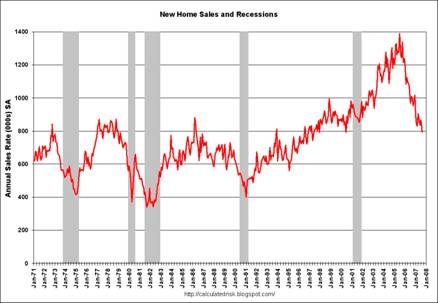

Today’s Census Bureau report on the number of new homes sold in August provides our first clear data for the impact on the housing market of the financial turmoil that began August 9. It is not a pretty sight.

In a typical year, most new home sales occur between March and August. In each of those months we usually might expect 35% more homes to be sold than at the seasonal low in December. This August, home sales were actually less than in December, the first time that’s happened in the 44 years these numbers are available.

|

And last December was not exactly a hot market– new home sales in December 2006 were down 17% from December 2005. August 2007 seasonally unadjusted sales were down 23% from August 2006 and down 37% from August 2005.

|

Where’s this headed? Bloomberg reports this cheery forecast:

Fannie Mae Chief Executive Officer Daniel Mudd said the housing slump will last beyond next year, dragging down home prices and increasing credit losses at the largest provider of financing for U.S. mortgages.

“We don’t think we hit a bottom until the end of ’08 and then we have some period of time to work our way back up again,” Mudd said today in an interview in Washington.

Wish I could say it wasn’t so.

Technorati Tags: macroeconomics,

housing,

recession,

economics

“Calculated Risk” has been quite accurate in his analyses for months (even years) except for the commercial side which has been somewhat slow to fall off.

A sort of a “Roubini without the flailing arms.”

Finally these numbers are returning to near the average of the post-Vietnam era. They will probably fall more before rebounding to this range.

But IMO, when we consider the increasing cost of energy, we can’t ever expect to see housing built at the recent boom numbers. Never again.

um, “Yes, housing can go down even more.”

I’m almost prepared to take this as a contrary indicator. I wonder if the professor is prepared to review and critique his blogs of June 2005 for the benefit of his readers.

Here’s a YouTube of interest, http://www.youtube.com/watch?v=tkuW8bCjC6c, one Miami condo developer auctioned off units receiving 50% of asking price. The prices almost sounded reasonable.

This always seemed inevitable to me. Not predictable in terms of time. I thought prices were out of control in maybe 2004, but real estate kept forging ahead. But it didn’t seem sustainable and arguments that it was appeared too much like those arguing that Worldcom was such a great stock.

We survived the early 90s problems, we’ll survive these. But the increase in prices seems much more dramatic in this run-up, and now we’re seeing price decreases nationally. That may bring some unique aspects we’ve not run into before.

Very nice analysis, Professor. Astounding, that August’s sales are below December’s.

With: vacancies in Q1/Q2 at all-time highs; homes still coming online despite sales plummeting and inventory near all-time highs; falling consumer confidence and household debt-to-disposable personal income at an all time high; real interest rates still relatively low, but increasing due to risk premiums returning; inflation now manifesting itself in food and fuel prices;

there is no way that this ends well, or in other than a hard, protracted recession/depression, in my opinion.

Maybe Prof. Chinn’s dynamic duo of Hillary/Obama will kickstart consumer confidence, productivity, and savings come Nov. ’08. I doubt it, but I’ll hope for the best, and plan for the worst.

What does the poor sales shown in the graph have to do with Aug 9?

The sales have been poor all year, as your graph clearly shows. The impact of Aug 9 and later is only going to start showing clear effects later this year.

ESB says that Calculated Risk is “A sort of ‘Roubini without the flailing arms.'”

This is one of those eras when flailing arms are entirely appropriate.

Seriously, Roubini called this play at least six months ahead of anyone else. He didn’t get the timing perfect and we have yet to see whether the hard landing he predicted will happen. But it was an extraordinary call, very helpful to investors.

In spite of the housing price weakness, local governments, expecially in Florida, are still rezoning recreational green space to allow for more residential development. This is how we got into the overbuilt situation and these idiots in local governments only want to line the pockets of their policitcal supporters and they don’t care about the housing price decline.

Blame local government on the housing mess, along with the easy credit terms.

August Housing in a historical context

And given that August is the first month in which the credit market freeze-up for MBSs could have results, we should expect to see even worse comparative results going forward.

Yeah, New Home Sales is a great recession predictor …except for the tech implosion, 650 has consistently been the recession threshold (as in THE RECESSION HAS BEGUN).

We went just below 800, so we have 150 left to go …it’s beginning to look a lot like Christmas. 🙁

Additional Note: As predictive as it’s been, I wonder if 650 is actually too low these days simply due to population growth. Might have risen to 700 or so as a new threshold…?

Hmm…so many want to blame someone for this looming difficulty (unmitigated disaster!)[somewhere between these 2]. Well, can we start with the general public (some of us) and that suspension of enquiry/curiousity that was cultivated by the domestic political climate…I mean the War on Terror…where to do anything but trust authority meant that you were helping the terrorists.

Great post as usual JDH, but I need to poke this bit a little:

Can Mudd review the past (much smaller) housing booms and say this graphically (–bottom as early as the end of ’08)?

Tisn’t so…tisn’t.

“we don’t think we hit bottom until….”

Folks who didn’t see it coming are now

offering predictions of when it will end?

Excuse me if I doze off.

e sciaroni,

In era of higher heating and commuting costs, we should also see smaller homes, and a steeper price gradient for homes with regard to employment centers. Now, the gradient is already pretty steep in some areas, due to the distortionate effect of the bubble, so there are going to be exceptions. In less bubbly areas, though, near-in homes are going to be very popular. That may even lead to some mini-booms, as demand to live “in” pushes up prices and construction near concentrations of employment. If that is correct, owners of houses that are “out” relative to employment centers may be in for trouble.

Anonymous:

The WSJ has already surveyed builders and builders are already downsizing developments – much to the chagrin of current residents. My community in suburb of Dallas has 200+ homes for sale, half over $300K, those being abouh 2X the median home value. ANd in TX, your electric bill can now rival your mortgage payment(deregulation!).

There is much to be reconed with yet, but we’ve seen it before.