No cheer for the New Year from the numbers released this week.

The bad news began on Wednesday with the release of the Institute of Supply Management’s manufacturing PMI reading, which fell from 50.8 in November to 47.7 in December. This index is based on a survey of managers, and the shift to a value below 50 indicates that now more plants are reporting declines rather than increases in categories such as new orders, production, and employment. The PMI has been below 50 on a number of occasions that would not be characterized as an economic recession, but I take its current value as a reliable indicator of at least some slowdown.

|

And today the Bureau of Labor Statistics reported that the U.S. unemployment rate jumped from 4.7% in November to 5.0% in December. Although that still leaves the level well below its historical average of 5.6%, a rapid increase in the level is almost a defining characteristic of an economic recession. The December move of 30 basis points is the biggest jump since 2001.

|

Other employment indicators confirm the impression of deteriorating job opportunities. Automatic Data Processing projected that seasonally adjusted employment in the private sector increased by only 40,000 jobs in December, while the BLS survey of establishments estimated a drop of 13,000 private-sector jobs. The separate BLS survey of households (the same data source from which the unemployment rate is constructed) suggested that total employment fell by 436,000 jobs in December. What distinguishes this from previous household survey reports of drops in employment in August and October is that, in the current instance, the BLS says that those newly without jobs are trying to find new work to do, but so far without success.

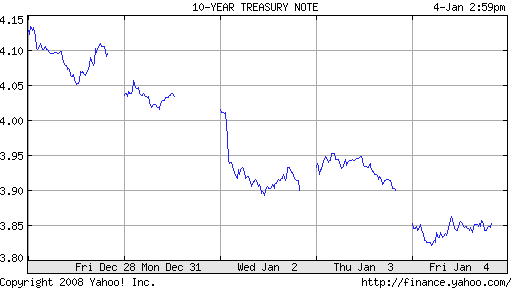

Fed funds futures contract prices responded sharply to the news. At the start of this week, the February contract was signaling an expected February fed funds rate of a little over 4%, suggesting investors were not completely certain the Fed would even cut at all from its current 4.25% target at the January 29/30 FOMC meeting. By contrast, today’s closing price implies an expected February rate of 3.84%– a cut is surely coming, and more likely than not, it will be 50 basis points rather than 25.

|

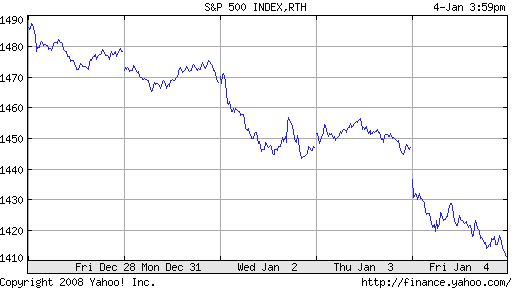

The stock market was not cheered by this prospect in the least, correctly perceiving that the Fed would only contemplate a cut of this magnitude in the face of some seriously bleak economic conditions. The S&P500 gave up nearly 5% of its value this week.

|

The ten-year Treasury yield fell almost 30 basis points this week, another unmistakable indicator of strong new bearish sentiment.

|

I still am not expecting the 2007:Q4 GDP figures to be released later this month to be that bad, based on what we know about October and November. But December could well mark the month in which things made a sharp turn for the worst. This week’s developments are certainly enough to bring the worry back to our Little EconWatcher’s face.

Technorati Tags: macroeconomics,

employment,

economics,

PMI,

ISM,

recession,

Federal Reserve

Happy New Year to you JDH and no serious disagreement from me on your new Little EconWatcher.

I see that TAF has increased the action amounts to $60B/mo and this seems like more than a minor tweak to me. Do you have any thoughts about this new instrument so far?

Current Probability of Recession : 80%.

Even ECRI with Laxman Achutan is worried.

I think Little EconWatcher’s face is also the face of the GOP looking at 2008 election prospects.

Happy New Year, Professor!

Judging from the historical experience of the unemployment rate, December is likely to be dated as the beginning of the new recession, if we are not already in it.

Is this ‘recession’ tag a bit “overweight” as the stockbrokers might say?…as overweight as ‘the market was up (down)…’ in describing the (right, prudent, prescient, money-making, capital enhancing) features of the broad economy?

The Nabob, not known for his shyness, bonks us with the view that we have been in a recession since 2002 following the dotcom bust. But the worst is yet to come: dustbowls and even worse: “elections”.

I don’t know whether to don my deep sea diving bell or my flame-retardant radiation-proof total encapsulation suit, you?

I have posted an updated version of the Unemployment Rate chart which shows that we are past the threshold point when economic deterioration takes on a self-sustaining character

and leads to recession.

See http://www.wrahal.blogspot.com

A well known Wall Street economist with good Fed connections had dinner with Dr. Bernanke and a couple of other officials in early December. She was reportedly more than a little surprised at Bernanke’s confidence that the economy was on solid ground, in large part because the employment data had been so strong.

Which strikes me as shortsighted, if true. Employment data’s hardly a leading indicator and given the meaningful and indeterminate lag between Fed action and monetary impact by the time unemployment shoots up all an aggressive easing can do is shorten the recession that’s already underway.

The totally confusing factors at the moment are gold, the price of oil and TIPS spreads, all of which are suggesting accelerating inflation even as falling treasury yields suggest otherwise.

But anarchy,

Which strikes me as shortsighted, if true.

isn’t that a bit shortsighted (blind even) to think that Bernanke is ignorant of the relationship of employment data and recessions?

So she either misreported or misunderstood, (along with those “other officials”)…is how we, bespectacled and tryin, readers respond to…the gossip, yes?

Or consider The Onion’s version: Bernanke dinner party jumps out window as Ben lets guests have the news: “We are sooo in forit!”?

Fuggedabout inflation that is not driven by wages.

Off topic:

i am amazed why no one has taken on the shrewed/cunning Jim Cramer, who thinks we need maybe 200 pt rate cut at once so that his stock market can go up.

he is just trying to fool his naive followers who dont have much clue about economics.

http://www.cnbc.com/id/22508517

Calmo:

I consider my source of the highest bespectacled caliber, but the information is secondhand.

I would say THIS, about THAT: observable Fed policy actions thus far have NOT been nearly aggressive enough to offset an incipient recession.

Go back and look at the unemployment series, and you see that in the last 50-60 years, when the unemployment rate rises 50 bp off the cyclical low the economy is in real trouble. It’s clear to me (and maybe Bernanke?) that the cyclical low in unemployment this go-round was March of 2007 at about 4.4%.

With 10 year T-Bills now yeilding 3.85%, the bond market agrees that recession is coming, and inflation is not the chief concern.

I think the 2 year T-note and FF make a more telling point regarding the far-off-in-left-field mentality of the Bernanke Fed: The 2 year note (that normally trades maybe 50 bp over FF) is at a 2.76% yield versus FF at 4 1/4%!

Looked at this way, the Bernanke Fed is at least 150 basis points behind the curve, and by the time they recognize the error their actions won’t impact the real economy until 1Q ’09 at the earliest.

I would not put too much weight on the one-month rise in the jobless rate. The rate fell just before it rose. The thing to look at (and it doesn’t look good) is the length of time since the jobless rate stopped falling and the extent of the rise since it rose. The low in the jobless rate was first hit over a year ago and the rise from the low of 0.6% is enough that a return to a steady or falling jobless rate is not likely. More likely is an acceleration in the rise in the jobless rate. Very likely the wobble in the rate from October to December has something to do with moving retail hiring around. Lots of people work during the holiday selling season. Pull them in early and a rate that would otherwise hold steady or rise falls – for one month. Then, when the late-comers show up looking for work in a slow year, all the jobs are gone and the rate rises.

Well, I would gladly hand off the “seasonal adjustments” to kh with that remark if it weren’t all stirred up in the B/D model which Bangladore at NT claims is accounting for an ever increasing amount of the job tally (Chart 3 of Jan 4, but also Jan 3 excellent too):

http://www.ntrs.com/pws/jsp/display2.jsp?XML=pages/nt/0601/1138283678319_6.xml&TYPE=interior

It appears we are unable to discuss much if we face the dissolution of data entailed by millions of undocumenteds…the only possible positive remark about the growing B/D presence: we need bigger guesses now.

Anarchus, I agree here:

observable Fed policy actions thus far have NOT been nearly aggressive enough to offset an incipient recession. but short of asking Congress to expand military adventures, I do not see that cutting earlier and deeper would have had any better result “offsetting” that incipient recession. [Those mortgage rates have not come down, those house prices somewhat but wages/salaries still inadequate, yes?]

Agree with Buzzy, (Damn.) and again not so much with the more detailed Anarchus who needs to whomp the Fed as failing to recognize the error of their ways. [Again, underestimating the intelligence of the Fed, could be a projection…it could.] It could be that there are also constraints on dropping 150bp for foreign investors who might think twice about continuing their kindness.

Ok, I wonder how many months of increases in the jobless rate (no matter how insecure this data might be) kharris would tolerate before joining the rest of the herd who think it spelled at least the first couple of letters of ‘recession’?

10 year is 3.84% today.

It’s hard to see a number like that and wonder what the hell Bernake and company are thinking.

The bond market thinks that there’s going to be a recession. The stock market thinks so. So where the HELL is the Fed?

In addition to my CNBC addiction, I listen to Money Talk with Bob Brinker on the weekends, and he’s been trash talking Bernake for 6 months now.

Correct me if I’m wrong, but back in the bad old stagflation days, T bill rates were pretty high, right? So if the bond market doesn’t see inflation, who is Bernake to say that inflation is a concern? Why can’t the market be his guide?