A couple of minor remarks on recession indicators.

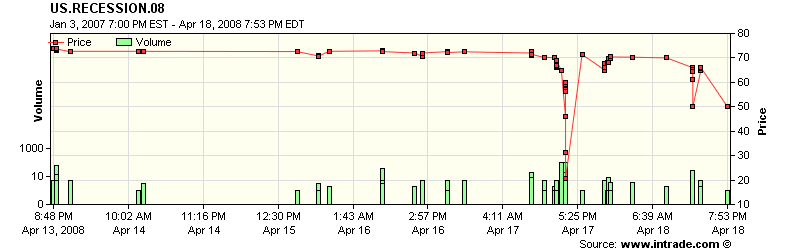

First, Mark Perry noted the plunge in the price of the Intrade recession contract at Thursday’s close. This seems to have represented a huge but transient move through the outstanding list of bid offers, with most recent trades at or above 50%. It’s a reminder not to draw too much from such a thin market.

Note also that the Intrade contract defines a recession narrowly as two consecutive quarters of falling real GDP. If we eke out a barely positive growth rate for real GDP for 2008:Q1, that along with the anemic 2007:Q4 performance and a sharp drop in 2008:Q2 would probably qualify as a recession. But the Intrade contract would require negative growth in 2008:Q3 as well to qualify if we do see any kind of positive number for Q1.

Here at Econbrowser, we’ll of course be making the final call on the basis of our own GDP-based index. Note in the side bar for the main page that I’ve decided to start referring to this as our “recession indicator index” rather than “recession probability index.” That’s a change in name only– it’s exactly the same index constructed in exactly the same way as it has been for the last three years. But I felt after explaining for the umpteenth time why it makes sense to associate a probability with an event that’s already happened, that there would be greater clarity if I referred to this simply as a “recession indicator index.” It has the same interpretation as it always has, namely, a probability that the economy was in recession as of the quarter previous to that for which the most recent GDP release is available. But for somebody who catches nothing more than the name, hopefully the new name will cause less confusion. Next update will be April 30.

Jim:

Just a minor clarification. Intrade includes 2007:Q4 in the count of two consecutive quarters of negative growth. The contract specific rules say:

“If the table as reported at that time indicates that any two consecutive quarters between (and including) Q4 of the previous year and Q4 of the year specified in the contract are negative, then the contract will expire at 100. Otherwise, the contract will expire at 0. For example, if Q4 of 2007 and Q1 of 2008 both experience negative growth then the contract for 2008 will expire at 100.”

Still, because growth in 2007:Q4 was positive (and assuming the revisions don’t change that), it is in practice irrelevant whether 2007:Q4 is considered or not in the determination of a 2008 recession.

So everything you wrote was right; I just wasn’t sure that this quirk in the determination of recessions by Intrade was understood.

The guys from ECRI has a recent article here in Forbes that doesn’t hedge or pull punches in its earnest belief in their own models. I’m keen to find some high level discussion on what people think about the validity of these type of historical models for confronting the current situation where rising demand leading to rising input costs is coming from economies outside of the G7. It bugs me that so many confidently state that “recession is the problem the Fed needs to focus on” or “inflation is the problem the Fed needs to worry about” without acknowledging that their beliefs may be grounded in empirical models that don’t apply well going forward or apply but don’t lead to the expected overall results.

Musings

Occasionally we find ourselves with a number of topics which are all important, but do not provide the basis for a full column. These musings are still highly recommended for your consideration. James Hamilton at Econbrowser takes a look at