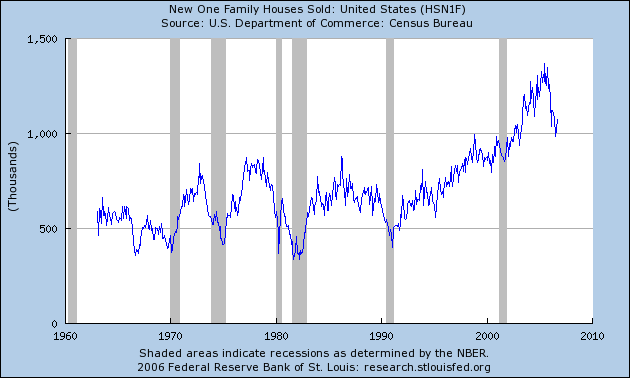

Data on new home sales and inventories released today from the Census Bureau continue to support the view that the market downturn may have reached its bottom.

Seasonally unadjusted September new home sales of 85,000 units leave us up slightly from the 83,000 units now reported for July. However, consistent with the recent pattern, the apparent July-to-September improvement is largely the result of continuing downward revision of the July sales figure, which had been initially reported to be 91,000, was revised down to 85,000 last month, and is now claimed to have been only 83,000.

Even though subsequent revisions to the September figure may cause the July-to-September change eventually declared to have been down rather than up, it seems likely not to show as big a drop from summer to fall as is usual for this time of year, in which case the currently reported uptick in seasonally adjusted new home sales could well be preserved:

|

The inventory of unsold new homes had been building sharply over the last year, leaving the ratio of unsold new homes to monthly new home sales comparable to the peak associated with the 1994-95 soft landing, though more mild than the peaks observed in the preceding recessions:

Moreover, looking in more detail to highlight the latest developments, September 2006 is now the second month in a row of improvement in the inventory-sales ratio, though again data revisions may take some of that improvement away:

There remain other factors that could produce a further deterioration, specifically:

- A presumption of future drops in prices would alter the perceived attractiveness of homes to buyers.

- Significant foreclosures may lie ahead.

- Calculated Risk believes that over 300,000 construction workers may soon lose their jobs.

Each of these has the potential to change the housing market dynamics significantly. Nevertheless, the data coming in so far appear to be consistent with the claim that this may be as bad as the housing downturn is going to get.

Technorati Tags: macroeconomics,

housing,

inflation

“The housing downturn” covers a lot of territory. This is a home sales series. Given the still-high inventory ratio and the still-large pipeline of unfinished homes, the downturn in employment and construction and demand for construction materials and in sales commissions may not be at an end. If sales stabilize at the present level, there is still some excess to work off in other areas. If there is feedback to housing demand from curtailing activity in related areas, then the bottom isn’t in. As Calculated Risk and others are fond of pointing out, housing corrections tend not to be brief.

Housing is not stable at all. October has taken a horrific downturn and that was from a already fallen base. But those numbers won’t start hitting the market to December. Real growth doesn’t look good for 2007.

Expect consistant revisions down. You making a bad mistake reporting this as ‘stable”.

I think this post is way off…you got supply understated, and prices and homes sold overstated..what about cancellations and what about the effect of incentives on “real” home prices?

We got more to slide in the housing mkt…much more…

right on dwight

and i will add

the holidays/cold season is fast approaching traditionally slow home sales times

Heh. Funny post. ;^)

The pace of building will stabilze – albeit at a slower pace. However, the builders will keep building, prolonging the absorption of the excess supply.

Prices will continue to decline until the excess is absorbed. This will take at least two years.

This post is horribly, catastrophically off by virtue of looking only at supply and not price.

Thanks to the almost total and complete subversion of the price news in the media today, apparently JDH missed the fact (I don’t blame him) that September had a nearly 10% YOY nominal price decline — the worst in 36 years.

So the conclusion is obvious: supply only improved because buyers overwhelmingly wrested control from sellers in this market, forcing dramatic price concessions.

This is not good news — even for buyers: it probably means there will be more dramatic price drops soon.

When buyers and potential buyers really catch on, this is going to snowball.

By the way, it gets even worse.

I have anecdotal evidence that many sales in the past year have relied on passing off houses at inflated prices to Mexican immigrants, often by using unscrupulous hispanic real estate agent shills.

These immigrants then (illegally) subdivide and rent out the properties, often to a ridiculous extent (e.g. 6 lessors and 9 people in a townhome, according to someone close to me).

Now, imagine what will happen when a crackdown finally occurs on this practice, or many of the involved are deported, or the sheer economic pressure of the construction-industry job loss of many of these black-market “tenants” hits: Foreclosure, and then you’ll suddenly have banks owning a heck of a lot of residential homes — and having to unload them on the open market.

Not good. No soft landing — time to panic.

“More evidence that housing may be stabilizing”

Econbrowser continues its look at housing markets.

…

I think the fear generated by recent housing trends is overblown. I have been in my current house for 20 years this week, and I bought near the top of the market. Of course, I sold my prior house near the top, too. Over the 20 years, I think my annual rate of price increase is in the vicinity of 4%, taking all the ups and downs in prices over that period. Prices in my area, Northern NJ, became ridiculous, and the subsequent declines have restored some sanity. The ups and downs of prices affect the marginal buyer and not those, like myself, who have lived in their current house for a long time and do not intend to move right now.

Professor- as usual you are a voice of reason.

I read recently that house sale volume has declined by about 36% in the Midwest; this doesn’t surprise me since houses in my Ohio neighborhood that would have sold in 1 to 2 weeks

a year ago are sitting unsold with drastically lowered prices for 7 months now.

I don’t understand why this is or should be so.

Housing values in my area have not risen bubble like over the last few years. (I read that the

Cincinnati area ranked 198 out of 200 in terms of

most expensive US housing.) Is this simply “contagion”?

Any thoughts would be appreciated.

Slightly non-responsive comment: One figure I found interesting from “Mean Markets and Lizard Brains” by Terry Burnham: Over the past thirty years, the population has grown 38% and the housing supply 71%. One cannot read too much into this, but it does counter the argument that population increases will drive further housing gains or ameliorate losses in the current market. Fox News’ “business” show with Cavuto was pushing that one the other day.

Americans are not saving much. GDP growth seems anemic. New home prices are declining significantly, existing home prices declining less so. Sales may be stabilizing at a new level, but the economy has lost the leverage derived from rising home prices, and is now facing the reverse–slowly decreasing home prices. Think of all the people who just bought new homes and now realize that their neighbors have purchased for 10% less. That’s an anecdote, or a somewhat isolate observation, but I think this realization will spread further through the economy.

I think a solid argument can be made based upon the above observations that the pain has just started.

I would not put my money into housing. I think we’ve got a few years of decline ahead of us. Unlikely to see any upside. Very likely to see more downside.

T.R. Elliot — I suspect the data you are looking at is the supply of new homes built and does not take into account the number of homes

destroyed to arrive at data on the actual change in the stock of homes. Over the last 30 years the growth in the stock of housing has not been significantly different then the growth in the number of households.

Rich B,

I too purchased a home near the top of the last peak (1988). Unlike you, we realized gaines of 300% or over 16% annually (? – am I adding this up right?) in 18 years. Purchased for 98k (was a pre-forclosure, so we thought we got a good deal) and sold in February ’06 for 400k. This is in Riverside, CA (the IE). I’ve worked in the RE industry since 1987. This is not normal. I think we have a long way to go to the bottom.

Angela

Aaron,

I would suggest you take a closer look at the data, as others have pointed out, the average price did decline by the headline figure of approximately 10%. The median price, which helps to remove skew from the data, fell by less than 2%, and it seems that resultant change in the national data, was a shifting in sales velocity from the pricier coastal regions to the less costly areas like the South. Given that the median price rose in each region. Also, given that the South did not see the same run-up in prices that prevailed in the West and Northeast, we would expect a sales shift as the South (especially Texas) finally rebounds from the 2001 recession. I agree with Professor Hamilton, that are we seeing some signs of stabilization.

There are a lot of housing doom & gloomers out there right now, so how about a contrarian perspective – maybe lower housing prices and a major housing slowdown will be GOOD for the economy. The GOOD:

1) If housing actually becomes affordable again, you will have fewer cash strapped people who paid too much for their house. The dream of home ownership will become a reality for more people.

2) Fewer loans will be taken out for high risk mortgages leaving fewer banks/investors holding the bag going forward. Enough bad loans have already been written, a housing slump might stem the tide.

3) Money that was being poorly invested in real estate will be put to more productive use.

4) Rent and mortgage payments going down will put more cash into the rest of the economy.

Spencer: You could be right. I don’t know. The chart I’m looking at says “US Census Bureau” and “US Housing Supply” and “Population”. I would think the housing supply would be just that: housing supply, taking into account destruction and construction. But it’s just a stupid chart in a book. It could be wrong or totally misleading.

That said: I do think we have to consider several issues: (1) There are more single people in the US since the 1970s. Therefore one could argue that, in the past, there might have been a need for one home (husband and wife) there now may be a greater need for two homes (single man and single woman). But…my sister is single, owns a home, but she rents out rooms to other people. So I’m not sure what affect the fact that we’ve got more single people–since we’ve also got more couples living together.

So I don’t know. I’ll have to look around to find additional data on this point.

Anyway: I still vote for down. I don’t think there has been enough pain yet.

Interestingly, Burnham does not argue that there is a housing bubble. His assessment is simply that there isn’t much money to be made in housing. We’ve seen the upside. His argument is that we’ve seen the upside on just about everything. Big decreases in interest rates in the last twenty years, a large increase in equity values (P/E, etc). And same for housing. I tend to agree. I think the big money has been made and we’re facng a lot of sideways with some ups and downs for the foreseeable future. He argues that if we see strong productivity growth, then a strong upside is possible. Otherwise pain. I’m still thinking pain.

“the population has grown 38% and the housing supply 71%.”

This is largely in response to the rapid decline in average household size as traditional mom+dad+ 2.2 kids have been replaced by single parent households or traditional households with fewer kids and other types.

Malcom,

Consider what drives most decisions on purchasing a home, the monthly payment. Most assume that employment will continue and they know how much home they can afford out of their monthly paycheck. Most people are grandfathered in now on their monthly payments and they will stay in their current home because they cannot afford a higher monthly payment. To move they would have to trade down not up like they have been able to over the past few years.

Housing has begun to stabilize because the FED has paused and so mortgage rates have paused. Housing prices are sliding because builders have excess inventory and they must liquidate at a price lower than they would like to cover their building costs.

If you want to know what will happen in housing in the future look nowhere but the FED.

Angela-

If you do the math, your compound rate of return is 8.1% (assuming that you made no capital improvements to the house or property). A good return but less than in equities.

Rich

Again we can look at this from different perspectives:

Has the housing market stabilized from a home builders perspective – hell no! Volume is down and already started projects are still being finished, and the construction loans are a ticking bomb. He needs to off load these fast.

Has the marked stabilized from a “house flipper’s” POV – Again NO – same reasons

Long term real estate investor (could be REIT). Probably, if you are into buy, rent out and hold. When house prices fall, rents rise, and vice versa, because land lords take appreciation/depreciation into consideration when setting rents, and there are now more renters, since they aren’t buying houses (and if they were, then we wouldn’t be talking about a crisis).

From a current home owner, who just bought a house – Not really, nothing got more expensive. If you couldn’t afford the house a year ago, you still can’t, and if you could, then you are OK.

The tricky part is if you just bought a year ago, with an ARM loan, and they are now adjusted upwards. Personally I’m in that category, my mortgage went up over the last 12 months from $1000/month to $1900/month. Not fun, but if the FED holds the rate, i.e. if interest payments doesn’t continue to rise, then most of us will be OK, we’ve gotta live somewhere, and as I earlier stated, rents are going up. In 6 to 7 years time prices will recover. Either bacause we are in a recession and interest rates will go down or because we are in boom times and salaries or inflation will go up.

For the long time owner, who bought several years, this is totally irrelevant. He may have lost some paper profits.

The point is: Most of us aren’t short term RE investors (builders or flippers), so only a small segment of real estate players are affected negatively – this means that prices will probably drop, but moderatly, and then they will rebound, even more moderatly, to remain relatively flat for 5 to 8 years. RE goes up in stair step fashion, short periods of huge appreciation followed by periods of level prices.

It would be interesting to hear if anybody has analyzed why this is. I’m suspecting that it’s mostly psycology, buttressed by a growing population.

Bellanson

I don’t see stabilization here. These are fairly dicey datasets, with large margins of error, and frequent revisions. There are also significant gaps in the data, as kharris noted, with cancellations and sales incentives not captured in the data. Most significantly, the inventory figures are very questionable with the difficulty of accounting for cancellations. Most of the uncertain elements in the data raise the possibility of the situation being worse than it looks.

I would also note that both the number of unsold completed homes and the ratio of unsold completed homes to sales are still rising, not falling. Don’t see how that implies stabilization.

I think Bellanson sums the whole thing up pretty well in saying that most of us aren’t short term RE investors and aren’t really going to be affected much. The exception would be if your livelihood has some relationship to the RE/Construction industry or you live in a community that is disproportionately hit by mortgage defaults because of high risk lending practices.

Bellanson,

Good post. The only thing is that you seem to discount the impact of interest rates. I interest rates come down appreciably in the next few years the housing boom will return, though probably at a lower level. Of course if the Democrats take control of government and allow the tax reductions to expire all bets are off. There will be no capital to buy houses.

dick: “Of course if the Democrats take control of government and allow the tax reductions to expire all bets are off. There will be no capital to buy houses.”

Not true at all. The capital that is flowing into government debt (because the current government is increasing spending while cutting taxes) will flow somewhere else.

T.R.

Do you understand the concept of malinvestment?

Do you want the housing boom to return? It was an artificial boom. Let the illegal Mexicans become citizens, then you will have a boom.