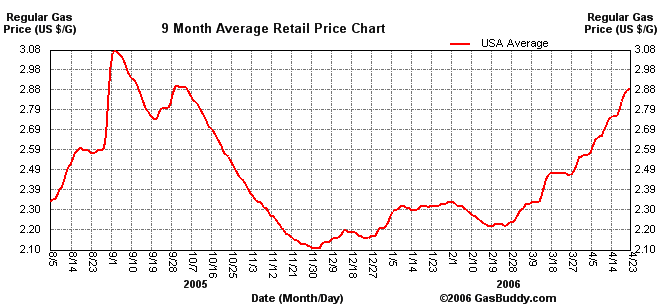

Does the expected strong 2006:Q1 GDP report mean that the economy will shrug off the recent resurgence of gas prices?

This fall’s spike in oil and gasoline prices brought us to the edge of the pit with a good look down. U.S. real GDP grew at an anemic 1.7% annual rate in 2005:Q4, for which ailing autos were the whole story.

Consumer confidence plunged.

|

And yet, after the hurricanes, the sun emerged anew. Auto sales, though not robust, recovered from the disastrous autumn, and confidence rebounded. American consumers evidently saw the hurricanes as an inherently short-lived phenomenon.

So the question of the hour is, how will people respond to oil and gas prices jumping back above the levels they reached even at the height of the fall shortages? There are two answers you could propose. One is that, having seen these prices before, consumers will be immune from any sort of panic reaction, and will make the gradual, sensible adjustments in spending that are necessary and beneficial in the long run.

|

The other possibility is that Americans will be shocked with the discovery that more expensive oil is here to stay and decide that significant changes in lifestyle are immediately called for. If as a result, consumers make sudden changes in plans for spending on such things as cars, durable goods, and vacations, vendors of those products may find themselves left in the lurch.

|

Harvard Professor Martin Feldstein has recently argued that consumers may not have much choice this time around. Consumers cushioned themselves from the oil cost shocks last year by dipping into their home equity to keep spending up. Higher interest rates are a strong deterrent to playing the same game this time around.

Nor do the auto makers have much of a cushion left. Ford’s $1.2 billion first-quarter loss has investors plenty worried, as has GM’s decision to sell off majority interest in GMAC, its one reliable money-maker. Neither company is in a good position to handle a sudden drop in sales.

As noted by Nouriel Roubini, high oil prices can interact with the Fed’s ongoing tightening in a number of other ways. Uncertainty about how to handle the commuting options and where the money to pay each month’s bills is going to come from could be one more factor to tip the scales for a significant downturn in home sales, and worries about the latter from those who depend for their living on home sales and construction could of course be another factor besides rising gas costs convincing consumers of the need to tighten up.

And even if none of this happens, it is hard to see how $75 oil could mean anything other than a further deterioration of the U.S. trade deficit. If the ultimate resolution of that turns out to be a rapid and unanticipated depreciation of the dollar, it will not be a pretty sight.

So here’s my bottom line:

Technorati Tags: gas prices,

gasoline prices,

oil,

oil prices

Will the unexpected depreciation of the dollar being uglier for the US or those countries that own all those dollar reserves? One thing is for sure, the emerging countries won’t be so happy to support our home prices with low, low rates.

Keynes famously commented that the market can stay irrational longer than one can stay solvent. It may be that the American consumer can keep consuming longer than the rational economist imagines. I foresee bad times in the sub-prime debt market, including mortgages, autos and credit cards when the combination of high energy costs (unavoidable for many blue collar workers) and higher interest rates finally bring over spending to a halt.

Meanwhile, GM is burning the furniture to heat the house. I don’t think it can get through a year of +$3 gas, and if it goes Ch.11, Ford will be forced to follow. Default on their bonds will cause the credit spreads on junk debt to sky rocket, and a number of hedge funds will bite the dust. All in all, while not being a Cassandra, I think its a bigger mistake to be a Pollyanna.

David Baskin

I like that first paragraph David. For what it’s worth, I was flipping channels yesterday and saw Fox News go from a gas price story to an interview with the author of “Credit Card Nation.” They all kind of went “oh man, what’s goint to happen?”

On the oil situation, Leanan, a commenter at The Oil Drum, found this March 28 speech by Bill Clinton:

more here

I think Bill gets it.

Sorry, I gave you a link back to this page. Bill’s speech is here

There are always plenty of Cassandras around predicting disaster. Talk is cheap. But go to the market and see what people say when they put their money on the line. We see expectations of low inflation, we see expectations of economic growth.

It’s fun to predict disaster. If bad things do happen (and they always do, eventually), you can say I told you so. And if nothing bad happens, well, you get to share in the good times like everybody else. It’s sort of like an insurance policy: you win either way.

I am not predicting disaster. I have taken the book “Fooled by Randomness” to heart and am now very fickle in my expectations.

One idea I might play with, when energy prices impact the lower and middle income segments of society first, is whether “the market” will be a leading indicator.

Regarding Hal’s comment.

It is unclear whether disaster would be inflationary or deflationary. I’m betting inflationary (and someone else must be, or gold wouldn’t be at $600/oz) but I don’t think low inflationary expectations tell us much about the probability of upcoming disastrous events.

I also don’t see how people can put their money on economic growth. Is there a liquid GDP futures market that I don’t know about?

I don’t anticipate disaster, but I am certainly somewhat pessimistic.

There’s a difference between “predicting disaster” and examing what the logical and natural consequences of the current actions of the society will be.

In every case in the past when countries have outspent their earnings, the results have not been pretty. What’s to make things any different this time around?

> In every case in the past when countries have outspent their earnings, the results have not been pretty.

In every case? Surely not. I recall that Britain closed out the Napoleonic wars with a national debt that was something like 250% GDP. That might be wrong, but it was a lot more than 100%. And what happened? They got to run the globe for a hundred years…

James Hamilton,

I essentially agree with your analysis. But given that total energy expenditures are still down in the range of 8% of income (I think), the effect of $75 oil might not be quite as bad as imagined.

I don’t think Bill ever gets anything that isn’t connected to puffing up his reputation.

It’s sooo hard to predict the impact of higher oil prices as not only is discretionary income at all income levels radically unique, so are household miles driven. People that live at the edge of their spending power and drive a lot of miles will suffer. People that have a few extra bucks and don’t drive much will barely notice. The concept that there is some dollar per barrel tipping point where all of society changes I think is a bit silly.

I don’t think a deflation would necessarily imply low gold prices.

Deflation is a bunch of money that disappears, right? So if you’re expecting deflation, you might put a large chunk of your wealth in gold, where it can’t disappear.

Many people doing this would cause the price of gold to increase quite a bit (because the demand is going up and supply is staying the same).

Then, when the deflation happens, the price of gold will fall proportionally—but not in real terms.

However, I happen to think we’ll have inflation. This is the route that is easiest on the government’s best buddies in big business. Also, Bernanke’s “never again” comments regarding a great depression imply he’ll never go that route–the route of deflation–again.

The prices of oil and gas aren’t just about consumers and cars. Energy is an input (i.e., a cost) of just about everything, and certainly for everything that is either manufactured or transported.

So a structural, long-lived rise in oil/gas will “trickle down,” as it were, into higher prices generally. With cost-push inflation comes higher nominal interest rates, higher mortgage rates, and so on down the chain of economic casuation.

Not good a prospect at all.

KipEsquire, I think you’re wrong. It seems fundamental that rising energy costs will raise costs on virtually everything, but that just doesn’t always hold true historically. The cost of some things certainly increases while effeciencies, alternatives, and demand destruction drive other costs down or keeps them flat. Everyone always expects food prices to shoot skyward when oil prices go up, but it hasn’t always happened that way.

“Who’s afraid of $3 gasoline?”

The folks at Econbrowser have a post up on the effects of $3.00 gas prices. They are not sanguine and forecast a far reaching impact from the bankruptcies of GM & Ford to further deterioration of the U.S. trade deficit to a possible “rapid…

Part of the issue with the pricier oil means pricier everything is that while oil is an input of many goods, it is only one of many inputs. The price of oil increases by 20% and the price of tomatoes might rise by 5%.

This recovery has already had one oil shock following hurricane Katrina. There were other factors at play that contributed to last year’s 4th quarter slowdown but there was also a good deal of countercyclical stimulation. I interpreted the slowdown as a reaction to steeply rising gaoline prices. Consumer sentiment slumped and so did spending.

This time around, interest rates are higher and rising. The latest oil shock is only a month old. The impact has yet to be fully experienced. The latest consumer sentiment numbers were sky high, even with a continuing downtrend in the LEI, rising interest rates, and sharp drops in new home sales.

Six months before the NASDAQ crash, even Allen Greenspan was commenting publicly about how strong and steady the future economic landscape looked. The bubble was raging full force.

Ultimately, the house of cards comes down, no matter how long it has managed to stand in the wind. There are enough “headwinds” to make me nervous.

Great summary Dr. Hamilton.

As I noted in my email, I continue to anticipate that the consumer will break down and will not be able to sustain all of the excesses in the economy and financial markets.

Volatility is coming this year in financial markets and as always, it will surprise many but it should not….

Ben,

Well put. You have no idea how many times I’ve had to refute the “a 10% rise in the price of oil gets magnified into a 100% rise in the price of bread” arguments.