fascist regime is not much better. (By economically Fascist I mean the government leaves ownership in the hands of the businessmen but regulate the cost of factors of production). This is not a slap at you. I like in the US and we do the same thing. I mean it is our delegation that is over in China right now.

If the Chinese are gaining such an advantage with their currency why not just change their currencies to compete with them? The answer to this is that those who are whinning about the Chinese currency know that changes in the yuan will only be destructive to Chinese production. They won’t do anything about creating more wealth for the world.

Finally, understand that the Chinese are in large part following the advice of Robert Mundell. That being the case they will have an optimal currency system for themselves. The rest of the world is just going to have to learn, or relearn, how to compete.

Menzie,

Thanks for the links.

I was almost sickened when I read the following. In my whole life I never remember any American chastising a communist country for not being socialist enough.

The words of Ben Bernanke, December 15, 2006.

“Although more flexibility in the exchange rate would be helpful, the most direct and probably the most effective way to reduce the external surpluses and increase the welfare of Chinese households is to take measures to reduce domestic saving relative to domestic investment. Why is domestic saving so high at present? The high saving rate of households, even very poor households, likely reflects the relatively thin ‘social safety net’ in China.”

“…Combined expenditures by the central government and local governments on education, health, pensions and relief, and social security amount to only about 4 percent of GDP, lower than most other countries at similar income levels. In the absence of a stronger social safety net, Chinese households save at high rates to protect themselves against risks such as unexpected medical expenses and poverty in old age.”

And you wonder why China is growing so fast? Could it be that their markets in some cases are more free than in the US? China should be giving us economic lessons…Oh yeah, I hear that is just what is going on in these talks. I just wonder if Paulson and Bernanke will learn their lessons.

I remember my surprise when Alan Greenspan refused to comment on the strength/weakness of the USD at a senate oversite hearing. He stated that this was the Treasury Dept area and he would not comment. Now we have Bernanke in China commenting on the strength of the Yuan, and telling the Chinese how to conduct their economic policies. It apprears to me that our central bank has lost it’s independance. If so, this tells me that the current system for selecting the Chairman of the Federal Reserve is not working as intended. (My first post).

Aaron Krowne: As I’ll discuss on Econoblog on Monday, the oil exporting countries have picked up on dollar asset accumulation.

DickF: (I think you mean “yuan revalued”). I’m trying to stay away from words like “mismanagement” and to focus on what actions would move the world economy to a sustainable trajectory.

praguetwin: I wonder if the massive budget deficits have anything to do with the currency overvaluation you perceive…In any event, I refer you to this paper on Rmb misalignment.

GeneF: In narrow legal terms, U.S. exchange rate policy is ostensibly within the purview of the Treasury, and hence Greenspan was wise to not make statements regarding the dollar’s strength. However, there is no legal stricture I know of regarding the Fed chairman commenting on other countries’ exchange rate policy. That is a big jurisdictional difference.

GeneF: I would add to what Menzie wrote that given that the Chinese central bank et al are depressing US long-term interest rates (& doing roughly half of it with fresh Yuan, Yen, etc.), our Fed chief has a duty to take an interest in PBoC’s $ peg. Said depression of US interest rates distorts the structure of production in the US, for example encouraging over-production of housing & other goods bought with long-term borrowing.

Dick,

Thanks for your thoughtful response. Yes, I’m aware that the Yuan is pegged to the dollar (although last year’s decision allowed it to float within a range so “pegged” is probably not the best description anymore). This pegging is what, in my view, undervalues the Yuan. With industrial production soaring, and a trade surplus that dwarfs the rest of the world, it seems to me that the Yuan should be strengthening. Just the opposite is true in the United States, and we see the effects of huge twin defecits: a rapid decline in the value of the dollar.

Pegging the Yuan, then, to the dollar amounts to artificially deflating the value of the Yuan vis-a-vis other world currencies, particularly the Euro.

I used the example of the Czech Koruna to demonstrate what happens when an underdeveloped country begins to benefit from a comparative advantage and their industrial production soars. Namely, the currency rapidly appreciates and the comparative advantage shrinks. This is how markets should work.

Certainly China is avoiding such an event with their currency manipulation (for lack of a better term). This clearly is benefitting their industry to the detriment of other developing countries that don’t wield such power.

Your points about the European economic regime are well taken. I don’t mean to say that it is any panacea over here. However there are certain advantages to controlling the means of production, especially for the working class. Again, just my opinion.

Menzie: Thank you for the link. I’ll be sure to read it and see if it changes my opinion on the points made above.

praquetwin,

Very good post. Thanks for a thoughtful response.

I used the example of the Czech Koruna to demonstrate what happens when an underdeveloped country begins to benefit from a comparative advantage and their industrial production soars. Namely, the currency rapidly appreciates and the comparative advantage shrinks. This is how markets should work.

If this is how markets should work why not different exchange rates between districts within a country, between cities?

Consider those hurt most by the debasement of the currency? Those hurt the most are those who hold the currency or use it in production/consumption. That means that currency manipulations always hurt the citizens of the country than they help anyone else. At most it simply shifts wealth from the general population to exporters.

When I ask the question “would world trade be better with one world currency” most economists answer yes, yet they continue to play exchange rate games. The reason trade would be better under one world currency is because it would remove the monetary distortion signals that business has to fight through to get to the real meat of an economy. Essentially this is why Robert Mundell was awarded the Nobel for his work on the euro.

China does not have a booming economy because of their monetary policies. They have a booming economy because they have allowed markets to become more free and in doing so have unleashed their pent up productive capacity. No matter what happens with currencies, China will continue to boom economically until it reaches its capacity to produce. Given the amount of governmental control and the uncertainty their potential and actual government intervention creates, China will see its boom end before it reaches its optimum level.

The US would be better served if the monetary and economic authorities would concentrate on removing production barriers in the US rather than trying to convince other countries to erect barriers to their own economies.

Menzie, Thanks for the comment. I agree with you about the focus on the practical and staying away from loaded words. It is just sometimes I get so frustrated….!

DickF: You might be amused to learn that the main contribution for which Mundell was granted the Nobel prize was for the Mundell-Fleming model, which shows how monetary and fiscal policies can be directed toward altering the exchange rate or the trade balance via expenditure switching and expenditure reducing methods; see the text of the speech at the awarding of the prize here (which differs substantially from the main points in Mundell’s speech).

Thanks Menzie. I did know that. I was a Mundell fan before he won the Nobel and I read his speech and the Nobel award statement.

I may have overstated the impact of the euro on his award, but I doubt he would have been noticed much had it not been for the euro. I do understand that the Nobel committe is much more economically Fascist (see my earlier definition) than Mundell.

I’m always wondering when I hear about so called “distortions” of the free-market why people don’t talk about intellectual property.

After all this is pure protectionism by the USA and a much bigger distortion of the free market than the chinese keeping some spare dollars around.

I love the “in the interest of China” :).

Dick,

I agree to a certain extent. It is the only the people who deal in several currencies who actually take advantage of the rate of exchange. The locals are more subject to fluctuation, but rarely benifit from it. As the currency appreciates here, there is little benefit for those who do not travel outside the country or who do not plan to sell their assets and purchase foreign assets. Sure, import prices moderate slightly, but mostly the commom man finds it harder to negotiate a higher wage from the international corporations. He can not understand why it makes any difference that the local currency is stronger as there is very little noticeable effect for those who are not connected to the international market.

In China’s case, I agree that their production is not simply a result of the exchange regime. The Ukraine also pegs their currency to the dollar yet they are not seeing the same result. However, the currency rate should temper that industrial power. If Americans suddenly had to pay more for Chinese goods becasue of the the exchange rate, this would give others a greater chance to compete (including us here in the little Czech Republic).

Finally, I agree with the global currency theory that you posit here. My feeling is that if there is to be a global economy and truly free trade, there must also be a global currency, but now we are delving into those areas that few dare or care to even entertain. Sure, it makes perfect sense, but “that’s talking crazy”

Thanks for a great discussion.

praquitwin,

I agree our discussion has been very good, thank you.

Just a few comments. Where I disagree is that I do not believe we should use currencies to “temper … industrial power.” Economics has lived up to the name “the dismal science.” It seems throughout history, whether Malthus encouraging us to let people die, or Carlyle encourging us to own slaves, economics has been more about destroying wealth and well-being than in satisfying wants and needs. The idea that we should use monetary policy to slow a growing country’s production is actually asking to destroy international wealth.

That said the US is the big man in the economic room and so most of the wealth destruction comes from US mismanagement (sorry Menzie). What is often ignored in monetary discussions is the other side of the transaction. When one benefits from monetary action another is harmed. That is not to say that we live in a zero sum world, but changes in monetary policy do have a “zero sum” effect.

The reason I talk of theoretical one world currencies is to try to make people think about how our current system is flawed. The closer we come to the ideal the better we will be, but if we continue to have a “trade war” mentality, as it appears the US delegation took with them to China, we will only destroy wealth.

Again thanks for the discussion. I hope we will have others.

Dick,

Pehaps “temper industrial power” is too strong. I guess what I was trying to get at is the fact that when one country exports like mad, and saves like mad, their currency should appreciate in the interests of balance. It seems logic to me, but alas, I am just a layman.

Thanks again, I’m sure we can find other topics to disagree on. 🙂