West Texas Intermediate closed today above $115/barrel. Does that reflect changes in the fundamentals of world supply and demand? My answer is no.

Let me acknowledge first that there has been some interesting news about world oil supplies.

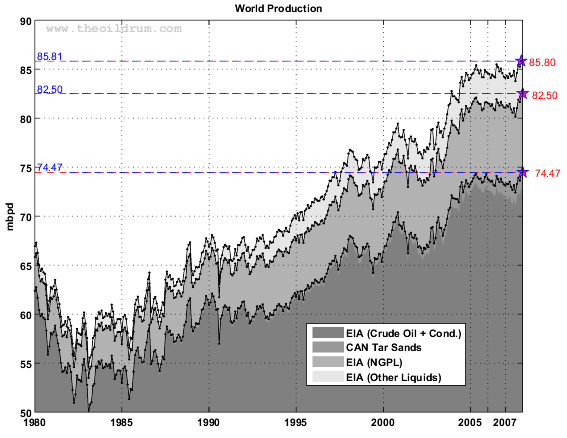

Nate Hagens noted that, although global oil production has stagnated over the last several years, the January 2008 data finally show a new all-time high in terms of the quantity produced worldwide.

|

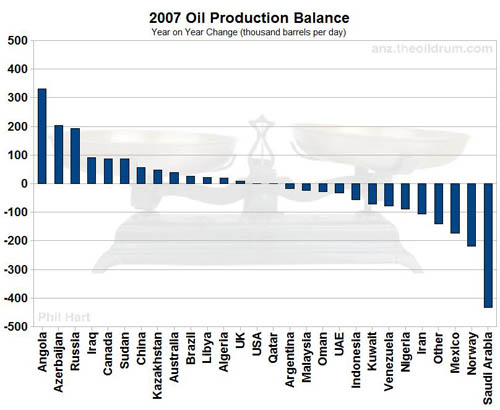

Phil Hart had an informative graphic showing how the stagnant oil production for 2007 represented a balance in which gains in production in some countries were just about matched by lost production from others.

|

|

And there were some important additional new developments just this week. On the positive side, Brazil announced the possibility of enormous new oil reserves. And for the pessimists, Russian oil production, whose increase has been a critical factor in world oil supplies up to this point, fell 1% in 2008:Q1.

Both of these stories are potentially huge developments. If both Russian and Saudi production have in fact peaked, the global peak cannot be far off, even if the Brazilian find is borne out. But I nevertheless am not persuaded that any of these news items is the primary explanation for the recent highs in oil prices.

The reason is that we’re seeing similar increases since the start of the year in the price of virtually every storable commodity. The 12% increase in oil prices this year is in fact just the median for the group of 15 commodities graphed below. It seems to me we should be looking for a single explanation behind the common behavior of the group, rather than try to develop a separate theory for aluminum, barley, coffee, cocoa, copper, corn, cotton, gold, lead, oats, oil, silver, tin, and wheat.

You can’t attribute much more than half of this increase in commodity prices to the decline in the value of the dollar. The dollar price of a euro (the bold red line in the graph above) is up only 7% for the year, which is less than the price increase for all but 3 of the 15 commodities shown. Another way to make that point is to recalculate the above graph in terms of the price of the commodities in euros rather than in dollars, as is done below. We’re seeing significant relative price changes, not simple depreciation of the dollar.

I also find it implausible to attribute the commodity price increase to a surge in demand. The economic news over the last three months has been very convincing that output is slowing, not accelerating.

Instead I believe that the price of oil, like the price of all the other storable commodities, and for that matter the dollar cost of a euro, is primarily responding to the Fed’s decision to move the real interest rate strongly into negative territory.

But once again the Fed has a golden opportunity to prove me wrong. Fed funds futures prices currently reflect an expectation that the Fed will make one more cut to 2% at the meeting at the end of this month, and then stay there. Here’s a prediction for you. If the Fed surprises the markets by holding steady at 2.25%, all those commodities will begin to crash within hours of the news.

If I’m wrong, well, the Fed can go ahead and opt for an intermeeting cut the following week, and I promise to quit carping about the havoc they’re causing.

What do you say, Ben? Do we have a deal?

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

commodity prices,

interest rates,

inflation,

oil prices

James, while you make great points and are certainly correct on the issue of the negative interest rates, I think you’re missing the issue of war. Fear of war, particularly on Iran, is driving the oil market. War in Iran would undoubtedly spill over into the Gulf States, with a major impact on world oil supplies. The Brazilian fields won’t be online for many, many years.

I think that the oil market is driving the food market. Perhaps there was a lag in the rise of food prices on the expectations that oil prices would return to more nearly normal levels. But now the rise is anticipatory.

The Brazilian fields are years and tens of billions of dollars away. The strata above the field, the depth both under the surface of the water and the surface of the earth is phenomenal. We are seeing signifigant declines in Russia, Mexico, and the North Sea. Best guesses suggest declines in Saudi as well.

We may be at record production, but we are also at record consumption. New barrels can be produced at extremely high costs. The Canadian tar sands require huge energy inputs to extract the oil, and that is for the “easy’ surface sands. There are also massive environmental costs associated with the tailings.

There is undoubtedly some speculative froth in oil and other commodities, but not as much as many assume. If this were the case, we would be seeing large increases in stocks. We are not. oil stocks are at five year averages. Grain stocks are at two decade lows.

There is also a bit of inflationary support for oil prices. Given that the US produces little other than war and torture, the USD is rapidly losing value. Look at oil in basket terms or in Euro terms and re-assess the supposed bubble.

Ben, if you’re reading this, you’ve no doubt seen this today, and perhaps this too – you know you’re going to get the room you need to pull it off and get away with it.

Worse case: if the commodities markets go the other way, you can point at Jim and say it was all his idea the next time you’re testifying before Congress. Just don’t tell them that you did it all on a bet for $1.00!

Charles: There’s a very strong likelihood that a collapse in support for ethanol subsidies would resolve much of the food inflation side of the picture. That’s more something the Congress could more easily achieve than the Fed. (Well, maybe not the current one!…)

As for the oil market, bear in mind that it’s in the interest of nations that rely heavily on revenues generated by their nationalized oil industries to fund their regimes to do what it takes to increase instability among their neighbors without actually going to war. That’s just as true in South America and Africa as it is in the Middle East.

Hi James

You write-off increasing demand very quickly. From everything I’ve read demand has been increasing hugely in all the oil producing economies. Price signals don’t really work when they aren’t passed on after all…

This implies that the amount of oil available for sale on the market may have decreased. Even at the same as production has reached a new high.

Hence record prices.

Cheers

Hansel

Rarely is the chance of any occurrence zero but I suspect that zero pretty much represents the chance that Benjamin Bernanke desires steady rates of interest or reasonable rates of inflation.

Never in my lifetime have I encountered a central banker so absolutely comfortable with the misguided use of inflation as a tool to attempt to engender employment.

The problems that BB has are that most economic actors understand this and that the BLS does not control the reportage of commodity prices.

The recent Volcker shots at Bernanke are clear early indications of the thinking of Barak Obama and his “inner” circle with respect to this nightmare,

and I have a $10,000 bet on the yes side of the following question, “will Obama demand and/or receive the resignation of Benjamin Bernanke on or before 1March2009,” against two $5000s on the no side.

If a President of the United States of America wants you “out” it is not wise to attmept to hold on to your chair.

Good point. Last time the fed did not deliver, commodities crashed but sooner or later there was an overdue correction and that triggered it. Now, I can bet you that if there is no cut rate the markets will no respond as you think(now you can hear some fed governors reluctant to more cut rates playing the good and bad cop game). 25bp does not make a difference, with negative real interest rates-despite inflation manipulation- to last for a long time, a lasting recession and a financial crisis far to be over, the dollar has too many fronts to defend. AS you pointed out in a recent post, the dollar has further to decline to rebalance the global economy.

Because the global boom isn’t over……..yet. It is close. Big IP losses occuring in April. Granted, some because of a early easter, but this cannot cross over soon enough.

I thought a problem with this story was that we have not seen an increase in inventories. How do you account for that?

JDH wrote:

…we’re seeing similar increases since the start of the year in the price of virtually every storable commodity. The 12% increase in oil prices this year is in fact just the median for the group of 15 commodities graphed below. It seems to me we should be looking for a single explanation behind the common behavior of the group, rather than try to develop a separate theory for aluminum, barley, coffee, cocoa, copper, corn, cotton, gold, lead, oats, oil, silver, tin, and wheat.

Exactly right professor!! Too many economic theories are postulated in a fish bowl of only one economic determinant.

JDH continued:

You can’t attribute much more than half of this increase in commodity prices to the decline in the value of the dollar. The dollar price of a euro (the bold red line in the graph above) is up only 7% for the year, which is less than the price increase for all but 3 of the 15 commodities shown.

But your willingness to discount inflation with superficial analysis misdirects the discussion. Inflation is not something that only reflects conditions of the past year. Inflation grows over a period of years dependent in large part on the length of contracts. Consider that since 2001 the English pound has risen 37% against the dollar, the euro has risen 71%, and the Aussie dollar 73%, and that is just three of the major world currencies. This is even more dramatic when you consider that each of these currencies alone has declined in relation to gold, the best proxy for all goods and services. That means that the dollar in terms of real goods and services has nose-dived.

But inflation is not just an issue of supply of the monetary unit, it is significantly related to monetary demand. FED interest rate cuts or increases have very little to do with economic activity until they rise or fall into the prohibitive range well below or above the natural rate of interest. Those of us who understand the FED interest rate methodology understand that the FED provides all the liquidity the market demands no matter what the interest rate because they must defend their interest rate target.

Congress loves this kind of debate because it takes the heat off of them. The truth is that congress is forcing down the demand for money in a powerful way by increases in government intervention and wedges against production. When business has to rise every morning and genuflect to Washington never knowing the whims of the politicans, their productive capacity is hampered. They must spend their time and effort protecting themselves. Hedge systems such as futures markets are important to smooth market fluctuations and allow business planning, but our hedge system has exploded with schemes used to protect production from the attacks of the government.

In truth if business were allowed to produce without government attacks the demand for money would grow and inflation would take care of itself. Yes, Bernanke has made a mess of our monetary conditions in the US but in reality that is only a footnote to the damage Congress is doing with such actions as considering massive tax increases, scheming to control executive compensation (why not sports figures and entertainters?), refusing to debate free trade issues with emerging countries such as Colombia, the list could go on and on.

The truth is that we are in a crisis of central planning just as we were in the 1930s, and I fear we may be headed for an even worse resolution.

The price of oil is a result of inflation, but that said unless we understand the underlying causes of inflation this statement has said nothing.

Jim,

I think you are right. This says that ironically the anti-recessionary thing to do would be to hold the target ffr steady, thereby tanking oil prices, with favorable effects on the real economy thereby following. Given that repo market, and even at times the actual nominal ffr, have been dipping into negative territory recently, it looks like lowering the ffr has run into the end of its ability to provide any further noticeably positive stimulus.

What’s wrong with the simple story that rising demand has met highly inelastic supply? The rising demand comes from many poor people moving into the middle class in China, India, and less obviously in other countries too. These people want better diets, boosting grain demand; cars, boosting petroleum demand; appliances, boosting electricity and commodity demand; and infrastructure, again boosting commodity demand. The price increases we’ve observed are a sign that supplies have been highly inelastic. Otherwise, why haven’t producers rushed greater supplies to market to take advantage of these relatively high prices?

Ironman says, “Charles: There’s a very strong likelihood that a collapse in support for ethanol subsidies would resolve much of the food inflation side of the picture.”

It’s certainly a factor, Ironman, but only to the extent that we’re talking grain ethanol. Cellulosic ethanol, which is what the current Congress is really trying to promote, doesn’t use grain. However, either way, the use of ethanol has been driven by the oil market and, to the extent it’s grain-derived, has driven the food market.

Great post DickF. I couldn’t agree more. Personally, I think the fed is going to find it increasingly difficult to smooth out the business cycle if we cannot rein in Congress.

Charles, I thought you would appreciate Jim assigning one variable to explain this. Isn’t that a hobby horse of yours? I guess you disagree in this instance and believe there are other more explanatory variables or that the commodities should not be grouped together? Myself, I like Jim’s analysis here but, I do think the ethanol policy has a large impact on current food prices.

JDH,

Your comment that commodities will “crash” if the Fed holds steady are indicative of a certain mindset.

How many years in this decade will we have negative interest rates? What % of the time? 50%? This is the second round, and the effect of the first round was profound: commodity price bubbles and rising global inflation.

And yet, and yet…This is something I’ve heard various commentators say: if the Fed shows any signs of meddle, if it just doesn’t cut, then the situation will be vastly better.

Its time to step away from the trees and look at the forest. The loss to the Fed’s credibility will take years and many more rate HIKES to remedy.

Lastly, take a look at Philly Fed prices paid and received. Every time the two have been at these levels the Fed has been in a major rate hike campaign. Same thing with core intermediate PPI. So again, the Fed has been cutting when it traditionally is hiking, all in the name of the Phillips Curve.

Couple comments:

Observation: Several months ago I commented that “stupid money” might start chasing commodities, “stupid money” a not-so-nice way to identify money chasing after stocks in the 90s and housing in the 2000s because “they’ve been going up.” Though it could be that money is not so stupid chasing commodities after all if interest rates are too low.

JDH: It would be nice to see a graphical representation of supply (production) versus demand for some of the commodities listed, as well as stores for some of them. Australia and biofuels are affecting some food supplies. I don’t know what is going on with metals in terms of supply and demand, but with countries like India and China ramping up car production, you’d think there might be some tightness in the markets. I’m not saying this is the explanation, and the simultanous rise argues for a simple answer, but as the saying goes–never make something simpler than it should be, and we do have the data to look at supply/demand.

Hitchiker and DickF: Please take no offense, but I still find it necessary (we are adults, aren’t we) to point out my opinion that DickF simply pulls out the same items from a somewhat dusty drawer for whatever the topic may be: Congress is currently affecting oil prices or metal prices? True, congress may have affected corn prices, but I see no connection with anything else and it seems necessary–to me–to point out that the statements seem specious. I am happy to be proven wrong.

Hitchhiker says, “Charles, I thought you would appreciate Jim assigning one variable to explain this. Isn’t that a hobby horse of yours?”

No, actually, Hitchhiker. My hobbyhorse has to do with making sure that multi-variable correlations come to the correct conclusion. I’m sorry that you also don’t understand statistics and hypothesis testing. Speaking of hypotheses, that could explain why you also evidently don’t understand much of the economic discussion.

Hitchhiker says, “I do think the ethanol policy has a large impact on current food prices.”

I’m sure it does, which is why I said it’s a factor. However, if the ethanol in question is not derived from food, then it probably doesn’t.

“Switchgrass!” to quote the right-wing Jesus.

Two comments. First the FED is a follower of the market, not a leader.

Second, if you are US centric and just go as far as the US disastrous economy, you could believe a commodities boom.

If you look beyond that, South Africa, no electric for 5 years, mines disrupted.

Russian and Saudi and Mexican and Venezualian oil production, down.

Look at companies like Daimler and listen to what they are saying. US demand is in the tank but, emerging markets will MORE than make up the difference.

And rather than list all companies like Daimler or IBM, just listen to Mark Mobious. There is NO slowdown in emerging markets. Just because construction is down in the US does that mean construction stopped in Dubai or Shanghai? I don’t think so.

While China is continuing to build infrastructure, India has barely started, and its coming.

The sun is setting on the US, true, but everywhere our jobs and manufacturing have been outsourced are booming. Computers, not so good US, booming world wide.

I would like to see an estimate of the changes in prices of storable assets that one would expect to result from the reduction in storage costs. A simple correlation between the two is not convincing.

I still think an important factor is that BB is ‘enabling’ other central banks that have been lending to the U.S. by buying dollar assets. As long as the U.S. response to a slowdown in U.S. demand is to try to keep up spending, even though U.S. spending already exceeds U.S. output by a substantial and unsustainable margin, the foreign lending can be expected to continue and demand for raw materials will stay high. This is a competing theory for the actions of commodity prices, and will not be proven or disproven if commodity prices tumble in the unlikely event that BB has the spine to keep interest rates on hold.

it will be interesting to see the COT’s on May the 9th. I think the restructuring of positions in certain types of COT reported tangibles will provide intersting clues.

who else is watching short end libor rates?

there have been radical imbalances created over the last decades which i blame on world policy makers that demands a rebalancing of price given mankind’s ability and the speed at which he reacts

Charles observed:

“Trying to promote” is very much not the same as being able to successfully deliver, which is par for the course for the latest session of Congress.

The technology and equipment simply isn’t there at this time to deliver cellolosic-derived ethanol in the quantities demanded (as affected by the level of subsidies involved.)

Because of this lack of production capacity, ethanol producers are sucking up an increasing amount of corn to exploit the separate subsidies for producing ethanol, which exist regardless of the source from which it’s produced, and because much of the existing ethanol production infrastructure in the U.S. is designed to use corn, as a consequence of both existing and past subsidies.

As a result, corn prices have risen, leading farmers to displace growing other crops in favor of growing corn, which in turn, has led to increases in the prices of other crops as their relative supply has been reduced, while demand for them has not.

Something to think about this summer, when you might be wondering why things like hot dogs and beer are a lot more expensive at the ballpark this summer.

James-

Most agricultural and mineral production have very high energy input requirements. The rise in oil prices, from $30/bbl in 2002 to $115/bbl in 2008 represents a 280% increase in the energy cost of production. Add to this, crop failures in Europe and Australia due to climate disturbance, and increased demand for minerals and food in Asia, and you have the perfect storm for commodity inflation.

Activity in commodities exchanges has increased considerably over the last year, as producers increase their hedges against input costs, and lock in current prices, as well as investors and speculators who pile into these markets for tangible value with a strong demand component as a hedge against declining equity markets, banking instability, and currency inflation. This speculation/investment activity tends to amplify price levels above utility demand.

World oil production has been essentially flat since mid-2004, however world oil demand growth has been about 2%/yr over the last two decades, and is accelerating. China’s oil consumption has been increasing 7%/yr since 1990 and at the current trend will exceed US consumption by about 2020. Currently, there are no viable liquid fuel substitutes for oil that can be produced in sufficient quantity at a low enough price to affect oil demand and prices. Energy price levels will have to rise until demand growth stops or substitute fuels enter the market in sufficient quantity and low enough price to take demand pressure off oil. Commodity prices will tend to rise in step with oil until such an equilibrium is achieved.

I strongly disagree with your theory that the FED’s decision to drop interest rates in response to the current financial crisis is the cause of commodity inflation. I would counter that the $7 trillion in accumulated US current account deficits, $50 trillion in unfunded US government liabilities, and the banking system’s 55% increase in M3 since 2004 are all more significant to the erosion of the dollar’s value.

The elephant in the bedroom is the political and financial erosion of the oil peg to the dollar. Over time, more and more oil trading will be conducted in local currencies rather than dollars. Consequently, international demand for dollars will be reduced, spurring increased dollar inflation. US military occupation of Iraq, and political belligerence against Iran are, in part, attempts of the US government to intimidate gulf producers to maintain the dollar peg, and destabilize the Iran oil bourse.

Our explanation for rising oil prices: declining net oil exports

http://www.energybulletin.net/38948.html

Financial times comments on tight copper supplies: “This situation, combined with strong signs of Chinese demand, a current market deficit and a historically low stock-to-consumption ratio signals that copper prices will push even higher during this quarter,” said Michael Lewis of Deutsche Bank. Copper dipped 0.7 per cent to $8,590 a tonne over the week.

Oil and rice race to record levels

Could be journalism relying on fallacious causality but I’d like to consider further.

“Our explanation for rising oil prices: declining net oil exports”

And this is good news. The petrotyrants will no longer be getting as much of a free revenue stream.

Everyone thinks that higher oil prices embolden petrotyrants due to more fees. But what they earn is a bell-shaped distribution. If prices get too high, domestic GDP growth is high, more cars are purchased, and exports get swallowed up.

Note that Ahmadinejad, Chavez, Putin, etc. have actually been quiter now at $115 than when oil was about $80.

Ironman says, “The technology and equipment simply isn’t there at this time to deliver cellolosic-derived ethanol in the quantities demanded (as affected by the level of subsidies involved.) ”

This is true and, as I have said repeatedly, makes grain-derived ethanol a factor in food prices. The shift toward cellulosic ethanol is occurring, with every 3 gallons produced by cellulosic means freeing up 1 bushel of corn. With thermochemical conversion replacing biological, the market incentives are there for rapid expansion of capacity and I expect it will occur more quickly than many people imagine.

“..and I expect it will occur more quickly than many people imagine. ”

Yes. While cellulose (and algae) are in their infancy in 2008, they will be well and truly cranking by 2011. Cellulostic ethanol will be a major force by 2013..

“Given that the US produces little other than war and torture, the USD is rapidly losing value. ”

Expat is the typical jealous anti-American loser. So if the dollar rises, does that mean the US is producing everything good now, other than War and Torture?

Logic and Euro-leftism don’t mix.

The US will still be the only superpower in 2030. This would cause much sadness to semi-educated Euro girlie-men (as Gov. Arnold correctly refers to them as). Except that very few EU-nuchs will be around by then..

I don’t see how actions by the U.S. Fed could affect changes in commodity prices denominated in Euros? Also, doesn’t this analysis suggest that Euros should go up (in terms of dollars) just as much as commodities? That would also make it hard to explain why commodities are so much more affected.

GK wrote:

Only if its production can scale up successfully *and* make real economic sense by that time. There’s an enormous amount of risk involved that makes it very much not a sure bet.

Ironman said: “Only if its production can scale up successfully *and* make real economic sense by that time. There’s an enormous amount of risk involved that makes it very much not a sure bet.”

Yeah. My tendency is to immediately translate the word “will” in any prediction (such as above) into “might” and then I’d like to see a probability provided based on analysis. Otherwise I think phrases like this fall into the realm of personal wishes or desires rather than ontologically grounded predictions.

Directionally I can see why a negative real interest rate would encourage purchase of tangible assets – but the magnitude here seems way off. We have at most a negative 1-2% / yr interest rate, but the commodities prices look like they are increasing at an annual rate of ~100%. It seems like the Euro vs dollar line would compensate for the inflationary expectations. Why would we think the fed policy explains this much move in commodity prices?

General Specific wrote:

DickF simply pulls out the same items from a somewhat dusty drawer for whatever the topic may be: Congress is currently affecting oil prices or metal prices? True, congress may have affected corn prices, but I see no connection with anything else and it seems necessary–to me–to point out that the statements seem specious. I am happy to be proven wrong.

General,

This reminds me of the story about a church who hired a new pastor because he preached a great sermon on Romans 6:23. His first week he again preached on Romans 6:23. This continued week after week until the deacons finally called him in and chastised him saying the people wanted him to move to another topic. His replay was, “Once you understand Romans 6:23 I will move on to another verse.”

When you write that you see no connection between that actions of congress and the price of oil (I assume you also mean acts of congress and inflation when you say with anything else) I must preach the sermon all over again.

Hitchiker, thanks for understanding. It is good to see not everyone is caught in the mercantilist muck.

The demand for cocoa has been slowing?

Why am I the last to know?

The point is that “economies” can slow without affecting the demand for hard commodities like oil and copper. It only takes a shift in relative proportion of investment/consumption.

As to oil consumption rates flat-lining, doesn’t consumption + inventory deltas always equal production? the Oil Drum curve may be telling us that inventory additions are negative relative to growing demand.

I’m with Lowsmoke that continued demand is driving commodity prices. Building production capacity takes time and an expectation that demand will remain long enough to recoup investment. We may very well be near a global bust since I’ve heard stories of overbuilding in China – nothing to back it up of course.

The good news is that some other country can lead the planet out of a next recession rather than the US. We’ve seemed to do that the last several decades and I tired of the heavy lifting.

I follow this markets as an investor, but I don’t pretend to know more about what is driving these commodity prices. I have to say, I do agree with your conclusion about the real Fed funds rate. There are a great deal of supply pinch problems for oil, but I don’t agree with other commentators that it is due to “war” concern, etc. We have had “war” concern in almost every decade I can remember. But with economic news for the globe being so negative, I think you are correct that the straw that may break the commodity camel’s back may indeed be the next move by the Fed.

Prof. Hamilton,

Very interesting post. Also provoking very interesting comments. Hansel & Dick F in particular make good points.

You may be right about its effect on commodity traders, but I think you may attributing too much value to the psychology of rate cuts. We forget that the need for these negative interest rates is so great because of the elevated level of endebtedness in the US…that elevation being the result of previous Fed policy. Bernanke is in a pickle: Doing the right thing, defending the value of the $, will require a painful recession.

I am interested in the potential for coal-liquid fuel refinery’s based in the US to have a meaningful production of transportation fuels, gasoline, diesel and jet fuels. If the US were to build 5 large scale refinery’s to produce synthetic liquid fuels from coal, would this make a meaningful contribution to our needs for transportation fuels? Does this make a meaningful reduction in our imported oil flow? Finally, does this do anything to support the value of the US dollar? thanks

Jack Kreg,

We don’t live in a country in which it would be possible to do such a thing. We are so demoschlerotic that it would take 5 years to get all the permits, if you could get them at all.

Oil is $116, yet no one suggests we drill in Alasha or the eastern Gulf of Mexico because of the politics. We even import refined gasoline at this point because it is impossible to build a refinery. Gov’t is as big a problem as oil shortage.

Dick, there’s another story your posts remind me of, quite different than Romans 6:23. I think it’s an SJ Perelman story.

A man is at a party and he’s approached by another fellow who asks him, “So what do you think of the market these days?”

The first man replies, “I have a cousin who says, ‘Plastics!'”

“Plastics?” asks the second man.

“Yes,” says the first man, “Plastics! Plastics! Plastics!” “In fact,” he went on, “that’s ALL he says. We have to keep him chained to the floor.”

I would save the sermons for church and let the threads be for genuine discussion.

What we have here is an Enron-esque gaming of the market. Demand has not grown considerably in the consumption of underlying commodities, however demand in the number of long positions in derivative contracts for commodities has.

As Barron’s pointed out a couple of weeks ago, cash going into long positions in futures contracts for commodities dwarfs the actual notional values of the underlying commodities themselves.

Here’s hoping that when the commodity bubble eventually bursts that it ruins the fortunes of many morally bankrupt traders and speculators.

I agree that the recent price rise in most commodities all have a common cause, (from which we can deduce that likely oil is probably not peaking, unless by coincidence). I don’t think it is negative interest rates though, I think it is simply demand increases. More precisely it is the rate of change of demand that has increased. The commodity industry was set up to increase production at say 1% per year, consistent with the growth in demand in mature economies. Now, thanks to the entry of China into the world economy, the commodities industries have to increase production by say 3 or 4% a year to meet demand. That means the supply chain that adds capacity to an industry needs to increase in size by 300% or 400%. It takes many years to add this kind of capacity in a supply chain, especially as companies (and individuals looking to enter the industry) are a bit cautious at first in case it is a blip. Try playing MIT’s beer game for some idea of how supply chains can under and over react to perturbations in demand. The best bit about playing that game is the rationalisations that people come up with afterwards for what they did.

algernon,

You seem to understand where I am coming from so I would like to explore this a little with you. Could you explain why you say “the need for these negative interest rates is so great because of the elevated level of endebtedness in the US?” Do you equate price levels with endebtedness, or do you mean the need for this kind of FED reaction is forced by endebtedness, or something else?

algernon wrote:

Bernanke is in a pickle: Doing the right thing, defending the value of the $, will require a painful recession.

How much do you believe the 1978 Full Employment and Balanced Growth Act that required the FED to “promote full employment … and reasonable price stability” binds Bernanke? This is often quoted by FED governors when they speak. The reason I ask is because I agree with you that the FED should be defending the value of the dollar, but the congressional mandate is actually price stability. The two are not necessarily compatible. And when you throw in employment the FED is required to hit about three targets with one arrow.

The FED seems to be trapped in a Catch 22. If they increase interest rates they they face higher unemployment as business slows, but if they lower interest rates below the natural rate they risk inflation. But in all of this they seem to choose bringing the economy down to the lowest common denominator ratehr than promote the best solution to both which is economic growth.

algernon wrote:

Oil is $116, yet no one suggests we drill in Alas(k)a or the eastern Gulf of Mexico because of the politics. We even import refined gasoline at this point because it is impossible to build a refinery. Gov’t is as big a problem as oil shortage.

I agree with you from a supply perspective that congress is the reason we are dependent on foreign oil no matter how much they demagogue it, but when we are talking price I am not sure greater supply will do much to lower the US domestic price of oil. Considering the massive decline in the dollar since 2001 inflation alone would have raised the price 70-75% at a minimum. Granted that would have only taken us to $50-60/bbl but it would still be a huge increase in the price of oil.

There can be no doubt that the price of oil is determined by supply, demand, international events, and monetary distortions (US dollar debasement). I just wonder how much of each is causing the current run up.

Sorry algernon. That is me above.

DickF said: “I must preach the sermon all over again”

This is the problem. I’m not looking for sermons of talking points. I’m looking for quantifiable analysis based on facts grounded in the real world. For example:

DickF said: “congress is the reason we are dependent on foreign oil no matter how much they demagogue it”

Can you provide me with the production flows that would result from opening up these areas in order for the US to not be “dependent on foreign oil?”

Let’s focus. Not go on and on about the fed. Let’s focus on that one statement and go from there.

The reason I responsd: I find blogs both useful (source of information) and a horrible source of disinformation and both bloggers and commenters pull out and dust off non-sequitors to address issues. I think people have a responsibility to address them. I might be banned for being divisive, but then again, my experience (I’m a physicist) is that a certain level of considerate divisiveness is the path to truth, not the modern medias “he said she said” and then let the audience decide. We need arbiters of truth everywhere.

So let’s focus on that statement about production of oil from Alaska and elsewhere that would grant the US independence. What’s your analysis. You made a positive statement (regarding US independence and congress). I’d like to see you back it up. I welcome being shown how this independence is possible. Consider the reservers that are there (available to US), the time frame in which they could have been developed, and the flows that resulted. Then show me how we would not be indepedent given them.

It’s got to be more than negative real interest rates, because the almost linear run in commodity prices began much further back in time — around the first week of August 2007 when the Bernanke Fed engineered its initial surprise discount rate cut. That’s when the commodity rally kicked in.

Real short rates moving negative may have pushed the commodity run into overdrive – after all, negative real short rates are supposed to be a significant economic accelerant by encouraging businesses to overproduce demand and add to inventories as the (aggregate) cost-of-carry turns positive. But if that’s what’s driving this commodity run, SHOW ME THE INVENTORIES. That’s the mechanism that drives the process, right? So, where are they?

AS for demand increases not being the cause, I think the oil production graph makes a strong case for weak elasticity of supply in that commodity, and I know similarly that copper and gold are in similar situations, AND of course the U.S. is producing grains flat out with all 330 million acres planted. If the elasticity of supply flattens out quickly as demand rises, you can get very large price increases to clear the market with relatively small increases in demand.

General Specific, I agree lets focus on the one statement first and then go from there:

“congress is the reason we are dependent on foreign oil no matter how much they demagogue it”

It’s pretty obvious when even the USA Today agrees with the statement by DickF. A cartoon Friday in the USA today depicted Congress demanding oil companies do something about the high prices. The oil companies respond with:

1. Can we drill in Anwar? Congress response – Forget it!

2. What about offshore? Congress response – Are you crazy?

3. Clean coal? Congress response – Out of the question!

4. Nuclear power? Congress response- You’re joking right?

5. Congress response – Well don’t just sit there, do something!

Oh yeah, and don’t forgot the liberal response to high prices is to “tax the greedy oil companies”.

I guess I’m perplexed why you wouldn’t think these restrictions, along with increased regulations (try getting permits to build a refinery), and the added perq of being vilified in Congressional Hearings by demagogues wouldn’t provide disincentives to domestic production.

You made a positive statement (regarding US independence and congress).Gen SP, physicist, This discussion is about “reducing” our dependence on imported oil, not become 100.0% independent.

For example, I have read that ANWR would completely replace the oil that we get from the Saudi’s for 30 years. Is that important? Yes, I think that it is!

Earlier, I asked the question, what if we built 5 large (?) coal-fuel refinery’s, Does this make a meaningful reduction in our imported oil flow? It is all about reducing our dependence on imported oil.

I sense an argument that goes, if the concept does not result in complete independence, then it should not be considered.

I don’t agree, I propose that each step should make a meaningful reduction in imported oil should be the goal, so if we can get 8% of our energy needs from ANWR, then thats significant.

I propose an American based energy production industry, as a concept for attracting sufficient political support to move out and get some significant action on this problem. Here is how,

1-drill for oil/gas in ANWR and the Gulf,

2-build large scale coal to fuel refinery’s

3-build nuclear power plants,

Our goal should be to significantly reduce the use of imported oil. I think that the American people are ready to accept the reality of our need for this solution and that it needs to start very soon.

What can this accomplish,

1- reduce imported oil,

2-reduce our dollar flow to OPEC

3-strengthen’s the dollar

4-convert our auto’s to electric, charge them with our nuclear plants,

5-electric cars, charged with nuclear power will reduce air polution,

6-builds a significant American industry, which employ’s American workers,

7-provides the USA with a lasting source of energy at significant levels.

I think that there is a solid link between exporting US dollars to purchase foreign oil and a weakening dollar. Half of our foreign trade deficit is oil, imported oil cost us $400B in 2007. As we are today that # is not going down. Without a significant surge in our energy industry, our oil-based trade deficit will only get ever larger.

I very much appreciate the messages on this site, thanks.

jack, dean: I’m responding directly to the statement “congress is the reason we are dependent on foreign oil no matter how much they demagogue it”

Saying that congress is the reason we are dependent implies that without congress we would not depend on it. Therefore it implies that the US need not rely at all on foreign source of energy.

Let’s not complicate with a discussion of refineries. Complication is a way to avoid specifics. The specific issue is foreign energy. A US refinery still requires energy at the input, so let’s look at the issue DickF said. If he wishes to change his statement and instead say that the US could reduce it’s dependence on foreign source of energy by x% and then provide some estimate of “X” I’m all for it.

Let’s see what DickF has to say. And if ANWR, Gulf, and Nuclear are under proposal, tell me what X will be if we then scale them up. What will the time period be? What companies will be building those reactors by the way? I know the state of France builds a lot of reactors. Are there many private companies willing to expend billions to do so?

And please note: this is not a liberal versus a conservative issue. That line of argument and thinking has become tedious. Let’s stick with facts. Facts are not liberal or conservative. Throwing out those terms ads no value–just diatribe.

I firmly believe that statements such as “x is y” involving real quantities in the world, e.g. energy, need to be backed up or they are creating noise in an world that is far too full of false and misleading data.

As to the question whether or not 5 new coal-to-liquids production plants would make a difference? Let me offer some calibration.

There are 150 or so operating oil refineries in the US. Plus we are increasing imported refined gasoline so it takes more to serve our internal demand.

Adding 5 new CTL plants each the average output of existing refinery doesn’t seem to really make a big difference.

The big complaint against existing CTL technology is that one burns a multiple of coal input per hydrocarbon output. That combustion energy input leaves it with a big carbon footprint.

For a gallon of gasoline, IF we had a good, near perfect process driven by nuclear energy, the inputs would 26 cents for the carbon via coal and only 6 cents in nuclear heat. Water is extra.

And if ANWR, Gulf, and Nuclear are under proposal, tell me;

-what X will be if we then scale them up.

-What will the time period be?

-What companies will be building those reactors by the way?

These are great questions and I don’t have firm figures for you, HOWEVER, there is no question that a solid program to produce energy in the USA would reduce our dependence on imported oil. Lets say for consideration; Is it possible to achieve a 50% reduction in 10 years? If I were running for a political office, I would get a smart energy consulting company and get an answer. This answer could be had in short time. Why, for these reasons,

1- oil and gas in the USA could replace 10 or 20% of our imported oil,

2- building coal to fuel refinery’s could be scaled to reduce by 25%, there are massive coal reserves in the USA,

3-at least half of our auto fleet could be converted to electric and nuclear charged in 10 years, again reducing our use of imported oil.

I have to make the additional point, that #3 provides considerable reduction in real air pollution, this point can not be understated.

Okay, it seems clear to me that the USA could reduce imports of foreign oil by 50% in 10 years.

If you want to know what companies will do this, start with; GE, Honeywell, United Technologies, Bechtel, Flour, Emerson, review the SP500, some of them.

We could start with this very rough plan, but get started now.

Why, what if Peak Oil is right, and we have to reduce imported oil, because less is there to import.

Bechtel is still privately held – no play there. GE’s nuclear division is chump change compared to their financial division. Plus, they missed the match and have no orders yet. The other reactor vendors are all foreign-owned – I like Toshiba but then I work for them.

Current nuclear plans include 30+ new reactors. They will start to come on line about 2017 but they will not directly substitute for imported oil unless electric cars (or partial ones) make some fleet penetration.

They should help offset an increasing dependence on imported LNG to fuel electric generators – that’s the next NEW mainline addiction we’re just skin popping today.

I’ll share the listed or OTC companies that stand to make some serious dough from nuclear AFTER I buy my shares.

Jack: I agree that we could reduce our consumption while improving production in the US.

One of my concerns is as follows: We seem to live in a borrow from the future to maintain our lifestyle today society. For that reason, I would like to understand better the tradeoff between developing and then using savings (reserves) like ANWR instead of letting the future decide what to do with it. In addition, and going back to DickF’s anti-regulation argument: I don’t see the free market jumping on any of these projects too extensively right now, whether it be coal to liquid, nuclear, or mass transit.

Seems like nothing will happen unless government–read congress–decides to do it. Unfortunately, they fund ethanol–which seems pointless and will expedite soil exhaustion.

General Specific, the claim that Congress is responsible for our dependence on foreign oil cannot be substantiated. The basic facts from the point of view of industry can be found at http://www.oilfield.com/info/energy.shtml. These facts are: the US consumes about 20 million barrels of oil per day. It produces a little less than 6 million barrels of oil per day (plus about 3 million barrels of natural gas liquids), meaning that 56% of oil is imported (as of 2000). Proven US reserves have fallen to 21 billion barrels, amounting to less than 3 years of supply. By contrast, Saudi Arabia alone has 259 billion barrels of proven reserves. However, the US may have as much as 110 billion barrels of technically recoverable oil onshore. The best guess is that there are 46 billion barrels offshore. In other words, at best, there are 25 years worth of reserves. But the petroleum geologists think they could get 1 million barrels per day out of ANWR, leaving us only 10 million barrels short of independence.

The reason that these sites aren’t being developed (and here you have to go elsewhere, because the petroleum geologists won’t tell you this) has very little to do with the Congress and much more to do with the cost structure of getting to the oil. As long as the Saudis can pump oil for 5 or 10 dollars a barrel, how stupid would one have to be to go after oil that costs 50 or 100 per barrel? Part of that cost structure, of course, has to do with drilling *safely*, so that the Florida and California tourist industries and the Gulf Coast shrimpers aren’t devastated by massive oil spills. The oil industry would like to shift the costs of drilling safely onto everyone else. But the truth is that even if you repealed every environmental law, and just made the drillers pay compensation for what their spills destroy, they wouldn’t drill in most of the places they say they want to.

Hedge funds

Managers made $29 billion in ’07

NEW YORK ? Top hedge fund managers took home huge sums last year, fed by a bull market in commodities and investors’ willingness to pay up for proven track records.

Institutional Investor’s Alpha reported Wednesday the top 50 hedge fund managers earned a combined $29 billion in 2007. Five managers earned more than $1 billion.

John Paulson of Paulson & Co. earned $3.7 billion last year, which consultant Peter Cohan pointed out means Paulson in 2007 made 30 times in one hour what the median family made all year.

It is no wonder everything cost more than it is worth when this much money is with drown before cost of product is counted.

What is ?ethics?? Merriam-Webster Dictionary defines ethics as: ?the discipline dealing with what is good and bad and with moral duty and obligation?a set of moral principles or values?the principles of conduct governing an individual or a group?a guiding philosophy.? Ethics is the art of what should be done, as opposed to what can be done. The debate about the ethical practices of hedge fund managers deserves serious attention.

Ethics is doing the right thing for the right reasons every time.

Ethics violations will destroy both friend and foe.

Dick F

Total US debt now exceeds 300% of GDP, whereas in the 80’s it was about 150% of GDP. (That situation is the result of government policies, Fed creation of money/credit, & cultural trends.) Greater debt makes higher interest rates more painful for debtors in proportion to their debt. In that sense the Fed’s supporting the value of the US$, which requires higher interest rates, is more difficult than in previous cycles. That is why they are inflating the money supply (M2, MZM) & thereby further devaluing the $.

As far as the dual mandate of the Fed, there isn’t a conflict in the long run: price stability is the sine qua non of prosperity. However, politicians like Bernanke live in the short run & therefore cannot be expected to do the right thing. He will inflate & screw the saver to postpone or moderate recession, only to create price inflation & a worse reckoning later on.

Why are all these commodities rising? Could it not be they are all heavily dependent on oil and rising oil prices are feeding the cost of all these other commodities? No, that couldn’t possibly be, it is too bloody obvious.

Rising Commodity Prices

James Hamilton considers why oil prices are rising:

If both Russian and Saudi production have in fact peaked, the global peak cannot be far off, even if the Brazilian find is borne out. But I nevertheless am not persuaded that any of these news items i…

Paul Krugman has a nice longer term chart on his blog showing the path of metals inventories and prices over the past decade+. Worth pondering perhaps, rather than blaming negative real interest rates so flagrantly.

Anarchus: Great reference (to Krugman). Exactly what I was looking for.

I think of this issue in terms of several perspetives. One I call the 5/25 problem. The US has 5% of the world’s popualation yet consumes 25% of its resources (roughly). I’m not complaining. The solution to poverty and population growth for libertarian elitists is growth, development, and ideas. Some even argue for a few more billion people.

I don’t discount ideas. But it often seems like those selling the idea of infinite ideas have few ideas of their own–other than that one “infinite idea” idea.

It’s seems likely there are limits to growth, I think we’ll find them eventually, I’m happy to be proven wrong, but we could very well be seeing the first signs now–namely, 50% to 75% of the world’s population would also like to consume a similar 25% like the fortunate 5%. But the math doesn’t work.

We’re often told that the price mechanism works and is the signal we should all watch(the real price, adjusted for inflation). I agree. Yet when prices are telling something it seems like many of a libertarian bent can’t manage to give up the faith. I think they have a bias to ignore the evidence.

Yet we have to be cautious. What were the price signals of housing telling us? Bubble if you ask me (irrespective of whether a bubble based on loose money or not–a bubble all the same–money chasing after an asset class that would not retain its value for long–hence bubble like in its race to get in while the getting was good and out when it collapsed).

Commodities seem different.

Thanks for the response concerning debt and inflation. Not sure I agree but I understand better where you are coming from. A question, by debt are you talking total US debt including consumer debt or are you only talking government debt?

algernon wrote:

As far as the dual mandate of the Fed, there isn’t a conflict in the long run: price stability is the sine qua non of prosperity.

Not sure if you understood that I was making a distinction between price stability and defending the value of the $. Price stability does not necessarily mean a stable dollar. Demand cannot be ignored in the equation. Congress mandated price stability rather than monetary stability. They demonstrate the same misunderstanding that most economic pundits have on inflation/deflation. Inflation/deflation is a change in the exchange value of money not a change in prices. This is an important distinction.

For example the government held prices artifically high during the Depression even though the currency was deflating. There was no actual change in prices when the currency first began to deflation. Prices fell later when the deflation began to manifested itself.

General Specific,

I did not make the claim that drilling in ANWR or off the coast of Florida or other areas protected by congress would end our dependence on foreign oil, but it probably would. I could go look up all the numbers and as a physicist I understand why this is attractive to you, but I am an economist so I am a social scientist.

That said let me try to clear something up. I believe in open markets in the global economy and so I do not want to end our dependence on foreign oil. I want the market to decide the exploration and distribution of oil. Now what this would do is actually lower the price and increase the use of oil in production. Opening up restricted areas to oil production would not make us independent of foreign oil, it would make us more efficient in the use of oil and would establish more rational world prices.

The bottom line is I could answer your question but for me it is a meaningless question. Producers who use oil in their production will not remain static in the face of changing oil supplies and prices so your question is like trying to score a touchdown when the goal keeps moving.

DickF:

Earlier you said that ” congress is the reason we are dependent on foreign oil no matter how much they demagogue it” and now just said that “other areas protected by congress would end our dependence on foreign oil, but it probably would.”

So you’ve said it again. This is moving goal posts. You made a statement (amongst many), I took issue with it, you said you didn’t say it, then said it again, then said it’s not important to prove (meaningless). And it’s not a meaningless question because anyone who wants to make money in the oil market (e.g. futures market) will be considering data such as this (oil production). It’s an extremely important and potentially enriching question–not meaningless by any measure.

Economists and physicists are both interested in these numbers. Hence the splendid collaboration–or at least mutual consideration–we’ve seen between James Hamilton and Stuart Staniford.

DickF said: “Now what this would do is actually lower the price and increase the use of oil in production. Opening up restricted areas to oil production would not make us independent of foreign oil, it would make us more efficient in the use of oil and would establish more rational world prices.”

I’m confused why increasing the use of oil in production, because of lower prices, would make us use it more efficiently. Efficiency improves with higher prices, not the opposite. So this is another statement that seems flat out wrong. This seems wrong in terms of economics. Efficiency will improve as prices go up, not down.

The issues under discussion are of interest to economists (social scientists) and physicists (natural scientists). If anything, since I happen to be reading it right now, the philosopher/physicist Mario Bunge makes a very good case (in “Social Sciences under Debate”) that those who try to create hard and fast dichotomies between the natural and social sciences are mistaken. If you’ve not read any of his thinking, I highly recommend it.

A statement from the Saudis:

Saudi Arabia, the worlds biggest oil producer, has put on hold any plans to further increase long-term production capacity from its vast oil fields, its most powerful policymakers have said.

In a series of statements, including one by the king himself, the kingdom has warned consumers it does not reckon there is a need for further expansion, an assumption disputed by the worlds biggest developed countries.

http://www.ft.com/cms/s/36b36e2a-0efe-11dd-9646-0000779fd2ac.html

touche:

What’s interesting about the recent Saudi statement (I can’t find the exact quote this morning): they claim that no amount of production would bring oil prices down because oil prices have nothing to do with supply and demand (pointing instead at the dollar and speculation).

Iran is on record stating (for what it’s worth) that oil prices need to find their real or appropriate price level.

Another one of those false statements from the Saudis. If the Saudis could open the spiggot tomorrow, prices would plummet.

BTW: That link above to FT seems to be broken.

A Closer Look at the Oil Price Spike

James Hamilton at Econbrowser, one of our recommended sites, takes a thoughtful look at oil prices. Examining data from a variety of sources (check out the charts) he notes that there has been a small increase in the production of oil, and excitement …

Ever read “Spengler” in the Asia Times?

He addresses the topic, explicitly rice prices, in this week’s column.

“The chart below shows the price of 100 pounds of rice against the euro’s parity against the US dollar during the past 12 months. The regression fit is 90%. There is an even tighter relationship between the price of rice and the price of oil, another store of value against dollar depreciation.”

Here’s the link:

http://www.atimes.com/atimes/Global_Economy/JD22Dj01.html

I don’t always agree with the guy, but he’s almost always interesting.

BTW, natural gas within the US hit $10.60 per million BTU on the Henry Hub per Nymex last week. And this is the Spring time with minimal demand – of course it’s a cold Spring so heating demand may still be high. Natural gas is an internal North American market with only 3% imports via LNG.

For comparison, most of the 1990’s say average prices about $2.50.

I agree with Hamilton’s thesis that non-traditional financial uses are likely driving recent price spikes in energy and other commodities.

Curiously enough, resource company equity markets appear to have been anticipating reduced growth/demand since last summer as illustrated by low performance ratios (e.g., share price to net earnings, share price to cash flow), trailing and forecast. Earlier this year, Chinese smelters delayed signing contracts for ore on the bet that prices would decline.

Since August 2007, the fed has taken every opportunity to surprise the market, presumably because unforeseen positive shocks will have a greater desirable impact on real output. Given that short-term economic growth and employment seem to be the most pressing priorities, it is hard to imagine that this fed would try to catch the market off guard by unexpectedly announcing a stand-pat policy.

When and if the market decides that slower US growth will slow global growth, commodity prices may very well correct sharply. What will be the exact catalyst for that correction is hard to say. An ordinary fed announcement sounds too easy.

US manufacturers and service sectors have been selling heavily into the commodity/resource boom so any dramatic collapse in energy and material prices could feedback and, in the process, deepen and prolong a US slowdown.

My thanks again to both Prof. Hamilton and Prof. Chinn for this wonderful public service.

touche,

That is a very disturbing statement coming from the Saudis. It looks more like they do not see themselves as being able to increase production, but do not want to confess that they are unable to. They have just spent huge amounts of money on building up capital stock to pump harder out of the northern part of al Ghawar and only achieved a minor increase/stabilization. It also suggests that some of their other potential sources, such as those in the Empty Quarter, do not amount to a whole lot.

The last paragraph from the link I posted above,

“King Abdullah, reported by the official news agency this month, said: I keep no secret from you that when there were some new finds, I told them: No, leave it in the ground, with grace from God, our children need it.”

Measuring the commodities in Euros does not solve the problem of inflation b/c the Euro is also suffering from inflation. Euro savings deposit pay barely over 2% which, after taxes, results in real losses instead of savings.

The reason for this is obvious – the world has a limited supply of food, oil, metals and other commodities and, as some populations (India, China, whose population is about 1/3rd of the world alone, plus others) get an increased share of these, the rest will get less. And of course those most effected by getting a smaller share are the erstwhile gluttons – mainly Americans but followed by Europeans.

But how does one lower the standard of living of Americans and Europeans? Well reducing salary would be met with an uproar. So devaluing the currency, combined with keeping wages flat, is the perfect solution. People have less real income, hence can purchase less goods, hence consume fewer resources – mission accomplished.

Jeffrey J. Brown

“Our explanation for rising oil prices: declining net oil exports”

That certainly sounds like an important factor, and it is a very useful observation.

James Hamilton: Presumably one tests for speculation-driven commodity price changes by examining ex post volatility. Speculative price increases that overshoot fundamental values should at some point result in sharp price corrections.

Much of the relative real increases in headline oil prices in the last few years have apparently driven by standard economic fundamentals given the apparent lack of increased volatility.

We’ll know if, for example, speculation is driving recent oil price hikes when we observe these same oil prices correcting sharply in the near future.

I share Krugman’s scepticism over the role of pure speculative behaviour in driving oil prices but question if intermediaries need to physically store the product in order to speculate. Most contracts are for future delivery.

Am about to buy (renew) more out-of-the-money puts on the US Oilfund…. but might mix it up with shorter-term out-of-the-money calls to in effect hedge the hedges on the long position oil & gas bets.

N.B.: Am a little new to this and want advice, am not qualified to give it; I implicitly assume energy markets are easier to predict than foreign exchange rates–that could be a huge mistake; long holds on cycle-resistent resource plays may be a better risk reduction strategy than off-setting bets with options. So many interesting ways to lose money in the markets….

————————————

Charles: Agreed, an attack on Iran threatens the country housing the world’s second largest reserves of light, sweet crude oil. Bush’s belligerent rhetoric of a few months ago is relatively recent but US foreign policy priorities in the region have been startling clear for many decades. Security of oil supply has consistently taken a back seat to other priorities (e.g., the fight against Arab/Muslim terrorism; the struggle to help close ally Isreal secure land occupied and slowly colonized as of 1967; the lowest fuel excise taxes in the OECD; massive subsidies for socially wasteful rent-seeking farmers).

Libya, Iraq, now Iran have all seen at some point foreign investment dry up and production either stall or decline. It may look like an evil cosmic joke to some, but coincidentally or not Libya, Iraq and Iran are all important sources and reserves of valuable, light sweet crude oil.

Does the US ME colonial policy premium show up in short-run, fatter risk premiums or is it already baked into the price through the reduction in productive capacity? Perhaps a bit of both though one could be excused for thinking the markets should have Bush II fingered for a final term, lame duck president at this point. Presidential Republican candidate forerunner Senator John McCain still has a fighting chance, effectively putting the attack of Iran on hold.

Given the increasing interest and focus on resource supplies, I think it would be very beneficial for people in positions of influence to start making price arguments similar to what JDH has made in this post. E.g. he poses a challenge to the Fed. Well I pose a challenge to folks like JDH: What criteria would make us decide that commodities aren’t in a bubble.

The economic argument about price as the means to distribute goods and services is a good one–barring calamities natural or man-made that create privation. Economists tell us that price tells us something. Well I ask: when will price tell us that we have a problem–or that production may very well be peaking.

It seems to be the same approach could be taken in the area of global warming, as an example.

Instead, what I mainly see are conditions changing–in some cases–yet the same old arguments trotted out time and again. Nice to fill the time–maybe write a paper–but not very useful in the sense of developing a consensus on where the world is headed.

Maybe I’m off in the weeds with this thought though. Not sure.

Higher oil prices will not hurt the USA only help wean us off oil, finally, creating a new economy. This will cause the price to crash in price in 2 to 3 years and we will not ever need oil like we use it now.

Oil rising for any reason is really good for the USA and developed nations.

The big problem is people who are hurt by the antics of Ahmadinejad and Chavez, and the arabs disgruntled by US policy. They are the ones causing the high oil prices. The ripple is rising prices for food back at them. Cause and effect of the high oil prices.

The dollar low is helping USA companies build exports and lower trade deficts. There is no real problem with a low dollar or high oil. We should have learned in the 70s with the oil embargo.

Re: ANWR, Rate Cuts, etc.

Some people here are re-arranging the deck chairs on the Titanic.

There is no substantial evidence that I can find that global — not American — output is falling, which justifies the argument that the latest commodities surge is due to Fed interest rate policies.

Subsidized demand, at least for oil, is growing in the BRIC countries and elsewhere — alarmingly, in Saudi Arabia, Venezuela, etc.

Even if some drop followed a Fed move, the longer term commodities trend is as clear as it could be.

When oil is $200/barrel in 2012, many will look back and wonder what the hell they were thinking.

Let’s Think Long and Hard About Extending Those Bush Tax Cuts

Menzie Chinn submits: There was a time one could plausibly argue that importing lots of

goods and services and borrowing a lot from abroad (financing the

budget deficits that we’ve incurred since 2001) was a great idea. But

at the time, about two and a ha

The Monetary Model of Exchange Rates, Money Demand Shocks, and Order Flow

Menzie Chinn submits: Yes, it’s an exchange rate prediction once again. Last Thursday, Michael Moore (of Queen’s University Belfast) and I presented a new paper at the IMF’s conference on International Macro-Finance (co-sponsored with the ESRC funded Worl

Oil is being pumpted from wells not used for years and even new wells, thats why China gets it’s oil increase…as for war, when is there not trouble in the middle east????????/